There is a tendency when analysing markets for tropical wood in Europe to focus heavily on demand for the main primary wood products –tropical hardwood logs, sawn, veneers and plywood. However globalisation trends, particularly the strong growth of China as a wood processing hub, combined with efforts by tropical producing countries to move up the value chain, has meant that these products have become relatively less important in the European market. Tropical and other developing countries are supplying a very wide range of secondary and tertiary processed products into this market.

At the same time, European subsidies to promote renewable energy sources – which have contributed to shortages and rising prices for wood fibre supplied to both the European energy and wood panels sectors – is now driving a trend towards rising imports of wood chips and other forms of biomass from developing countries.

An analysis of Eurostat data indicates that last year out of a total of 26.6 million m3 (Roundwood Equivalent –RWE) of wood products imported into EU from developing countries, 10.8 million m3 (41%) comprised primary processed products, 11.5 million m3 (43%) comprised secondary and tertiary products, and 4.3 million m3 (16%) comprised wood chips and other biomass.

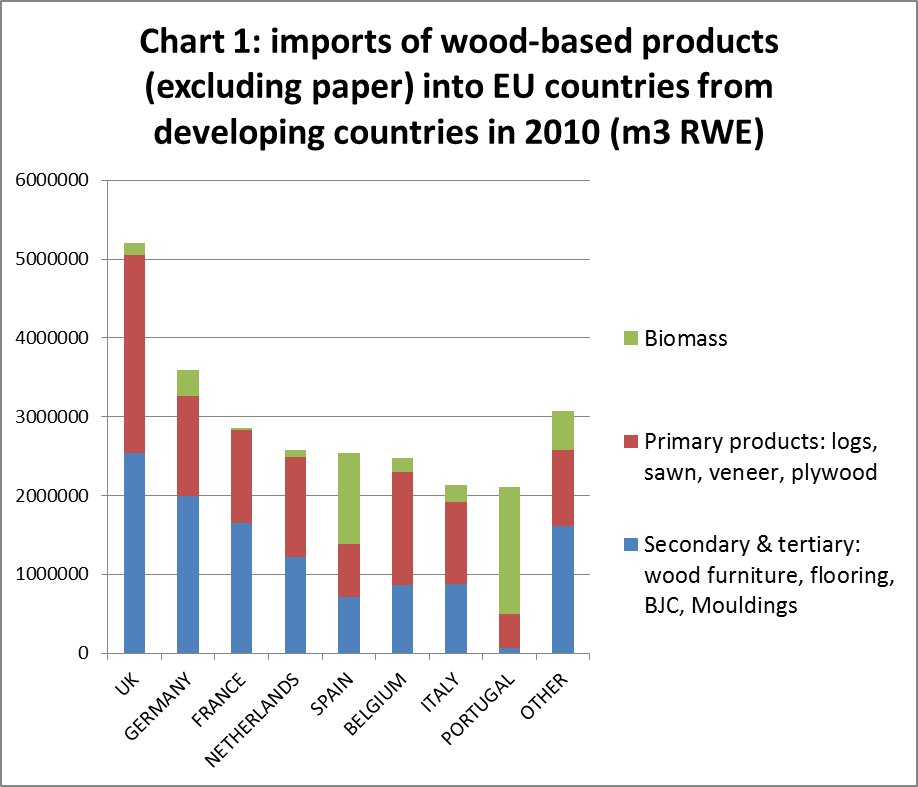

Chart 1 shows that of all European countries, the UK was by far the largest importer of wood products from developing countries, importing 5.2 million m3 (RWE) in 2010, followed by Germany (3.6 million m3), France (2.9 million m3), Netherlands (2.6 million m3), and Spain (2.5 million m3). The high volume of imports into the UK is largely explained by dependence on wood furniture and plywood imports from China.

Chart 1 also reveals that very large volumes of biomass are now being imported from developing countries by Spain and Portugal, with smaller volumes destined for Germany, Italy and Belgium.

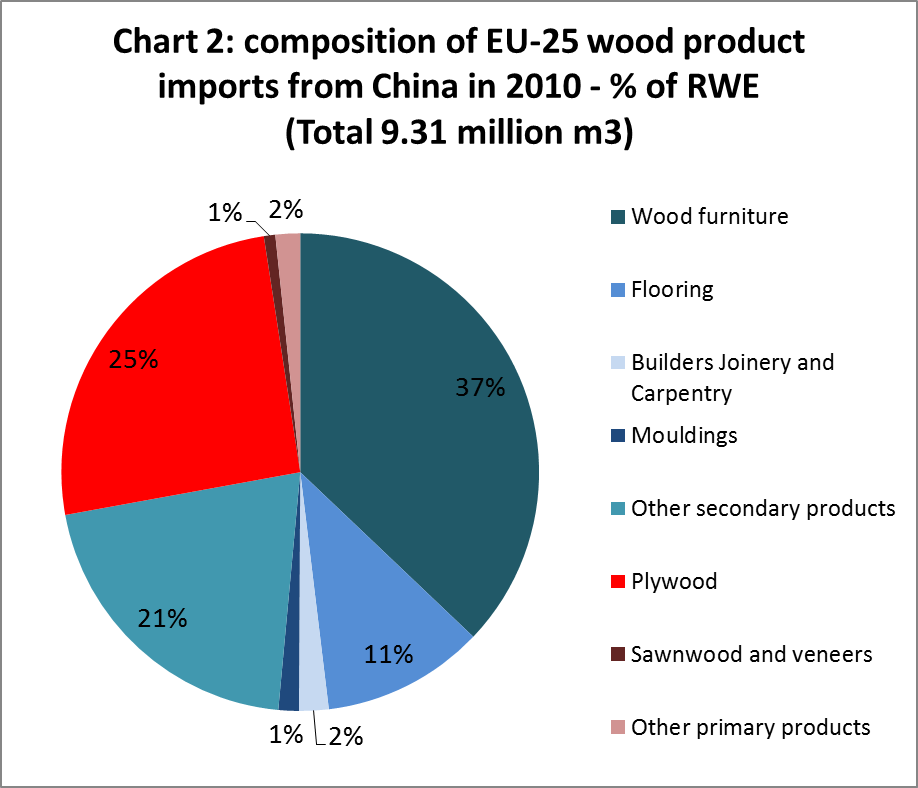

Over recent years China has emerged as a huge supplier of a wide range of secondary and tertiary processed wood products to the EU. Of the 9.3 million m3 (RWE) of wood products supplied to the EU from China in 2010, around 6.7 million m3 comprised further processed products – mainly wood furniture and flooring (Chart 2). Unfortunately, trade data is insufficiently detailed to allow differentiation between further-processed products derived respectively from tropical hardwoods and other wood types. The majority of wood volume sourced from China is likely to be made up of softwood and derived products (such as composite panels) and temperate hardwoods (notably Chinese poplar and Russian birch). But the sheer scale of trade suggests that significant volumes of tropical hardwood may also be involved.

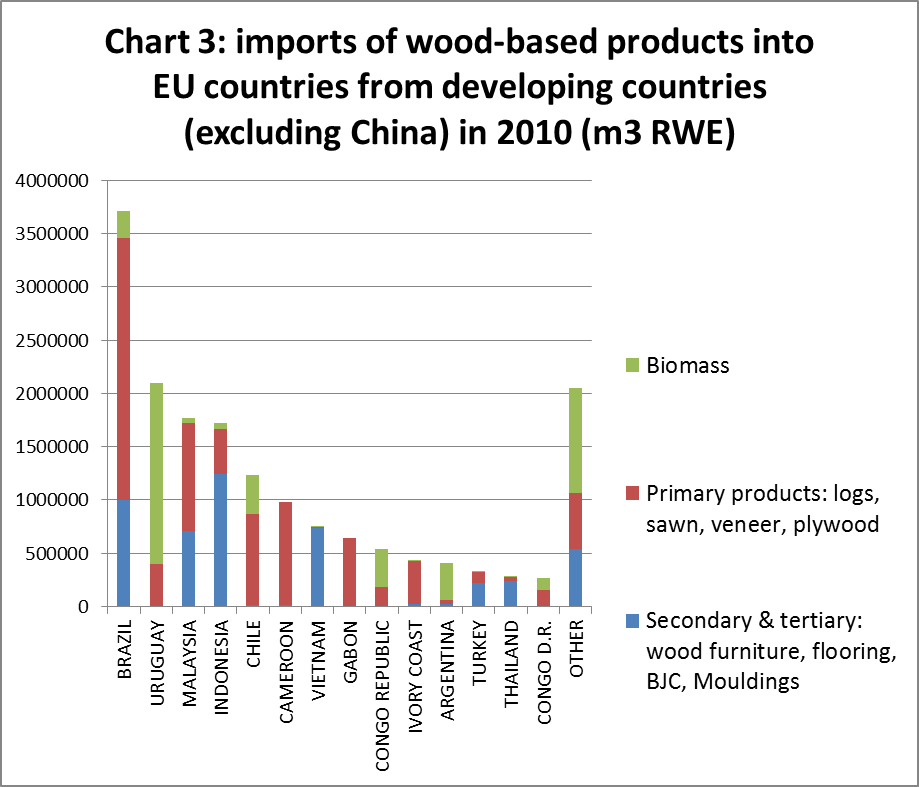

The range of products imported into the EU from developing countries other than China is also expanding. Chart 3 highlights that secondary and tertiary products such as furniture, flooring and mouldings, now make up a very significant proportion of European wood product imports from Vietnam (99%), Indonesia (72%), Malaysia (40%), and Brazil (27%). Uruguay, Argentina and Chile are particularly important sources of biomass into the EU. However primary wood products – particularly sawn lumber – continue to dominate European imports from the key African supply countries (Cameroon, Gabon and the Ivory Coast).

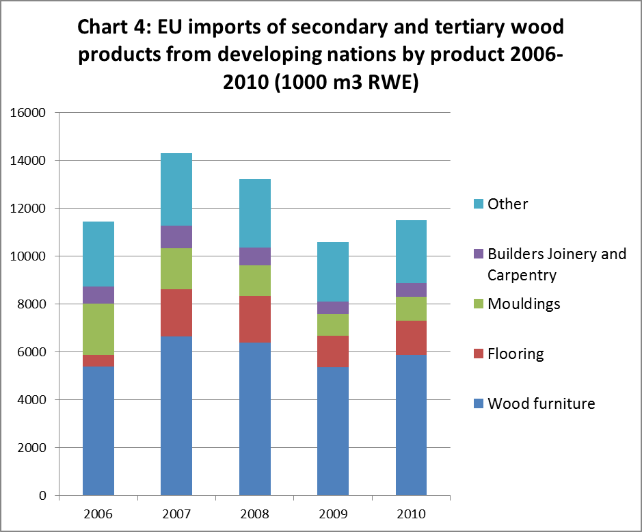

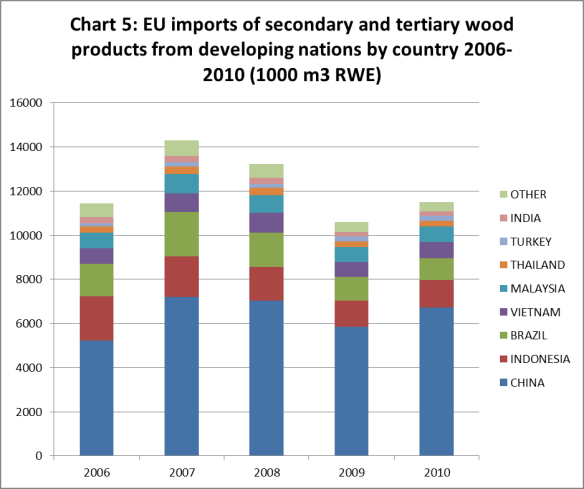

Recent trends in European imports of secondary and tertiary wood products from developing countries are shown in Charts 4 and 5. The credit crunch led to a significant downturn in European imports of these products during 2008 and 2009, but there was a return to import growth last year. Chart 4 indicates that imports of wood furniture, flooring and mouldings all rebounded last year. Chart 5 shows that China accounted for much of the increase in EU imports of these products between 2009 and 2010. Imports of secondary and tertiary wood products from other leading supply countries, including Indonesia, Brazil, Vietnam, and Malaysia, were stable between 2009 and 2010.

The growing share of finished and semi-finished wood products from China and other developing countries in the European market raises obvious questions over likely long-term impact on overall levels of consumption of the primary products of tropical hardwoods in Europe. It also has important implications for policy measures such as the FLEGT VPA process and the European Timber Regulation – which will increasingly have to accommodate legality verification procedures in more complex global supply chains for value-added products. This analysis highlights both the critical importance of engagement with suppliers in China to ensure effective implementation of these policy measures, and also the importance of ensuring that the legality and sustainability of biomass supply to the energy sector is subject to the same level of scrutiny as the timber sector.

European corporations report second quarter gains in tropical hardwood business

The latest financial reports from Rougier and DLH, two of Europe’s leading tropical hardwood corporations, indicate continuing gains in trade during the second quarter of the year.

Rougier announced €74.1 million in revenues for the first half of 2011, up 9.3% in relation to last year. Building on quarterly gains made in the first quarter of 2011, business remained strong over the second quarter, with revenues coming in at €39.6 million, 5.9% higher than the second quarter of 2010. The Rougier Africa International division recorded €55.6 million in half-year revenues, up 10.8% compared with the first half of 2010. The second quarter of 2011 showed a strong rate of growth(+7.9%) confirming positive trends in demand and sales prices in both the main Western countries, particularly Northern Europe, and certain emerging countries.

Rougier noted that their dynamic commercial performance has been accompanied by the development of certified sales, which accounted for around 33% of log equivalent volumes for Rougier Africa International’s timber production over the first half of 2011. Rougier Africa International’s revenue growth is based on the good level of activities in Cameroon and Congo, with business in Gabon partially affected by shipping delays at Libreville Port.

Rougier’s France Import-Distribution segment recorded €23.1 million in revenues, an increase of 8.0% in relation to the first half of 2010. During the second quarter of 2011, sales remained at a sustained level, even if the period is compared with a high benchmark figure for 2010. Driven by on-going adaptations to the product ranges, the business has benefited from an improvement on the French construction market, as well as the particularly dynamic renovation market.

Rougier reports a continuing shift away from logs towards more value-added in their product mix. Processed products represented 75.8% of sales for the first half of 2011. Growing demand for sawn timber in Asia and certified sawn timber in mature markets allowed Rougier to consolidate the increase in sales prices for the primary African hardwood species compared with the first half of 2010. However plywood and veneer sales were down 11.9% in the first half of 2011 compared with the same period of 2010. This change primarily reflects longer shipping and delivery times from Gabon.

Overall, Rougier comment that “tropical woods from the Congo Basin significantly improved their competitiveness on the world markets during the first half of 2011. Boosted by the development of certification, Rougier’s business has benefited from growing demand on Northern European and North American markets, which are sensitive to environmental issues. Growth is also being encouraged by the highly dynamic development seen in certain emerging markets, particularly in Asia (China, India, Vietnam, etc.), where revenue growth (19.9%) reflects the increase in primary-processed product sales“.

DLH’s financial report for the first six months of 2011 is similarly upbeat, noting that the “results show both absolute and relative improvements to largely all our financial ratios despite an unchanged turnover level on the year“.

In the second quarter of 2011, DLH recorded a net turnover of DKK 849 million against DKK 895 million for the same period last year. DLH note that lower sales in the second quarter were expected because Easter, which traditionally means lower activity levels, fell in April this year. Total turnover for the first half of the year was DKK 1,630 million which is on a par with last year. However, the Group’s overall profitability improved over the half-year. Earnings Before Interest and Tax (EBIT) was DKK 42 million against DKK 39 million last year.

DLH turnover growth was particularly strong in the Nordic countries, up 7.6% in the first half of 2011 compared to the equivalent period in 2010. Turnover and earnings in Western Europe (Netherlands, Belgium, France) and in Poland for the second quarter were consistent with last year.

DLH is currently implementing a strategy to strengthen its long term financial position and focusing on core business areas. The strategy includes amalgamation of a number of inventory and sales functions in Scandinavia and the expansion of DLH’s Asian activities in Hong Kong. Despite greater economic uncertainty in the second half of 2011, DLH said it expected its initial forecasts for a turnover of DKK 3.3 billion and an EBIT of around DKK 60 million in 2011 to be achieved.

Timber Expo – UK’s first dedicated timber industry show

The inaugural Timber Expo designed to bring the UK’s timber trade and industry together for the first time under one roof will take place at the Ricoh Arena in Coventry on the 27 and 28 September 2011. Timber Expo aims to reveal the widest and most comprehensive display of applications for timber within the built environment. It will be the UK’s only dedicated event for the timber industry.

Timber Expo is designed by the timber industry and delivered by the timber industry. It will give everyone involved an opportunity to see and hear about the strengths of timber and understand how it can deliver an effective, more attractive and sustainable built environment

TRADA’s flagship conference In Touch with Timber will run across both days of Timber Expo and will inform about the latest developments across key industry areas. The 2011 sessions will feature several high-calibre speakers discussing why timber is one of the most exciting, flexible and sustainable building materials available.

The Expo also features a series of Timber Talks on responsible timber sourcing and certification, engineering with timber, low carbon timber solutions and solid wood solutions. Of particular relevance to hardwood are presentations by Rupert Oliver on Life Cycle Assessment in the hardwood industry and by Dave Smedley on the first hardwood glulam structure in Malaysia.

More details at http://www.timber-expo.co.uk/

PDF of this article:

Copyright ITTO 2020 – All rights reserved