Headline figures for sawn hardwood consumption in Europe show that demand has been flat for the last decade. However, these figures obscure major underlying changes in the European market.

This was clear from presentations and discussion during the International Hardwood Conference (IHC) in Berlin during November, an event co-organised by the European Organisation of Sawmill Industries (EOS), the European Timber Trade Federation (ETTF) and German Sawmill and Wood Industries Association (DeSH).

There was a widespread view that new opportunities are emerging, particularly driven by strong political and emerging consumer interest in carbon mitigation and other environmental concerns. However, it also became apparent that other factors are undermining the ability of the hardwood sector to respond to these opportunities.

The European hardwood market has become too narrowly focused on a single species, oak, and there has been insufficient focus on driving demand for and adding value to lower grades of hardwood lumber.

Lack of investment in hardwood market development in Europe has contributed to a large proportion of logs being exported, particularly to China, a market which has lately become very volatile.

Supply side problems are also arising as drought and pest infestations in Europe have led to large volumes of low-quality hardwood being placed on the market contributing to falling prices for low grade lumber and by-products such as chips, sawdust and bark.

There is also uncertainty over long term supply security. Lack of consistent and harmonised inventory data across Europe, combined with resource changes due to climate change, have made projections of future supplies less reliable.

In retrospect too, the almost exclusive focus on certification in environmental communication may have been a distraction from pressing environmental imperatives in the hardwood sector that are not addressed in existing certification frameworks.

These imperatives include the need to:

- ensure that consumers buy the full range of hardwood species and grades that the forest can produce sustainably;

- promote efficient processing and use to minimise waste and maximise yield and value;

- provide transparent data on the likely long-term availability of different hardwood species;

- respond effectively to changes in the resource due to climate and other environmental impacts and past management decisions (and failures);

- remove illegal wood from hardwood supply chains while promoting market access for legal operators (both large and small); and

- better demonstrate and exploit the carbon mitigation potential of hardwood products.

Eastward shift in European hardwood consumption

According to data presented to IHC by Rupert Oliver, Trade Analyst to the FLEGT IMM, the ITTO project supported by the EU, EU-wide sawn hardwood consumption was around 9.98 million m3 in 2018, 3% more than in 2017. EU sawn hardwood consumption was projected to have fallen back again to around the 2017 level in 2019.

Despite these minor ups and downs, overall sawn hardwood consumption in the EU in the 2017-2019 period remained firmly within the narrow band of 9.5 to 10.5 million m3 per year prevailing since 2009 and well down on figures closer to 15.0 million m3 typical before the financial crises.

Underlying these recent trends, said Mr Oliver, was reasonably robust, if unexciting, growth in EU GDP and construction in 2017-2018 and the first half of 2019. However, economic uncertainty contributed to slowing sawn hardwood trade in the second half of 2019.

Mr Oliver noted that the latest data from the joinery sector shows that wood generally was holding its own against other materials in doors and window manufacturing, although much of this benefit may have accrued to softwoods rather than hardwoods.

Mr Oliver said that EU wood furniture manufacturers are continuing to maintain their dominance of domestic markets and holding their own against imports. While there is some weakness in EU wood furniture production in western Europe, this is offset by a rise in Eastern Europe.

Mr Oliver’s data showed that per capita sawn hardwood consumption in western European countries remains low, typically less than 20 litres per year, and the trend is either flat or sliding downwards.

In contrast, per capita sawn hardwood consumption is generally rising in eastern Europe and already exceeds 100 litres per year in the Baltic States and is approaching 60 litres per year in Romania.

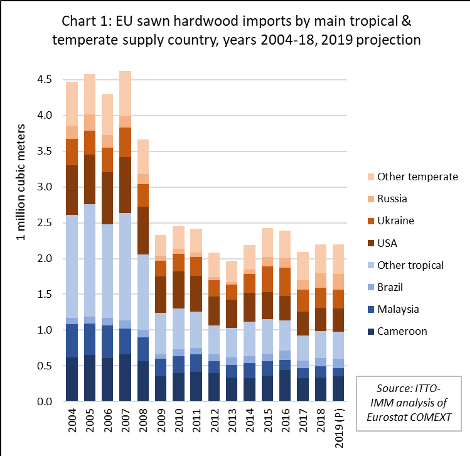

Mr Oliver estimated that EU imports of sawn hardwood from outside the region were around 2.2 million cubic meters in 2019, very similar to the level in 2018, maintaining the gains made compared to 2017, but still down on imports of 2.4 million m3 in 2015 and 2016, and only half of the level of before the financial crises (Chart 1).

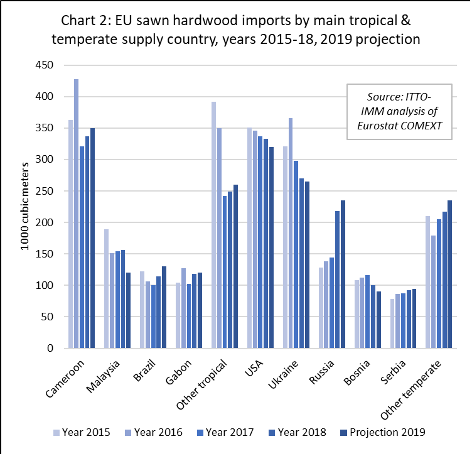

Mr Oliver noted that eastward shift in manufacturing in Europe has been linked to a partial shift towards East European and CIS hardwood suppliers in recent years, with most growth in EU sawn hardwood imports coming from Ukraine and Bosnia in 2016 and 2017, and Russia and Serbia in 2018 and 2019.

According to Mr Oliver, total imports of tropical sawnwood are projected to be 980,000 m3 in 2019, marginally down from 993,000 m3 in 2018. Imports from Cameroon and Brazil recovered some ground in 2019, helping to offset a significant fall in imports from Malaysia (Chart 2).

Expanding scope of TLAS and due diligence regulations in tropical trade

Mr Oliver also commented on the evolving situation in relation to legality verification, due diligence regulations and certification in the international tropical hardwood trade. He highlighted the considerable scope of efforts to develop Timber Legality Assurance Systems (TLAS) in tropical countries, a process encouraged by the EU’s FLEGT Action Plan.

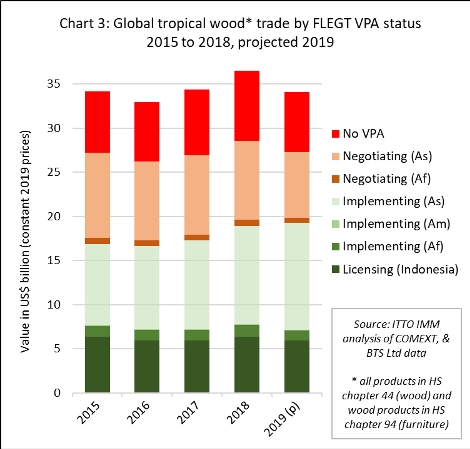

According to Mr Oliver, tropical countries that are either already issuing FLEGT licences or in the process of implementing a FLEGT licensing system accounted for 57% of global the value of trade in tropical wood and wood furniture products in 2019, up from 52% in 2018 (Chart 3).

The rising share of FLEGT partner countries in tropical trade last year was driven mainly by a sharp rise in exports by Vietnam, a country which has set an initial objective of establishing a FLEGT licensing system by the end of 2020 (although this plan is acknowledged to be ambitious and time scales and activities are likely to be adjusted with experience).

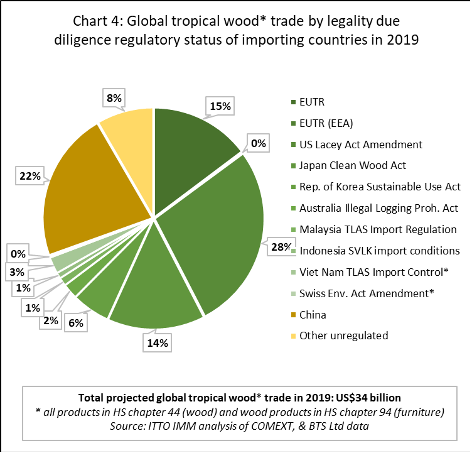

The work by tropical countries to implement TLAS is mirrored by the wide range of countries that have introduced regulatory measures requiring legality due diligence for timber products in trade. According to Mr Oliver, in 2019 around 70% of the total global value of tropical wood and wood furniture trade is imported by countries implementing such legislation, including the US (28%), EU (15%), Japan (14%), South Korea (6%), and Vietnam (3%) (Chart 4).

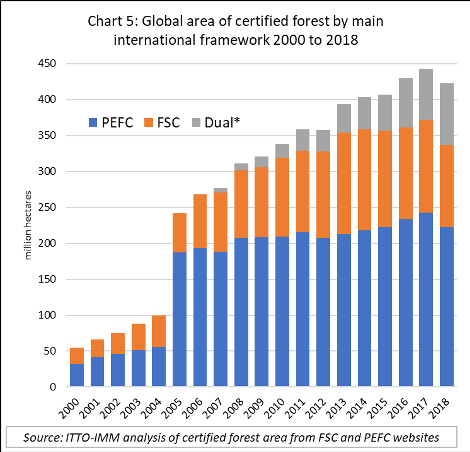

Mr Oliver said the widespread evolution of TLAS in tropical timber supplying countries contrasts with the implementation of forest certification. Analysis of data from FSC and PEFC suggests that the total area of forest certified by these schemes worldwide actually declined for the first time in 2018.

Although FSC and PEFC both reported either stable, or a slight increase in their own certified forest area during the year, this was only because of a rise in the area dual certified to both schemes (Chart 5).

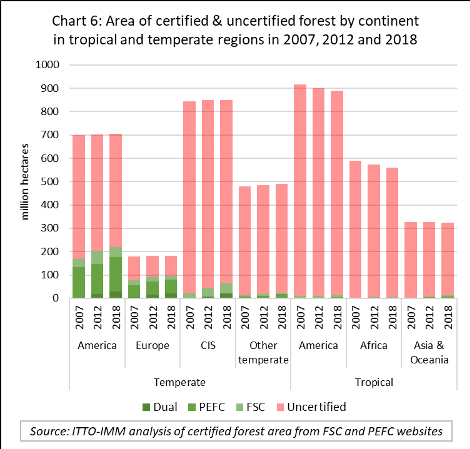

According to Mr Oliver, closer analysis of the data reveals that most new certificates issued in recent years have been for large state-owned and industry managed lands in temperate and boreal regions, particularly in Russia. Tropical countries and small non-industrial operators remain seriously under-represented amongst certified forest areas (Chart 6).

Certification necessary to overcome market prejudices: a widespread view

While tropical countries are making headway to implement TLAS systems, tropical wood promotion activities in the EU is remains heavily oriented towards certified products. There is a strong view in parts of the EU timber trade and industry that the market is so prejudiced against tropical timber that nothing short of assurance of full conformance to FSC and/or PEFC certification will overcome this bias (and even this may not be enough for some influential European specifiers and buyers).

Although not said explicitly, this was an underlying narrative behind the presentation to IHC by Mr Benoît Jobbé-Duval, Managing Director of the International Tropical Timber Technical Association (ATIBT).

Mr Jobbé-Duval provided an update on two years of progress to implement the Fair & Precious (F&P) “verified sustainable” tropical timber branding campaign in Europe. This campaign, which ATIBT is implementing in cooperation with various agencies including STTC, FAO, European timber associations (including the European TTF and national associations in Belgium, France, Germany, UK, Fedustria), promotes FSC and PEFC certified tropical timber.

The key message of the campaign, and the 10 commitments made by organisations adopting the brand, is that FSC and PEFC certified forest operations directly contribute to the delivery of the UN Sustainable Development Goals in tropical countries.

Mr Jobbé-Duval noted that three separate F&P communication campaigns have been launched targeting 15,000 architects, specifiers, and potential buyers of tropical timber, covering France, UK, Germany, Italy, Spain and the Netherlands. Seventy-seven press articles have been published so far reaching a total audience of 1.2 million.

A new F&P website (https://www.fair-and-precious.org) was launched in October 2019, and a series of press trips are planned in certified forest concessions. Social media campaigns are underway through Instagram and Linked In. Seventeen organisations are now F&P partners and the number is gradually rising.

In France, said Mr Jobbé-Duval, a successful partnership has been formed between F&P and the national railway operator SNCF that now acknowledges the environmental benefits of certified tropical timber and actively promotes its wider use in the French rail sector.

ATIBT has also contributed to efforts, alongside STTC, and the Danish offices of various organisations including WWF and FSC, to rectify an effective ban on all tropical timber in products certified by Nordic Swan, the official ecolabel of the Nordic countries. The label can be voluntarily applied to products in 60 categories groups, the most relevant for tropical timber being furniture, outdoor furniture and playground fittings, construction and façade panels, and windows and exterior doors.

Mr Jobbé-Duval said that besides insisting that all timber products bearing the Ecolabel were 70% FSC or PEFC certified, with the remainder FSC controlled wood or from PEFC controlled sources, Nordic Swan has drawn up an 82-strong list of species, dominated by tropical wood, that it would not cover irrespective of whether or not certified.

As well as many lesser-known species, these included many commercial species widely available and sold in Scandinavia and the rest of Europe. Among them are ipé, doussie, jatoba, movingui and okoumé.

Qualifications for being put on the prohibited list were CITES listing, and inclusion on the IUCN red list (categorized as critically endangered (CR)), endangered (EN), vulnerable (VU) and relevant species as Near Threatened (NT).

The decision to ban all these species from use in labelled products takes no account of the fact that species listed in CITES Appendices are not prohibited from exploitation and sustainable use is often the best form of protection.

Mr Benoît Jobbé-Duval reported that a decision on this policy is still pending by Nordic Swan (the “Forestry Requirements” for the label reported on the Nordic Swan website in mid-January 2020 continue to include over 80 species of mainly tropical timber prohibited from use in labelled products).

Deteriorating market and supply challenges for European hardwood

The market situation for German hardwoods was described at IHC by Steffen Rathke, Vice President of DeSH who said that both domestic and export market demand deteriorated in the second half of 2019, partly a response to responding to mounting economic uncertainty in Europe and China, the main export market.

Mr Rathke also highlighted that raw material availability is becoming more challenging in the hardwood sector with pests and drought having an increasing impact. Mills are having to cut back on production of beech because of severe damage to logs during lengthy periods of drought in recent years. Although the freshly harvested beech logs often appear unblemished on the outside, the timber contains a lot of defect and the yield of higher-grade lumber is negligible.

Referring to a previous period when the export market for European beech logs was severely undermined by shipment of a lot of low quality (in this instance storm-thrown) beech, Mr Rathke said that “it is has taken 15 years to get the beech market back in China, but now again we are seeing more of these lower quality being sent to China and we could lose this market again”.

Mr Rathke also expressed concern about the possibility of a similar fate for oak with a rising incidence of worm holes, which cannot be detected when logs are inspected in the forest, also caused by drier conditions. “Our trees are under stress”, concluded Mr Rathke, “the industry needs to do more to help forest owners, to bring out the dead wood out, to replant and reestablish the forest resource”.

A similar narrative emerged from a review of the wider market for European hardwoods delivered to IHC by Maria Kiefer-Polz, EOS Vice President for Hardwood. She emphasised the rising impact of drought, pest and disease increasing hardwood forest mortality and leading to rising proportion of logs of lower grade being placed on market and contributing in turn to a significant fall in prices for chips, sawdust and bark, undermining the profitability of hardwood sawmills.

There has also been a decrease in demand and prices for packaging wood in parts of Europe due to a large increase in low grade softwood on the market following a major bark beetle infestation.

Ms. Kiefer-Polz said that the pressure on supply of European oak eased during 2019 in response to cooling demand both in Asia and Europe. Although prices for higher grades of European oak logs had remained reasonably stable, prices for lower quality oak logs were down around 15% during the year. Longer term supply problems are expected with rising oak mortality in the face of drought.

European beech prices were also easing in 2019, with log prices down around 15% due to lower log exports, particularly to China. Demand for beech sawnwood is also slowing in China. French beech sawmills are suffering from falling prices in the context of rising raw material availability and declining export demand. Drought has meant there are now 700,000 m3 of dead beech trees in Eastern France.

European ash log prices have remained high, benefitting for some extent from this species popularity as a cheaper alternative to oak. There has been particularly strong demand for French ash logs in Viet Nam. However, ash dieback is now hitting the European ash resource hard and led to a rise in production which is expected to be short-lived.

In Romania, according to Ms. Kiefer-Polz, there has been falling export demand in China, North Africa and the Middle East, traditionally the major markets for Romanian sawn hardwood. Romania’s domestic furniture industry is also declining and consuming less hardwood, while Romania’s imports of furniture are rising.

Prices for Romanian sawn hardwood are falling and warehouse stocks were rising in the second half of 2019. Romanian sawn hardwood production is being curtailed and is expected to be down up to 15% overall in 2019. The whole wood sector in Romania is suffering from lack of access to finance and low levels of investment.

The market situation of European hardwoods is made more challenging by lack of reliable data on the resource and understanding of the changing resource dynamics as the climate changes. This issue was highlighted at IHC in a presentation by Gert-Jan Nabuurs, Professor at the Wageningen University and lead scientist for European forests.

Surprisingly, given the long tradition of systematic forest management in Europe and widespread perception of a stable well-managed resource, Professor Nabuurs commented that “We know very little about hardwood stocks, increment, and diameters [in Europe]. Data gathering needs to improve. EU member states are not sufficiently open with national forest inventory data and inventory methodologies are inconsistent between countries”.

This in turn had contributed to a situation where “the hardwood processing sector is not ready for the challenges coming at us; climate change, matching regional demand-supply, and fragmented ownership. The hardwood sector needs much stronger collaboration between forest owners and industry and much greater investment in forest resources”.

On the changing composition of the European hardwood forest, Professor Nabuurs suggested that “there will be more beech, but even this species is suffering. We hardly know how fast the ash decline is taking place. Overall there are some indications that we are eating up quality [hardwood] stocks”.

US hardwood struggles in face of China trade dispute

The US hardwood industry is also facing challenges, though for different reasons, according to American Hardwood Export Council (AHEC) Executive Director Mike Snow. From 2009 to 2017, US hardwood exports to China had ‘exploded’. By 2018, one out of every four boards of graded hardwood lumber produced in the United States was destined for China.

However, this left the sector especially vulnerable to the on-going US-China trade dispute. In fact, since the dispute started, American hardwood sales lost in China have exceeded total US hardwood exports to Europe and the rest of Asia put together.

In the first eleven months of 2019, US sawn hardwood exports to China were down 40%, with red oak and ash each falling 38%, and white oak down 45%. China is not a market that can be easily replaced. The loss of export sales has been “absolutely devastating for the industry” said Mr Snow.

Mr Snow noted that US hardwood exports were hit particularly hard by China’s immediate reaction to the trade dispute. “At the same time as imposing a 10% tariff on US imports, China allowed the RMB to devalue, effectively increasing their cost still further,” said Mr Snow.

While the only real solution, said Mr Snow, was resolution of the trade dispute, he added that the US hardwood industry needs also to invest more in domestic market promotion. US domestic consumption of hardwood is driven by industrial applications, such as packaging and pallets, rig mats used in the oil and gas industry, and railroad ties, which collectively account for almost 60% of volume. Although volumes are large in these sectors, profitability is low.

Despite the current challenges for US hardwood in China, caused by the trade dispute, and signs that the wider Chinese economy is slowing, Mr Snow suggested that this country still offered significant opportunities for the hardwood sector.

“China still has major hardwood growth potential, with development of its western provinces and huge investment in its belt and road programme, in particular, set to increase its consumption still further,” he said. “But at the same time, there’s realisation in the US hardwood sector that it must diversify exports – and grow its domestic market. It can’t afford to put all its eggs in the China basket.”

Major focus on American red oak promotion in Europe

David Venables, AHEC Europe Director, highlighted that the sharp downturn in US exports of hardwoods to China has important implications for the market development of American hardwoods in Europe. Specifically, it has greatly increased availability of red oak, a species which is largest single component of the US hardwood forest and which previously dominated exports to China.

American exporters now need a new outlet for red oak which traditionally has not been favoured in Europe. Europeans have always tended to favour white oak which closely matches the European oak familiar to European manufacturers.

Mr Venables observed that in recent years there has been strong demand for European and American white oak while supplies have come under pressure, pushing prices higher. The market has been looking for more options, initially turning to ash as the grain and colour is similar and availability has been high in the short term, due to dieback in Europe and the Emerald Ash Borer outbreak in America.

Red oak provides another option, particularly as prices are currently much lower than for white oak. However, Mr Venables noted that amongst European importers and manufacturers there has been a negative attitude to red oak with questions raised over its colour, performance and durability.

Mr Venables said that this view stems largely from lack of knowledge, experience and familiarity with red oak in Europe. However, AHEC has found, through regular contacts with the European design community, that they are often very responsive to red oak’s appearance. Those manufacturers that can be persuaded to use red oak have come quickly to appreciate its strong technical characteristics.

AHEC’s strategy for red oak aims to supplement, but not replace, the existing demand for white oak in Europe. The main target group is designers, building on their evident interest in the wood, but also involves efforts to educate and inform European manufacturers and importers of the opportunity offered from increased sales and use of red oak.

Testing has also been undertaken to better assess and document the technical performance of red oak, to demonstrate that it is at least as good as other oaks, and to highlight it’s versality, especially on finishes. There is also a major focus on red oak’s vast resource base, consistent supply, and sustainability.

Mr Venables said that throughout 1919 and 2020 AHEC is engaged in multiple red oak design and building projects across Europe to generate a constant flow of publicity. These are being linked with targeted online and social media campaigns.

Meanwhile, AHEC continues to development work on new hardwood applications in Europe. AHEC has worked with specifiers and designers on hardwood projects, including the world’s first cross laminated hardwood building, a cancer care centre near Manchester in the UK built with a core structure of American tulipwood CLT and clad with thermo-treated tulipwood.

Mr Venables also described the range of tools AHEC has developed to demonstrate and promote US hardwoods’ environmental credentials. These include an interactive map showing forest growth and timber harvest, a life cycle analysis (LCA) tool for US hardwood species and the American Hardwood Environmental Profile (AHEP), which details the carbon and wider environmental impacts of hardwood consignments shipped anywhere in the world.

In all these tools, emphasis is placed on providing easy access to data individually tailored for all commercially available American hardwood species. According to Mr Venables, this helps “avoid too much focus on just a narrow range of hardwood types. Our resource cannot be sustainably managed unless we encourage use of the whole portfolio of species”.

Mr Venables emphasised that “in the hardwood sector, we have one of the world’s the most sustainable materials, a fact not yet widely recognised. We need to broaden the discussion away from just certification and to innovate in our communication. For technical reasons, we can’t offer certified volume, so instead we have developed an interactive map, making US forest inventory data accessible to end users and specifiers”.

He went on, “we have also reviewed and updated the Seneca Creek study, first commissioned by AHEC in 2008, which demonstrates that American hardwood forests are sustainably managed and that there is a negligible risk, certainly much less than 1%, of any illegal wood entering the US hardwood supply chain. Through our LCA work, we prove to specifiers and our customers that we are supplying not only a technically superior material, but also a carbon store”.

PDF of this article:

Copyright ITTO 2020 – All rights reserved