World production of furniture has grown constantly over the last five years. The CSIL Word Furniture Outlook currently estimates its worth at about US$480 billion, up from US$437 billion in 2013. Production in Europe and North America stagnated between 2009 and 2014. High-income countries accounted for 39% of production in 2014 and middle and low-income countries for 61%. The share of middle and low-income countries in world production first exceeded 50% in 2010 and has risen steadily since.

A closer look at the different regions reveals variations among the low and middle-income countries. CSIL observed that production in South America, the Middle East and Africa was static between 2009 and 2014. The only region to show growth in the reporting period was Asia and Pacific. Production there almost doubled over the last five years.

According to CSIL, the world’s five largest furniture producing countries in 2014 were China, the USA, Germany, Italy, and India. Production in China more than doubled between 2009 and 2014. Over half of world furniture production was in China last year. Meanwhile, production in the US and India is increasing slowly while production is stagnant in Germany and gradually declining in Italy.

World furniture trade has also grown steadily since the low of US$94 billion in 2009 during the financial crises. CSIL estimates that the trade volume reached US$134 billion in 2014, an 8% increase compared to US$124 billion in 2013. CSIL expects further growth to US$141 billion in 2015. This estimate is based on assumed world GDP growth of 3.5% in 2015, with forecast growth of 2.4% in advanced economies and 4.3% in emerging and developing economies.

Only half of world furniture trade takes place between countries in geographically distant regions, according to a study published by the EU Commission at the end of 2014. The most important of these flows are from the middle and low-income countries of Asia to the United States and Europe. In the European Union plus Norway, Switzerland and Iceland about 75% of foreign furniture trade takes place among the same countries. In the NAFTA area (USA, Canada and Mexico), about 28% of foreign furniture trade is among the three countries. In the Asia and Pacific region about 38% of total foreign furniture trade is within the region.

Upward trend in EU furniture production continues

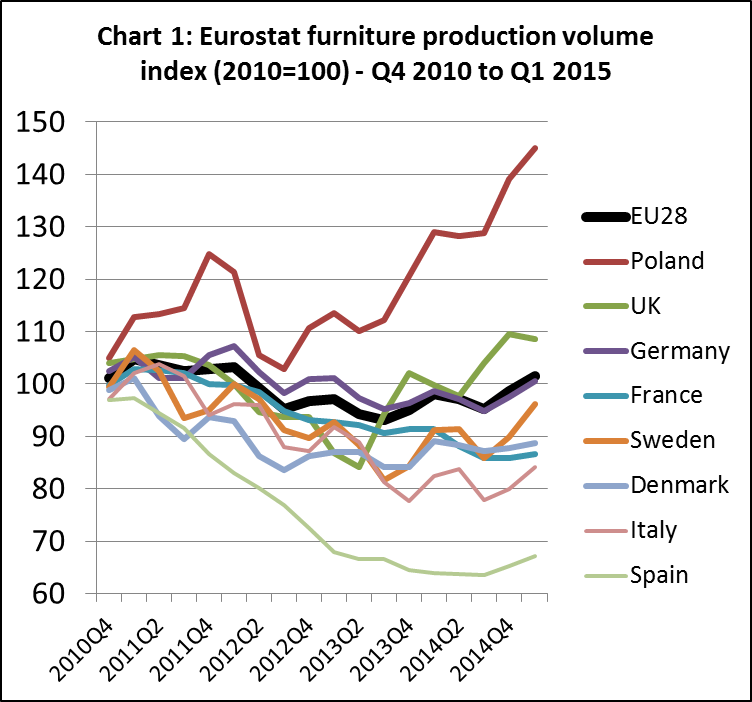

Eurostat data shows that furniture production in the EU is slowly recovering from the period of weakness in 2012 and 2013. The production volume index was around 1.6% above the 2010 reference level in the first quarter of 2015, the first time it has exceeded this level since early 2012 (Chart 1).

Europe’s three largest furniture producing countries – Italy, Germany, and Poland – all raised their output in 2014 and early 2015. Furniture production in Poland increased particularly sharply last year and in the first quarter of 2015. In the first quarter of 2015, Polish production was 45% higher than the 2010 reference level. The furniture edition of the German trade newsletter EUWID reports that Polish producers exported 78% of their output in 2014. And around 80% of the exports went to other EU countries, with Germany being the most important recipient, followed by France, the Czech Republic, Belgium and the UK.

The trend in German furniture production has been very much in line with the overall EU trend over the last four years. German production has been rising slowly since the end of 2013. The German furniture industry remains under pressure from cheaper products, especially from Poland and China, both on the domestic market and abroad.

However, to some extent German furniture producers are benefiting from robust domestic construction sector and relatively strong German consumer confidence as well as recovery in several European export markets. The kitchen furniture industry, for example, has seen a positive trend in 2014 and early 2015, both on the domestic and in various European markets. According to the German furniture industry federation VDM, there is an on-going trend towards higher-quality and priced kitchen furniture in Germany. Moreover, the export markets in the Benelux region, in particular, rebounded last year. The positive trend for German kitchen furniture producers has continued in the first two months of 2015, according to EUWID, with an increase in turnover of around 1.3%. Turnover in the German upholstery furniture sector was stable in the first two months of this year.

Italian furniture production dipped in mid-2014 but picked up speed again in the last quarter of 2014 and first quarter of 2015. EUWID reports that Italian furniture producers booked good increases in export sales towards the end of 2014, especially in non-European countries such as the USA, China, Saudi Arabia and the United Arab Emirates. On the domestic market Italian furniture producers profited from tax advantages for building renovations, which include an extra bonus for furniture, according to FederlegnoArredo.

EU wood furniture trade analysis

The remainder of this report contains a review of the most recently available EU wood furniture trade data to end March 2015. Seasonal fluctuations are a major feature of the EU furniture trade. EU wood furniture exports are almost exclusively interior products, mainly destined for other western countries, which tend to rise sharply at the end of the year in the run-up to the Christmas holiday season. In contrast, EU imports of wood furniture tend to be higher in the opening months of the year. This is partly because they contain a high proportion of exterior products mainly imported from Asian countries in the spring months. In addition, a relatively large proportion of the Asian furniture imported into the EU is bought during the January sales season.

Against this background, the following analysis of EU furniture trade uses “12 month rolling average” data. This is calculated for every month by averaging the monthly imports or exports for the previous twelve months. The data irons out seasonal variations so that potentially significant long-term changes can be more easily identified.

Fall in EU wood furniture trade surplus

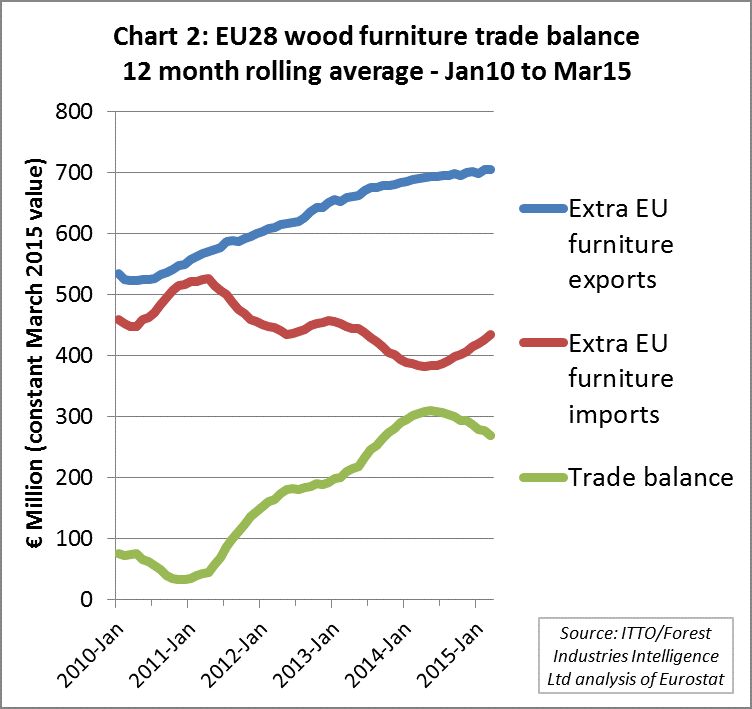

Chart 2 illustrates the trend in EU trade balance of wood furniture using 12 month rolling average data between January 2010 and March 2015. It shows a steady rise in EU wood furniture exports over the last four years, although the rate of growth has flattened somewhat in recent months.

On the other hand, EU wood furniture imports, which had declined since 2011 – except for a brief interruption in 2012 – have rebounded in late 2014 and throughout the first quarter of 2015. This is partly due to an increase in wood furniture deliveries from China, which had plummeted in 2013 and recovered again in recent months. Vietnam has also delivered more wood furniture to Europe again in the first months of 2015.

The shift in trade balance is partly due to improved consumption in individual EU markets, especially in Germany and the UK, where the construction sector has been comparatively strong in 2014 and early 2015.

Impact of EUTR

The recent downturn and subsequent recovery in deliveries from China and Vietnam may be partly attributable to the EU Timber Regulation (EUTR). The sharp fall occurred at around the time the EUTR came into force in March 2013 and may have been partly due to concerns about the reliability of evidence provided by Chinese and Vietnamese suppliers to demonstrate negligible risk of illegal timber origin. Now the EUTR has been in effect for two years, more buyers may have established reliable supply chains and documentation and feel more confident about importing wood furniture from outside the EU.

There is some evidence for the impact of EUTR from interviews with large European retailers. A recent trade article based on interviews with representatives of European furniture manufacturer and retailer IKEA, flooring manufacturer Kahrs, and DIY retailer B&Q observes:

“EUTR did not require major revision of their anti-illegal timber strategies. Illegality risk assessment and due diligence were already integrated into their operations, and they are also all working towards 100% certified sustainable sourcing. What the EUTR did do, however, was prompt renewed scrutiny and reappraisal of existing systems and a step up in communication on illegality risk”.

The interviewees noted that EUTR prompted an extensive effort to tighten and extend existing procedures, gather additional data from suppliers and to train staff but did not generally lead to any significant change in the supply base. The interviewees said that they had to temporarily stop sourcing from some companies when documentation was inadequate. However problems were almost always resolved so that trading could resume.

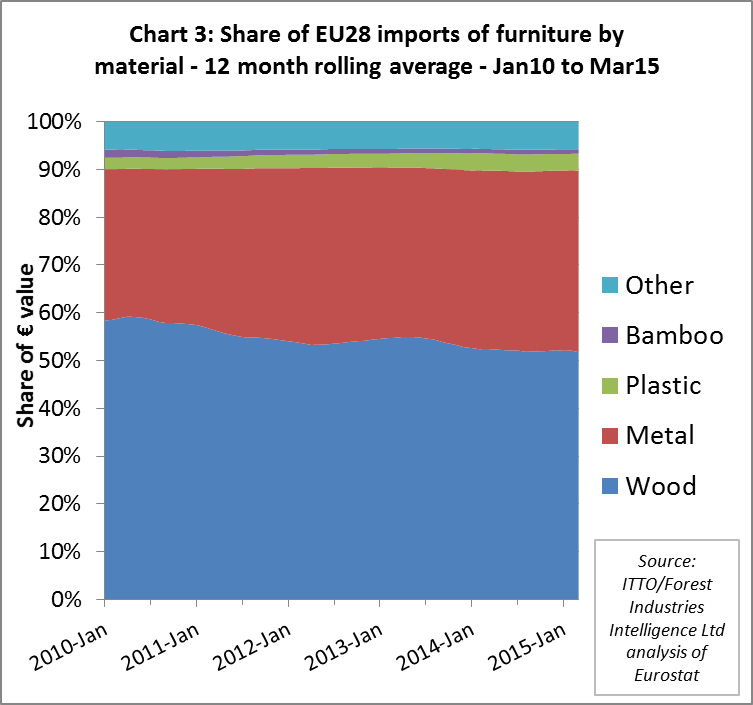

Another line of evidence for the impact of EUTR is provided by analysis of the share wood in total furniture imports (Chart 3). Wood’s share of total furniture import value fell in the second half of 2013 when EUTR was first implemented, from around 55% to 53%. This loss of share was at the expense of metals and, to a lesser extent, plastic. However, wood’s share of import value stabilised in 2014 and 2015. In the 12 months to March 2015, wood still accounted for 53% of furniture import value, compared to 38% for metals, 3.5% for plastic, 1% for bamboo and 5.5% for other materials.

Euro-dollar exchange rate influencing trade balance

An important factor in the recent euro-based increase in EU wood furniture imports is the dramatic loss in value of the euro against the US dollar over the last twelve months. This has led to exchange-rate related price inflation. The euro lost around 16% of value against the US dollar between June 2014 and June 2015. Early this year the euro hit a historic low, triggered by the renewed financial troubles in Greece and the Swiss government decoupling the franc from the euro in December 2014.

Turnaround in imports from Asia

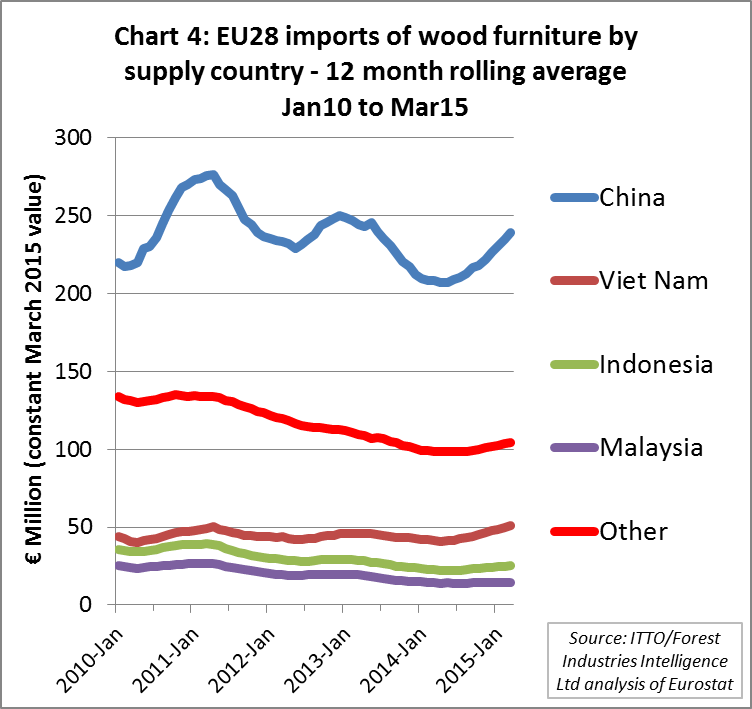

Chart 4, which shows the trend in EU imports of wood furniture by supply country using 12 month rolling average data, reveals that the lasting downhill trend in imports has turned around at the end of 2014. This positive trend continued through the first quarter of 2015. In the first quarter of this year, Chinese wood furniture deliveries to the EU rose by 12.4% and China alone accounted for 55% of total imports. In the first quarter of last year, China’s share stood at 54%.

Vietnam and Indonesia also regained some of the ground lost between 2011 and 2014, while deliveries from Malaysia were stagnating. Vietnam’s share in total imports rose from 11% to 12 % between the first quarter of 2014 and the first quarter of this year. Indonesia’s share was stable at 6% while Malaysia’s slipped from 4% to 3%.

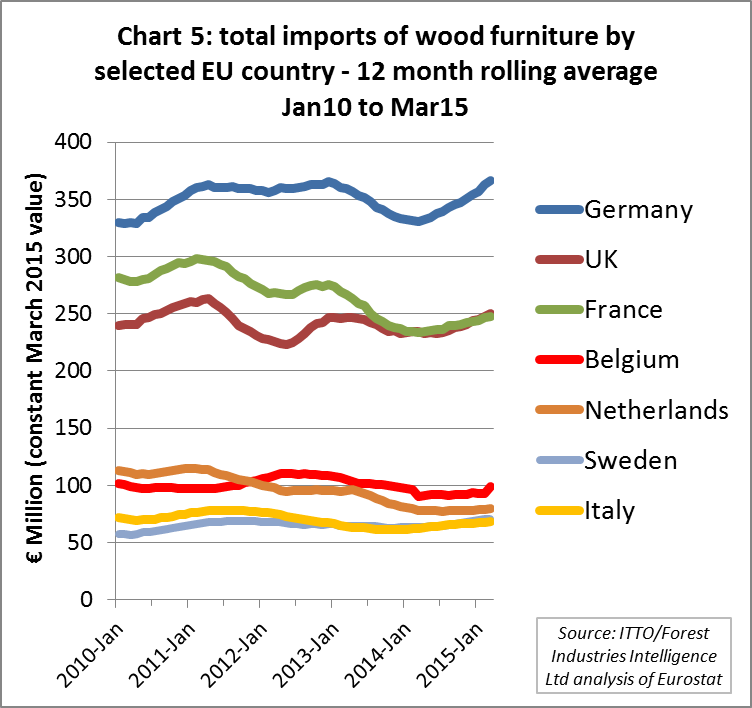

Chart 5 shows the trend in all imports of wood furniture (from both within and outside the EU) by EU member state using 12 month rolling average data. It indicates that the overall downhill trend that persisted during most of the period from 2011 to 2014 has turned around in various member states.

The important German market went through a period of weakness from the end of 2012 to the beginning of 2014. However, German wood furniture imports have picked up significantly in recent months and early 2015 volumes exceed the previous peak in early 2012. UK furniture imports have been relatively stable overall in the last four years and were showing signs of strengthening in the first quarter of 2015. Imports into France, much affected by the financial crisis in recent years, are also showing signs of recovery. Among the smaller importing countries, the slow but steady stabilisation in Italy has continued through the first few months of 2015 and Sweden and Belgium are also recovering slowly. However imports into the Netherlands remain at a very low level.

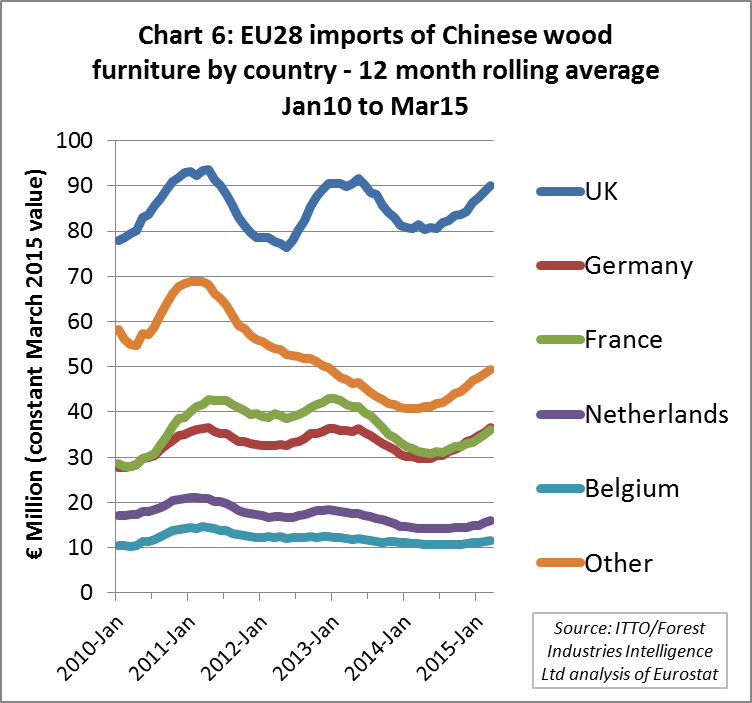

Analysis of EU member states’ imports of Chinese wood furniture reveals strong recovery across a wide range of markets since mid-2014 (Chart 6).

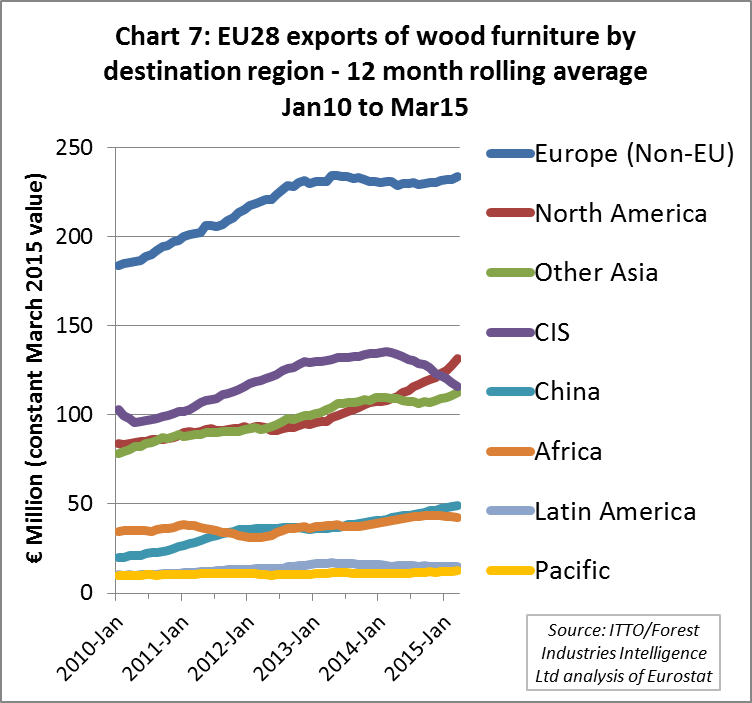

Lower EU furniture exports to CIS region

Chart 7 shows the trend between January 2010 and March 2015 in EU exports of wood furniture to non-EU countries by destination region using 12 month rolling average data. It reveals that the slow-down noted in growth of EU exports to Russia and Eastern Europe from the second half of 2013 has since turned into decline. This reflects political tensions between the EU and Russia in connection with the crisis in the Ukraine as well as economic difficulties in Russia, which have been aggravated by the political crisis. According to an article in the German magazine Spiegel, the World Bank expects Russian GDP to shrink by 2.7% this year. This in turn is expected to have a significant impact on Russian imports of consumer products from the EU and Switzerland during the rest of 2015.

EU wood furniture exports to European countries outside the EU were stable over the last twelve months. The same is true for deliveries to Latin America, the Pacific region and Africa. On the other hand, exports to North America continued to rise sharply and deliveries to China and other Asian countries are also increasing.

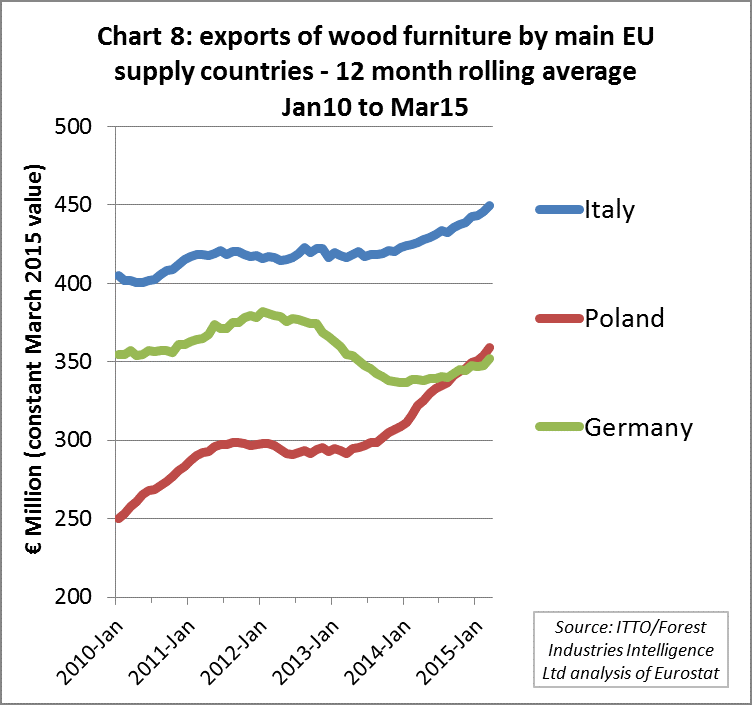

Poland now second most important EU exporter of wood furniture

Chart 8 shows the trend in exports of wood furniture (both within and outside the EU) by the EU’s three largest furniture producing countries in the period to end March 2015. Exports from Poland and Italy have performed more strongly than those from Germany in recent years. Italy is still by far the largest European exporter of wood furniture but Poland has been closing the gap in the last two years. In late 2014 Poland overtook Germany to become Europe’s second largest exporter of wood furniture. However German exports have been rising since the start of 2014 after a sharp downturn in 2012 and 2013.

Besides competitive pressure, the comparatively weak performance of German exporters over the last few years could also be due to the relatively strong domestic market in Germany. Against this background, German producers were under less pressure than Italian furniture manufacturers, for example, to find new export opportunities.

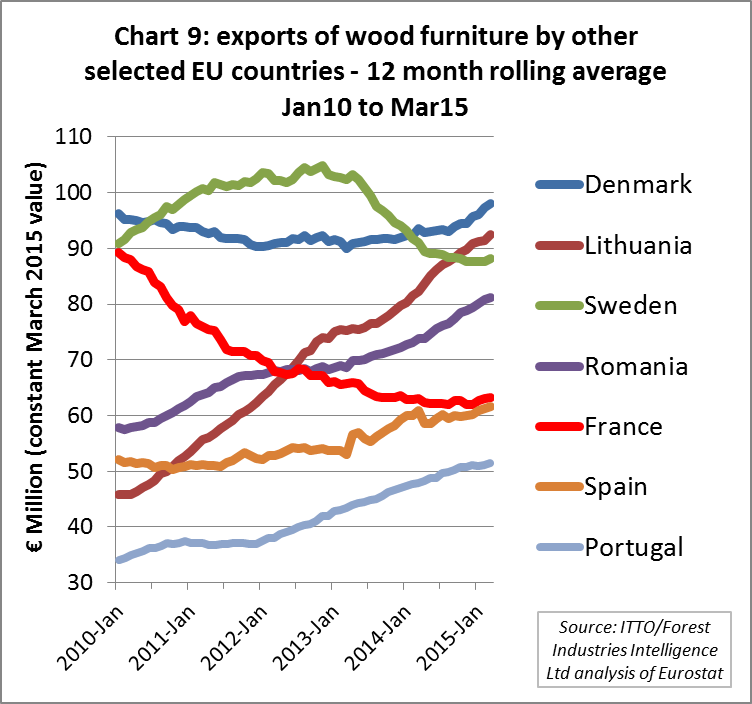

Exports by other EU wood furniture exporting countries showed mixed trends (Chart 9). The sharp downward turn in French exports registered since 2010 levelled off in 2014 and exports have since stabilised at a relatively low level. Exports from Denmark show a slow but steady upturn since 2013 and the country is now the fourth largest exporter of wood furniture in the EU. Sweden has fallen back to sixth place following a steep decline in trade in 2013 and 2014. However Swedish exports are now showing signs of stabilisation. The gradual increase in wood furniture exports by Portugal and Spain since 2012 and 2013, respectively, has continued through 2014 and into 2015.

Lithuania has overtaken Sweden in the ranking of Europe’s largest wood furniture exporters. Lithuanian exports more than doubled between 2010 and 2015. According to “enterpriselithuania.com” major furniture producers invested heavily in production expansion in the country in the last few years. Lithuania is also a major supplier of IKEA. Some of the loss in importance of Sweden and the increase in importance of Lithuania may be linked to IKEA shifting production capacities.

Romania is also growing in importance as a furniture exporter, with average monthly exports rising around 35% between January 2010 and March 2015. Romania benefits from abundant quality raw material, particularly beech, and a labour force which is relatively cheap by European standards with a long-tradition of wood furniture manufacturing. Romania’s exports are mainly destined for the EU, Russia, and Middle East. There is also rising domestic furniture demand in Romania, particularly in the hospitality sector. Romania’s manufacturers increasingly concentrate on higher quality hardwood furniture as Chinese manufacturers are taking a rising share of the Romanian market for lower end furniture based on wood panels.

Fashion for contrasting light and dark woods

The 2015 “Trend Telegramm” published by a leading German wood importer and trader for the IMM Cologne and Milan furniture fairs notes a trend towards either very light or very dark coloured wood in European furniture production this year. Rustic walnut was found to be particularly popular and gaining ground also in kitchen furniture production. Kitchen furniture producers are increasingly combining timber with high-gloss and other surfaces. Moreover, the Trend Telegramm noticed an increased presence of crafted solid wood furniture in Milan.

PDF of this article:

Copyright ITTO 2020 – All rights reserved