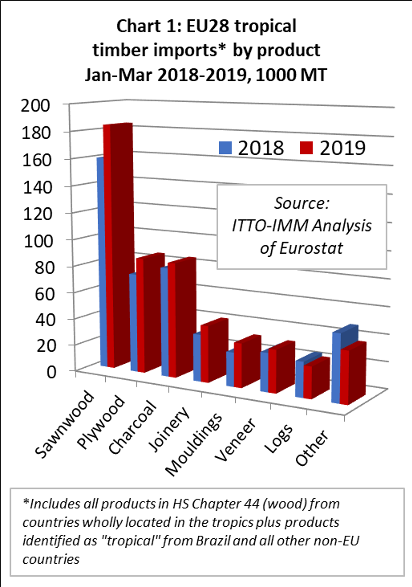

The EU’s trade in tropical wood products was more buoyant in the first quarter this year compared to the same period in 2018. Total imports of all wood products (classified in HS Chapter 44) from tropical countries in the first quarter of 2019 were 525,000 MT, 9% more than the same period in 2018. Import value increased 17% to €561 million.

This is surprising given that the wider economic situation in the EU is not particularly promising this year, the European Commission having recently downgraded GDP growth projections to only 1.4% for the whole of the EU in 2019 in response to signs of deteriorating economic conditions.

To some extent the rise in EU tropical wood imports so far in 2019 is only a reflection of just how poor the market was last year when imports for several commodities barely exceeded the record lows of the 2008-2009 financial crises. Nevertheless, it is encouraging that the rise in EU imports so far this year has been consistent across nearly all tropical wood product groups (Chart 1).

The latest upturn in imports is also quite well distributed across the EU with imports of tropical wood products higher during the first quarter in all the leading EU markets except Germany. In the first quarter of 2019 compared to the same period in 2018, total imports of tropical wood products increased in Belgium (+5% to 102,500 MT), the UK (+23% to 91,000 MT), Netherlands (+16% to 72,000 MT), France (+4% to 60,000 MT), Italy (+13% to 44000 MT), Spain (+36% to 26,600 MT), Portugal (+70% to 19,400 MT) and Greece (+23% to 18,700 MT).

In contrast, total imports of tropical wood products in Germany declined 9% to 42,400 MT in the first quarter of 2019. This decline is partly driven by increasing reliance on indirect imports of tropical wood products from other EU countries by German distributors.

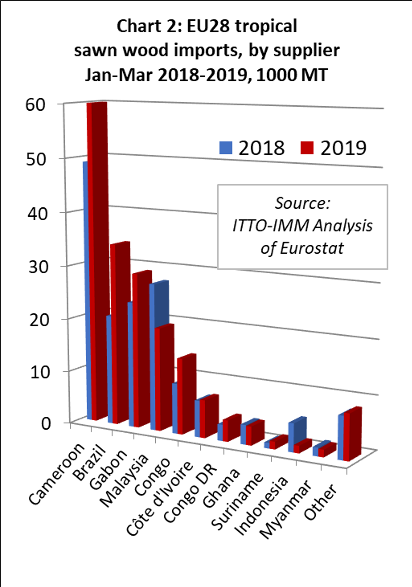

15% rise in EU imports of tropical sawn wood.

EU imports of tropical sawn wood increased 15% to 184,000 MT in the first quarter of 2019 compared to the same period in 2018. Import value increased 12% to €181 million.

Imports from Cameroon, particularly slow in the first quarter of last year, increased 22% to 60,000 MT in the same period this year. Imports also increased sharply from several other countries including Brazil (up 66% to 34,000 MT), Gabon (up 23% to 29,000 MT), Congo (up 52% to 14,200 MT), and DRC (up 32% to 4,000 MT). Imports increased slightly, by 4%, to 7100 MT from Cote d’Ivoire. These gains offset a 30% decline in imports from Malaysia, to 19,400 MT. (Chart 2).

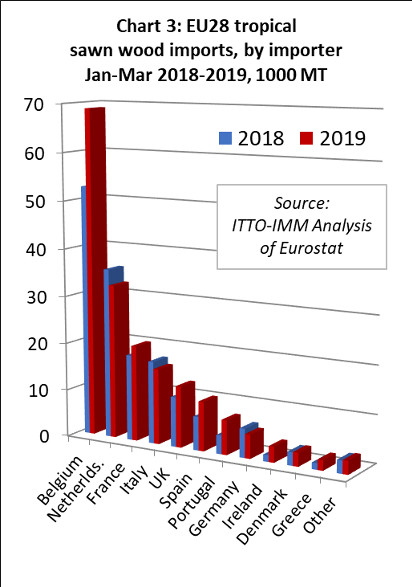

The trend towards increased concentration of tropical sawn wood imports into the EU by way of Belgium has continued this year. In the first quarter of 2019 compared to the same period in 2018, imports into Belgium increased 31% to 69,000 MT. Imports also increased in France (up 12% to 20,100 MT), the UK (up 23% to 12,900 MT), Spain (up 47% to 10,370 MT) and Portugal (+85% to 7,200 MT). However, imports fell 9% to 32,500 MT in Netherlands and were down 8% to 15,900 MT in Italy. (Chart 3).

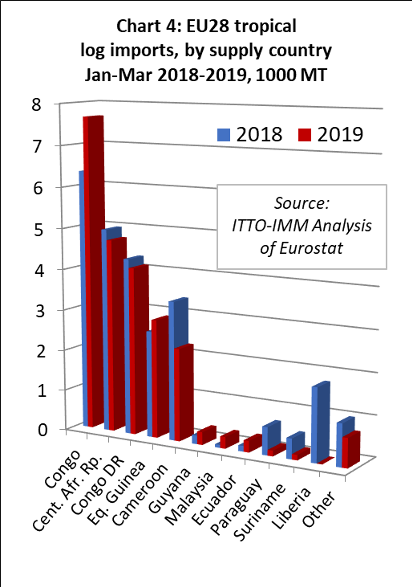

Slowdown in EU imports of tropical logs

After recovering a little ground in 2018, EU imports of tropical logs slowed again in the first quarter of 2019. Imports of 23,500 MT during the first quarter of the year were 10% less than the same period in 2018. Import value fell 16% to €11.2 million during the period.

While EU imports of tropical logs increased by 20% to 7,680 MT from Congo, the leading supplier, this was offset by falling imports from the Central African Republic (-5% to 4,730 MT), DRC (-5% to 4,100 MT) and Cameroon (-33% to 2,260 MT). There were also zero EU imports of tropical logs from Liberia during the first quarter of 2019 compared to 1790 MT in the same period last year. (Chart 4).

All three of the leading EU markets for tropical logs declined in the first quarter of 2019 compared to the same period last year; imports fell 7% to 11,200 MT in France, 26% to 4,360 MT in Belgium, and 10% to 3,450 MT in Portugal.

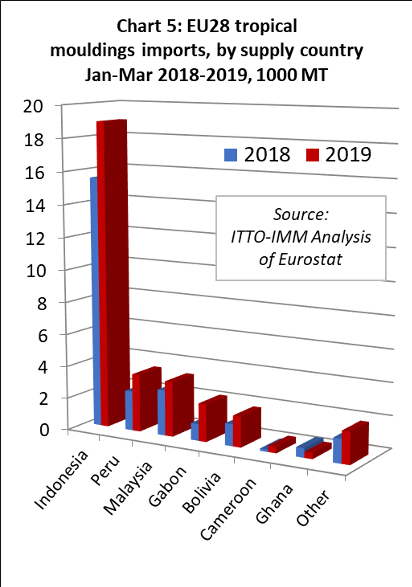

Sharp rise in EU tropical moulding imports

EU imports of tropical mouldings (which includes both interior mouldings and exterior decking products) increased sharply, by 30%, to 32,900 MT in the first quarter of 2019. Import value increased 46% to €54 million.

EU imports of tropical mouldings increased from all the leading suppliers of this commodity in the first quarter of 2019 including Indonesia (+22% to 19,000 MT), Peru (+45% to 3,600 MT), Malaysia (+21% to 3,400 MT), Gabon (+124% to 2,300 MT) and Bolivia (+40% to 1,900 MT) (Chart 5).

In the first quarter of 2019, imports of tropical mouldings increased in all the leading EU markets including Germany (+33% to 9,500 MT), Netherlands (+30% to 7,400 MT), France (+58% to 5,100 MT), Belgium (+11% to 4,600 MT), and the UK (+49% to 3,500 MT).

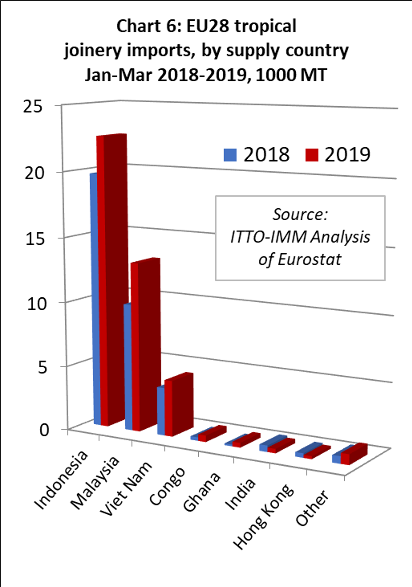

Tropical Asian suppliers make gains in EU joinery market

EU imports of tropical joinery products, mainly doors (from Indonesia), and laminated window scantlings and kitchen tops (from all leading tropical suppliers), increased 21% to 42,300 MT in the first quarter of 2019. Import value increased 26% to €87.2 million.

EU imports of tropical mouldings increased in the first quarter of 2019 from all three of the countries that dominate international trade in tropical joinery products including Indonesia (+15% to 22,600 MT), Malaysia (+33% to 13,100 MT), and Viet Nam (+17% to 4,300 MT) (Chart 6).

In the first quarter of 2019, imports of tropical joinery products increased by 13% to 17,400 in the UK and by 115% to 12,300 MT in the Netherlands. These gains offset a 10% fall in imports in Belgium to 4,200 MT, a 33% fall in France to 2,500 MT, and a 14% fall in Germany to 2250 MT.

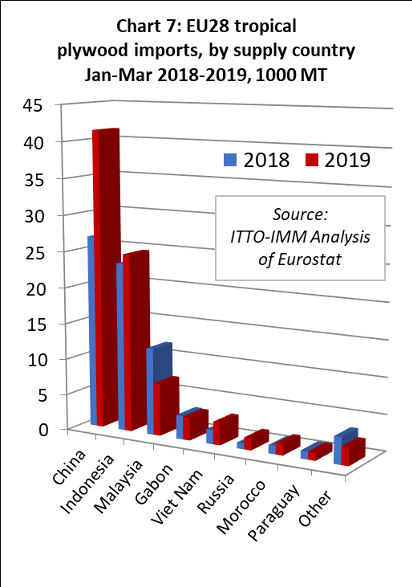

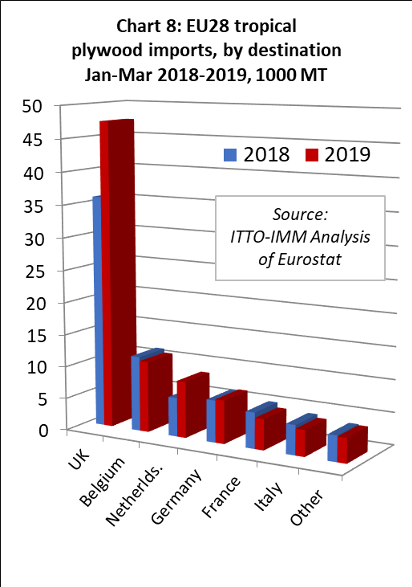

EU imports of tropical plywood made in China continue to increase

EU imports of tropical plywood products increased 17% to 86,600 MT in the first quarter of 2019 compared to the same period last year. Import value increased 24% to €76.6 million.

A large and growing proportion of the plywood faced with tropical hardwood imported into the EU is manufactured in China. The EU imported 41,400 MT of this product from China in the first quarter of 2019, 55% more than during the same period in 2018. Imports also increased from Indonesia, by 6% to 24,700 MT, and from Viet Nam, by 60% to 3,100 MT. These gains offset a 40% fall in imports from Malaysia, to 7,300 MT (Chart 7).

In the first quarter of 2019, imports of tropical plywood products increased 32% to 47,500 in the UK, by 45% to 8,700 MT in the Netherlands, and by 3% to 6,700 MT in Germany. These gains offset a 5% fall in imports in Belgium to 11,000 MT, a 14% fall in France to 4,750 MT, and a 12% fall in Italy to 4,050 MT. (Chart 8).

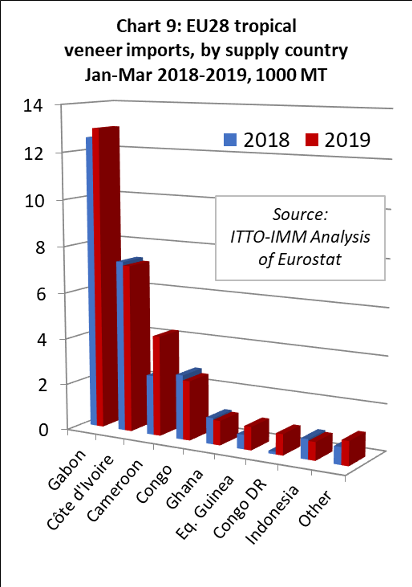

EU imports of tropical veneer up 11%

EU imports of tropical veneer increased 11% to 31,800 MT in the first quarter of 2019 compared to the same period last year. Import value increased 13% to €42.6 million.

The EU imported 12,970 MT of veneer from Gabon in the first quarter of 2019, 3% more than during the same period in 2018. Imports from Cameroon rose sharply, by 68% to 4,300 MT, after a poor year in 2018. There was also a significant increase in imports from two smaller African suppliers of this commodity, Equatorial Guinea (+61% to 1000 MT) and DRC (+700% to 900 MT). Meanwhile imports from several long-term veneer suppliers to the EU lost ground, including Cote d’Ivoire (-2% to 7,200 MT), Congo (-8% to 2,560 MT), and Ghana (-6% to 1,050 MT). (Chart 9).

In the first quarter of 2019, tropical veneer imports increased by 10% in France, to 11,600 MT, by 22% in Italy, to 8,100 MT, and by 120% in Greece to 2,500 MT. However, imports fell slightly, by 4%, to 4,550 MT in Spain.

Benefits to UK merchants of stocking wide range of hardwoods

The first edition of the UK Timber Trade Federation’s Merchant News (https://ttf.co.uk/latest/merchant-news/) includes an article focusing on the challenges and opportunities in the UK hardwood trade. The article seeks to answer the question “Are merchants missing out on business by not making available a selection of sustainably-grown hardwoods from around the world?“

The article highlights how the market for hardwoods in the UK is constrained by the costs to merchants of holding a diverse range of expensive stock as well as by lack of knowledge of end-users of the wide range of species available.

The article quotes John Dowd, Specialised Product Category Director at International Timber,one of the UK’s largest hardwood importers: “For many merchants the main difficulty is not having sufficient space to carry the ideal inventory: boards may not be the right width or length for bespoke joinery work, for example. The main hardwood species we find demand for are American White Oak, Sapele, Meranti, European Oak, Beech, and, for decking, Bangkirai. One or two merchants succeed by keeping a small stock of hardwoods on the ground in-branch, but sawn hardwood lumber can be expensive to stock“.

Commenting on the main hardwood species available to UK buyers and their respective uses, Chris Bowen-Davies, Key Accounts Manager at Brooks Bros Timber, notes that: “In terms of African hardwoods, Sapele is our largest seller. It’s a good all-rounder for external and internal use, with reasonable density and good machining capabilities. It’s good for paint application too. Utile is still favoured as it tends to be more stable than many external hardwoods.

“Iroko is classed as Very Durable and lasts well in outdoor situations. It can be used for example as cill sections or for other outdoor joinery. It can also be used in boat-building and garden furniture, as well as for marine work,” Brooks’ Chris Bowen-Davies says. “Idigbo is another durable material, but it needs a primer coat before any top paint coat is applied. Its availability from legal and sustainable sources can be somewhat erratic. Travelling further round the globe, Meranti, which comes from the far east, is a very popular joinery hardwood used in window and door manufacturing. It paints satisfactorily but its density can vary considerably.”

The article notes that that UK merchants are seeing a sales benefit from stocking the more familiar types of hardwood, in defined ranges to suit particular market segments, as Business Development Director at builders’ merchants MGM Timber, relates: “We stock a range of hardwood mouldings in our branches. European Oak mouldings match the current fashion for Oak flooring, joinery and kitchens. We also stock Meranti mouldings for the replacement market, including skirtings, architraves and window cill sections.

“The market for hardwood mouldings is very wide-ranging, from the enthusiastic DIYer to builders and joiners involved in RMI, window fitters and even housebuilders. Local housebuilders want to increase the value of the homes they build by providing a high spec finish, which is where hardwood mouldings come in,” Grant Wilson says.

Grant Wilson also notes that “ensuring sustainable sourcing is of primary importance on hardwoods“, and this is a theme also highlighted by TTF Managing Director David Hopkins. Hopkins particularly emphasises the role of the FLEGT VPA process which is seen as having strong market development potential in the UK.

According to Hopkins, “FLEGT licensing is a mechanism for ensuring the legality of harvesting and supply at country-level, whereas the two main certification schemes license at individual forest and producer level. Merchants should watch the FLEGT space as a number of African countries are going through the licensing process, which will eventually make more species available for purchase under EUTR rules.”

PDF of this article:

Copyright ITTO 2020 – All rights reserved