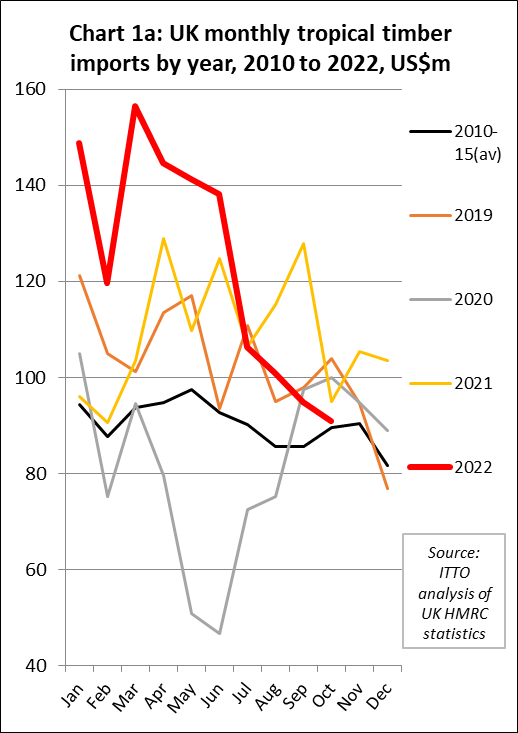

The import value of tropical wood and wood furniture into the UK in the first ten months of last year was USD1.24B, 13% more than the same period last year. Following the strongest start to the year in terms of UK import value since before the 2008 financial crises, imports fell sharply between July and October (Chart 1).

The trend looks different in quantity terms (Chart 1b). Import quantity of tropical wood and wood furniture into the UK in the first ten months of 2022 was 398,000 tonnes, 2% less than the same period last year. In quantity terms, imports were at around the pre-covid level in the first half of 2022 but fell to well below that level between July and October. This shows that price inflation was the major factor behind relatively high UK import value last year, driven both by historically high material and freight prices and extreme weakness of sterling against the USD.

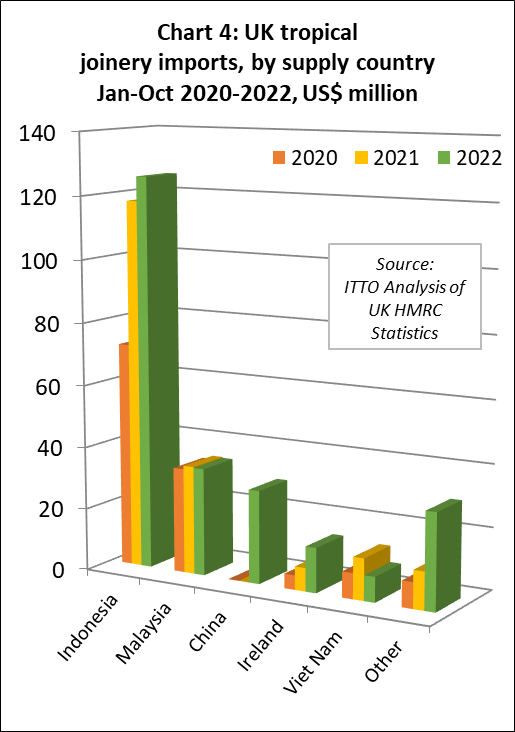

UK economy expected to be worst performing amongst G7 next year

According to UK government figures published on 22 December, the economy contracted by more than first estimated in the third quarter of last year. GDP fell by a revised 0.3% against the 0.2% decline initially estimated from July to September, the Office for National Statistics (ONS) said. The manufacturing and construction sectors performed worse than expected. Manufacturing activity contracted 2.8%, worse than the 2.3% contraction previously announced, while construction activity actually shrank 0.2% compared to earlier estimated growth of 0.6%.

According to ONS, household incomes continued to fall during the third quarter of 2022, though the rate of decline slowed compared to the first two quarters of the year, and household spending fell for the first time since the final spring lockdown of 2021. The level of households’ disposable income fell by 0.5% in the quarter, the fourth consecutive drop. Household spending fell by a revised 1.1% in the quarter as declines in tourism, transport, household goods and services, and food and drink spending were seen.

A slowing in real consumption expenditure in the UK was seen during 2022 including in restaurants and hotels, and recreation and culture as a result of that reduced disposable income and a cost of living crisis, fuelled by high inflation. The UK government blamed the disappointing figures on high inflation caused by the invasion of Ukraine.

More positively, ONS recorded GDP growth of 0.5% in October, a stronger performance than expected by economists. However this was explained by the number of working days returning to normal rather than any real surge in output.

However, the UK economy is still expected to be confirmed as having entered a recession at the end of 2022 as the fourth quarter as a whole is forecast to have experienced negative growth. The Confederation of British Industry (CBI) has also forecast that the economy will contract 0.4% next year. The UK is expected to be the worst performing than any of the other G7 countries that form the group of the world’s largest industrialised democracies, according to forecasts from the Organisation for Economic Cooperation and Development (OECD).

UK construction activity slows sharply in December

Overall, the UK construction sector was performing quite well in the year to November. According to comments by Timber Development UK, the UK trade association, new house construction performed well in 2022 with contractors well booked through to end of year. Housing completions in the third quarter of 2022 were at the highest level since 2007. However, there was mounting uncertainty towards the end of last year about future prospects in the residential construction sector because of rising interest rates.

While new residential construction was still strong in 2022, activity in the renovation and refurbishment sector – which is particularly important for the hardwood sector – was slowing from the heights achieved during and immediately following the pandemic when a lot of money was invested in home improvement. This sector is expected now to slow much further, possibly by as much as 10% in 2023.

The latest data from the S&P Global/CIPS UK Construction Purchasing Managers’ Index (PMI) – which measures month-on-month changes in total industry activity – mirrors these trends. Overall UK construction activity was growing between September and October last year – driven mainly by the new residential sector – but then activity recorded the fastest rate of decline since May 2020 in December.

Also in that month, sentiment amongst construction firms towards activity in the year ahead dipped into negative territory for only the sixth time on record, reflecting fears around the near-term economic outlook. Pessimistic expectations were reflected in the first round of job shedding in the UK construction sector since January 2021.

At 48.8 in December, down from 50.4 in November, the headline Construction PMI registered below the 50.0 mark to signal the first contraction in construction sector output since last August. Commercial construction activity continued to rise in the final month of the year, but only marginally, and this growth was outweighed by contractions across the residential and civil engineering sectors.

December PMI data also highlighted a reduction in new orders placed with UK constructors, following a modest uplift in November. According to survey respondents, the fall was driven by weak client demand, linked in turn to higher prices. Construction firms pared back on their purchasing in December for the first time in three month, reportedly due to lower workloads. Notably, the rate of reduction was the steepest for over two-and-a-half years.

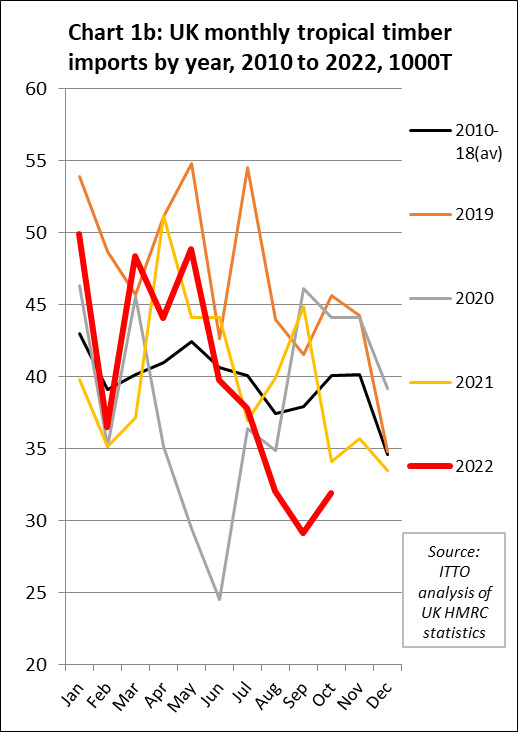

UK imports of tropical wood furniture much lower in third quarter

The UK imported USD647 million of tropical wood furniture products in the first ten months of 2022, which is 3% more than the same period in 2021. In quantity terms, wood furniture imports were 133,000 tonnes during the ten month period, 9% less than the same period the previous year. This indicates that the rise in value was driven more by price inflation than strong demand. Imports between June and October 2022 were much lower than the same period in 2021.

In the first ten months of 2022 compared to the previous year, UK import value of wood furniture increased 8% from Vietnam to USD323 million, 15% from India to USD72 million, 1% from Indonesia to USD63 million, and 30% from Thailand to USD19 million. Import value of USD111 million from Malaysia was 1% less than the previous year, while import value of USD49 million from Singapore was 25% down compared to 2021. (Chart 2).

UK import quanitity of tropical wood products flat overall in 2022

Total UK import value of all tropical wood products in Chapter 44 of the Harmonised System (HS) of product codes was USD595 million between January and October last year, 27% more than the same period in 2021. However in quantity terms imports increased just 1% to 265,000 tonnes during the period. Compared to the first ten months of 2021, UK import value of tropical joinery products increased 31% to USD243 million, import value of tropical sawnwood increased 53% to USD108 million, and import value of tropical mouldings/decking increased 39% to USD29 million. Import value of tropical plywood was unchanged at USD147 million (Chart 3).

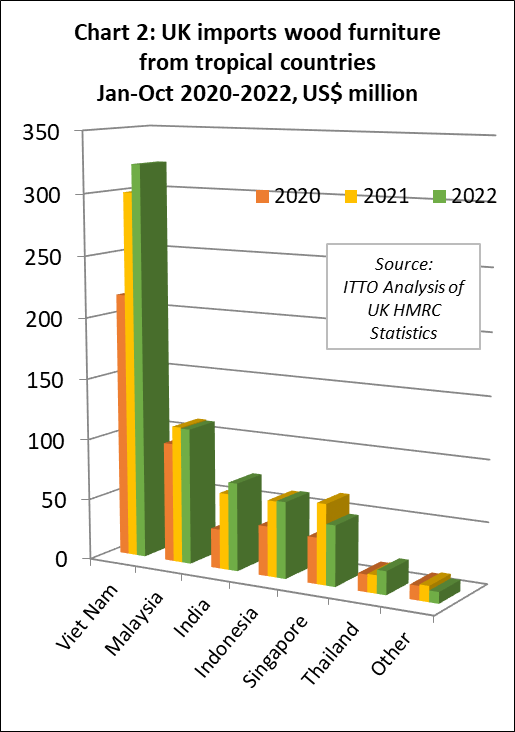

Slowing pace of UK imports of wood doors from Indonesia

The pace of increase in UK import value of tropical joinery products slowed sharply between July and October 2022. Import value from Indonesia, by far the largest supplier of tropical joinery products to the UK (in this case mainly doors), was at USD126 million still up 7% year-on-year in the first ten months of 2022 (Chart 4). In quantity terms, UK joinery imports from Indonesia were 40,650 tonnes in the first ten months of last year, 6% less than the same period in 2021.

UK imports of joinery products from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) were slow from the start of last year. Import value from Malaysia was USD35 million between January and October last year, 1% less than the same period in 2021. In quantity terms, imports from Malaysia were 8,900 tonnes, 28% less than the same period in 2021. Joinery imports from Vietnam of 2200 tonnes valued at USD8 million were respectively 40% and 39% less than the same period in 2021.

UK imports of Chinese tropical joinery products, nearly all comprising doors, were 11,900 tonnes with value of USD30 million in the first ten months of 2022, up from negligible levels in previous years. The recorded rise was due to introduction from 1st January 2022 of new product codes which identify wood doors and windows manufactured using a wider range of tropical wood species in UK and EU trade statistics. This may also explain the apparent rise in UK imports of tropical joinery products from Ireland which were 1,400 tonnes with value of USD14 million in the first ten months of 2022, respectively 53% and 91% more than the same period in 2021.

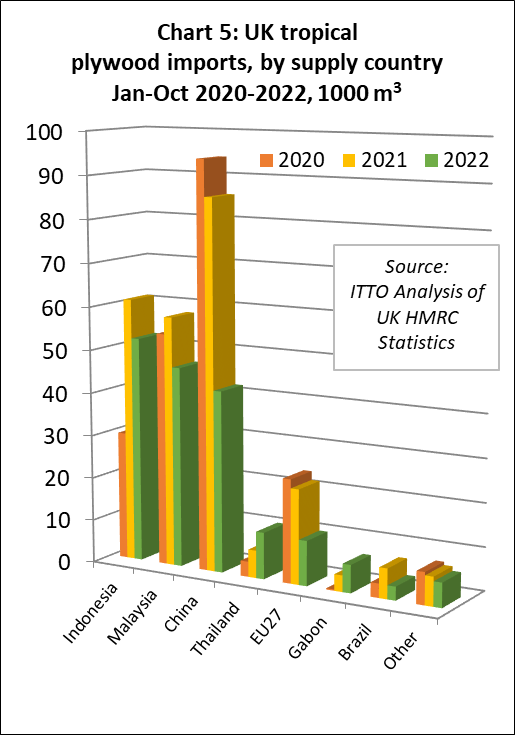

UK tropical hardwood plywood imports decline from all leading supply sources

In the first ten months of 2022, the UK imported 177,600 m3 of tropical hardwood plywood, 29% less than the same period the previous year, with significant decline in imports from all the main traditional supply sources including Indonesia, Malaysia, and China (Chart 5).

After a strong start to 2022, UK tropical hardwood plywood imports from Indonesia and Malaysia slowed dramatically between June and October last year. After the first ten months, imports from Indonesia were, at 52,400 m3, 15% less than the same period the previous year. The UK imported 46,500 m3 of plywood from Malaysia in the first ten months of 2022, 20% less than the same period the previous year.

The UK imported 42,100 m3 of tropical hardwood plywood from China in the first ten months of 2022, 51% less than the same period in 2021. Probably the biggest shift in the UK hardwood plywood trade in the last two years has been a rapid decline in imports of Chinese products faced with tropical hardwoods in favour of Chinese products faced with temperate hardwoods. Chinese temperate hardwood plywood has been the largest beneficiary of UK sanctions against all trade in Russian wood products since the start of the Ukraine conflict.

Meanwhile, the combined effects of Brexit, supply shortages and rising energy and other material costs on the European continent is impacting on UK imports of tropical hardwood plywood from EU countries which were just 10,400 m3 in the first ten months of 2022 compared to over 20,000 m3 during the same period in the previous two years.

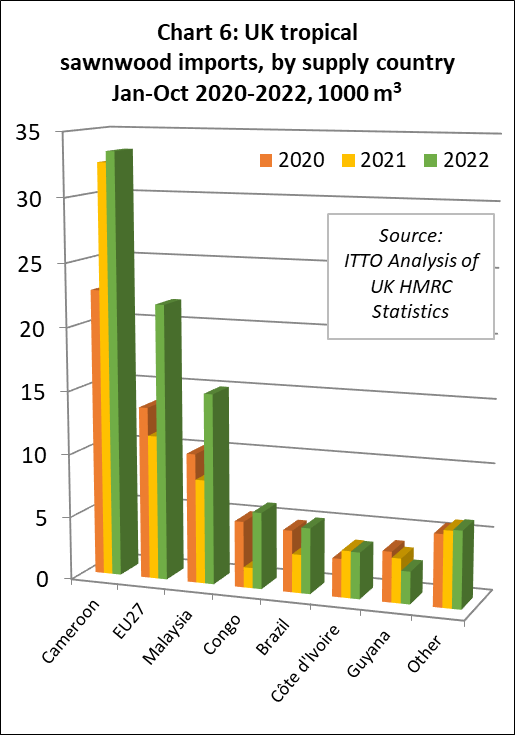

Bouyant UK imports of tropical sawnwood during 2022

Unlike tropical hardwood plywood, UK imports of tropical sawnwood were buoyant last year. Total UK imports of tropical sawnwood were 93,800 m3 in the first ten months of 2022, 34% more than the same period in 2021. In addition to making gains overall, there were some significant changes in the countries supplying tropical sawnwood to the UK last year (Chart 6).

UK imports of tropical sawnwood from Cameroon were 33,400 m3 in the first ten months of 2022, 3% more than the relatively high level in the same period in 2021. UK imports of tropical sawnwood from the Republic of Congo recovered lost ground last year, with imports of 6,000 m3 in the first ten months, a 274% gain compared to the same period the previous year. UK imports from Côte d’Ivoire were 3,700 m3 in the first ten months of last year, a 1% decline compared to the same period in 2021.

UK imports of sawnwood from Malaysia, which had fallen to little more than a trickle in previous years, were 15,000 m3 in the first ten months of 2022, 83% more than in the same period in 2021. UK imports of tropical sawnwood from Brazil were 5,200 m3 in the first ten months of last year, 71% more than the same period in 2021. Indirect UK imports of tropical sawnwood via the EU also recovered ground last year despite the Brexit disruption, increasing 91% to 22,000 m3 in the first ten months of 2022.

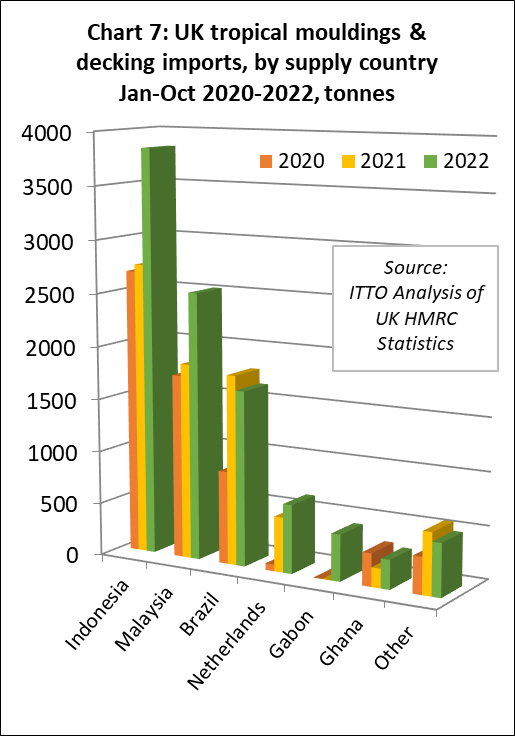

UK imports of tropical hardwood mouldings/decking were high in the first ten months of 2022, at 9,900 tonnes, 28% more than the same period in 2021. This commodity group has benefited in the UK market from shortages of non-tropical products, particularly since the start of the war in Ukraine and sanctions on Russian decking products that directly compete with tropical decking. Imports of 3,800 tonnes from Indonesia were 40% more than the same period in 2021. Imports of 2,500 tonnes from Malaysia were 37% up on the same period in 2021. However mouldings/decking imports from Brazil of 1,650 tonnes were 8% less than the same period in 2021. (Chart 7).

UK tropical hardwood imports expected to remain low over winter months

UK hardwood contacts suggest that imports from tropical countries are likely to remain low over the winter months. Conditions on the demand side are uncertain and, in the case of sawnwood and decking products, importers are now carrying a lot of expensive stock following the high levels of import in the first half of the year. The supply side situation is also challenging, particularly as the UK is not such an attractive market as in the past with buyers elsewhere in the world generally willing to pay more and to be more flexible with regard to species and grade.

For African wood, UK importers report very difficult supply conditions, with many logistical challenges, problems of cash flow, and high energy costs. Lack of kiln drying capacity in the UK and a preference for certified products makes it even more challenging for UK importers to place contracts in Africa. The UK market for tropical sawnwood is very focused on sapele, for which demand was still reported to be quite good in the final quarter last year. However, as one importer noted, “there is lot of sapele about in the UK at the moment”. Demand for sapele benefited in the early months of last year from difficult supply conditions for accoya and other modified temperate woods, but supply of those alternatives is now improving again.

For Southeast Asian hardwoods, decline in global demand and the rapid falloff in freight rates that occurred in the second half of last year has helped ease the supply situation, and there are more opportunities to buy product at competitive prices, but UK buyers are wary given current market uncertainty and existing high stock levels.