It’s been six months plus of extremes and superlatives in the European sawn hardwood sector.

Importers, distributors and merchants say the trading environment has been like nothing they’ve experienced during decades in the business. Demand has climbed across key markets. Freight rates have reached unprecedented levels. Supply has become exceptionally tight and lead times have stretched from sources globally. Prices have consequently hit the heights, while margins are variously described as good to extremely so.

“It’s been a challenging trading period, in terms of obtaining supply, operating a managed volume sales system so we can service as many customers as possible and keeping up with shipping costs hitting stratospheric levels,” said one importer. “But if you didn’t make money in the hardwood trade over the last six to nine months, there’s something wrong with your business model!”

At the start of September, traders were detecting the energy going out of the market to a degree, with rising nervousness among customers about committing to current high prices in case they were about to peak. However, while some species may be set for a sharper price downswing than others in coming months, the consensus was that the overall market, at most, is set for a gradual adjustment to lower levels of growth and consolidation rather than any marked reversal.

After slumping in the first and second quarter of 2020 during the first pandemic lockdowns, European hardwood consumption is reported to have started to recover towards the end of May last year. The next 12 months saw a pretty continuous upward curve, with May and June 2021 proving particularly frenetic .

A key demand driver across the continent and in the UK has been the boom in home improvement, refurbishment and DIY markets.

“Being stuck at home in lockdown, isolation and on furlough, consumers have been prompted to improve houses and gardens – and they’ve got the money as they haven’t been spending on holidays and other leisure activities,” said an importer-distributor. “There’s also been significant growth in home and garden office construction, with the expectation that increased remote working will be a permanent fixture, even post-pandemic.”

“We saw particular growth in sales of hardwood cladding destined for garden buildings, and the decking to go with it, as householders turned properties into live/work spaces,” said a merchant. “Sleepers and other hardwood garden products sold strongly too.”

This repair, maintenance and improvement market (RMI), in particular, is where hardwood businesses are now seeing some cooling off.

“European consumers are finally able to take vacations and go out as covid travel and social distancing restrictions are relaxed, so there’s less disposable income, plus more are back at work, with less time for DIY projects,” said an importer. “But we’re not seeing this business dry up overnight. Our RMI customers still report pretty good order books.”

Building sector demand also picked up as lockdown restrictions wound down. It was given a further boost by governments across Europe seeing construction as a vital engine for jump starting stalling Covid-hit economies, supporting it with spending on public projects and fiscal stimulus measures.

Some importers report this sector also losing some momentum late summer/early autumn this year.

“Builders are facing rising prices and shortages across all raw materials and some land banks are deferring development projects, presumably to wait for supply to improve,” said one. “If they can’t get the steel or bricks or concrete, even where they can source the wood, some builders are also delaying buying to see if prices stabilize or come down.”

Again, however, other traders say demand from the general construction joinery sector is slowing rather than turning down and window, door and staircase makers are reported still very busy.

Lead market analysts also agree that through 2021 as a whole European construction will have racked up a robust performance. According to the latest outlook for its 19-country region from Euroconstruct, the sector’s volume output will rise 3.8% this year, after last year’s 5.1% contraction. While it varies from country to country, Euroconstruct says the rate of building recovery has been faster than initially expected, underpinned by generally favourable economic conditions. It predicts most of the losses resulting from Covid to be recovered and activity to return to pre-pandemic levels by 2022, with further growth next year of 3% and 2.1% in 2023.

Distributors report recovery in hardwood demand from furniture manufacturers too and the hotel and wider hospitality markets. Some say even shopfitting, which was devastated in the pandemic, is showing signs of life, although starting from a very low base.”

Adding all these markets together and the generally agreed figure for volume growth in the European hardwood sector in 2021 to date is 20%. That, said one importer, returns business almost to 2019 levels.

Further underlining the level of activity and limited supply, with mills’ efforts to catch up with demand still constrained by covid-safe work practices, there has, until recently, been little customer push-back on rising prices. “They’re busy and need the wood, so they’re paying the price and paying on time – bad debt has been at all-time lows,” said an importer/distributor. “There may be a bit more caution on price now, but we’re still finding most customers who decide to shop around coming back and paying because they can’t get cheaper elsewhere.”

Another sign of the times has been widespread allocation. “Our suppliers are allocating timber to us, so we’re allocating to customers. It’s less a sales role, more rationing!” said an importer.

European importers report extended lead times for African hardwood

In terms of supply, European importers report African hardwood producers affected later and less severely by Covid than other sources. However, pandemic safe working has increasingly impacted output and lead times have extended.

Administration has been disrupted too, with delays reported in securing export documentation.

“We’ve also seen hold-ups at the [Cameroon] port of Douala, with vessels having to use their own cranes as portside ones have been out of commission due to lack of maintenance staff,” said an importer. “Kribi is also under-resourced and not yet fit for purpose.”

Of the lead African species, iroko is currently reported readily available, but utile described as ‘very scarce’. There are differing views on sapele supply. Some importers say they’re securing sufficient volume, others report less coming out of the forest.

“We’re not sure why – it could be it’s less abundant in specific areas being harvested, but it’s not an issue isolated to one country or region,” said one importer.

Secondary African species are reported to have gained some traction through the pandemic period as supply of main commercial species has tightened. One company highlighted increased interest in its engineered products in lesser-used varieties, including kosipo and tali.

European importers report prices increasing across African hardwoods, but with rises more modest than those seen from other sources, the main commercial species up an average 10-15% in the year to date.

Tenfold increase in freight rates between Asia and Europe

The key topic when it comes to European imports from Asia remains freight rates. A 40ft container from Malaysia or Indonesia as late as last autumn cost $1500 -$2000. By Q2 2021 importers were being quoted $15,000-20,000 and rates have stayed there. This is attributed mainly to the general disruption to world trade caused by the pandemic, with a lack of return freight from western markets to South East Asia and empty containers stock piling in the wrong locations.

In response, there has been a shift for some timber products, such as plywood and sawn timber, to break bulk. But shippers have capitalised and put rates up here too. It’s also not proved a straightforward solution.

“It takes longer than shipping by container and is more complex to organise. You have to have the volume to make it viable, goods are more prone to damage and unloading is a time-consuming process,” said an importer. They added that the breakbulk vessel Konya from Malaysia to Rotterdam and London Tilbury this summer spent weeks discharging at the latter, partly as the port was so busy, partly because personnel weren’t used to the work. It was reported to be the first timber breakbulk from Malaysia into London in 30 years.

“Breakbulk also just doesn’t work for more vulnerable and valuable goods, like flooring,” said one importer. “We’ve just had to pay the container rate and hope customers will cover the cost. Asian timber price rises this year average 8-10%. Freight has pushed that to 30%.”

No-one sees container rates changing significantly in the near future and, despite the issues with the Konya, another breakbulk vessel is due to set sail for continental Europe and the UK in October.

“Christmas goods traffic from China will now further underpin container prices, so we see little sign of softening for the next six to eight months,” said an importer. “Talk is also now that rates have historically been too low and that, even when they come down, it won’t be to former levels.”

Importing from Brazil is also proving a greater challenge. “Prices are sky high, driven up by US and wider global demand and also the serious Covid situation, which has led to personnel shortages and restricted mills’ output,” said an importer. “The combination of the pandemic and political turmoil has also hit administration and it’s become increasingly difficult to secure export licences.”

Decline in availability of US hardwood for European importers

US hardwood supply to Europe in the last six to nine months was described by importers as turbulent. According to Judd Johnson, editor of the Hardwood Market Report, quoted in a recent article in the UK Timber Trades Journal, the American hardwood sector entered the pandemic in a ‘diminished state’. It was hit first by tariffs in the US-China trade war and subsequently a general weakening of Chinese demand when trade relations improved. Mill capacity was then significantly further reduced by Covid absenteeism and what some saw as the government ‘paycheque protection program’ disincentivising employees from returning to work.

The widely broadcast result has been sharp declines in availability and sharp increases in price. At one point this summer, a UK importer described 4 quarter American white oak as ‘vanishingly scarce’ and forward order availability ‘non-existent’. The price had doubled over the year, as had that for tulipwood, while walnut was up 65-70%, maple 30% and ash 40-50%.

Availability was not helped by some hardwood mills switching to softwood to capitalise on booming demand from US construction.

The situation does now seem to be easing, with more ‘offers on the table and timber in the pipeline’.

“It may partly be a case of timber drying quicker in the summer and so more coming available, but mills do seem to be keeping pace better with demand, and we hear some of those which switched to softwood have switched back again as that business has softened,” said an importer.

Despite this, little change is expected in US prices until sometime into next year.

Switching to European hardwood species

Given the price and supply situation in US hardwoods, there has been some switching in Europe to European species, notably oak. Due to this and rising demand elsewhere, plus it is reported the decision of the Croatian authorities to put higher oak grades from state forests to auction rather than sell be tender, prices are up 15-25% this year, with further 3-5% rises anticipated in coming quarters.

European oak availability is also reported to have declined recently and concerns were expressed about longer term supply given the prospect of a Russian log export ban in 2022.

“China buys such huge volumes of Russian logs of all varieties,” said an importer. “Unless it can cut a bilateral deal with Russia, or Chinese companies can build sawmills there, it’s going to be looking to other sources, and that includes Europe.”

European beech is also reported to be up in price 10% in the year to date and one importer said they were experiencing longer lead times. One factor seems to be customers substituting beech for tulipwood due to the latter’s high price.

EU+UK tropical sawn hardwood imports rise 8% in first half year

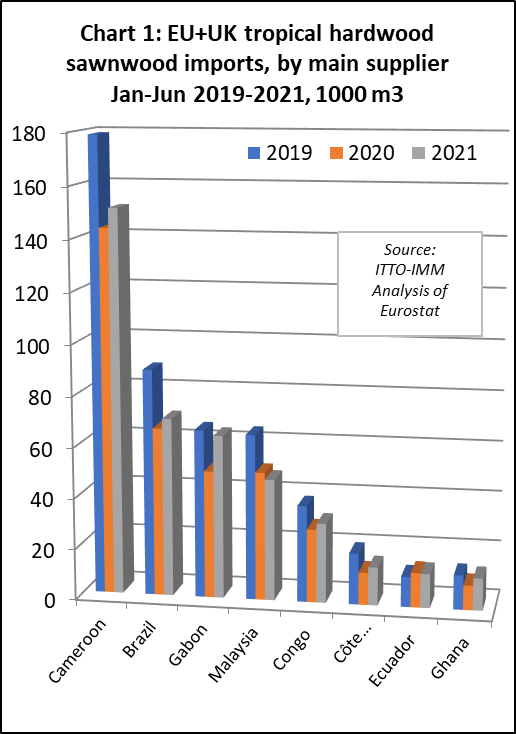

After declining 15% to 842,000m3 in 2020, analysis of Eurostat figures shows EU and UK tropical sawn hardwood imports from January to June 2021 rising 8% to 443,000m3. Imports from Cameroon for the first half increased 5% to 151,000m3, from Brazil 6% to 70,000m3, Gabon 28% to 64,000m3, Republic of the Congo 9% to 31,300m3, Côte d’Ivoire 19% to 15,000m3 and Ghana 31% to 12,600m3. Imports from Malaysia, where production was reported to be particularly hard-hit by lockdown, were down 5% at 47,700m3, while those from Ecuador declined 2% to 13,300m3 (Figure 1).

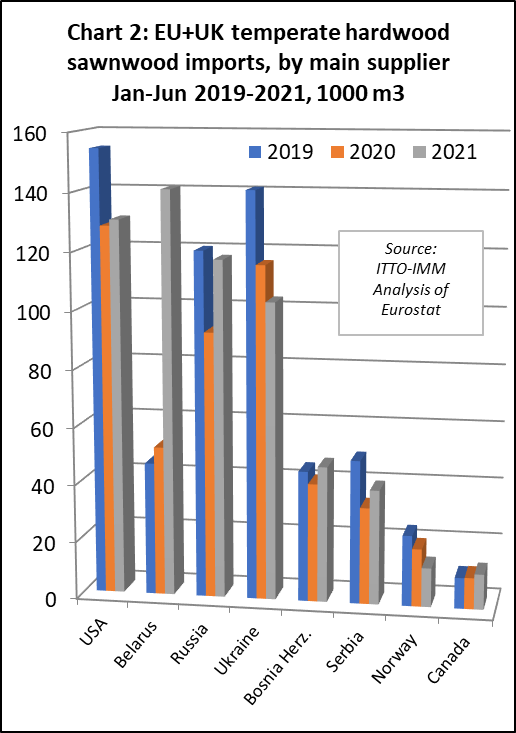

After declining 7% in 2020 to 1.1 million m3, EU and UK imports of temperate sawn hardwood in the first half of 2021 rose 22% to 640,700 m3. Imports from Belarus jumped 171% to 140,800m3, while those from the US were up 2% at 130,300m3. Imports from Russia rose 27% to 117,300m3, from Bosnia Herzegovina 15% to 47,300m3, from Serbia 19% to 39,900 and Canada 13% to 12,300m3. Those from Ukraine dropped 11% to 103,300m3 and from Norway 32% to 13,600m3 (Figure 2).

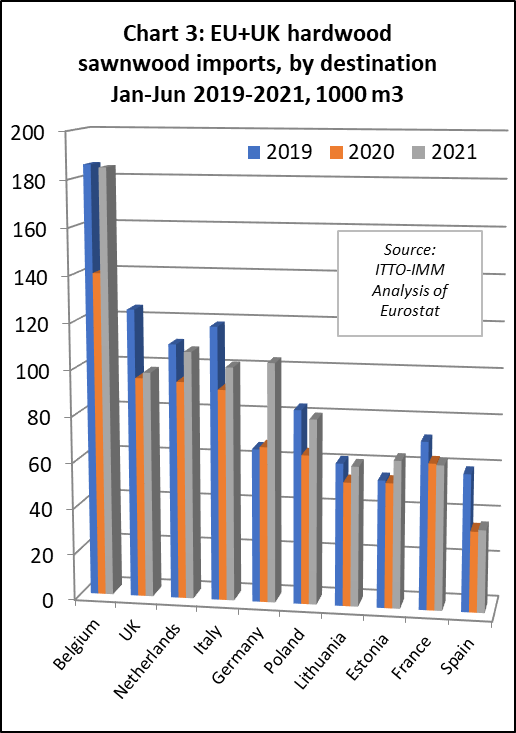

Biggest sawn hardwood importer in Europe overall was Belgium, with its total up 32% from January to June at 184,500m3. Total imports in the Netherlands were up 14% to 107,500m3, Germany 53% to 103,800m3, Italy 11% to 101,400m3, UK 3% to 98,000m3, Poland 24% to 80,300m3, Estonia 18% to 64,000m3, Lithuania 18% to 60,800m3 and Spain 2% to 35,800. French imports were down 1% at 62.8m3 (Figure 3).

Belarus imposes sawnwood export duties

The large hike in imports from Belarus is likely related to anticipated introduction of Belarus president decree No.305 of 5th August 2021 stating that export duties on sawn timber and woodworking industry products will be enforced from 16th August 2021. The export duties will stay in place at least until 31st December 2021 pending a decision by the Belarus government on an extension. The export duty on sawn timber has been set at €100 per cubic meter. It applies to exports to all countries except to other Eurasian Economic Union member states (Azerbaijan, Georgia, Moldova, Tajikistan, Uzbekistan, Turkmenistan, and Ukraine). The timber export duties are designed to encourage more timber processing in the country.

The leading EU importers of sawn timber from Belarus, and therefore most affected by the export duties, are Germany, Poland, Netherlands, Latvia, Belgium, and Estonia. All these countries reported a very large increase in sawnwood imports from Belarus in the first 6 months of 2021, but these gains may well be reversed in the second half of the year.

Rising European sales of modified softwoods

In recent years, European sales of modified softwood, often sold as a hardwood and particularly a tropical hardwood alternative, have continued to climb and a distributor said given buoyant timber demand generally, they could have sold 30-40% more of the Accoya product from Netherlands-based Accsys Technologies in the last year.

However, output was limited by disruption during the pandemic in supply of the New Zealand radiata pine on which it’s based, plus capacity expansion at Accsys’s production site.

Another modified timber producer, UK-based Lignia went into liquidation in April, but this was attributed to ‘failure to secure necessary funds to continue to develop and grow its product offering’ rather than any market issue. Accsys subsequently acquired Lignia’s through-colouring technology to continue to expand and diversify Accoya production.

An importer of another growth product in Europe, engineered grandis eucalyptus from Uruguay, also reported constraints in supply due to the pandemic, plus strong demand for sawn grandis in the US.

That other hardwood rival, wood plastic composites are reported to have further increased European market share recently, particularly in cladding and decking and including via some of the hardwood distributors and merchants consulted for this article. But their competitive edge has also been blunted to an extent by rising raw materials costs.

European hardwood market must acclimatise to higher prices

Looking forward, the mood of the European hardwood sector seems generally positive. One saw margins and volumes drifting down through the rest of 2021 ‘due to increasing turmoil in construction’. But this would be from a ‘very high position’ and there would still be ‘super profits to go round for the year’.

An importer-distributor felt prices would remain ‘firm’ish’ for the immediate future.

“Then we may see some further readjustment, but we certainly don’t see any danger of a radical market reset given the level of demand and the fact there still isn’t enough timber in the system.”

Another also saw prices ‘steadily settling’. “But I don’t think we’ll see a return to pre-pandemic levels any time soon,” they said. “The market will have to acclimatise to a higher priced new norm and attach a greater value to hardwood, which many see as a good thing.”