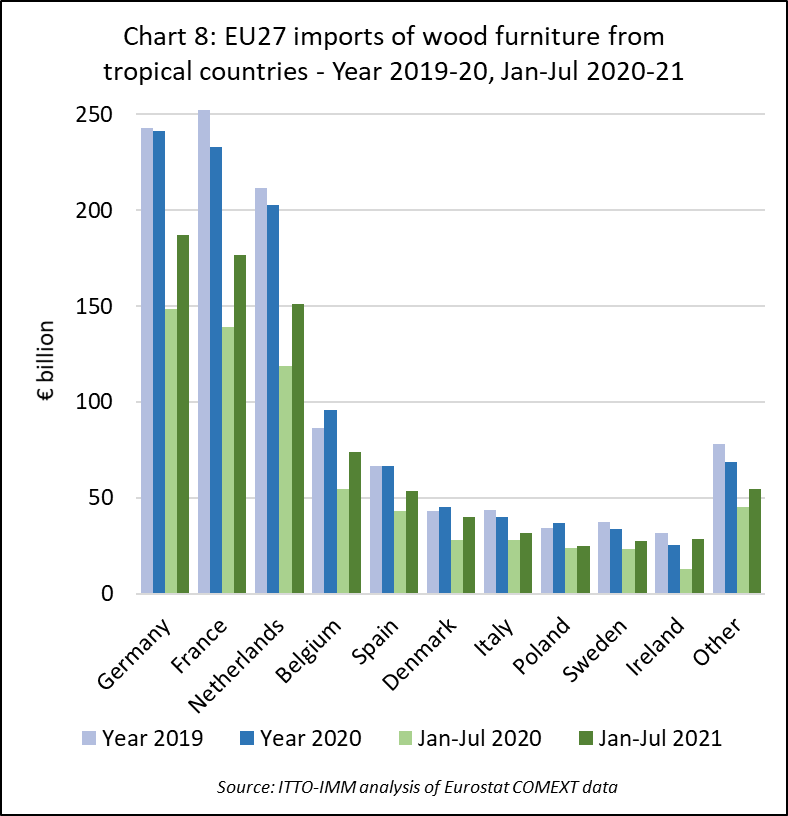

The latest Eurostat PRODCOM data reveals that the total value of wood furniture production in the EU27 declined 5% to €32.4 billion in 2020. This performance for the year is significantly better than initially anticipated at the start of the pandemic. It is also an improvement on the 8% decline in total EU27 furniture production in 2020 implied by the Eurostat furniture production index published earlier this year. Nevertheless, the decline was a major setback for a sector that has been sliding since 2018. Production value last year was the lowest since 2014 when the EU27 was just emerging from the depths of the Euro Debt Crisis in the aftermath of the 2007-2008 global financial crash (Chart 1).

The production downturn in 2020 was particularly dramatic for shop furniture which saw a decline of 13% to €2.8 billion. This was the result of widespread closure of retail outlets and increased reliance on online shopping as much of Europe went into lockdown early in the pandemic. The decline was much less severe in other sectors including upholstered seating (-5% to €7.0 billion), office furniture (-1% to €4.0 billion), bedroom furniture (-3% to €2.8 billion), dining/living room (-4% to €6.3 billion), and “other wooden furniture” (-6% to €6 billion). Production value of non-upholstered seating was flat at €0.6 billion.

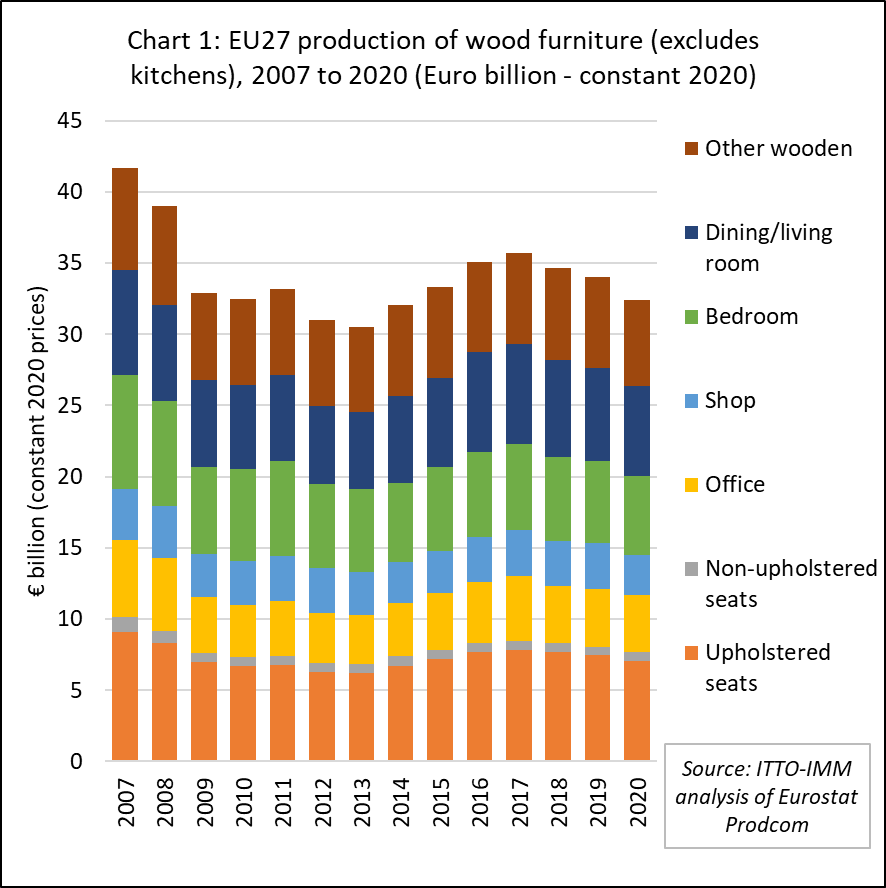

Wood furniture production value in Italy, the largest producer in the EU27, increased last year, rising 4% to €8.0 billion and recovering ground lost in 2019. Production was down in all other leading supply countries including Poland (-3% to €5.9 billion), Germany (-8% to €5.7 billion), Spain (-11% to €1.9 billion), France (-17% to €3.2 billion), Romania (-9% to €1.5 billion). Lithuania (-2% to €1.4 billion), Portugal (-7% to €1.0 billion), and Denmark (-5% to €0.8 billion) (Chart 2).

The value EU27 wood furniture consumption fell 4% to €28.3 billion in 2020. As for production, the consumption downturn was most pronounced for wooden shop furniture, down 10% at €2.4 billion. The total value of EU27 consumption of wooden office furniture increased in 2020, rising 1% to US$3.6 billion, probably a result of workers purchasing office equipment for their own homes during the lockdown. Consumption of all other furniture types declined in 2020 including upholstered seating (-6% to €6.0 billion), other seating (-5% to €0.7 billion), bedroom furniture (-4% to €5.0 billion), dining/living room (-4% to €5.7 billion), and “other wooden furniture” (-4% to €5 billion).

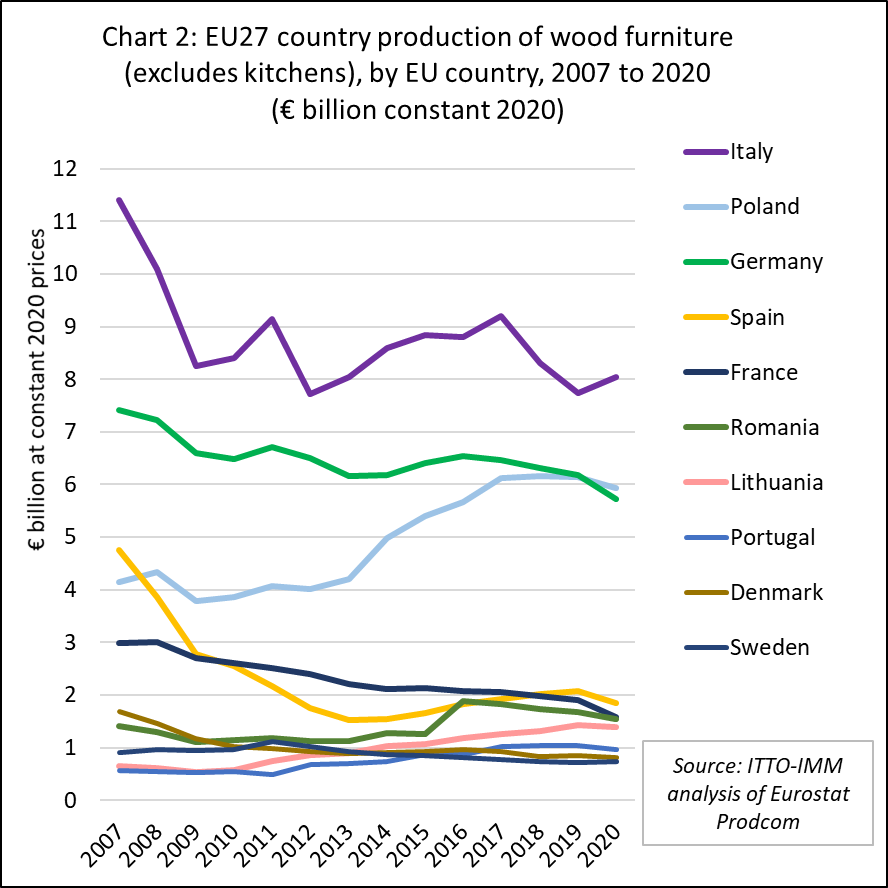

Wood furniture consumption in Germany, by far the largest single market in the EU27, was relatively stable in 2020, as it has been for the last 4 years, falling only 2% to €8.2 billion. Italy, again surprising given the severe effects of the pandemic in the country during the year, recorded an 8% increase in wood furniture consumption value in 2020, to €4.9 billion. Gains in consumption were also recorded in Austria (+5% to €0.8 billion) and Sweden (+7% to €0.8 billion). Elsewhere there were large falls in consumption in France (-12% to €3.6 billion), Spain (-12% to €1.9 billion), the Netherlands (-11% to €1.3 billion), Romania (-7% to €1.0 billion), and Poland (-22% to €1.0 billion). Consumption in Belgium was flat at €0.8 billion during the year (Chart 4).

EU27 wood furniture imports from tropical countries hit by freight problems

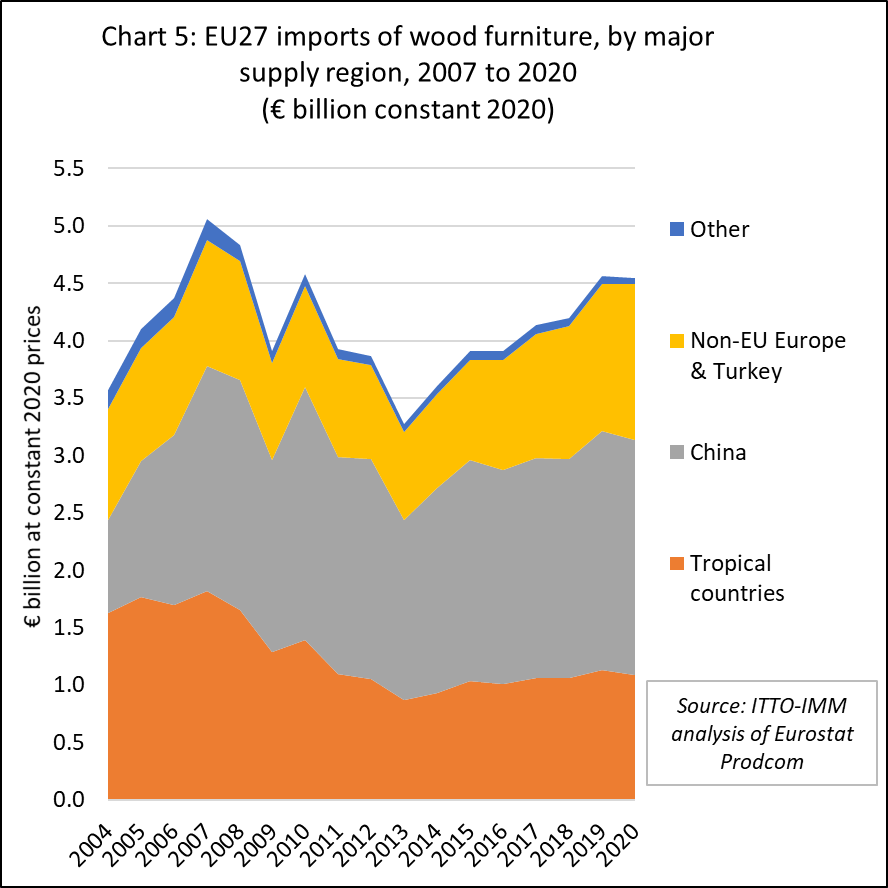

In 2020, the EU27 imported €4.5 billion of wood furniture from outside the bloc, only 0.3% less than the previous year. Imports of €1.1 billion from the tropics were down 4% at €1.1 billion, while imports from China fell 2% to €2.0 billion. In contrast imports from other countries outside the tropics increased 5% to €1.4 billion. The large decline from tropical countries was partly due to the severe shortages of containers and sharp rises in freight rates for shipments from Southeast Asia to Europe during the year. However, this is also a continuation of a long term trend of rising share of EU27 wood furniture supplies being sourced from other temperate countries, particularly in the European neighbourhood, notably Turkey, Bosnia Herzegovina, Ukraine, Belarus and Serbia (Chart 5).

In recent years, tropical countries have made some slight gains in the EU27 market for wood furniture, with their total share of consumption value rising slowly from 3.5% in 2014 to 3.8% in 2019, a level maintained into 2020, despite pandemic-related problems. Vietnam’s share crept up from 1.4% to 1.6%, Indonesia’s from 0.9% to 1.0%, and India’s from 0.5% to 0.7% during this period. However, these gains came only after a long period of decline between 2007 and 2014. Before the global financial crises, tropical countries accounted for around 5% of all wood furniture consumed in the EU27.

The long-term shift away from tropical suppliers in the EU27 wood furniture market was due particularly to loss of share for tropical wood in the outdoor sector, both to other wood products and, more significantly, to non-wood materials. Furniture manufacturers in tropical countries have so far been relatively unsuccessful in accessing EU markets for interior furniture – unlike in the United States where tropical countries, particularly Vietnam, are rapidly increasing share.

To put EU27 wood furniture imports from tropical countries into perspective, it can be noted that the total value last year – in dollar terms around USD1.24 billion from all tropical countries – was slightly less than USD1.26 billion of US wood furniture imports just from Vietnam in the month of July this year.

Meanwhile, in recent years, larger gains in the EU27 wood furniture market were made by Chinese suppliers, whose share of EU27 consumption increased from 6.7% in 2014 to 7.2% in 2020, and by other temperate suppliers, rising from 3.3% to 5.0% over the same period. These gains were at the expense of domestic producers, but only around the margins without at all threatening the overwhelming market dominance of EU27 manufacturers. Domestic production in the EU27 accounted for around 84% of all wood furniture consumption in the EU27 in 2020, a decline from 87% in 2014.

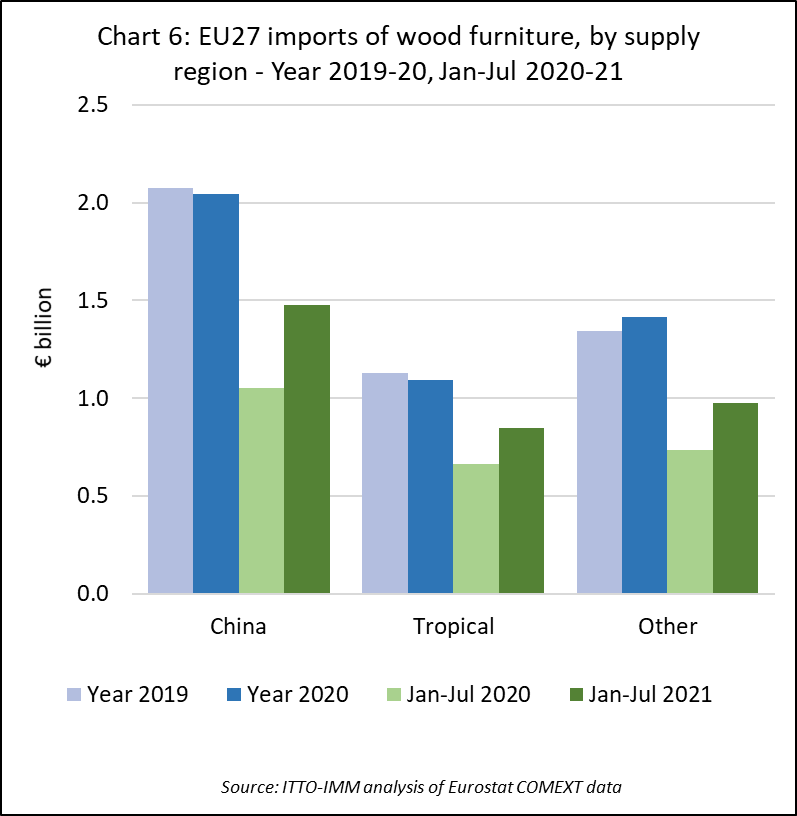

EU27 imports of wood furniture have picked up pace this year, although again suppliers outside the tropics have benefited more than tropical suppliers (Chart 6). Total import value in the first seven months of 2021 was €3.3 billion, 35% more than the same period in 2020 when much of the continent was operating under strict lockdown conditions. However, import value during the seven month period was also up 22% compared to the same period in 2019.

While it is a positive sign that EU27 importers are willing to spend more on wood furniture from tropical countries this year, these gains in import value must be seen against the background of a five-fold increase in freight rates from Southeast Asia to Europe between September 2020 and July this year. Many tropical manufacturers are probably benefitting very little in terms of improved sales value.

EU27 wood furniture import value from China in the first seven months this year was €1.47 billion, 40% and 21% more than the same period in 2020 and 2019 respectively. The equivalent figure for import value from tropical countries was €850 million, up 28% and 19% compared to 2020 and 2019 respectively. Import value from other countries (almost all neighbouring countries in Europe outside the EU) in the first seven months was €970 million, up 33% and 26% compared to 2020 and 2019 respectively.

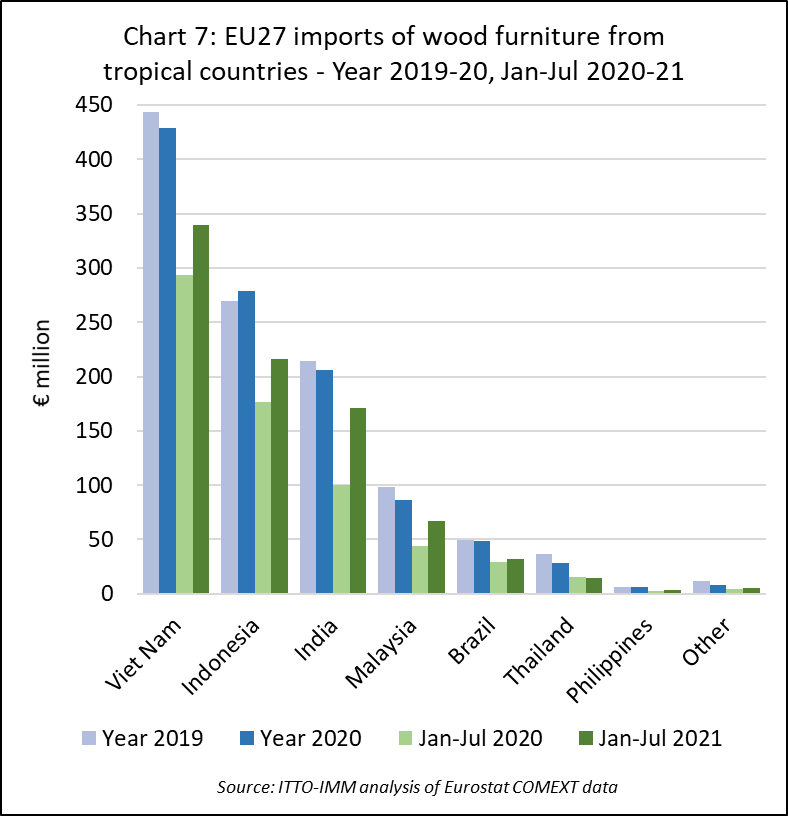

Of the main tropical suppliers of wood furniture to the EU27, import value from Vietnam was €340 million in the first seven months of 2021, 16% and 15% more than the same period in 2020 and 2019 respectively. Import value from Indonesia was €216 million, up 23% compared to 2020 and 25% compared to 2019. India made even more spectacular gains, import value of €171 million in the first seven months this year being 71% and 36% more than the same period in 2020 and 2019 respectively. Growth in import value of €67 million from Malaysia was more modest, up 53% compared to 2020 but only 14% more than 2019. Import value of €32 million from Brazil was just 10% and 16% more than the same period in 2020 and 2019 respectively. Import value from Thailand, at €15 million, was still 3% down compared to the first seven months of 2020 and 34% less than the same period in 2019 (Chart 7).

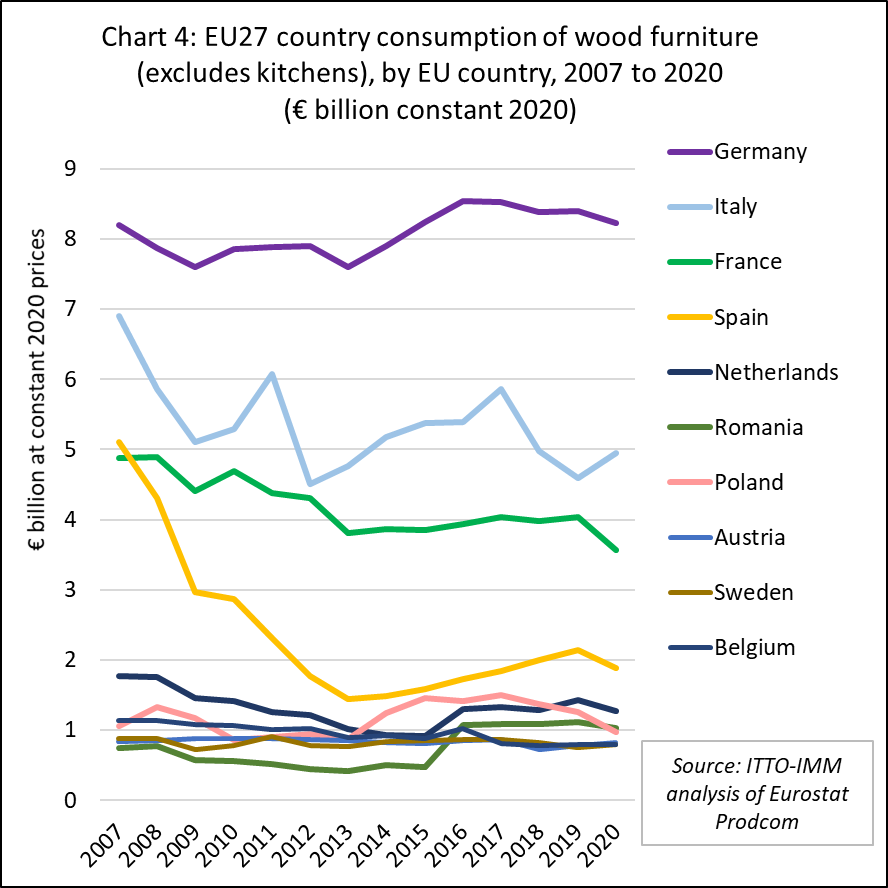

There were universal gains in import value of wood furniture from tropical countries across all the leading EU27 markets in the first seven months this year including Germany (€187 million, +26% on 2020 and +19% on 2019), France (€177 million, +27% on 2020 and +15% on 2019), Netherlands (€151 million, +27% on 2020 and +13% on 2019), Belgium (€74 million, +35% on 2020 and +48% on 2019), Spain (€54 million, +24% on 2020 and +25% on 2019), Denmark (€40 million, +43% on 2020 and +48% on 2019), and Italy (€32 million, +14% on 2020 and +6% on 2019) (Chart 8).