One prized commodity has been the object of log export protests on the Champs Élysées, a free trade legal challenge by the EU to the Ukraine and a packed recent European conference in London. That commodity is European oak.

The species must currently rank as one of the most sought after hardwoods. Alongside US white oak, it has become the European consumers’ timber of choice for furniture, flooring and joinery.

In fact, such is demand, one of the continent’s fastest growing retailers, solid oak furniture specialists, UK and now USA-based Oak Furniture Land, is predicting its sales will hit £1 billion in five years, up from £300 million in 2016.

Europe’s oak is also in strong demand elsewhere, principally in Asia and most notably China. Much of the material is still processed by Asian producers, particularly in Vietnam and China, and made into manufactured product for export to Europe, the US and elsewhere. But increasing volumes are used for goods destined for expanding domestic Asian consumption, led once more by the Chinese market.

China has been importing more European oak lumber, but its imports of logs have been growing faster, to the point it is seriously concerning the European processing sector, fearing for its raw material supply. The result has been calls for export controls, including in the sawmillers’ protests in Paris.

France is Europe’s biggest oak source and believes it has been most affected by the Asian log drain. Some say it even threatens to reduce the scale of French sawmilling, with the repercussions for downstream businesses and jobs that could have.

French mills acknowledged steps have been taken to alleviate the situation, including a government measure stipulating that 300,000 m3 of timber from state forests had to be further processed in the EU. Some companies were reported to be bypassing this by trucking logs to Belgium for simple squaring off for export to China and elsewhere, but the policy is thought to have had some impact.

New phytosanitary regulations, curbing timber treatment in situ in the forest and stipulating it is undertaken in notified premises, was also said to have put an added administrative brake on log exports.

At the same time the French have been actively marketing their oak lumber in Asia, with some success.

““We’re selling more sawn timber to China and at least 10 other Asian countries, with fastest growth now in Vietnam and India,” said Florence Perrucaud, export manager at sawmillers Ducerf.

Guillaume Maniere, export sales manager at Monniot reported a similar experience.

“Asian flooring and furniture producers are now our main industrial qualities customer and we’re supplying them beams for lamellas and cutting to their specified thicknesses.”

But despite rising lumber export demand and the log export restraints, French mills say the flow out of the country remains considerable and there is currently no reason to think it won’t rise further.

Adding to the pressure on European oak sawmill and timber using industries is the unprocessed timber export ban by Ukraine. This was imposed for a decade in 2015 on all timber except pine, then extended to the latter in 2017.

A European parliament study alleges the measure was introduced to support Ukrainian timber processing and manufacturing sectors and was thus contrary to trade agreements. So far, however, Ukraine has resisted EU demands to have the ban lifted.

EU countries hit hardest by the Ukrainian ban, says the European Organisation of Sawmill Industries (www.eos-oes.eu), are Romania, Slovakia, Poland and Austria, which between them in 2014 imported 1.4 million m3 of Ukrainian roundwood.

At the same time, the European industry has faced temporary oak log and green lumber transit and export controls in Croatia. These were introduced last summer, ostensibly to prevent the spread of oak lace beetle (corythucha arcuata).

Raw timber was estimated to have accounted for a third of Croatia’s total €1.09 billion wood exports in 2016 and the export ban is reported to have left sawmill customers in the rest of the EU, notably Italy, short of material. It is also said to be causing green timber bottlenecks as, despite increased investment in kilning, including from Italian sawmillers, the Croatian industry does not have enough drying capacity to handle previously exported material.

Increasing wider EU concern about Croatia’s move have been reports in its press that the ban will assist its domestic processing and manufacturing sectors by reducing competition for raw materials, implying this was part of the original motivation.

The result of this combination of factors has been oak price rises, especially for logs.

“While lumber has risen 20% in three years, log prices have increased by 40%,” said export sales manager Marie-Thérèse Carrey of French hardwood mill Eurochêne.

And the upward trend looks set to continue, according to one EU trader-importer. “We’re currently seeing European oak rising around 5% every six months, with 26mm-40mm dimensions under particular pressure” he said.

All these issues were addressed at the European Oak Conference, hosted in London by the UK Timber Trade Federation on 19 April, and a capacity audience of 110-plus delegates from the UK and the rest of Europe underlined the intense trade interest.

The opening address came from Silvia Melegari, Secretary General of the EOS, whose 35,000-sawmill membership in 13 countries represents 77% of all European sawn wood output. She underlined the seriousness of the raw materials situation facing EOS members, particularly due to Chinese demand.

Various ingredients had come together recently, she maintained, to heighten China’s appetite for roundwood hardwood of all types (with its imports jumping from 14.3 million tonnes in 2016 to 16.5 million tonnes in 2017), but particularly oak. Its domestic market for timber goods has been expanding rapidly. At the same time, it has further reduced its own natural forest harvest and cut VAT on log imports.

“We’ve seen overall European sawn oak exports to China rise 34% in the last seven years, but log exports have increased 244% in the same period,” said Ms Melegari. “And in 2010 63% of oak roundwood exported from EU countries was consumed in other EU countries. In 2017 50% was exported outside the EU, with 42% destined for China.”

She did not draw a direct connection with roundwood exports, but also stated that 30% of French, Belgian and German hardwood sawmills had closed in the last 10 years.

While the EOS acknowledges it is difficult to dissuade forest owners from selling logs to the highest bidder, it is actively lobbying national and EU governments to support the European hardwood sawmill sector. A group of MEPs had written a letter to European Commission President Jean-Claude Juncker on the topic and urged an EU action plan for the industry.

An appeal has also been made via the European Economic and Social Committee requesting measures “to ensure wood supply from the region’s forests is sufficient to satisfy local industry needs on a sustainable basis,”.

The EU, said Ms Melegari, was also continuing to pursue legal proceedings over its decade-long log export ban against Ukraine, where oak comprises 28% of the forest, second only to pine at 35%. Partly as a response to the measure it has now blocked payment of the €600 million final tranche of a package of ‘macro financial assistance’.

However, speaking at the European Oak Conference on behalf of the Ukrainian Association of Wood Processors, trade journalist Vasyl Masyuk said the export ban was unlikely to be dropped. It was popular in his country’s timber and timber using sectors and there were concerns that without it, Ukraine risked becoming primarily a raw materials supplier to the EU and Asia.

This echoed reported comments from Liudmyla Hurina of the same organisation. “Since the ban, Ukraine’s wood processing figures have grown by 15% and furniture companies’ by 12%, while the export of processed lumber has risen by 12%,” she said.

Other EU producers also gave their market perspective at the conference. Rafał Gruszczyński of the Polish Economic Chamber of Commerce said his country’s mills, previously key importers of Ukrainian oak logs, were hit by high raw material prices and shortages.

He added, however, that the complexity of Poland’s log auction system was likely a deterrent to export buyers, notably in China. Polish sawn oak exports last year were around 85,000m3, of which 29% each went to Slovakia and Austria, 18% to Germany and 1% to China.

Jean-François Guilbert, Managing Director of the French Timber promotional body, said 2017 French sawn oak output had been relatively strong at 615,000m3, with buoyant domestic demand from the railway, flooring, joinery, furniture and barrel industries.

However, according to Mr Guilbert, rising oak lumber prices were not offsetting more sharply increasing raw materials costs and oak log exports to China remained a worry. In 2007 they comprised just 7% of the French harvest, he said. Last year they hit 23%.

Some traders report a degree of European market migration to other hardwood species due to European oak price and supply pressure. These include European and American ash, and US white oak, although the latter is also characterised by growing global demand, including of course from China, and upward price pressure.

In what one trader described as ‘the oak obsessed European market’, the American Hardwood Export Council (AHEC) also sees opportunities for the US red variety of the species. This has not been anything like as popular with European specifiers as US white or European oak, but there’s belief current market pressures could change that.

EU hardwood log export hike continues

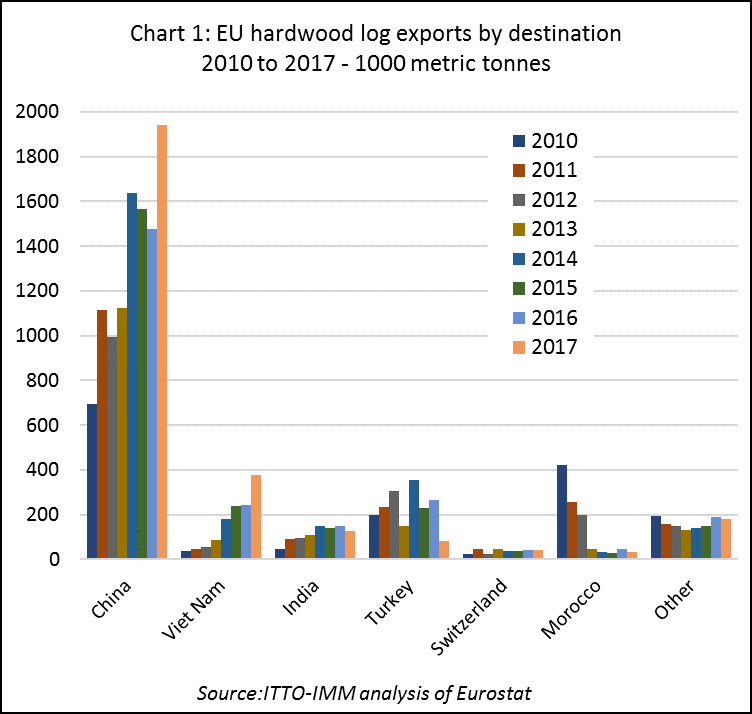

In 2017, total EU hardwood log exports were 2.8 million tonnes, up 15% on 2016 and 53% on 2012.

In 2004, the EU exported just 7000 tonnes of hardwood logs to Vietnam. By 2017 that figure had risen to 377,000 tonnes. The growth in imports continued to accelerate throughout the period, with the biggest jump of 577% coming in the five years from 2012.

While it may have outstripped it in terms of growth rate, however, Vietnam still has some way to go to catch up with China as the EU’s biggest hardwood log customer. Over the 13-year period to 2017, EU exports to China increased from 365,000 tonnes to 1.94 million, with growth in the last five years hitting 95%.

Last year for the first time India overtook Turkey to become the third largest EU hardwood log buyer, even though exports to India fell 37.5% from 2016 to 129,000 tonnes. (Chart 1).

In terms of species, beech was the EU’s biggest hardwood log export last year, with a total of 799,000 tonnes. But oak continued to catch up rapidly with log exports rising a further 46% to reach 728,000 tonnes.

The third biggest log export species was birch, although its 2017 total was down 20% at 500,000 tonnes.

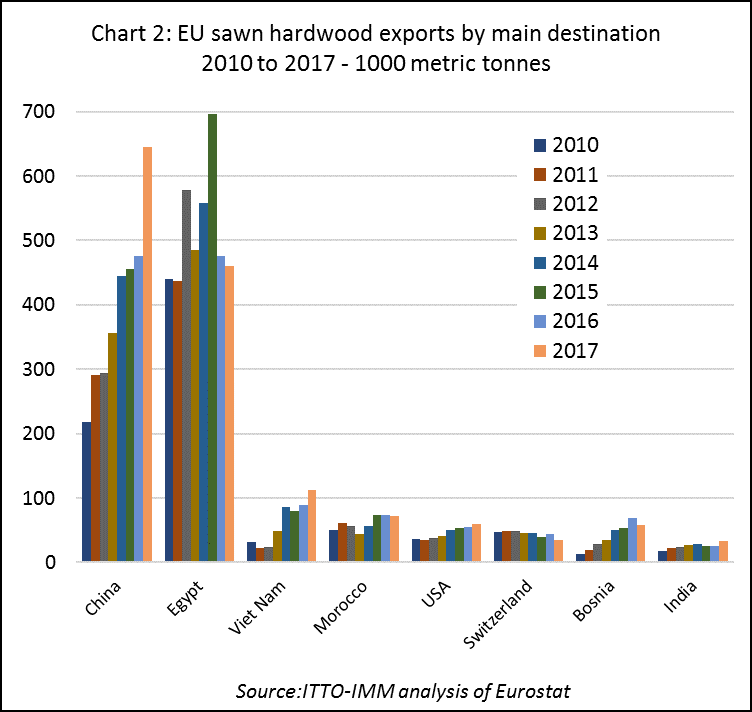

Total EU sawn hardwood exports were 1.9 million in 2017, a rise of 7.4% on 2016 and 31% on 2012.

China took top spot in terms of EU sawn hardwood exports in 2017, with its total rising 119% since 2012 and 35.4% last year to reach 645,000 tonnes.

Egypt remained the second biggest market for EU sawn hardwood outside the region, with a total of 460,000 tonnes, but Vietnam again saw fastest growth, with EU exports to the country rising 379% in the five years to 2017 to 113,000 tonnes. (Chart 2).

Beech remained by far the EU’s biggest sawn hardwood export, and the total grew another 12.7% to 1.36 million tonnes. Oak followed someway behind at 256,000 tonnes, but this represents 93.1% growth since 2012.

Ash was third biggest sawn export species in 2017, at 50,000 tonnes, and the EU’s fourth largest export category was sawn tropical hardwood. The latter grew 10% to 24,000 tonnes, but this was down 23.2% on five years ago. The EU’s exports of sawn tropical hardwood are mainly destined for neighbouring countries such as Switzerland, Norway and Bosnia, but smaller amounts go further afield, including to the USA, Japan, China and UAE.

ITTO-IMM and ATIBT to hold joint conference during Carrefour

The ITTO FLEGT Independent Market Monitor (ITTO) is to hold a second EU Trade Consultation jointly with an ATIBT conference on 31 May during the Carrefour du Bois trade show in Nantes, France. The event will take place at Exhibition Park la Beaujoire.

ATIBT will open the conference with a series of short presentations covering the organisation’s mission as well as some of its most recent activities, including the Lesser Known Species (LKTS) project and the Fair and Precious tropical timber promotion program.

IMM will then speak about FLEGT licensing and sustainable forest management in Indonesia, trends in EU tropical timber trade, results from IMM’s on-going EU furniture sector scoping study and FLEGT recognition in European public procurement.

The afternoon will be dedicated to workshops on the following topics:

- Purchase dynamics for companies sourcing from Indonesia, including knowledge about legality and sustainability standards

- FLEGT impacts on Central African producing countries

- Market trends for tropical timber in Europe

The event is free but pre-registration is required. Further details, including the agenda and registration form are available at:

PDF of this article:

Copyright ITTO 2020 – All rights reserved