The Netherlands has traditionally played an important role as a driver of tropical timber demand in the EU. In addition to relatively large timber consumption for water protection works, and a long-term preference for Asian meranti for window frames, the Netherlands acts as a hub for distribution of tropical wood products to other parts of the EU. The Dutch government and private sector have also been influential in development of environmental procurement practices throughout the continent.

This influence looks set to continue as the Netherlands has been one of the few bright spots for tropical wood imports in Europe in the last two years. At the same time, Dutch traders and agencies, notably the Dutch sustainable trade initiative IDH which is the main backer of the European Sustainable Tropical Timber Coalition (STTC), continues to support far-reaching policies designed to ensure that importers and buyers in the EU give preference to FSC and PEFC certified products.

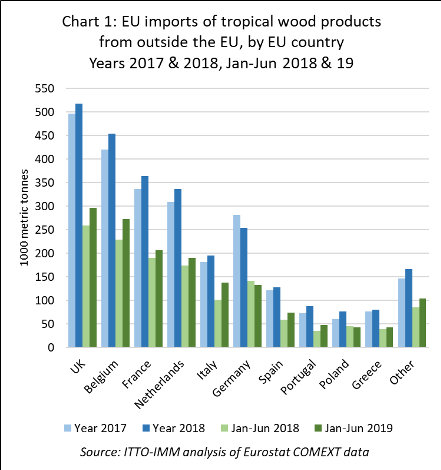

For direct imports, the Netherlands is the fourth largest importer of tropical wood products in the EU, after the UK, Belgium, and France (Chart 1). In 2018, the Netherlands accounted for 12.8% of all EU imports of wood-based products in Chapters 44 (Wood) and 94 (Furniture) of the internationally harmonised system (HS) of product codes, up from 12.3% the previous year.

Total imports of tropical wood products into the Netherlands from tropical countries were 336,000 tonnes in 2018, 9% more than in 2017. Import growth continued in the first half of 2019, with imports of 190,000 tonnes, another 9% gain on the same period last year.

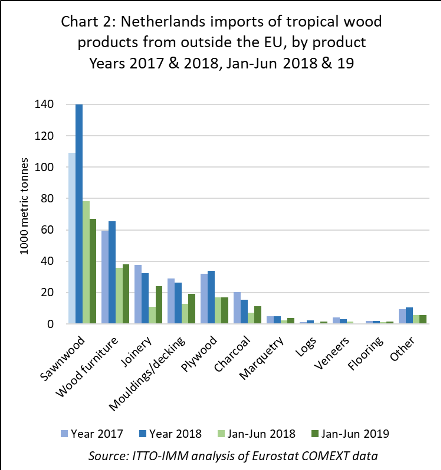

Much of the gain in Netherlands tropical wood imports in 2018 was in sawnwood, for which imports increased 29% to 140,000 tonnes (Chart 2). However, this growth stalled in the first six months of 2019, with imports of 67,000 tonnes 15% less than the same period in 2018. Growth in Dutch imports of wood furniture from the tropics has been more consistent, rising 10% in 2018 to 65,000 tonnes and reaching 38,000 tonnes in the first 6 months of 2019, 6% more than the same period last year.

Dutch imports of joinery products from the tropics have been quite volatile, falling 14% to 32,000 tonnes in 2018 but rebounding by over 120% to 24,000 tonnes in the first half of 2019. This volatility is all due to trade in glulam (mainly window scantlings from Malaysia), which declined very sharply in 2018 but staged a significant recovery this year. Imports of doors from tropical countries into the Netherlands, mainly from Indonesia, have been increasing more consistently.

Dutch imports of mouldings and decking products from tropical countries – mainly Indonesia – fell 9% to 26,000 tonnes in 2018 but increased by over 50% to 19,000 tonnes in the first half of 2019. In contrast, plywood imports increased 6% to 34,000 tonnes in 2018 and were stable, at 17,000 tonnes, in the first half of 2019. Imports of plywood from Indonesia are rising, offset by a decline in imports from Gabon.

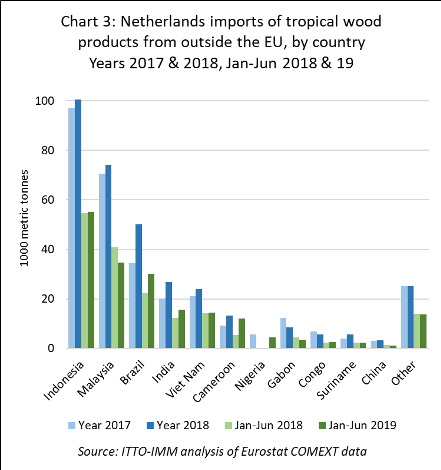

In 2015, Indonesia overtook Malaysia to become the largest single supplier of tropical timber products to the Netherlands, with quantity just exceeding 100,000 tonnes in 2018, 4% more than the previous year. Imports from Indonesia in the first half of 2019 were level at 55,000 tonnes. Imports from Malaysia increased 5% to 74,000 tonnes in 2018, but were down 15%, at 35,000 tonnes, in the first half of this year.

Imports from Brazil increased sharply, by 45%, to 50,000 tonnes in 2018, and were up another 35% to 30,000 tonnes in the first half of 2018. Imports from Viet Nam and India, in both cases mainly of wood furniture, are also rising. Imports of sawn wood from Cameroon, volatile into other EU countries in recent years, were recovering ground in the Netherlands in both 2018 and 2019. Nigeria recently emerged as a significant supplier of charcoal to the Netherlands (Chart 3).

Netherlands as a timber distribution hub

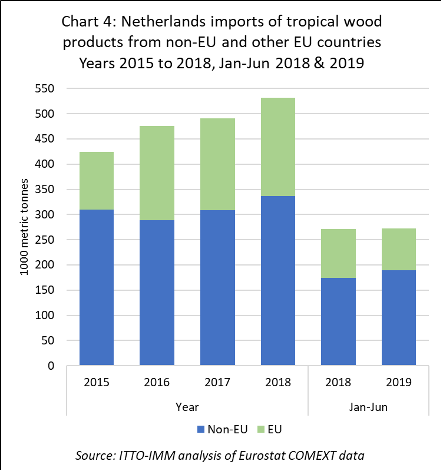

To some extent, the focus on direct imports under-estimates the role of the Netherlands in overall EU trade for tropical wood products. If imports from other EU countries are included, total imports of tropical wood products into the Netherlands were 532,000 tonnes in 2018, a gain of 8% compared to 2017. Imports in the first half of 2019 were 272,000 tonnes, unchanged from the previous year (Chart 4). Much of the tropical wood entering the Netherlands from other EU countries comprises logs and sawnwood sourced via Belgium and Germany, and veneer sourced via Poland.

The Netherlands also distributes large quantities of tropical wood products to other parts of the EU. In 2018, the Netherlands exported 92,000 tonnes of products known to contain tropical wood to other EU countries, mainly sawnwood, logs, and plywood with a smaller volume of decking, joinery and veneer. The leading EU destinations were Belgium, Germany, the Czech Republic, France, the UK, and Italy.

Continuing potential for market growth in the Netherlands

The national report on the Dutch timber market issued in advance of the 77th session of the ECE Committee on Forests and the Forest Industry (COFFI), due to be held from 4 to 7 November 2019 in Geneva, Switzerland, highlights continuing potential for market growth in the Netherlands, in contrast to other European countries where market conditions appear to be deteriorating.

According to CPB (Netherlands Bureau for Economic Policy Analysis), the Dutch economy will grow by 1.8% in 2019 and 1.5% in 2020. Although the uncertainty created by external issues such as US trade policy and Brexit has undermined confidence, business investment growth has been robust so far this year and the disposable income of Dutch households continues to increase on the back of tax cuts, rising wages and high levels of employment. At 3.3% of the work force, the level unemployment in the Netherlands is now lower than before the financial crisis and amongst the lowest in the EU.

After the sharp 40% decline in house completions between 2008 and 2012, residential construction has been recovering due to low mortgage rates and government stimulus measures. House completions in 2018 were 6% up on the previous year.

The number of residential building permits continued to rise in the Netherlands in 2018, although at a slower rate than in 2017 due to lack of available land for new construction and the constrained capacity of municipalities and private developers. Building contractors are suffering from a lack of skilled workers while projects are being delayed by shortages in the supply of concrete. This year housing completions are expected to be slightly down on last year.

While the pace of new housing construction is slowing slightly, there is still strong activity in the Netherlands timber industry in 2019, particularly in sectors involved in finishing and remodelling activities, such as joinery and furniture. According to Statistics Netherlands, total timber industry turnover increased in the second quarter of 2019 by 9.0% compared to the same quarter of 2018. Dutch timber companies also anticipate profitability to be enhanced by declining material prices on the back of the slowing global economy.

According to the COFFI report, the positive market prospects in the Netherlands extend to tropical products, for which consumption is benefitting from strong construction activity and from associated good demand for joinery, garden decking and furniture products. However, the report also cautions that consumption levels were insufficient to absorb larger tropical wood import levels in 2018, leading to a build up in stocks.

Demand for tropical timber for water protection works, a particularly significant market in a country with large areas reclaimed from the sea, has remained more consistent than the construction sector over the long term. The sector suffered less during the financial crises, propped up by government investment, and has grown only slowly since.

There is also some expectation that timber might benefit in other sectors from increased environmental awareness amongst consumers and architects. Although competition with other building materials is intense, there are indications that timber is recovering some market share. For example, there are signs of wood being preferred over PVC plastic in renovation projects.

Concerted efforts to reinforce this trend in the Netherlands are being made by private sector timber promotion activities led by Centrum Hout, a collaboration between the Netherland Timber Trade Association (NTTA) and Dutch Timber Industry Association (NBvT).

Centrum Hout has developed campaigns targeting specific end use applications. For example, one plan which aims to increase use of certified tropical timber in water protection works is supported by 12 companies. All are provided with detailed technical and environmental guidance.

Communication activity is also targeted at the most influential decision makers in the specification and procurement process. Civil engineers have been identified as a particularly crucial target group and there is a strong focus on direct contact with the largest engineering firms to identify their concerns and the information they need.

Centrum Hout has also commissioned work on life cycle assessment (LCA) and full life cycle costing studies to assess the relative environmental impact and costs of using different materials on a cradle to grave basis

Netherlands proactive support for green supply chains

Alongside this promotion work, the Dutch timber trade and industry has taken a proactive approach to develop the green supply chain, setting ambitious sustainability criteria for all members of the Netherlands Timber Trade Association (VVNH) that together account for 80% of tropical timber imports. Through development and communication of this policy, the trade is recognised by government and NGOs as a credible partner.

According to the latest annual trade report issued by VVNH, association members have already achieved their original target that 90% of wood traded be certified by either FSC or PEFC by 2020. However, this target has been met primarily through Netherlands heavy reliance on softwoods and sheet materials from supply regions, particularly in Europe, where there is widespread availability of certified wood.

The trade report, which covers VVNH’s 216 members and was prepared by the consultancy firm Probos, indicates that 91.9% of the 1.8 million m3 of softwood, hardwood and sheet materials imported by VVNH companies in 2018 was backed with an FSC or PEFC certificate, about the same level as 2017.

The highest proportion of certified imports came in softwood, up from 98.4% in 2017 to 99.1%. Certified sheet materials showed an increase in the certified total from 93.5% to 94.5%, while certified temperate hardwood imports were up from 46.6% to 59.6%. But the proportion of certified tropical timber imported into the Netherlands fell from 66.1% in 2017 to 63.6% last year.

VVNH Director Paul van den Heuvel said that there were various factors involved in this decline. “Members earlier reported that it was becoming increasingly difficult to get verified sustainable tropical wood. Now this is also reflected in the figures,” he said. “Among the causes is that some certified forest concessions are in conflict areas, making them no longer accessible. Also implicated is increasing tropical timber demand in Asia, where sustainability is hardly ever a purchasing criterion.”

In addition, Jan Oldenburger from Probos added; ‘Malaysia is the most important supplier of certified material for the Dutch market and if the certified sustainably managed forest area there decreases, it will impact the market share.”

In the Netherlands, leading timber and associated trade associations, construction and retail sector bodies, unions, conservation organisations and various government ministries have signed a ‘Covenant’ to make “verified sustainable” the norm across the supply chain.

Mr Van den Heuvel, chairman of the Covenant board, said the VVNH and the other 23 signatories needed to step up their efforts in supporting sustainable tropical timber demand, which in turn supports sustainable tropical forest management.

“One thing is clear,” he said. “If the market for verified sustainable wood doesn’t lead quickly to a better business case for sustainable forest management in the tropics, we will probably lose even more certified concessions, with over-harvesting or deforestation as a result. In short, the remaining challenges are great and all parties must work hard to meet Covenant objectives”.

Limitations of Netherlands “verified sustainable” monitoring

There are several limitations to the VVNH assessment of certified timber trade in the Netherlands. Although the exact methodology of the assessment is not made clear (at least in English translation) the report seems to be based primarily on self-declarations by importing companies, so there is no guarantee of accurate reporting of certified volume in trade. The report also seems to consider all “certified product” as alike, without consideration of the extent to which companies might be using “mixed content” labels with differing proportions of wood derived ultimately from certified forest.

The report is also comprehensive with respect only to trade by VVNH members. Although an effort has been made to assess the overall Dutch market, the report acknowledges technical problems in acquisition of data from companies that are not members of the association. The report only covers roundwood, sawnwood, veneer and plywood, the principle products traded by VVNH embers, and does not assess the proportion of secondary and tertiary products that may be certified.

This last fact is particularly relevant in relation to the handling of FLEGT licensed timber from Indonesia. VVNH do not include FLEGT licensed timber from Indonesia, which is all SVLK certified, in their definition of “verified sustainable”, but instead record it separately as “verified legal”. If this is included, the proportion of verified tropical wood in the Dutch market, according to the VVNH analysis for 2018, rises by only 10.2%, to 73.8%.

This approach of labelling FLEGT licenses as no more than “verified legal” seems to significantly undervalue the actual and potential role of such licensing to facilitate market access for tropical timber products in the EU.

From a purely technical perspective, a large and growing proportion of EU tropical timber imports now constitute composite secondary and tertiary products, like furniture. Due to the complexity of supply chains, these products have always been much more challenging to certify by way of the FSC and PEFC frameworks. This is particularly true in tropical countries like Indonesia, Viet Nam and Thailand, where much wood material for furniture in exports is derived from smallholders.

A key feature of national systems of certification like SVLK, the basis for FLEGT licensing, is that it provides a framework for verification of these more complex products from tropical countries, which also offer significant sustainability benefits in terms of value-added production and rural livelihoods.

The “verified legal” label also fails to differentiate the FLEGT process and all it entails in terms of broad stakeholder engagement in governance reform, development of comprehensive nationwide wood tracking systems, independent monitoring, and procedures to ensure equitable access for all producers, from the much narrower forms of “legality verification” offered for specific supply chains by several auditing companies.

STTC to report on EU importers views of tropical timber

A new survey of leading importers’ views on growing the EU market for tropical timber will be unveiled at the Sustainable Tropical Timber Coalition (STTC) annual conference in Berlin. Key findings from the survey, undertaken by the Dutch consultancy Probos, will be presented and delegates invited to discuss and share their ideas on the issue. This will be just one focus at the conference titled “Exploring pathways to verified sustainable tropical timber” to be held 20 November.

According to STTC, “the background to the event will be continuing contraction in overall use of tropical timber in the European market at a time when there is growing urgency to increase sales of verified sustainable tropical material”.

“The whole supply chain has a role, responsibility and interest in reversing this downward trend, and market-wide effort is vital for success,” states the STTC. “Growth of the EU tropical timber market and the share of verified sustainable timber will incentivise tropical suppliers to introduce sustainable forest management.”

“We need to find ways to improve the business model of certified forest companies and to the best of our ability to make them stronger,” added Benoît Jobbé-Duval managing director of ATIBT, the International Tropical Timber Technical Association, which runs the STTC partner tropical timber branding campaign Fair&Precious.

According to the STTC announcement of the event, one conference session will be headlined “Promoting tropical timber- a new urgency” which STTC indicates will focus on developing markets for third party certified tropical timber products in Europe.

A spokesperson from the City of Berlin will also describe its work to promote timber via its procurement process and leading European companies will present their marketing initiatives.

In a session on “Navigating the journey from the EU Timber Regulation through to verified sustainable”, STTC state that “speakers will examine the stepwise approach to sustainability certification, including through building on existing regional and national forest management initiatives, such as the EU Forest Law, Enforcement Governance and Trade initiative and Verified Sourcing Areas. There will be presentations on trends in sustainable tropical timber market share and the impact of certification on landscapes”.

STTC note that a significant part of the day will be given over to delegate participation and feedback using the table talks format and discussions will be initiated under the themes “The sustainable verification journey” and “Tropical timber promotional imperatives and activities”.

According to STTC, “the overarching message of the Conference will be the importance of building scale in the verified sustainable tropical timber market to achieve real impact in tropical forest governance and management….the day will close on a rousing note, with a ‘call to arms’ for the tropical timber sector, including an address from a leading tropical timber country figure, highlighting the key role of forests, trees and timber to their future development”.

The Conference is the day before the two-day International Hardwood Conference in Berlin, giving delegates the opportunity to attend both. After the STTC conference, there will be an opportunity to network with fellow delegates and participants of the International Hardwood Conference.

The STTC is expecting a capacity audience drawn from across the tropical timber sector, with delegates already signed up from the spectrum of timber businesses, trade federations, the research sector, international agencies, NGOs and government.

More details, including registration, at:

PDF of this article:

Copyright ITTO 2020 – All rights reserverd