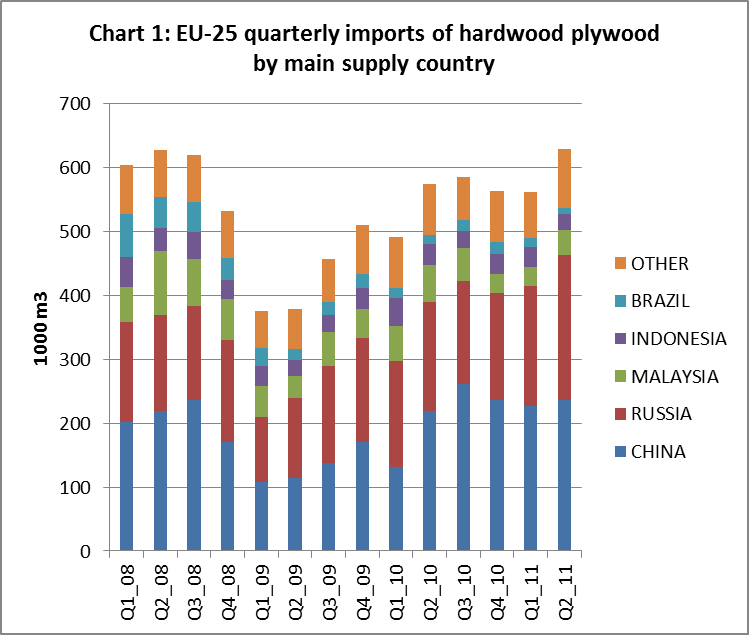

At 630,000 m3, EU hardwood plywood imports in the second quarter of 2011 were up 12% on the previous quarter and up 9% on the same quarter of the previous year (Chart 1). Imports during the second quarter of 2011 were at levels not seen since before the onset of the economic crises in 2008. Imports over the first 6 months of 2011 stood at 1.2 million m3, up 12% on the same period in 2010.

Much of the increase in EU hardwood plywood imports has consisted of birch plywood from Russia. EU imports of hardwood plywood from Russia reached 416,000 m3 in the first half of 2011, up 23% from 340,000 m3 in the same period last year.

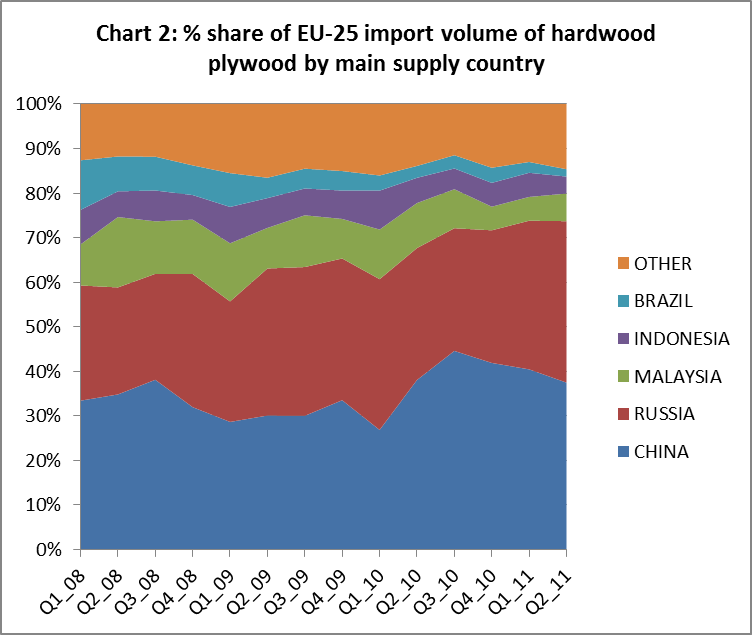

EU imports of hardwood plywood from China were up 32% at 464,000 m3 in the first 6 months of this year. However on a quarterly basis, imports from China have been slipping since reaching a peak in the third quarter of 2010 and China’s share of overall EU imports has been falling relative to Russia during 2011 (Chart 2). However, in practice there is little direct competition between Russian and Chinese plywood in the EU market since most Chinese plywood is destined for the UK and Belgium while Russian plywood is sold primarily to Germany, Finland, the Baltics and Italy.

EU imports of hardwood plywood from the major tropical producers have continued to slide this year. During the first 6 months of 2011, imports from Malaysia were 69,000 m3, down nearly 40% on the same period of 2010. Imports from Indonesia were down 28% at 55,000 m3, and imports from Brazil reached only 24,000 m3, down 25%. Over the last 3 years, the share of these three countries in overall EU hardwood plywood imports has slipped from 28% to 12%.

European plywood market prospects deteriorate for the rest of the year

There is little prospect of any significant improvement in hardwood plywood market conditions during the rest of the year. In their most recent plywood market report, the UK’s TTJ notes that forward purchasing was so limited over the summer that the large monthly break-bulk shipment from China to the UK for August was cancelled. Furthermore, plywood trading has been very slow to pick up in September and UK stocks of most forms of plywood are already considered sufficient to satisfy demand for some weeks to come. In fact many UK importers have more inventory of Chinese hardwood plywood than they would like and prices for onward sales in the UK have been weakening. This is occurring even while CIF prices for Chinese plywood have continued to firm in response to the escalating costs of poplar veneer in China.

TTJ comment that Chinese plywood now dominates the lower end of the UK plywood market and that its impact is extending into the top end. Its presence has led to reduced price expectations in the UK market as a whole and made it more difficult for Malaysia’s exporters to obtain a margin that amply reflects the higher quality on offer.

The latest plywood market report by Germany-based EUWID notes that demand for all types of Chinese plywood has also been quiet in mainland Europe in recent weeks with only occasional signs of a higher rate of top-up purchases during September. Although mainland European stocks of Chinese plywood are low at present, the imminent arrival of some fairly large shipments delayed from July and August are expected to be sufficient to avoid any shortfalls in supply in the last quarter of the year.

EUWID also note that demand for Indonesia and Malaysian plywood in mainland Europe declined significantly in July and August. Furthermore plywood bought from Malaysia and Indonesian mills at the end of September is unlikely to reach importers before the end of November when consumption is likely to be low and declining. Therefore importers are already citing concern to avoid any build-up of stocks at the end of the year as a reason to curtail forward purchases.

There are also indications that tight margins and lower price expectations driven partly by China’s large presence in the European market is now pushing some shippers in Malaysia to compromise on quality.

Unease deepens over European economic outlook

Clear signs are emerging of increasingly cautious buying during September of both hardwood plywood and lumber by European importers. Underlying this trend is deepening unease over the immediate prospects for the European economy. Since their return from summer vacations in August, European traders have been hit by a wave of gloomy news.

In a recent report on the euro-zone’s “flagging economy”, The Economist suggests that the region is caught in “a vicious feedback loop between growth, sovereign-debt concerns and banking woes”.

At the start of 2011, there was confidence that a surging recovery in the euro-zone, led by Germany, would enable the region to withstand the debt crises that is now threatening to engulf Greece. However, between the first and second quarters of 2011, GDP growth fell sharply from 0.8% to 0.2% across the euro-region and from 1.3% to 0.1% in Germany.

This led the IMF on 20 September to yank down its predictions for euro-area growth this year from 2% to 1.6%. The European Commission also now forecasts that GDP growth across the euro-zone will slow to a virtual standstill for the rest of this year, rising by 0.2% in the third quarter and just 0.1% in the fourth.

Slower growth across the euro-zone will make it even more difficult for governments to hit their fiscal targets. It implies that austerity measures will be even deeper and more painful than expected. The rising risk of recession is also likely to damage Europe’s fragile banking sector which already faces, according to the IMF, potential losses of around $200 billion from higher risk on sovereign debt.

Under these circumstances, there seems little prospect of any easing in the extremely tight credit available to smaller firms – including those in the wood sector – which has been impeding private sector growth over the last 3 years. And as growth stalls, it becomes even trickier for increasingly unpopular politicians to convince European tax payers to reach deeper into their pockets to rescue the struggling euro.

Prospects seem little better outside the euro-zone at present. On 20 September, the IMF reduced its forecast for UK GDP growth to just 1.1% in 2011 compared to 1.7% forecast in April. IMF now predicts the UK economy will grow by only 1.6% in 2012 compared to 2.3% in the previous forecast.

European Forest Sector Outlook study

The United Nations Economic Commission for Europe (UNECE) and the Food and Agriculture Organisation (FAO) have jointly released a comprehensive and far-reaching analysis of the outlook for the European forest sector over the next 20 years. Using computer modelling techniques and the best available economic, forest inventory and trade data, the “European Forest Sector Outlook Study II 2010-2030” considers the impact of various policy scenarios.

The study indicates that Europe will remain, in all scenarios, a net exporter of wood and forest products. Significant net exports of wood products will continue to outweigh relatively minor net imports even if demand for the latter increases substantially in order to achieve ambitious renewable energy targets. The study’s projections also show a steady rise in prices of forest products and wood over the whole period, driven by expanding global demand and increasing scarcity in several regions.

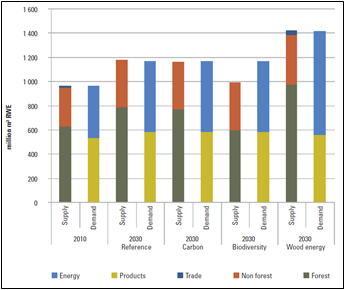

The study compares various alternative policy scenarios against a reference “business-as-usual” scenario (Chart 3). In this scenario, consumption of forest products and wood energy is projected to grow steadily and wood supply to expand to meet this demand, from around 970 million m3 RWE in 2010 to 1180 million m3 RWE in 2030. All components of supply will have to expand, especially harvest residues.

Chart 3: European Wood Supply/demand balance in EFSOS scenarios, 2010-2030

The “maximising biomass carbon” scenario explores how much carbon could be stored in the European forest by changing silvicultural methods while not affecting the level of harvest. It concludes that the forest sector’s contribution to carbon storage may be maximised in the medium term by combining longer forestry rotations and a greater share of forest thinnings to provide a steady flow of wood for products and energy. In the long term however, the sequestration capacity limit of the forest will be reached, and the only potential for further mitigation will be more regular harvesting to store the carbon in harvested wood products and also avoiding emissions from non-renewable materials and energy sources.

The “Priority to biodiversity” scenario assumes that decision makers give priority to the protection of biological diversity. The study concludes that this would lead to 12% less wood production than the “Business-as-usual” scenario. It would necessitate reduced consumption of wood products and energy, and/or increased imports from other regions and/or intensified use of other sources like landscape care wood and wood originating from conservation management and short-rotation coppice.

The “Promoting wood energy” scenario explores what would be necessary for wood to contribute to achieving the ambitious targets for renewable energies adopted by most European countries. The study concludes that this would require supply to increase by nearly 50% in twenty years through strong mobilisation of all types of wood. But such mobilisation would have significant environmental, financial and institutional costs. For example, it would be necessary to expand areas of short rotation coppice on agricultural land with potential loss of food production capacity.

The study also reviews the sustainability implications of all the scenarios. It concludes that for most indicators of sustainability the outcome is “relatively satisfactory”. The main concern is for biodiversity, as increased harvest pressure in all scenarios, except for the “Priority to biodiversity” scenario, lowers the amount of deadwood and reduces the share of old stands. The “Promoting wood energy” scenario shows a decline in sustainability with regards to forest resources and carbon, due to the heavy pressure of increased wood extraction to meet the renewable energy targets.

More details at: http://www.unece.org/press/pr2011/11tim_p06e.html

PDF of this article:

Copyright ITTO – 2011 All rights reserved