ITTO’s analysis of Eurostat year-end data showed that the total value of tropical wood imports into the EU increased slightly in 2018, although at a slower rate than imports from non-tropical countries tropical wood continued to lose share last year (ITTO MIS Volume 23 Number 4 16-28 February 2019).

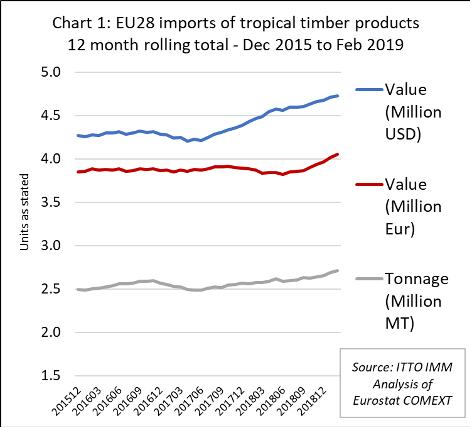

Closer analysis of monthly data to end February 2019 reveals a slightly more positive picture, showing that EU imports of tropical timber products began to rise more strongly, both in quantity and value terms, in the second half of 2018. EU imports began to rise earlier, from the start of 2017, in dollar terms as the euro strengthened significantly against the US currency between December 2016 and February 2018 (Chart 1).

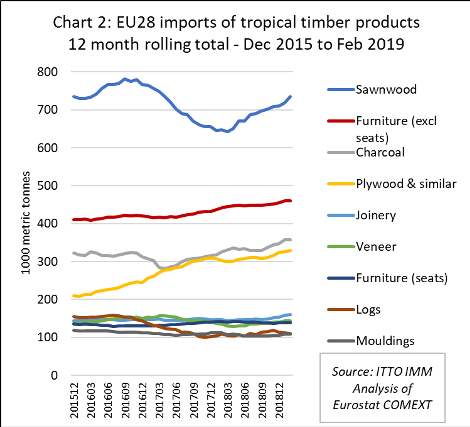

The rise in EU imports of tropical timber in the second half of 2018 and the first quarter of 2019 was driven by several products groups. EU imports of tropical sawn wood, which have been highly volatile in recent years, regained ground lost during the slump in the second half of 2017. EU imports of wood furniture (excluding seating) from tropical countries have been rising slowly and consistently since the start of 2017, driven by Vietnam and India.

Imports of tropical charcoal and plywood have also been rising during this period. Most tropical charcoal is derived from Nigeria and Cuba. The rise in tropical hardwood plywood imports is concentrated in product from China and Indonesia, the latter partly boosted by FLEGT licensing. (Chart 2).

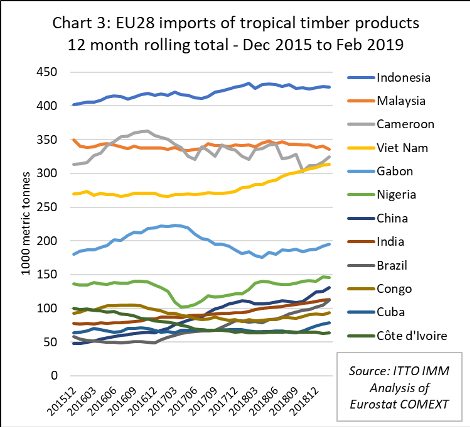

While imports of plywood from Indonesia have been rising, EU imports from Indonesia across all product groups were flat in 2018 and have remained so in 2019. So too have imports from Malaysia. EU imports from Cameroon have been extremely volatile in recent times, with the overall trend downward. However, there was a slight uptick in imports from Cameroon at the start of 2019.

EU imports from Vietnam, nearly all furniture have been rising steeply since the start of 2018 and this trend continued into the new year. After a long period of very slow trade, EU imports from Brazil, mainly of decking, have been recovering in the last six months. (Chart 3).

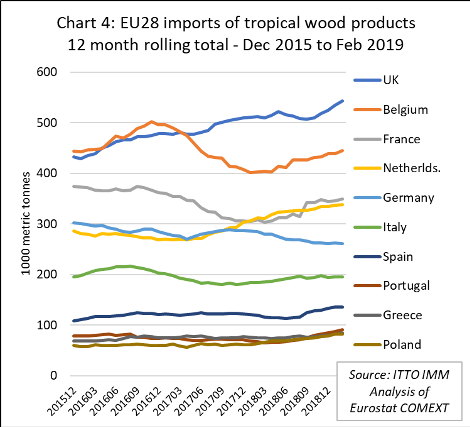

Trends in tropical timber imports tend to vary widely at national level, although the latest upturn in imports has been quite well distributed across the EU. Of the largest destination countries, only Germany registered a decline in direct trade of tropical timber at the start of this year (and as noted in the last issue of ITTO MIS, a feature of Germany’s trade in tropical timber is that most is now sourced indirectly from other EU countries).

Imports increased sharply into the UK in the opening months of 2019 and were also rising in Belgium, France, Netherlands, Spain, Portugal, Greece and Poland. Imports remained flat in Italy however (Chart 4).

The recent upturn in tropical timber imports is rather surprising as, to a large extent, it is against the grain of broader economic trends in the EU. The value of the euro and the British pound eased against the dollar in 2018 and remain at historically low levels, acting as a drag on imports.

According to the EU’s Spring 2019 Economic Forecast, issued on 8th May, “economic activity in the EU slowed further in the second half of 2018 as growth in the global economy and trade weakened amid tightened global financing conditions, unresolved trade tensions, high uncertainty, and as a result of exceptional weakness in the manufacturing sector that extended into the start of 2019.”

The Forecast identifies a wide range of factors that “weighed on sentiment” in the EU, including “disruptions in the car manufacturing sector, social tensions, policy uncertainty, as well as uncertainty related to Brexit.” Overall, GDP growth in the EU is forecast to moderate from 2.1% in 2018, to 1.4% this year and to remain at this lower level in 2020.

On the other hand, according to the Forecast, “domestic demand has been less affected. Employment growth, which has so far remained resilient, is expected to continue in the euro area, but at a slower pace. Combined with rising wages, muted inflation and supportive fiscal measures in some Member States, job creation should continue to underpin household spending this year and next. At the same time, low financing costs should help to at least partly offset the negative impact of lower sales expectations on investment”.

The relative resilience of domestic demand goes some way towards explaining the rise in tropical timber imports in the EU in recent months. It has been enough to encourage importers that have been holding stocks at relatively low levels for many months back into the market.

Equally, some cooling in global demand against the background of slowing economic growth in China and the trade dispute with the US, has made international prices for hardwood products more attractive to European buyers. The growing global competitiveness of Vietnam and India is also becoming more evident as these countries are increasing penetration of the EU wood furniture market.

The particularly strong growth in the UK market in the opening months of 2019 is surprising given the high levels of uncertainty in the UK economy created by Brexit. Both new construction and building renovation markets, the latter being critical for hardwoods, were slowing at the end of 2018. The UK economy appears to have grown weakly in the first quarter of 2019, with the services and manufacturing purchasing managers index hovering only slightly in expansionary territory amid soft new orders.

Latest surveys from the Construction Products Association (CPA) and Federation of Master Builders (FMB) are slightly more positive. The CPA’s State of Trade Survey for Q1 shows continued growth in UK sales of construction products and materials, while the FMB’s survey demonstrates better expectations for small and medium sized builders.

However, the surveys also indicate that the political and economic situation is holding back product manufacturers’ capital investment in the UK, particularly in commercial offices, industrial factories and high-end residential.

Feedback from the UK hardwood trade indicates that buying remains quite cautious, although trade data suggests some importers may have carried out stockpiling in the weeks immediately before 29 March 2019, the original date of UK departure from the EU. It may be that imports tailed off in March and April after the decision to delay the official Brexit date until 31 October.

The growth in Belgium tropical timber imports this year is driven mainly by sawn timber and decking products and mainly reflects Belgium’s key role as a distributor of tropical timber to other parts of the EU. This has become more pronounced with the move to Just-in-Time purchasing and EUTR implementation which discourages manufacturers and smaller distributors from direct imports from the tropics.

Prospects for consumption of tropical hardwood within Belgium itself are not promising. There was sluggish but stable economic growth in Belgium last year but household spending is falling with declining consumer confidence. Economic sentiment is falling in the run-up to federal elections in May.

The market in France is turning around slowly after several years of stagnation. Fourth-quarter GDP growth was modest but resilient, stable from a quarter earlier despite the social unrest of last year’s ‘gilets jaunes’ protests. Domestic demand was hit by the demonstrations, with a decline in household spending. Market sentiment was improving in France in the first quarter of this year and fiscal policy is helping to prop up private consumption. However, growth is likely to be constrained against the backdrop of global trade tensions and lingering Brexit-related uncertainty.

The Italian market remains subdued and is still adjusting to the long-term effects of the economic crisis of a decade ago, with fewer manufacturers processing a narrower range of species and fierce competition for business. The bigger hardwood importers and distributors now favour smaller just in time ordering, as end users try and keep stock to a minimum and order only what they immediately need to process.

The Italian economy continues to struggle weighed down weak domestic demand which is driving down industrial output and sales and contributing to low business confidence. As for households, worsening consumer confidence and a deterioration in the labor market point to subdued spending patterns. In other news, the Italian government endorsed China’s Belt and Road Initiative in late March, in the hope of receiving substantial infrastructure financing.

Spain’s hardwood market dipped after the summer break in 2018 with importers blaming instability both internally and externally. At home the issue of independence for Catalonia has not gone away, state budgets are not approved and indecision about potential new mortgage taxes affected investment in the housing sector. Generally, importers have reacted by maintaining stock at low levels and buying only essential items on a “just in time” basis.

However, there are also positive signs in Spain. Industrial production rebounded solidly in January and the services sector is stable. Private consumption is quite solid, propped up by healthy employment growth and higher purchasing power thanks to low inflation. There was a slight upturn in Spain’s imports of tropical products at the end of 2018 and in the first two months of 2019.

The Netherlands still stands out as a growth area for the EU market. In the final quarter of last year, the Dutch economy accelerated on the back of firming domestic demand and an improved trade balance. Economic growth is expected to moderate in the Netherlands during 2019 as the external environment becomes more challenging, but domestic demand should remain robust on the back of fiscally expansionary policies.

Turnover in the Dutch construction sector increased 10% to a 10-year high last year. The total number of new home starts was stable, with 70,000 building permits issued, the same as in 2017. That is some way below pre-crisis levels, when around 80,000 new permits were given every year, but still implies good levels of consumption this year in the finishing sectors important to hardwoods.

PDF of this article:

Copyright ITTO 2020 – All rights reserved