The European trade show season is now well underway, starting in Germany during January with the Domotex flooring show in Hanover and the IMM furniture show in Cologne. The shows provide good insights into European wood market prospects in the year ahead.

There was mood of optimism at both shows this year, with each reporting a significant rise in visitor numbers and exhibitors, in line with the general improvement in economic performance across the continent.

However, the shows once again highlighted the challenges both for tropical manufacturers in relation to other wood manufacturers, and for wood generally compared to non-wood materials in the European furniture and interiors sector.

DOMOTEX 2018 showed that the European flooring sector continues to be a diminishing market for tropical wood suppliers and product manufacturers.

The IMM show was more positive for tropical suppliers, highlighting that some furniture manufacturers in the tropics are successfully implementing innovative market development strategies in Europe, building on traditional skills and craft traditions, as well as lower labour costs and environmental initiatives like FLEGT licensing.

Natural materials preferred at Cologne furniture show

IMM held in the German city of Cologne between 15th and 21st January, was host to around 1200 exhibitors – over 70% from outside Germany – and 125,000 visitors, a slight increase compared to the similarly-sized event in 2016, with larger numbers attending from both Europe and Asia.

The proportion of foreign visitors rose to around 50% compared to 46% in 2016. From Europe, increases in visitor numbers were particularly evident from Spain (+31%), Belgium (+16%), France (+11%) and Eastern Europe (+54%). Significant increases were seen in visitors from Asia (+50%), with especially strong growth from China (+82%) and Japan (+63%), as well as the Middle East (+15%), Australia/Oceania (+51%), North America (+12%) and Central America (+21%).

In terms of overall styles, the show highlighted once again the fashion in Europe for contemporary furniture with a Scandinavian touch. Discreet designs, fresh new interpretations of traditional forms, mainly small and practical furniture with charm in pleasant colours.

These styles conform to the current European desire for simplicity and a sense of orderliness in the home, to help cope with modern life flooded with information, while also providing comfort and reassurance. Solid wood, accompanied by appropriate natural materials, such as stone, wool or wool-like textiles, wicker, leather and metal, dominate as materials.

The preference for natural materials went hand in hand with an interest in sustainability which permeated the show, with an expanded range of sustainable and fair-trade furniture and an emphasis on healthy home living. This extended to the choice of colours, with a strong preference for warm earth colours, including shades of smoked oak and teak.

ITTO-IMM review Indonesian furniture presence in Cologne

IMM Cologne 2018 was attended by Robin Fisher, consultant to the ITTO’s Independent Market Monitor (ITTO-IMM) initiative. On behalf of ITTO-IMM, Mr Fisher identified and interviewed a large number of furniture retailers, wholesalers and manufacturers, focusing particularly on those engaged in supply of Indonesian products to the European market.

The interviews undertaken by Mr Fisher are the first stage of a larger study commissioned by ITTO-IMM with the objective of better understanding the structure of the trade in FLEGT licensed furniture products with the EU, with respect to products, competitiveness, and distribution networks. The results of the larger study will be made available during 2018 at the ITTO-IMM website (www.flegtimm.eu).

There was a wide variety of furniture sourced from Indonesia on display at the show, and the range of exhibitors also highlighted the different market niches and distribution channels involved in supply of Indonesian wood furniture to the EU, for example:

- Lower-end mass produced outdoor furniture, mainly in plantation grown teak, as exemplified by Indoexim, selling to larger department chain stores, furniture retailers, and garden centres throughout Europe.

- Higher-end outdoor furniture – high quality products usually designed by European designers and distributed under European brands such as Gloster, Fischer-Möbel, Ethimo, Life Outdoor Living, and Kettal which market themselves as “outdoor space designers” particularly towards contract customers in the hotel and hospitality sector. The products combine teak, both from plantations and often recycled, occasionally acacia and mango wood, with other high-quality materials such as stainless steel, lacquered aluminium, powder coated steel, glass. In some cases, the product is entirely manufactured in Indonesia in others certain components are made in Indonesia and assembled in Europe. Products are distributed via specialist retailers of top end outdoor furniture.

- Locally-designed Indonesian indoor furniture, which tends to be hand-crafted in solid wood, often quite heavy and with a rustic and rough finish and targeting the low to middle end of the market. The most commonly used species are teak, mahogany (Toona Sureni), mango wood, munggur (Indonesian redwood) and acacia. The use of black forged iron combined with the solid wood is a dominant trend in this style of furniture.

- Large industrial Indonesian manufacturers of both interior and exterior furniture. The Vivere Group which was exhibiting in Cologne is an example of an Indonesian company making a very wide variety of furniture including mass-produced panel-based furniture with modern design concepts, often for large scale contracts, and which also has a subsidiary that specializes in high end furniture for the export market.

The competitive market position of each of these types of Indonesian furniture varies widely and needs to be better understood to fully appreciate the impact of policy measures like FLEGT licensing.

For example, the more traditional locally-designed Indonesian furniture is competing directly with, and was often exhibited alongside, furniture from India of a similar type and in similar species (although furniture in sheesham wood was specific to the Indian continent).

Some EU-based furniture importers and wholesalers are working with some of these smaller craft-based Indonesian manufacturers and are helping them to “westernize” furniture product lines to meet customer trends in Europe. These companies are now selling Indonesian interior furniture to a wide range of customers from big to small retailers as well as online.

In contrast a large Indonesian group like Vivere is competing more directly with large manufacturers elsewhere in Asia. However, part of their strategy is also to differentiate in the international market by bringing Indonesia’s traditional strong craft skills into more modern designs.

Vivere have called on Indonesian designers to come up with furniture designs that highlight Indonesian hand weaving skills with natural rattan while embracing contemporary design with clean lines and a light touch. Rattan is combined with coated metal frames and occasionally some elements in teak. In Cologne they were launching Sadha an indoor furniture range which includes teak hand rests for their sofas and armchairs.

Attendance at DOMOTEX 2018 at all-time high

DOMOTEX held in Hannover, Germany, between 12th and 15th January claims to be the world’s leading trade fair for floor coverings. It was host to 1,615 exhibitors this year, an all-time record, with the largest exhibitor nations other than Germany being Turkey, India, Belgium, China, Netherlands, Iran, Italy, Egypt and the USA.

There were 45,000 visitors to the show, another record and up from around 40,000 last year. Nearly 30,000 visitors came from outside Germany, of which around 60% were from other European countries, 25% from Asia and 11% from the Americas. This year there was a significant increase in attendance from the United States and South and Central America.

The majority of DOMOTEX visitors were buyers from specialist retailers and wholesalers as well as architects and interior designers and workers from the skilled trades. A significant increase in attendance was particularly evident among home furnishing and furniture stores, architects, interior designers, contract floorers and skilled tradesmen.

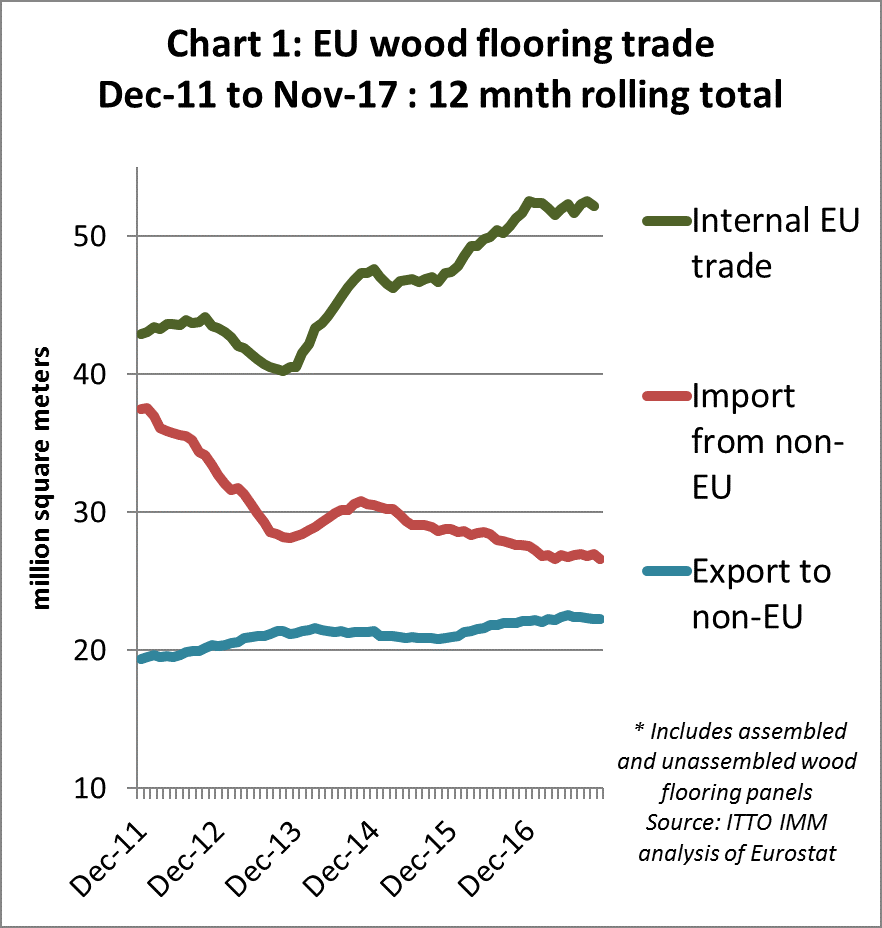

The trade background to DOMOTEX 2018 is shown in Chart 1. This highlights that the recent trends towards a narrowing in the EU trade deficit in wood flooring and a rise in internal EU trade levelled off in 2017. Both these trends were indicative of a rise in the relative competitiveness of domestic European flooring manufacturers compared to external suppliers and were partly driven by the relative weakness of European currencies.

Recent strengthening of European currencies against the US dollar has helped boost the competitiveness of external suppliers of flooring to the EU market, but so far this has only slowed their decline in share and not led to any significant improvement in sales.

EU imports from China, by far the largest external supplier accounting for around 60% of total imports, were 16.0 million m2 in the 12 months to end November 2016, compared to 16.2 million m2 a year earlier and over 21 million m2 in 2012.

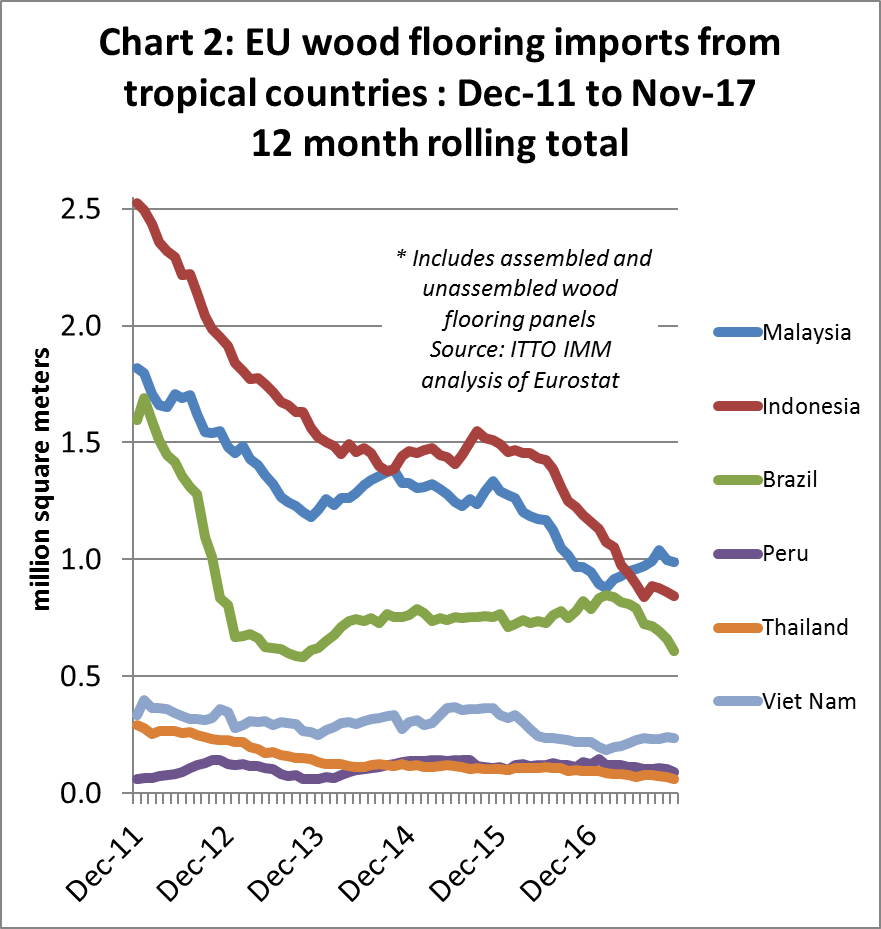

EU imports of wood flooring from tropical countries also declined again in 2017. EU flooring imports from tropical countries were 3.04 million m2 in the 12 months to end November 2016, compared to 3.68 million m2 a year earlier and 5.61 million m2 in 2012. In the 12 months to November 2017, imports from Malaysia were 2% more than the same period the previous year. However, imports from Indonesia, Brazil, and Peru all fell by over 25% in the same period (Chart 2).

The report of the European Federation of the Parquet Industry (FEP) board meeting held at DOMOTEX 2018 also shows that total European consumption of parquet flooring (i.e. faced with real wood and excluding laminates) is growing only very slowly, despite the improvement in economic conditions.

According to FEP’s first estimates for the year, total parquet consumption in Europe increased only 1% in 2017, a slowdown compared to the 1.7% increase reported in 2016. This implies that overall in 2017, the EU consumed around 101 million m2 of real-wood flooring, around 70% from domestic manufacturers and 30% from imports.

This estimate is based on information received from member country and company representatives present at the board meeting. It should be seen as a first estimate subject to variations, in anticipation of the consolidated results to be presented at FEP’s annual General Assembly next June in Sorrento, Italy.

This moderate progression is mainly a result of a decline in consumption in Germany, the biggest European market for parquet, and Switzerland. In contrast, all other European countries are benefiting from positive trends reported in the construction sector and rising consumer confidence.

At country level, Poland, The Netherlands, Belgium and Sweden are experiencing the highest growth in parquet consumption, followed by the Czech Republic, Austria and France. Parquet consumption in the Southern European markets such as Italy and Spain is also progressing though to a lesser extent. The political situation in Spain and the coming elections in Italy are somewhat limiting the positive developments observed in 2016. The Nordic market (Denmark, Finland and Norway) remains stable after years of turbulence.

FEP report that the slow pace of increase in European wood flooring consumption is partly owing to difficulties in wood procurement, particularly for oak which now surfaces around 80% of all parquet manufactured in Europe. EU manufacturers have been particularly affected by restrictions on exports of oak timber imposed by Russia, Belarus, Ukraine, and Croatia.

FEP also noted the tough competition from “wood look flooring substitutes” as another reason for the very slow increase in parquet flooring consumption in recent times.

Laminate flooring also losing share to non-wood alternatives

Much of the competitive pressure on real-wood flooring comes from the laminate flooring industry, which is large with sales figures dwarfing those of the parquet industry. However, this sector is also now losing share in Europe to a range of non-wood flooring solutions such as luxury vinyl tiles, porcelain tiles, and products made of recycled materials and other renewables like bamboo and cork.

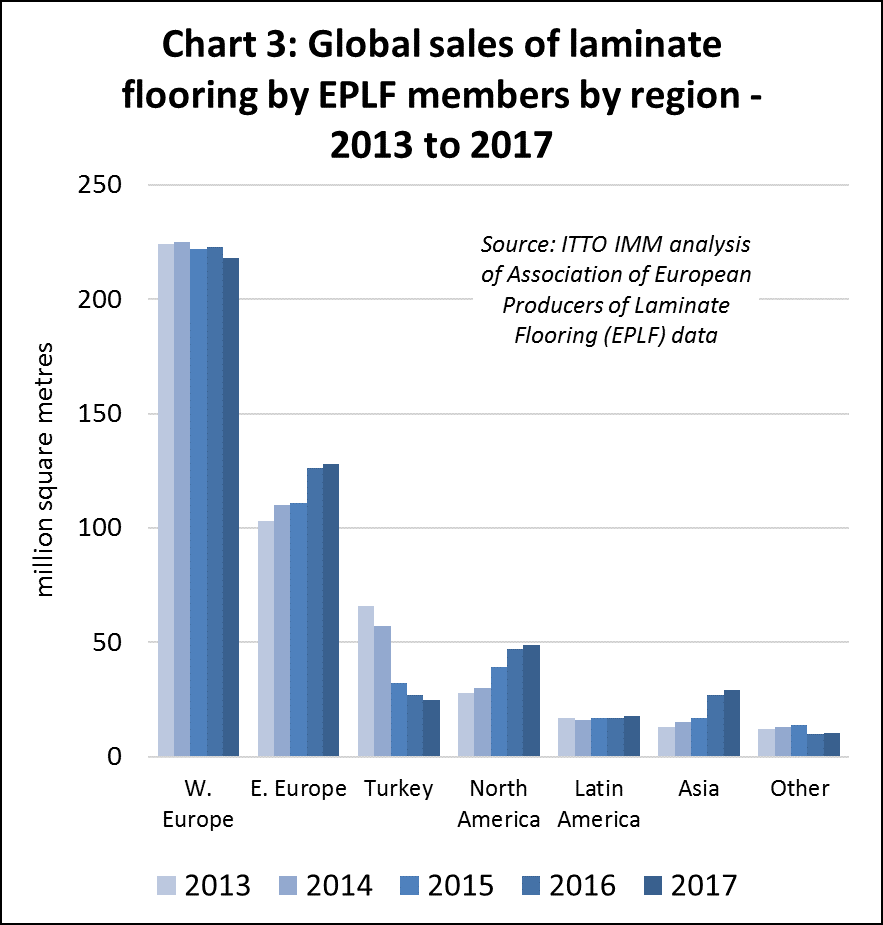

According to data released by the Association European Producers of Laminate Flooring, to coincide with DOMOTEX 2018, total European sales of laminate flooring were 346 million square meters in Europe in 2017, around 1% less than in 2016. Sales in Eastern Europe increased 2% to 128 million square meters. However, this was insufficient to offset a decline in sales in Western Europe, by 2% to 218 million square meters.

European laminate flooring manufacturers are compensating for the decline in European consumption by increasing sales in other parts of the world, particularly North America and Asia. (Chart 3).

Meanwhile there are signs that the carpet sector, which remains dominant in European flooring despite the recent trend to harder and cleaner flooring types, is now responding more effectively to the competition. Annual sales of carpets in Europe are still around 700 million square meters.

Carpet manufacturers are now concentrating on improved durability and performance, and are exploiting the wide variety of designs, styles, and colours, and benefits of noise reduction. They are also responding to rising environmental concerns in Europe by investing in development of biodegradable and more sustainable products.

Some indication of intense competitive pressure on wood floors is provided by the media coverage of DOMOTEX 2018 which barely touched on new wood products and instead focused heavily on innovations to increase the use of recycled and alternative materials.

For example, the designer website IDEAT spoke about the “omnipresence of eco-designed products, innovations in floors made from natural materials and processed without chemicals, and coatings derived from recycled products”. Despite this focus on the environment, only recycled wood flooring products featured in the article alongside products in a range on non-wood materials.

An example is a new wood-look floor covering manufactured by German giant Windmöller derived primarily from rapeseed and other natural vegetable oils celebrated because “it contains no PVC or petrochemical elements”. IDEAT also highlighted the “insistent presence of cork” at DOMOTEX 2018, including a product by the Portuguese company Wicanders with a high definition wood finish printed directly on to the cork.

In addition to the green theme, exhibitors at DOMOTEX 2018 were keen to align with the show’s motto “Unique Youniverse” which was splashed across the various exhibitions and aimed to highlight an industry trend towards individualization; the tailoring of flooring products and support services to customers’ needs and lifestyles.

Although natural wood products are by their nature “unique” and “individual”, this theme creates challenges for suppliers of wood flooring, particularly overseas suppliers located at some considerable distance from the final consumer. Non-wood flooring suppliers were very keen to emphasise the huge range of colours and finishes they can offer, in large volumes, including the ability to duplicate the look, and increasingly the feel and texture, of wood and other natural materials as required, and their ability to respond immediately to changeable customer demands.

Wood flooring innovations

While the European parquet flooring sector was not the headline act at DOMOTEX 2018, the industry was keen to demonstrate various innovations to maximise the advantages of natural wood, improve the quality of products and the range of applications, and to simplify the installation process.

An example was the Italian company Garbelotto which works creatively with lengths and widths of wood to produce unusual herringbone patterns, and also offers a new line of floors designed “to optimize the natural essence of wood” through use of a water full-cycle coating treatment that slows down the oxidation of the boards and leaves them exceptionally matt.

Another example was the German company HocoHolz promoting a new line responding to rising demand for flooring in very wide natural boards, offered with the company’s standard 19 surface finishes and either a patented click system or tongue and groove connection for bonded laying if required, with the aim of ensuring that “all rooms can be planned to suit individual, customized requirements.”

Similarly, the Belgian Vetedy Group which specializes in producing and distributing high-quality outdoor terrace decking and indoor parquet flooring – often using tropical woods including teak, merbau, iroko, padauk, doussie, and wengé – has built sales on the success of its internally developed Softline system which allows fitting of wooden terraces with no visible fastenings. At DOMOTEX this year, the company showcased another innovative system, Techniclic, which extends the advantages of invisible fastening to luxury wooden facades, walls and ceilings.

PDF of this article: