Plywood prices are rising sharply in the EU on the back of buoyant demand across the region and supply issues in a range of key exporting countries. There is also now an increasing tendency to order more just-in-time, little and often to hedge against the risk of the present ‘market bubble’ bursting. That summarises recent feedback from leading European plywood importers and distributors on trade and market trends.

One leading player described market dynamics over the last six months as ‘increasingly tricky’. It had reached the point where, due to constrained supply and competition for what supply there was, the company was now effectively rationing product.

“There’s certainly no need for advertising currently – everything we’re bringing in is already sold,” he said. “In fact, we’re allocating product to a waiting list, with loyal, long-term customers obviously at the front of the queue.”

Adding to market challenges, importers say they have had to become ever more selective in choice of supplier in response to what they describe as increasingly stringent and more uniform application of the EU Timber Regulation (EUTR).

“This and our own increasingly strict corporate social responsibility policy and stress on minimising reputational risk means that, where we previously had 10-15 suppliers, we now have just four or five who we know we can rely on to consistently satisfy our due diligence requirements,” said another importer. “But clearly that potentially exacerbates availability issues when supply is tight generally.”

Significant plywood price rises

Descriptions of price rises resulting from this combination of market pressures range from ‘significant’ to ‘seismic’. A UK importer said in the last six months they’ve seen prices for Malaysian and Chinese tropical plywood increase 25% and 20% respectively, while Brazilian elliottis is up 30%.

A continental European buyer said they’d seen an even steeper hike in the cost of elliottis pine plywood since last June. “Then we were paying $240/245 per m3 fob for standard 20mm C+C, now we’re at $330,” they said.

“We’ve been cushioned to an extent by the weakening of the dollar, which nine months ago was at €1.06 and is now €1.23. But even so, a rise of $80 per cubic meter is a lot to take on board – and if the dollar strengthens, we’ll be in for even stiffer rises. Larger customers with a more global perspective understand the situation and accept they have to pay more, but efforts to pass on at least some of the increases to smaller businesses are meeting with resistance.”

The main driver for EU demand of both tropical and temperate hardwood and coniferous plywood is continuing construction growth across much of the EU, particularly, according to one international importer/trader, in north west European countries where a relatively mild winter has meant the market has remained more active than usual at this time of year.

The latest report from Euroconstruct forecast 2017 construction growth in its 19 focus countries at 3.5%. It added that it was the first time there had been an ‘across the board’ increase in activity in all countries since 1989, and that growth in a basket of construction market measures was at its highest since 2006. The result, say suppliers is healthy demand for everything from shuttering/formwork plywood, to top end structural and exterior grades.

Furthermore, Euroconstruct predicts that the EU building sector will see another 6% expansion by 2020, with civil engineering projects and refurbishment and maintenance sectors taking over from residential and non-residential building in providing most market momentum.

Buoyant EU economy

EU building growth is underpinned by generally buoyant economic performance and this, in turn, says the plywood sector, is fuelling sales rises in other markets, notably packaging and furniture.

Demand in the latter is reported being given added impetus by a design trend to use plywood as the sole manufacturing material, with faces and edges expressed, even unfinished, to reveal its structure and achieve an ‘industrial look’. Birch is the favoured species here, but one leading kitchen maker said they were also exploring the use of darker-faced tropical varieties.

Against this bullish economic backdrop, latest EU plywood import statistics make clear why the market generally is reporting a squeeze on supply. Imports didn’t just fail to keep up with demand last year, they declined.

EU plywood imports down 7% in 2017

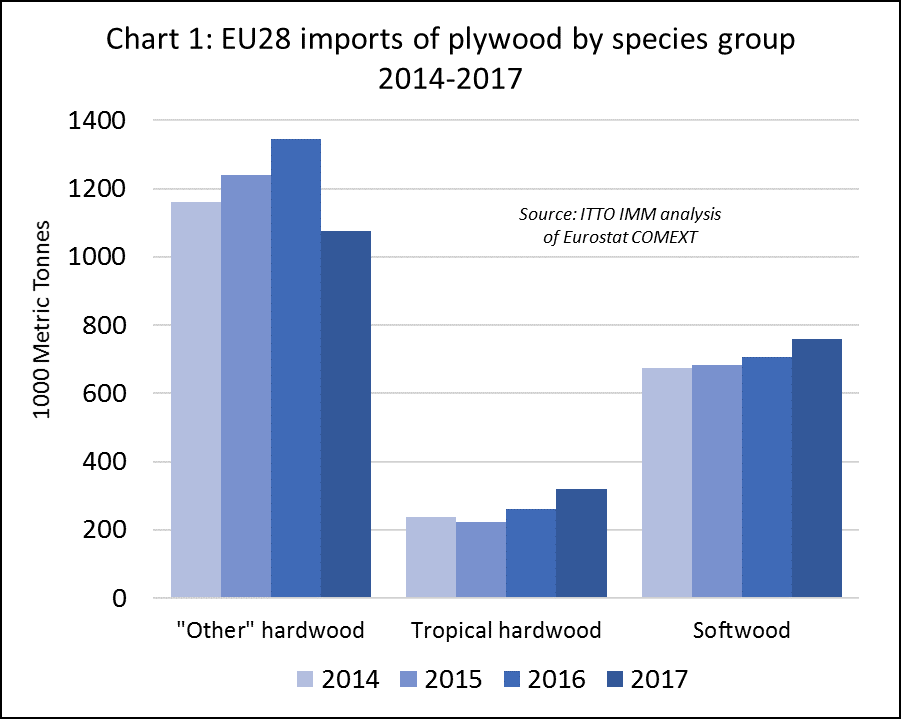

Total EU plywood imports in 2017 were down 7% to 2.159 million metric tonnes (MT). This was due entirely to contraction in the ‘other hardwood’ plywood category, with imports down over 20% from 1.346 million MT to 1.076 million MT. Part of this was likely due to a revision of customs product codes in 2017, which saw a large number of species previously labelled ‘other hardwoods’ now identified as ‘tropical’.

However, this was clearly not the only factor in the downturn, as tropical and softwood plywood imports increased by a combined total of only 115,000 MT in 2017; the former rising from 262,000 MT to 320,000 MT, the latter from 707,000 MT to 760,000 MT. (Chart 1)

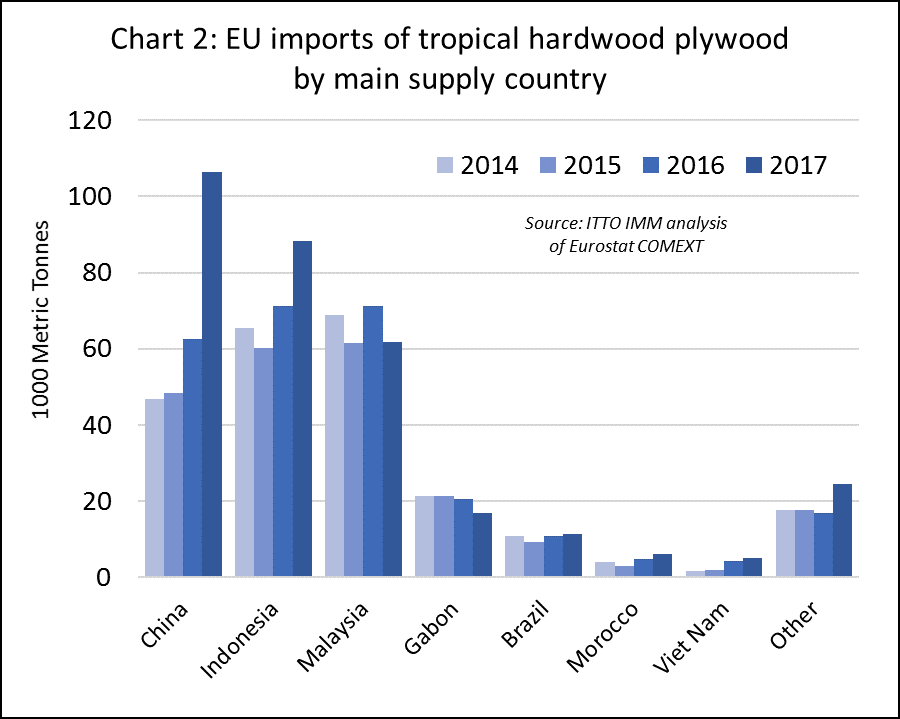

Overtaking both Indonesia and Malaysia as the largest supplier of tropical hardwood to the EU was China, with imports up 44,000 MT to 106,000 MT in 2017. This is almost entirely due to the HS product code reclassification, as Chinese ‘mixed red hardwood’ plywood was most affected.

EU imports of Indonesian plywood were ahead 24% in 2017, rising from 71,000 MT to 88,000 MT, while imports of Malaysian plywood dipped 15% from 71,000 MT to 62,000 MT, and imports of Gabon plywood fell 19% from 21,000 MT to 17,000 MT. (Chart 2).

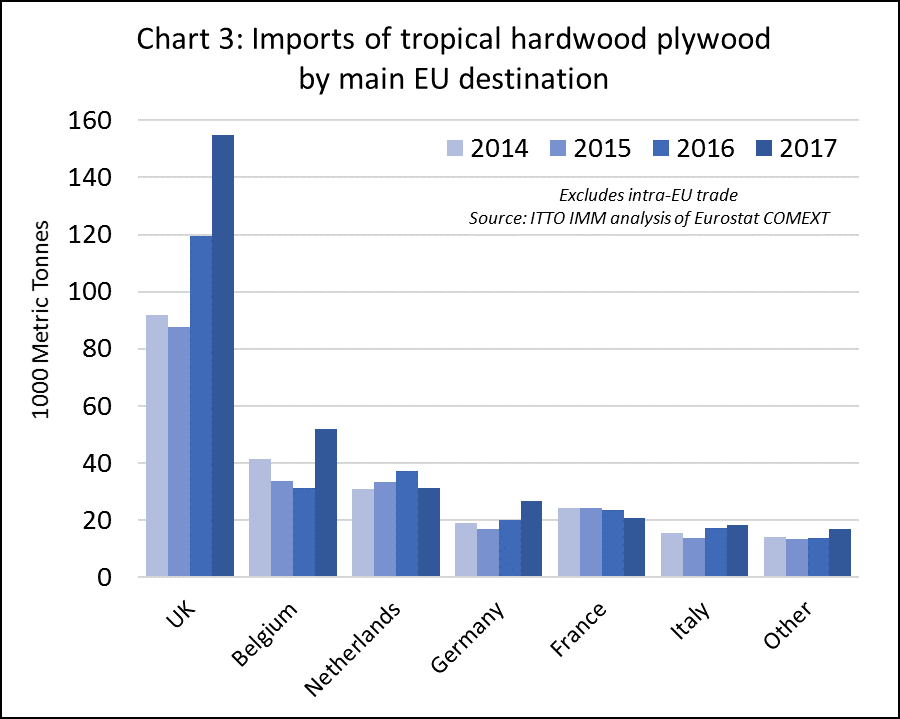

The largest EU tropical plywood importer in 2017 remained the UK, which increased its purchases by 29% from 120,000 MT to 155,000 MT. Belgium became the second biggest, with imports rising 21,000 MT to 52,000 MT, taking over from the Netherlands where imports fell 6,000 MT to 31,000 MT. Germany also saw an increase of 35% to 27,000 MT in 2017. (Chart 3).

FLEGT licensing and plywood demand

The extent to which the start of FLEGT licensing in November 2016 played a part in Indonesia’s EU export growth last year is a matter of debate, but the consensus amongst importers seems to be that it was one of several factors and it is now becoming more important.

One importer said the availability of third-party quality assured marine plywood from Indonesian producers was more of a factor in their increased imports. But another said they had “switched sourcing to Indonesia to a degree” due to the availability of FLEGT licensed material and the savings in administrative time and cost on EUTR due diligence involved.

Meanwhile, a Belgian importer distributor saw a FLEGT licence becoming an increasingly valuable reputational guarantee. He suggested that EUTR monitoring and enforcement activity are growing, led by the national competent authorities (CAs) of Germany, the UK, Netherlands and Denmark, and to a degree France, and with others just beginning to step up capacity to undertake more checks, including in Belgium.

This importer also suggested that there’s now greater operational collaboration and intelligence sharing between CAs. “It’s got to the point where companies like ours are adopting a zero-tolerance policy on risk of any illegal material entering our supply chain. If we have any doubts about a supplier, species or source of supply, we won’t use them”, he said.

He went on, “in that context a product backed by a FLEGT licence as proof of legality clearly is set to become an increasingly attractive option.”

Multiple plywood supply constraints

EU plywood importers suggest that recent trends in imports have been driven as much by supply side issues as by changes in European consumption. Supply constraints have been mounting in the last six months.

According to one importer, the severe rainy season in Indonesia was an important factor limiting supply of tropical hardwood plywood last year. Harvesting was impacted and mills were running increasingly short of raw material. “Indonesia may have increased its exports to the EU overall last year, but more recently we’ve been getting as little as 50% of normal deliveries,” said the company. “Many mills must be losing money and some have gone on to short-time, or mothballed production.”

This importer was hoping that the rainy season will finish, as normal, end of March. “But last year that didn’t happen,” said another importer. “Some feel it’s another possible sign of climate change. It maybe we’re facing more unpredictable weather patterns generally and our industry will just have to adapt.”

Chinese environmental regulation reduces plywood supply

EU plywood importers also report that production output of their Chinese suppliers is being affected by tough new environmental and health and safety regulations. This has forced Chinese producers to invest heavily in new production and pollution control technology. Some have cut or even stopped output while installation work goes on.

“The new rules are also driving many of the small-scale, family-run, rotary cut veneer plywood manufacturers out of business,” said an importer. “They principally served the domestic market, so now domestic customers are also turning to the bigger export producers, adding another supply pressure.” He added that, combined with the rise in the value of the RMB against the dollar, the result was Chinese producers looking for higher prices.

It’s generally agreed that the main pressure on elliotis supply has been rising global demand. Brazilian mills last year were reported to have topped 2 million m3 in output last year, but EU importers say their US counterparts have been buying particularly heavily, and demand elsewhere in the region has also risen, including in Mexico and Caribbean markets. “Add in freight rate rises, and that’s why elliotis has become an increasingly costly commodity,” said one EU importer.

Weather is cited as a factor in recent Russian supply trends. A slow start to the winter, is reported to have delayed harvesting, leading to a backlog of orders. “Now mills are sold quite well ahead, with order books full for March and April,” said an EU importer. “We anticipate a price uptick as a result.”

Signs of overheating in the plywood sector

For the immediate future, the EU plywood sector sees little change in trading conditions. Further ahead, however, the picture is less certain. “There are now signs of the market overheating, and at some point there will be a correction,” said an importer distributor. “I don’t see it in the next six months. But, if US buyers exit the Brazilian market, as we’ve seen happen before, our other leading global suppliers raise output and demand comes off current levels, we could be looking at a very different market scenario from the fall onwards. Leading up to this point I think we’re already seeing more cautious, hand to mouth purchasing so companies aren’t over-exposed.”

EU associations push for higher plywood quality standards

Timber trade associations in two leading EU importing countries have recently been pushing forward plywood quality, performance and legality initiatives.

In the UK, the Timber Trade Federation (TTF) has undertaken a Plywood Review over the last 18 months. This is in response to concerns over import of products, mainly from China, that the TTF claim do not meet key EU/UK legal compliance legislation. That included products classified as high risk under the EUTR not being adequately risk mitigated through tropical veneer species testing. The initiative was also in response to insufficient glue-bond testing being undertaken, notably in EN.314 Class 2 product, to be able to draw up a Declaration of Performance (DoP).

The TTF has liaised with Chinese trade associations on these issues and produced recommendations for members. These include; for EUTR compliance, to implement regular plywood species testing from high-risk suppliers; to provide clear species marking on packs; and to ensure suppliers operate documented Factory Production Control (FPC) in compliance with the EU Construction Products Regulation.

The TTF said the review is ongoing and will be subject to more discussion and actions in coming weeks.

In Germany, GD Holz has been continuing to develop its Plywood Quality Initiative (Initiative Qualitäts Sperrholz /IQS). With five member importers, and aims to include more, the focus is on ‘ensuring correct description of all product characteristics and properties’. The companies are obliged to ensure suppliers meet national product codes and to include all relevant product technical details and descriptions with deliveries.

Recently GD Holz has issued a leaflet to inform members’ customers what to expect from an IQS supplier and a brochure detailing softwood and hardwood plywood production codes of Brazil (ABNT), Russia (GOST), Finland (SFS) and the EU (DIN-EN).

Currently IQS is concentrated on technical issues, but it intends eventually to add legality and sustainability to its remit.

PDF of this article:

Copyright ITTO 2020 – All rights reserved