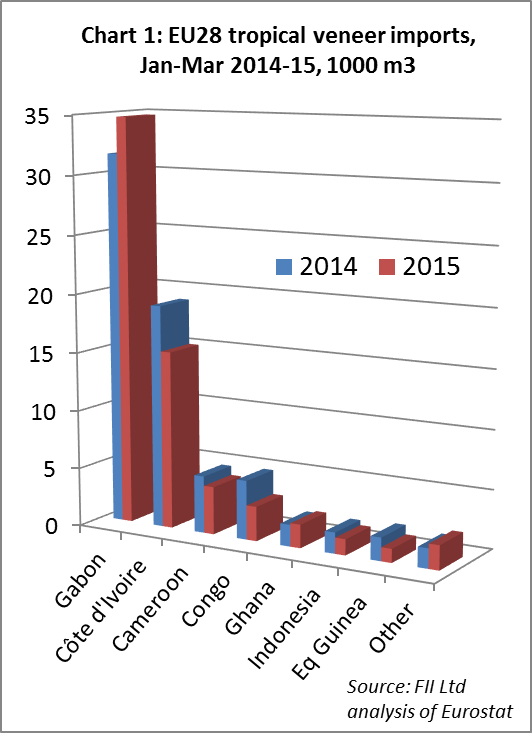

EU imports of tropical hardwood veneer were 63,550 m3 in the first quarter of 2015, 6% down on the same period in 2014. Imports from Gabon, the largest supplier, were 10% up at 34,744 m3. This gain failed to offset falling imports from Côte d’Ivoire (-20% to 15,189 m3), Cameroon (-16% to 4,085 m3), and the Republic of Congo (-42% to 2938 m3) (Chart 1).

The year-on-year rise in imports from Gabon in the first quarter of 2015 compares to very depressed imports in the same period of 2014 following a change in Gabon’s GSP status. Buyers had taken steps to build stocks in the last quarter of 2013 to beat the anticipated rise in EU import duty from 3.5% to 7% which came into effect on 1 January 2014.

The EU subsequently suspended the GSP tariff for okoume veneer from Gabon on 24 June 2014 and backdated the suspension to 1 January 2014. The suspension was designed to support Europe’s domestic manufacturers of tropical hardwood plywood which are concentrated in the Poitou-Charentes region of France. The 0% tariff on okoume veneer from Gabon is now expected to apply at least until the next GSP review on 31 December 2018.

Following suspension of the tariff in mid-2014, EU imports of tropical hardwood veneer from Gabon have averaged around 12,000 m3 per month. Imports were averaging around 10,000 m3 per month in the first 11 months of 2013 before surging to 20,000 m3 in December of that year.

Declining imports of hardwood veneer from countries other than Gabon imply that tropical wood continues to lose share in Europe’s sliced veneer sector.

In line with prevailing fashion in the European flooring and furniture sectors, Europe’s sliced veneer market is now heavily dominated by oak.

Supply problems for European oak veneer

Europe’s heavy reliance on a single hardwood species may now be creating problems for manufacturers. A recent article in the German trade journal EUWID suggests that large-scale veneer plans in eastern and south-eastern are now suffering from severe shortages of oak. The scarcity is particularly evident for mass-produced veneers used by veneered panel and furniture manufacturers. There is also limited supply of thick-cut oak veneers used in the European flooring industry at a time when demand from this sector is just beginning to pick up again. EUWID notes that prices for some specifications of oak veneer have risen by up to 20% since the middle of last year.

EUWID attributes lower availability of high-quality oak for the European veneer industry to a variety of factors including competition on procurement markets from barrel manufacturers and Asian buyers and lack of availability of supply from Ukraine. The latter is said to be due mainly to concern over lack of reliable evidence of legality in Ukraine following implementation of EUTR. This is a more significant factor than to the political situation which has had only a minor effect on timber harvesting.

However the supply of Ukrainian oak to the European veneer seems certain now to become even more restricted following the decision of the Ukrainian Parliament, on 9 April 2015, to pass law #1362 which bans log exports.

The tight supply situation and rising prices for oak veneer has some potential to create new market opportunities for tropical hardwood veneer. However EUWID also warns that supplies of popular tropical veneer species such as zebrano and macassar are also now restricted to European buyers. This is due both to firm demand in other sales markets and to concerns over the reliability of legality documentation to satisfy EUTR requirements.

19% increase in EU imports of tropical hardwood plywood

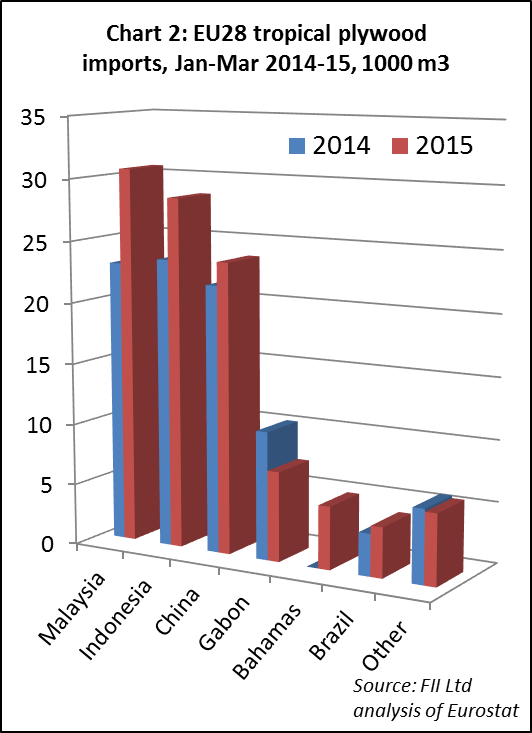

EU imports of tropical hardwood plywood were 105,201 m3 in the first quarter of 2015, 19% more than the same period in 2014. Imports from Malaysia, the largest supplier, were 33% up at 30,658 m3. There were also significant gains in imports from Indonesia (up 21% to 28,521 m3) and China (up 9% to 23,675 m3). After several years of decline, imports from Brazil increased by 19% to 4090 m3 during the period. For the first time ever, the Bahamas has emerged as a significant supplier in 2015, contributing 5124 m3 in the first quarter of the year. However imports from Gabon were down 30% at 7328 m3 during this period (Chart 2).

Over 80% of all EU imports of tropical hardwood plywood in the first quarter of 2015 was destined for only four Member States. In declining order of significance, these were the UK, Belgium, Netherlands and France.

In the 12 months to March 2015, there has been a consistent increase in demand for tropical hardwood plywood in both the UK and Netherlands. Demand has been more changeable in France and Belgium during this period, but imports of tropical hardwood into both countries began 2015 more strongly than in 2014.

The sharp year-on-year rise in EU plywood imports from Malaysia in the first quarter of 2015 is partly explained by particularly low levels of trade during the same period in 2014. Malaysia lost GSP preferential tariff status from 1 January 2014 which contributed to a spike in EU imports from Malaysia in the closing months of 2013 followed by a slowdown in early 2014.

European imports of Indonesian plywood benefitted during the first quarter of this year from stronger construction sector activity, particularly in the UK and Netherlands, and from more regular break-bulk shipments.

However, there has also been intense competition from European birch plywood which has been readily available at relatively low prices during 2015. The extreme weakness of the rouble against both the euro and the dollar has particularly boosted the price competitiveness of Russian birch plywood. EU imports of Indonesian plywood are widely expected to have been weaker in the second quarter than in the first quarter of 2015.

Although imports of okoume plywood from Gabon were slow in the first quarter of 2015, recent reports in EUWID indicate that overall European demand for okoume plywood has been reasonable this year.

Ordering of okoume plywood by the construction industry has been quite lively, particularly for interior remodelling and especially in the Netherlands. There’s also been a slow rise in okoume plywood consumption in the boat industry. The French market, while still subdued, has regained a little ground this year.

Improved demand combined with limited supply, especially for FSC certified material, has allowed okoume plywood manufacturers to push through minor price increases this year. Lead times for delivery are also becoming more extended.

Given the low level of import of finished plywood from Gabon, the signs are that this trend is benefitting Europe’s domestic manufacturers of okoume plywood more than Gabon-based operations.

Big brands give firm backing to EUTR

An article by Mike Jeffree, formerly Editor of the UK’s TTJ and now a freelance journalist, highlights the strong support for the EU Timber Regulation (EUTR) amongst some of Europe’s largest consumer brands in timber products.

The article draws on interviews with representatives of three companies: Anders Hildeman, Global Forestry Manager of IKEA, the home product retailer; Julia Griffin, Sustainability Manager at B&Q, the UK home improvement leader and part of the wider Kingfisher group; and Bruce Uhler, Environmental Sustainability Ambassador at Kährs, the Swedish flooring giant.

All the interviewees emphasised that eradication of illegal trading is a core corporate value. And this is not just for the sake of image or because it undercuts legitimate business. It is also seen as a necessary pre-requisite to recruitment of the best staff, to encouraging business investment and to minimising commercial risks.

“The forests and people at the sharp end who depend on them are core concerns for Kährs” said Bruce Uhler. “In fact, our unequivocal environmental stance is one reason people join us. For the millennial generation, it’s a prerequisite to recruiting new talent.”

Similarly, Anders Hildeman noted that “naturally IKEA cares about green issues; forests, habitat, biodiversity. At IKEA it’s absolutely embedded and central to corporate social responsibility (CSR).”

Training and Communication

All three companies have the complexity of dual status under the EUTR; being both ‘operators’, which first place timber on the EU market, and traders, which sell it on. But it did not require major revision of their anti-illegal timber strategies. Illegality risk assessment and due diligence were already integrated into their operations, and they are also all working towards 100% certified sustainable sourcing.

What the EUTR did do, however, was prompt renewed scrutiny and reappraisal of existing systems and a step up in communication on illegality risk.

“The Regulation has specific due diligence requirements we had to accommodate,” said Mr Hildeman. “We also undertook extensive EUTR training and, I believe, it also helped us strengthen legality messages to suppliers.”

Supply chain communication is a B&Q focus too. “EUTR made proof of legality harder, especially for paper-, chip-or fibre-based products due to complex supply chains,” said Julia Griffin. “But the more we ask suppliers questions, the easier obtaining information and risk assessment becomes.”

But further proof provided of the overall effectiveness of their existing legality controls is that none of the companies had to axe suppliers post EUTR.

“We pre-empt problems later by being clear on legality requirements with them from the outset,” said Mr Uhler.

“Occasionally we’ve stopped sourcing from companies when documentation is inadequate, but we work with them and restart trading when problems are resolved,” said Mr Hildeman. “I understand some operators dropped suppliers where due diligence was particularly challenging, but that wasn’t the EUTR’s objective. It disincentivises suppliers from raising legality standards in places which need most support. It’s an area the EU should examine.”

What B&Q believes the European Commission (EC) should also now do is assess the EUTR’s performance to date and publish the findings. “Currently there’s insufficient data on its impact on illegal logging and illegal trade flows into the EU,” said B&Q Sustainability Manager-Products Julia Griffin. “It’s vital to improving its operation and something we hope we’ll get from the EC’s current EUTR review.”

Enforcement issues

One area where there’s solid consensus that the EUTR is not where it should be is enforcement uniformity. “There’s wide variance between member states in levels of scrutiny and requirements of Competent Authority (CA) enforcement agencies,” said Ms Griffin. “That risks distorting trade routes and accentuating unfair competition due to uneven policing and administrative and financial burdens of compliance.” The disparity created particular confusion for smaller suppliers, but also problems for “multinationals trying to centralize a uniform EUTR approach across member states”.

“It would also help suppliers and operators, and make the EUTR more effective, if the EC devised a way not to have 28 different due diligence systems across 28 EU states,” said Mr Hildeman.

There are calls too for the EUTR to be dovetailed more closely with forest certification. “The EU’s stated aim is to support sustainable forest management, but with business obliged to apply the same EUTR due diligence to certified as uncertified products, interest in voluntary certification could drop,” said Ms Griffin.

Mr Hildeman said certification schemes, with “systematic chain of custody”, should be accepted as evidence of negligible illegality risk. “Clearly FSC and PEFC certified products can’t have carte blanche through EUTR due diligence, but a negligible risk classification is reasonable and logical,” he said. “And it would allow the EU to focus on higher risk areas and what should be the EUTR’s prime target, large-scale illegal timber trading by organised crime.”

“Legality should be the base level requirement, with sustainability the natural next step – we should aim for both,” said Mr Uhler.

Global approach

These multi-national companies would also like to see closer alignment between the EUTR and its enforcement agencies, and anti-illegality systems elsewhere. Their prime targets are the US Lacey Act and Australian Illegal Logging Prohibition Regulation (AILPR), but Japan’s Goho scheme and China’s embryonic legality system were also mentioned.

“If we harmonise legality definitions internationally, it could give all schemes momentum and create a ripple effect into other markets,” said Mr Hildeman. “It would also further benefit the battle against organised crime, which operates in the illegal trade globally.”

Another recommendation is to reduce or end current EUTR product category exemptions. “We appreciate the operational difficulties of including all products when EUTR implementation remains a work in progress,” said Ms Griffin. “But ultimately we want all wood products in scope so we’re not effectively running two [legality assessment] systems. It would make it more practical across larger product ranges.”

The value of FLEGT VPAs

None of the companies are currently major tropical timber consumers, largely they say because of their product profiles and customers’ tastes. But all urged even greater backing for tropical suppliers in meeting EUTR requirements.

“It’s reported that European tropical timber imports have declined since introduction of the EUTR, and the fact that they’re seen as high risk of illegality and a due diligence challenge is clearly implicated,” said Mr Hildeman.

“The tropics are experiencing some of the fastest deforestation, partly due to illegal logging, but mainly land conversion, so we need to support them in the marketplace to incentivise forest maintenance” said Mr Uhler.

It’s because of its particular focus on tropical areas that all three companies also want to see the EUTR-associated FLEGT Voluntary Partnership Agreement (VPA) initiative for supplier countries given added impetus.

Under the programme, VPA signatory states undertake forest governance reform and establish legality assurance systems. In return, they can supply FLEGT-licensed timber, which is exempt further due diligence risk assessment under the EUTR.

As no FLEGT-licensed timber has yet been shipped, after several years of the VPA scheme’s existence, Ms Griffin acknowledged it had not been front of mind at B&Q. “That’s not a criticism, we accept it’s a demanding initiative working in hugely challenging environments, and it has to be 100% water tight,” she said.

At the same time, B&Q would now like to see information flow on VPA progress stepped up.

“Ultimately we’ll be putting FLEGT-licensed timber on the market, so trade understanding needs to be developed, so we can get behind it and position it to customers,” said Ms Griffin.

Mr Hildeman agreed. “It is going to be a challenge to create market incentive for FLEGT-licensed timber, as it will depend on achieving a critical mass,” he said. “It can’t be a market niche. Once those first countries start supplying licensed

material, we need others following quickly behind.”

In particular, said Ms Griffin, it’s important to communicate the benefits VPAs are already having on the ground in supplier countries, in terms of transparency, forest governance, and stakeholder engagement, another condition of the Agreements. “Our customers pick up on social stories about supply chains,” she said. “They associate with them and subsequent purchases mean more.”

“If we can communicate that FLEGT motivates suppliers to maintain their forest and supports livelihoods that pass down the generations, that’s a really powerful message,” said Mr Uhler.

Mr Hildeman believes that once FLEGT-licensed timber is available in the EU market, the initiative could also have value as evidence of risk mitigation under other market legality regulation, such as Lacey and the AILPR. That, in turn, would give it added impetus. So his final statement, is that, the sooner outstanding issues in the EUTR are resolved and FLEGT-licensing up and running, the better. “I don’t underestimate the challenges, but my message would be let’s get on with it!”

PDF of this article:

Copyright ITTO 2020 – All rights reserved