An analysis of EU trade data by the FLEGT Independent Market Monitor (IMM), an ITTO project funded by the EU, shows that FLEGT licensed products from Indonesia, particularly wood furniture and doors, were on course to be the biggest winners in the EU tropical timber market last year.

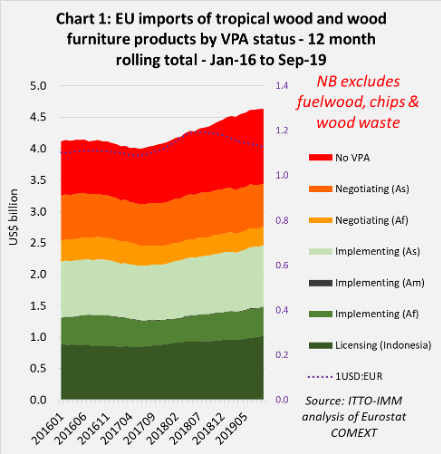

Overall the EU’s trade in tropical wood and wood furniture products was more buoyant in the first nine of months of 2019 than the same period in 2018. Chart 1 shows twelve monthly rolling total US$ value of imports (to iron out seasonal fluctuations) from tropical countries into the EU of all wood and wood furniture products listed in HS Chapters 44 and 94 (excluding fuelwood, wood waste and chips).

The 12-month rolling total fell to a low of US$3.99 billion in June 2017 but had rebounded to US$4.35 billion by September 2018 and gained an additional US$0.28 billion in the following 12 months to reach US$4.63 billion by September 2019.

Initially, the recovery in the US dollar value of EU imports was driven by exchange rate fluctuations as the euro increased sharply in value against the US dollar in 2017. However, from mid-2018 to mid-2019, the euro was weakening against the US dollar and the rise in dollar import value coincided with a genuine increase in import quantity.

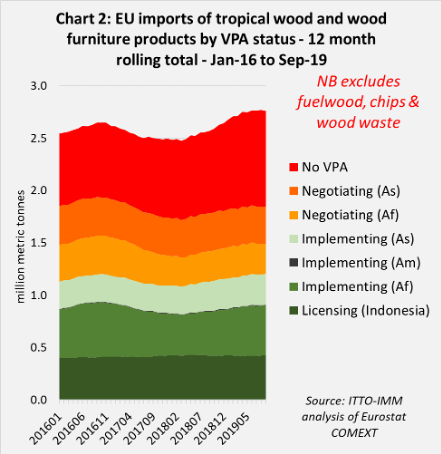

Chart 2 shows that the 12-month rolling total quantity of EU tropical wood and wood furniture imports dipped to 2.5 million metric tonnes (MT) in March 2018, then increased to 2.8 million MT in June 2019, remaining at that level through to September 2019.

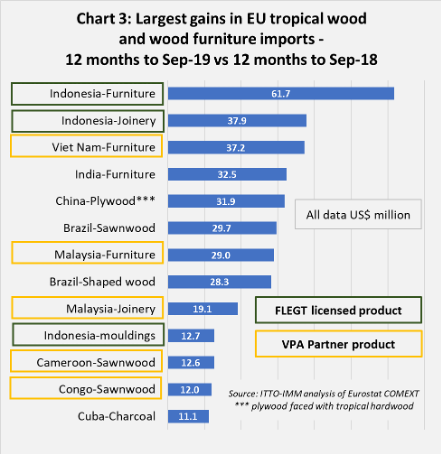

Indonesian Licensed products feature prominently in the league table of the largest gains in EU tropical wood product imports in the year to September 2019 (Chart 3).

Indonesian furniture led the way with imports in the year to September 2019 being US$61.7 million greater than in the previous 12-month period. Indonesian joinery products were in second place, gaining US$37.9 million in the same period. Indonesian mouldings/decking made it on to the list of big gainers, adding US$12.7 million.

There was also a small gain in EU imports of Indonesian plywood, which were US$3.6 million greater in the year to September 2019 compared to the previous 12-month period. This occurred despite a background of intense direct competition from Russian birch plywood products. IMM contacts with EU plywood importers suggest that prices for Russian products are highly competitive due both to low prices for birch logs in Russia and continuing weakness of the Russian rouble.

Amongst VPA countries other than Indonesia, significant gains were also seen in EU imports of furniture from Viet Nam and Malaysia, joinery (mainly laminated wood) from Malaysia, and sawnwood from Cameroon and the Republic of Congo.

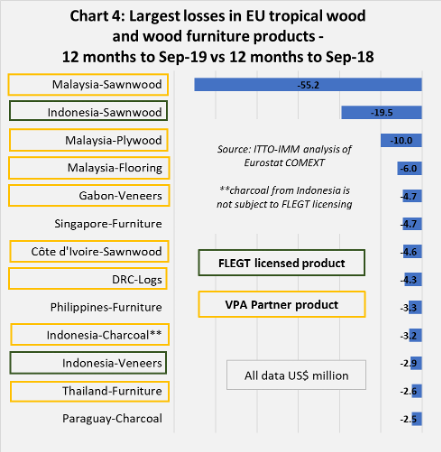

Less positive from a FLEGT perspective is that two Indonesian product groups – sawnwood and veneer – also appear in the list of the biggest losers in the year to September 2019, although the deficits are more moderate than for Malaysia which suffered a particularly sharp decline in EU imports of sawnwood (Chart 4).

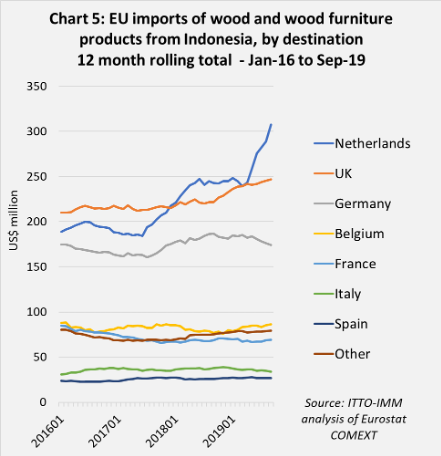

Much of the recent growth in EU imports of Indonesian wood and wood furniture products has been destined for the Netherlands and UK (Chart 5). Last year’s surge in imports of Indonesian wood furniture was destined mainly for the Netherlands. The UK is the largest growth destination for wooden doors and plywood from Indonesia. Most EU imports of decking and mouldings from Indonesia are destined for Germany and the Netherlands.

Campaign to promote FLEGT licensed timber

The UK Timber Trade Federation’s FLEGT communication project is planning to take installations featuring FLEGT-licensed timber around the EU in 2020. The initiative is funded by the UK Department for International Development under its Forest Governance, Markets and Climate programme (FGMC).

Last year the TTF project promoted FLEGT at the Brussels Furniture Fair and several conferences and organised a Tropical Trade Forum at the TTF’s London headquarters.

It also supported an installation called Momento, designed by students using FLEGT licensed balau as part of the London Festival of Architecture.

The 2020 installation will be called Conversations and will feature seating in FLEGT-licensed timber created by craft students and leading designers, intended to stimulate discussion about FLEGT and using legal and sustainable tropical timber. After a pilot in the UK it is intended to set up in prominent locations across the EU.

The TTF campaign will run more seminars, develop an e-learning resource for architects and contractors. It is also liaising on FLEGT with Chinese timber trade bodies. Under the FGMC grant, the Federation is also backing a timber marketing advisory programme being undertaken by the Global Timber Forum in Ghana and Indonesia.

Indonesia loses GSP status in the EU

As of 1 January 2020, Indonesia no longer qualifies for Generalised Scheme of Preferences (GSP) tariff rates on Wood and Wood Products in the EU.

The GSP system has ‘graduation mechanisms’ for ascertaining a country’s eligibility for preferential duty rates. These include the value of its exports of specific goods to the EU as a percentage of all EU GSP imports of those products. According to the EU, Indonesia exceeded the ceiling of 57% under this calculation for three years, so losing its GSP status.

It remains to be seen whether removal of Indonesia’s GSP status from 1st January 2019 will have any significant impact on EU imports.

Loss of GSP status will have no effect on trade in those products like decking/mouldings and most wood furniture which are zero tariff for all EU imports. However, it means higher tariffs for Indonesian plywood, veneers, and planed, sanded and finger-jointed sawn timber.

For plywood, probably the most significant Indonesian wood product influenced by GSP status, the tariff has increased from 3.5% to 7%.

EU imports from Myanmar continue despite EU prohibition

At their December meeting, the EU Expert Group on EUTR and FLEGT, comprising representatives of the EC and government authorities from across the EU, reiterated their view that it is not possible to demonstrate a negligible risk that any timber from Myanmar is legally harvested in line with EUTR definitions.

According to the Expert Group this is due to “lack of sufficient access to the applicable legislation and documentation from governmental sources”.

This opinion of the Expert Group, which reiterates previous conclusions made at earlier meetings in June and September, implies that any operator placing Myanmar timber on the EU market will be liable to prosecution for failure to undertake adequate due diligence under the terms of the EUTR.

Authorities in several EU member states have sanctioned operators trading in Myanmar teak. In the three years since 2017, a variety of legal cases have been brought against importers of teak in Belgium, Denmark, Germany, Netherlands, Sweden, and the UK, involving confiscation of the timber or requiring it’s return to Myanmar, and additional sanctions such as fines.

The report of the Expert Group’s December meeting indicated that additional cases are now being brought in the Czech Republic and Austria. The Expert Group observed that these enforcement activities are leading to changes in the direction of trade around the EU.

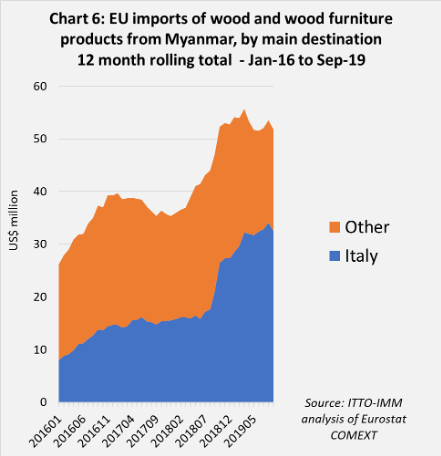

ITTO’s own analysis of trade flow data confirms that there have been significant changes in the direction of trade, but no sign of decline in overall imports from Myanmar. EU imports of wood products from Myanmar were valued in excess of US$50 million in the 12 months to September 2019, double that of 5 years before. During this period imports into Italy increased four-fold to over US$30 million (Chart 6).

During the same period direct imports from Myanmar into Germany, Netherlands, Belgium and Denmark fell to negligible levels. However, in addition to Italy, there was a significant increase in imports (from a very small base), into Greece, Croatia and Sweden. Imports into France remained low but consistent at around US$2 million per year (Chart 7).

The continuing reluctance of EU officials to accept that negligible risk of illegal harvest can be demonstrated in Myanmar comes despite additional information and wide-ranging discussion of EU due diligence requirements at a national FLEGT multi-stakeholder dialogue held in Nay Pyi Thaw, Myanmar, in November.

According to a report on the dialogue in the minutes of the EU Expert Group meeting in December, “this multi-stakeholder group (MSG) was set up in the course of the pre-preparatory process towards a VPA in Myanmar”, although “already last year it was made clear that the [VPA] process was halted”.

The MSG, which operates at national level with associated regional groups, includes representatives of government (including State-owned Myanmar Timber Enterprise, MTE), private sector and civil society organisations (CSOs). The dialogue meeting in November involved about 150 people. The dialogue was funded and facilitated by the EU FLEGT facility and the FAO-EU FLEGT Programme.

The EU Expert Group minutes go on to note that “although the VPA process is stopped, having the MSG as an interlocutor is very helpful in the strife for improved forest governance and law enforcement in Myanmar”.

The EU Expert Group minutes state that “Myanmar applied for funding from the FAO-EU FLEGT Programme for further multi-stakeholder meetings to prepare a work programme for activities that could be funded by the Programme from 2020-2021 and build capacity to submit quality project proposals”.

“The intention is to ensure ownership of the process [in Myanmar] of all stakeholders and at the same time avoid the pursuit of (often costly) activities promoted by some stakeholders predominantly interested in trade, which, in the end, do not constitute adequate measures to ensure good forest governance and legal timber harvest”, according to the EU Expert Group minutes.

The EU Expert Group meeting minutes conclude that “dialogue with Myanmar has clarified what issues must be addressed in order to outline a way forward towards good forest governance and legal timber harvest, which would provide sufficient transparency to enable operators to carry our due diligence correctly and adequately mitigate to a negligible level the risk of illegal harvested timber being placed on the internal market. It also showed avenues for working together with MM in this context, without giving false expectations”.

The EU Expert Group also “took note of the fact that the Annual Allowable Cut (AAC) for the 2019/2020 season was made available online in November”.

However, the EU Expert Group also note that “other applicable legislation is not fully accessible for EU operators within the meaning of Article 6 (1)(a) of the EUTR, enabling operators to fully comply with Article 5 of Implementing Regulation (EU) No 607/2012, e.g. because it is declared internal or it only exists in Burmese. Full risk assessment and choosing and applying adequate mitigation measures to address each of these risks is therefore not possible”.

EU invites feedback on EUTR and FLEGT Regulations

The EU Commission is calling for public feedback on the functioning of the FLEGT Regulation and EUTR, the two key legal instruments of the FLEGT Action Plan. According to the EU Commission, this “fitness check” will consider “the effectiveness, efficiency, coherence, relevance and EU added value of both regulations [and] will help assess whether the instruments are fit for purpose or need to be revised”.

Findings of the fitness check will also be considered in the assessment of demand-side measures for other commodities associated with deforestation. Commitments to this effect are embedded in a “Communication on Stepping up EU Action to Protect and Restore the World’s Forests”, which the Commission adopted in July 2019.

Comments on the EUTR and FLEGT Regulations can be submitted until 28 February 2020 at the following link:

https://ec.europa.eu/info/law/better-regulation/initiatives/ares-2020-581028-0_en

New VPA partner profiles on IMM website

The FLEGT IMM website now features detailed profiles of all VPA partner countries that have either reached the FLEGT Licensing stage (Indonesia) or are implementing a VPA (Cameroon, Central African Republic, Ghana, Guyana, Honduras, Liberia, Republic of Congo, and Viet Nam).

The profiles include overviews of countries’ forestry sectors, timber industry and trends in global trade in timber and timber products as well as more detailed analysis of trade with the European Union. The profiles also contain a summary of each country’s progress in VPA implementation.

More country reports of currently still negotiating countries will be added as soon as the VPA with the EU is signed and work to implement a FLEGT Licensing system is underway.

More details at: https://www.flegtimm.eu/index.php/vpa-countries

UK plans to spearhead crackdown on illegal timber

According to an article in the Guardian newspaper, the UK wants to spearhead “a major global crackdown on illegal timber and deforestation” by forming a coalition of developing countries against the trade as part of its hosting of UN climate talks in Glasgow in November this year.

According to the article “all countries are expected to come forward with tougher plans to reduce global emissions as part of COP 26, and experts have said this will only happen if the UK takes the lead in forming a coalition of small and big developing countries, including forested African nations and Indonesia, as well as major economies such as the US, China, India and the EU”.

The new project, still in the planning stages, will build on the UK government’s forests governance, markets and climate programme, the focus of which includes strengthening the rule of law in affected countries in the developing world, influencing international partners to increase their efforts, supporting responsible trade and helping stakeholders on the ground to act.

The article notes “in 2005, only about a fifth of Indonesia’s timber trade was legal. But today, after interventions by the UK and other partners, 100% of exports are sourced from independently audited factories and forests”.

More details: https://www.theguardian.com/environment/2020/feb/13/uk-lead-global-fight-illegal-logging-deforestation-cop-26

France requires public buildings to be at least 50% wood

According to the Times of London, President Macron has ordered that new public buildings financed by the French state must contain 50% wood or other organic material by 2022 under an ambitious government plan for a greener urban life.

The government announcement, made on 5 February, is part of a drive for sustainability by Mr Macron, who wants France to set an example in the face of climate change.

Julien Denormandie the minister for cities and housing, said the plan would promote low-carbon towns “that are capable of adapting to heatwaves and floods. To show an example by the state, I am imposing on all the public entities that depend on me and which manage development. . . to construct buildings with material that is at least 50 per cent wood or from bio-sourced material.”

According to the Times, bio-sourced material can include a vegetable component such as hemp or straw.

Building works covered by the new 50% rule include urban development projects co-financed by the state and local government in Paris and 13 other cities. According to the Times, in two decades some €9 billion has been spent on these projects, which mix housing and business premises.

The Times also reports that Paris has promised to include a high level of wood in all new construction for its 2024 Olympic games. Olympic buildings of up to eight storeys must be 100% wood and if higher contain some wood in their structure.

Elsewhere in France, according to the Times, work has begun on a 16-storey 181ft all-wood building with 98 apartments in Bordeaux, which will be France’s tallest wooden construction.

EU Commission urges Romania to stop illegal logging

The European Commission issued a letter of formal notice to Romania on 12 February giving it one month to take the necessary measures to address shortcomings in forest governance identified by the Commission.

The Commission is urging Romania to properly implement the EU Timber Regulation (EUTR), which prevents timber companies from producing and placing on the EU market products made from illegally harvested logs. In the case of Romania, the national authorities have been unable to effectively check the operators and apply appropriate sanctions.

Inconsistences in the national legislation do not allow Romanian authorities to check large amounts of illegally harvested timber. In addition, the Commission has found that the Romanian authorities manage forests, including by authorising logging, without evaluating beforehand the impacts on protected habitats as required under the Habitats Directive and Strategic Environmental Assessment Directives.

Furthermore, there are shortcomings in the access of the public to environmental information in the forest management plans. The Commission also found that protected forest habitats have been lost within protected Natura 2000 sites in breach of the Habitats and Birds Directives.

FAO statistics show that Romania is the EU’s second largest producer of hardwood sawlogs, after France, producing around 4.3 million m3 in 2018. It is also the EU’s largest single producer of sawn hardwood, with production of 1.6 million m3 in 2018. Much of this volume is exported, mainly to China, North Africa and the Middle East, although exports declined last year in response to cooling global demand.

At the International Hardwood Conference in Berlin in November last year, the European Sawmillers Association EOS reported that prices for Romanian sawn hardwood were falling and warehouse stocks were rising. Efforts were being made to curtail Romanian sawn hardwood production which EOS expected to be down up to 15% overall in 2019. EOS noted that the whole wood sector in Romania is suffering from lack of access to finance and low levels of investment.

The EU’s formal letter implies that widespread illegal logging is another factor contributing to unstable market conditions in the country.

PDF of this article:

Copyright ITTO 2020 – All rights reserved