This analysis of EU wood furniture supply draws on production data from the Eurostat database of manufacturing statistics and trade data from the Eurostat COMEXT database. In line with Eurostat practice, all value data is reported in euros. The data covers all types of wood furniture with the exception of kitchens. Kitchen furniture is excluded because it is supplied almost exclusively by domestic manufacturers and is therefore less relevant to overseas manufacturers. In practice, the EU’s kitchen furniture industry has more in common with the joinery sector than with other parts of the furniture industry. Note that while all data is ultimately derived from Eurostat, it has been subject to significant adjustment during preparation of this report in an effort to remove numerous inconsistencies.

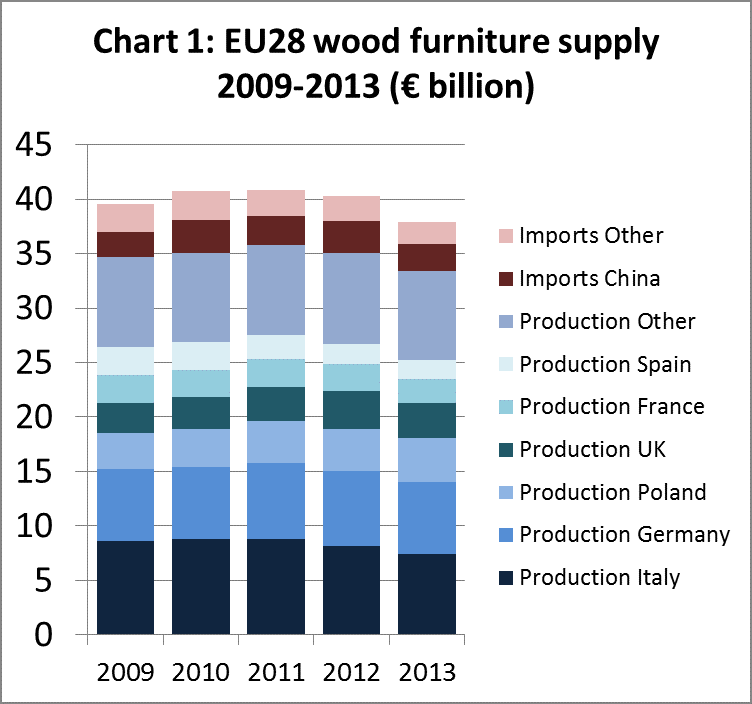

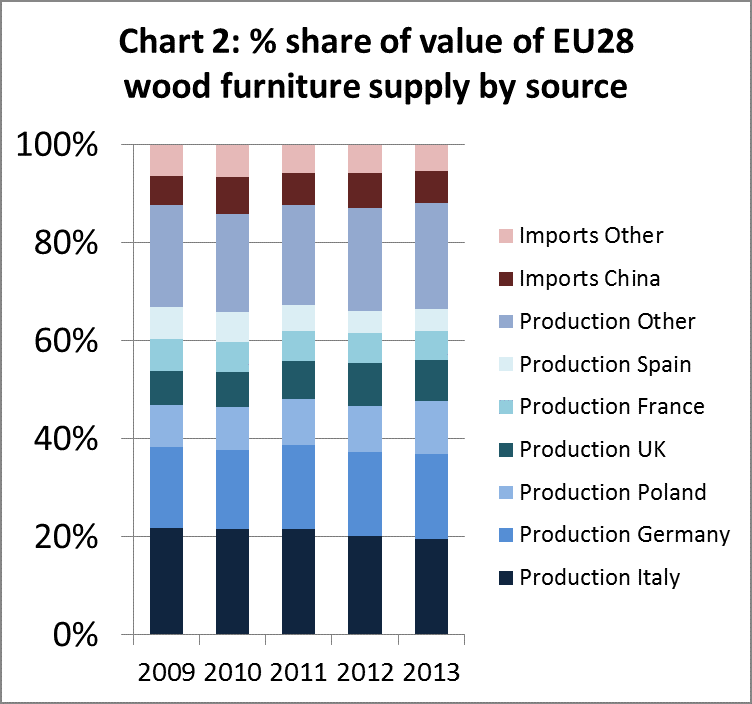

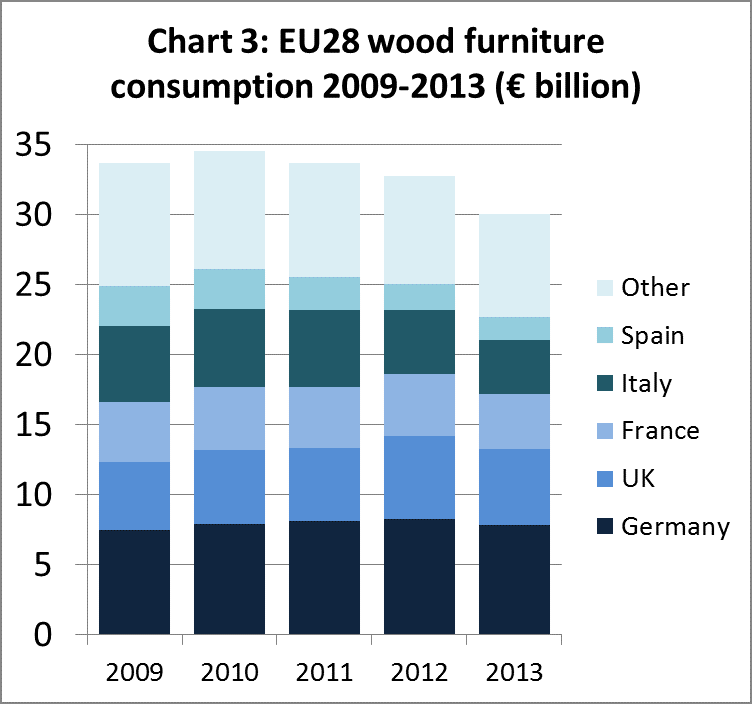

Total supply of wood furniture into the EU28 market is estimated to have been €37.9 billion in 2013, down 6% from €40.3 billion in 2012 (Chart 1). EU28 wood furniture production decreased 4% from €46.45 billion to €45.22 billion between 2012 and 2013. Imports decreased 13% from €5.2 billion to €4.5 billion during the same period. In 2013, imports accounted for 12% of wood furniture supply to the EU, down from 13% the previous year and the peak level of 14% recorded in 2010 (Chart 2). Overall consumption is estimated to have fallen 8% in 2013 from €32.7 billion to €30.0 billion (Chart 3).

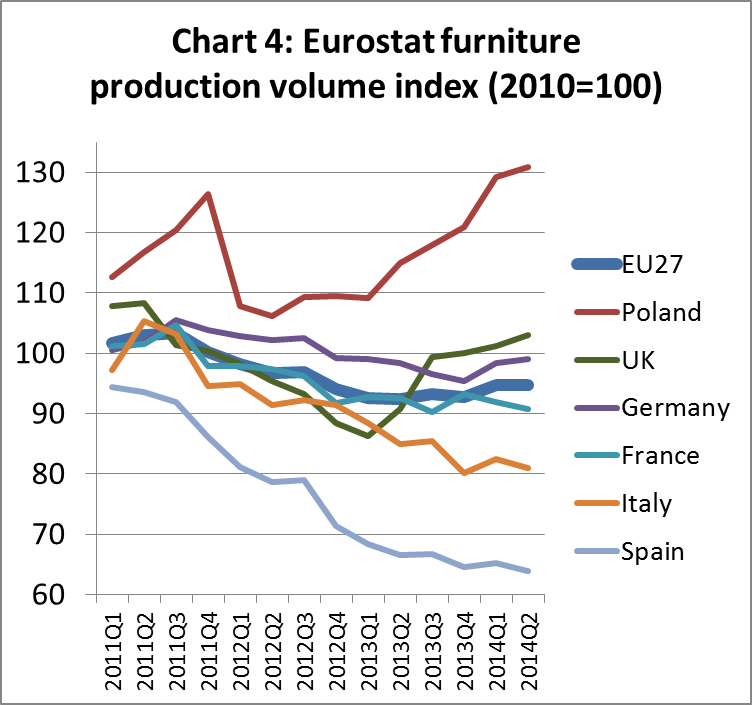

The Eurostat wood furniture production index suggests that the downward trend in EU furniture manufacturing has levelled off in 2014 (Chart 4). Production has risen sharply in Poland and the UK since the middle of last year. After sliding in 2013, production in Germany, Italy and France stabilised in the first half of 2014. However production has continued to slide in Spain this year.

Italian wood furniture production down 8% in 2013

The value of wood furniture production in Italy is estimated to have fallen 8% to €7.45 billion in 2013, continuing the decline of the previous two years. Italian manufacturers recorded a 1% decrease in export market sales during 2013, from €4.27 billion to €4.21 billion. Continuing weakness in the Italian domestic furniture market led to a sharp 9% decline in imports from €702 million to €636 million. Overall wood furniture consumption in Italy is estimated to have fallen 15% from €4.57 billion to €3.88 billion during 2013.

After a year of relative stability in 2012, the German wood furniture market declined in 2013. German wood furniture production is estimated to have fallen by 5% from €6.91 billion in 2012 to €6.57 billion in 2013, mainly due to a 6% decrease in domestic market consumption from €8.27 billion to €7.81 billion in 2013. Between 2012 and 2013, German wood furniture exports decreased 14% from €2.65 billion to €2.28 billion, while imports decreased 12% from €4.01 billion to €3.52 billion.

Meanwhile Poland, a country which has seen significant inward investment in furniture production capacity in recent years, recorded a 7% increase in production value from €3.81 billion in 2012 to €4.01 billion in 2013. This reverses a slight decline the previous year. The rise in production was mainly due to growth in the local market. Poland’s domestic consumption of wood furniture increased 30% to reach €936 million in 2013, the highest level for four years. Poland’s wood furniture exports remained stable at around $3.35 billion in both 2012 and 2013.

Euro value of UK wood furniture consumption down 8% in 2013

In terms of € value, UK consumption of wood furniture recorded an 8% fall from €5.94 billion in 2012 to €5.49 billion in 2013. UK production declined 10% from €3.54 billion in 2012 to €3.18 billion in 2013. UK exports of wood furniture decreased 4% from €331 million in 2012 to €318 million in 2013. The value of UK wood furniture imports fell 4% from €2.74 billion in 2012 to €2.63 billion in 2013.

These negative numbers for the € value of consumption and production in the UK need to be considered in the light of exchange rate fluctuations. The GBP was on average around 10% weaker against the euro in 2013 compared to 2012. This depresses the € value of UK production and trade in 2013 relative to 2012. The UK government’s own Index of Production for UK furniture suggests production measured in GBP fell to a low in February 2013 but then increased consistently for the next 18 months.

After a slow year in 2012, French wood furniture consumption suffered a further 11% decline to €3.90 billion in 2013. French products also came under increasing competitive pressure in export markets. Exports of wood furniture from France decreased 3% from €688 million in 2012 to €669 million in 2013. Overall, French wood furniture production fell 7% from €2.44 billion in 2012 to 2.27 billion in 2013. Imports of wood furniture into France decreased 13% to €2.30 billion in 2013.

Catastrophic collapse of Spanish furniture sector continues

The catastrophic collapse of Spain’s wood furniture sector continued during 2013. Production fell a further 7% from €1.83 billion to only €1.70 billion. Concerted efforts to boost overseas sales led to a 5% increase in exports from €515 million in 2012 to €541 million in 2013. This follows a 3% rise in exports the previous year. However this could not offset a 13% decrease in Spanish wood furniture consumption from €1.90 billion in 2012 to €1.64 billion in 2013. Spain’s imports of wood furniture declined 16% from €579 million in 2012 to €485 million in 2013.

In contrast to Spain, wood furniture production in Portugal has rebounded quite strongly. Production in Portugal increased 42% to €682 million between 2011 and 2012, and then gained a further 2% to reach €697 million in 2013. Portugal’s domestic market has remained very weak. Imports into the country fell 16% to €123 million, while total consumption was down 19% at €294 million in 2013. However, Portugal’s wood furniture exports increased 13% to €527 million in 2013.

Dutch wood furniture market falls sharply

In the Netherlands, wood furniture consumption fell 16% to €1.024 billion in 2013. Production in the country fell 12% to €649 million while imports were down 20% at €782 million. Weaker demand in neighbouring EU countries also led to a 19% decline in Dutch wood furniture exports to €408 million in 2013.

Wood furniture consumption and trade were also much weaker in Belgium last year. Consumption in the country declined 10% to €811 million, production was down 5% at €631 million and imports fell 13% to €841 million. Exports from Belgium were €520 million in 2013, 16% less than the previous year.

Rise in Romanian wood furniture production

Wood furniture production continued to rise in a number of Eastern European countries during 2013. Romania is the second largest manufacturer of wood furniture in Eastern Europe after Poland. Wood furniture production in the country increased 4% to €1.05 billion in 2014. Romanian exports of wood furniture were €783 million in 2013, little changed from the previous year. After a steep decline in 2012, domestic consumption of wood furniture in Romania increased 10% to €382 million in 2013. However the Romanian furniture sector may face challenging times ahead. Romania’s economy is weakening and there are reports of shortages of wood for furniture manufacture in the country.

Wood furniture production in Lithuania increased 3% from €766 million in 2012 to €788 million, the vast majority of this being exported. The value of wood furniture production in Lithuania has increased by around 65% in the last five years. Following recent investment, Lithuania is now the fifth largest supplier of products to the furniture giant IKEA.

Elsewhere in Eastern European during 2013, wood furniture production increased 7% to €442 million in Slovakia and was stable in Czech Republic (€337 million), Estonia (€224 million), Hungary (€287 million), and Slovenia (€163 million). Wood furniture production in Croatia was €133 million in 2013, a 30% decline compared to the previous year.

EU wood furniture imports recover some ground in 2014

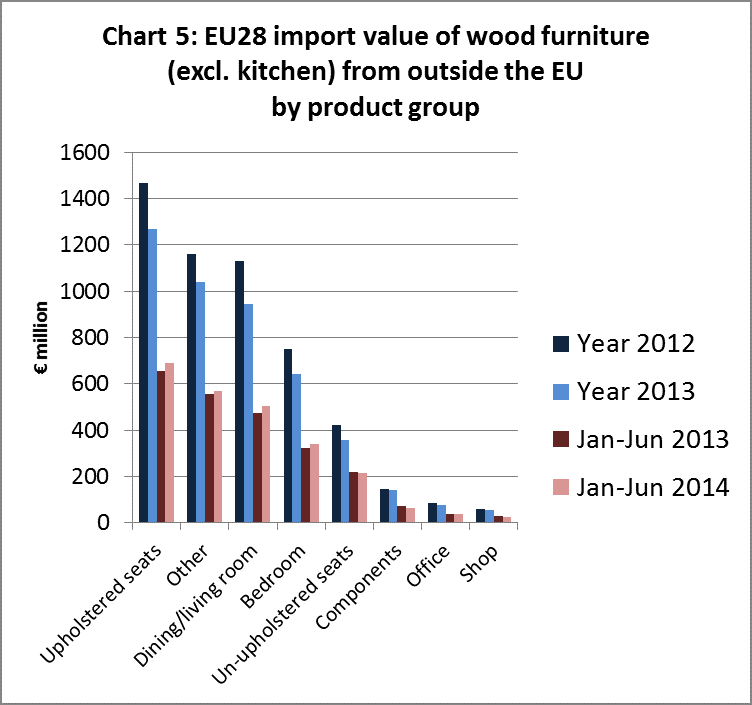

Imports of wood furniture into the EU from outside the region declined 13% from €5.27 billion in 2012 to €4.53 billion last year. However, the falling trend in imports in 2013 has reversed in 2014. In the first 6 months of 2014, the EU imported €2.45 billion of wood furniture, 3% more than the same period in 2013. These trends are broadly in line with trends in the wider EU market for wood furniture which declined in 2013 but is showing signs of recovery this year.

EU import performance has varied widely by product group this year (Chart 5). During the first 6 months of 2014, there was a rise in imports of upholstered seats (+5%), dining/living room furniture (+6%) and of bedroom furniture (+5%). However there was a decline in imports of un-upholstered seats (-2%). EU imports of wood furniture components and of shop and office furniture – which already account for only a tiny share of the market – were also declining.

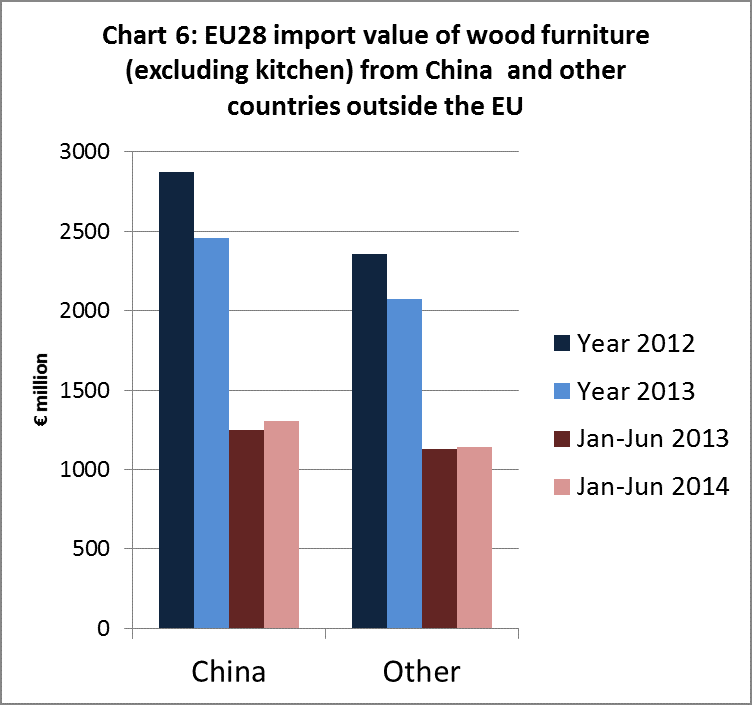

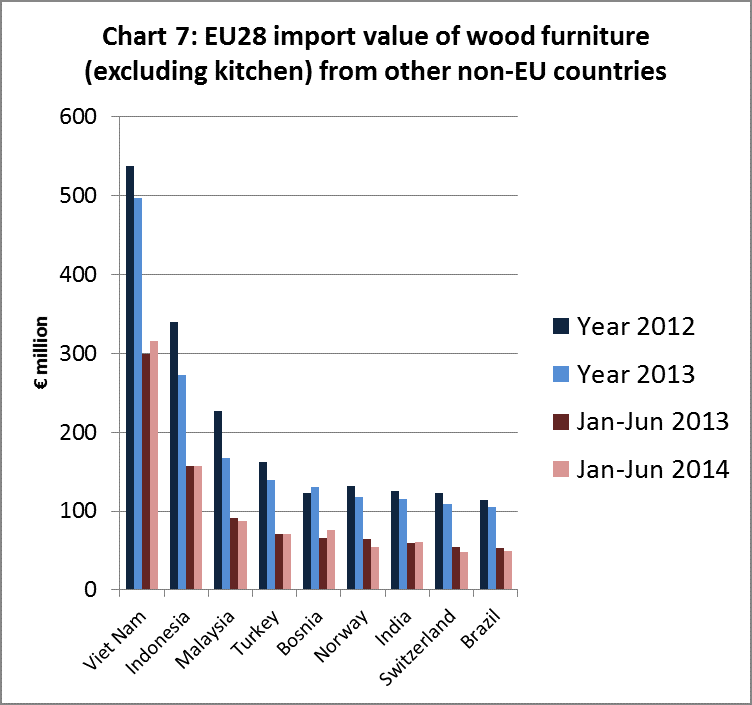

After falling 14% to €2.46 billion in 2013, EU imports of wood furniture from China were €1.31 billion in the first 6 months of 2014, 5% more than the same period in 2014 (Chart 6). EU imports of wood furniture from Vietnam were also up 6% at €316 million in the first half of 2014 (Chart 7). However imports declined from Indonesia (-1% to €157 million) and Malaysia (-4% to €87 million) during the 6 month period.

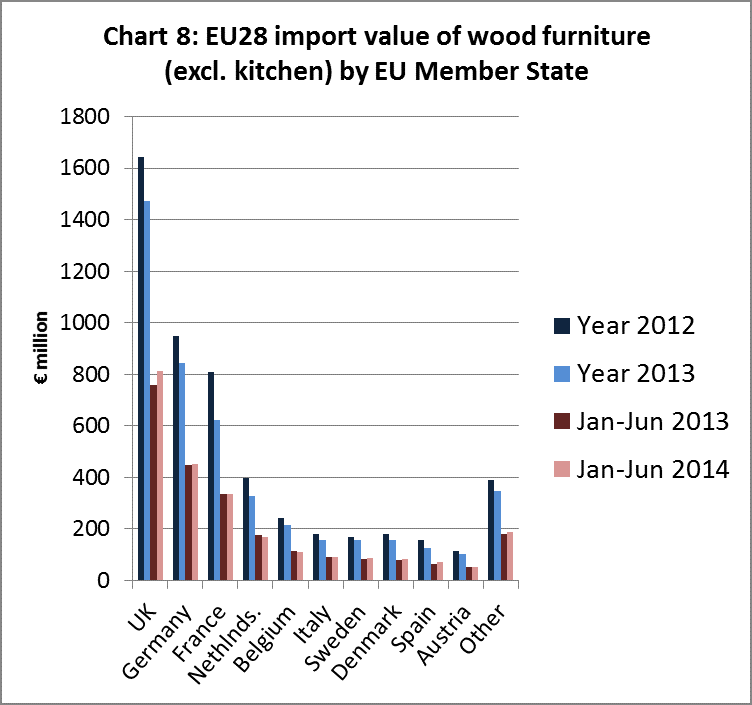

In the first six months of 2014, imports of wood furniture from non-EU countries increased into the UK (+7% to €813 million), Germany (+1% to €452 million), Italy (+2% to €91 million), Sweden (+4% to €85 million), Denmark (+4% to €83 million) and Spain (+14% to 70 million). However imports from non-EU countries have fallen into France (-1% to €334 million), Netherlands (-4% to €169 million) and Belgium (-4% to €111 million).

PDF of this article:

Copyright ITTO 2020 – All rights reserved