CIF Europe prices for South East Asian and Chinese hardwood plywood increased dramatically in the second quarter of 2011 in response to tight supplies, rising production costs, currency movements and firm demand in Asia. Prices have continued to rise for July and August shipment. Prices for Malaysian BB/CC raw plywood on offer to European buyers now exceed Indo96+40% and those for equivalent Indonesian products may be over Indo96+50%, levels never seen before.

However underlying consumption of plywood in Europe is still subdued so that few importers are experiencing significant supply problems. In the UK, there are even reports of importers reducing prices of their landed stock for onward sale in an effort to generate cash before the summer holiday season. In this environment, most UK importers seem content to work from their existing stock holdings and few are showing much interest in paying the higher CIF prices.

The German journal EUWID reports a similar situation in mainland Europe noting that “rather subdued demand for plywood imported from South East Asia on the whole has so far staved off any major shortages in Europe.” On the other hand, the UK journal TTJ notes that mainland European importers are showing much greater willingness to pay the higher prices for Malaysian and Indonesian plywood because unlike their European counterparts they “are not prepared to go down the Chinese route”.

The extent to which the UK has switched more to Chinese plywood products is revealed in the import data for the first quarter of 2011. During that period, the UK imported 109,000 m3 of Chinese hardwood plywood compared to only 32,000 m3 in the same period of 2010. UK imports of hardwood plywood during the first quarter of 2011 from Malaysia stood at 25,000 m3, down from 43,000 m3 in the same period of 2010, while imports from Brazil were less than 5000 m3 compared to 10,000 m3 in the first quarter of 2010.

A different situation prevails in mainland Europe. EUWID reports that in recent months several importers in this region have tested Chinese birch plywood and Chinese mixed light hardwood plywood as possible substitutes for Indonesian and Malaysian plywood. However they decided against placing large orders on quality grounds. In mainland Europe, the most notable trend this year has been a revival in imports of Russian birch plywood as the supply situation has gradually improved after the dramatic fall in availability following the severe forest fires in Russia last summer.

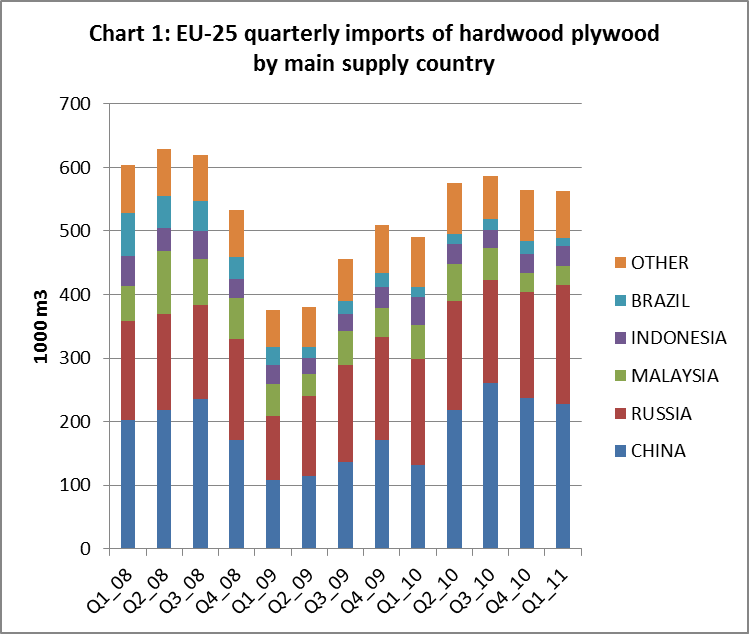

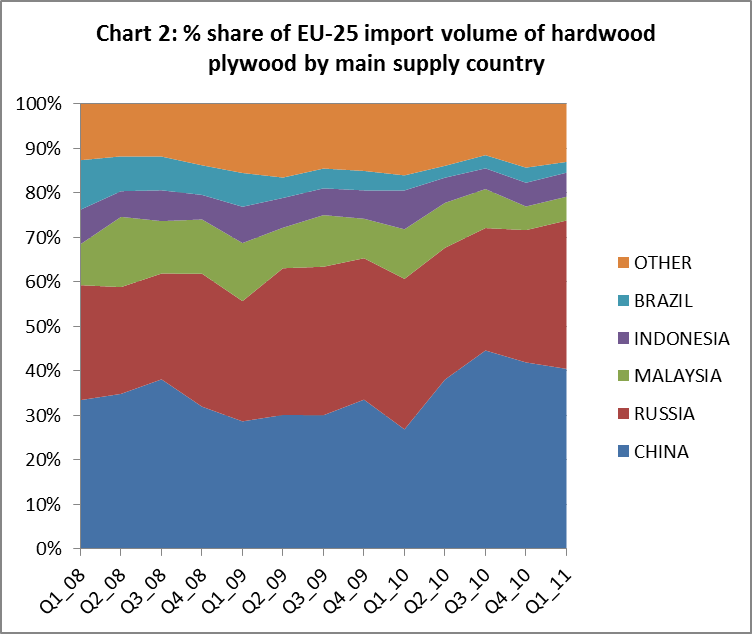

In total, the EU-25 group of countries imported 563,000m3 in the January to March period of 2011, 15% up on the same period in 2010 and almost exactly the same as the previous quarter (Chart 1). Chart 2 showing market share of countries supplying hardwood plywood into the EU-25 since the start of 2008 highlights that the major beneficiaries of recent trends have been China (mainly to the UK) and (mainly to mainland Europe). Together these two countries now account for 74% of all hardwood plywood imported into the EU compared to 60% at the start of 2008. Meanwhile, the main tropical suppliers of hardwood plywood – Malaysia, Indonesia, and Brazil – have seen their combined share of EU imports fall from 28% to 13%.

Note EU-25 includes all members of the EU with the exception of Romania and Bulgaria that acceded in January 2007

European construction sector rebounds weakly

Although the low point in European construction activity has passed, future growth will be hampered by the international debt crisis, rising inflation, government austerity measures and the progressive withdrawal of stimulus measures aimed to offset the worst effects of the downturn. This is the main conclusion of the 71st Euroconstruct Conference in Helsinki, Finland on 17th June, 2011.

Between 2007 and 2010, total construction activity fell continuously by a total of more than 15% to reach a level not seen since 1998. The downturn in annual figures is expected to end this year, but there is variance by country and region. This year construction sector growth will be highest in Poland and the Nordic countries, while France and Germany will also achieve reasonable growth. In Spain, Ireland and Portugal, construction is still declining rapidly. More moderate declines will be recorded in the UK and a few smaller Central and Eastern European countries.

Of all sectors, the largest fall from the industry’s peak year in 2007 has been in the construction of new residential buildings. While around 2.5 million new residential buildings were completed in 2007 in the Euroconstruct countries, less than 1.5 million will be completed this year. However, the numbers of houses built across the region is expected to sustain annual growth of slightly under 5% from this year forward.

While office construction weathered the financial crisis better than the housing sector, it still suffered a major downturn. The total value of construction in the office sector shrank by around 13% between 2007 and 2010, while new office construction fell by almost 20%. Office construction tends to lag behind economic trends and it is not predicted to grow until 2012. New office construction suffered more from the fall caused by the financial crisis than did renovation.

The heavy decline in new build and emphasis on improving energy efficiency of existing building stock in government stimulus measures has meant that renovation now dominates European construction activity. The value of building renovation in Europe is currently one and a half times that of new build.

Falling government spending from 2011 onwards will hit construction activity particularly hard in the infrastructure segment. Activity in this segment remained almost unchanged between 2008 and 2009, but suffered a 5% decline in 2010. Infrastructure activity is expected to continue to fall during 2011, particularly in Eastern Europe as EU funding and national investment funds are shrinking.

However, overall construction activity is projected to remain higher in eastern than in western Europe. Construction activity in western Europe is expected to grow by 1.5% per annum until 2020, a slightly slower pace than growth in GNP. Relatively higher rates of growth in Nordic countries will be offset by little or no growth in south west European countries. A large oversupply of housing and business premises combined with high levels of debt and government austerity are expected to lead to weakness in construction activity in south western Europe at least until 2020. During the same period, construction activity is expected to grow by 4.5% to 5% in central Eastern Europe where economies are closing the gap on their richer western European neighbours.

While overall European growth in construction will be subdued before 2020, underlying demographic and social factors give confidence of at least stable long-term demand, particularly in the renovation sector. These factors include: ageing building stock, the trend towards living alone which is increasing the numbers of households, rising urbanisation, and tightening energy efficiency requirements.

PDF of this article:

Copyright ITTO 2020 – All rights reserved