European demand for hardwood plywood is very slow. The UK market is slightly more buoyant than elsewhere on the continent. Importers report that slow European consumption is matched by reduced availability in China due to labour and log supply shortages. Apparent supply shortages are partly the result of European buyers becoming more selective in their choice of plywood suppliers since enforcement of the EU Timber Regulation (EUTR) after March 2013.

FOB prices for Chinese hardwood plywood products on offer to European buyers have remained stable in recent months. Although exporters are keen to raise prices to cover rising costs, importers have been strongly resisting this tendency due to the low level of European consumption. Some European importers are already reducing prices below replacement cost in an effort to offload their existing landed stocks.

In addition to weak consumption, a recent sharp increase in freight rates is discouraging importers to place new orders for Chinese plywood. Rates on the Asia to Europe route were falling during the first six months of the year, declining to around $1000 per 40 foot container in June 2013. However rates have rebounded dramatically since then, to over $2500 per 40 foot container by mid-August. This has added around $35/m3 to the cost of shipping plywood from China into the EU.

The EUWID trade journal reports that German buyers are increasingly switching their standard grade of Chinese poplar plywood from 21mm to 20mm. In an increasingly cost conscious and highly competitive market, the 5% price advantage offered by the 20mm product has been sufficient to encourage the switch.

EUTR and CPR driving changes in EU plywood market

EUTR continues to drive changes in the market for Chinese plywood products. European buyers are focusing on a smaller number of exporters considered better able to provide the legality assurances required. European companies are preferring suppliers with which they have long term relationships to help ensure products are supplied with appropriate technical and environmental documentation. This trend is driven as much by the new demands of the Construction Products Regulation (CPR) as by the EUTR. Since 1st July, CPR has imposed mandatory requirements for CE marking of all plywood for structural use in the EU.

One important implication of both the EUTR and CPR is that importers now need very precise information on the species content of veneers used to manufacture plywood. Strong emphasis is placed on species considered to be low risk of illegal harvest to replace those considered higher risk. Information on species content is also obviously necessary for determining product strength and durability for CE marking purposes.

African sapele is increasingly preferred over bintangor from Papua New Guinea for face veneers. There is some FSC availability of sapele and greater European confidence in legality documentation from Cameroon which is engaged in the FLEGT VPA process. On the other hand sapele veneer is a relatively expensive option. Increased demand has already driven a significant rise in prices for sapele logs, particularly those that are FSC-certified. As a result other African species, lesser used in the past, are also being tried, such as lotofa (Sterculia rhinopetala) from Cameroon. There is also rising European interest in plywood faced with dyed poplar reconstituted “fineline” wood veneer.

China’s share of EU plywood market dips in 2013

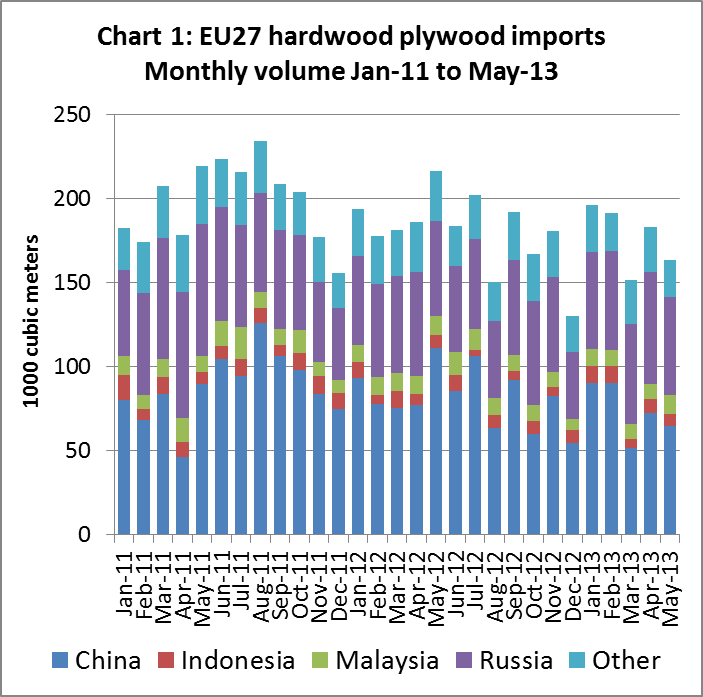

The latest trade data shows that there was a sharp fall in EU imports of hardwood plywood in March 2013 (Chart 1 and Table 1). This was almost entirely due to a dip in imports from China. Imports from China rebounded a little in April, but then weakened again in May.

In the first five months of 2013, EU imports of all hardwood plywood from China were 367,000 m3, down 15% from 434,000 m3 in the same period in 2012. China’s share of total EU hardwood plywood imports fell from 45% in the first five months of 2012 to 42% in the same period of 2013.

It’s still too early to say whether the decline in China’s share represents a significant structural shift in the EU plywood market, or a short term response to Europe’s weak consumption.

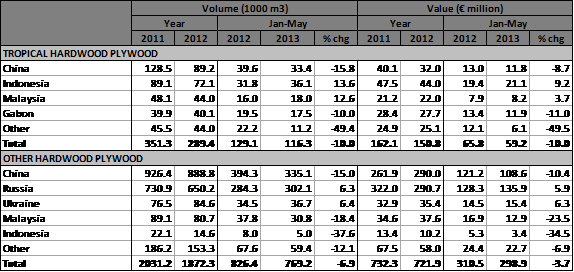

Table 1: Imports of hardwood plywood into the EU

China expected to maintain leadership position in the EU market

Looking ahead, there are reasons to believe that China’s large and globally dominant plywood sector will maintain a leadership position in the European market. Chinese manufacturers remain highly price competitive and some manufacturers are already adjusting well to the new market requirements. In addition to switching species, some Chinese plywood manufacturers supplying the European market have been taking steps to cut out middlemen in China and importing their own logs or veneers with the necessary documentation.

On the other hand, European importers also report that those Chinese mills capable of supplying to the EUTR standard are already oversold leading to delayed shipments. European importers are also being much more selective in the plywood products they procure from China, with many now buying only plywood manufactured from plantation grown poplar and eucalyptus, which are considered low risk. For specialist grades of marine and other high quality tropical hardwood plywood, EUTR is expected to encourage greater efforts by European importers to shorten their own supply chains by buying direct from tropical countries.

Still no rise in demand for direct imports of tropical plywood

However, with consumption in Europe still low, there is yet to be any significant rise in direct imports from tropical countries. European demand for South East Asian plywood remains restricted. Despite the recent sharp rises in freight rates, prices for South East Asian plywood on offer to European buyers have risen only slightly. 18mm BB/CC plywood from Indonesia is currently selling for between INDO96+38 and +40. Prices for the same grade from Malaysia are between INDO96+25 and +30. Supply of South East Asian plywood is reported to be sufficient compared to current levels of demand and new orders may be shipped promptly within no more than about four weeks.

European demand for African okoume plywood also remains very slow due to weak construction activity in the main French and Dutch markets. There was some increased purchasing by importers and distributors in the first quarter of2013 in preparation for the summer construction season and in anticipation of rising prices. However, poor weather delayed the start of construction season and consumption remained low even as the weather improved over the summer. Supplies from French manufacturers are readily available and can be dispatched promptly. Deliveries from Africa are less certain, taking 2 to 3 months with frequent delays.

The downturn in the European okoume plywood market is clear from the recent financial statements of French-owned Rougier which operates large concessions and plywood mills in Gabon. In their financial report for the first quarter of 2013, Rougier note that their plywood sales in Europe were down 15% compared to the same period in 2012. Within a cautious market context, the quarter was marked by delays withindustrial production in Gabon and the high level of competition on temperate timber plywood in Europe.

Birch plywood diverted away from the EU market

European and Russian birch plywood manufacturers are reporting good sales and have been forcing through price rises. Finnish birch plywood is selling quite well in Germany and the UK. However consumption in other parts of Europe has been disappointing and weaker than last year. Much demand for Russian and European birch plywood is now coming from markets outside Europe, notably in Russia itself and in the US, the Middle East, and North East Asia. Russian manufacturers are increasingly focusing on these markets, with the result that European buyers often struggle to obtain product from Russia at consistent prices for prompt shipment. Lead times for Russian filmed birch plywood is typically over four weeks and may be longer for other grades. Finnish birch plywood manufacturers are also making less product available to the European market and selling almost exclusively to regular customers under long-term contracts.

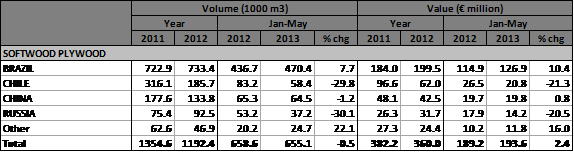

EU imports of softwood plywood remain stable in 2013

The latest EU import data suggests that the softwood plywood trade is being less affected by the recent construction downturn and EUTR than the hardwood trade (Chart 2 and Table 2). Total EU imports of softwood plywood in the first 5 months of 2013 were 655,100 m3, down only 0.5% compared to the same period in 2012. A rise in imports from Brazil offset falling imports from Chile and Russia. Imports from China remained stable at around 65,000 m3 in the first 5 months of the year.

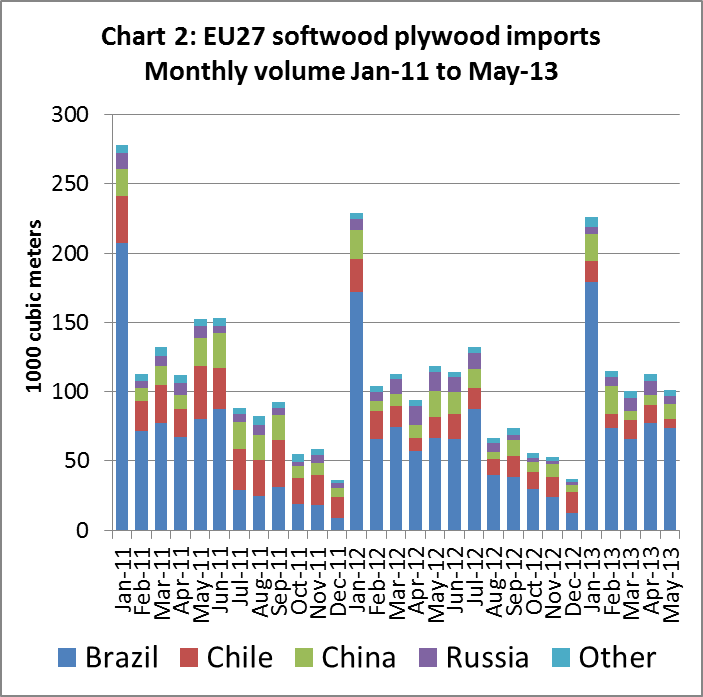

Table 1: Imports of softwood plywood into the EU

Substitution of hardwood plywood products

Substitutes are making more inroads into applications previously dominated by hardwood plywood in the European market. For example, Medite based in Ireland has been producing Medite Tricoya “Extreme Durable MDF” since the end of 2011 in a joint venture with the British company Accsys Technologies. Tricoya is now selling into several European countries including Germany, Ireland, the Netherlands and the UK.

According to Medite, sales in all markets in which Tricoya has been launched “has met or surpassed expectations, with customers willing to pay a significant premium over conventional MDF material due to the greatly enhanced properties of Medite Tricoya”.

At present Tricoya production is limited and dependent on acetylated material supplied by Accsys. However Medite is planning to greatly expand their own acetylation capacity in 2016 with the introduction of a new continuous production process developed by Accsys. The plant will have an initial annual capacity of approximately 42,000m3 of Tricoya MDF panels.

PDF of this article:

Copyright ITTO 2020 – All rights reserved