The European market for tropical hardwood lumber is quiet but relatively stable. Uncertainty about future demand has meant that speculative purchasing is being kept to a minimum. Overall European stocks of lumber of the most popular species such as meranti, bankirai, sapele, sipo, and wawa remain at historically low levels. However with slow consumption this has not led to reports of significant supply problems. Orders are being placed to replace stocks as and when gaps open up.

Long lead times for African species remains a problem in the European market. Turnaround times for forward orders are currently running at around three months for sapele and significantly longer for other species. As a result there is heavy reliance on cross trading with other importers for many species. Meranti sawn lumber, which despite log procurement problems in Malaysia is still more readily available at shorter notice, also gains a marketing edge.

The supply situation in Ivory Coast still remains difficult with the result that availability of framire/idigbo and iroko is restricted. Gabon’s log export ban which has yet to be offset by sufficient development of domestic sawing capacity, has also resulted in limited supplies of a wide range of more specialist species such as afzelia/doussie, izombe, kevazingo/bubinga, and movingui.

Availability of Indonesian bangkirai decking profiles has improved slightly since earlier in the year. However the existing landed stocks of bangkirai decking are generally regarded as sufficient to meet relatively subdued demand in the European market this year. This combined with high prices is deterring any significant upturn in new orders for bangkirai by European importers.

With only a few exceptions, prices on offer to European buyers for the leading commercial species – sapele, sipo, iroko,framire, and meranti – have remained relatively stable in recent weeks. The most notable exception is bangkirai decking, prices for which have continued to escalate to levels that importers say cannot be achieved in Europe under current market conditions. There are also reports of firming prices in the European market for more specialist species formerly cut from logs imported from Gabon.

High levels of uncertainty over future consumption and exchange rates

A key factor discouraging speculative timber purchasing by European importers is the high level of uncertainty over future consumption levels and exchange rates trends. Having started the year at around €1.28/USD, the euro strengthened considerably to reach €1.48/USD in early May. Since then the euro has lost only some of this strength, falling to €1.38/USD by 10 July.

The strength of the euro has been maintained over recent months by relatively high interest rates set by the European Central Bank (ECB), by solid economic performance in parts of north central Europe, particularly Germany, and by Chinese investors’ efforts to diversify out of dollars in favour of euro assets.

However, concerns continue to mount over contagion from the sovereign debt crises in Greece. Furthermore, in the last few days ECB President Jean-Claude Trichet observed that economic activity in the Eurozone appears to be slowing. Trichet’s statement is backed by disappointing Italian Industrial Production numbers as well as German Trade Figures which show that Europe’s largest economy is becoming increasingly dependent on imports of finished goods. These factors have encouraged some analysts to predict more substantial weakening of the euro against the dollar and other international currencies over coming weeks.

From the perspective of the European hardwood industry, weakening of the euro would have several benefits. It would help boost competitiveness of Europe’s furniture manufacturers which have been struggling against the pressure of cheaper imports. And while it would increase import prices for raw material, it would also lead to appreciation in the value of importers existing landed stocks. A weaker euro against the dollar also tends to improve the relative competitiveness of African sawn lumber (typically invoiced in euros) compared to South East Asian and Brazilian sawn lumber (typically invoiced in dollars).

ThermoWood sales rebound strongly in 2010

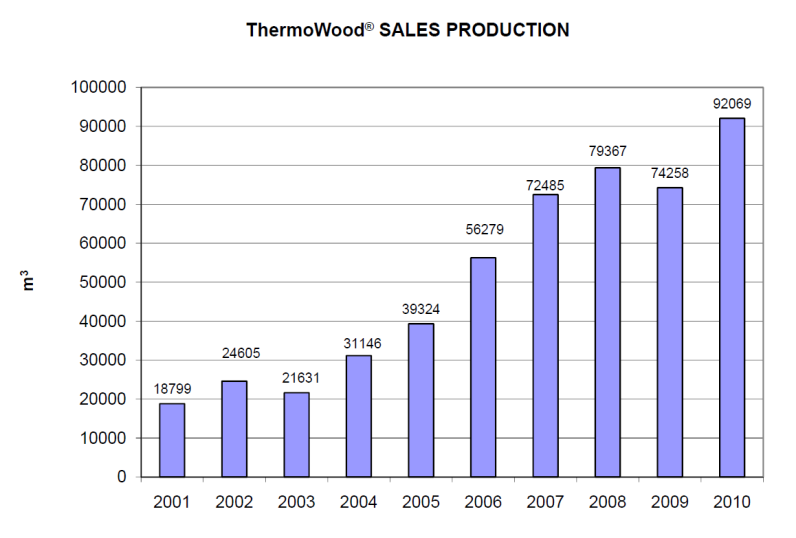

Production data published by the International ThermoWood Association (ITWA) based in Finland gives an insight into the recent development of Europe’s thermal treatment business. Members of the Association are those companies using the ThermoWood method developed in Finland and which have the legal right to use the word ThermoWood on-product and in their marketing material. The ThermoWood method greatly enhances the durability and stability of softwoods and temperate hardwoods so that they are capable of competing with tropical hardwoods in certain end-use sectors including decking, window frames, cladding and external doors. Of 13 ITWA members, 10 are based in Finland and one each in Sweden, Japan and Turkey.

According to ITWA, ThermoWood sales increased continually between 2003 and 2008 to reach 79,000 m3 in 2008 before the onset of recession led to a decline in sales to 74,000 m3 in 2009 (see chart). However sales rebounded strongly in 2010 to reach an all time high of 92,000 m3. Around 91% of ThermoWood production was based on pine and spruce in 2010, with birch, aspen and ash accounting for much of the rest. Last year, 87% of all Thermowood produced was sold inside the EU.

Membership of ITWA does not include companies using the expanding range of alternative heat and chemical treatments to ThermoWood. A recent analysis by the German trade journal EUWID identified a total of 30 companies across Europe operating various treatment plants of this type with capacity of around 300,000 m3. On this basis, members of the ITWA probably account for between 30 and 40% of total capacity across Europe. Other countries with significant capacity include Germany (about 13% of total European capacity), Netherlands (12%), and Estonia (8%). Other countries with treatment plants include France, Croatia, Austria, and Switzerland.

European countries to negotiate a legally binding forest agreement

European Ministers agreed to begin negotiations to establish a legally binding agreement (LBA) for sustainable management of Europe’s forests. The announcement came at the Ministerial Conference on the Protection of Forests in Europe (or Forest Europe) held in Oslo, Norway from 14-16 June 2011. The agreement would require all European countries to develop and ensure implementation of a national sustainable forest programme. This would integrate climate adaptation and mitigation strategies with broader sustainability goals such as biodiversity conservation and rural development. Ministers also agreed at the meeting to cut the rate of biodiversity loss within forest habitats by half, and to take steps to eliminate illegal logging.

According to the BBC, there was not universal support for adopting an LBA amongst European countries. Sweden’s Rural Affairs Minister Eskil Erlandsson told the conference that while he supported the concept of sustainable forest management, he favoured a voluntary approach rather than an LBA. “I do not believe in common legislation for forests across the pan-European region. Put simply, one size does not fit all,” he said. “We need to recognise the different geo-climatic and socio-economic conditions. Therefore, my conclusion is that the voluntary track is the best way of supporting the development and implementation of sustainable forest management.” However, he said he signed the declaration in order for negotiations to begin.

As background for the Forest Europe meeting, and to provide a starting point for negotiation of an LBA, the UN Economic Commission for Europe (UNECE), the UN Food and Agriculture Organization (FAO) and Forest Europe collaborated to produce “State of Europe’s Forests 2011: Status and Trends in Sustainable Forest Management in Europe”. The report is based on detailed information provided by countries.

The main findings of the report include that: forests cover one billion hectares in Europe, 80% of which are in the Russian Federation; European forests cover 45% of total land area, or 32% if Russia is excluded; European forests are expanding at a rate of 0.8 million hectares every year and remove the equivalent of about 10% of European greenhouse gas (GHG) emissions; there is a high degree of fragmentation with around 30 million private owners; most Europeans think that their forests are shrinking; the sector provides four million jobs and accounts for 1% of the region’s GDP; and most countries have explicit objectives on forest-related carbon.

Authors of the report developed a draft method to assess European forests’ sustainability, which while not yet peer-reviewed, identifies a number of threats and challenges, including: landscape fragmentation; a shrinking and aging workforce; negative net revenues of several forest enterprises; and mobilizing enough wood for energy while reconciling biodiversity values and the needs of the traditional wood sectors.

The report (45.2 MB) is available at: http://www.foresteurope.org/?module=Files;action=File.getFile;ID=1630

New guide to legal and sustainable forest and trade initiatives

A new guide to global initiatives designed to promote legal and sustainable timber production and trade has been published by Tropenbos International with support from the Ministry of Economic Affairs, Agriculture and Innovation of the Netherlands. The guide describes a total of 127 government, private-sector and NGO initiatives in an effort to enhance understanding and support the exchange of views and proposals on efforts to advance forest governance and encourage legal and sustainable forest industries and trade. The guide suggests that “the range of initiatives reflects the increasing commitment from a large variety of stakeholders who are willing to address illegality in the forest sector — substantial momentum has been created”.

While recognising the benefits from such a diversity of initiatives, the guide also points to the dangers: “the growing number… of initiatives….may make communication, cooperation and coordination challenging. Initiatives should avoid duplication and ensure consistency in issues such as transparency, inclusiveness, market pricing, equality, synergies and effectiveness, both in policy development and in implementation.” It also notes that there are gaps in the frameworks and that “still, some countries and regions either have limited or no initiatives”.

The guide recommends that “various areas should be further explored for their potential to expand the scope and effectiveness of efforts to halt illegal timber production and trade. Examples include timber procurement initiatives and codes of conduct by the public and private sector, incorporating effective forest governance, and promotion of legal and sustainable timber production and trade in bilateral cooperation initiatives”.

The guide is available at: http://illegal-logging.info/uploads/enhancingtradelegallytimberweb.pdf

PDF of this article:

Copyright ITTO 2020 – All rights reserved