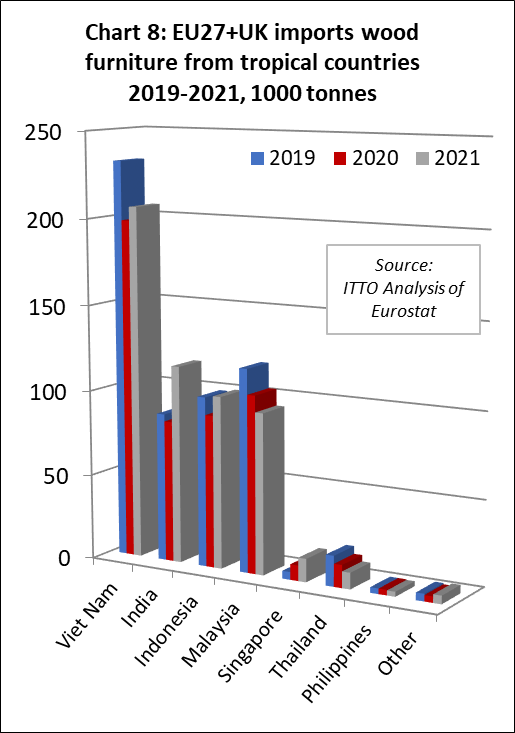

In 2021, the EU27+UK imported 2.22 million tonnes of tropical wood and wood furniture with a total value of USD4.93 billion, a gain of 8% and 27% respectively in quantity and value terms. Compared to the pre-pandemic level of imports in 2019, imports last year were up 12% in value terms but still down 6% in quantity terms.

Chart 1 showing EU27+UK trade trends for the period 2004 to 2001 puts last year’s trade figures into long term perspective. The only other increase in tropical wood import value comparable to 2021 occurred in 2007, the last year of the bubble economy driven by abundant liquidity and the real estate boom which immediately preceded the financial crash of 2008-2009. However, unlike in 2007, the actual quantity of imports last year was in line with the long term average – which has remained static at around 2.2 million tonnes for the last decade.

The increase in trade value last year was driven mainly by the sharp increase in prices. The average unit price of all EU27+UK tropical wood furniture imports increased by 17% from USD1900 per tonne to USD2220 per tonne. This occurred as severe supply shortages and a big rise in freight rates coincided with the short-term surge in demand due to higher refurbishment activity during COVID lockdowns was further boosted last year by COVID-recovery stimulus measures.

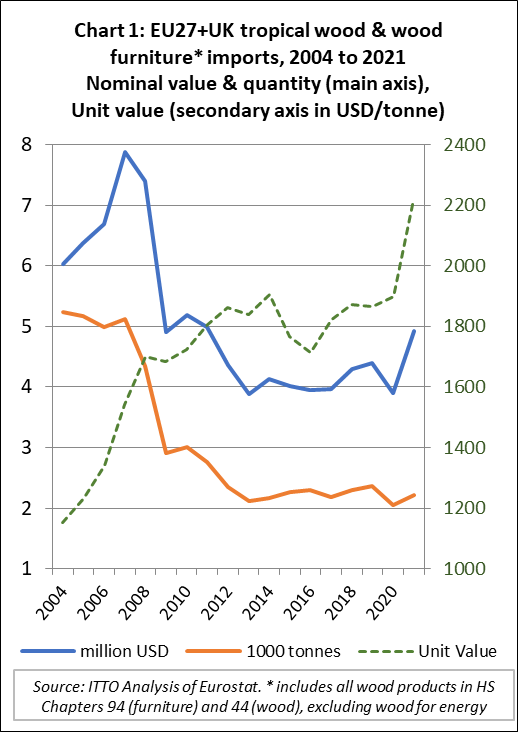

EU27+UK imports of tropical sawnwood down on pre-COVID level

EU27+UK import value of tropical sawnwood was US$806 million in 2021, up 14% on 2021 but down 1% compared to 2019 before the pandemic. In quantity terms, imports of 930,200 cu.m in 2021 were 11% higher than in 2020 but down 6% compared to 2019.

Average unit value of EU27+UK tropical sawnwood imports was USD867 per cu.m in 2021. This was only a slight increase compared to USD842 per cu.m in 2020, a reflection of European importers heavy reliance on tropical sawnwood from Africa for which prices increased less dramatically during the pandemic than in other parts of the world. The share of EU27+UK imports of tropical sawnwood from African countries increased in 2021, mainly at the expense of Brazil and Malaysia.

Imports of 351,200 cu.m from Cameroon in 2021 were 16% higher than in 2020 but 1% less than in 2019. For Gabon, imports were 138,700 cu.m in 2021, up 35% on 2020 and 22% on 2019. Imports from Congo were 69,300 cu.m in 2021, 29% more than the previous year but still down 9% compared to the pre-pandemic level in 2019. Imports from Côte d’Ivoire were 31,300 cu.m in 2021, up 8% compared to 2020 but down 20% on 2019. Imports from Ghana were 27,200 cu.m in 2021, a gain of 31% compared to 2020 and 2% up on 2019.

While EU27+UK imports of tropical sawnwood from African countries recovered ground last year, imports from Brazil and Malaysia continued to slide. Imports of 121,200 cu.m in 2021 from Brazil were 6% less than in 2020 and 20% down on 2019. For Malaysia, imports of 91,400 cu.m were 13% less than the previous year and 23% down compared to 2019 (Chart 2).

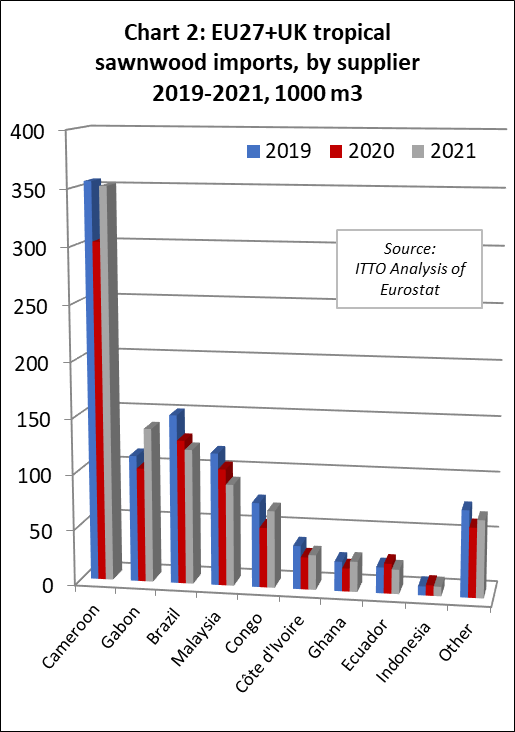

Switch from Brazil to Indonesia in EU27+UK decking imports

EU27+UK import value of tropical decking/mouldings was US$350 million in 2021, up 25% and 6% compared to 2020 and 2019 respectively. In quantity terms, imports of 190,100 tonnes in 2021 were 7% higher than in 2020 but down 2% compared to 2019. Average unit value of EU27+UK tropical mouldings/decking imports was USD1840 per tonne in 2021, a 17% increase compared to USD1570 per tonne the previous year. The sharp increase in unit value is indicative of significant supply shortfalls and rising freight rates at a time when demand was booming in Europe.

As for sawnwood, imports of decking/mouldings from both Brazil and Malaysia continued to slide in 2021. Imports from Brazil, at 68,300 tonnes, were 10% less than in 2020 and 16% less the pre-pandemic level in 2019. Imports from Malaysia were 8,700 tonnes, down 12% compared to 2020 and 28% less than in 2019.

In contrast, and despite widespread reports of supply shortages for Indonesian bangkirai decking, imports of mouldings/decking from Indonesia were 69,500 tonnes in 2021, 16% more than the previous year and 10% up on 2019. Imports of mouldings/decking from Peru were 14,300 tonnes last year, 48% more than in 2020 and 31% up on 2019. Imports from Gabon were 9,500 tonnes in 2021, 65% and 25% more than in 2020 and 2019 respectively. (Chart 3).

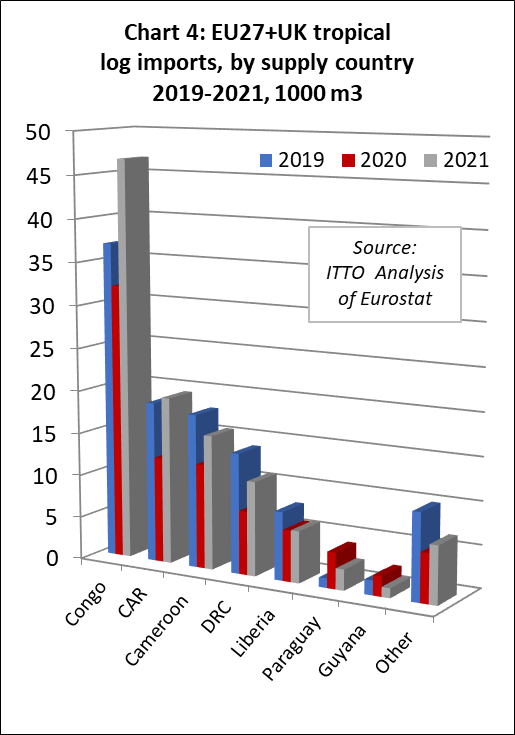

Rebound in EU27+UK log imports from Congo

EU27+UK import value of tropical logs was US$60 million in 2021, 43% more than in 2020 and a gain of 10% compared to 2019. In quantity terms, imports of 109,300 cu.m were 33% more than in 2020 but only 1% compared to 2019. Unit value increased from USD506 per cu.m in 2020 to 546 per cu.m last year.

Imports of 46,700 cu.m from Congo, now by far the largest supplier of tropical logs to the European region, were 46% and 27% more than in 2020 and 2019 respectively. EU27+UK log imports from CAR also recovered significant ground last year, at 19.500 cu.m, 58% more than in 2020 and 4% up on 2019. Imports from DRC were 11,000 cu.m last year, 49% more than in 2020 but still down 21% compared to 2019. Imports from Liberia increased 2% to 6,000 cu.m in 2021 but still trailed the 2019 level by 24% (Chart 4).

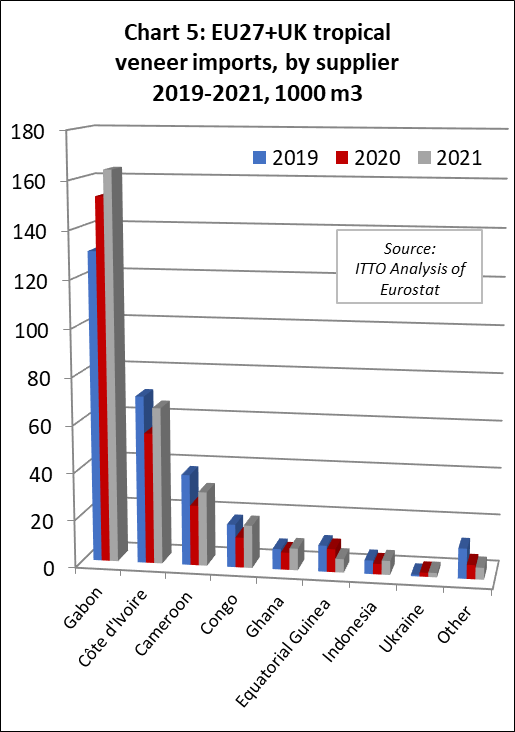

Gabon more dominant in EU27+UK imports of tropical veneer

EU27+UK import value of tropical veneer was US$208 million in 2021, 18% more than in 2020 and a 6% gain compared to 2019. In quantity terms, imports were 306,600 cu.m in 2021, a gain of 11% compared to 2020 and 4% compared to 2019. Unit value of veneer imports was USD680 per cu.m in 2021, 6% more than in 2020.

EU27+UK tropical veneer imports are almost exclusively derived from Africa, with Gabon by far the largest supplier. Imports from Gabon were 163,700 cu.m in 2021, 7% more than in 2020 and 25% more than in 2019. At 66,000 cu.m, veneer imports from Côte d’Ivoire were 20% more than in 2020 but still down 7% compared to 2019. Imports of 31,300 cu.m from Cameroon were 23% more than in 2020 but 18% less than in 2019. Veneer imports from Congo were 18,000 cu.m in 2021, 41% more than in 2020 and exactly matching the 2019 level. Imports from Equatorial Guinea were 5,700 cu.m in 2021, 41% down compared to 2020 and 48% less than in 2019 (Chart 5).

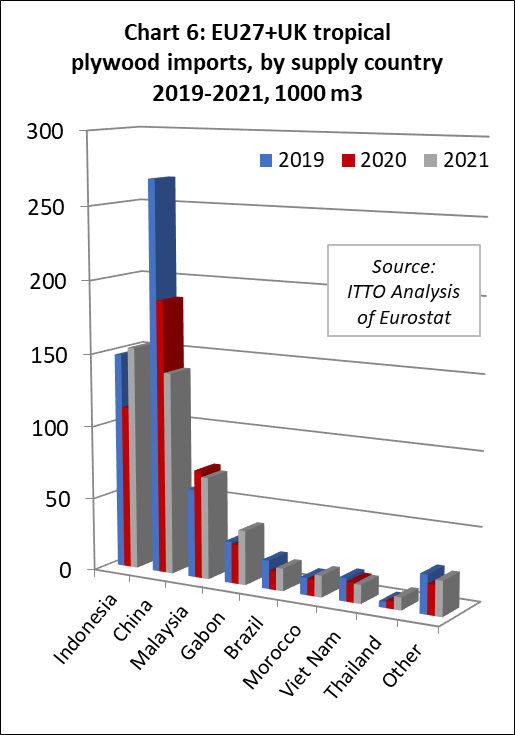

Indonesia overtakes China as largest tropical plywood supplier to EU27+UK

EU27+UK import value of tropical plywood was US$312 million in 2021, up 31% compared to 2020 but only just matching the 2019 level. In volume terms, imports of 474,600 cu.m in 2021 were 3% up compared to 2020 but 18% down compared to 2019. Unit value of tropical plywood imported into the EU27+UK last year was USD658 per cu.m, 27% more than the previous.

In addition to the sharp rise in freight rates and generally higher international prices for plywood, the increase in unit value is also due to a significant shift in the balance of EU27+UK imports away from cheaper Chinese product towards higher value products, particularly from Indonesia, Gabon and Morocco.

EU27+UK imports of tropical hardwood faced plywood from China were 138,500 cu.m in 2021, 26% less than in 2020 and 48% down compared to 2019. Meanwhile, imports from Indonesia increased to such an extent that the country overtook China as the largest supplier of tropical plywood into the region. EU27+UK imports from Indonesia were 153,400 cu.m in 2021, 37% more than in 2020 and a gain of 4% compared to 2019. In contrast imports from Malaysia lost ground in 2021, falling 6% to 70,000 m3, after rising 23% the previous year despite logistical problems created by the pandemic.

There were positive trends in EU27+UK imports of tropical hardwood plywood from Gabon, Morocco and Thailand in 2021. Imports from Gabon were 37,300 cu.m during the year, 39% and 32% more than in 2020 and 2019 respectively. Imports from Morocco were 14,800 cu.m, 32% and 26% more than in 2020 and 2019 respectively. Imports of plywood from Thailand were 8,600 cu.m last year, 65% more than in 2020 and more than double the 2019 level.

EU27+UK imports of tropical hardwood plywood from Brazil were 15,400 cu.m last year, a gain of 23% compared to 2020 but still down 20% compared to 2019 (Chart 10).

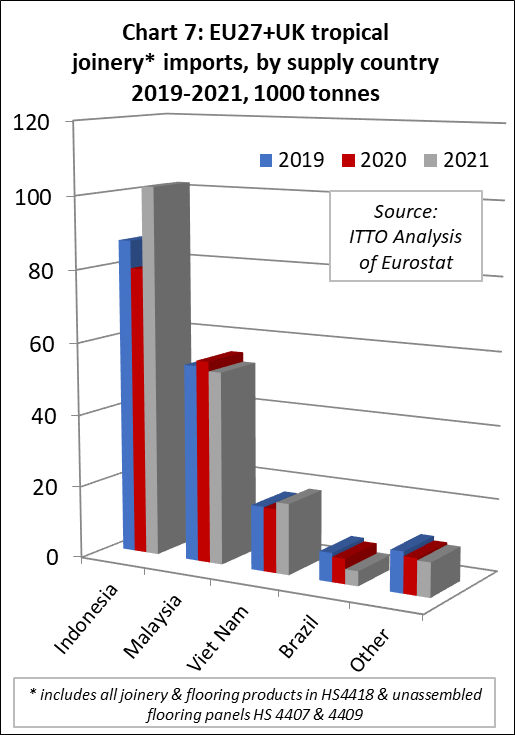

Indonesia extends lead in EU27+UK imports of tropical joinery products

The value of EU27+UK imports of joinery products from tropical countries – mainly comprising wood doors, laminated window scantlings and kitchen tops, and flooring components – increased 32% to US$510 million in 2021. Import value was also up 24% compared to the pre-pandemic level in 2019. In quantity terms, imports of 188,300 tonnes in 2021 were 11% more than the previous year and up 6% compared to 2019. Unit value of tropical joinery imports was USD2710 per tonne, 20% more than USD2270 per tonne the previous year.

By far the largest gains in the European market for tropical joinery products were made by Indonesia last year. The EU27+UK imported 102,000 tonnes of joinery products from Indonesia in 2021, 28% more than the previous year and 17% up compared to 2019. Imports from Viet Nam also made gains last year, at 19,600 tonnes, 11% more than in 2020 and 10% up on 2019. This contrasts with Malaysia, for which imports of 53,100 tonnes were 5% less than in 2020 and down 2% compared to the 2019 level. Imports from Brazil fell even more dramatically, at only 4,100 tonnes in 2021, down 41% compared to the previous year and 48% less than in 2019 (Chart 7).

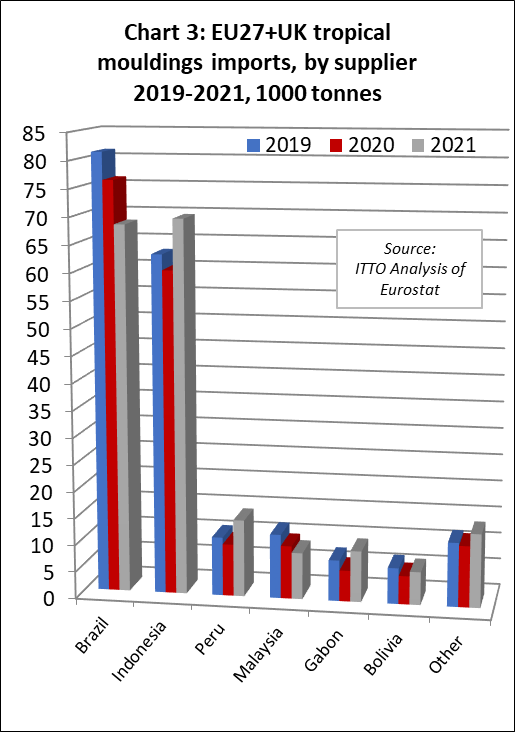

Rising EU27 wood furniture imports from Vietnam, Indonesia, and India

EU27+UK import value of wood furniture from tropical countries was US$2.32 billion in 2021, 33% and 21% higher than in 2020 and 2019 respectively. For all three leading tropical supply countries of wood furniture to the EU27+UK – Vietnam, Indonesia, and India – import value in 2021 was significantly higher even than in 2019 before the pandemic.

However, the rise in value was due more to rising prices and freight costs than to an increase in the quantity of furniture being traded. In tonnage terms, EU27+UK imports of wood furniture from tropical countries increased only 9% to 548,200 tonnes. Import quantity last year was still 3% down compared to the pre-pandemic level in 2019. The unit value of wood furniture imported into the EU27+UK was USD4224 per tonne in 2021, 22% more than the previous year.

In 2021, the EU27+UK imported 206,300 tonnes of wood furniture from Vietnam with a total value of USD928 million, respectively 4% and 24% more than the previous year. Imports from India were 115,800 tonnes with a total value of USD450 million in 2021, respectively 40% and 61% more than the previous year. Imports from Indonesia last year were 100,800 tonnes with a total value of USD537 million, 13% and 46% more than in 2020. For Malaysian wood furniture, import quantity declined 9% to 94,200 tonnes while value increased 9% to USD241 million in 2021 (Chart 8).