The EU imported tropical wood products worth €517 million in the first three months of this year, a healthy increase of 20.9% compared to the same period in 2014. To some extent the strong growth figures for the first quarter of 2015 are due to particularly weak imports in the same period the previous year. The increase in the euro value of imports also needs to be seen against the background of the very weak euro on currency exchange markets. The euro was at its lowest level ever against the US dollar in the first quarter of 2015 and around 30% down compared to the same period the previous year.

Nevertheless, closer analysis of the data shows that the volume of EU imports of tropical wood products were also rising alongside the value of imports. It also shows that while EU tropical timber imports continue to fall short of historic levels, recovery in European trade in tropical timber is becoming more resilient and now extends to a wider range of products and market sectors.

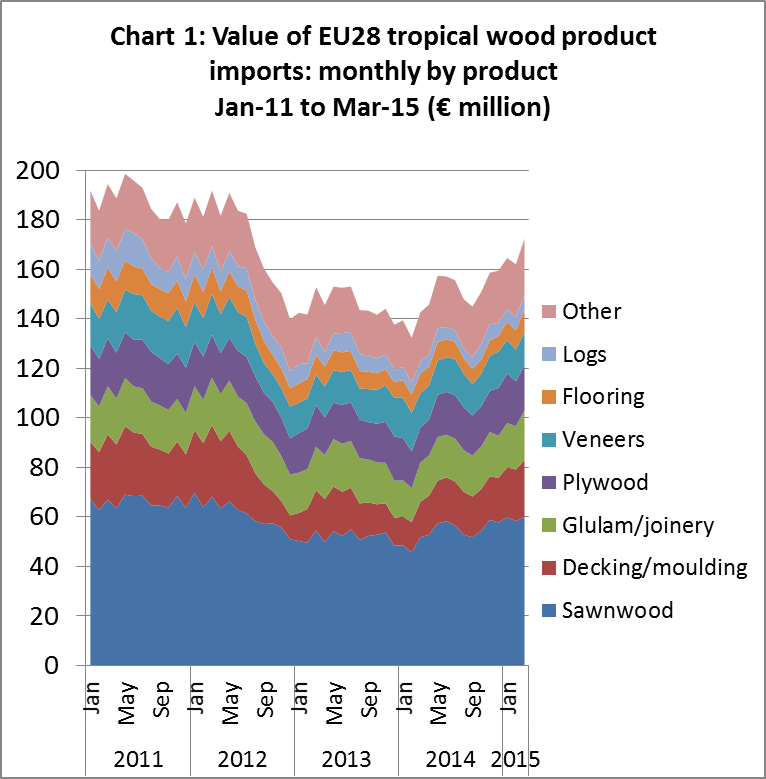

The increase in the euro value of EU tropical wood imports during the first quarter of this year follows a 3% rise in the full year 2014. Consideration of monthly data shows that most of this gain was generated towards end of last year. In the final quarter of last year, EU imports of tropical wood products were up by 10.6% at €469 million (Chart 1).

Imports rise across most tropical wood sectors

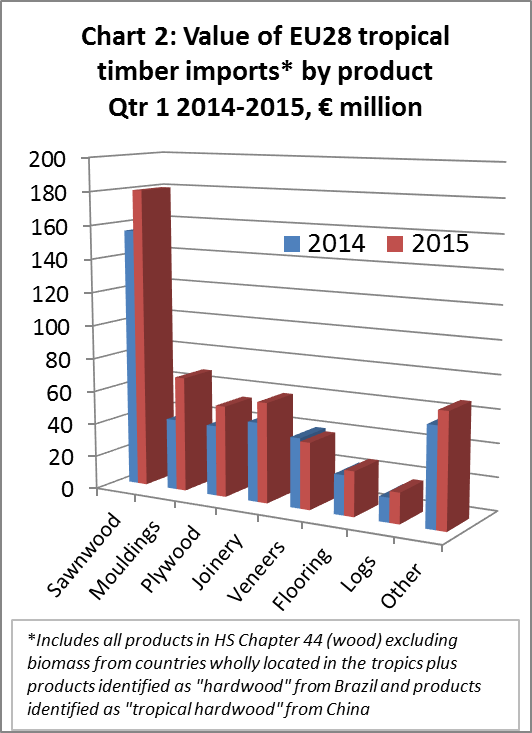

A closer look at the value of EU imports of the various tropical product types reveals that most showed significant increases in the first quarter of 2015 compared to the same period in 2014 (Chart 2).

Imports of sawnwood were €180 million in the first quarter of 2015, 16% more than the same period in 2014. Imports of mouldings (including both decking and interior mouldings) increased 61% to €69 million. Plywood imports were 29% greater at €55 million. Imports of tropical joinery products (mostly LVL for window frames) increased 26% to €60 million, while flooring products increased 13% to €27 million. Perhaps most surprisingly, tropical log imports jumped 25% to €18 million after plummeting for several years almost without interruption. However imports of veneers continued their downward slide, at €40 million in the first quarter of 2015, down 5% compared to the same period in 2014.

Key tropical timber markets are bouncing back

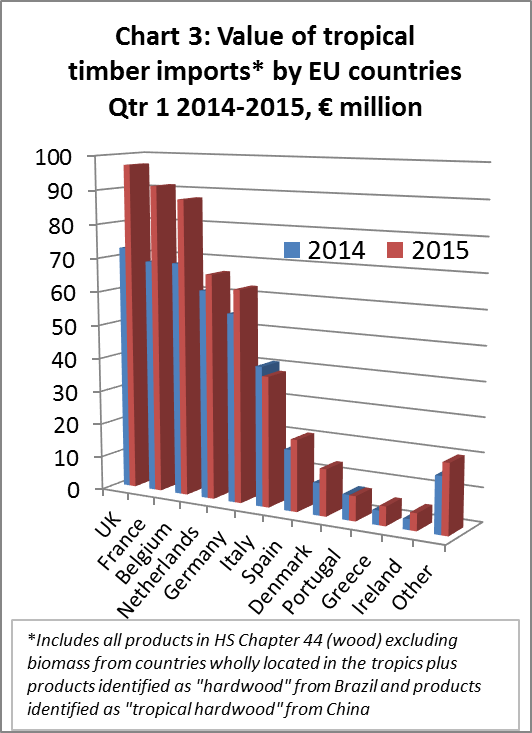

There was significant growth in the euro value of tropical timber imports in nearly all the main EU markets in the first quarter of 2015 (Chart 3).

The UK once more outperformed its continental partners, with imports of tropical timber products valued at €97 million in the first quarter of 2015, 34% more than the same period in 2014. The UK therefore maintained its position as the EU’s largest importer of tropical timber products during the period.

However, a particularly encouraging sign is that imports to the traditional tropical timber markets in France, Belgium and the Netherlands also increased sharply in the first quarter of 2015. Compared to the same period the previous year, first quarter 2015 imports increased 32% to €91 million in France and 27% to €83 million in Belgium. Imports by the Netherlands, at €67 million, were up 16% and deliveries to Spain were €22 million, 22% above the very low recession level of the previous year. Germany also imported more than the year before, increasing 11% to €59 million, but import growth there was less pronounced than in the other major markets.

It is too early to tell whether the sharp uphill trend in EU tropical timber imports in the last six months is the beginning of a lasting recovery or driven mainly by stock replenishment and exchange-rate effects. Purchases of tropical timber traded in US dollars have become significantly more expensive for buyers in the euro-zone since mid-2014 – and particularly since the beginning of this year. This has had an impact on the import value, especially as prices have remained fairly stable or were only revised downwards a little in Indonesia, Malaysia and South America.

The supply situation for tropical timber in Africa, which was difficult throughout 2014, has also improved in the last few months from European buyers’ perspective. Importers interviewed for this report note that China continues to consume large quantities of African timber. However demand in China has eased this year creating a better balance between supply and demand for European importers.

Positive signs on the consumption side in Europe are the stable construction market in Germany and confidence that the UK market will pick up again over the summer, after weakening in the first quarter. There are also signs of recovery in Spain, the Netherlands and Poland. In France and Italy, the construction and furniture industries continue to struggle, but there are some signs of improvement in the wider economy.

The German Ifo Institut published an encouraging economic climate report for the euro-zone at the beginning of May. The Ifo Index for the economic climate in the euro-zone in the second quarter of 2015 was 129.2 points, up from 112.7 points in the first quarter. The index is now at a level last seen before the global financial crisis. And an expert survey conducted by Ifo found that the euro-zone economy is expected to grow by 1.5 % this year.

10% growth in EU tropical sawn hardwood imports

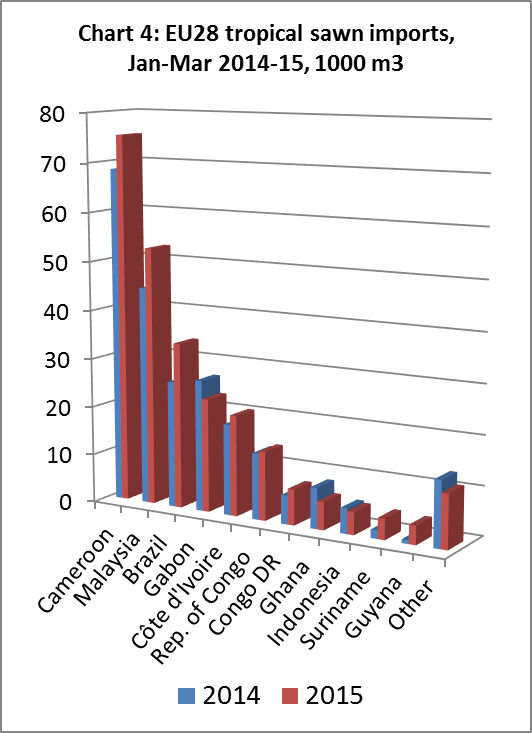

The EU imported 257,000 m3 of tropical sawn hardwood in the first three months of 2015, 10% more than the same period in 2014. The rise was broadly based being recorded across a wide range of supply countries and EU Member States. It benefitted suppliers irrespective of whether they typically invoice in euros or dollars – hinting that this may be driven more by improving EU consumption than by short-term stock replenishment.

In the first quarter of 2015, EU imports increased sharply from the three most important supplier countries: Cameroon (+10% to 75,000m3), Malaysia (+18% to 53,000m3) and Brazil (+31% to 34,000m3). There were also significant increases in imports from Ivory Coast (+11% to 21,000m3), the Republic of the Congo (+4% to 14,000m3) and the Democratic Republic of the Congo (+25% to 7,000m3). There were increasing imports from two South American countries that have not featured strongly in EU supplies in recent years – Suriname and Guyana. However imports from Gabon were down 14% at 23,000m3 and imports from Ghana fell 31% to just 6,000m3 (Chart 4).

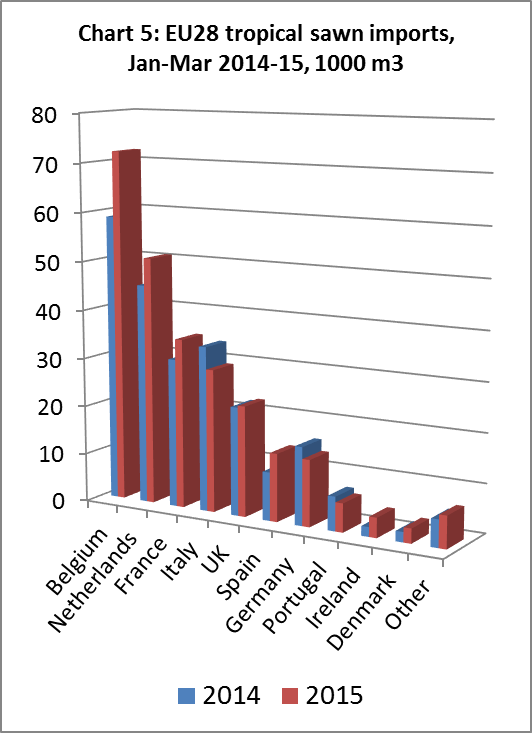

On the recipients’ side, Eurostat data indicates particularly strong growth in imports of tropical sawn hardwood into Belgium and the Netherlands in the first quarter of 2015 (Chart 5). Imports into Belgium increased 23% to 72,000m3 during this period, cementing the country’s position as the leading EU importer of this commodity. Imports into the Netherlands, which started to recover last year, also showed a continuing positive trend rising 12% to 51,000m3 in the first quarter of 2015.

The growth in imports into Belgium and the Netherlands aligns with anecdotal reports indicating that larger importers based close to the major European ports are playing an increasingly important role to distribute tropical hardwoods throughout the continent. This is partly driven by the trend towards tighter stock control and just-in-time trading in the European manufacturing sector which has been a consistent feature of the European trade now for at least a decade.

In the last two years, the EU Timber Regulation (EUTR) appears to have added impetus to this trend as European manufacturers and smaller distributors are now less inclined to buy direct and increasingly rely on larger importers to shoulder requirements for legality due diligence. There are expectations that arrival of the first FLEGT Licensed timber, which is excluded from EUTR due diligence obligations, on the EU market later this year or early next year will ease this over-dependence on larger operators.

The troubled French market has also picked up in 2015, with imports rising 14% to 35,000m3 in the first quarter. Deliveries to the UK, which were quite strong in 2015, increased by a further 2% to 23,000m3 in the first quarter of 2015. Imports of tropical sawn hardwood into Spain, while still quite low, continue to improve rising 40% to 14,000m3 during the same period.

In contrast, imports of tropical sawn hardwood by Italy (-13% to 29,000m3) and Portugal (-16% to 6,000m3) weakened significantly in the first quarter of 2015.

There was also a 15% fall in German imports of tropical sawn hardwood to 14,000m3 in the first quarter of 2015. German importers report that after a good start in January demand slowed down again and remained at a disappointing level through to April. There was a slight improvement in May. Despite a strong economic environment, importers report that tropical timber sales in Germany are falling short of expectations. This is attributed to an on-going and intensifying trend to replace tropical timber with European species such as larch, Douglas fir, and beech and, for certain applications, with non-wood materials such as WPC, stone and ceramics.

Turnaround in tropical log imports

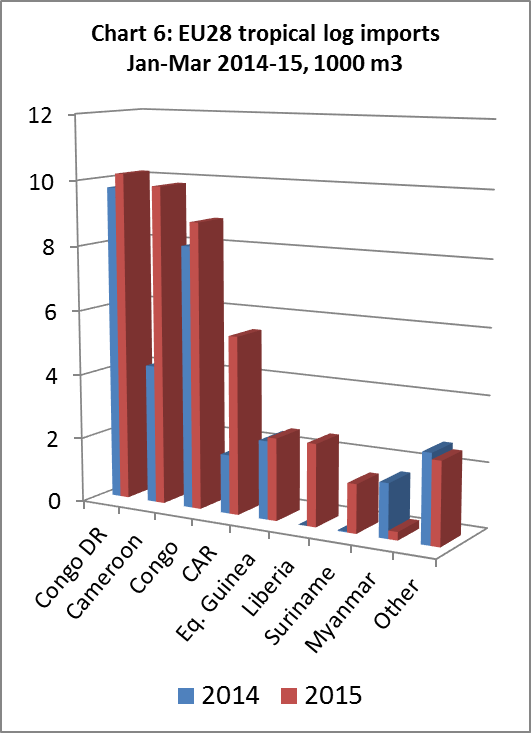

After roughly ten years of almost uninterrupted decline, there was a sharp 42% increase in EU tropical log imports to 43,638m3 in the first quarter of 2015. Much of this growth was due to a 129% increase in imports from Cameroon to 9,832m3. The scale of the increase is partly due to the particularly low level of imports from Cameroon in the first quarter of 2014 when trade was seriously disrupted by logistical problems at Douala port. Imports also increased by 9% from the Republic of Congo to 8,820m3 and by 4% to 10,155 m3 from the Democratic Republic of the Congo. Most imports of logs from Cameroon and the Congo countries in the first quarter of 2015 were destined for France, Belgium and Portugal.

Besides the increases in deliveries from the large, established suppliers, another trend is the sharp rise in imports from new sources and from countries that only delivered small volumes of logs to the EU in the recent past. EU imports from the Central African Republic, for example, jumped 202% to 5,480m3, mostly destined for France and Belgium. Imports from Liberia, which went mainly to Germany, reached 2,530m3, after no imports had been registered in the same period the year before.

The EU also imported 1,496m3 of tropical logs from Suriname in the first quarter of 2015, up from negligible levels last year. Almost all of this volume was destined for the Netherlands and is assumed to be primarily FSC certified timber for water defence works. EU imports from Myanmar fell sharply due to the country’s log export ban that came into effect as of April 2014 (Chart 6).

Sharp rise in imports of decking and mouldings

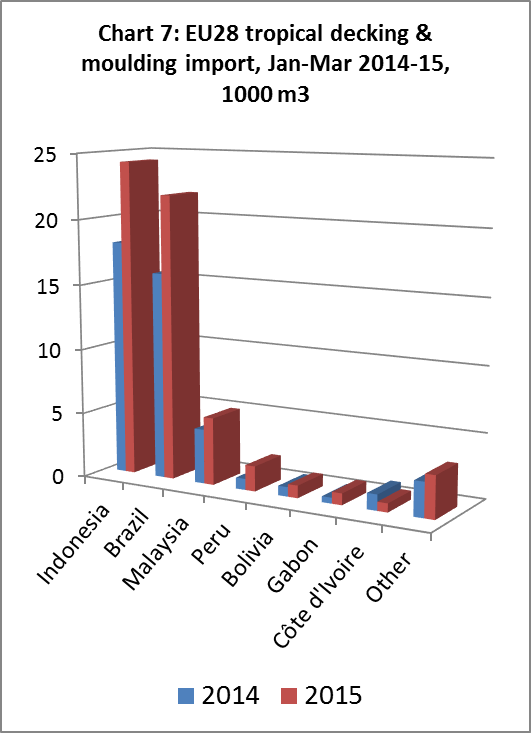

EU imports of “continuously shaped” wood (HS code 4409), which includes both decking products and interior decorative products like moulded skirting and beading, were 59,062 m3 in the first quarter of 2015, up 34% compared to the same period in 2014. This increase was primarily attributable to much higher deliveries from the two main suppliers, Indonesia and Brazil (Chart 7). Imports from Indonesia increased 34% to 24,274 m3. Indonesia has profited from the better demand in the Netherlands and Germany, traditionally major markets for Indonesian decking.

Meanwhile EU imports from Brazil were up 38% at 21,879 m3, with a particularly significant increase in imports by Belgium and France. Imports of Brazilian decking were constrained last year after a Greenpeace campaign raising concerns about the legitimacy of documentation to demonstrate legal origin of Brazilian tropical timbers. This encouraged suspension of sales of Brazilian decking products by several large European merchants and blockage of shipments while Belgium’s Environment Ministry undertook EUTR-related investigations. These subsequently confirmed the legality of the shipments which were cleared for entry. The trade data confirms that EU imports of Brazilian decking products were flowing more freely during the first quarter of 2015.

EU imports of tropical LVL scantlings show solid growth

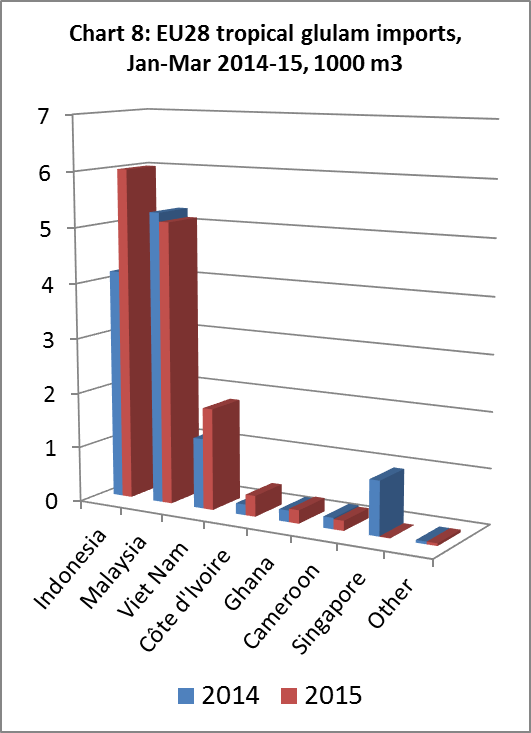

Following on a 6% increase last year, EU imports of tropical glued-laminated timber increased by a further 12% in the first quarter of 2015. Most imports consist of LVL scantlings for the window sector in Germany, the Netherlands and Belgium. In 2014, Indonesia and Malaysia supplied similar volumes to the EU market, with imports from Malaysia rising more rapidly than imports from Indonesia. However, Chart 8 shows that in the first three months of this year, Indonesia boosted its deliveries by 45% to 6,010m3 while imports from Malaysia fell by 3% to 5,115m3. Vietnam also gained in importance as a glulam supplier in the first quarter of 2015, with imports rising 44% to 1,840m3. Imports from Singapore, which were close to 1000 m3 in the first quarter of 2014, were near zero in the same period of 2015.

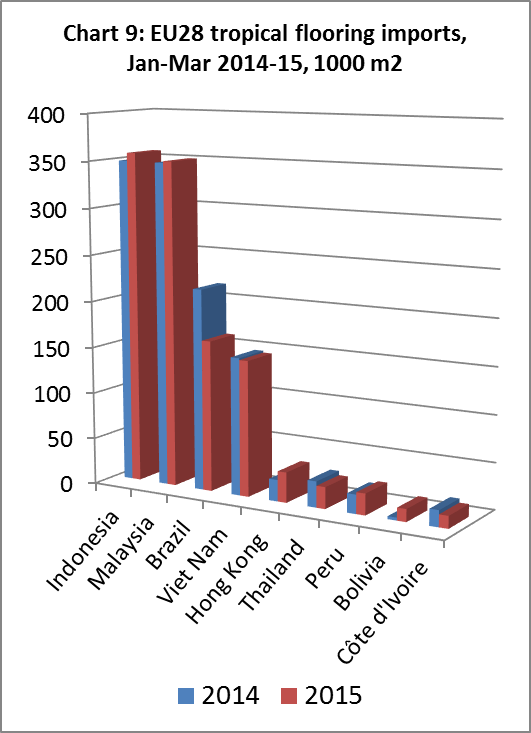

Weak trend for tropical wood flooring continues

EU imports of tropical wood flooring fell by 6% to 1.161 million m2 in the first quarter of 2015. In 2014, imports had stabilised with a small increase of 2%, after a very weak year in 2013. As a result, it looks as if the overall downhill trend for tropical wooden flooring continues this year. Most of the 6% decline was due to the 25% drop to 163,000m2 in deliveries from Brazil, the third most important supplier (Chart 9). Deliveries were relatively stable from the other main supplier countries including Indonesia (+2% to 357,000m2), Malaysia (+1% to 350,000m2), and Vietnam (-1% to 146,000 m2).

PDF of this article:

Copyright ITTO 2020 – All rights reserved