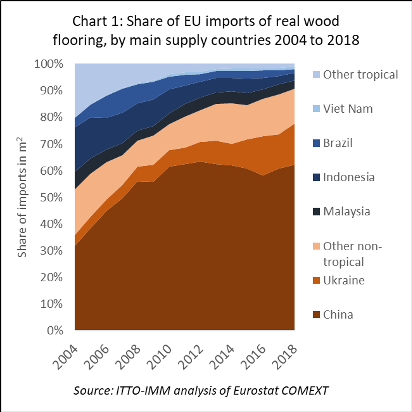

Total imports of real-wood flooring into the EU increased 6.2% to 29.52 million m2 in 2018. Tropical countries accounted for only 9.2% of total imports in 2018, down from 11.1% the previous year and close to 50% before the financial crises. After nearly two decades of almost continuous decline, the real-wood flooring sector in the EU is now a negligible market for VPA partner timber products (Chart 1).

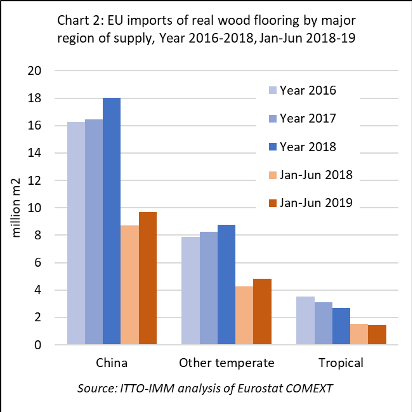

EU imports of real-wood flooring from China increased 10% to 18.04 million m2 in 2018. China’s share of total imports increased from 59.2% in 2017 to 61.1% in 2018, regaining some of the share lost between 2012 and 2016. This trend continued in the first half of 2019; imports from China, at 9.68 million m2, were 11% more than the same period last year (Chart 2).

The biggest increase in EU flooring imports in 2018 was from other temperate countries, notably Ukraine. Imports from Ukraine increased 19% to 5.02 million m2 last year. Ukraine’s share of total imports increased from 15% in 2017 to 17% in 2018. Imports from Ukraine and several other temperate countries have continued to rise in 2019. In the first six months, total imports from temperate countries other than China were 4.83 million m2, 13% more than the same period in 2018. Imports from Ukraine increased 17% to 2.91 million m2.

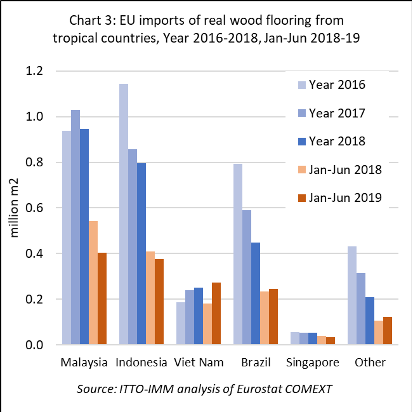

EU imports of real-wood flooring from tropical countries fell by 12% in 2018 to 2.70 million m2 and were down by 4%, to 1.46 million m2, in the first six months of 2019. Imports from Malaysia were down 8% to 950,000 m2 in 2018 and fell 25% to 400,000 m2 in the first half of 2019. Imports from Indonesia were down 7% to 800,000 m2 in 2018 and a further 8% to 380,000 m2 in the first half of this year. Imports from Brazil fell 24% to 450,000 m2 in 2018 but recovered a little ground, up 4% to 240,000 m2, in the first half of 2019.

Only Viet Nam has consistently bucked the declining trend. Imports from Viet Nam, which increased 4% to 250,000 m2 in the whole of 2018, had already reached 270,000 m2 in the first 6 months of 2019, 50% more than the same period in 2018. (Chart 3).

Flooring offers insights into wider EU market for tropical timber

Despite the shrinking share of tropical countries in the EU market for real-wood flooring, analysis of this sector is worthwhile for the insights it provides into wider market trends more directly relevant to VPA countries.

Due to the efforts of the European Association of Parquet Flooring Manufacturers (FEP), this is the only sector using significant volumes of hardwood for which there is reliable data on the usage of different species in finished products. Flooring is also a high visibility product which impacts significantly on the look and feel of a room. The consumer choices made in the selection of flooring are likely to be strongly correlated with choices of other products, such as furniture, kitchens, doors and panelling which are all more important markets for VPA Partner countries and for which there is little or no data on wood species preferences.

The real-wood flooring sector highlights the significance of fashion trends in driving demand for different wood products. A complex mix of forces is at play in setting these trends. Fashion is itself an iterative process driven by the interaction, through the media and other communication channels, between designers, manufacturers and retailers on the one hand, and their customers on the other.

In their designs and material choices, manufacturers and designers both respond to signals from their customers and the wider socio-economic environment, and some of the larger and more influential can themselves reinforce consumer attitudes and preferences. The smaller, less influential and innovative, or simply more risk-adverse, will follow their lead and reinforce the trend.

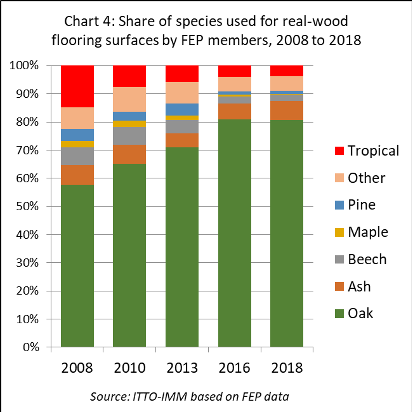

Analysis of the real-wood flooring sector suggests this process has been a powerful force in reducing demand for tropical timber products in the EU market. FEP data shows how a single species – oak – has come to dominate surfaces in this sector. The share of oak surfaces in European real-wood flooring production was 80.7% in 2018, up from 71% five years earlier and 58% in 2008. During the same period, the share of tropical timber fell from 15% to less than 4% (Chart 4).

The initial preference for oak amongst manufacturers was due to the species being readily available from regional sources in Europe, the species attractive grain and good working properties, and that it had strong appeal as a “traditional” product in the European market.

The fashion has focused very much on European oak due to its distinctive grain and colour, although American white oak is widely used as an alternative. As it is perceived to be less attractive to European customers, manufacturers have been less inclined so far to use American red oak despite this being the staple wood for flooring in North America.

Over time, European manufacturers have extended the range of looks that can be achieved with oak through development of new stains and other finishes and broadened applications with development of new surface coatings. The appeal of European oak to customers has been further boosted by it being widely portrayed as an environmentally benign material, widely available either FSC or PEFC certified, contributing to development of rural livelihoods and with a low carbon footprint.

However, this level of market dominance of a single, relatively slow growing and naturally constrained, hardwood species, has created its own problems for the European hardwood sector. Demand has declined for other hardwoods, including temperate species which are now much more readily available, such as beech and maple, as well as tropical timbers. Prices for European oak have risen dramatically in recent years, particularly since manufacturers in China and other Asian countries have also followed the fashion for oak.

Under normal circumstances, high prices for oak might be expected to encourage manufacturers to look for and switch to cheaper hardwood alternatives. However, there has been enormous resistance to this. The only species other than oak to have seen any recent growth in usage has been ash, primarily because it can most closely match the grain and look of oak. Availability of ash timber may also be increasing, temporarily, due to the spread of ash die back in Europe and the emerald ash borer in North America.

The reasons for the resistance amongst European manufacturers to switch away from European oak are not entirely clear and may be varied. Some larger hardwood processors in the EU have mitigated the impact of rising oak log prices through innovation to increase yield, for example through CT scanning of logs and use of increasingly thin face veneers alongside new impact resistant layers.

The wood flooring sector in Europe is also highly fragmented, dominated by many smaller manufacturers, which lack the resources to develop and market innovative new products using different wood species. In this sector, there are many more followers of fashion than operators willing and able to shift customers’ entrenched attachment to oak.

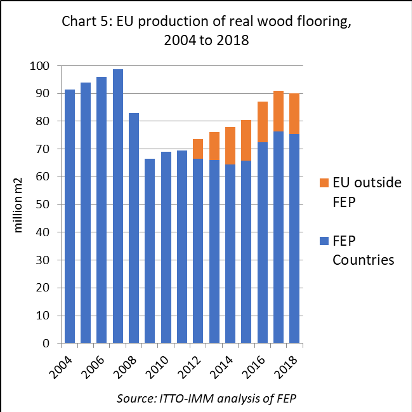

The ability of real-wood flooring manufacturers in Europe to influence the market is further constrained by the intense competition in the sector, not only from other real-wood manufacturers, but from the wide and expanding range of producers of laminates and non-wood products. Margins have been severely squeezed by this competition. One indicator of this competition is provided by FEP data which shows that, after reaching a decadal high in 2017, real-wood production in FEP countries fell 1.3% to 75.3 million m2 in 2018 (Chart 5). Total real-wood flooring consumption in FEP countries also fell in 2018, by 2.3% to 79.9 million m2.

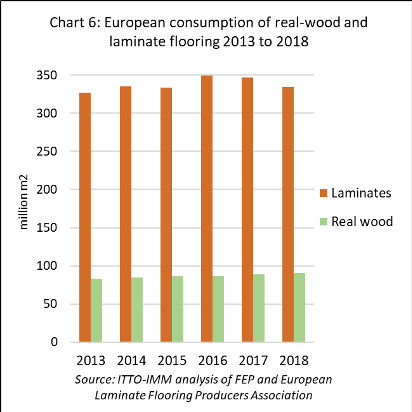

The real-wood flooring sector faces particularly fierce direct competition from Europe’s laminate flooring industry which is large and sophisticated with sales dwarfing those of the real-wood sector (Chart 6). Through scale and innovation, this industry has become increasingly capable to supply products which mimic the look and feel of real wood, while offering superior technical performance and lower maintenance at a fraction of the cost.

According to the Association European Producers of Laminate Flooring total European sales of laminate flooring were 334 million m2 in Europe in 2018, around 4% less than in 2017 and the second straight year of decline. While sales of laminate flooring in Eastern Europe were flat at 128 million m2 in 2018, sales in Western Europe declined 6% to 206 million m2.

This shows that even the laminates industry may be losing share in the EU to a range of non-wood flooring products such as luxury vinyl tiles, porcelain tiles, and products made of recycled materials and other renewables like bamboo and cork.

PDF of this article:

Copyright ITTO 2020 – All rights reserved