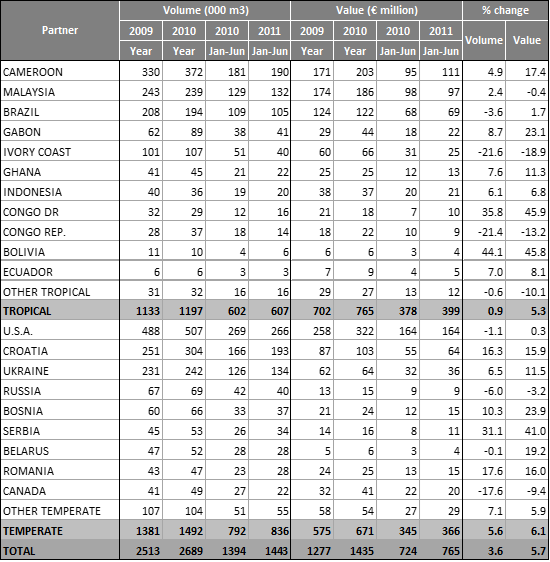

Table 1 shows imports of hardwood lumber into the EU-25 group of countries during the January to June 2011 period. Overall imports are up only slightly compared to the same period in 2010, with most of the growth in temperate hardwood, particularly from the countries of former Yugoslavia. These countries are capable of supplying high quality oak, a timber which has consolidated its hugely dominant position in the European market this year.

During the first six months of 2011, EU imports of tropical hardwood were very similar in volume terms and 5% up in (euro) value terms compared to the same period the previous year. EU imports from Cameroon, Gabon, Ghana, the Democratic Republic of Congo and Bolivia have recovered quite robustly this year. However these gains have been offset by a decline in imports from Ivory Coast, Congo Republic and Brazil. Imports from Malaysia have remained static compared to the previous year.

Table 1: Imports of hardwood lumber into the EU by main supply country

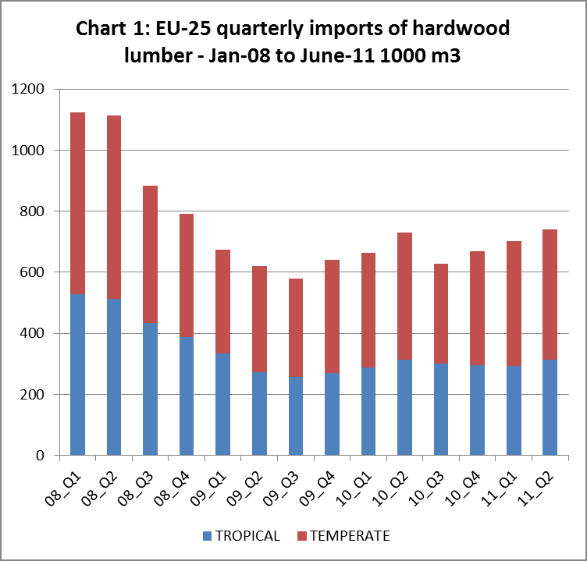

Chart 1 shows quarterly trends in EU imports of hardwood lumber during the last 3 years. Total hardwood lumber imports rose consistently in the 12 months before June 2011, although they still remain well below levels prevailing before the economic crises. Most of the gains over this period have been in temperate hardwoods, of which quarterly imports increased from 327,000 m3 to 427,000 m3. In the year to June 2011, tropical hardwood imports remained flat at around 300,000 m3 each quarter.

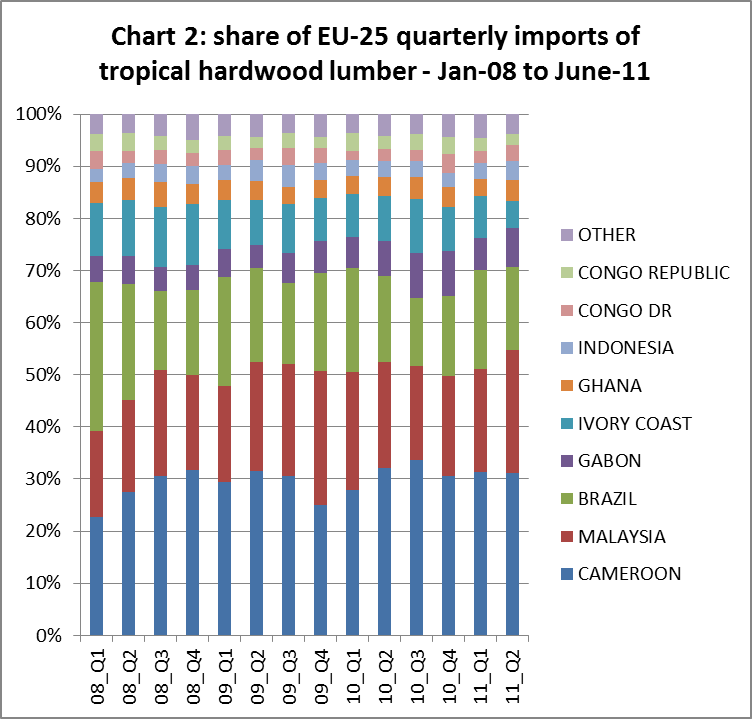

Cameroon consolidates position as dominant supplier to the EU

Chart 2 shows how the share of different countries in total tropical hardwood imports has varied since the start of 2008. Cameroon is now well established as the largest single supplier of tropical sawnwood to Europe, consistently contributing around 30% of all imports. Malaysia’s share has been fluctuating but generally increasing and consistently accounts for around 20% of EU tropical wood supply. Brazil’s share has been decreasing in the EU as more wood is now being diverted to Brazil’s domestic market. However, Brazil continues to account for around 15% of total European tropical sawnwood supply and the country remains an important supplier to the exterior decking market. Political problems have led to Ivory Coast progressively losing share in the European market, from around 10% to 5% in the 12 months to June 2011. Gabon’s share of the European tropical sawnwood market has been rising and now stands at around 7% following inward investment in wood processing and the country’s ban on log exports.

No prospect of any significant upturn in EU demand

Prospects for any significant improvement in European demand for tropical wood during the last quarter of 2011 and in 2012 seem slim. Demand for both African and South East Asian hardwood lumber has barely picked up any pace since the summer slowdown. Meanwhile economic uncertainty is once again mounting across the continent.

The market for African sawn timber in Europe is characterised by cautious buying for main commercial species despite relatively low stocks for the time of year. This is due to a combination of economic uncertainty, continuing tight credit conditions, and nervousness about long lead times when buyers are increasingly demanding quick deliveries. Only a very limited number of importers are in a position to speculate on the purchase of larger volumes to hold in stock.

Overall FOB prices for African sawn timber remain broadly stable, with slow consumption balanced by limited supply. However market conditions vary according to species and specification. There are reports of significant divergence between markets for air dried and kiln dried African sapele lumber in Europe. While stocks air dried lumber is readily available on the ground in Europe and prices are quite low, prices for kiln dried are rising due to shortages of kiln space. Meanwhile lead times for kiln dried material imported from Africa are very lengthy.

UK importers report that framire/idigbo is now much easier to source from Ivory Coast than earlier in the year. However, most large UK importers are now less inclined to purchase from Ivory Coast due to continuing difficulties of obtaining credible documentation to demonstrate legality at source. This is becoming more of an issue as importers are tightening up due diligence systems in preparation for enforcement of the EU Timber Regulation from March 2013.

European landed stocks of iroko are reported to be quite low at present. However there are also reports of weakening prices for onward sales in Europe, implying only slow consumption.

There is now relatively limited availability of sawn lumber in the range of close-grained and fine-textured timber species such as padouk, doussie , and bubinga formerly cut in Europe from Gabonese logs. FOB prices of sawn lumber for these species is now around 20% up compared with the start of 2011.

European purchases of Indonesian bangkirai decking have remained slow due to weakening of the euro against the dollar and limited availability with strong demand in East Asia and Australasia relatively firm prices. These factors have encouraged more importers to look again at Brazilian supplies of decking species such as massaranduba and angelim pedra.

While Malaysian meranti lumber in popular European specifications is available for immediate shipment, demand has been sufficiently slack to encourage some shippers to ease off on dollar prices to offset the rise in the euro value. However, this trend may be short-lived as log prices are expected to rise again in South East Asia.

Modified wood divides opinion

Long lead times for tropical hardwoods, combined with the desire to work from low inventory levels and to reduce financial and perceived environmental risks, continue to encourage some European importers to search for substitutes to tropical hardwoods. The European modified wood industry was out in force again at the recent Timber Expo show in the UK, with some major importers reporting their expectation to gradually phase out tropical woods in favour of these alternatives.

On the other hand, there are indications that the modified wood industry has a way to go before this expectation is realised. At Timber Expo in Coventry there were a few specialist importers willing to make the case for tropical wood over modified wood. One importer of hardwood decking said that modified wood could not yet compete with the technical qualities of the best tropical hardwoods. He suggested that poor application of the thermal treatment process in particular created a very dry product which would then absorb water and discolour and degrade.

The UK’s TTJ also recently reported the difficulties experienced by Indurite, a well-known modified wood brand, to build market share in Europe. Indurite noted that current modified wood prices mean that it is still hard to find clients willing to switch away from established products such as tropical hardwood coming from South America. Prices for modified wood are tending to rise on the back of increased energy and material costs.

Growing fears of double-dip recession in Europe

A recent poll of 70 economists by the news agency Reuters suggests a growing chance the euro-zone economy will slip back into recession as fears rise that the debt crisis will escalate, financial markets slump further and a global slowdown knock growth. The poll undertaken in early October 2011 suggests a 40% chance of a return to recession, up from a 30% in a poll taken just a month earlier and a mere one-in-five in August.

Reuters comment that “leading indicators point to weaker economic conditions. Sentiment surveys have deteriorated across key sectors of the euro zone economy, against a backdrop of unusually high uncertainty and financial market tensions,”

The Reuters poll aligns with the October 2011 Regional Economic Outlook for Europe by the IMF which forecasts that growth for all of Europe will slow from 2.3% in 2011 to 1.8% in 2012.

Economic indicators have weakened particularly dramatically in Southern Europe, including in sectors of considerable relevance to hardwood demand. For example, the latest medium-term forecasts published by the Italian construction industry association ANCE in July 2011 suggest that construction sector investment will decrease by 4% in 2011 (this compares to a decline of 2.4% forecast at the beginning of 2011).

Similarly, the latest data from the Spanish Government (Fomento) indicates that activity in Spain’s devastated construction sector is sliding back into the red. Planning approvals in the first seven months of 2011 (50,209) were 13% down on the same period in 2010. A new report by ICD Research published in September 2011 concludes that growth in the Spanish construction sector will remain extremely slow at around 1% per annum at least until 2015.

However the economic news is not all bad. German consumption figures have been good in recent months. Building activity in Germany has risen well this year. German furniture sector sales have also been increasing, up 7.3% in the first half of 2011. Interior door manufacturers are reporting brisk orders. German flooring manufacturers are expecting sales growth of between 5% and 15% for 2011 as a whole.

PDF of this article:

Copyright ITTO 2011 – All rights reserved