The European construction and joinery sectors continue to recover slowly. The rate of recovery in the UK, which was rapid in 2014, weakened again in the first quarter of 2015. However there is confidence that the UK market will pick up again over the summer months. The large German market remains stable with good consumption. There is improving activity in the Netherlands, Poland, Spain and Belgium. The Italian and French construction markets are still weak and declining but there are signs of improving economic conditions in both countries. Imports of finished joinery products from outside the EU increased slightly in 2014, but the weak euro is acting as a drag on imports in 2015.

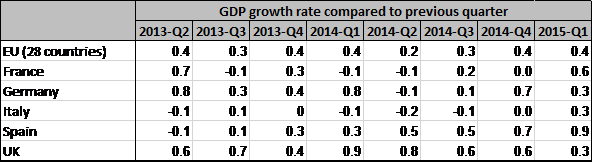

Total GDP across the EU expanded by 0.4% in the first quarter of 2015, the same rate of growth as in the previous quarter (Table 1). Growth in the UK and Germany slowed in the first quarter of 2015. However growth in France, Italy and Spain was stronger than anticipated. Overall the data suggests that economic recovery is becoming more resilient and widespread across Europe.

Table 1: Quarterly change in GDP for the EU28 and selected EU countries

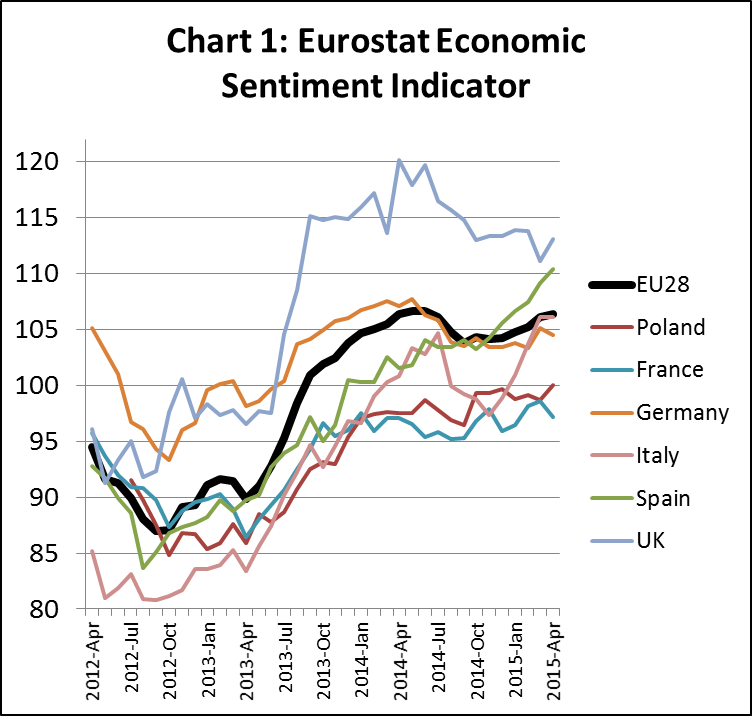

Economic Sentiment in the EU was falling in the second half of 2014 but has been improving again in 2015. Overall economic sentiment has improved significantly in Spain and Italy this year, although this has yet to filter through into a significant increase in construction activity. Economic sentiment in the UK declined a little in the first four months of 2015, but remains high. The decline is probably related to uncertainty over the outcome of the UK election on 7 May 2015 (Chart 1).

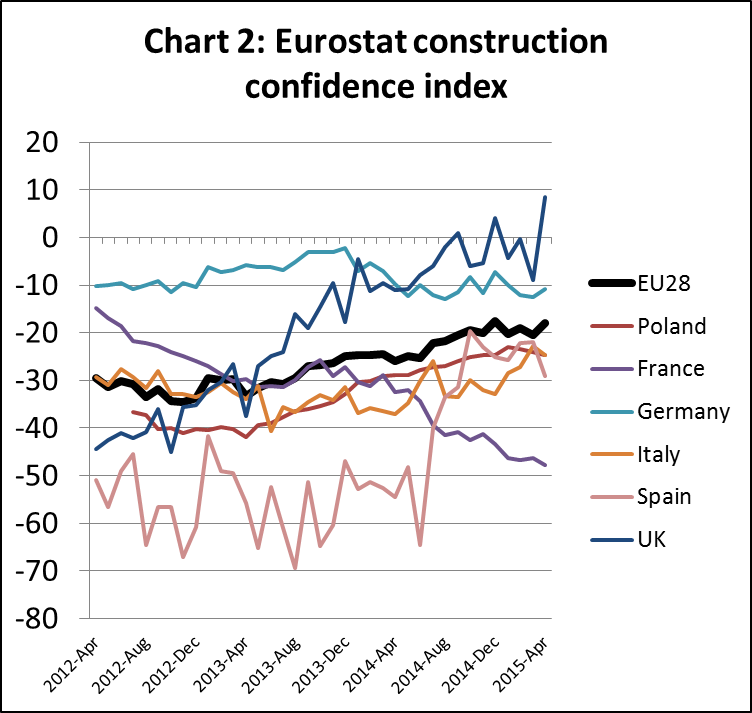

Construction confidence in Europe, after rising slowly in 2013 and 2014, has remained stable overall during 2015. However it is still in negative territory (meaning that a majority of construction companies still expect order books and employment levels to fall in the next 3 months). Construction confidence remains relatively high in the UK and Germany, and is recovering in Italy, Spain and Poland. However confidence is weak and declining in France (Chart 2).

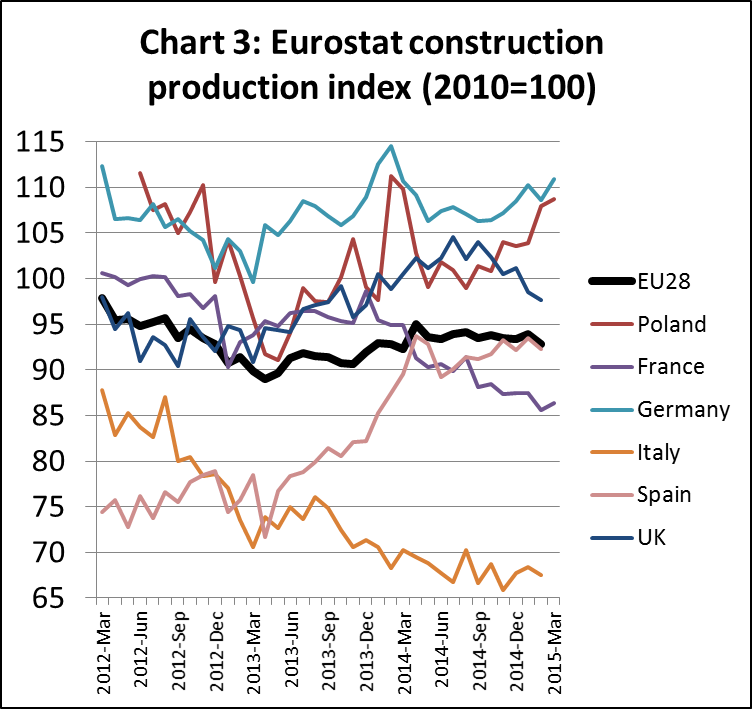

EU construction production was flat at around 6% below the 2010 level between the start of 2014 and March 2015. This is a slight improvement on the low of 10% below the 2010 level recorded in March 2013. Construction production is high and rising in Germany and Poland. Production has weakened in the UK this year but still remains quite strong. Production is declining in France and remains very weak in Italy (Chart 3).

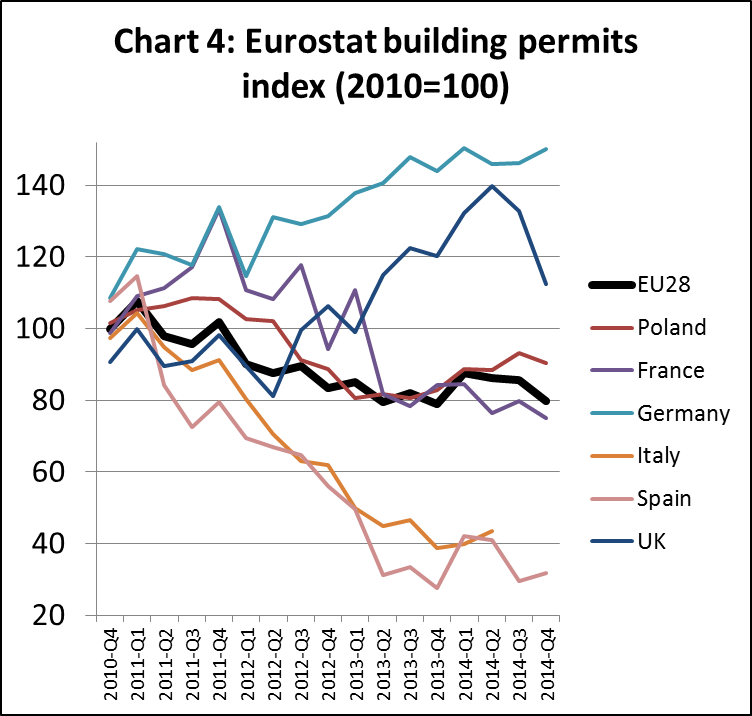

After a brief surge in the number of building permits issued across the EU in the first quarter of 2014, these declined again in the second half of the year. This was mainly due to a sharp rise and fall in building permits issued in the UK during 2014 (Chart 4).

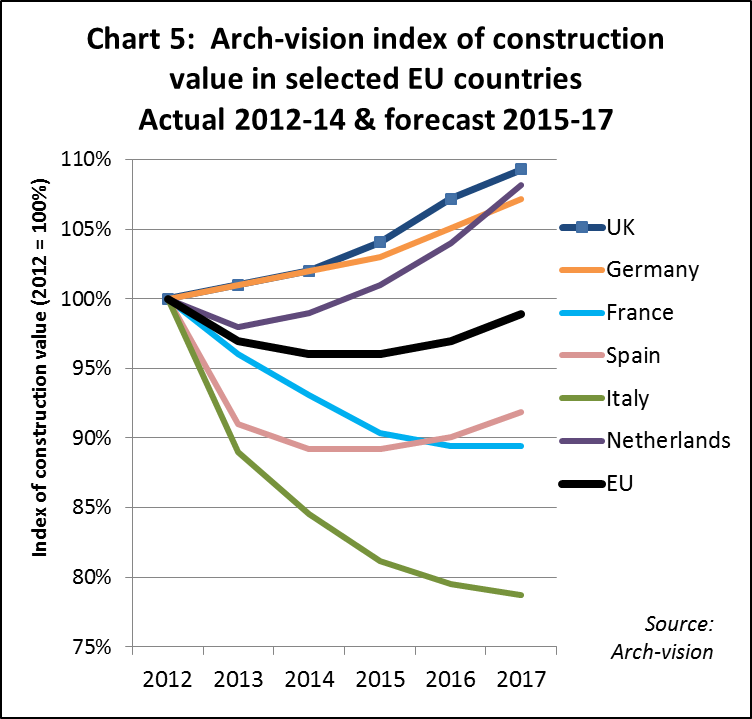

EU construction value forecast to remain flat in 2015

The independent research organisation “Arch-vision” estimates that total EU construction value may have declined 1% from around €830 billion in 2013 to €820 billion in 2014. Construction value is expected to remain level at around €820 billion this year before rising 1% to €830 billion in 2016. These forecasts draw on the latest European Architects Barometer (EAB) survey of 1,600 architects undertaken by Arch-Vision in eight European countries for the first quarter of 2015 combined with analysis of other European construction industry data (Chart 5).

There follows more detailed consideration of construction sector activity at national level in the EU.

United Kingdom: the construction market continues to improve in 2015 but at a slightly slower pace than in 2014. According to Eurostat, construction confidence in the UK fell in the first 3 months of the year, but increased sharply in April. Most construction companies expect continuing growth in the market in 2015. Arch-Vision’s survey in the first quarter of 2015 indicates most architects have good order books and expect rising turnover for the rest of the year. The UK construction market is expected to benefit from the rise in building permits issued last year. Arch-Vision predicts 2% growth in UK construction value in 2015 strengthening to 3% in 2016. Arch-vision’s forecasts are more conservative than those of the UK Construction Products Association which forecasts that construction output may increase by as much as 5.5% in 2015.

Germany: most construction market indicators remain positive. Building permits are high and stable. Arch-Vision’s survey suggests that architect’s order book and turnover development were positive in the first quarter of 2015. The Eurostat construction confidence indicator is higher than in most other EU countries. However it is still negative – indicating that German construction companies remain cautious about the future. Arch-Vision expects 1% growth in German construction value in 2015 followed by 2% growth in 2016.

France: although the French economy improved significantly in the first quarter of 2015, the construction sector is not yet showing any improvement. Construction confidence remains very low. The Arch-vision survey indicates that French architects order books continue to decline. Arch-Vision predicts that French construction value will decrease 3% in 2015 and a further 1% in 2016.

Spain: after several years of serious depression in the Spanish construction sector, there was a significant rise in both confidence and production last year. However this trend has levelled off in 2015. Building permits also remain at historically very low levels. The results of the Arch-vision survey are equally mixed. Spanish architects continued to report improving order books in the first quarter of 2015. But they also reported an increase in the number of cancelled or postponed projects. Arch-Vision concludes that overall construction value will remain flat at historically low levels in 2015, before rising 1% in 2016 and 2% in 2017.

Italy: the construction sector is still in deep recession. Construction production value remains static at only around two thirds the level of 2010. Construction confidence has improved a little in 2015 but remains deep in negative territory. The Arch-vision survey indicates that architects order books and turnover development continued to decline in the first quarter of 2015. Arch-Vision predicts that Italian construction value will fall 4% in 2015 with further falls of 2% in 2016 and 1% in 2017.

Netherlands: the construction market is showing signs of significant improvement. The Arch-vision survey indicates that architects order books and turnover were improving throughout 2014. This positive trend strengthened in the first quarter of 2015. The Eurostat confidence indicator and the number of building permits has increased sharply since the start of 2014. The construction production index has been rising gradually over the same period. Arch-Vision forecasts construction value will increase 2% in 2015, with growth rising to 3% in 2016 and 4% in 2017.

Belgium: Eurostat indicates that the value of construction in Belgium has remained stable at a reasonable level during the last 2 years. Building permits strengthened in the first half of 2014, but slowed again in the second half of the year. The construction confidence index is negative but stable at around the EU average. The Arch-vision survey indicates that architects order books are rising slowly. Arch-vision predict that Belgian construction value will increase by 1% in 2015 and by 2% in both 2016 and 2017.

Poland: construction activity in Poland is volatile but generally improving. The volatility is partly due to heavy reliance on just one sector – new build – which accounts for over 70% of all construction value. Polish construction production increased sharply in the first quarter of 2014. It then fell back again during summer 2014 and increased again at the end of last year. The upward trend has continued into 2015. Construction confidence, architects orders books and building permits have all been rising since the start of 2014. Arch-Vision forecasts that Polish construction value will increase 2% each year in 2015, 2016 and 2017.

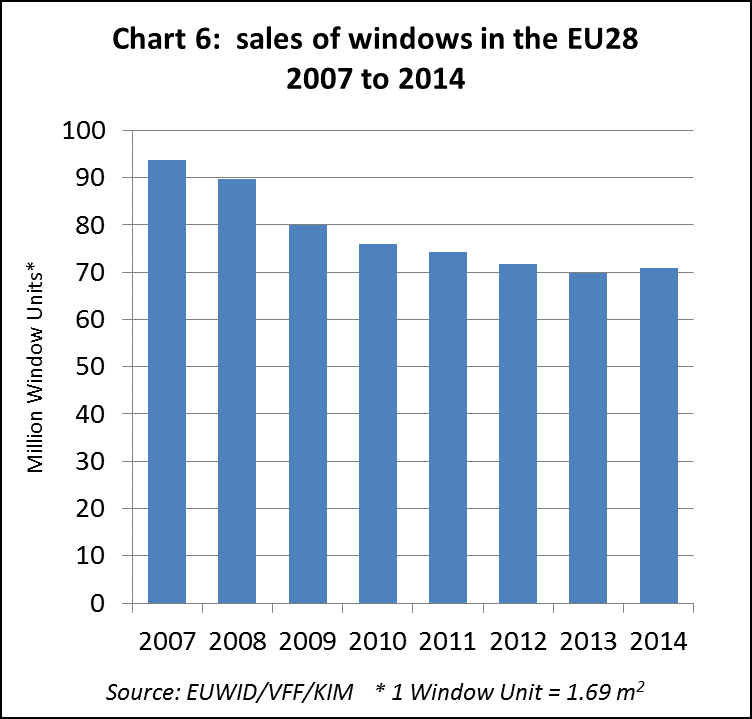

European window market hits bottom in 2014

After seven straight years of decline, window sales in the EU28 countries increased by 1.6% to 70.1 million units in 2014 (Chart 6). This is according to data jointly compiled by the German Verband Fenster & Fassade (VFF – Window and Facade Association) and the Kunzelsauer Institut fur Marketing der Hochschule Heilbronn (KIM).

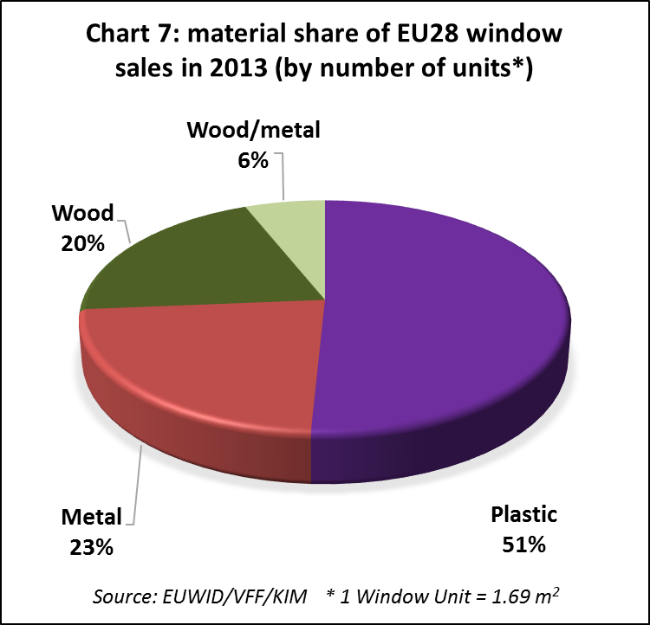

The VFF/KIM study also shows that in 2013, of total sales of 69.8 million window units, 14.1 million units (20.2%) consisted of wood and 4.3 million units (6.1%) of a wood-metal combination. In 2013, just over half of window units sold in the EU28 (35.5 million units) comprised plastic while 23% (16 million units) comprised metal (Chart 7).

European joinery product import trends

With the exception of flooring products, imports contribute only a small proportion of total EU consumption of joinery products. In terms of value, only around 4.5% of doors and glulam, and around 0.5% of wood windows installed in the EU are imported from outside the region. This is indicative of the very strong commercial benefits from proximity to the consumer in the joinery sector and the essential need for detailed knowledge of national construction markets.

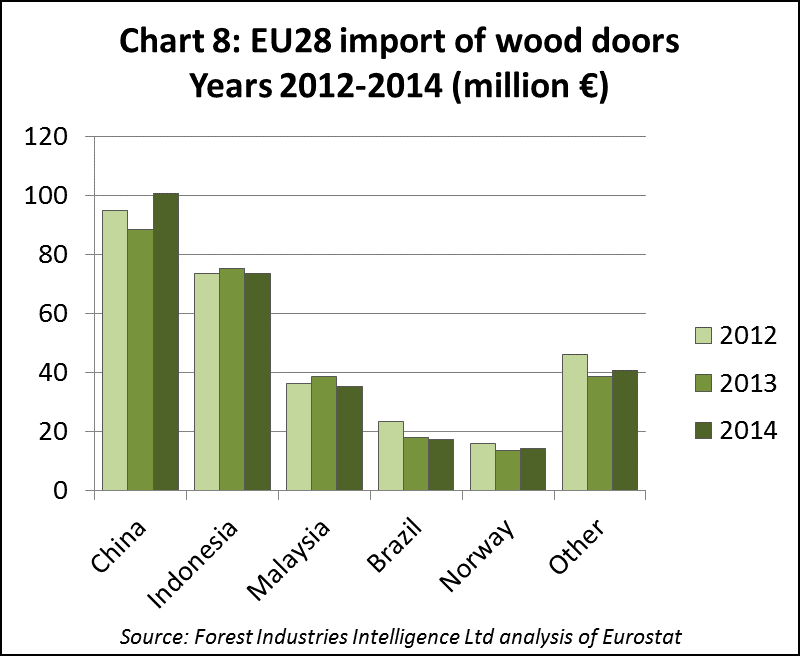

The EU imported wooden doors with total value of €285.3 million in 2014, 3.8% more than the previous year. The value of wooden door imports from China, the largest non-EU supplier, increased 13.7% to €100.7 million in 2014. However imports decreased from Indonesia and Malaysia – the second and third largest non-EU suppliers. Imports from Indonesia declined 2.6% to €73.4 million in 2014. Imports from Malaysia declined 8.7% to €35.1 million (Chart 8).

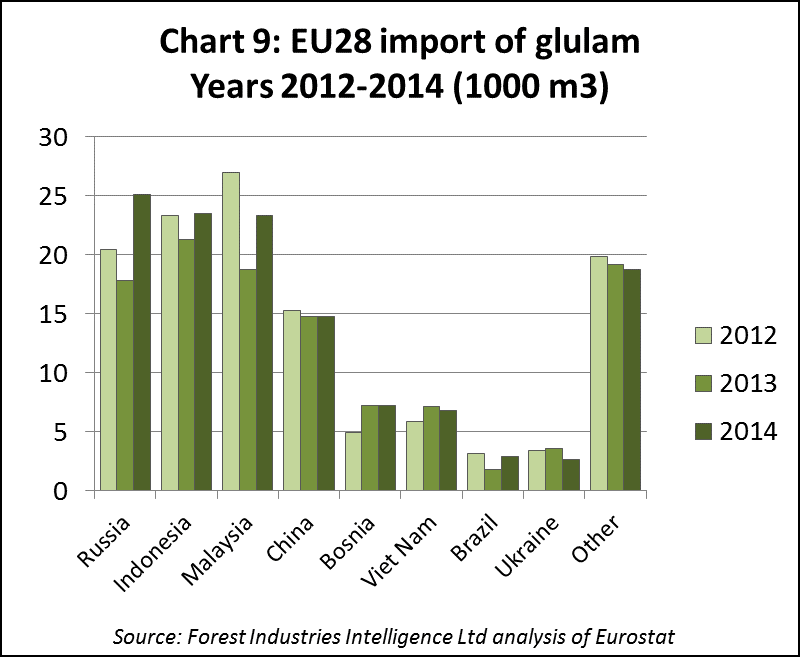

The EU imported 125,200 m3 of glulam in 2014, 12.1% more than the previous year. Most glulam imported from outside the EU consists of Laminated Veneer Lumber (LVL) for window frames and other smaller dimension products rather than larger structural beams. During 2014 there was a significant increase in imports of LVL from Russia, Indonesia and Malaysia, the three largest external suppliers of this commodity to the EU. Imports from Russia increased particularly strongly, by 41% to 25,100 m3, boosted by the weakness of rouble in the second half of 2014. Imports from China, the fourth largest external supplier, were at a similar level to the previous year (Chart 9). Competition from European LVL production is expected to increase significantly in 2016 with development of new domestic capacity (see below).

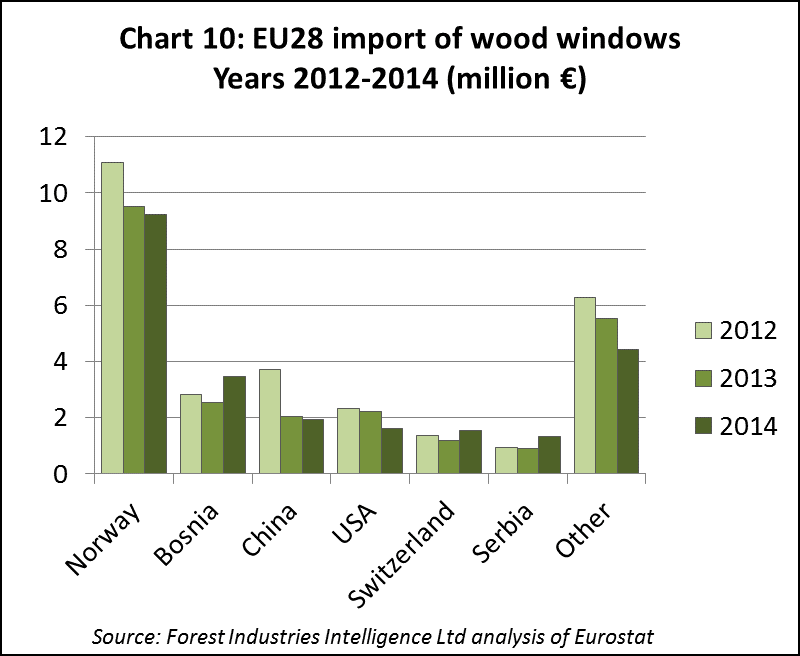

EU imports of wood windows were €24.8 million in 2014, 7.3% more than the previous year. Most of these imports derive from other European countries, notably Norway, Bosnia, Switzerland and Serbia. Imports from China, the largest supplier outside Europe, were only €1.9 million in 2014, 5.3% less than the previous year (Chart 10).

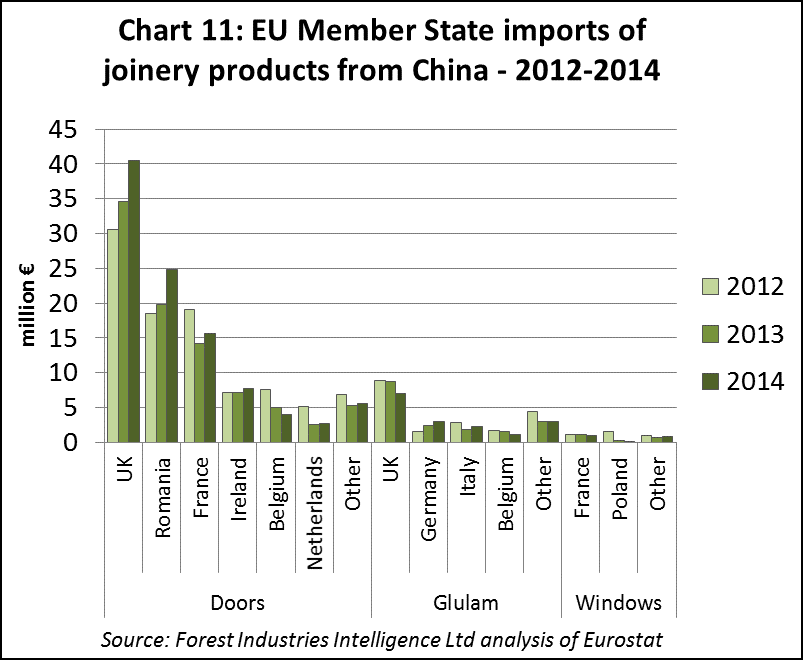

Chart 11 provides more detail of recent trends in EU markets for joinery products imported from China. Imports of wooden doors from China increased into the UK, Romania, France and Ireland during 2014, but declined into Belgium. German and Italian imports of Chinese glulam increased slightly in 2014, but this was offset by a decline in imports into the UK. EU imports of wooden windows from China were mainly destined for France in 2014. Exports to Poland, previously a significant market, were negligible last year (Chart 11).

Large increases in LVL capacity in Europe and Russia

The German trade journal EUWID reports that LVL capacity in the EU is expected to rise from the current level of 410,000 m3 to 590,000 m3 by the middle of next year. Current capacity consists of a 230,000 m3 line operated by Metsa in Finland and a 180,000 m3 line operated by Pollmeier in Germany. An additional 80,000 m3 of capacity is now being installed by Steico in Poland and a further 100,000 m3 by Stora Enso in Finland.

Meanwhile, MLT which operates in western Russia currently has 120,000 m3 of installed LVL capacity. New investment by MLT is expected to increase this capacity to 150,000 m3 by the middle of next year.

All this production is believed to be based on softwoods, with the exception of Pollmeier in Germany which utilises beech.

PDF of this article:

Copyright ITTO 2020 – All rights reserved