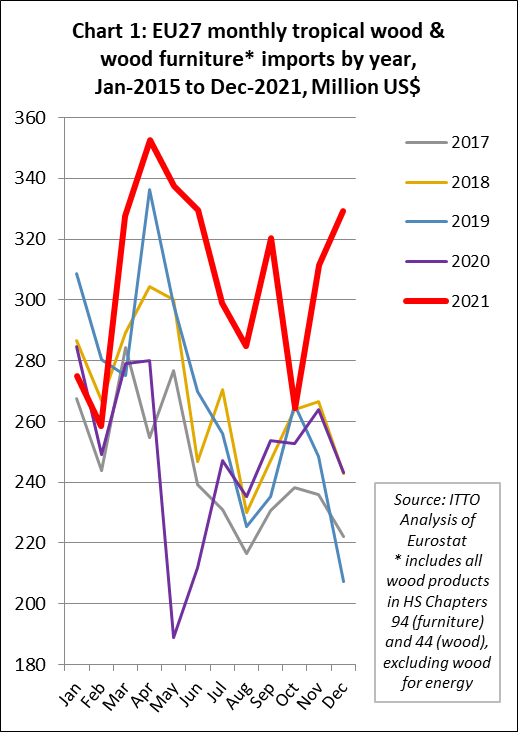

EU27 import value of wood and wood furniture products from tropical countries was USD3.69 billion in 2021, a gain of 23% compared to the previous year and 15% more than the pre-pandemic level in 2019. Imports finished the year strongly, the USD value of trade in November and December being at the highest level recorded for these two months for over a decade (Chart 1).

The 23% increase in EU27 import value from the tropics in 2021 was not mirrored by an equivalent increase in import quantity. In quantity terms, imports from tropical countries period were 1.76 million tonnes in 2021, only 7% more than in 2020 and still 4% down compared to 2019.

A large part of the gain in import value of tropical products was due to a significant rise in CIF prices, partly driven by rising freight rates which were at unprecedented levels in 2021. The Drewry World Container Index shows that global rates for a 40 foot container peaked at US$10400 in the middle of September 2021 compared to US$2000 in the same month in 2020. The index fell to $9200 by the beginning of November 2021 but has remained static at this higher level for the last four months.

FOB prices for tropical wood products were also driven up during 2021 in response to the sharp increase in global demand at a time when supplies were scarce and tropical producers continued to operate under extremely challenging conditions during the pandemic. This in turn encouraged European importers to buy larger quantities from more accessible suppliers in the European neighbourhood and a continued loss of market share for tropical suppliers in the EU market.

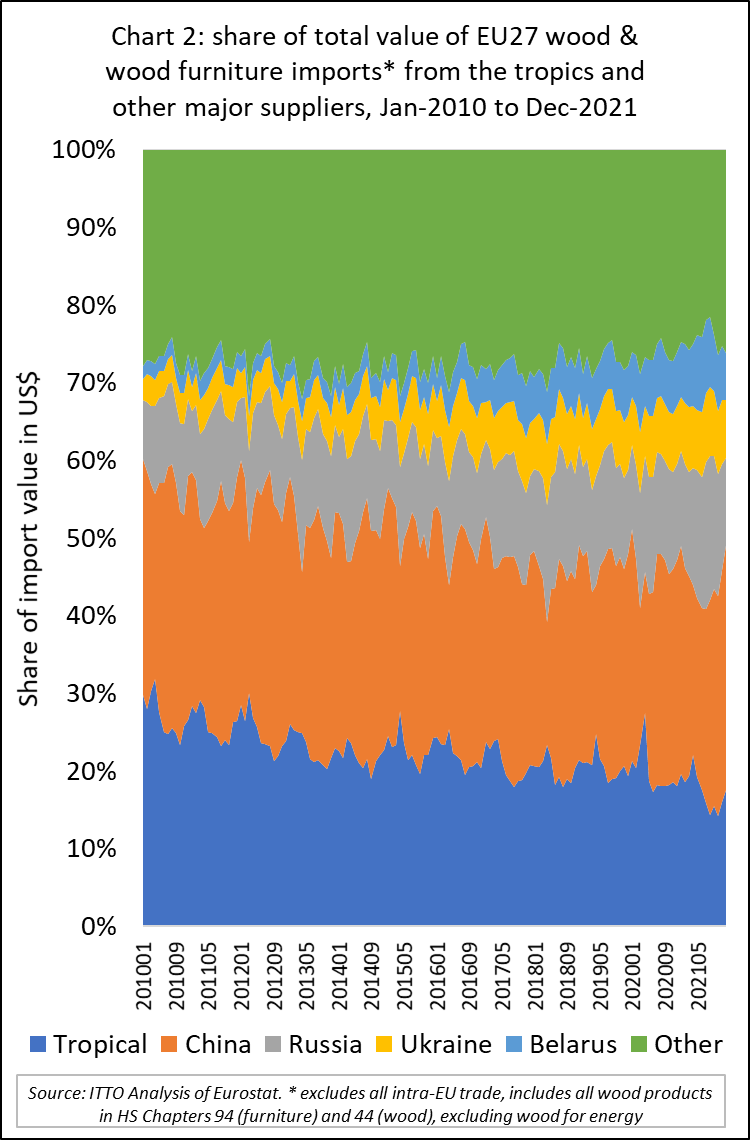

In 2021, tropical wood and wood furniture products accounted for 17.3% of all imports of these products by value into the EU27, down from 19.6% the previous year and 20.6% in 2019. The logistical problems on the supply side during the pandemic accelerated the long term trend away from tropical countries in 2020 and 2021 (Chart 2).

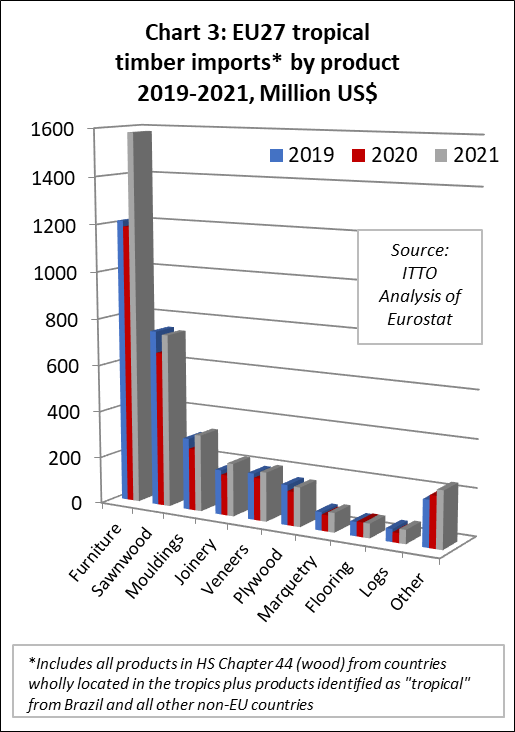

The 2021 increase in the value of EU27 imports from tropical countries was heavily concentrated in wood furniture products (Chart 3). For these products, import value of USD1.58 billion in 2021 was 33% more than the previous year and 31% higher than in 2019 before the pandemic. For tropical sawnwood, import value of USD739 million was 12% up on the previous year, but still 1% less than in 2019. Import value of tropical mouldings/decking was USD327 million last year, a gain of 24% compared to 2020 and 7% more than in 2019. Import value of tropical joinery products (mainly doors and laminated window scantlings and kitchen tops) was USD225 million last year, 31% more than the previous year and 18% up on 2019. Import value of tropical veneer was USD208 million, 16% more than in 2020 and 6% up on 2019. Import value of tropical plywood was USD166 million, 16% more than in 2020 but 1% down compared to 2019.

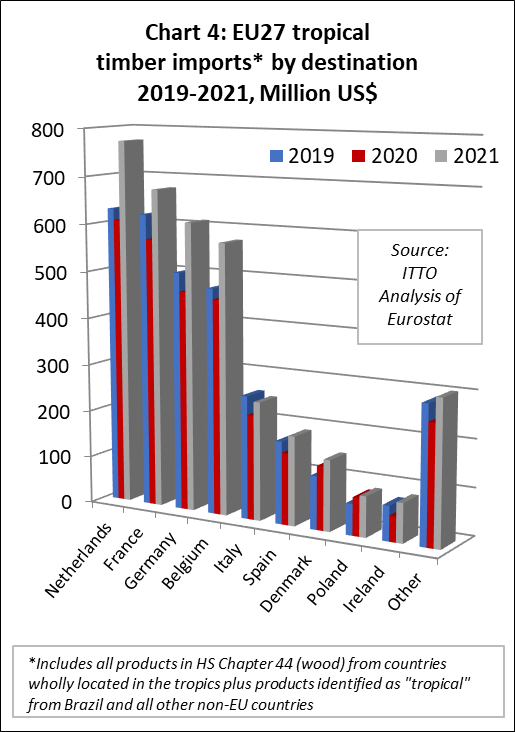

Import value into the four largest EU27 destinations for tropical wood and wood furniture products was significantly higher in 2021 than in the previous year, and also made big gains compared to 2019 (Chart 4). Import value in the Netherlands was USD772 million in 2021, 27% and 23% up on 2020 and 2019 respectively. For France, import value of USD674 million in 2021 was a gain of 18% on 2020 and 9% on 2019. In Germany, import value of USD610 million was a gain of 31% compared to 2020 and 21% compared to 2019. Similarly, in Belgium import value of USD573 million was 26% up compared to 2020 and 20% more than in 2019.

More moderate gains were made in import value of tropical wood and wood furniture products in Italy and Spain last year. Import value in Italy was USD250 million in 2021, 13% more than in 2020 and 4% less than in 2019. Import value in Spain was USD188 million in 2021, 25% more than in 2020 and an 8% gain compared to 2019.

Denmark and Poland are notable for being the only EU countries to record a significant rise in import value of tropical wood and wood furniture products in the first year of the pandemic in 2020. The rising trend continued in both countries last year. Import value in Denmark was USD149 million in 2021, 11% more than in 2020 and 33% more than in 2019. Import value in Poland was USD86 million last year, 7% more than the previous year and 30% up on 2019.

Severe wood supply shortage expected in wake of Russia-Ukraine conflict

The 2021 trade figures highlight the extent to which recent tragic events in Ukraine will impact on future wood supply in the EU. In 2021, the EU27 imported wood and wood furniture with a total value of USD6.71 billion from Russia, Belarus and Ukraine, nearly one third of total import value of these products.

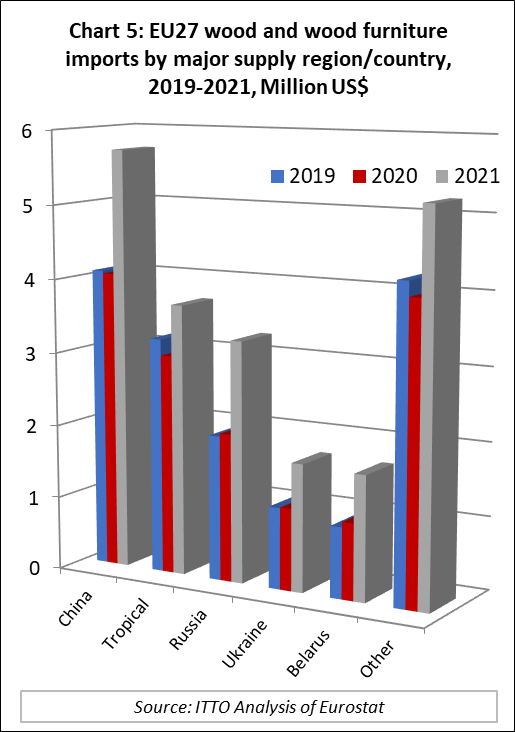

Total EU27 import value of wood and wood furniture products from all countries, both tropical and non-tropical (excluding intra-EU trade), in 2021 was US$21.34 billion, 40% more than the previous year. Imports were up by 42% from China to US$5.72 billion, by 63% from Russia to US$3.28 billion, by 63% from Belarus to US$1.70 billion, and by 55% from Ukraine to US$1.74 billion (Chart 5).

Since the majority of wood product importers from Russia, Belarus and Ukraine are of relatively lower value primary products (particularly softwood and lighter hardwood logs, sawnwood, and plywood), their significance is even greater in terms of the sheer quantity of wood fibre. In 2021, of total EU27 import quantity of 26.4 million tonnes of wood and wood furniture products, 14.1 million tonnes (53%) derived from just these three countries.

Given the current situation in Ukraine, there is every chance that the large majority of EU27 trade in wood products with Russia, Belarus and Ukraine will cease during 2022. On 2 March, the EU imposed trade sanctions on Belarus covering timber alongside multiple other commodities. EU sanctions on wood imports from Russia have yet to be announced, but on 10 March Russia’s Industry and Trade Ministry said that a ban on all wood and timber-related exports to “unfriendly countries”, including the EU, UK and US, would be introduced, to remain in place at least until the end of this year.

At the same time, the exclusion of selected Russian banks from Swift, the financial messaging system that enables most international bank payments, has already effectively shut out a lot of Russian firms from international trade. EU companies are also announcing voluntary withdrawal from the trade with Russia and Belarus. A particularly notable example is IKEA, for which Russia is the second largest supplier of wood products, after Poland.

Furthermore, many European companies have become heavily dependent on Russia and Belarus for their supplies of FSC and PEFC certified wood. Now both FSC and PEFC have announced the suspension of all certificates in Russia and Belarus.

Of total FSC global forest area of 237 million hectares, 63 million hectares (27%) is in Russia and 15 million hectares (6%) in Belarus. Of PEFC certified area worldwide of 328 million hectares, 32 million hectares (10%) is in Russia and 9 million hectares (3%) is in Belarus. Nearly a third of all FSC certified area globally and 13% of all PEFC certified forests has been effectively removed from these certification networks.

In a joint statement by CEI-Bois (the European Confederation of Woodworking Industries) and EOS (the European Organisation of the Sawmill Industry) following a meeting on 9th March, it is noted that “European sanctions against trading with Russia and Belarus are expected to produce a shock in the wood product value chain. The war in Ukraine is already impacting transport and supply chains in several countries”.

The two organisations stated their support for the decision taken by PEFC to classify Belarus and Russian products as “conflict timber” and therefore ineligible for accredited certification, and that they “welcome that wood and forest products from Russia and Belarus cannot be used in FSC products or be sold as FSC certified anywhere in the world as long as the armed conflict continues”.

CEI Bois and EOS stated that they now expect wood shortages in Europe and that “many wood-based construction materials, such as birch plywood and sawn timber, will be very hard hit, which in turn could hamper the EU’s Green Deal push to decarbonise the built environment”.

The two organisations announced that they are “now working closely with the EU institutions and national European Governments to identify sustainable and efficient mitigating measures that could increase self-reliance, help reduce critical shortages, increase harvesting rate, ensure security of logs supply and seek to mobilise existing wood resources to fill the supply gap created by these necessary trade sanctions”.

Commenting Silvia Melegari, Secretary General of CEI-Bois and EOS said: “Beyond the human tragedy that this conflict is causing, the European Timber Industry will be negatively affected by a shortage of wood products. Although companies are already working in order to cope with the current situation, it is undeniable that our sector will need immediate interventions by national governments and European institutions on how to prevent a critical logs shortage. The European wood industry hopes for a rapid and peaceful resolution to the ongoing conflict in Ukraine.”

EU economic recovery threatened by conflict in Ukraine

The conflict in Ukraine comes at a time when the EU economy continues to be strongly influenced by the pandemic and is likely to strengthen some existing trends – including logistics and supply bottlenecks, energy price rises, and considerable inflationary pressures – which are all acting as a drag on growth.

The latest EU Winter 2022 Economic Forecast, issued on 10 February before the start of hostilities in Ukraine, estimated that the EU economy expanded by 5.3% in 2021 and that GDP for the region as a whole had reached its pre-pandemic level in the third quarter of 2021. But after the robust rebound in economic activity that started in spring last year and continued unabated through early autumn, the growth momentum in the EU is estimated to have slowed to 0.4% in the last quarter of 2021, from 2.2% in the previous quarter.

While a slowdown was already expected in the Autumn 2021 Economic Forecast, after the EU economy closed the gap with its pre-pandemic output level in 2021-Q3, it was sharper than projected as headwinds to growth intensified: notably, a surge in COVID-19 infections, high energy prices and continued supply-side disruptions.

Nevertheless, the Winter Forecast assumed that the strain on the economy caused by the current wave of covid infections would be short lived. It suggested that economic activity “is set to regain traction as supply conditions normalise and inflationary pressures moderate”. It also refers to the “strong fundamentals” including “a continuously improving labour market, high household savings, still favourable financing conditions, and the full deployment of the Recovery and Resilience Facility (RRF)”. The Winter Economic Forecast concluded that the EU economy would grow by 4.0% in 2022 and 2.8% in 2023.

However, these economic projections are now widely expected to be downgraded due to the spill-over effects of the situation in Ukraine, particularly the additional pressures on energy supply. Russia is the EU’s main supplier of oil (27% of imports, 2019 data), coal (47%) and gas (41%).

Already the conflict has created another round of supply-chain disruptions inside Europe and transportation costs are increasing again. There is market volatility and financial losses may be large in certain European sectors – including banking, energy companies, and wood manufacturing. Inflation in the euro area, already at a record rate of 4.6% in the fourth quarter of last year, may continue to rise.

More positively, activity in the construction sector in the EU, a key driver of timber demand in the region, was growing more strongly in the opening months of 2022. The IHS Markit Eurozone Construction Index increased from 52.9 in December last year to 56.6 in January before easing to 56.3 in February. During February, growth of both commercial and civil engineering activity accelerated to the quickest since January 2018, while house building remained the strongest sub-sector in the eurozone, despite posting a slower rate of expansion.

February data pointed to a series record upturn in Italian construction activity, while German firms highlighted a second successive rise. Activity in France however, stagnated midway through the first quarter. Eurozone construction companies signalled solid optimism regarding the year-ahead outlook for activity in February, though confidence eased from that seen in January.

However, IHS also cautioned that “severe price pressures and material shortages remain key headwinds for the eurozone construction sector. Notably, delays in sourcing and receiving raw materials intensified, adding to price pressures”.