EU28 imports of plywood increased 12% to 3.7 million m3 in 2014, the highest level since before the financial crises. Import value also increased 12% to €1.35 billion. The rise was driven mainly by improved consumption in several European markets, notably the UK. Another key factor was an increase in supply of Russian birch plywood combined with a sharp decrease in the value of the Russian rouble on foreign exchange markets which increased competitiveness of imported Russian product relative to domestic production. Another notable feature of the European plywood market in 2014 were signs that rising concern for the environmental and technical performance of plywood is having a more a significant impact on trade.

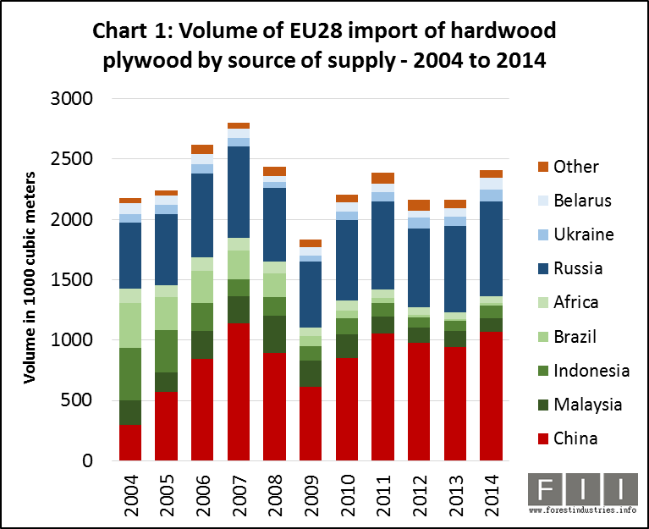

In 2014, the EU imported 2.4 million m3 of hardwood plywood with value of €986 million, up 11% and 13% respectively compared to the previous year. EU imports of this commodity were at their highest level since 2008 (Chart 1).

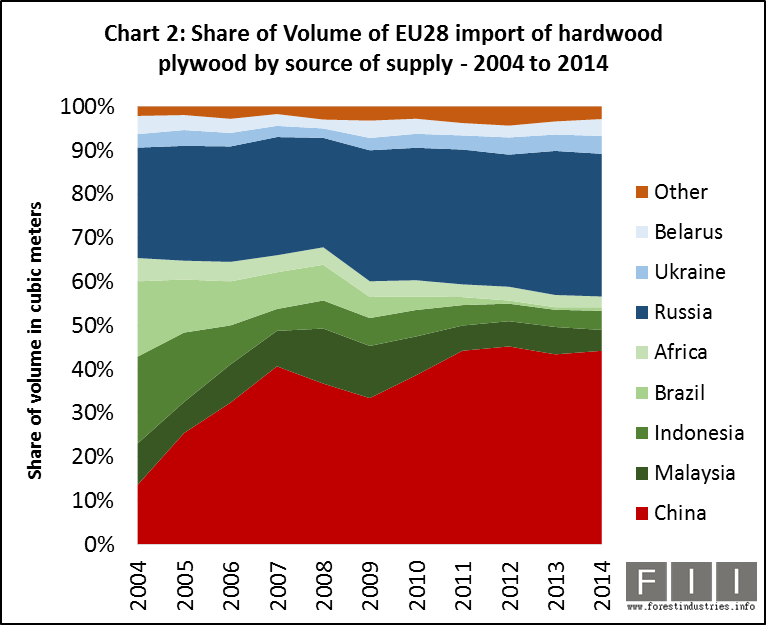

Compared to previous years, in 2014 the EU market for hardwood plywood was less volatile and changes in supply sources and overall market share were relatively minor (Chart 2). EU28 imports of hardwood plywood from China increased 14% to 1.07 million m3 in 2014. However China’s share of total EU28 imports increased only slightly from 43% in 2013 to 44% in 2014. Imports from Russia increased 10% to 785,000 m3 in 2014 and Russia’s share of total imports remained stable at 33%.

Share of EU28 imports of hardwood plywood from tropical countries fell from 14% in 2013 to 12% in 2014. The decline in share was mainly due to a 15% fall in imports from Malaysia to 115,000 m3 in 2014. Imports from African countries also declined by 3% to 59,000 m3. In terms of tropical hardwood market share, these declines in imports were only partly offset by increases from Indonesia (+24% to 105,000 m3) and Brazil (+61% to 20,000 m3).

Sharp increase in EU imports of MLH plywood from China

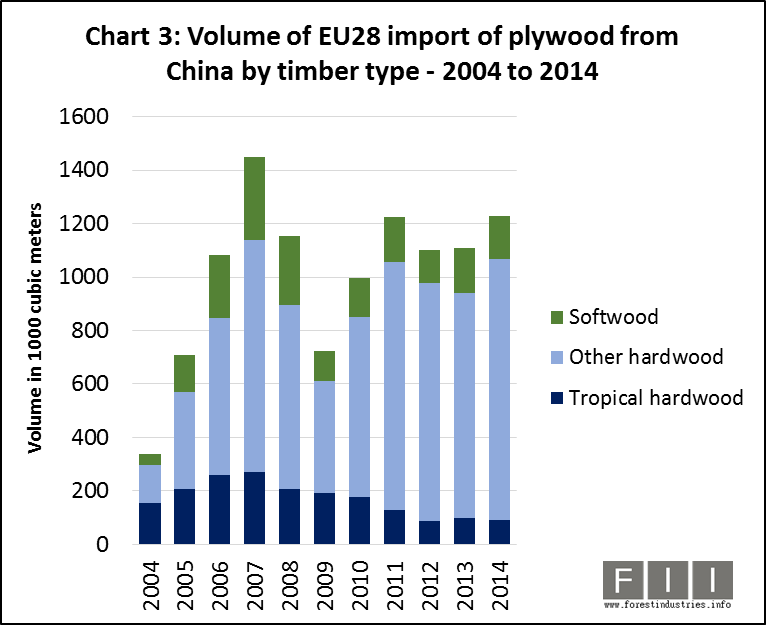

The increase in EU28 imports of Chinese plywood in 2014 was driven mainly by rising demand for plywood faced with “other hardwood”. Most consists of Mixed Light Hardwood (MLH) plywood faced with eucalyptus and poplar, with a smaller amount of birch, other temperate hardwood and lesser known tropical species. EU imports of Chinese softwood plywood and plywood identified as faced with tropical hardwood continued to decline last year (Chart 3).

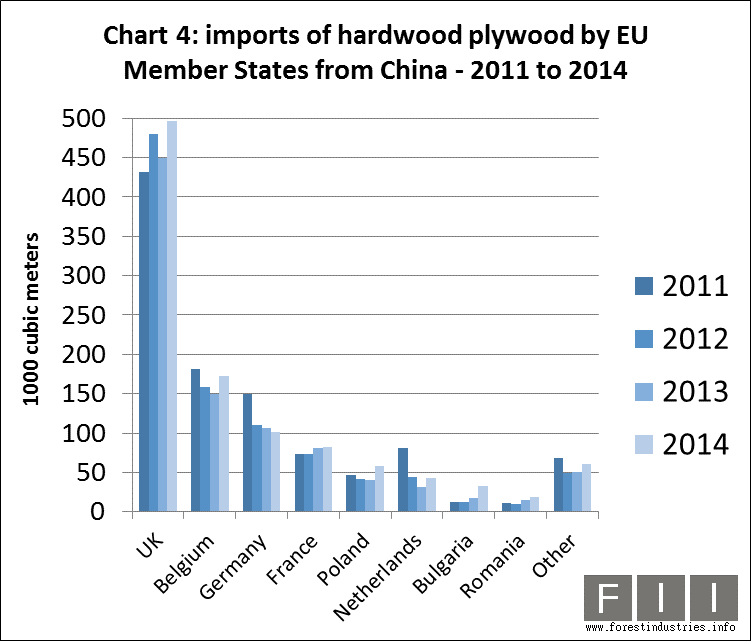

During 2014, there were significant gains in imports of Chinese hardwood plywood into the UK, Belgium, Poland, Netherlands, Bulgaria and Romania. Imports into Germany declined while imports to France were stable (Chart 4).

EU imports of MLH plywood from China benefited from the relatively stable supply situation during 2014 with delivery times into Europe of no more than around 4 to 5 weeks. The decline in imports into Germany is partly due to the recent practice by German customs to record some plywood imports from China as LVL thereby pushing them into a higher tax bracket.

Speculation that implementation of EU Timber Regulation (EUTR) might lead to loss of market share for Chinese plywood in the EU has yet to be realised. It was assumed that obtaining reliable legality documentation might be difficult for Chinese plywood due to complex supply chains and dependence on imported face veneers. Rather than shifting to alternative supply countries in response to EUTR, EU operators have increased purchases of Chinese plywood faced with plantation grown domestic hardwoods perceived to be lower risk.

Sharp decline in UK imports of Malaysian plywood

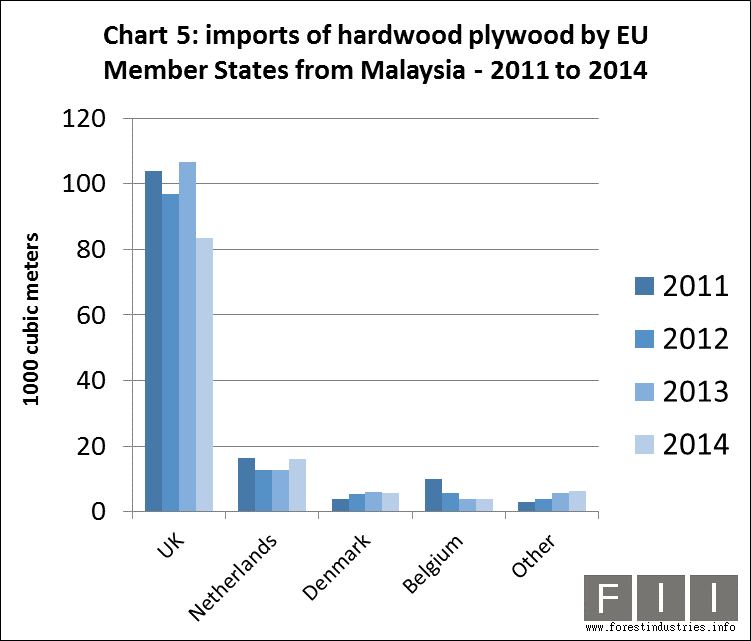

The fall in EU trade in Malaysian plywood was driven by a large decrease in imports by the UK, by far the largest European market for this commodity (Chart 5). Imports by the Netherlands, the second largest market, increased slightly while imports by other EU countries were relatively stable. The decline in UK imports may be partly explained by Malaysia losing GSP preferential tariff status from 1 January 2014. This led to a sharp increase in UK imports from Malaysia in the closing months of 2013 followed by a slowdown in 2014.

Imports from Malaysia also clearly lost competitiveness relative to China and Indonesia in the UK market last year. Malaysian plywood prices were tending to rise in 2014 on the back of higher prices for logs and other materials. The trend is also supply related. In 2014, Malaysian suppliers were focusing more on other more buoyant markets, such as in North America and the Middle East.

Regular shipments and SVLK boost Indonesian plywood market share

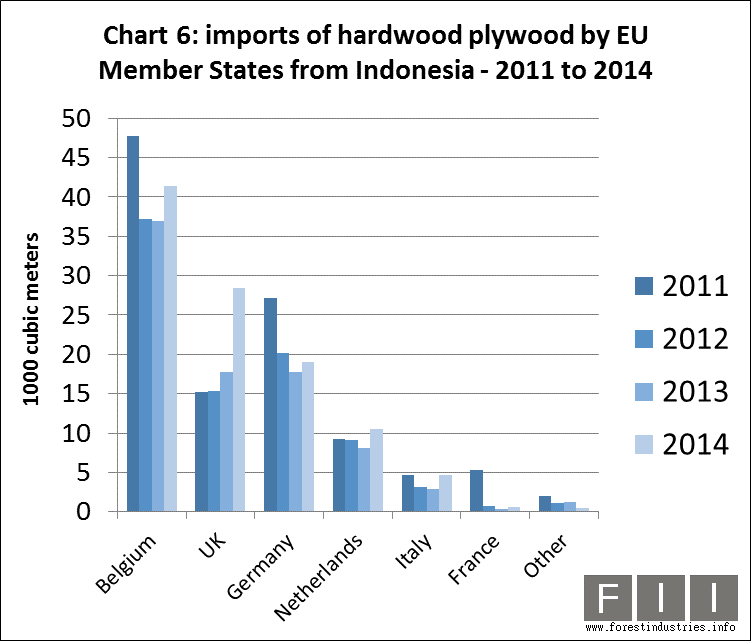

After several years of decline, imports of Indonesian hardwood plywood increased into all five of the leading EU markets – Belgium, the UK, Germany, Netherlands and Italy (Chart 6). Imports into the UK increased particularly rapidly, by 60%, and the country overtook Germany to become Europe’s second largest market for Indonesian plywood.

The increase in UK imports can only be partly explained by the strong recovery in the UK construction sector. The increase is particularly significant for a market not traditionally known for its’ willingness to pay higher prices for better quality product. For many years, Indonesian plywood was squeezed out of the UK market by lower priced plywood from China, Malaysia and Russia, and by other panel products. The rise in UK imports in 2014 comes despite Indonesian plywood prices remaining relatively firm in 2014 and also against the background of a substantial weakening in the value of the GBP relative to the US$.

One factor that has certainly helped boost UK and wider EU imports from Indonesia in 2014 was the resumption of regular break bulk services in response to volatile container freight rates. Indonesian plywood may also be benefitting from rising awareness of the V-Legal/SVLK system, particularly now that EUTR is forcing plywood importers to look more closely at the legality of product. Implementation of the Construction Product Regulation, which extended mandatory requirements for CE Marking of construction products throughout the EU, is also increasing importers focus on species content and other quality aspects of plywood.

Slow French market and new tariffs hit African plywood

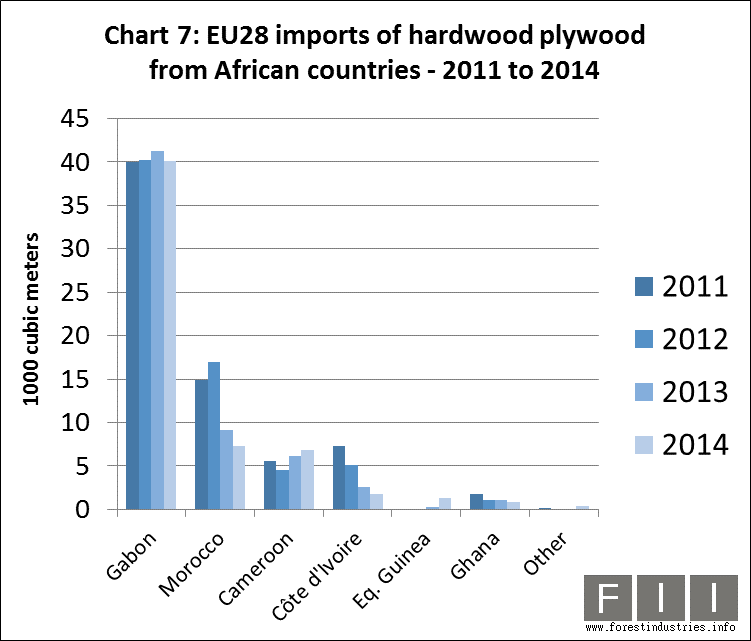

Trends in EU imports of hardwood plywood from African countries varied widely in 2014 (Chart 7). Imports from Gabon, by far the largest African supply country, declined 3% to 40,000 m3. A significant proportion of this product is FSC certified derived from large European-owned operations in Gabon.

Demand was impeded by slow recovery in France, traditionally the main European market for okoume plywood. EU imports in 2014 were also disrupted by occasional strikes by customs officials at Libreville port in Gabon.

Like Malaysia, Gabon’s GSP status changed from 1 January 2014 leading to imposition of a 7% tariff on EU imports of hardwood plywood from Gabon. However, under pressure from EU-based plywood manufacturers, Gabon’s exports of hardwood veneers to the EU were exempt from the increase in duty. The overall effect of the new tariff regime is to favour EU-based over Gabon-based manufacturers.

EU imports of hardwood plywood from Morocco declined sharply in 2014, continuing the downward trend of the previous year. Log export restrictions by Gabon and other countries in the Congo region have meant that Moroccan manufacturers now have limited access to logs. EU imports of plywood from Cameroon have climbed in the last two years, but were still limited at only 7000 m3 in 2014. EU imports from Ivory Coast and Ghana were negligible in 2014.

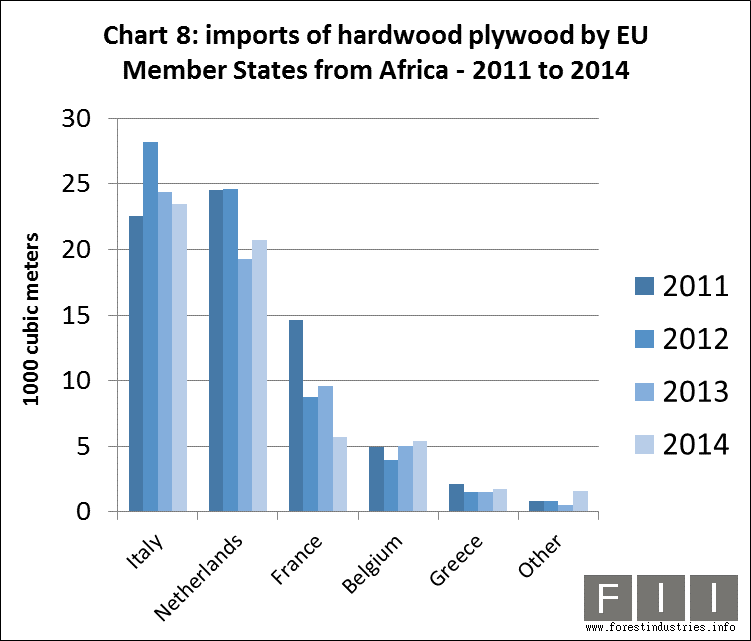

The majority of all African hardwood plywood imported into the EU is now destined for just two countries– Italy and the Netherlands – with smaller volumes destined for France, Belgium and Greece (Chart 8). European consumption of okoume plywood has been in long term decline, particularly in France, formerly the leading market. Imports into France were down 40% in 2014 at only 6000 m3. However imports into Italy were relatively stable, while there were small gains in imports by the Netherlands, Belgium and Greece.

Both EU manufacturers and importers reported slightly better demand for okoume plywood in 2014 than in the previous year. This was driven by slow improvements in the construction sector in the Netherlands and Belgium and by rising boat-building activity in Italy. Sales of okoume plywood – generally sold in euros unlike Asian plywood sold in US$ – also benefitted from the weak euro exchange rate during 2014. Another advantage is relatively short delivery time. Lead times for standard dimensions may be under 2 weeks. A growing share of supply and demand for okoume plywood in the EU market is FSC certified.

With extremely tight margins in the industry, okoume plywood manufacturers were trying to push through price increases in 2014, but struggled in the face of weak European consumption and intense competition from alternative products. However, in early 2015 the market situation has been sufficiently favourable to allow manufacturers and distributors to push through limited price increases, particularly for FSC certified products.

Weak rouble boosts EU imports of Russian birch plywood

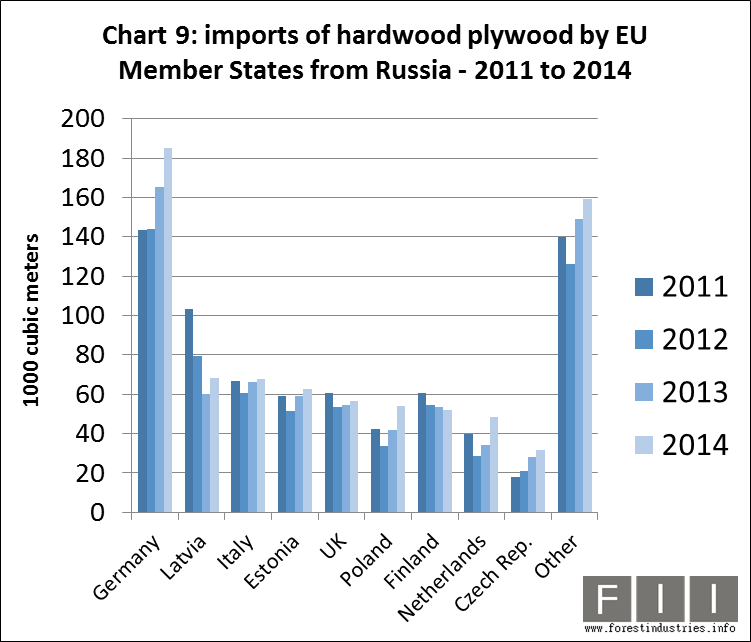

Total EU imports of Russian birch plywood increased 10% to 785,000 m3 in 2014. Unlike other imported hardwood plywood, which is sold into a limited range of Western European countries, the market for Russian birch products is widely distributed across the continent (Chart 9).

In 2014, there was a particularly sharp increase in imports of Russian birch plywood into Germany, the largest market, and also gains in imports into Latvia, Italy, Estonia, the UK, Poland, Netherlands and the Czech Republic. Of larger markets, only Finland imported a lower volume of Russian plywood in 2014. Finland has been mired in recession for the last three years and has a large domestic birch plywood industry.

The price competitiveness of Russian birch plywood increased dramatically in the second half of 2014 due to the sharp fall in the value of the Russian rouble – which plunged 40% against the euro and 50% against the US$ between July and December 2014. Supplies of Russian birch plywood were also readily available. In the last quarter 2014, lead times between ordering and delivery into the EU were no more than around 4 weeks on average. There was particularly good availability of filmed plywood grades as domestic demand for this product in Russia has been weakening.

The dramatic fall in Russian birch plywood prices forced domestic European manufacturers of this commodity to reduce prices to boost market share. In an effort to stem the flow of cheap product into the European market, Russian and European birch plywood manufacturers are now working hard to develop markets in other parts of the world, notably in the United States, South Korea, Egypt, and Turkey.

13% increase in EU imports of softwood plywood

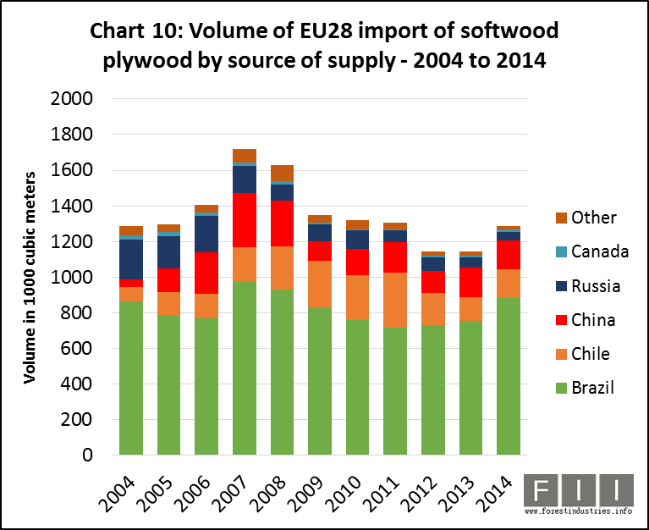

EU imports of softwood plywood were 1.3 million m3 with value of €365 million in 2014, up 13% and 9% respectively compared to the previous year (Chart 10).

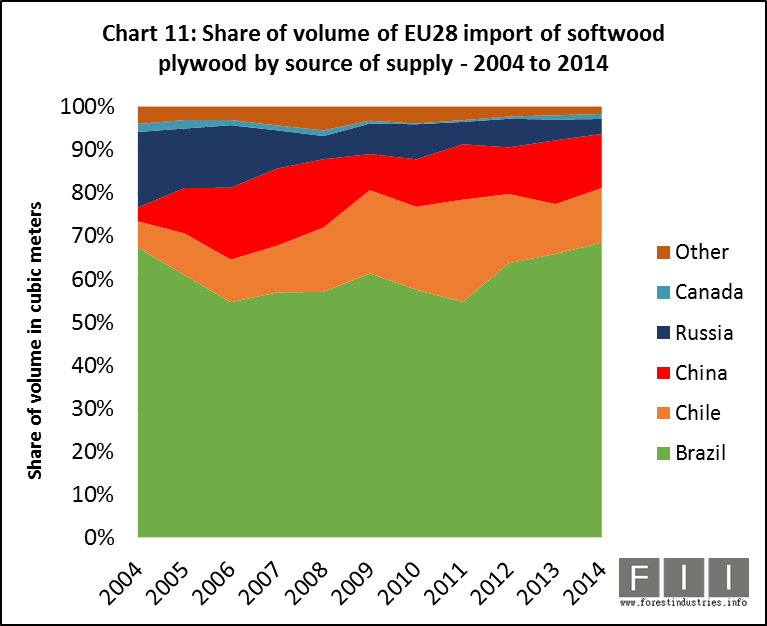

Imports from Brazil increased 17% to 883,000 m3 in 2014. Brazil’s share of total imports increased from 66% in 2013 to 68% in 2014, continuing an upward trend in share that began in 2011 (Chart 11). Imports from Chile also increased 23% to 163,000 m3 in 2014, recovering from a decline in 2013. Between 2013 and 2014 Chile’s share of total EU imports increased from 12% to 13%. However imports of softwood plywood from China declined 5% to 162,000 m3 in 2014. China’s share of EU imports fell from 15% to 13% during the year.

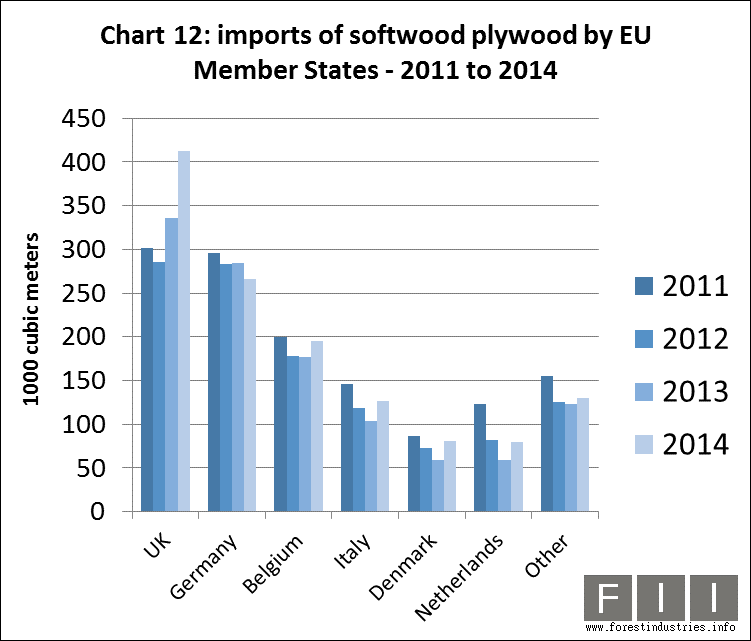

Much of the gain in EU imports was due to improving market conditions in the UK. However imports also increased into Belgium, Italy, Denmark and the Netherlands in 2014. Imports into Germany were weaker in 2014 (Chart 12).

In the first half of 2014, Brazilian exporters were constantly pushing their European buyers to pay higher prices following appreciation of the Brazilian real exchange rate against the dollar and with strong demand in other export markets. Exporters also needed to cover higher log, energy and wage costs. These pressures eased in the second half of 2014 as the Brazilian real once again depreciated against the dollar, GBP and the euro. There has also been sustained downturn in the Brazilian domestic market. Nevertheless, export demand for Brazilian softwood plywood has remained good in North America, Asia and Oceania.

Chinese plywood target of EUTR enforcement activities

Earlier this year, the UK government published a report on EUTR enforcement measures targeting importers of Chinese plywood. The report was prepared by the National Measurements Office (NMO), the UK government agency responsible for EUTR. The report states that the focus on Chinese plywood is not due to concerns about illegal harvesting in China. Instead it is due to the perceived risks of China’s high dependence on imports and the complexity of supply chains for plywood in China.

The NMO report summarises EUTR enforcement action taken against 16 companies importing Chinese plywood into the UK. All the importing companies involved are small-to-medium enterprises (SMEs). Together they were responsible for no more than 10% of the plywood imported from China into the UK in the last year. The action specifically excludes companies that have already demonstrated due diligence to the satisfaction of NMO. The latter includes the whole of the UK’s large-scale timber retail sector which accounts for by far the largest share of plywood imported into the UK.

NMO observes that “the Chinese forestry system and exploitation of domestic forests tend to represent a minor risk due to strong legislation and governance as well as a low risk to the species harvested (poplar, eucalyptus) for plywood manufacturing”.

However NMO also claim that “a range of independent background studies have indicated that timber imported into China is likely to be done so illegally and therefore is unlikely to comply with the due diligence requirements of the EUTR”. This allegation is based on the observation that “large volumes of tropical wood are imported into China from high risk areas (e.g. Papua New Guinea or Africa) specifically for the face and back veneers”.

The NMO report highlights the challenges of due diligence in a long and complex supply chain. In the countries of origin for both the core and the face veneers there can be a number of forests/plantations and a number of harvesters supplying the constituent parts. In turn there are a number of different suppliers to the peeling mills and manufacturers. The supply chain is further complicated as many UK importers employ an agent to do most of their sourcing and purchasing. These agents are in turn using companies that source timber from other agents, resulting in a complicated supply chain.

Species wrongly identified in Chinese plywood

As part of the enforcement action, the NMO performed microscopic analysis on plywood purchased from the importers to ascertain species content. Of the 13 purchases tested so far, 9 products did not match the declaration supplied by each company regarding the species contained within the plywood.

In the 13 tested products, there were four cases in which face veneers were wrongly identified (including sapele misidentified as lotofa, ozigo misidentified as eucalyptus, bintangor misidentified as eucalyptus, and palaquium misidentified as bintangor). There were 8 cases in which the core veneer was wrongly identified. All of these were described as either pure poplar or eucalyptus but in fact contained other species (including kedongdong, pine, kasai, elm, pulai, red meranti, and medang).

Because of supply-chain complexity and the lack of accurate data on the actual level of risk associated with different species and supply sources, NMO does not claim to show that any of the timber in the plywood traded by the 16 UK importers is from an illegal source. The report states that “the species that are found may still be covered by the felling licences, phytosanitary certificates and third-party verification certificates”.

The detailed results of the species analysis suggests no systematic attempt to misrepresent one particular species for another. Instead it indicates a random process due to species mixing and inadequate control in a complex supply chain. Having considered the evidence in more detail, NMO concludes that “the overall risk is low in relation to the possibility of illegal logging in the supply chain”.

No need for EU authorities to prove illegality to prosecute under EUTR

However the report also highlights a key feature of the EUTR. Prosecution of EU operators does not require the EU authorities to establish a credible chain of evidence to show that timber is illegal. The importer has a responsibility to demonstrate due diligence in line with the risk management system specified in the EUTR. This includes documented steps to identify and mitigate any risk that timber is from an illegal source before placing the product on the EU market. The importer can be prosecuted simply for failing to demonstrate to the EU authorities that the risk management system is in place.

The 16 UK importers targeted for enforcement action were requested to supply details of the due diligence system for the Chinese plywood that they place on the market in the EU. The report notes that “14 of the 16 companies submitted due diligence systems that were insufficient when compared to Article 6 of the European Timber Regulation (EUTR) No. 995/2010 that outlines an Operators obligation to implement a due diligence system”.

According to NMO, “the common thread running through these failures was a lack of narrative explaining how the combination of document gathering, risk assessment and mitigation (where necessary) enable the company to reach a conclusion of negligible risk that the timber in the product was sourced illegally”. The failure to accurately identify species in product declarations “further indicated the unreliability of the supply chain of these products”. The NMO also commented that the “unreliability of paperwork was ubiquitous, indicating that this is a clear area for concern in due diligence procedures”.

Following visits to the companies, NMO decided to take no further action in relation to 4 companies. However 7 companies were issued with a warning letter and 5 companies were issued with a notice of remedial action. The NMO also noted that it continues to investigate the companies and that further sanctions will be applied if companies fail to take necessary remedial action.

Implications for UK trade in Chinese plywood

The long-term implications of the NMO report are very significant for the future of the EU trade in plywood manufactured in China. The report shows the determination of the NMO to ensure that the due diligence system specified in the EUTR is applied rigorously. The report also suggests that, in some respects, the NMO is imposing a very rigid and rather inflexible interpretation of the EUTR which may be challenging to implement, particularly for SMEs and when dealing with complex supply chains and composite products.

UK plywood importers are on notice that they must accurately identify the exact species used both for face and core veneers despite the complexity of the supply chain and even if the underlying risks of illegal origin are small. NMO also insist in the report that operators should always assess the paperwork themselves and record their own risk determination. They cannot take certificates and other documents issued by their overseas suppliers at face value and must assess the broader governance environment in the region of supply. Nor can they rely on the assessments of their agents, certifiers or other third parties.

NMO records as an example of a “positive step” taken by one plywood company that it “suspended all supply from Papua New Guinea as they didn’t feel they could reach negligible risk without investing more time and money than what they had originally budgeted”. Boycotting timber from a developing country due to lack of information and resources to undertake risk assessment hardly seems a positive outcome for EUTR.

Other examples of “positive steps” identified by NMO following their engagement include: 9 companies have begun to implement their own species testing procedures as part of their mitigation procedures; a company director visited suppliers in China to establish the origin of species found in plywood cores; a number of importers employed new members of staff or tasked current members to establish and maintain due diligence systems; and introduction of novel approaches to the EUTR such as risk matrices and software systems.

All these steps imply a much more rigorous approach to supply chain management and scrutiny than in the past. The downside is that this means higher transaction costs for the EU trade in Chinese plywood to be absorbed by the supply chain. More positively, the strong focus on species content and transparency in supply chains is an opportunity to improve the quality and reputation of Chinese plywood in the EU market.

NMO conclude their report: “given there is a high overall level of non-compliance in this particular area of the timber trade, it is recommended that a similar project is conducted during the next financial year, targeting other companies, in order to monitor the progress of this sector of the industry”.

Global plywood sector primed for greater inward investment

Global production of plywood increased by 18% between 2005 and 2013, primarily due to a 76% rise in China’s production. There is expected to be continuing high levels of investment in the global plywood industry as facilities are modernised to improve product quality, production efficiency, and to allow processing of smaller logs. These are key conclusions of a wide-ranging review of the international plywood sector by Raute, a company based in Finland which claims to be “the global market leader in supply of machinery, equipment and services to the plywood industry, with a 15–20 percent market share”[1].

[1] Raute’s production facilities are situated in Nastola and Kajaani in Finland, in the Vancouver area in Canada and in the Shanghai area in China. Raute claims to be the largest technology supplier to the plywood industry in Europe, Russia and Chile. It also claims to have been “the first western company to develop modern plywood manufacturing in China”. However Raute plays a smaller role in Japan and North America, where local equipment manufacturers have a strong foothold.

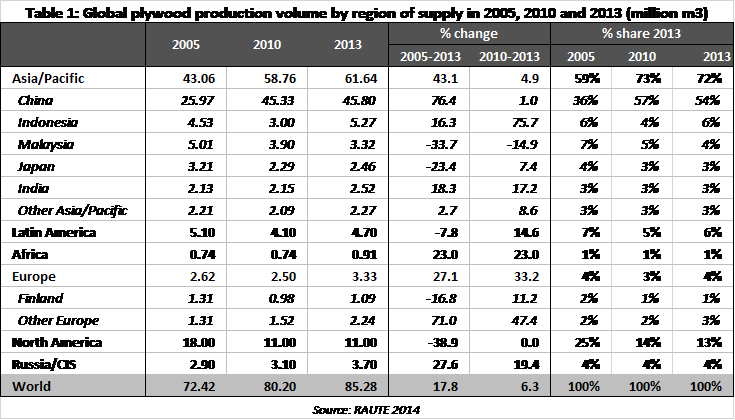

Raute’s analysis of the global plywood sector, which draws on research by Indufor, a Finnish consultancy company, indicates that total global production was 85 million m3 in 2013, a rise of 6% compared to 2010 and of 18% compared to 2005. Production in China is estimated to have been 45.8 million m3 in 2013, only marginally higher than in 2010, but 76% higher than in 2005. China accounted for 54% of global production in 2013, up from 36% in 2005 (Table 1).

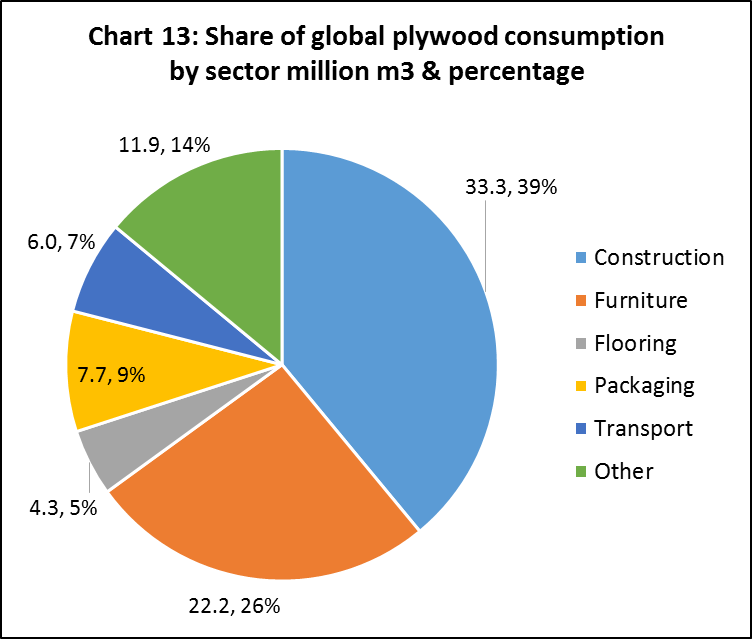

According to Raute, around two thirds of all plywood produced worldwide is used in the construction and furniture sectors, with most of the remainder destined for flooring, packaging and transport applications (Chart 13).

Raute’s analysis considers the present status and potential for future development of the plywood industry in different parts of the world. Key conclusions include:

- Europe is a mature plywood market where manufacturers focus on production of high value-added, high quality end products. Most plywood manufactured in Europe is used domestically, but larger volumes of speciality grades are now being exported, particularly to the US and Asia. The level of technology used in European plywood production is generally high, with a strong focus on production efficiency and systematic maintenance.

- While total capacity in Europe is limited and growth is slow, new plywood facilities have been established in recent years with two major expansion projects launched in 2014 alone. Finland remains by far the largest single producer in Europe, accounting for a third of total production in 2013. However the focus of recent investment has been in the Baltic States and Poland.

- Although Africa is an important supplier of round wood to the global plywood industry, the development of domestic manufacturing capacity has been slow. However recent restrictions on wood exports, notably in Gabon, have encouraged some inward investment in plywood manufacturing. Raute foresees additional future inward investment in the sector, particularly encouraged by demand for more efficient process technologies and the need to add value to aging rubber plantations.

- Russia has a long tradition and a high level of expertise in plywood manufacturing. Russia’s large forest resources, competitive production costs, developing economy and controls on log exports led to a 100% increase in plywood production in the decade before 2013. More recently, poor economic growth has led to a slowdown in plywood sector growth, a trend which became even more pronounced in 2014. However, prospects for future growth still seem good. Weakening of the rouble has boosted the competitiveness of Russian plywood producers in global markets. Russian plywood manufacturers are developing new innovative products and new export markets.

- In China, after a sharp increase in production during the period 2000 to 2010, growth has slowed to a more sustainable level over the last three years. Plywood production in China is traditionally based on highly manual and simple technology. The industry is expected to develop rapidly during the next few years in terms of technology, as rising quality demands imposed in export markets require more modern manufacturing processes. Demand for higher-quality plywood is also likely to increase in China’s domestic market. While a large proportion of raw material used is still imported, the role of domestic plantations is growing.

- Japan’s plywood production has recovered slightly in recent years after a sharp fall between 2005 and 2010. Domestic production has been hampered by the high cost of raw material and competition from imports and alternative products. This in turn has encouraged investment in new technology to deliver improvements in production efficiency and quality.

- There was a sharp decline in the relative share of Indonesia and Malaysia in global plywood production in the decade after the year 2000. However, Raute forecast that expanding plantation forests will facilitate plywood production growth in the coming years. Due to the change in the raw material base, Raute expects the existing machine base to be rebuilt and modernized.

- In India, the majority of plywood production continues to be highly labour-intensive and relies on simple technology. India’s extensive eucalyptus and poplar plantations are insufficient to meet the increased raw material needs of the industry. India therefore remains a significant importer of plywood, particularly tropical plywood from East Malaysia.

- Brazil is the biggest plywood manufacturer in South America, but the technology in use is outdated. According to Raute, import controls and financial subsidies for local machinery manufacturers have reduced investment in technology upgrades. In addition, Brazil is losing competitiveness relative to Chile which now has higher quality raw material resources. The main export market for Brazilian plywood is Europe, but domestic demand has increased following the country’s economic growth. Plywood manufacture is expected to be consolidated in the future, but total production is likely to remain at the current level.

- In Chile, rising profitability and availability of good quality plantation resources are encouraging further expansion of the plywood industry. New production capacity is being built this year and further investment is expected in 2016. The industry has a relatively high level of consolidation and is dominated by a few large companies. Most plywood is exported to North America and Europe, but domestic consumption is also increasing.

- North America is the world’s second largest plywood production region. However there was a significant decline in production capacity during the financial crises, driven by the collapse in U.S. housing starts and increased competition from Chinese plywood and other substitute products. The plywood industry in the area is now highly consolidated. New investment in the industry has been very low in recent years and mainly targeted at modernization projects. Raute forecasts no significant change in this situation in the medium term.

PDF of this article:

Copyright ITTO 2020 – All rights reserved