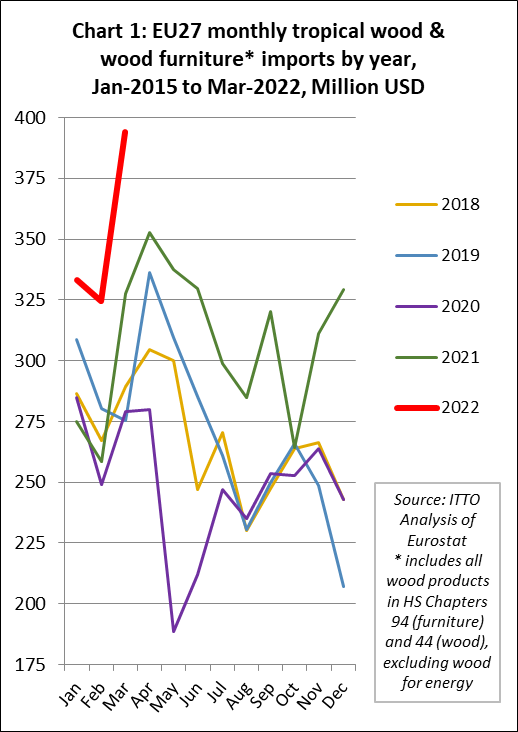

In the first three months of this year, the value of EU imports of tropical wood and wood furniture was at a level not seen for over a decade. Import value was USD1.05 billion in the first quarter, a gain of 22% compared to the same period last year. It was also 16% up on the last quarter in 2021 when trade was already at a decadal high for that period of the year (Chart 1).

A large part of the gain in tropical wood import value in the first quarter this year reflected a rise in CIF prices, driven both by continuing high freight rates and severe shortages of wood and other materials due to logistical challenges during the global pandemic. In quantity terms, EU imports of tropical wood and wood furniture products in the first quarter this year were, at 459,000 tonnes, up only 10% compared to the same period in 2021 and slightly below the pre-pandemic level of 479,000 tonnes in the first quarter of 2020.

The Drewry World Container Index shows that global rates for a 40 foot container, after peaking at USD10400 in the middle of September 2021 compared to USD2000 in the same month in 2020, were still in excess of USD9000 for most of the first quarter this year. The index began to fall from mid-March this year but remains at an historically high level of USD7600 in May.

Nevertheless, a robust rebound in EU economic activity following the COVID downturn did play a role to underpin stronger trade in tropical wood products during the first quarter this year. Rising activity in key sectors such as furniture and construction, particularly in private sector renovation, maintenance, and improvement (RMI), coincided with severe shortfalls in the supply of tropical wood alternatives.

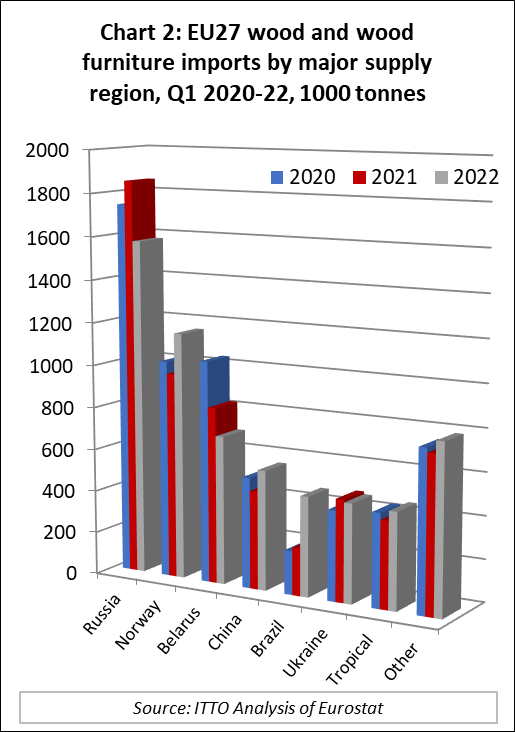

These shortfalls have become even more pronounced since Russia’s invasion of Ukraine on 24 February greatly curtailed availability from Russia, Belarus and Ukraine. Together these three countries accounted for over 50% of all wood fibre imported into the EU for outside the bloc last year.

The curtailment of supplies from these countries is opening up new opportunities in the EU market for some tropical wood products, notably plywood and decking for which Russian birch and larch products have been important substitutes.

The first quarter import data doesn’t reveal any increase in share for tropical wood in the EU market, unsurprising as the full impact of the war in Ukraine on wood supply in the EU had yet to be felt in that period. However, EU imports from Russia and Belarus did begin to decline during this period and early beneficiaries of the opening supply gap appear to have been Norway, China and, most notably, Brazil (non-tropical products only) (Chart 2).

Meanwhile the war in Ukraine is having a severely detrimental effect on the wider European economy. Before the invasion, the EU economy was well positioned for robust recovery as COVID restrictions have been eased and as funds from the €723.8 billion Recovery and Resilience Facility are now being rolled out across the EU Member States.

But now growth projections are being severely cut back in the face of rapidly rising energy costs as EU countries are under considerable pressure to reduce dependence on Russian gas and oil. Rising energy costs, combined with the direct impact of the war and trade sanctions on availability of agricultural and other essential commodities, is driving inflation in the EU to historically high levels. The inflation shock has been made worse by the impact on supply chains from Covid lockdowns in China.

To dampen inflation, European central banks are now under pressure to raise interest rates. But this would bring borrowing costs to levels unseen since the recession caused by the 2008 financial crisis and would likely undermine fragile consumer confidence and reduce business investment. So while EU demand for wood products was high at the start of this year, it may tail off later in the year.

Strong growth in EU27 import value of wood furniture, sawnwood and decking

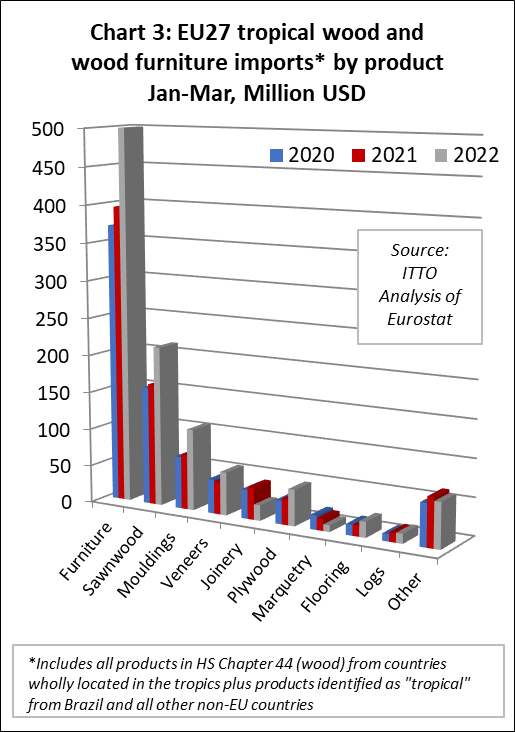

The increase in the value of EU27 imports from tropical countries in the first quarter this year was concentrated in wood furniture products, sawnwood and mouldings/decking (Chart 3). For wood furniture, import value of USD500m during the three month period was 26% more than the same period last year. For tropical sawnwood, import value of USD214m was 31% up on the same period last year. Import value of tropical mouldings/decking was USD108m in the first quarter this year, a gain of 47% compared to the same period in 2021.

There were also significant gains, but from a smaller base, in the value of EU imports of tropical veneer (+32% to USD57m), plywood (+41% to USD48m), and flooring (+41% to USD20m) in the first quarter this year. Import value of tropical logs was USD13m in the first quarter this year, just 6% more than the same period last year. In contrast, EU import value of other tropical joinery products (mainly doors and laminated window scantlings and kitchen tops) declined by 52% to just USD21m in the first quarter of this year.

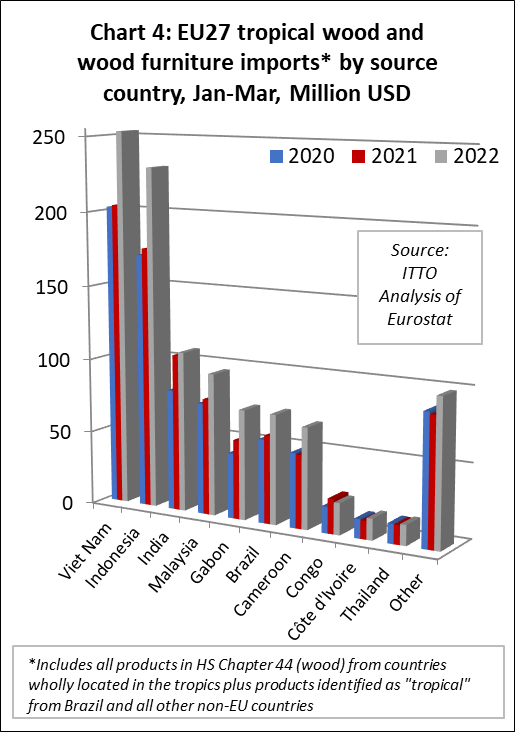

In terms of source countries, EU27 import value of wood and wood furniture in the first quarter this year was up significantly compared to the same period last year from Viet Nam (+24% to USD253m), Indonesia (+31% to USD230m), Malaysia (+22% to USD96m), Gabon (+39% to USD74m), Brazil (+25% to USD74m), Cameroon (+38% to USD68m), and Cote d’Ivoire (+18% to USD14m). However, import value from India increased only 2% to USD108m while import value from the Republic of Congo declined 9% to USD21m (Chart 4).

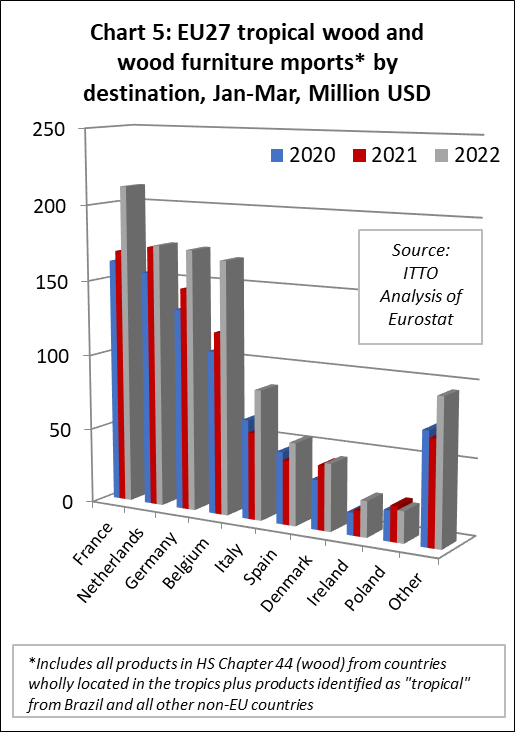

In terms of destinations, EU27 import value of tropical wood and wood furniture in the first quarter this year was up significantly compared to the same period in 2021 in France (+25% to USD212m), Germany (+17% to USD173m), Belgium (+39% to USD168m), Italy (+50% to USD86m), Spain (+28% to USD55m), and Ireland (+42% to USD24m). Import value was little changed compared to last year in Netherlands (USD175m) and Denmark (USD45m). Import value was down 11% to USD21 million in Poland (Chart 5).

EU wood sanctions against Russia and Belarus

Since March 2014, the EU has progressively imposed sanctions against Russia, initially in response to Russia’s annexation of Crimea and Sevastopol and deliberate destabilisation of Ukraine. On 23 February 2022, the EU expanded the sanctions in response to the recognition of the non-government controlled areas of the Donetsk and Luhansk oblasts of Ukraine and the ordering of Russian armed forces into those areas.

After 24 February 2022, in response to Russia’s invasion of Ukraine, the EU massively expanded the sanctions. It added a significant number of persons and entities to the sanctions list and adopted unprecedented measures with the aim of significantly weakening Russia’s economic base, depriving it of critical technologies and markets, and significantly curtailing its ability to wage war.

EU economic sanctions now directly target exchanges with Russia in a wide range of economic sectors. The wood sector is specifically identified as subject to EU sanction so that all EU wood product imports from Russia into the EU are now banned according to EU legislation.

In addition, in response to Belarus role in support of Russia’s invasion of Ukraine, the EU has banned all trade in wood products with Belarus, and all transhipment of Belarus wood products to other countries via the EU.

Other measures indirectly affect the wider trade in timber, including a ban on access of all Russian ships to EU ports and a ban on the entry of Russian and Belarusian road transporters into the EU.

Overall the measures are expected to add to volatility of wood markets in the EU and contribute to a significant wood supply deficit as around 45% of wood imports, by tonnage, into the EU from outside the bloc were formerly derived from Russia and Belarus. Certification systems are also affected as timber sourced from Russia and Belarus is considered as “conflict timber” and therefore cannot be FSC or PEFC certified.

More details EU sanctions against Russia and Belarus are available at:

Reduction in EU growth forecast due to conflict in Ukraine

According to the EU’s Spring Forecast published on 16 May, the outlook for the EU economy before Russia’s invasion of Ukraine on 24 February was for a prolonged and robust expansion. But the war in Ukraine has posed new challenges just as the EU had recovered from the economic impacts of the pandemic.

By exerting further upward pressures on commodity prices, causing renewed supply disruption and increasing uncertainty, the war is exacerbating pre-existing headwinds to growth, which were previously expected to subside. This has led the European Commission (EC) to revise the EU’s growth outlook downwards, and the forecast for inflation upwards.

Real GDP growth in both the EU and the euro area is now projected by the EC at 2.7% in 2022 and 2.3% in 2023, down from 4.0% and 2.8%, respectively, in the Winter 2022 interim Forecast. Continued growth is due to the combined effect of post-lockdown re-openings of service industries and the strong policy action taken to support growth during the pandemic.

A strong and still improving labour market, lower accumulation of savings and fiscal measures to offset rising energy prices are set to support private consumption. Investment is set to benefit from the full deployment of the EU’s Recovery and Resilience Facility and the implementation of the accompanying reform agenda.

The main hit to the global and EU economies due to the war in Ukraine comes through energy commodity prices. Although they had already increased substantially before the war, from the low levels recorded during the pandemic, uncertainty about supply chains has pressured prices upwards, while increasing their volatility. This is true for food and other basic goods and services, with households’ purchasing power declining.

War-induced logistics and supply chain disruptions, as well as rising input costs for a broad array of raw materials, add to the disturbances in global trade caused by the drastic COVID-19 containment measures still applied in parts of China, weighing on production.

Together these factors have led to a sharp rise in inflation in the EU. Inflation is expected to increase from 2.9% in 2021 to 6.8% in 2022 and fall back to 3.2% in 2023.

More encouragingly, the EU labour market is entering the new crisis on a strong footing. In 2021, more than 5.2 million jobs were created in the EU economy, which attracted nearly 3.5 million more people into the labour market. In addition, the number of unemployed decreased by nearly 1.8 million people. Unemployment rates at the end of 2021 fell below previous record lows. Labour market conditions are expected to improve further with unemployment rates forecast to decline to 6.7% this year and 6.5% in 2023.

Despite the costs of measures to mitigate the impact of high energy prices and to support people fleeing Ukraine, the aggregate government deficit in the EU is set to decline further in 2022 and 2023 as temporary COVID-19 support measures continue to be withdrawn. From 4.7% of GDP in 2021, the deficit in the EU is forecast to fall to 3.6% of GDP in 2022 and 2.5% in 2023 (3.7% and 2.5% in the euro area).

The EC notes that risks to the forecast for economic activity and inflation are heavily dependent on the evolution of the war, and especially on its impact on energy markets. For example, an outright cut in EU gas supply from Russia – which is possible given rising tensions – would lead to GDP growth rates around 2.5 and 1 percentage points below the baseline forecast in 2022 and 2023.

On top of such potential disruptions in energy supply, worse than expected problems in supply chains and further increases in non-energy commodity prices, especially food, could lead to additional downward pressures on growth, and upward pressures on prices. COVID-19 also remains a risk factor.

Sharp fall in EU construction orders in April

Mounting economic uncertainty in the EU since the start of the Ukraine war is feeding through into a slowdown in construction sector growth. This is evident from the latest S&P Global Eurozone Construction Purchasing Managers Index (PMI) issued 5 May.

S&P Global note that “The upturn in the eurozone construction sector may have extended to a seventh month in April, but the rate of growth eased considerably to reach the slowest in this sequence. The slowdown in activity came amid the sharpest reduction in new order inflows since February 2021 as supply shortages and headwinds from the war in Ukraine weighed increasingly on confidence and potential tenders”.

S&P Global also highlight that construction firms continued to report widespread shortages of raw materials across the bloc and beyond in April, which placed sustained strain on supply chains and cost burdens. As a result the rate of input price inflation accelerated from March to the second-highest in the survey history. Increased headwinds from supply chains and the impact of the war dampened confidence, with firms signalling the greatest degree of pessimism since November 2020.

At the national level, S&P Global report that Italian firms indicated a solid rise in activity that was the slowest for six months, while French companies saw a renewed rise. However constructors in Germany reported the sharpest fall in activity since August 2021.

Tropical timbers added to EU Endangered Species regulation

In January 2022, the European Commission listed new species in Annex D of the EU Regulation of 16 December 2021 amending the Regulation on the protection of species of wild fauna and flora by regulating trade therein and the EC Regulation. Annex D : includes species which are not listed in CITES, but whose import volumes the EU considers justify monitoring. Species listed in EU Annex D include

Okoumé: Aucoumea klaineanaIpe:

Handroanthus sppSapelli:

Entandrophragma cylindricumMoabi:

Baillonella toxisperma :

All imports of Annex D species must be covered by an Import Notification. Blank import notification forms for specimens of species listed in Annex D are available from the CITES Management Authority of the EU Member State of destination. The EU importer is responsible for completing the form and presenting the notification to the Customs service at the first point of introduction into the EU. After verification of the documents presented, the customs service completes and endorses the import notification sheets.