In the first ten months of 2022, the EU27 imported 1.68 million tonnes of tropical wood and wood furniture products with a total value of USD3.79B, respectively 15% and 24% more than the same period the previous year. However, imports have been slowing since summer 2022 and the economic outlook in the EU deteriorated sharply in the last quarter of the year. The war in Ukraine is contributing to huge increases in energy prices, while business and consumer confidence has been hit by expectations of higher interest rates to control inflation.

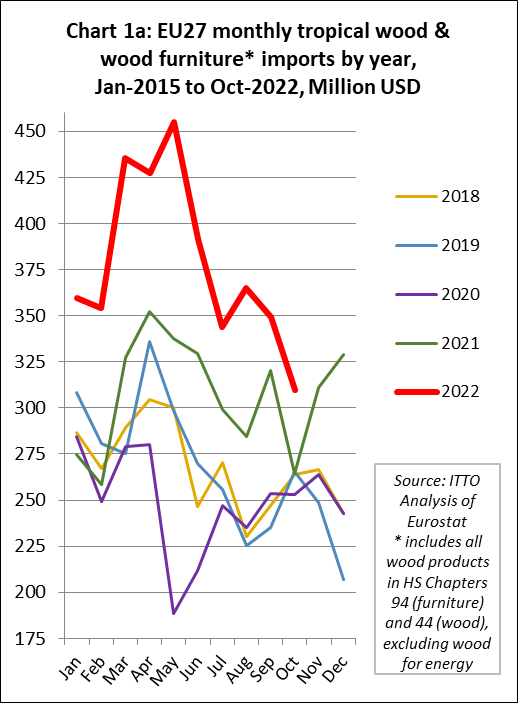

In US dollar terms, total EU27 imports of tropical wood and wood furniture imports were still high in October last year compared to the same month in the previous five years despite falling sharply since the summer (Chart 1a).

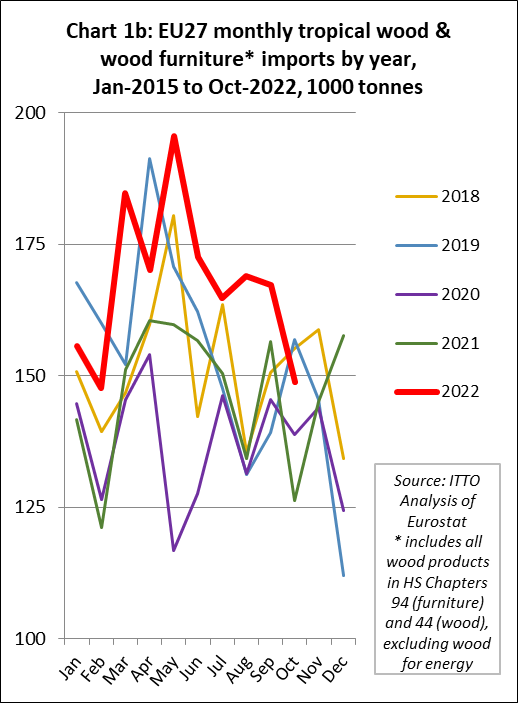

However in tonnage terms, EU27 total imports of tropical wood and wood furniture in October last year were in line with the level achieved in that month in the previous five years and well below levels typical of a decade ago (Chart 1b).

EU economy projected to grow just 0.2% this year

The extent of the economic downturn in the EU27 is highlighted in the 2023 edition of the “World Economic Situation and Prospects” (WESP) published by the United Nations Department of Economic and Social Affairs (UN DESA) in January.

According to the WESP report “the economic outlook for Europe has continued to deteriorate amid the protracted war in Ukraine. Soaring energy prices have pushed inflation to multi-decade highs, eroding household purchasing power and increasing production costs for firms. Market liquidity has tightened as the region’s central banks have accelerated interest rate hikes to rein in inflationary pressures. Higher borrowing costs, sizeable fiscal deficits and elevated debt levels continue to constrain fiscal space in many European economies”.

The WESP report also notes that “the external environment has worsened amid weakening growth in China and the United States and heightened global economic uncertainty”.

Against this background, the WESP report projects that there will a “mild recession” in many European countries during the winter of 2022 to 2023, followed by a subdued recovery. GDP in the European Union is projected to grow by only 0.2 per cent in 2023, a sharp downward revision from earlier forecasts. In 2024, the WESP forecasts that growth will pick up to 1.6 per cent as inflation eases and the monetary tightening cycle ends.

This comes, according to the WESP report, after a surprisingly strong expansion of 3.3 per cent in 2022, when further relaxation of COVID‑19 mobility restrictions and pent-up demand boosted spending on contact-intensive services, including tourism-related activities. But the report observes that “in the third quarter of 2022, consumer confidence both in the European Union and in the United Kingdom plunged to the lowest level since the 1980s, with only a slight improvement in October and November”.

For 2023, the WESP report states that “while the worst-case scenario of massive disruptions to industrial activities will likely be avoided, Europe is still projected to see a marked economic downturn. Private consumption will weaken due to significant purchasing power losses by households and tightening financial conditions. Businesses are expected to cut back on capital spending amid elevated uncertainty and higher input and borrowing costs. In addition, external demand is projected to soften further as the region’s main trading partners – China and the United States – face subdued growth prospects in 2023”.

The WESP report suggests that some European countries will be hit much harder than others. GDP is forecast to contract in Germany, Italy, Sweden and the United Kingdom in 2023, as these economies are particularly vulnerable to the combination of soaring energy prices and rising borrowing costs. By contrast, economic growth is expected to be more resilient in a few smaller economies, including Ireland and Portugal.

The latest data from the S&P Global eurozone construction purchasing managers’ index (PMI) underlines the extent of economic deterioration. It shows that the construction sector is suffering its worst decline since the pandemic brought the economy to a near-standstill in 2020.

December’s PMI showed a total activity index of 42.6, down from 43.6 in November. Figures below 50 indicate declining activity. The data marked the eighth consecutive month of contraction in home building. Activity declined in all three of the 20-nation bloc’s biggest economies — Germany, France and Italy.

Excluding periods of Covid-19 lockdowns, total home-building activity dropped in December at the sharpest rate since March 2013 and new orders for all construction projects declined at the fastest rate since September 2014, S&P said. The biggest falls in both cases were in Germany. Commercial building activity also fell for the ninth consecutive month, said S&P, adding that the biggest drop was in France.

The gloomy findings underline how rising borrowing costs, sharply higher raw material prices and worries that a recession could accelerate a fall in property prices are all weighing on the European construction industry. According to S&P “December data suggested that firms were anticipating challenging economic conditions to continue into the future”. More positively, S&P reported a “sustained easing” in both cost and supply pressures.

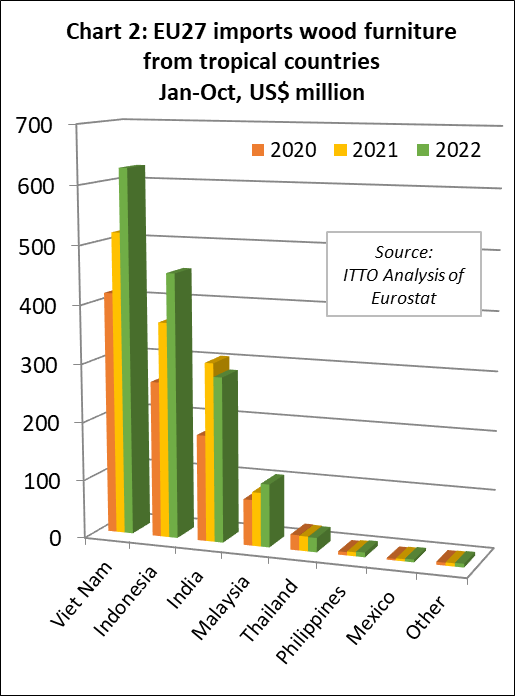

Rise in EU27 import value of tropical furniture masks fall in quantity

In the first ten months of 2022, EU27 import value of wood furniture from tropical countries was USD1.52B, 14% higher than the same period in 2021. This increase in dollar value was entirely due to higher freight rates and prices and the weakness of the euro last year. In tonnage terms, imports declined 6% to 305,500 tonnes during the ten-month period.

In the first ten months of 2022, there were large increases in EU27 wood furniture import value from Vietnam (+21% to USD626M), Indonesia (+23% to USD454M), Malaysia (+17% to USD108M) and the Philippines (+17% to USD8M). Import value fell from India (-7% to USD284M) and Thailand (-3% to USD25M). EU27 wood furniture imports from all other tropical countries were negligible (Chart 2).

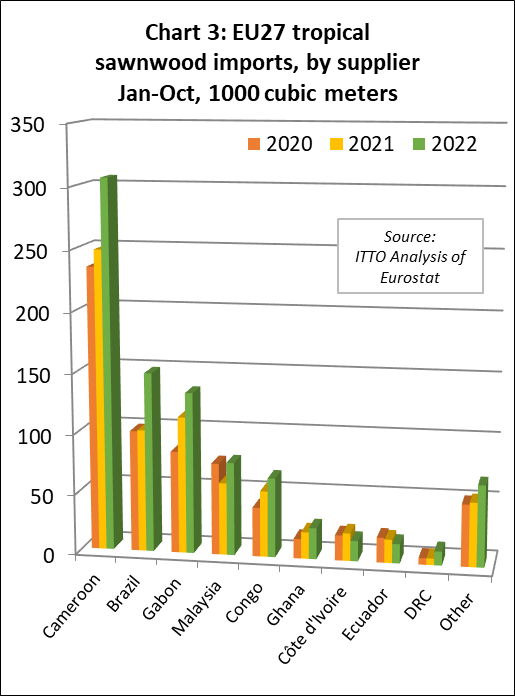

EU27 imports of tropical sawnwood up 24%

After two slow years during the global pandemic, EU27 imports of tropical sawnwood recovered ground in the first ten months of last year. Imports of 869,000 cubic meters between January and October last year were 24% higher than the same period in 2021 and 34% more than the same period in 2020.

Sawnwood imports increased during the ten-month period last year from all the largest tropical suppliers to the EU27 including Cameroon (+23% to 306,400 cubic meters), Brazil (+47% to 148,700 cubic meters), Gabon (+18% to 133,600 cubic meters), Malaysia (+29% to 77,000 cubic meters), Congo (+20% to 65,600 cubic meters) and Ghana (+17% to 25,800 cubic meters).

Of smaller sawnwood supply countries, there were large percentage increases in imports from DRC (+113% to 11,500 cubic meters), Suriname (+64% to 9,400 cubic meters), Indonesia (+46% to 9,000 cubic meters), Angola (+35% to 6,200 cubic meters), and CAR (+167% to 5,700 cubic meters). In contrast imports from Côte d’Ivoire fell 26% to 16,800 cubic meters and from Ecuador were down 17% to 25,800 cubic meters. (Chart 3).

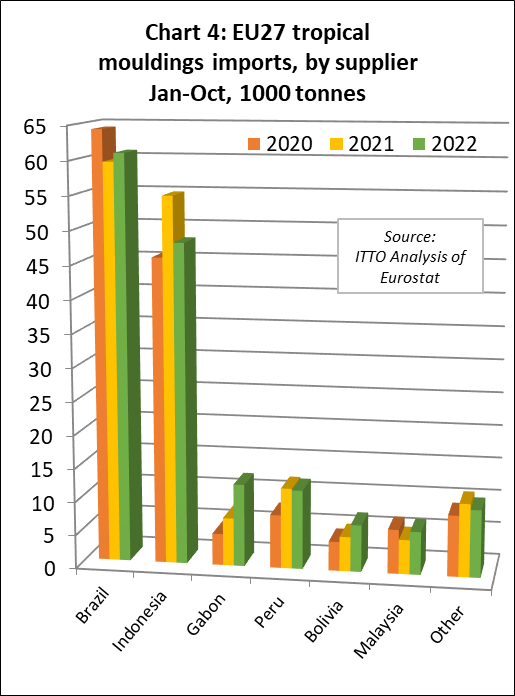

Unlike sawnwood, EU27 imports of tropical mouldings/decking were slow between January and October last year. Imports of 156,600 tonnes between January and October 2022 were just 1% more than the same period in 2021. Supply shortages contributed to falling imports from Indonesia, which declined 12% to 48,000 tonnes during the ten-month period. The fall in imports from Indonesia was offset by rising imports from Brazil (+2% to 60,800 tonnes) and Gabon (+72% to 12,400 tonnes). Of smaller suppliers, there were increases in imports from Bolivia (+36% to 7,000 tonnes) and Malaysia (+25% to 6,400 tonnes). Imports from Peru declined by 2% to 11,900 tonnes in the first ten months of last year after strongly rising the previous year (Chart 4).

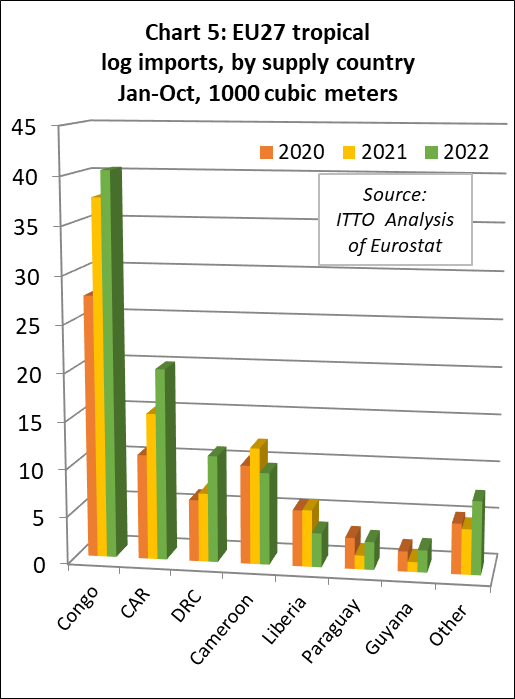

Between January and October 2022, the EU27 imported 98,100 cubic meters of tropical logs, 14% more than the same period in 2021. EU27 log imports increased from all three of the largest African supply countries in the first ten months of last year compared to the same period in 2021; Congo (+7% to 40,400 cubic meters), CAR (+31% to 20,100 cubic meters), and DRC (+56% to 11,200 cubic meters). In the first ten months of last year imports also increased sharply from negligible levels in 2021 from two South American countries, Paraguay (+101% to 2,900 cubic meters) and Guyana (+123% to 2,300 cubic meters). However, log imports were down 21% to 9,700 cubic meters from Cameroon and down 40% to 3,600 cubic meters from Liberia (Chart 5).

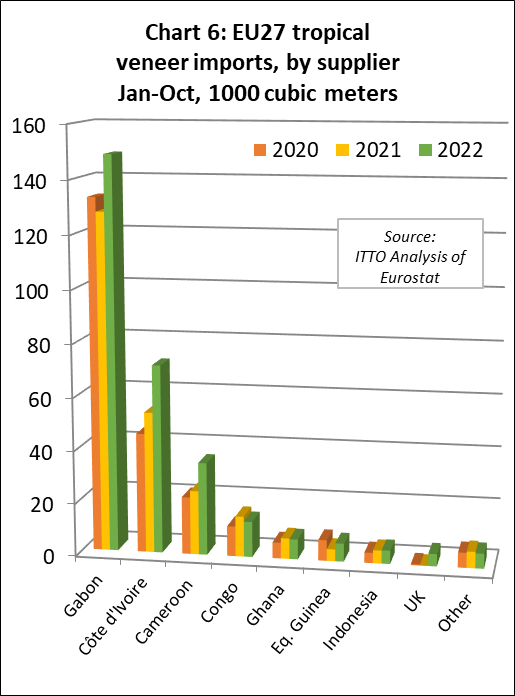

Large gains in EU27 imports of tropical hardwood veneer from Africa last year

Between January and October 2022, the EU27 imported 298,300 cubic meters of tropical veneer, 22% more than the same period in the previous year. Imports of tropical veneer from Gabon, by far the largest supplier to the EU27, increased 16% to 148,800 cubic meters. There were also large gains in imports from Côte d’Ivoire (+34% to 71,300 cubic meters), Cameroon (+45% to 35,100 cubic meters) and Equatorial Guinea (+53% to 6,800 cubic meters). After virtually no indirect trade in tropical veneer to the EU27 via the UK in 2021, this trade totalled 4,600 cubic meters between January and October last year. These gains in EU27 tropical veneer imports were partly offset by a 12% decline in imports from Congo to 13,400 cubic meters and a 3% fall in imports from Ghana to 7,500 cubic meters (Chart 6).

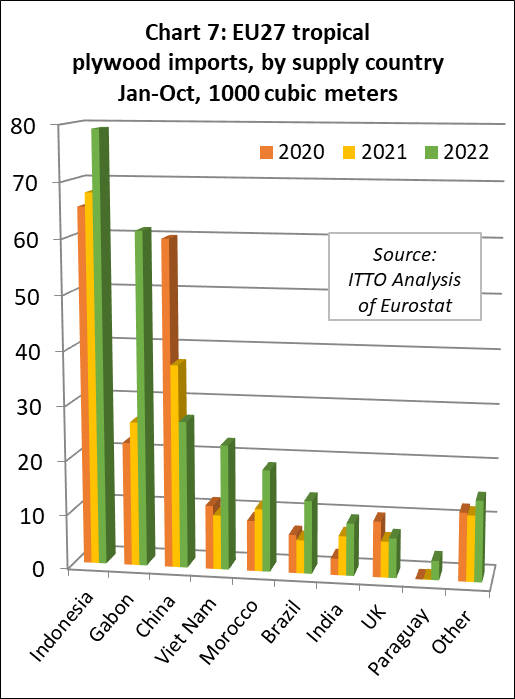

Between January and October 2022, EU27 tropical plywood imports of 257,900 cubic meters were 39% more than the same period the previous year. Imports from Indonesia, at 79,100 cubic meters, were up 17% compared to the same period in 2021. However, the biggest percentage increases were in imports from Gabon and Vietnam, both rising 130% to 61,300 cubic meters and 23,000 cubic meters respectively. Imports of tropical plywood also increased from Morocco (+63% to 18,700 cubic meters), Brazil (+119% to 13,400 cubic meters), India (+33% to 9,700 cubic meters), and the UK (+10% to 7,300 cubic meters). Tropical plywood imports from Paraguay increased from negligible levels in 2021 to 3,500 cubic meters in the first ten months of last year. These gains offset a 28% decline in imports of tropical hardwood faced plywood from China to 27,000 cubic meters (Chart 9).

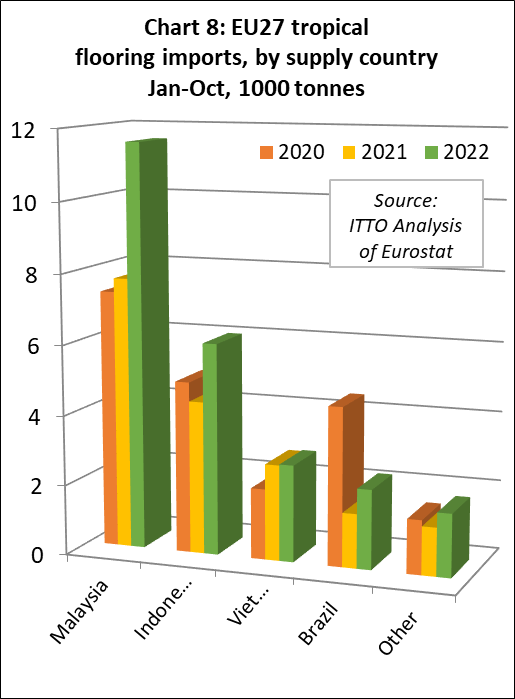

Rise in EU27 imports of tropical flooring from Malaysia continues

Between January and October 2022, the EU27 imported 24,500 tonnes of tropical wood flooring, 38% more than the same period in 2021. The rise in EU27 wood flooring imports from Malaysia, that began in 2020, continued last year. Imports of 11,600 tonnes from Malaysia in the first ten months of 2022 were 49% more than the same period in 2021. There were also large gains, from a smaller base, from Indonesia (+39% to 6,000 tonnes) and Brazil (+46% to 2,300 tonnes). Flooring imports from Vietnam were, at 2800 tonnes in the ten month period, at the same level as the previous year (Chart 8).

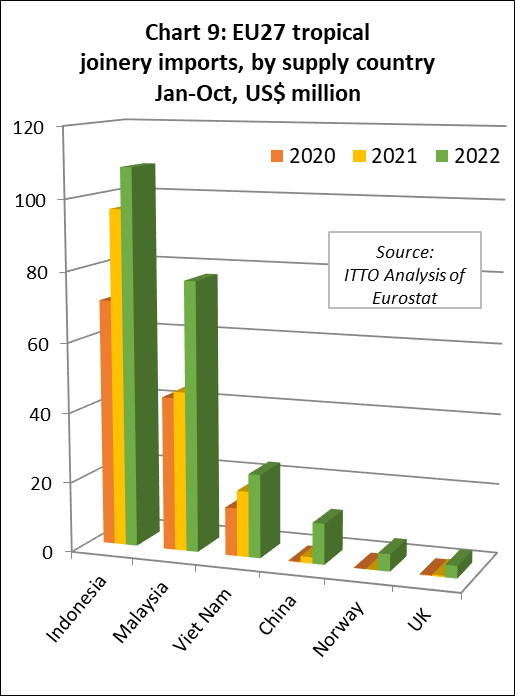

The dollar value of EU27 imports of other joinery products from tropical countries – which mainly comprise laminated window scantlings, kitchen tops and wood doors – increased 40% to USD249M in the first ten months of 2022. Import value increased 12% to USD108M million from Indonesia, 69% to USD77M from Malaysia, and 27% to USD24M from Vietnam. The apparent large increase in imports of this commodity group from China, from negligible levels to USD12M in the first ten months of last year, is due to a change in product codes from the start of 2022 allowing more joinery products manufactured using tropical hardwood in non-tropical countries to be separately identified (Chart 9).

Unlike for furniture, the rise in import value for joinery last year was not driven entirely by rising prices but was also indicative of an increase in import quantity. In quantity terms between January and October last year, the EU27 imported 92,800 tonnes of tropical joinery products, 29% more than the same period in 2021.