Sawn hardwood distributors in Europe are reporting good levels of activity but this has yet to feed through into a significant rise in tropical sawn hardwood imports.

Against an improving economic backdrop, the EU’s sawn hardwood trade was reported stable to very good from 2016 through the first three quarters of 2017, with customers, notably joinery producers, reporting healthy order books.

A clear indication of long-term confidence in the European hardwood market derives from latest developments at Vandecasteele. The company is already one of Belgium and Europe’s biggest hardwood importers and international traders. Now it is expanding its stock holding capabilities by building a further four hectares of warehousing at its Aalbeke distribution hub. That will take total undercover storage to 16 hectares and the overall area of its site to 20 hectares.

In contrast to this positive picture, however, latest statistics (to November 2017) show tropical sawn hardwood imports declined sharply last year. The EU imported 822,600 m3 of tropical sawn hardwood between January and November 2017, 20% less than the same period in 2016.

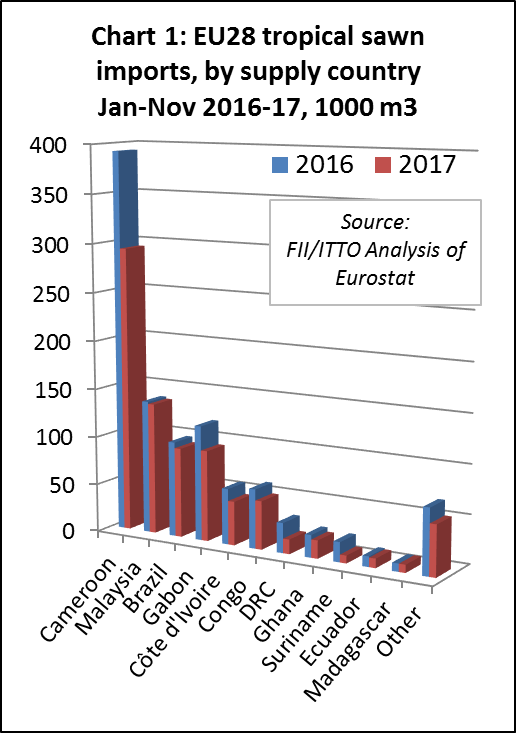

In the eleven-month period, tropical sawn hardwood imports declined from all 10 of the top suppliers to the EU. From Cameroon imports fell 21% to 293,800 m3, from Gabon 21% to 93,700 m3, from Brazil 6% to 92,500 m3, Congo 18% to 49,900 m3, Cote d’Ivoire 21% to 45,200 m3, Ghana 19% to 18,600 m3, Democratic Republic of Congo 51% to 15,000 m3 and Ecuador 11% to 9,600 m3. Best figures were shown by Malaysia and Madagascar, but EU imports were still down from both countries, albeit just 1% to 135,400 m3 and 8,300 m3 respectively (Chart 1).

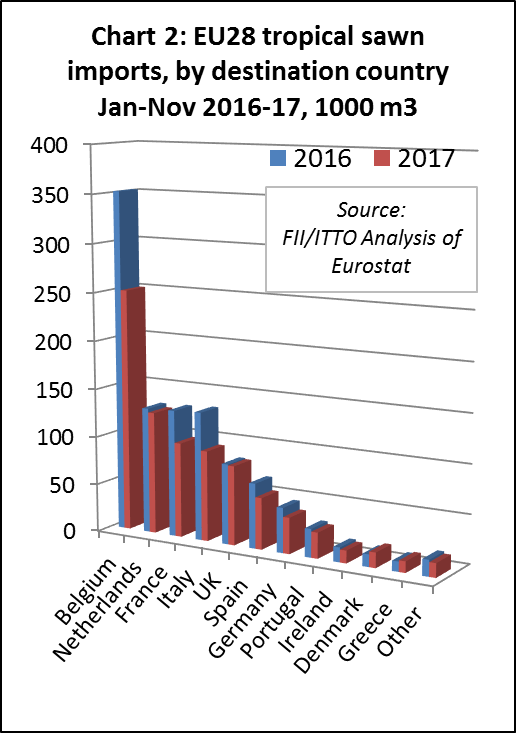

The decline in tropical sawn hardwood trade affected nearly all the main EU countries. Belgian imports were down 29%, at 251,000 m3, French 24% at 98,000 m3, Italian 30% at 93,400 m3, Spanish 21% at 53,200 m3, German 20% at 37,300 m3, Portuguese 9% at 26,600 m3, and Ireland 14% at 13,000 m3. UK imports were only down 1% at 81,900 m3 while Denmark’s were up 24% at 15,700 m3 and Greece’s 12% at 11,600 m3 (Chart 2).

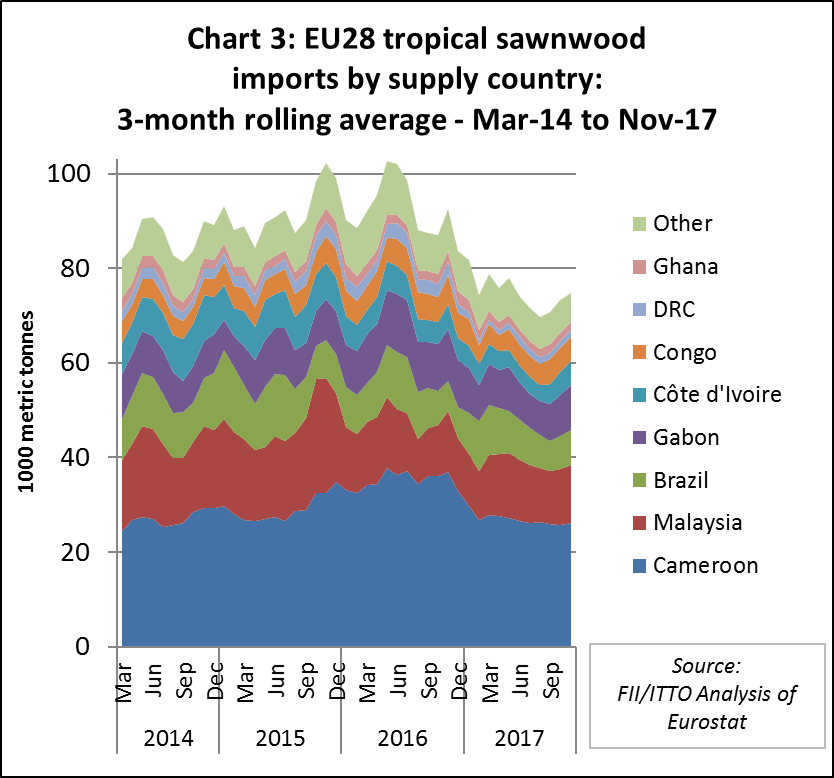

Closer analysis of the monthly data indicates that following a sharp dip in EU imports of tropical sawn hardwood in the middle of 2017, imports were rising slowly again between September and November 2017. However, it is too early to say whether this is just a seasonal trend or the start of a longer-term recovery. (Chart 3).

Various reasons for weak EU imports of tropical sawn wood

European timber businesses suggest a range of factors that may explain the apparent dichotomy between good underlying demand for hardwoods and the sharp fall in imports of tropical wood in 2017. Some are short-term trade trends, others longer-term international market structural changes.

According to some importers, one reason is adjustment after over optimistic buying in 2015 and 2016. Trade was further disrupted in 2017 by particularly heavy seasonal rains in both Africa and Asia. Worsening congestion at the Cameroon port of Douala, due to supply bottlenecks following the rains, combined with lack of dredging resulting in reduced vessel load factors, added to problems in West Africa.

While also pointing out that a significant proportion of timber shipped into their country is en route to other European markets, Belgian importers also attributed the dramatic fluctuation in its imports from Cameroon from 2015/16 to 2017 to post-recession improvement in supplier mills’ capacity and efficiency. Long lead times immediately after the international downturn, in some cases extending to two years, led to some Belgian importers increasing order volumes to secure sufficient stock.

However, as Cameroon mills improved performance, numerous orders were reported arriving in quick succession in 2016. That resulted in excess stocks in 2017 and further orders being reined back until these had been cleared.

The downturn in EU tropical imports is also attributed to international economic improvement and increase in demand elsewhere, with supply diverted to other such healthy markets as the US, Middle East and, most notably, Vietnam and China.

Rising demand in the latter is put down particularly to the continued rise of the country’s affluent middle class and consequent growth in domestic consumption of timber and wood products. While referring to temperate hardwood, this is most clearly illustrated in American Hardwood Export Council (AHEC) statistics for Chinese timber imports from the US.

As little as a decade ago, AHEC estimates that 85% of China’s US hardwood imports were re-exported as manufactured goods, with just 15% staying in China. Today that ratio is almost exactly reversed and the vast bulk is consumed in the Chinese market.

EUTR deterring tropical suppliers

Some EU importers maintain that the EU Timber Regulation (EUTR) has also played a part in an international hardwood trade shift. They may welcome the EUTR as a tool to combat the illegal timber trade. However, they say the due diligence requirements it imposes on suppliers can deter them from the European market and make Chinese customers especially appear easier to do business with. This is even more the case as the latter are also reported now to be buying a wider range of wood, from logs and lower quality sawn timber, to top end lumber.

Rising global demand, combined with supply constraints, has also led to generally firming prices and tighter margins. That, say some EU buyers, has increased customer caution in forward ordering, reinforcing a longer term underlying trend towards buying little and often, or just-in-time, where customers expect importers increasingly to act as their stockholders, from which they can draw timber as required.

EU imports of sawn temperate hardwood decline 7%

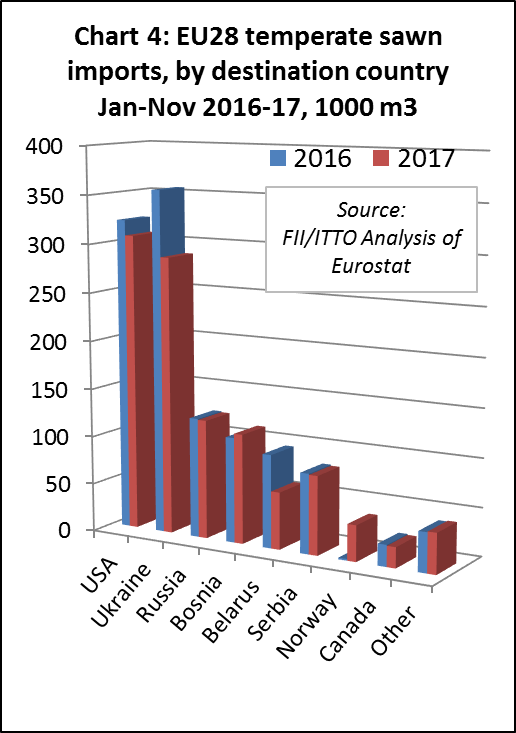

EU imports of sawn temperate hardwoods also declined in 2017, although less dramatically than imports of sawn tropical hardwoods. Total EU imports of sawn temperate hardwoods from outside the region were 1,072,300 m3 in the first eleven months of 2017, down 7% compared in 2016.

The sharpest falls in EU imports of sawn temperate hardwood were from Ukraine, down 19% to 287,300 m3, and Belarus, 39% lower at 59,100 m3. Imports also fell from the US (down 5% to 307,400 m3), Russia (down 1% to 123,200 m3), Serbia (down 1% to 81,400 m3), and Canada (down 1% to 21,400 m3). Imports increased from several countries, but these insufficient to offset the declines elsewhere. Imports increased from Bosnia (by 4% to 113,400 m3), Norway (a dramatic 2,111% increase to 37,000 m3) and other temperate countries (by 2% to 41,800 m3). (Chart 4).

As for tropical timber, the downturn in imports of temperate hardwoods was also attributed to some stock adjustment to clear an excess from earlier over-ordering, together with a rising demand elsewhere, notably China and other South East Asian importers.

Particularly good EU demand for sapele

Looking at individual species and products, importers in several EU countries, report particularly good demand for sapele in 2017, with prices firming as a result. Iroko continued in especially tight supply, due at least partly, it is thought, to less coming out of the forest in current harvest cycles, and prices reflected that.

Some predict that framire/idigbo is gradually being replaced on the EU market due to mills’ inability to satisfy due diligence information requirements, although there are also now reports of suppliers improving their legality assurance.

Particularly tight supply and firm prices were also reported by a Belgian importer in afzelia/doussie, ayous, tali, padouk and azobe.

Malaysian meranti and Indonesian bangkirai availability declined towards the end of 2017, with prices in the last quarter up for the former by 9-12% and by 9-17% for the latter, according to a UK importer. Meranti lead times were also reported up to four to five months. Brazilian ipe supply is said to be increasingly short too.

European importers remain concerned about the supply of teak from Myanmar. This follows concerns about the reliability of legality assurances being reported by the Environmental Investigation Agency, which triggered EUTR enforcement agencies in several countries into taking action against importers and demanding that teak be more effectively tracked to forest of origin in Myanmar.

The EU’s successful boat building industries, notably in Italy, Denmark and the UK raised particular anxieties over this and importers are now urging greater legality assurance collaboration between EU and Myanmar authorities.

In temperate species, white oak remains the EU leader among US varieties, although it is reported to be facing increasing competition from European oak. Supply of the latter has been an issue recently due to curbs on Croatian log and green lumber exports, ostensibly to stop spread of oak lace beetle. However, Croatian kilning capacity is increasing, partly thanks to inward investment by Italian mills, and customers are still said to be showing increasing preference for the European species due to various factors, including specification, FSC certification and lead times.

US walnut, tulipwood and ash are all reported to be in generally good to strong demand, with maple and cherry faring better in some countries than others.

Market resistance to US red oak continues, but the Americans hope that its large-scale use in 2017 in the new European headquarters of financial data giant Bloomberg in London will give it a prime, prestige European showcase. The building includes 37,150 m2 of red oak flooring alone.

Efforts to introduce more lesser known tropical species to the EU were reported to be meeting some success, with movingui mentioned by several importers. Further processed and engineered hardwood products were also said to be gaining momentum, notably laminated and finger jointed joinery components. Gaining ground too is Eucalyptus grandis in both sawn and engineered form.

At the same time hardwood is also meeting increasing competition from substitutes. Modified timber, notably Accoya and Kebony brands, are reported to becoming ‘staples’ in certain markets and wood-plastic composites continue to gain in popularity, particularly for external applications, such as cladding, decking and outdoor furniture.

Taking stock for the future

Other challenges predicted for the EU hardwood trade into 2018 include more checks on EUTR compliance and tougher policing as EU authorities gain expertise and increasingly collaborate and exchange intelligence. Belgium has also been ordered by the EC to improve enforcement generally. The combined result is expected to be more multi-national actions, such as the simultaneous probes in several EU countries into teak imports last year.

Global competition for supply is also expected to continue to grow. The longer-term consequence predicted by some is that the EU hardwood trade will become increasingly polarised.

On one side are forecast to be fewer small to medium-sized niche operations, with a limited number of long-established supply connections, and on the other larger operations with economies of scale, able to order and store large volumes to meet just-in-time market requirements, and also with the resources to manage market legality regulation requirements with numerous suppliers.

In fact, this trend is reported already underway. Importers in several countries forecast that 2018 will be a good year for EU companies holding plentiful stocks.

PDF of this article:

Copyright ITTO 2020 – All rights reserved