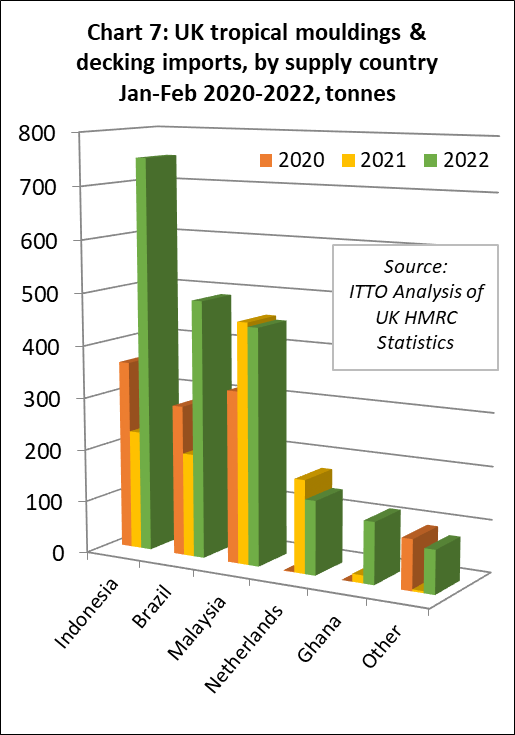

The import value of tropical wood and wood furniture into the UK in the opening two months of this year were at record levels. In the January to February period, import value totalled US$270 million, 47% more than the same period in 2021 when imports were also high following a strong rebound after the downturn during the first COVID lockdown in 2020. In fact, this was by far the highest value import of tropical wood and wood furniture products into the UK in any two month period since at least before the 2008 financial crises.

The strong performance in the first three months of this year reflect both high consumption in the UK, still supported by post-COVID government stimulus, and the late arrival of delayed shipments from the previous year. Demand has remained particularly good in housing repair, maintenance, and improvement, always a big driver of hardwood demand and the fastest growing part of the UK construction sector following the initial COVID lockdown.

Meanwhile availability of hardwood and furniture products from the UK’s traditionally largest suppliers in Europe and the United States was very tight even before Russia’s invasion of Ukraine in the last week of February, encouraging importers to look more to tropical products. Importers also tend to thrive when prices are high and margins wide, so there has been a strong incentive to look around for supplies and build stock.

The high level of UK import value in the opening months of the year is also partly owing to high material prices and freight costs. Although hardwood product prices were declining steadily from the middle of last year to February this year, they are still very high compared to the beginning of last year. Freight rates also declined from the heights reached in the third quarter of last year but were still at an historically very high level at the end of February.

The downward trend in hardwood prices has reversed since Russia’s invasion of Ukraine. This event seriously disrupted all supplies of European and Russian hardwood products, partly because of the direct effects of sanctions against Russia, partly the immediate effects of the war on Ukrainian supply, and partly because of the large numbers of Ukrainians, who contribute a disproportionately large number of truck drivers operating in Europe, who returned home during the conflict. The war has also driven up energy costs, filtering through into rising prices for all European manufactured products, including for wood and furniture.

According to statistics provided by the UK Department for Business, Energy & Industrial Strategy (BEIS), timber prices in the UK have been significantly affected by the war in Ukraine. The price of sawn or planed wood imported into the UK increased on average by 2.5% in March this year following five months of steady decline. The price was also 11% more than in March 2021. The price of imported plywood also increased 2.5% in March this year and was up 28% compared to March 2021.

Less positive outlook for UK market in 2022 and 2023

Prospects for strong demand for wood products in the UK continuing throughout this year and into 2023 look increasingly uncertain. In early May, the Bank of England warned that Britain’s economy could plunge into recession before the end of this year.

The gloomy outlook statement came as the Bank’s monetary policy committee (MPC) raised interest rates from 0.75% to 1% to tackle spiralling inflation made worse by Russia’s war in Ukraine and the impact on supply chains from COVID lockdowns in China. With a fresh jump in UK home energy bills expected in October, when a government-imposed cap on energy charges is due to be removed, it forecast inflation would rise above 10% this year, the highest level since 1982.

Squeezed between rising borrowing costs and high levels of inflation, the Bank said that British households this year are likely to suffer the second biggest squeeze on their incomes since records began in 1964. Economists at the Resolution Foundation said the Bank’s projections showed the average household in Britain would lose about £1,200 this year from the cost of living squeeze, laying the ground for a weaker period of growth ahead as families rein in their spending.

The pound fell sharply after the rate decision as the City reacted to Britain’s weaker economic prospects. Sterling tumbled by almost 3 cents against the dollar on the currency markets and by more than a cent against the euro.

The MPC said the sharp rise in energy costs projected in October this year would likely result in a fall in GDP in the fourth quarter. Although a modest recovery is expected at the start of next year, ensuring two consecutive quarters of falling GDP (the technical definition of a recession) is likely to be avoided, the Bank warned Britain’s economy would shrink by 0.25% over the course of 2023 as a whole, in effect a slow-burn recession.

Reflecting this uncertainty in the wider economy, the UK Construction Products Association (CPA) sees a dramatic slowing in growth in its latest forecast published in early May. In previous years, the predicted 2.8% growth in construction output anticipated by the CPA team would be cause for celebration. However, while a robust figure, this is a sharp revision down from the 4.3% growth forecast just three months ago.

According to CPA, demand has continued to be strong across the UK construction industry in the second quarter, and the current project pipeline suggests that this will support activity levels until at least the third quarter of this year. The downward revision to the growth forecast stems from concern around a host of price pressures arising from both local and global issues.

Prior to the conflict in Ukraine, UK construction was already facing labour and product availability issues due to disruption during COVID pandemic and effects of Brexit. Rising energy costs were driving near-record price increases in construction products and the conflict has exacerbated this issue, according to CPA.

Across all sectors of UK construction, the picture is one of positive market conditions in the short term with anticipation of tougher times ahead. Conditions are expected to be particularly volatile in the private housing repair, maintenance, and improvement sector. While booming at present, this is the sector arguably most exposed to current price inflation, falls in consumer confidence and pressures on household incomes. Overall, CPA expect output in this sector to fall by 3% in 2022 and 4% next year from current all-time highs.

Private housing, the largest construction sector in the UK, remains strong, with housebuilders reporting resilient demand. Longer term, there must be questions over consumer confidence but CPA forecasts output in this sector to rise by 1% in both 2022 and 2023. This contrasts with the 3% per year growth forecast three months ago. The fastest growth is expected in the industrial sector, in which output is forecast to rise by 9.8% in 2022 and 9.3% in 2023, due to a strong pipeline of warehouse projects, resulting from a long-term shift towards online shopping.

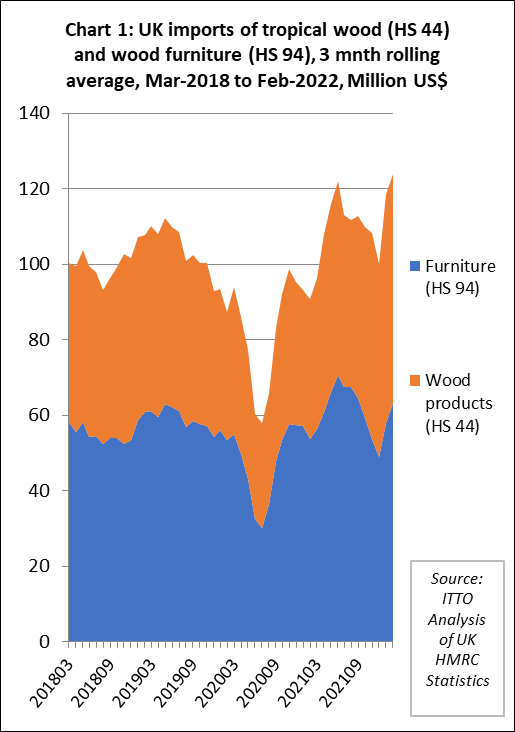

Indonesia leads rise in tropical wood furniture imports into the UK

Overall the UK imported USD136 million of tropical wood furniture products in the first two months of 2022, which is 29% more than the same period in 2021. It is also 23% more than the same period in 2020, before trade was affected by the first COVID lockdown which began in the UK on 23 March 2020. UK imports of wood furniture from all four of the leading tropical supply countries to this market were very strong in the opening two months of this year compared to last including Vietnam (+27% to USD66 million), Malaysia (+28% to USD28 million), Indonesia (+103% to USD17 million) and India (+71% to USD16 million). Imports from Singapore, which increased sharply last year due to shipping problems elsewhere in Southeast Asia, fell back 57% to more a “normal” level of just USD3 million in the two month period (Chart 2).

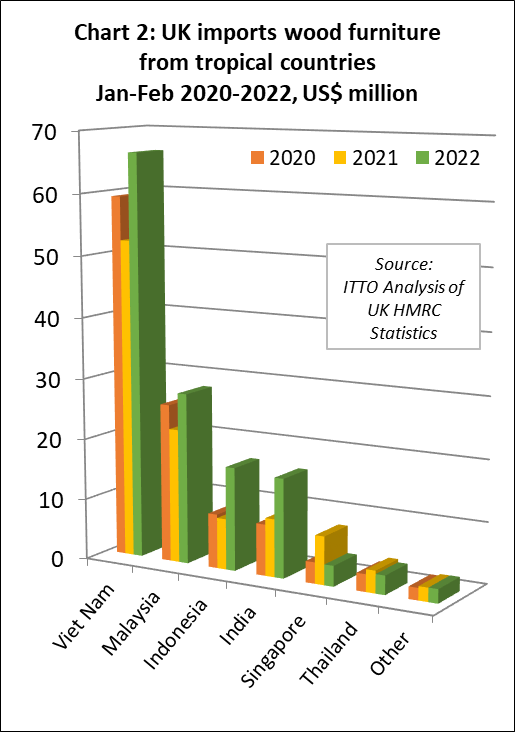

UK tropical wood imports up 72% in the first two months of 2022

UK imports of all tropical wood products in Chapter 44 of the Harmonised System (HS) of product codes were USD134 million in the first two months of 2022, 72% more than the same period in 2021 and 81% up on the (pre-COVID) level in the same period in 2020. Compared to the first two months last year, UK imports of tropical joinery products increased 64% to USD53 million, imports of tropical plywood were up 46% to USD32 million, imports of tropical sawnwood were up 132% to USD28 million, and imports of tropical mouldings/decking increased 71% to USD6 million (Chart 3).

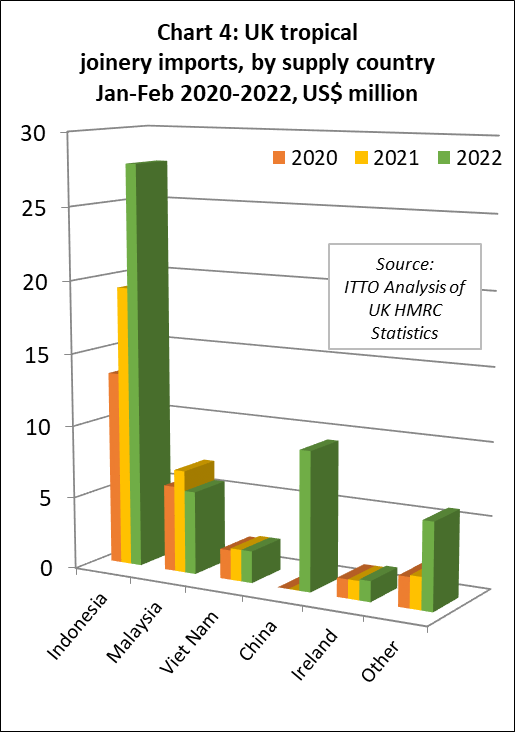

After the sharp dip in UK imports of tropical joinery products during the first lockdown period in the second quarter of 2020, imports of this commodity group have progressively built momentum. This trend is mainly driven by Indonesia for which UK joinery imports, mainly consisting of doors, were USD28 million in the first two months this year, 44% more than the same period in 2021 and 108% more than the pre-COVID level in the first two months of 2020 (Chart 4).

UK imports of joinery products from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) started this year more slowly. Imports from Malaysia were USD6 million in the two month period, 20% less than the same period last year. Imports of USD2 million from Vietnam in the first two months this year were the same level as last year.

UK import value of Chinese joinery products, nearly all comprising doors, was USD10 million in the first two months of 2022, up from negligible levels in previous years. Due to introduction from 1st January 2022 of new product codes in the EU Combined Nomenclature (still mirrored by the UK post-Brexit) it is now possible to identify wood doors and windows manufactured using a wider range of tropical wood species in UK and EU trade statistics. The apparent rise in imports of “tropical” wood joinery from China is very likely due to these products now being identifiable as of tropical species, whereas previously they were classified as “other non-coniferous” in the trade statistics and excluded from the figures for tropical wood imports.

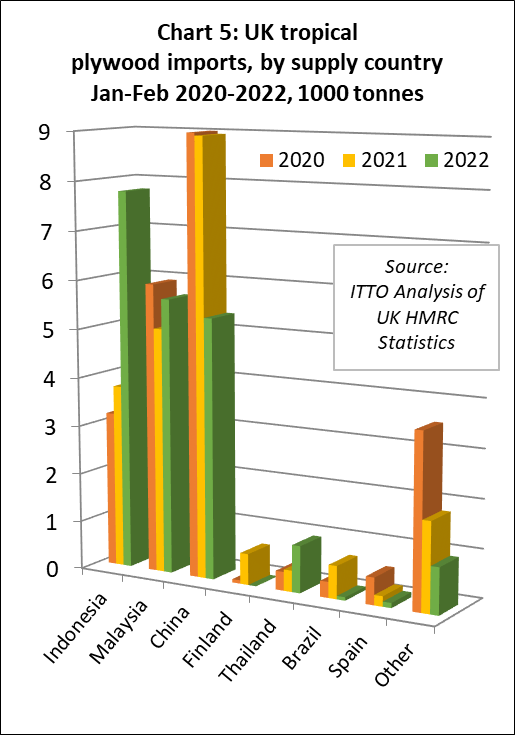

In the first two months of 2022, the UK imported 20,900 tonnes of tropical hardwood plywood, 3% less than the same period last year and 9% down on the same period in 2020. Imports from the UK’s three largest suppliers of tropical hardwood plywood – Indonesia, Malaysia, and China – have followed very different trajectories in recent years (Chart 5).

UK imports of tropical plywood from Indonesia were 7,800 tonnes in the first 2 months of this year, a gain of 107% compared to the same period last year and 144% more than the pre-pandemic level in the first two months of 2020. This suggests a potentially significant shift towards Indonesia in the UK plywood sector, all the more remarkable because it was occurring before economic sanctions against Russia, imposed from March onwards, effectively removed Russian birch plywood from the UK and wider EU supply equation.

The likelihood is that the UK will have to turn more to Indonesia for hardwood plywood supply in the future, if only Indonesian exporters are able, or willing given potentially strong demand elsewhere, to make sufficient volumes available to the UK market. However too much shouldn’t be read into just two months of data, particularly when logistical challenges and high container rates have led to more dependence on less frequent breakbulk shipments into the UK from Indonesia.

In contrast to the very large gains in UK imports of plywood from Indonesia in the first two months of 2022, imports of 5,700 tonnes from Malaysia were just 12% more than the same period last year and 5% less than the same period in 2020. UK tropical hardwood plywood imports from China started this year even more slowly, at 5,300 tonnes in the first two months, down 40% on the same period in 2021 and 41% less than this period in 2020.

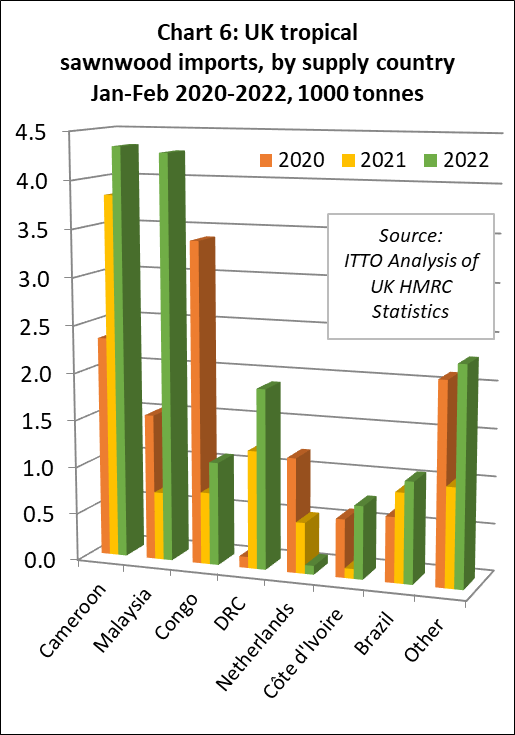

Big shift in countries supplying tropical sawnwood to the UK

UK imports of tropical sawnwood started this year strongly. Imports were 15,800 tonnes in the first two months of 2022, 72% more than the same period last year and 32% more than the same period in 2020. In addition to making major gains overall, there were big changes in the countries supplying tropical sawnwood to the UK in the opening months of this year (Chart 6). This is indicative of the major shifts in hardwood markets since the start of the pandemic which have led to significant supply shortages and sharply increasing prices in many supply regions and continuing high levels of demand in markets like the UK.

UK imports of tropical sawnwood from Cameroon were 4,300 tonnes in the first two months of this year, 13% more than the relatively high level in the same period last year and 86% more than the same period in 2020. UK imports from Malaysia, which had fallen to little more than a trickle in recent years, were 4,300 tonnes in the first two months this year, a 5-fold increase compared to the same period last year and nearly a 3-fold gain compared to the pre-pandemic level in the opening two months of 2020.

In contrast, UK imports of tropical sawnwood from the Republic of Congo (RoC) were only 1,100 tonnes in the first two months of this year which, while 43% more than the same period last year, were 68% less than the same period in 2020. Before the pandemic, the UK had been sourcing more sawn hardwood from RoC but this trend has faltered in the last two years. However, there has been a big rise in UK imports from DRC, which were 1,900 tonnes in the first two months this year, a gain of 52% compared to the same period last year. UK imports from DRC were negligible before the pandemic.

UK imports of tropical sawnwood from Côte d’Ivoire were 800 tonnes in the first two months this year, a big increase compared to negligible imports in the same period last year and a 25% increase compared to the same period before the pandemic in 2020. Imports of tropical hardwood sawnwood from Brazil also made gains from a small base, at 1,100 tonnes in the first two months of this year, 13% more than the same period last and 55% more than the same period in 2020.

Indirect UK imports of tropical sawnwood from other EU countries have fallen dramatically since the UK’s departure from the EU single market on 1st January 2021. Total UK imports from EU countries were 2,600 tonnes in the first two months of this year, 30% less than the same period last year and 39% down on the same period in 2020.

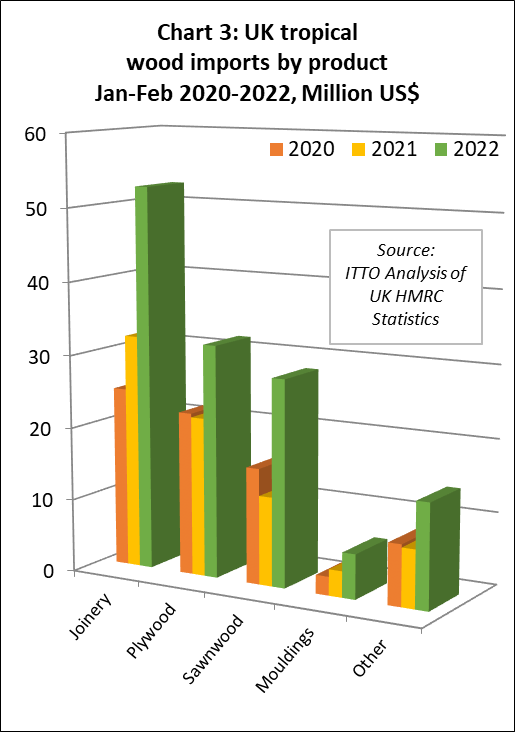

UK imports of tropical hardwood mouldings/decking were relatively high in the opening two months of 2022, at 2000 tonnes, 88% more than the same period the previous year and 90% more than the pre-pandemic level in the first two months of 2020. This is another commodity group for which there has been particularly strong demand in the UK, combined with sharply tightening supply since the start of the pandemic. And like in the plywood sector, the war in Ukraine and sanctions on Russia are expected to lead to even tighter supplies of non-tropical decking products that directly compete with tropical decking in the short to medium term.

UK imports of decking/mouldings increased sharply from Indonesia and Brazil in the first two months of this year. Imports of 751 tonnes from Indonesia were 230% more than the same period last year and 108% more than the same period in 2020. Imports of 490 tonnes from Brazil were 149% up on the same period in 2021 and 71% more than the same period in 2020. Imports from Ghana, at 117 tonnes in the first two months of this year, while still very small were potentially significant for representing the first notable increase in imports of this commodity from Ghana for several years. (Chart 7).