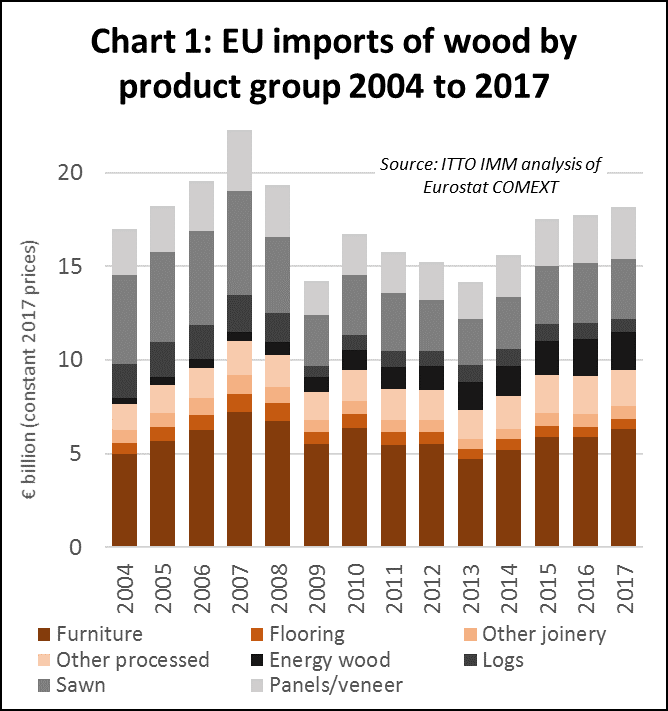

The total value of EU imports of wood products was Euro 18.17 billion in 2017, 2.4% more than in 2016. This followed an increase of 1.3% to Euro 17.74 billion in 2016. In 2017 EU import value was at the highest level since 2008 just before the global financial crises (Chart 1).

Imports into the EU were boosted in 2017 by stronger economic growth. According to Eurostat, the EU economy grew at its fastest rate in 10 years in 2017, registering a 2.5% increase on the year before. That is the highest annual growth since 2007, when the economy expanded by 2.7%. The bloc of 28 countries put in a strong performance in the final quarter of the year, growing 0.6%, mainly driven by good economic results from Germany, Spain and France.

Good economic growth fed through into a rise in the value of the Euro last year, which strengthened against the U.S. dollar by around 15% during 2017. For importers in the eurozone, this helped offset the general rise in global prices for timber products resulting from strong demand in other regions including China, North America and the Middle East.

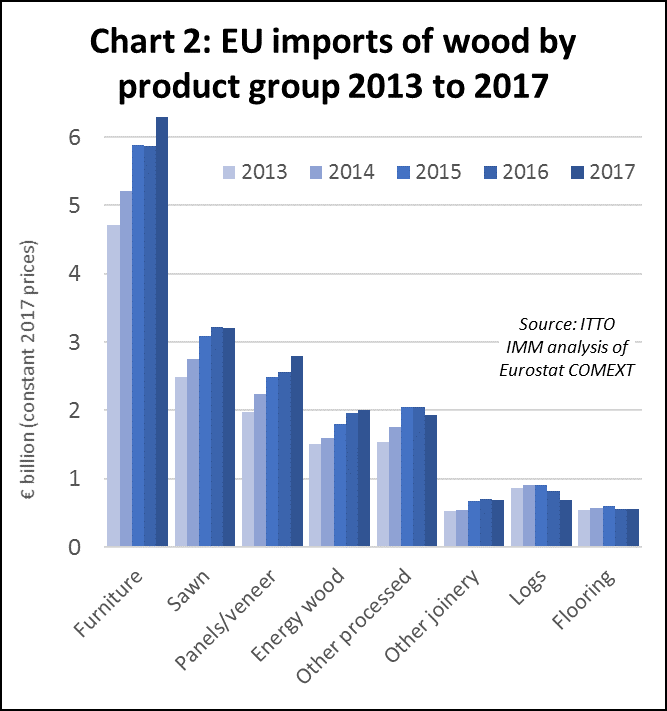

Considering individual products (Chart 2), the value of EU imports of wood furniture increased by 7.3% to Euro 6.29 billion in 2017 after a slight dip in 2016. EU imports of wood furniture increased from all the main supply regions last year, including China and South East Asia. However, the strongest growth in EU furniture imports in 2017 was from European countries outside the EU. This forms part of general trend of increasing EU dependence on wood furniture manufactured in central and Eastern Europe.

The value EU imports of sawn wood (including both softwood and hardwood) was unchanged in 2017, at Euro 3.2 billion, ending the rising trend which began in 2013. There was a particularly significant 21% decline in the value of EU sawn wood imports from Africa in 2017 which offset a 12% rise in imports from the CIS countries. EU imports of sawn wood from Russia and other CIS countries continue to benefit from the relative weakness of currencies in the region.

EU imports of panels (mainly plywood) increased 9% to Euro 2.79 billion in 2017. This follows a 3% rise in 2016 and an 11% increase in 2015. Most of this gain was due to a rise in plywood imports from Russia and other Eastern European countries. The value of EU plywood imports from China and tropical countries was generally stable or declining in 2017.

The long-term rise in EU imports of energy wood continued in 2017 with annual import value exceeding Euro 2.01 billion for the first time. This was only 3% more than in 2016, a slower pace of increase compared to average annual growth of 11% in the previous five years. EU imports of energy wood (now dominated by pellets) increased sharply from the CIS region last year. Imports from the US, still by far the largest external supplier to the EU, were stable in 2017.

Following a 22% increase in 2015 and 4% increase in 2016, EU imports of other joinery products (mainly doors and laminated wood for window frames) declined 1% to Euro 690 million in 2017. Imports of joinery products from Russia and Ukraine continued to rise last year, while imports from the tropics and China lost ground (although China is still the single largest external supplier).

EU imports of wood flooring were stable at Euro 550 million in 2017, after falling back 9% in 2016. Flooring imports from China, by far the largest external supplier, were flat in 2017, while imports from the CIS region increased 12%, helping to offset a decline in imports from South East Asia and South America.

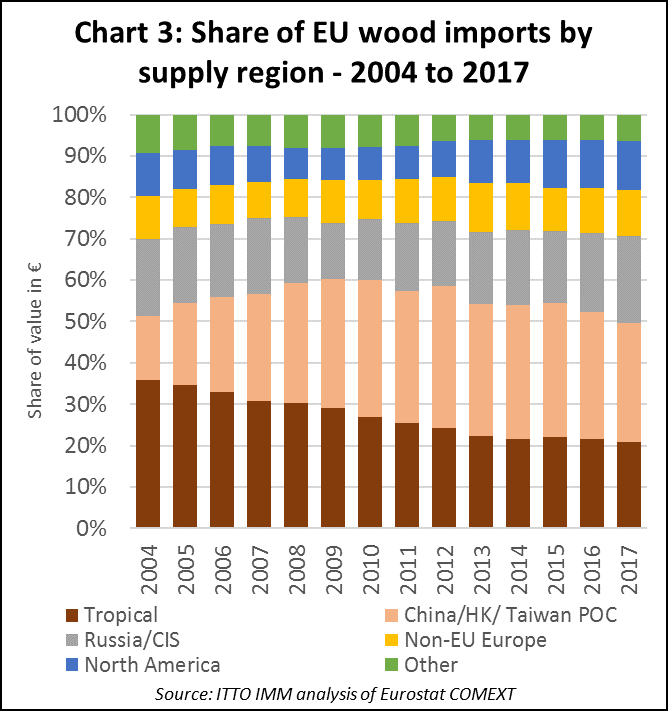

The value of EU imports of wood products from tropical countries decreased 1.8% to Euro 3.78 billion in 2017. This follows a 1% fall the previous year. The share of tropical countries in the total value of EU wood product imports declined from 22% in 2016 to 21% in 2017. This is a resumption of a long- term trend in declining share of tropical countries in total EU imports after a brief rebound in 2015 (Chart 3).

China’s share in total EU imports of wood products fell from 30.5% in 2015 to 28.9% last year, the lowest level since 2008. Meanwhile the share of Russia and other CIS countries increased from 19.3% to 21.1%. In 2017, there was a slight increase in share of EU imports from non-EU European countries (from 10.9% to 11%) and North America (from 11.5% to 11.7%).

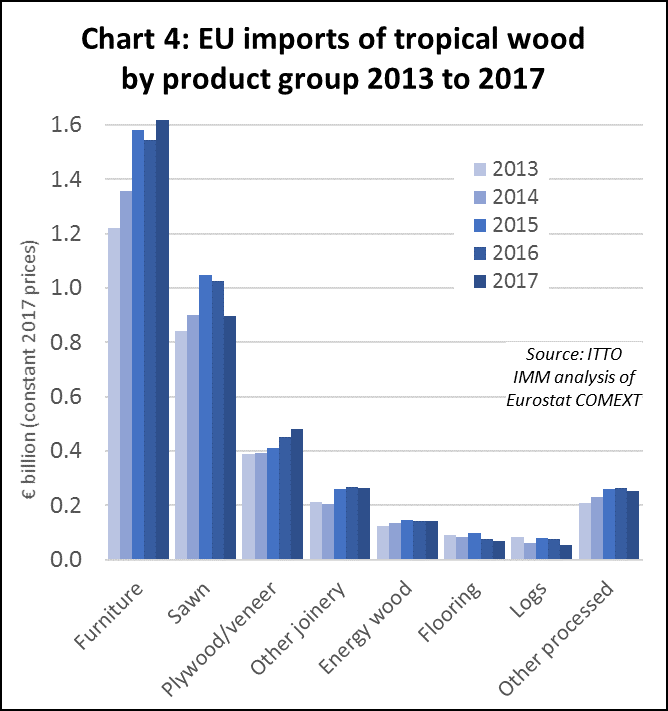

The slight decline in the total value of EU wood product imports from the tropics in 2017 hides variations between products groups (Chart 4). Last year, there was a sharp 13% decline in EU imports of sawn wood from tropical countries, from Euro 1026 million to Euro 896 million. There was also a continuing decline in EU imports of tropical flooring, by 12% to Euro 68 million, and tropical logs, by 29% to Euro 53 million.

However, these declines were offset by rising EU imports of tropical furniture, up 5% to Euro 1.62 billion, panels (mainly plywood), up 7% to Euro 480 million, and energy wood (notably charcoal), up 2% to Euro 143 million.

EU wood products exports at record level in 2017

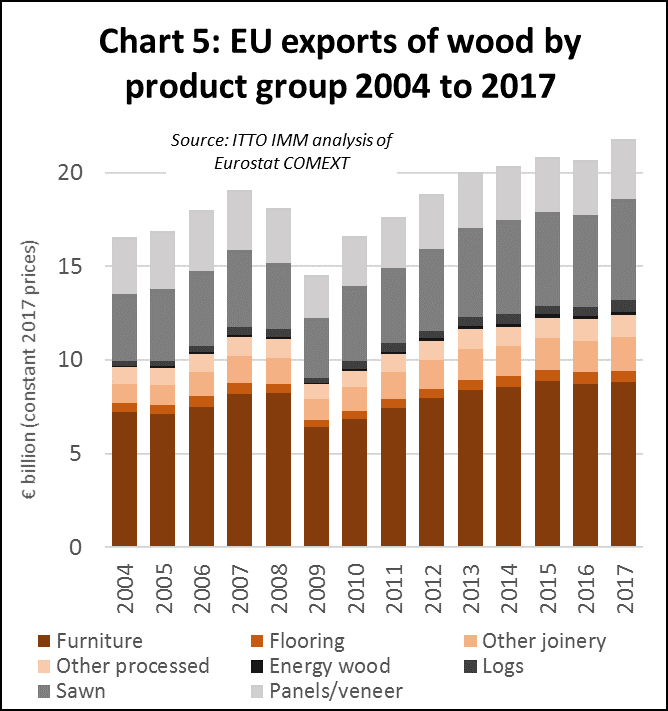

In 2017, the EU exported wood products with a total value of Euro 21.8 billion, 5% more than in 2016 and overtaking the previous record level of Euro 20.51 billion in 2015 (Chart 5). The EU increased exports of a wide range of wood products last year, but there was particularly strong growth in sawnwood, logs, energy wood, and panels. The increased exports were mainly destined for North America, China and other Asian countries.

Last year, the rate of EU export growth exceeded the rate of import growth, resulting in an increase in the EU’s timber product trade surplus with the rest of the world, from Euro 2.97 billion in 2016 to Euro 3.62 billion in 2017.

Brexit to significantly impact EU trade balance

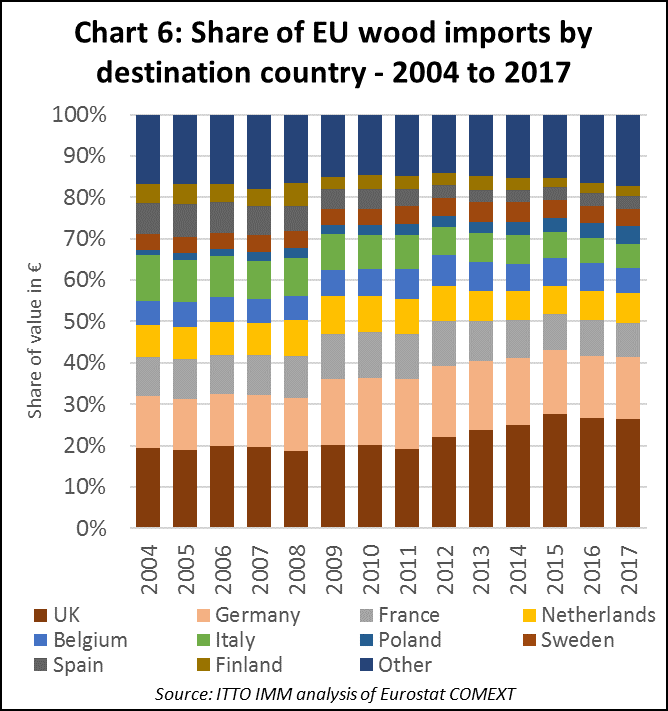

Looking to the future, the EU trade data highlights the extent to which Brexit will impact on the EU trade balance. The UK is consistently the largest EU importer of timber products from outside the bloc, due partly to the country’s limited domestic forest resources, partly to the UK’s coastal position and traditional trade links with many countries in other parts of the world, and partly to the UK’s relatively concentrated timber distribution and retailing sectors which has been more accessible to external suppliers, particularly in China and Asia.

The UK’s share of total EU imports of timber products from outside the bloc increased sharply from 19% in 2011 to 28% in 2015. The UK’s share of total EU timber product imports declined slightly in 2016 and 2017, but only to a little under 27% (Chart 6).

During this time the UK was recovering from the financial crises, driving a strong increase in imports from outside the EU, particularly wood furniture and plywood from China, and wood furniture from Vietnam. There was also a big increase in UK imports of wood pellets during this period, mainly from the U.S., driven by the UK’s climate change commitments which encouraged some large energy suppliers to switch from coal to biomass.

Without the UK, in terms of global trade, the EU becomes more relevant as an exporter, and less relevant as an importer of timber products. This is because the UK is not only a large importer of timber products from outside the EU, but also a large importer from other EU countries, and only a small exporter to all parts of the world.

In 2017, the value of the timber trade surplus of the EU excluding the UK was Euro 12.69 billion, more than three times the Euro 3.62 billion surplus with the UK included. Last year the EU27 (i.e. excluding the UK) imported Euro 13.91 billion (compared to Euro 18.17 billion for the EU28) and exported Euro 26.60 billion (compared to 21.79 Euro for the EU28).

UK pledges to retain FLEGT commitment after Brexit

In relation to policy initiatives like FLEGT, the decline in the relative significance of the EU as an importer of timber products after Brexit will be mitigated by the commitment of the UK government and timber trade to continue to support the VPA process and EUTR.

Speaking at a meeting organized by the UK Confederation of Timber Industries in February, Therese Coffey, parliamentary under-secretary of state at the Department for Environment, Food and Rural Affairs (DEFRA), stated that: “When the UK leaves the EU, the Withdrawal Bill will make sure the whole body of European environmental law continues to have effect in UK law. That [includes] two regulations that the UK timber sector played a great role in shaping: the European Union Timber Regulation and the Forest Law Environment Governance and Trade Regulation.

She went on to state that: “We are committed to supporting sustainable and legal timber and forest industries and recognize the value of the EUTR and the EU FLEGT initiative in assuring this.”

This was believed to be the first time that a UK minister had made a definitive statement of this kind and was welcomed by the audience of forestry and timber sector representatives and leading businesses.

“The UK timber sector was at the forefront in the development of the EUTR and the EU FLEGT initiative and the vast majority of our members support their retention post-Brexit,” said David Hopkins, UK TTF Managing Director, and Director of the CTI. “The EUTR is a business friendly, flexible regulation to ensure goods are sourced responsibly, protecting the environment AND business reputation. Abandoning the regulation [and support for the EU FLEGT initiative] now would cause unnecessary upheaval and market confusion. I would like to thank the Minister for this commitment and giving us the certainty our sector needs.”

PDF of this article:

Copyright ITTO 2020 – All rights reserved