The EU’s trade in tropical wood products was more buoyant in the first half of this year compared to the same period in 2018. Total imports of all wood products (classified in HS Chapter 44) from tropical countries in the first half of 2019 were 1.24 million metric tonnes (MT), 16% more than the same period in 2018. Import value increased 15% to €1.26 billion.

This growth is surprising given that the wider economic situation in the EU has continued to deteriorate this year. In the European Central Bank (ECB)’s latest projections, published in September 2019, the euro-area is forecast to grow only 1.1% in 2019 and 1.2% in 2020. This compares to the ECB’s December 2018 forecast of 1.7% growth in both 2019 and 2020.

According to ECB, “recent data and forward-looking indicators – such as new export orders in [eurozone] manufacturing – do not show convincing signs of a rebound in growth in the near future and the balance of risks to the growth outlook remains tilted to the downside….The longer the weakness in manufacturing persists, the greater the risks that other sectors of the economy will be affected by the slowdown”.

The ECB observe that the trade war and other geopolitical factors are affecting European output and economic confidence, especially the manufacturing sector. As a result, Germany is “one of the euro area members most affected by the slowdown”, given the importance of its manufacturing sector which contributes 39% of German GDP (compared to the eurozone average of 28%).

In response to the latest slowdown, in September the ECB unveiled a package of stimulus measures including: a cut in interest rates charged on bank deposits at the ECB, to -0.5% to encourage lending; a pledge to maintain the ECB’s headline borrowing interest rate at zero indefinitely and at least until there is a robust rise in inflation; and a commitment to restart the ECB’s quantitative easing programme with €20bn of bond purchases each month from November 2019.

For long-standing political reasons, Germany has a strong commitment to a balanced budget and is very reluctant to implement any stimulus measures leading to additional government borrowing. However, on 20 September Germany unveiled a 54 billion euros ($60 billion) package over the next four years, ostensibly to speed up the country’s transition to renewable energy and reduce carbon emissions, but widely interpreted as part of underlying effort to support the ailing growth.

The German package, which contains a mechanism for monitoring progress on reaching emissions goals,

may provide new opportunities for timber products, but that depends on the industry investing time and effort in acquiring the necessary carbon footprint data and getting its carbon messaging right.

At present, prospects for the UK economy appear no better than in euro-zone countries, in fact likely even worse given on-going political challenges. On 16 September, the British Chambers of Commerce (BCC) released its latest economic forecast, downgrading growth expectations for the UK in 2019 to 1.2% (from 1.3% forecast in June 2019) and to 0.8% (from 1.0%) for 2020.

While the BCC expects the UK economy to avoid a technical recession and return to modest growth in the third quarter, downgrades to its GDP growth forecast for 2019 and 2020 reflect a weaker outlook for investment, trade and productivity amid a continued lack of clarity over the outcome of Brexit and deteriorating global economic conditions.

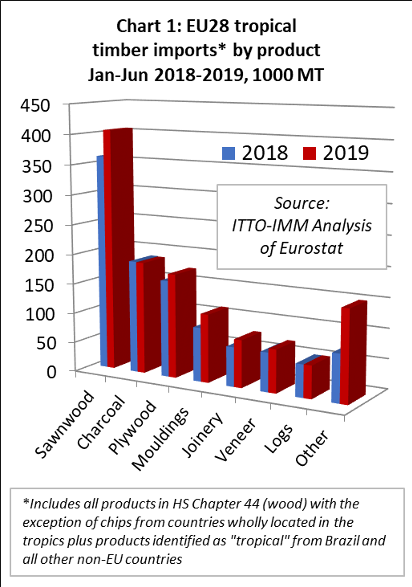

To some extent the rise in EU tropical wood imports in the first half of 2019 is only a reflection of just how poor the market was last year when imports for several commodities barely exceeded the record lows of the 2008-2009 financial crises. Nevertheless, it is encouraging that the rise in EU imports so far this year has been consistent across nearly all tropical wood product groups (Chart 1). It also accords with anecdotal reports, from interviews with European importers, of generally robust trading conditions in the first six months, at least in some sectors, notably sawn hardwood.

The latest upturn in imports is also quite well distributed across the EU with imports of tropical wood products higher during the first quarter in all the leading EU markets except Germany and Poland. In the first half of 2019 compared to the same period in 2018, total imports of tropical wood products increased in Belgium (+20% to 257,400 MT), the UK (+14% to 187,600 MT), Netherlands (+12% to 154,000 MT), France (+13% to 164,700 MT), Italy (+42% to 128,800 MT), Spain (+28% to 62,400 MT), Portugal (+38% to 46,700 MT) and Greece (+8% to 38,300 MT).

In contrast, total first half 2019 imports of tropical wood products in Germany declined 9% to 42,400 MT and 7% in Poland to 34,900 MT. The decline in Germany is partly driven by increasing reliance on indirect imports of tropical wood products from other EU countries by German distributors.

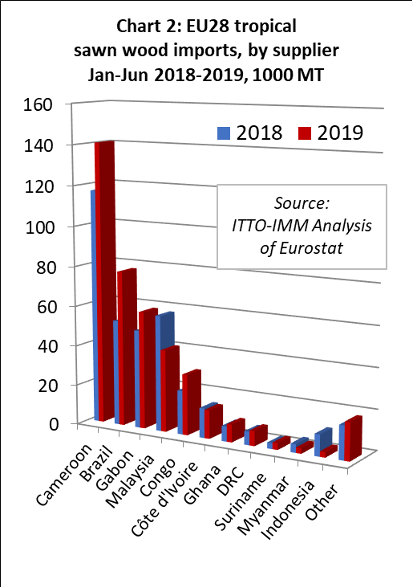

12% rise in EU imports of tropical sawn wood

EU imports of tropical sawn wood increased 12% to 405,600 MT in the first half of 2019 compared to the same period in 2018. Import value increased 7% to €388.4 million. This aligns with market commentary earlier in the year, with sawn hardwood importers reporting generally steady, in some cases strong trading in 2019 including in tropical timber, despite some slowdown in economic activity and increased downside concerns about the medium-term outlook.

During the first half of 2019, EU businesses reported some issues with supply, but overall consumption was holding up while sawn hardwood prices were steady to firm with demand underpinned by construction sector consumption.

Imports from Cameroon, particularly slow in the first half of last year, increased 20% to 141,000 MT during the first six months of 2019. Imports also increased sharply from several other countries including Brazil (up 47% to 77,600 MT), Gabon (up 20% to 58,600 MT), Congo (up 38% to 30,200 MT), Ghana (up 17% to 8,800 MT) and DRC (up 32% to 7,300 MT). These gains offset a 29% decline in imports from Malaysia, to 40,900 MT, and a 4% decline from Côte d’Ivoire, 14,200 MT. (Chart 2).

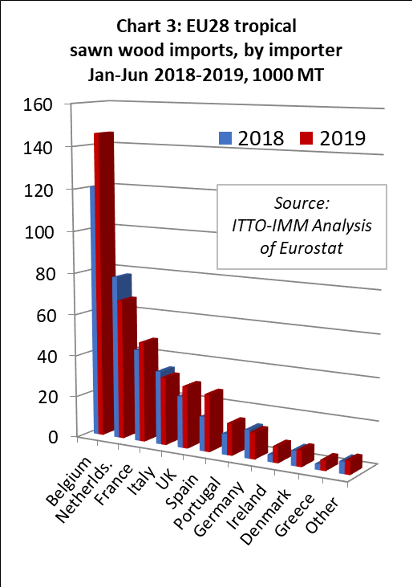

The trend towards increased concentration of tropical sawn wood imports into the EU by way of Belgium has continued this year. In the first half of 2019 compared to the same period in 2018, imports into Belgium increased 21% to 145,900 MT. Imports also increased in France (up 9% to 48,200 MT), the UK (up 21% to 29,800 MT), Spain (up 67% to 27,570 MT) and Portugal (+53% to 15,200 MT). However, imports fell 14% to 67,100 MT in Netherlands, 8% to 32,500 MT in Italy, and 7% to 12,600 MT in Germany. (Chart 3).

The decline in EU imports from Malaysia this year was attributed by some importers to a decline in the availability of PEFC certified product following the suspension of MTCS certification in Johor and Kedar states led to the total certified area in Malaysia to fall by around 25%. According to MTCS, both states are now working to regain their MTCS certificates. There was a 40% fall in imports of Malaysian sawn hardwood in the Netherlands, the leading EU destination for Malaysian timber where there is also a particularly strong emphasis on sourcing certified product.

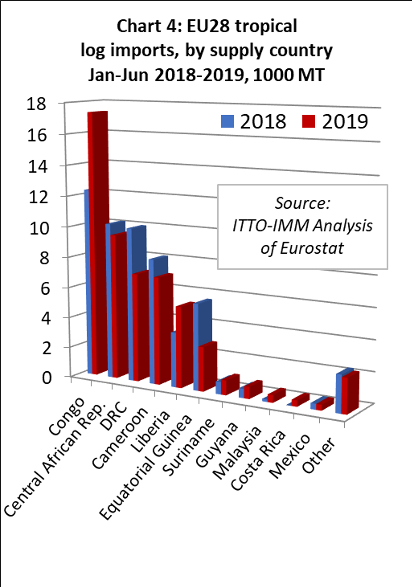

Congo Republic increasing focus for EU log imports

After recovering a little ground in 2018, EU imports of tropical logs maintained the level of the previous year in the first half of 2019. Imports of 54,400 MT during the first half of the year were 0.3% more than the same period in 2018. Import value fell 3% to €26.2 million during the period.

While EU imports of tropical logs increased by 41% to 17,400 MT from Congo, the leading supplier, and by 48% from Liberia, to 5,300 MT, these gains were offset by falling imports from the Central African Republic (-7% to 9,500 MT), DRC (-29% to 7,100 MT), Cameroon (-14% to 7,000 MT), Equatorial Guinea (-49% to 2,900 MT), and Suriname (-19% to 1000 MT) (Chart 4).

After a slow start to the year, tropical log imports picked up pace in France and Belgium in the second quarter of 2019. By the end of the first half, France had imported 22,800 MT of tropical logs, 3% more than the same period in 2018, while imports into Belgium were up 9%, at 14,600 MT. However, in the first six months of 2019, imports were down 15% to 6,800 MT in Portugal, 12% to 4,800 MT in Italy and 78% to 1,700 MT in the Netherlands.

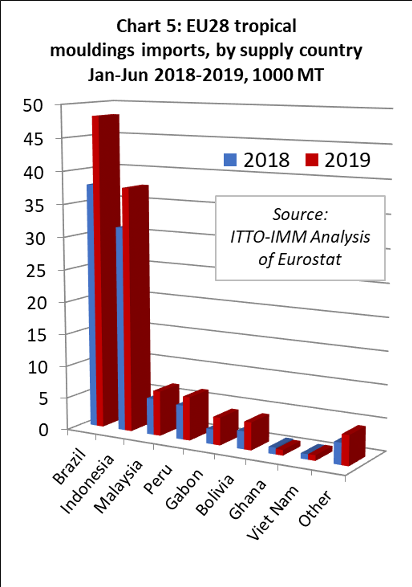

Sharp rise in EU tropical moulding imports

EU imports of tropical mouldings (which includes both interior mouldings and exterior decking products) increased sharply, by 26%, to 114,100 MT in the first half of 2019. Import value increased 37% to €173.5 million.

EU imports of tropical mouldings increased from all the leading suppliers of this commodity in the first half of 2019 including Brazil (+28% to 48,200 MT), Indonesia (+19% to 37,600 MT), Peru (+27% to 6,700 MT), Malaysia (+23% to 6,900 MT), Gabon (+85% to 4,200 MT) and Bolivia (+55% to 4,200 MT) (Chart 5).

Although most of the Brazilian hardwood moulding product imported into the EU is likely to consist of tropical hardwood, a proportion will be “lyptus”, comprising plantation grown eucalyptus, which some European importers are known to stock and to offer as a PEFC certified product.

In the first half of 2019, imports of tropical mouldings increased in all the leading EU markets including France (+37% to 36,500 MT), Germany (+9% to 20,800 MT), Netherlands (+51% to 19,400 MT), Belgium (+1% to 16,000 MT), the UK (+56% to 6,900 MT), and Italy (+20% to 4,900 MT).

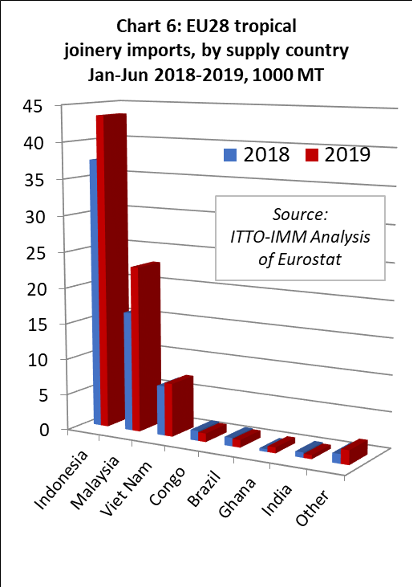

Tropical Asian suppliers make gains in EU joinery market

EU imports of tropical joinery products, mainly doors (from Indonesia), and laminated window scantlings and kitchen tops (from all leading tropical suppliers), increased 21% to 79,500 MT in the first half of 2019. Import value increased 33% to €166 million.

EU imports of tropical mouldings increased in the first half of 2019 from all three of the countries that dominate international trade in tropical joinery products including Indonesia (+16% to 43,500 MT), Malaysia (+39% to 23,000 MT), and Viet Nam (+7% to 7,400 MT) (Chart 6).

In the first half of 2019, imports of tropical joinery products increased by 5% to 32,400 in the UK, by 129% to 24,800 MT in the Netherlands, and by 4% to 9,600 MT in Belgium. There were also significant gains in two smaller markets for tropical joinery products, Ireland increasing 87% to 1,600 MT and Poland up 58% to 800 MT. These gains offset a 26% fall in France to 5,300 MT, and a 24% fall in Germany to 3,300 MT.

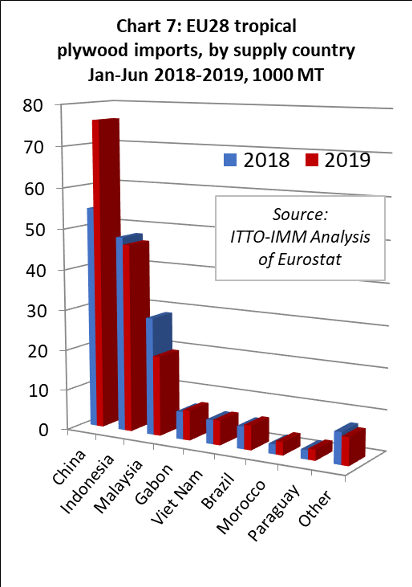

EU imports of tropical plywood made in China continue to increase

EU imports of tropical plywood products were 174,200 MT in the first half of 2019, 8% more than the same period last year. Import value increased 14% to €154.4 million.

A large and growing proportion of the plywood faced with tropical hardwood imported into the EU is manufactured in China. The EU imported 76,100 MT of this product from China in the first half of 2019, 39% more than during the same period in 2018. Imports also increased from Gabon, by 9% to 7,400 MT, Viet Nam, by 3% to 6,100 MT, and Brazil, by 9% to 6,000 MT. These gains offset a 4% fall in imports from Indonesia, to 46,300 MT, and 32% fall from Malaysia, to 19,700 (Chart 7).

EU imports of tropical hardwood plywood during 2019 are being strongly influenced by market issues elsewhere in the world, notably the US-China trade dispute which has led to a dramatic decline in Chinese hardwood plywood exports to the United States and increasing diversion of Chinese product to the EU, mainly destined for the UK.

In the first half of 2019, UK imports of tropical plywood products increased 17% to 95,400 MT, despite widespread reports of overstocking and declining plywood consumption in the country. UK imports of tropical hardwood plywood from China increased 81% to 55,000 MT in the first six months of 2019, while UK imports from Malaysia fell 32%, to 16,800 MT, and were down 14% from Indonesia to 17,800 MT.

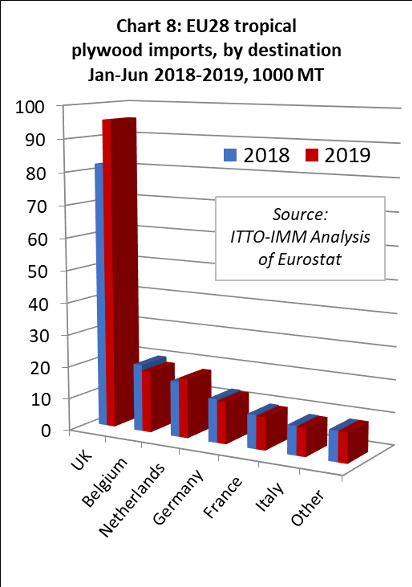

Tropical plywood imports into other EU countries were less volatile in the first half of 2019. Moderate declines in imports in Belgium (-8% to 19,100 MT), Germany (-3% to 13,000 MT), France (-3% to 10,100 MT) and Italy (-2% to 8,800 MT) were offset by an 8% rise in imports in the Netherlands, to 18,500 MT. (Chart 8).

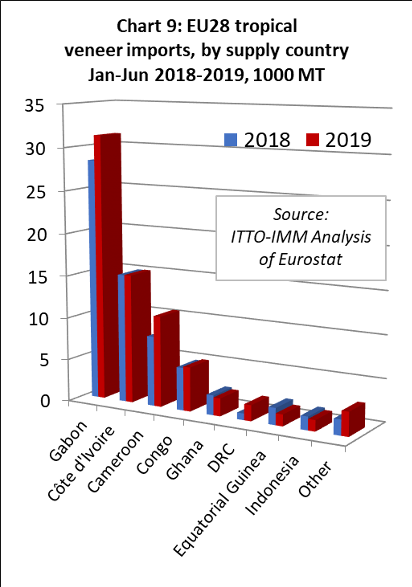

EU imports of tropical veneer up 11%

EU imports of tropical veneer increased 10% to 71,900 MT in the first half of 2019 compared to the same period last year. Import value increased 9% to €92.3 million.

The EU imported 31,300 MT of veneer from Gabon in the first half of 2019, 10% more than in the same period in 2018. Imports from Cameroon rose sharply, by 30% to 10,700 MT, after a poor year in 2018. There was also a significant increase in imports from DRC, by 143% to 1,900 MT in the first half of 2019. Imports from the Congo Republic were up 3% during the same period, at 5,200 MT. Imports from Cote d’Ivoire were stable at 15,200 MT, while imports from Ghana declined 10% to 2,100 MT and imports from Equatorial Guinea fell 31% to 1,400 MT. (Chart 9).

In the first half of 2019, tropical veneer imports increased by 20% in France, to 27,400 MT, by 22% in Italy, to 18,900 MT, and by 48% in Greece to 5,500 MT. However, imports fell by 17% in Spain, to 9,600 MT.

The recent slight recovery in EU imports of tropical hardwood veneer and logs may be linked to a minor recovery in EU domestic production of plywood with a tropical hardwood face. Although EU manufacturing of this product fell sharply in the 2005-2015 period as controls on log exports were introduced in Gabon and other African countries, and with the influx of large volumes of cheap product from China, there is evidence of a small upturn in production since 2015. According to Eurostat, EU production of tropical hardwood plywood increased from 315,000 m3 in 2016, to 409,000 m3 in 2017 and 446,000 m3 in 2018. This comprised 177,000 m3 in Spain (10% less than in 2017), 114,000 m3 in France (+6%), 123,000 m3 in Italy (+54%) and 31,000 m3 in Estonia (+32%).

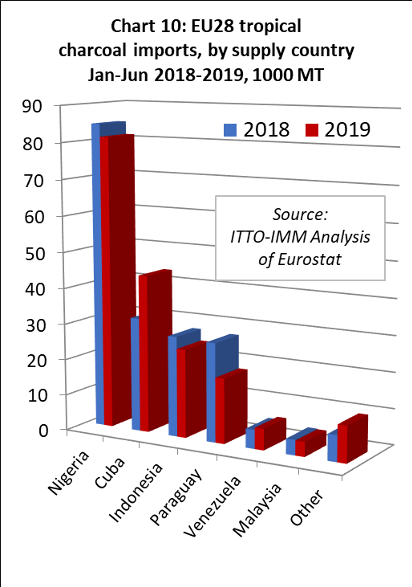

EU imports of tropical charcoal level off in 2019

Between 2015 and 2018, the value of EU charcoal imports increased from around €225 million to US$280 million, almost exactly half of which derives from tropical countries. However, the rising trend slowed in the first half of 2019, with EU import value of tropical charcoal reaching €74 million, only 3% more than the same period in 2018.

EU import quantity of tropical charcoal declined 0.3% to 187,900 MT in the first half of 2019. While there was a 38% increase in imports from Cuba, to 43,800 MT, and a 13% gain from Venezuela, to 5,900 MT, this was offset by declining imports from Nigeria (-4% to 81,200 MT), Indonesia (-12% to 24,600 MT), and Paraguay (-34% to 18,000 MT) (Chart 10).

A revealing study of the charcoal market in the UK was recently published by the Earthworm Foundation (formerly known as The Forest Trust). This involved the use of wood identification techniques to establish the actual content, in terms of wood species and likely origin, of the charcoal contained in bags bought from major retailers in the UK and comparing this with the claims on origin made.

The study showed that, in 2018, 100% of the analyzed charcoal bags in the UK contained tropical or subtropical charcoal, 81% of the bags were certified FSC, and only 38% had a declared country of origin, with only Namibia or South Africa being identified. The report concludes that “consumers cannot make an informed choice, because in a majority of cases, information on the country of timber origin is not mentioned on charcoal bags…. Retailers highly rely on FSC charcoal, giving additional guarantee to consumers…There is still an important opacity in the UK charcoal industry; steps need to be taken to move towards greater transparency”.

The report also observed that charcoal is not included in the EU Timber Regulation and recommended that it should be included. More details at https://www.earthworm.org/uploads/files/European-charcoal-market_UK_2019_190606_093634.pdf

PDF of this article:

Copyright ITTO 2020 – All rights reserved