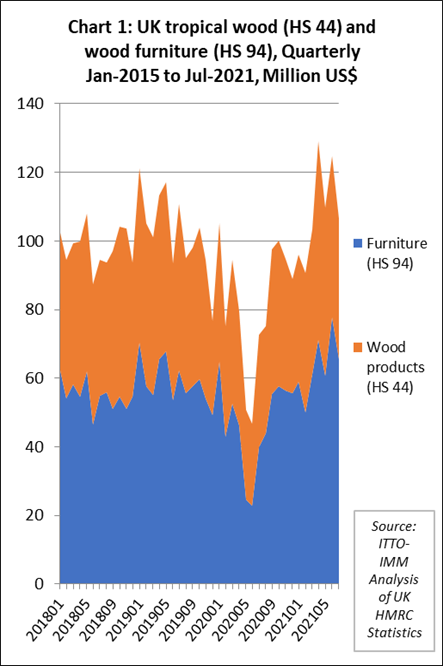

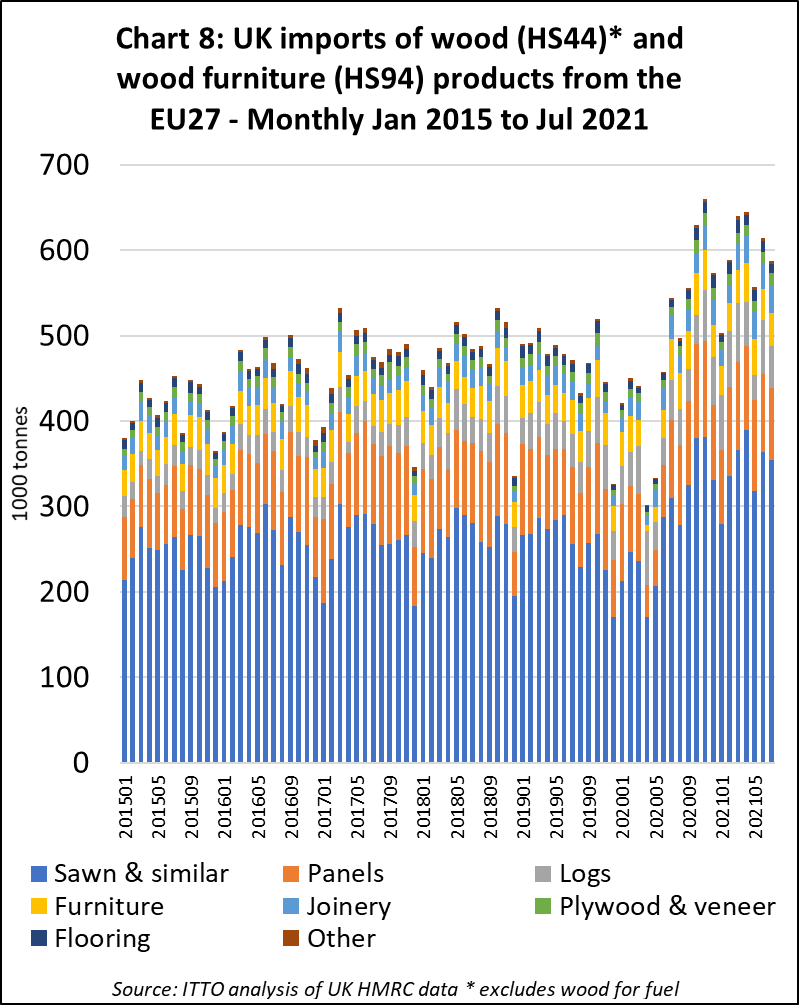

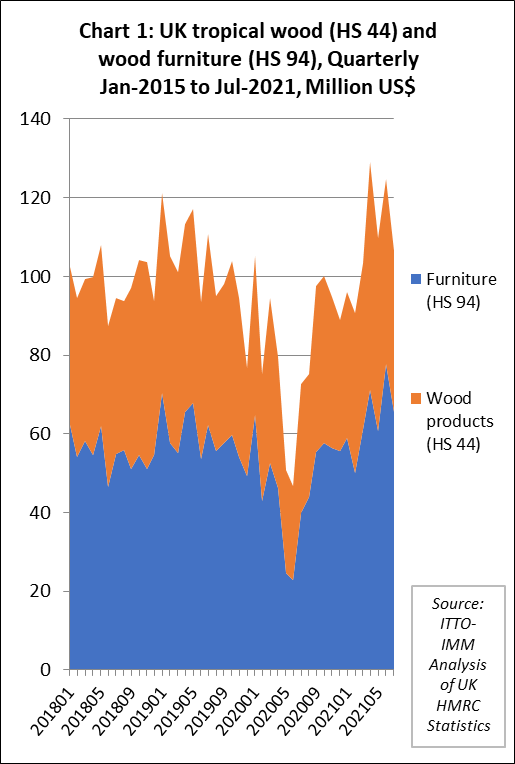

The UK imported tropical wood and wood furniture products with a total value of USD760 million in the first seven months of 2021, a 36% increase compared to the same period in 2020. Following the sharp increase in April, when import value was at the highest monthly level since before the financial crises of 2008-2009, imports declined only slightly from this peak between May and July (Chart 1).

While UK import value of tropical and wood furniture was strong compared to the first seven months last year, which was severely affected by COVID lockdowns, import value was marginally down compared to USD762 million in the same period of 2019. This is disappointing at a time when import prices are inflated by a dramatic rise in freight rates, particularly from Southeast Asia and other tropical supply regions, and overall demand for timber products in the UK is at unprecedented levels.

This year, the UK is experiencing a very robust rise in construction sector activity and in timber trade and consumption. There has been a welcome rebound from the lows of last year in the value of wood product imports from tropical countries into the UK, and importers are benefiting from strong sales, high prices and larger margins. However, much bigger gains are being made in this market by wood products suppliers outside the tropics.

The latest UK Construction Products Association (CPA) Trade Survey shows construction remained in expansion mode during the second quarter of this year, with private housing and repairs, maintenance and improvement leading the industry. Much of the activity in these sectors has been sustained by government housing policies, an increase in the disposable income across households in the UK, and a homeworking trend that has been driving demand for greater or improved outdoor and office space.

According to the Building Merchants Building Index (BMBI), in the three months between May and July this year, UK sales of timber were at record levels and performing better than all other building material categories. During the three month period, total UK builders’ merchant sales were 35% up on a COVID-affected period last year, while sales of timber and joinery products increased 65%. Total sales in May to July were 9% higher than in February to April, while timber and joinery products sales were up 19%. Sales were also exceptionally strong compared to 2019, before the pandemic. Total builder’s merchant sales in May to July 2021 were 17% higher than in May to July 2019, while timber and joinery product sales were 44% higher.

A statement by the UK Timber Trade Federation issued earlier in September suggests that longer term prospects for timber demand in the UK are good, but short term logistical issues are putting severe strain on supply.

“The supply chain has been working hard to satisfy this additional demand, which is expected to continue in the short to medium term according to industry forecasts. While some of this demand may ease as pandemic restrictions subside, the demand for timber is likely to remain strong amidst a construction industry seeking to rapidly decarbonise. By choosing to build with responsibly sourced timber, architects, engineers and house builders are helping to turn our built environment into a form of carbon capture and storage. There is a significant opportunity for the timber sector to grow into a pillar of the UK’s low-carbon economy”.

The TTF go on to note that “The main brake on this growth will come from other factors, particularly labour shortages in areas across the supply chain from logistics to skilled on-site labour, with the CBI [Confederation of British Industry] warning this could take at least two years to settle down.”

The latest IHS Markit/CIPS UK Construction Purchase Managers Index (PMI) for August suggests that these factors are beginning to act as a drag on the rate of market growth. The PMI dropped to 55.2 in August 2021, from 58.7 in the previous month and below market expectations of 56.9. Although any figure over 50 indicates continuing growth in the UK construction sector, the latest reading points to the softest pace of expansion since February.

Commenting on the slowing growth in August, IHS Markit/CIPS note that “given the amount of stimulus and relatively early stage in the recovery, to be slowing so close to the long-term trend is disappointing. Part of the slowdown can be linked to weaker growth of new orders for construction work, with the survey’s New Orders Index slowing for a third consecutive month to register a further cooling of demand growth from May’s record high.

“The slowdown can also be partly attributed to ongoing and near-record shortages of raw materials, as measured by suppliers’ delivery times, which have in turn led to unprecedented price hikes for building materials in recent months… in August 68% of construction companies reported even longer delivery times for materials compared to July. A combination of ongoing covid restrictions, Brexit delays and shipping hold-ups were responsible as builders were unable to complete some of the pipelines of work knocking on their door”.

However, IHS Markit/CIPS end on a positive note, “optimism improved on last month as more than half of building firms believe that output will continue to rise in the year ahead.”

UK tropical furniture imports recover ground lost during the pandemic

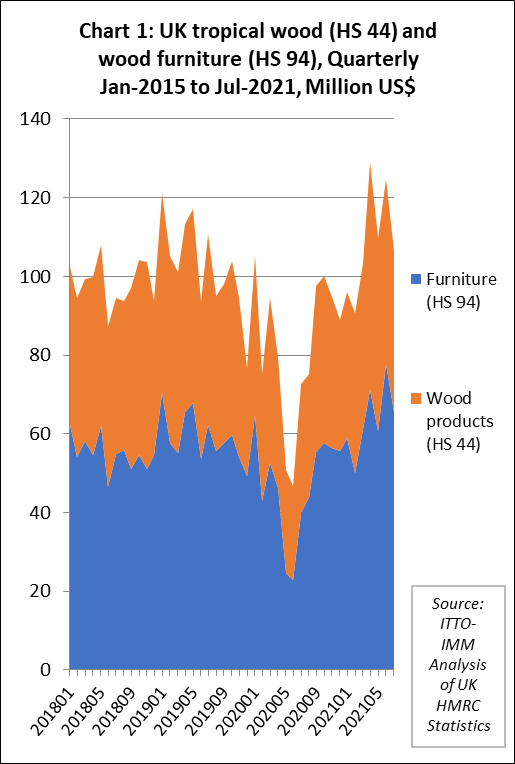

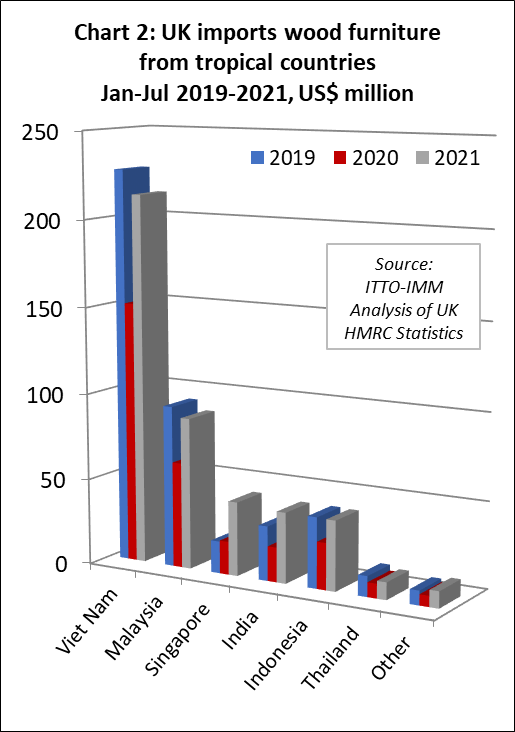

Overall the UK imported USD445 million of tropical wood furniture products in the first seven months of this year, 52% more than the same period in 2020, but just 3% more than the same period in 2019. After a slow first quarter this year, when lockdowns once again disrupted trade, imports strengthened considerably in the second quarter to reach monthly highs not seen for over a decade.

Overall during the first seven months of 2021 compared to the same period last year, UK wood furniture imports were up from all four of the leading tropical supply countries to this market; Vietnam (+41% to USD214 million), Malaysia (+44% to USD88 million), Singapore (+123% to USD43 million), India (+103% to USD41 million), Indonesia (+50% to USD40 million) and Thailand (+19% to USD10 million).

While gains were made across the board when compared to the depressed levels of 2020, wood furniture import value was still trailing the pre-pandemic 2019 level from Vietnam (-6%), Malaysia (-6%), Indonesia (-1%), and Thailand (-15%). In contrast the pre-pandemic rise from India has resumed, with import value from the country 30% higher this year than in 2019. Import value from Singapore, which has become more important as a supply hub due to logistical problems elsewhere during the pandemic, is 130% higher than in 2019 (Chart 2).

UK tropical wood imports still down on pre-pandemic level

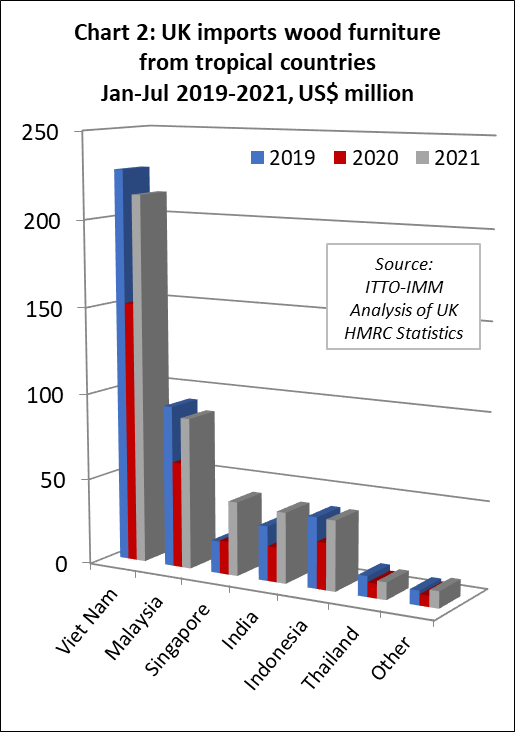

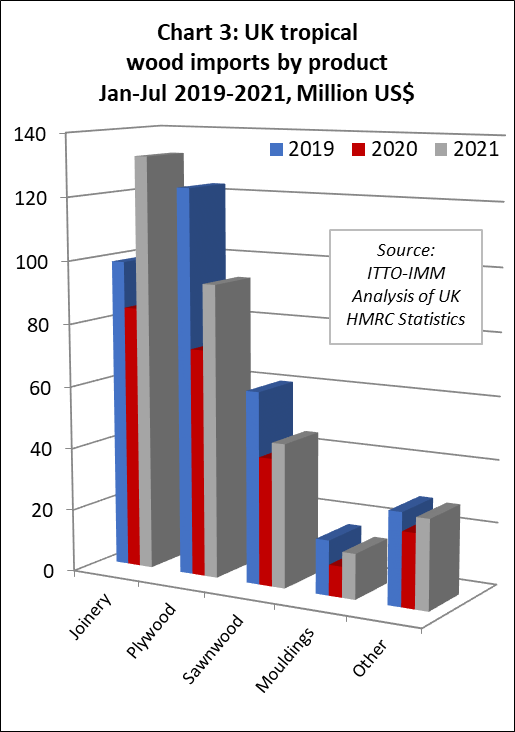

UK import value of all tropical wood products in Chapter 44 of the Harmonised System (HS) of product codes was USD315 million in the first seven months of 2021, 36% more than the same period last year but 5% less than the same period in 2019.

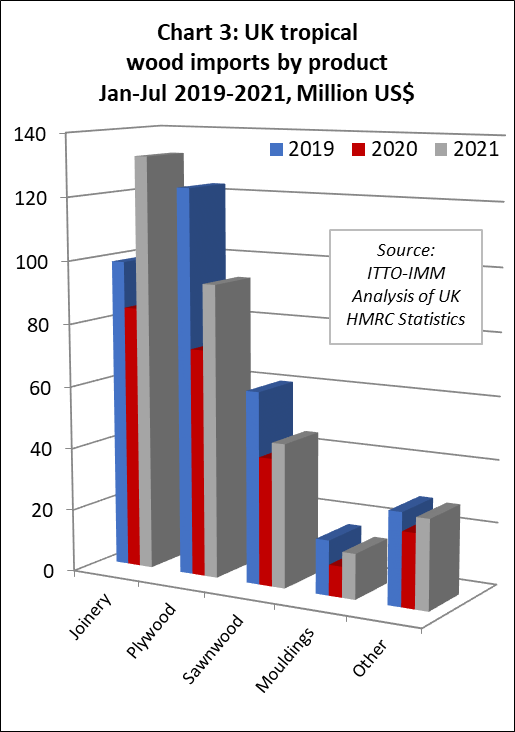

Comparing UK import value in the first seven months of 2021 with the same period in 2020, tropical joinery was up 57% at USD132 million, tropical plywood was up 29% at USD94 million, tropical sawnwood was up 12% at USD46 million, and tropical mouldings/decking was up 47% at USD8 million.

While import value of tropical joinery in the first seven months of this year was also up 34% on pre-pandemic level in 2019, UK import value of all other HS 44 tropical wood products was significantly behind the 2019 level including plywood (-24%), sawnwood (-25%), and mouldings/decking (-17%) (Chart 3).

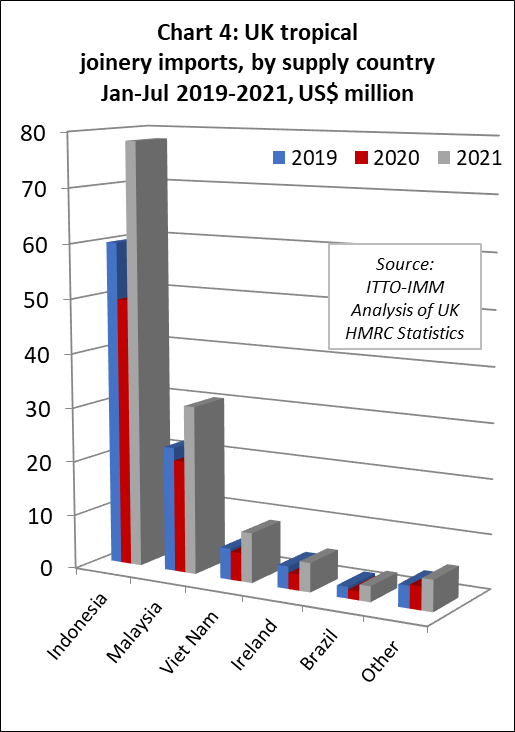

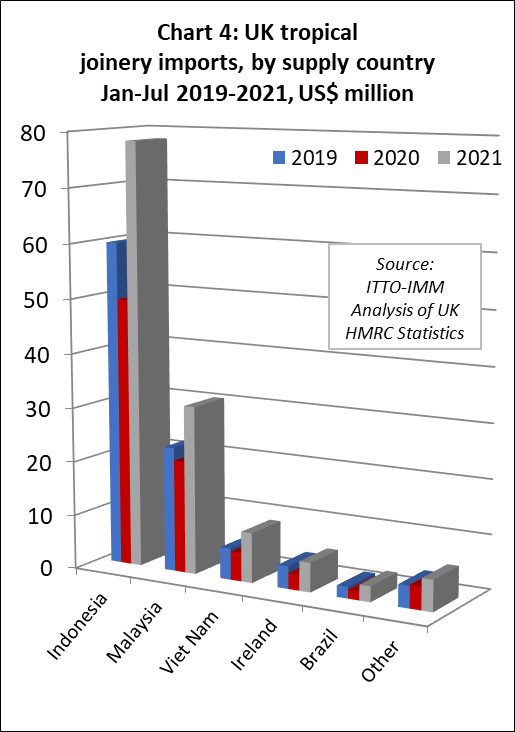

After the sharp dip in UK imports of tropical joinery products during the first lockdown period in Q2 2020, imports gradually built momentum until March this year and then surged in the second quarter. Imports from Indonesia, mainly consisting of doors, were USD78 million in the first seven months of 2021, 58% more than the same period last year and 31% up on the same period in 2019.

UK imports of joinery products from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) also made strong gains in the first seven months of 2021. Imports from Malaysia were USD31 million between January and July this year, 50% more than the same period in 2020 and 35% up on the same period in 2019. Imports of USD9 million from Vietnam were 76% more than in the same period in 2020 and 60% more than the same period in 2019 (Chart 4).

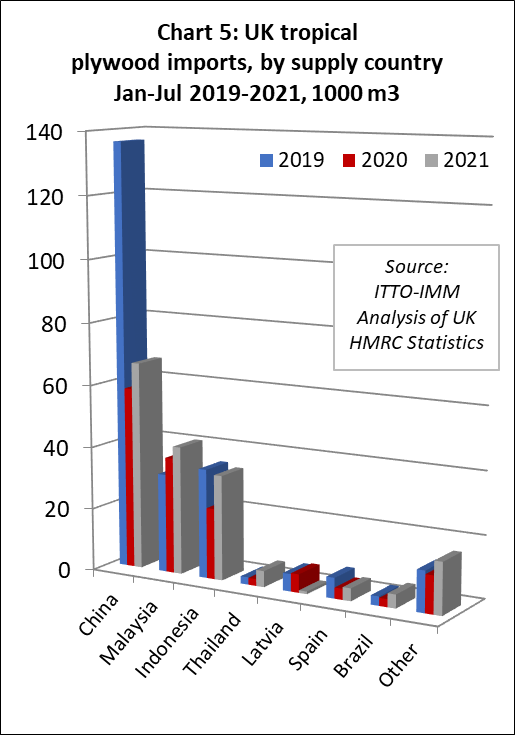

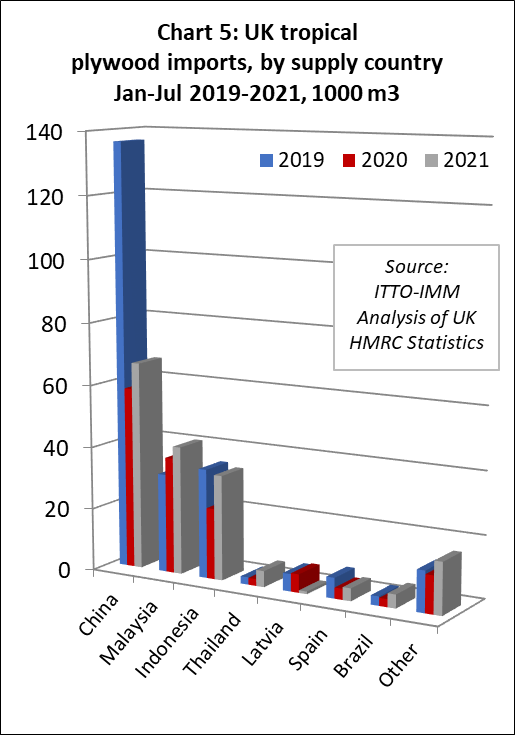

In contrast to joinery products, UK imports of tropical hardwood plywood have remained at relatively low levels this year. In the first seven months of 2021, the UK imported 172,400 cu.m of tropical hardwood plywood, which is 20% more than the same period in 2020 but still down 26% compared to the same period in 2019.

Imports from the UK’s three largest suppliers of tropical hardwood plywood – China, Indonesia and Malaysia – have followed very different trajectories this year (Chart 5). The UK imported 66,700 cu.m of tropical hardwood faced plywood from China in the first seven months of this year, 15% more than the same period in 2020 but down over 50% compared to the same period in 2019.

In contrast, Malaysian plywood has made gains in the UK market this year, imports of 41,100 cu.m in the first seven months being 11% more than the same period in 2020 and 30% up on the same period in 2020. But it should be said these gains are being made against historically very low levels after a long period of decline in UK imports of Malaysia plywood in the years before 2019.

So far this year, UK imports of plywood from Indonesia have rebounded from the lows of 2020 but are still below the relatively modest levels of 2019. Imports of 33,600 cu.m in the first seven months of this year are 48% more than the same period in 2020 but 4% less than in 2019.

As with other hardwood product groups, UK demand for tropical hardwood plywood has been strong this year, driven by high levels of construction activity and shortages of competing materials. The main market challenges have been on the supply side, notably the considerable escalation in freight rates on Asian routes to the UK. A 40ft container from Malaysia or Indonesia as late as last autumn cost $1500 -$2000. By Q2 2021 importers were being quoted $15,000-20,000 and rates have stayed there.

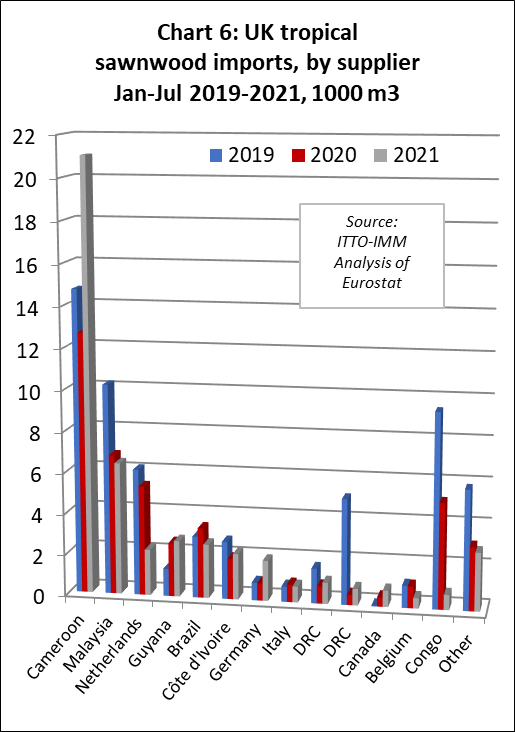

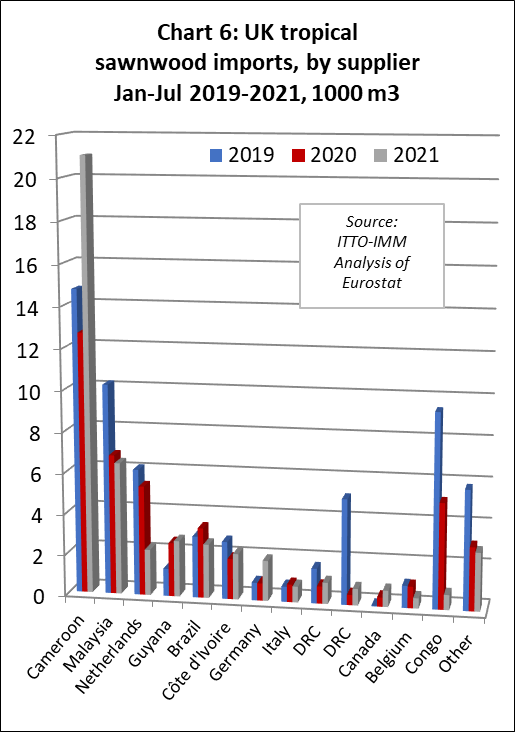

After falling sharply in May and June last year, UK imports of tropical sawnwood have gradually strengthened, but the strength of the rebound has been impaired by significant logistical problems on the supply side. UK imports were 46,700 cu.m in the first seven months of 2021, just 3% more than the same period in 2020 and 26% less than the same period in 2019. Although imports from Cameroon, now by far the leading supplier of tropical sawnwood to the UK, were up 66% on 2020 and 43% on 2019 during the seven month period, imports from nearly all other leading tropical sawnwood supply countries have remained weak this year (Chart 6).

The large increase in imports of sawnwood from Cameroon was due to the long lead time in shipment of contracts placed back in 2020. UK importers now report that supply for hardwoods from Cameroon and other African supply countries is very limited. Global demand for species such as sapele, sipo and iroko, accompanied by production delays and logistical difficulties, have been such that many African mills placed a moratorium on taking new orders in late March and throughout April this year.

UK imports of tropical sawnwood from Côte d’Ivoire were just 2200 cu.m in the first seven months of this year, 13% more than the same period in 2020 but still down 20% on the same period in 2019. The UK was previously a significant buyer of framire from Côte d’Ivoire but UK importers report that this species is proving increasingly difficult to source, both due to a lack of raw material in the forest and the challenges of obtaining assurances of legality that satisfy UK Timber Regulation requirements.

Meanwhile, UK imports of tropical sawnwood from both the Republic of Congo and DRC have fallen to a trickle since the start of the pandemic. Imports from the Republic of Congo were just 700 cu.m in the first seven months of the year, down 86% and 92% compared to the same period in 2020 and 2019 respectively. Imports from DRC were 800 cu.m, which is 62% more than the negligible amount imported last year, but 84% less than the same period in 2019.

After an extremely slow start to the year brought on by pandemic induced production problems and extreme shortages of containers, UK imports of tropical sawnwood from Malaysia picked up a little in the second quarter with the arrival in May of the first breakbulk shipments of Asian meranti and keruing lumber into the UK for nearly 30 years. UK imports of Malaysian sawnwood were 6,400 cu.m in the first seven months of 2021. That is still 6% less than the same period last year and 37% down on the same period in 2019.

With shortages in supply from other sources, UK importers were turning more to South America in the opening months of this year. Imports from Brazil were quite good in the first quarter but ground to a halt in the second quarter. By the end of the first seven months, total UK imports of tropical sawnwood from Brazil were 2,600 cu.m, 23% less than the same period last year and 13% down on 2020. Imports from Guyana on the other hand have continued to rise, at 2,700 cu.m in the first seven months this year, a gain of 4% on the same period in 2020 and double the volume imported in the same period in 2019.

Indirect UK imports of tropical sawnwood from other EU countries have fallen dramatically this year. Total UK imports from EU countries were 6,900 cu.m in the first seven months of 2021, 25% less than the same period last year and 46% down on the same period in 2019.

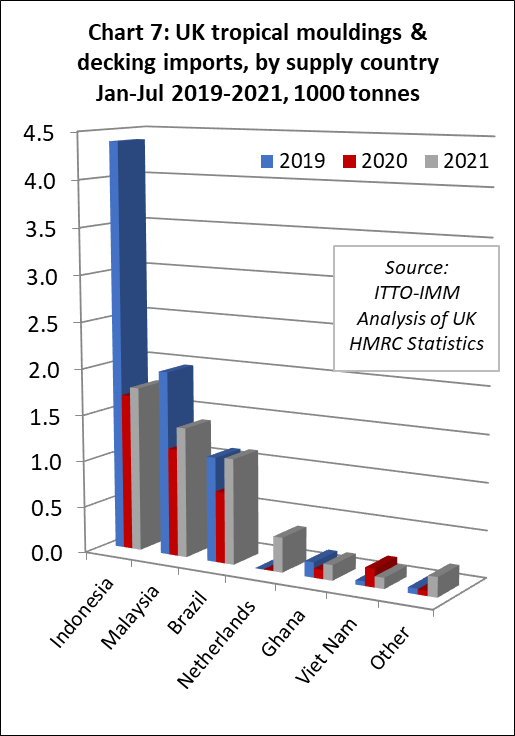

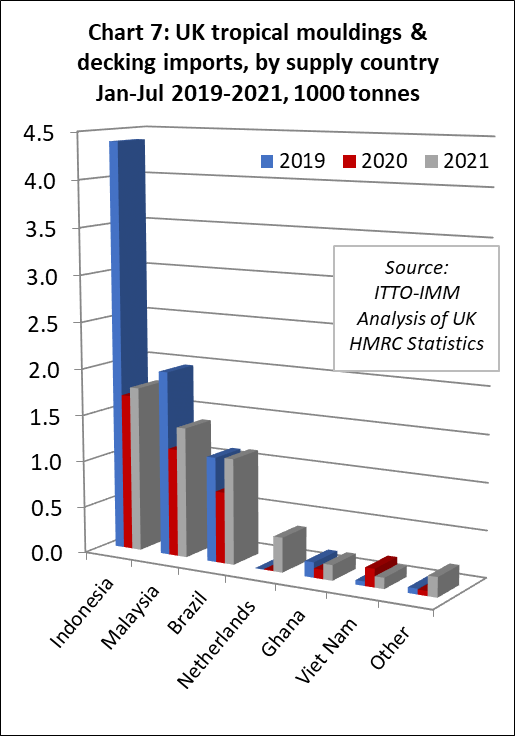

The UK imported 5,200 tonnes of tropical hardwood mouldings/decking in the first seven months of 2021, 31% more than the same period in 2020 but still 33% less than the same period in 2019. The arrival of the first breakbulk shipments into the UK this year boosted imports a little from Indonesia, which at 1,800 tonnes in the first seven months were 6% more than the same period in 2020, but still down 60% compared to 2019. Similarly, imports from Malaysia, at 1,400 tonnes, were 21% more than the same period in 2020 but 29% less than in 2019. Imports from Brazil have also picked up a little, at 1,100 tonnes in the first seven months, 49% more than the same period last year 1% more than in 2019 (Chart 7).

The UK market is currently suffering from severe lack of availability of tropical hardwood decking, due both to the freight hikes and also to suppliers preferring to sell the limited stocks they have available to other markets. This has forced more UK importers to purchase more tropical decking from importers in the Netherlands. The UK imported 400 tonnes of tropical hardwood decking from the Netherlands in the first seven months of this year when previously very little was sourced indirectly from there.

Big increase in UK timber imports from the EU despite Brexit

An impact of the UK’s departure from the EU single market and customs union on 1st January this year was meant to be a decline in the quantity of UK timber imports from the EU. This forecast followed expectations of logistical problems as new controls were introduced at the UK border, increased scrutiny of the plant health and legal status of EU wood products imported into the UK, and sluggish economic activity in the UK due to post Brexit uncertainty.

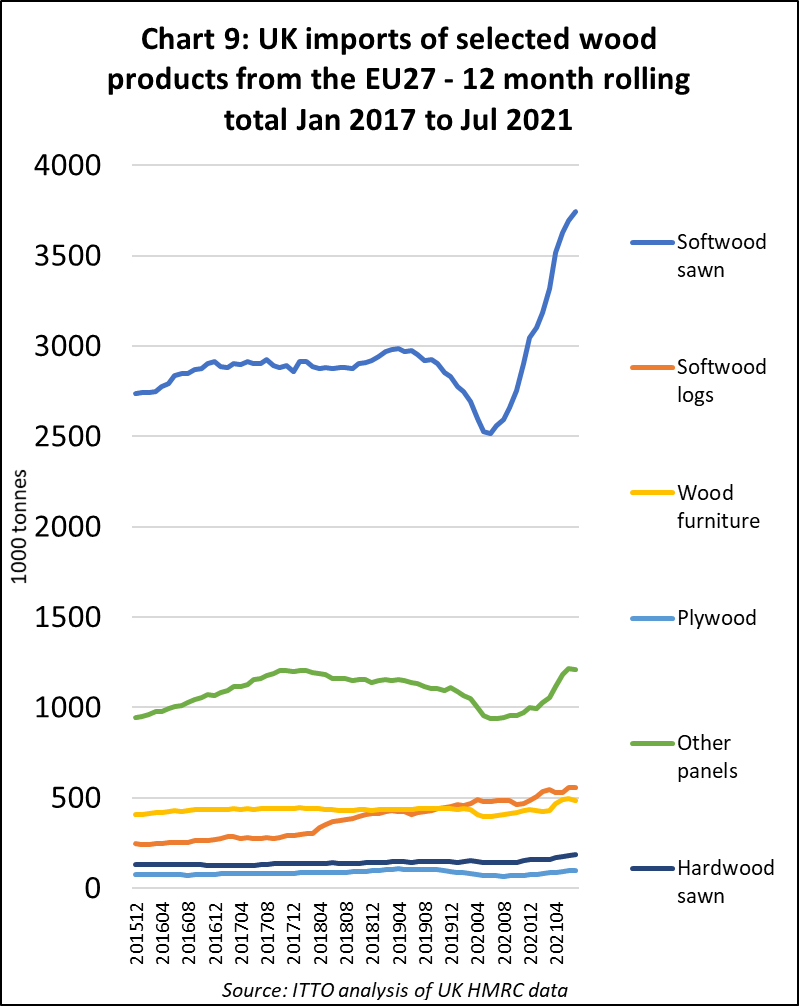

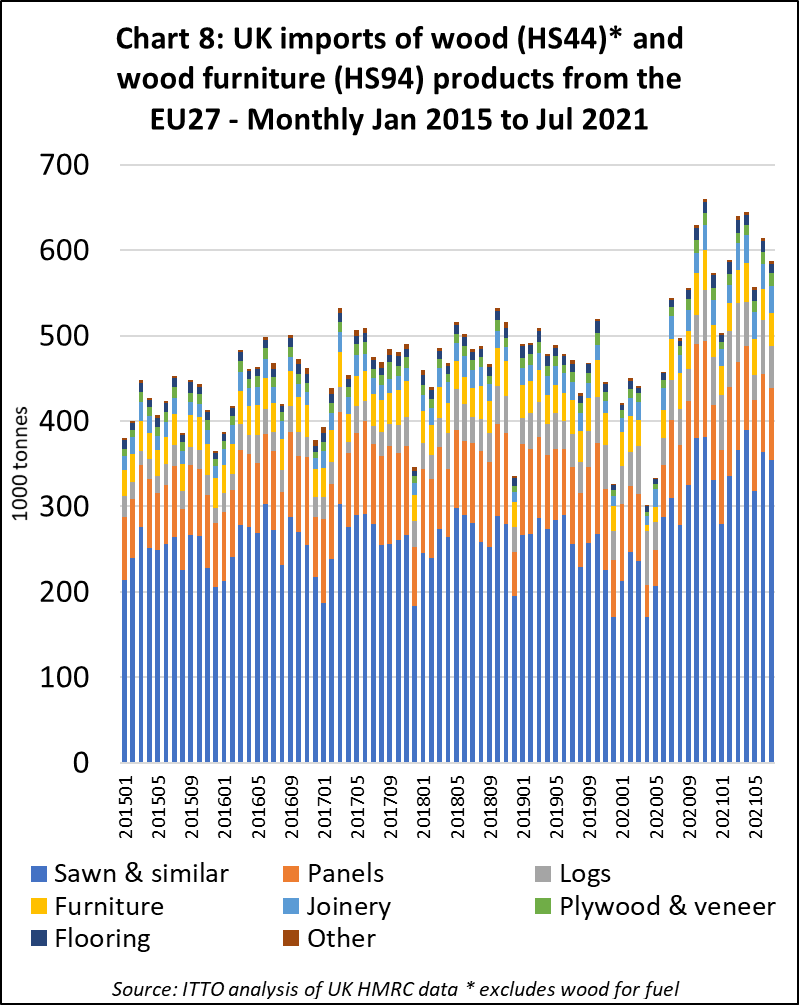

However, not only did UK imports from the EU fail to decline in the first half of 2021, but they were at record levels. Chart 8 shows the quantity of UK imports of all wood and wood furniture products from the EU (excluding wood for fuel) on a monthly basis since the start of 2017. In total, the UK imported 4.13 million tonnes of wood products from the EU27 in the first seven months of 2021, 40% more than the previous year, which of course was COVID-affected, but also 21% more than in 2019, the last “normal” year.

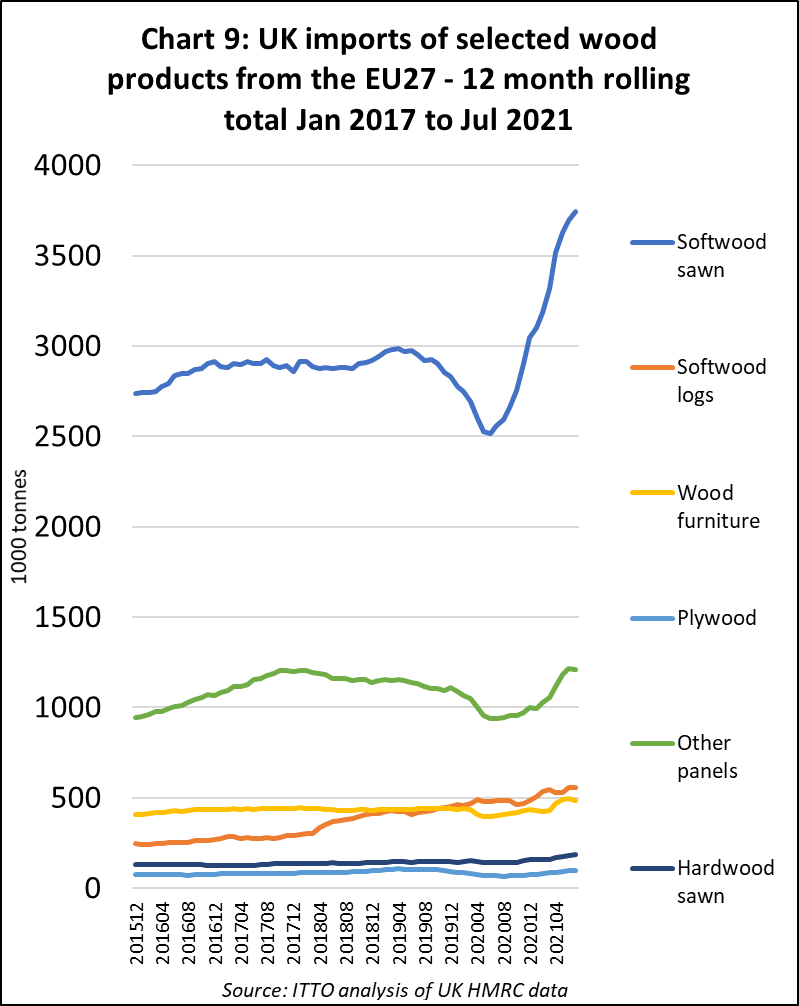

Most of this growth was concentrated in softwood sawnwood and logs and panel products, which dominate UK imports from the EU27 (at least in tonnage terms). However, imports of furniture and hardwood products which compete more directly with imports from the tropics also grew strongly from the EU in the opening months of this year.

Of course it is early days for the UK outside the EU single market, and the UK timber market is currently experiencing unprecedented conditions due to the COVID pandemic. The combination of very high levels of consumption in the UK construction and DIY sectors and severe disruption of supplies from sources further afield – in China, Southeast Asia, North and South America, and Africa – has fed a significant upturn in UK demand and prices for timber imports from the EU. Importers and distributors have had a strong incentive to overcome the new logistical and bureaucratic challenges of sourcing from the EU.

The main question now is whether this situation will be maintained for the long term, and whether there is any genuine potential for the UK to pivot away from the EU as logistical problems ease in other parts of the world. The market signals are still mixed in relation to this question. The UK’s exit from the EU has contributed to a significant fall in indirect imports of tropical sawnwood and plywood from the European continent during 2021. But this has yet to be compensated by any significant rise in direct imports of these same products from tropical countries.

However, the uptick this year in UK imports of wooden doors from Indonesia and of other joinery products from Malaysia to levels exceeding those pre-pandemic, despite very high freight rates, is some grounds for optimism.

Imports of tropical wood rebound in the UK but lose share in a rising market

The UK imported tropical wood and wood furniture products with a total value of USD760 million in the first seven months of 2021, a 36% increase compared to the same period in 2020. Following the sharp increase in April, when import value was at the highest monthly level since before the financial crises of 2008-2009, imports declined only slightly from this peak between May and July (Chart 1).

While UK import value of tropical and wood furniture was strong compared to the first seven months last year, which was severely affected by COVID lockdowns, import value was marginally down compared to USD762 million in the same period of 2019. This is disappointing at a time when import prices are inflated by a dramatic rise in freight rates, particularly from Southeast Asia and other tropical supply regions, and overall demand for timber products in the UK is at unprecedented levels.

This year, the UK is experiencing a very robust rise in construction sector activity and in timber trade and consumption. There has been a welcome rebound from the lows of last year in the value of wood product imports from tropical countries into the UK, and importers are benefiting from strong sales, high prices and larger margins. However, much bigger gains are being made in this market by wood products suppliers outside the tropics.

The latest UK Construction Products Association (CPA) Trade Survey shows construction remained in expansion mode during the second quarter of this year, with private housing and repairs, maintenance and improvement leading the industry. Much of the activity in these sectors has been sustained by government housing policies, an increase in the disposable income across households in the UK, and a homeworking trend that has been driving demand for greater or improved outdoor and office space.

According to the Building Merchants Building Index (BMBI), in the three months between May and July this year, UK sales of timber were at record levels and performing better than all other building material categories. During the three month period, total UK builders’ merchant sales were 35% up on a COVID-affected period last year, while sales of timber and joinery products increased 65%. Total sales in May to July were 9% higher than in February to April, while timber and joinery products sales were up 19%. Sales were also exceptionally strong compared to 2019, before the pandemic. Total builder’s merchant sales in May to July 2021 were 17% higher than in May to July 2019, while timber and joinery product sales were 44% higher.

A statement by the UK Timber Trade Federation issued earlier in September suggests that longer term prospects for timber demand in the UK are good, but short term logistical issues are putting severe strain on supply.

“The supply chain has been working hard to satisfy this additional demand, which is expected to continue in the short to medium term according to industry forecasts. While some of this demand may ease as pandemic restrictions subside, the demand for timber is likely to remain strong amidst a construction industry seeking to rapidly decarbonise. By choosing to build with responsibly sourced timber, architects, engineers and house builders are helping to turn our built environment into a form of carbon capture and storage. There is a significant opportunity for the timber sector to grow into a pillar of the UK’s low-carbon economy”.

The TTF go on to note that “The main brake on this growth will come from other factors, particularly labour shortages in areas across the supply chain from logistics to skilled on-site labour, with the CBI [Confederation of British Industry] warning this could take at least two years to settle down.”

The latest IHS Markit/CIPS UK Construction Purchase Managers Index (PMI) for August suggests that these factors are beginning to act as a drag on the rate of market growth. The PMI dropped to 55.2 in August 2021, from 58.7 in the previous month and below market expectations of 56.9. Although any figure over 50 indicates continuing growth in the UK construction sector, the latest reading points to the softest pace of expansion since February.

Commenting on the slowing growth in August, IHS Markit/CIPS note that “given the amount of stimulus and relatively early stage in the recovery, to be slowing so close to the long-term trend is disappointing. Part of the slowdown can be linked to weaker growth of new orders for construction work, with the survey’s New Orders Index slowing for a third consecutive month to register a further cooling of demand growth from May’s record high.

“The slowdown can also be partly attributed to ongoing and near-record shortages of raw materials, as measured by suppliers’ delivery times, which have in turn led to unprecedented price hikes for building materials in recent months… in August 68% of construction companies reported even longer delivery times for materials compared to July. A combination of ongoing covid restrictions, Brexit delays and shipping hold-ups were responsible as builders were unable to complete some of the pipelines of work knocking on their door”.

However, IHS Markit/CIPS end on a positive note, “optimism improved on last month as more than half of building firms believe that output will continue to rise in the year ahead.”

UK tropical furniture imports recover ground lost during the pandemic

Overall the UK imported USD445 million of tropical wood furniture products in the first seven months of this year, 52% more than the same period in 2020, but just 3% more than the same period in 2019. After a slow first quarter this year, when lockdowns once again disrupted trade, imports strengthened considerably in the second quarter to reach monthly highs not seen for over a decade.

Overall during the first seven months of 2021 compared to the same period last year, UK wood furniture imports were up from all four of the leading tropical supply countries to this market; Vietnam (+41% to USD214 million), Malaysia (+44% to USD88 million), Singapore (+123% to USD43 million), India (+103% to USD41 million), Indonesia (+50% to USD40 million) and Thailand (+19% to USD10 million).

While gains were made across the board when compared to the depressed levels of 2020, wood furniture import value was still trailing the pre-pandemic 2019 level from Vietnam (-6%), Malaysia (-6%), Indonesia (-1%), and Thailand (-15%). In contrast the pre-pandemic rise from India has resumed, with import value from the country 30% higher this year than in 2019. Import value from Singapore, which has become more important as a supply hub due to logistical problems elsewhere during the pandemic, is 130% higher than in 2019 (Chart 2).

UK tropical wood imports still down on pre-pandemic level

UK import value of all tropical wood products in Chapter 44 of the Harmonised System (HS) of product codes was USD315 million in the first seven months of 2021, 36% more than the same period last year but 5% less than the same period in 2019.

Comparing UK import value in the first seven months of 2021 with the same period in 2020, tropical joinery was up 57% at USD132 million, tropical plywood was up 29% at USD94 million, tropical sawnwood was up 12% at USD46 million, and tropical mouldings/decking was up 47% at USD8 million.

While import value of tropical joinery in the first seven months of this year was also up 34% on pre-pandemic level in 2019, UK import value of all other HS 44 tropical wood products was significantly behind the 2019 level including plywood (-24%), sawnwood (-25%), and mouldings/decking (-17%) (Chart 3).

After the sharp dip in UK imports of tropical joinery products during the first lockdown period in Q2 2020, imports gradually built momentum until March this year and then surged in the second quarter. Imports from Indonesia, mainly consisting of doors, were USD78 million in the first seven months of 2021, 58% more than the same period last year and 31% up on the same period in 2019.

UK imports of joinery products from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) also made strong gains in the first seven months of 2021. Imports from Malaysia were USD31 million between January and July this year, 50% more than the same period in 2020 and 35% up on the same period in 2019. Imports of USD9 million from Vietnam were 76% more than in the same period in 2020 and 60% more than the same period in 2019 (Chart 4).

In contrast to joinery products, UK imports of tropical hardwood plywood have remained at relatively low levels this year. In the first seven months of 2021, the UK imported 172,400 cu.m of tropical hardwood plywood, which is 20% more than the same period in 2020 but still down 26% compared to the same period in 2019.

Imports from the UK’s three largest suppliers of tropical hardwood plywood – China, Indonesia and Malaysia – have followed very different trajectories this year (Chart 5). The UK imported 66,700 cu.m of tropical hardwood faced plywood from China in the first seven months of this year, 15% more than the same period in 2020 but down over 50% compared to the same period in 2019.

In contrast, Malaysian plywood has made gains in the UK market this year, imports of 41,100 cu.m in the first seven months being 11% more than the same period in 2020 and 30% up on the same period in 2020. But it should be said these gains are being made against historically very low levels after a long period of decline in UK imports of Malaysia plywood in the years before 2019.

So far this year, UK imports of plywood from Indonesia have rebounded from the lows of 2020 but are still below the relatively modest levels of 2019. Imports of 33,600 cu.m in the first seven months of this year are 48% more than the same period in 2020 but 4% less than in 2019.

As with other hardwood product groups, UK demand for tropical hardwood plywood has been strong this year, driven by high levels of construction activity and shortages of competing materials. The main market challenges have been on the supply side, notably the considerable escalation in freight rates on Asian routes to the UK. A 40ft container from Malaysia or Indonesia as late as last autumn cost $1500 -$2000. By Q2 2021 importers were being quoted $15,000-20,000 and rates have stayed there.

After falling sharply in May and June last year, UK imports of tropical sawnwood have gradually strengthened, but the strength of the rebound has been impaired by significant logistical problems on the supply side. UK imports were 46,700 cu.m in the first seven months of 2021, just 3% more than the same period in 2020 and 26% less than the same period in 2019. Although imports from Cameroon, now by far the leading supplier of tropical sawnwood to the UK, were up 66% on 2020 and 43% on 2019 during the seven month period, imports from nearly all other leading tropical sawnwood supply countries have remained weak this year (Chart 6).

The large increase in imports of sawnwood from Cameroon was due to the long lead time in shipment of contracts placed back in 2020. UK importers now report that supply for hardwoods from Cameroon and other African supply countries is very limited. Global demand for species such as sapele, sipo and iroko, accompanied by production delays and logistical difficulties, have been such that many African mills placed a moratorium on taking new orders in late March and throughout April this year.

UK imports of tropical sawnwood from Côte d’Ivoire were just 2200 cu.m in the first seven months of this year, 13% more than the same period in 2020 but still down 20% on the same period in 2019. The UK was previously a significant buyer of framire from Côte d’Ivoire but UK importers report that this species is proving increasingly difficult to source, both due to a lack of raw material in the forest and the challenges of obtaining assurances of legality that satisfy UK Timber Regulation requirements.

Meanwhile, UK imports of tropical sawnwood from both the Republic of Congo and DRC have fallen to a trickle since the start of the pandemic. Imports from the Republic of Congo were just 700 cu.m in the first seven months of the year, down 86% and 92% compared to the same period in 2020 and 2019 respectively. Imports from DRC were 800 cu.m, which is 62% more than the negligible amount imported last year, but 84% less than the same period in 2019.

After an extremely slow start to the year brought on by pandemic induced production problems and extreme shortages of containers, UK imports of tropical sawnwood from Malaysia picked up a little in the second quarter with the arrival in May of the first breakbulk shipments of Asian meranti and keruing lumber into the UK for nearly 30 years. UK imports of Malaysian sawnwood were 6,400 cu.m in the first seven months of 2021. That is still 6% less than the same period last year and 37% down on the same period in 2019.

With shortages in supply from other sources, UK importers were turning more to South America in the opening months of this year. Imports from Brazil were quite good in the first quarter but ground to a halt in the second quarter. By the end of the first seven months, total UK imports of tropical sawnwood from Brazil were 2,600 cu.m, 23% less than the same period last year and 13% down on 2020. Imports from Guyana on the other hand have continued to rise, at 2,700 cu.m in the first seven months this year, a gain of 4% on the same period in 2020 and double the volume imported in the same period in 2019.

Indirect UK imports of tropical sawnwood from other EU countries have fallen dramatically this year. Total UK imports from EU countries were 6,900 cu.m in the first seven months of 2021, 25% less than the same period last year and 46% down on the same period in 2019.

The UK imported 5,200 tonnes of tropical hardwood mouldings/decking in the first seven months of 2021, 31% more than the same period in 2020 but still 33% less than the same period in 2019. The arrival of the first breakbulk shipments into the UK this year boosted imports a little from Indonesia, which at 1,800 tonnes in the first seven months were 6% more than the same period in 2020, but still down 60% compared to 2019. Similarly, imports from Malaysia, at 1,400 tonnes, were 21% more than the same period in 2020 but 29% less than in 2019. Imports from Brazil have also picked up a little, at 1,100 tonnes in the first seven months, 49% more than the same period last year 1% more than in 2019 (Chart 7).

The UK market is currently suffering from severe lack of availability of tropical hardwood decking, due both to the freight hikes and also to suppliers preferring to sell the limited stocks they have available to other markets. This has forced more UK importers to purchase more tropical decking from importers in the Netherlands. The UK imported 400 tonnes of tropical hardwood decking from the Netherlands in the first seven months of this year when previously very little was sourced indirectly from there.

Big increase in UK timber imports from the EU despite Brexit

An impact of the UK’s departure from the EU single market and customs union on 1st January this year was meant to be a decline in the quantity of UK timber imports from the EU. This forecast followed expectations of logistical problems as new controls were introduced at the UK border, increased scrutiny of the plant health and legal status of EU wood products imported into the UK, and sluggish economic activity in the UK due to post Brexit uncertainty.

However, not only did UK imports from the EU fail to decline in the first half of 2021, but they were at record levels. Chart 8 shows the quantity of UK imports of all wood and wood furniture products from the EU (excluding wood for fuel) on a monthly basis since the start of 2017. In total, the UK imported 4.13 million tonnes of wood products from the EU27 in the first seven months of 2021, 40% more than the previous year, which of course was COVID-affected, but also 21% more than in 2019, the last “normal” year.

Most of this growth was concentrated in softwood sawnwood and logs and panel products, which dominate UK imports from the EU27 (at least in tonnage terms). However, imports of furniture and hardwood products which compete more directly with imports from the tropics also grew strongly from the EU in the opening months of this year.

Of course it is early days for the UK outside the EU single market, and the UK timber market is currently experiencing unprecedented conditions due to the COVID pandemic. The combination of very high levels of consumption in the UK construction and DIY sectors and severe disruption of supplies from sources further afield – in China, Southeast Asia, North and South America, and Africa – has fed a significant upturn in UK demand and prices for timber imports from the EU. Importers and distributors have had a strong incentive to overcome the new logistical and bureaucratic challenges of sourcing from the EU.

The main question now is whether this situation will be maintained for the long term, and whether there is any genuine potential for the UK to pivot away from the EU as logistical problems ease in other parts of the world. The market signals are still mixed in relation to this question. The UK’s exit from the EU has contributed to a significant fall in indirect imports of tropical sawnwood and plywood from the European continent during 2021. But this has yet to be compensated by any significant rise in direct imports of these same products from tropical countries.

However, the uptick this year in UK imports of wooden doors from Indonesia and of other joinery products from Malaysia to levels exceeding those pre-pandemic, despite very high freight rates, is some grounds for optimism.