As usual in January, the IMM furniture fair in Cologne and the Domotex flooring show in Hamburg were key events for the European wood trade, providing a signal of market sentiment and an insight into emerging trends.

Official reports from both shows were typically bullish, implying a high level of underlying confidence in sophisticated and innovative European manufacturing sectors. IMM Cologne reported 1,233 exhibitors from 53 countries and over 128,000 visitors, up from 125,000 the year before, with over 50% of the 82,000 trade visitors from overseas. Domotex reported 35,000 attendees, 70% of them from abroad, and over 1,400 exhibitors from more than 60 different nations.

An emphasis on “sustainability” has, of course, been a common theme running through these and similar shows in Europe now for several years. However, this year there was a sense that the environmental issue has become more urgent, that industry needs to move decisively beyond the greenwash, and that failure to do so voluntarily will almost certainly lead to imposition of new taxes and regulations.

The intense focus on sustainability at the shows is not so surprising given the “Greta effect”, which is galvanising EU efforts to meet the goals of the Paris climate agreement, and the timing of the shows so soon after the launch of the new “Green Deal” by the European Commission which aims to make the EU climate neutral by 2050.

This policy initiative, and associated design trends towards more authentic, natural and carbon neutral products, higher quality items that are more durable and less often replaced, and increasing interest in furniture that can be used interchangeably either inside or out of doors, all have clear and generally positive implications for wood product suppliers.

To some extent though, the sunny outlook portrayed in the publicity for these trade shows, flies in the face of economic and trade data which suggests that the European trade in both wood furniture and flooring products, which has never really recovered the dynamism of the years prior to the financial crises, was cooling again in 2019.

There is intense competition, which is certainly acting to spur innovation in some sectors, but the concern is always that wood manufacturers, particularly those dealing with solid hardwood, are falling behind in the R&D stakes. There remains an almost overwhelming focus on the oak-look, a trend which extends even into artificial surfaces, which is damaging prospects for wider hardwood market development.

Slowdown in European wood furniture consumption in 2019

In the wood furniture sector, recent trade trends suggest a slowdown in overall European consumption, although there is some positive news for external suppliers who benefited from increased EU market penetration during 2019.

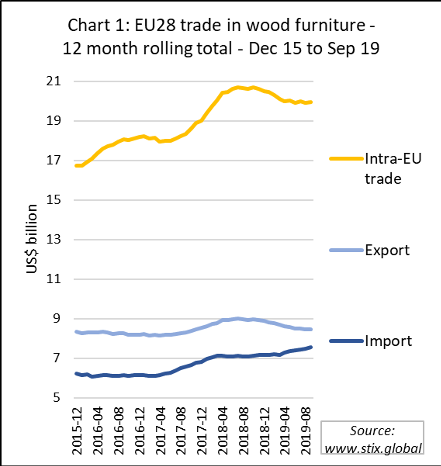

Chart 1, which shows the 12-month rolling total US dollar value of EU trade in wood furniture, highlights that internal EU trade which had been rising strongly in 2018, fell back sharply in the first quarter of 2019 before levelling in the in the second half of the year. Meanwhile EU wood furniture exports were sliding consistently throughout 2019 while imports were beginning to rise. Taken together these trends imply a slowdown in sales for the EU wood furniture manufacturing sector in 2019.

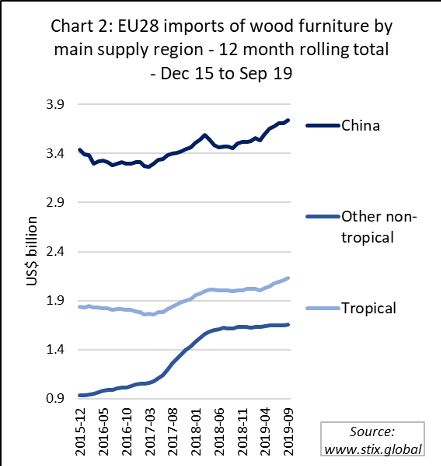

Chart 2 indicates that the main beneficiaries of growth in EU wood furniture imports during 2019 were China and tropical countries. This is in stark contrast to the 2017-2018 period when EU wood furniture import growth was driven by non-tropical countries other than China, particularly Turkey, Bosnia, US, Serbia, Ukraine and Belarus.

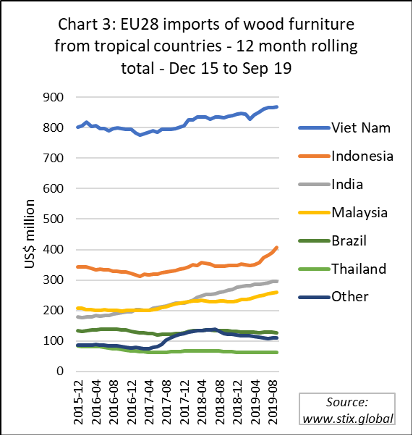

One reason for this shift in trade is likely to be the US-China trade dispute which has encouraged Chinese manufacturers to redirect export sales from the huge US market into Europe. The upturn in EU imports of tropical wood furniture products is being driven by a gradual long-term increase in market penetration by Vietnam and India, combined with a surge in imports from Indonesia in the second and third quarters of 2019 (Chart 3).

This last trend may be partly linked to the competitive advantage for Indonesian furniture in the EU market due to the FLEGT license which is becoming more of an issue now that more concerted efforts are being made to enforce EUTR in the wood furniture sector.

One indication of this was news in January that a UK importer, Heartlands Furniture (Wholesale) Ltd, was fined a total of £13,300 for two EUTR offences dating back to 2017 for failure to undertake adequate due diligence with respect to a Brazilian pine Corona bed frame from Brazil and an American oak Stirling glass-fronted cabinet from Vietnam.

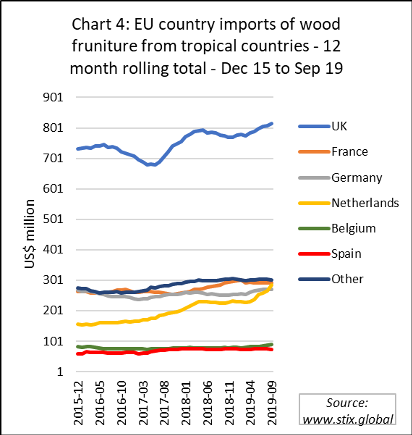

The recent surge in EU wood furniture imports from Indonesia was destined mainly for the Netherlands, although the UK remains by far the largest destination for tropical wood furniture in the EU (Chart 4).

With the UK due to depart from the EU on 31st January, there are of course profound implications for the overall EU trade balance in tropical wood furniture. In the twelve months to 2019, the UK imported just over US$800 million of wood furniture from tropical countries, nearly 40% of all EU imports from these countries.

European wood flooring consumption recovers a little ground in 2019

At the Domotex show, the European parquet floor association FEP provided a preliminary assessment of the European wood flooring market in 2019. Drawing on information from FEP member companies and national associations, it was estimated that European consumption was flat overall during the year.

FEP emphasised that this was a first assessment subject to change in anticipation of the complete data to be communicated at FEP’s Annual General Assembly due to be held on 11th and 12th June in Hamburg, Germany.

After a year in 2018 when parquet flooring consumption in FEP countries fell by 2.3% to 79.9 million m2, consumption is estimated to have recovered slightly in 2019. This is mainly due to a moderate upturn in Germany, the largest European parquet market. Consumption also improved in Austria, France, Poland and Spain.

However, these positive developments in 2019 were offset by declining consumption in Italy, Sweden, Switzerland, and the Nordic Cluster (Denmark, Finland and Norway).

Regarding competition, FEP members emphasised both the continued rise in market share of products with a wood-look, especially Luxury Vinyl Tiles (LVT). They also stressed the uncertainties created by the trade war between the US and China on global and European markets.

In contrast, FEP sees the European Green Deal as an opportunity for the wood flooring industry, particularly welcoming the strong focus on construction and renovation. According to FEP, “the European Parquet Industry is offering a circular sustainable product which saves carbon and substitutes energy-intensive and/or fossil-intensive alternatives”.

Further information on FEP’s 64th General Assembly and 45th Parquet Congress to be held in Hamburg in June can be obtained from Isabelle Brose, FEP Managing Director (isabelle.brose@parquet.net).

Increased import penetration in EU wood flooring market

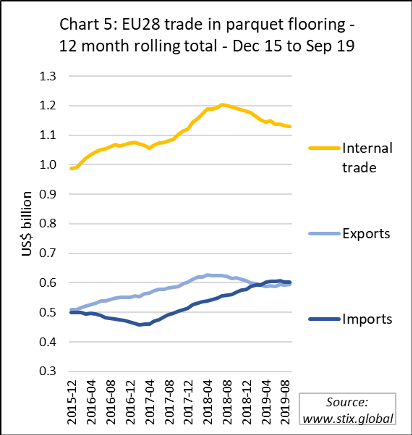

When speaking of competition, it is perhaps surprising that the FEP report on the Domotex meeting made no mention of imports. Analysis of EU wood flooring trade trends shows that imports from outside the EU have been rising strongly since 2017, a trend only moderating in the third quarter of last year. The rise in wood flooring imports from outside the EU contrasts with the slowing pace of internal EU trade and EU exports (Chart 5).

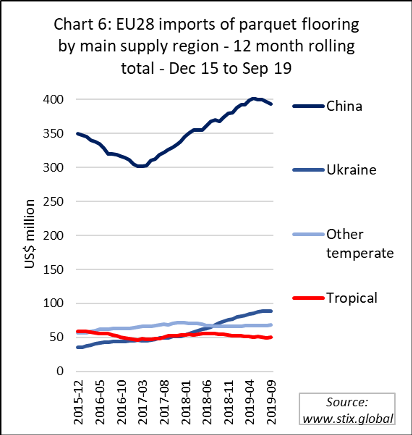

Chart 6 shows that the rise in EU wood flooring imports is almost all due to China and Ukraine. Imports from China in the 12 months to September were US$400 million, up from only US$300 million two years before. During the same period, imports from Ukraine have nearly doubled from US$50 million to close to US$100 million.

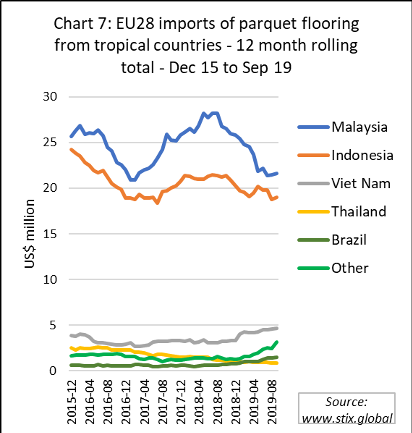

EU imports of wood flooring products have changed little in the last four years, remaining broadly flat at around US$50 million per year. In US$ value terms, imports from the two largest tropical suppliers, Malaysia and Indonesia, have followed a similar trajectory, rising in 2017 and until August in 2018, but declining thereafter. Meanwhile imports have continued to rise slowly from Vietnam, Brazil and India, but to decline from Thailand (Chart 7).

European laminate flooring sales stabilised in 2019

Europe’s globally dominant laminate flooring sector is another key competitor for parquet flooring in Europe. Of estimated global laminated flooring production of nearly 1 billion m2, the 18 manufacturers in nine European countries (including in Russia and Turkey) that are members of the European laminate flooring association EPLF accounted for around 50% last year. This compares to global share of around 25% for Chinese manufacturers and 8% share for US manufacturers.

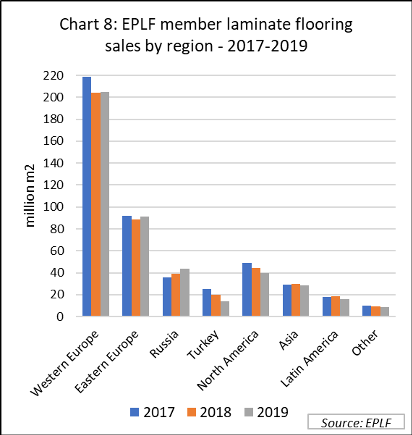

According to data presented by EPLF at Domotex, worldwide laminate flooring sales by EPLF members were 446 million m2 in 2019, a decline of 2% from 454 million m2 in 2018. However, after a significant fall in 2018, laminate flooring sales in Europe stabilised last year. The decline in sales in 2019 was due to a decline outside Europe, notably in Turkey, North America, and Asia (Chart 8).

Laminate flooring sales continued to fall in Germany in 2019, by far the largest single market in Europe, accounting for around 50 million m2 last year, but the pace of decline has been slowing. Sales in Germany were down 4% in 2019 compared to a 9% fall the previous year. The decline in Germany in 2019 was offset by an 8% rise in sales in the UK, to 33 million m2, a 1% rise in France to 36.5 million m2, and a 3% rise in the Netherlands to 18.6 million m2.

A clear upward trend is also evident in Eastern Europe where 2019 sales of 91.2 million m² were 3% more than the previous year, and Russia, where sales increased 11% to 44 million m2.

Laminate flooring is distributed via two major channels which have been growing at around the same pace in recent years; specialist wholesalers which supply most professional floor installers, and DIY retailers that target the general public.

Key trends in the flooring sector identified by EPLF at their press conference at Domotex include:

- Natural: flooring aims to look and feel ever more like real wood;

- Oak is still the dominant material in real-wood floors and look in artificial finishes;

- Concrete, granite and raw steel are increasingly used as contrasting elements to wood;

- There is a strong focus on improving the water resistance of floors; and

- The use of renewable wood and low-emission production supports the sustainability of laminate flooring.

EU “Green Deal” creates new opportunities for timber

The Green Deal, published on 11 December 2019 by the new European Commission and adopted by the European Parliament on 15 January 2020, sets out a three-decade effort to upend just about every policy area in the EU to make the bloc climate neutral by 2050. In doing so, it has real potential to create a policy environment very favourable for the wood industry.

The strategy includes 50 specific policy measures of which the flagship is a climate law, to be presented by the Commission before the end of March, which will commit the bloc to slash emissions to net zero by 2050, and a plan to increase the 2030 emissions reduction target to at least 50 percent and “towards” 55 percent from the current 40 percent goal.

The Annex to the Green Deal indicates the Commission will put forward an EU Industrial Strategy in March, as well as a new Circular Economy Action Plan. The latter will include a sustainable product policy with “prescriptions on how we make things” in order to use less materials and ensure products can be reused and recycled.

On trade, the Green Deal pledges to make respect of the Paris Agreement “an essential element for all future comprehensive trade agreements.” Another measure likely to attract attention – and controversy – is a proposal for a carbon border tax.

There is also a commitment to building renovation to improve insulation and reduce energy efficiency. The key objective there is to “at least double or even triple” the renovation rate of buildings, which currently stands at around 1%.

On forests, there is a specific objective to promote products that do not involve deforestation and forest degradation, to be encouraged through new labelling rules. There is also recognition that the “EU’s forested area needs to improve, both in quality and quantity, for the EU to reach climate neutrality and a healthy environment”.

The potential for the strategy to help drive demand for responsibly sourced wood products is well recognised in the European wood sector and initiatives are being put in place to better exploit the opportunities, although there is a lot of work still to do.

This was highlighted in a recent article for the Timber Trades Journal by Patrizio Antonicoli, secretary-general of the European Woodworking Industries Confederation – CEI Bois. Mr Antonicoli said CEI-Bois has developed three key assets to underpin the industry’s transition to the era of the Green Deal.

The CEI-Bois Manifesto for the EU term 2019-2024 illustrates how the European woodworking industry can help the EU reach key goals, such as reduction of GHG emissions in line with the Paris Agreement and the deployment of a circular bioeconomy, while ensuring jobs creation and employment stability.

The Manifesto focuses on six priorities; Wood Availability and Sustainability, Circular Bioeconomy, Competitiveness of Wood in Construction, Free but Fair Trade, Research and Innovation and Industrial Relations & Social Affairs.

The second asset is the wood itself. CEI-Bois’ “Building the Bioeconomy” booklet shows how Europe can reduce emissions by using low carbon, renewable alternatives, such as timber, over high carbon materials, such as concrete, steel and plastic.

With this publication, the European wood-working sector is calling on policy makers to put wood at the centre of emission reduction and zero carbon strategies and to recognise it as a model product for transition towards a circular economy.

Finally, the Forest-Based Industries vision 2050 focuses on how forest-based solutions can help achieve five ambitious targets:

- To decarbonise Europe by 2050 by substituting CO2-intensive raw materials and fossil energy with forest-based alternatives

- Eradicate waste in the circular economy, with a sector target of 90% material collection and 70% recycling

- Drive resource-efficiency in the forest-based industries value chain by enhancing productivity

- Meet demand for raw materials by maximising new secondary streams and ensuring primary raw material supply from sustainably managed forests

- Satisfy growing demand for climate-friendly products by increasing use of wood.

Mr Antonicoli concludes, “we see our sector becoming the most competitive, sustainable provider of net-zero carbon solutions through research, break-through technologies, increased recycling and reuse. Together the European woodworking industries can ride the Green Deal wave”.

PDF of this article:

Copyright ITTO 2020 – All rights reserved