Analysis of the timber market in Germany, which plays central in the European wood products sector, highlights the extent to which tropical wood is losing market share, with important implications for the long-term future of tropical wood demand in the broader European market.

Germany is Europe’s largest economy with GDP likely to have exceeded US$4 trillion for the first time in 2018 (according to IMF), over 40% more than the UK, Europe’s second largest economy. Germany is Europe’s largest producer of sawnwood and wood-based panels, with output of 22 million m3 and 11 million m3 respectively in 2017 (according to FAO).

Germany is also Europe’s largest consumer (annually €9.4 billion) and second largest producer (annually €7.3 billion) of wood furniture. Germany’s annual per capita consumption of wood furniture is €118, second only to Luxembourg amongst European countries.

Germany weathered the economic storms of the last decade better than most other European economies. Although GDP growth slowed in the second half of last year as Germany’s large export-oriented manufacturing sector came under pressure from cooling demand in overseas markets, domestic consumption in Germany has been very resilient.

Germany’s domestic market has benefited from strong consumer confidence, which has remained much higher than in other European countries in recent years, bolstered by a low and declining unemployment rate (which fell to only 3.1% in February 2019) and the expansionary policy of the European Central Bank which has combined low interest rates with quantitative easing.

In 2019, domestic consumption in Germany is expected to remain high, particularly as the German government has introduced further fiscally expansionary measures, including a higher minimum wage to help offset an anticipated slowdown in export demand for German products. Economic indicators this year have revealed further rises in consumer sentiment and the composite Purchasing Managers Index showing better business conditions.

Feedback from hardwood traders in Germany indicates that there is good activity in the door and kitchen sectors. Furthermore, German importers continue to sell significant volumes of hardwood into the expanding furniture and joinery manufacturing sectors in Eastern European countries, notably Poland and Lithuania.

The successful 2019 edition of IMM-Cologne interior design fair held in January confirmed that underlying market sentiment in Germany is good and, with strong growth in overseas visitors, highlighted once again that Germany is viewed as a major global leader both in wood product design and innovative processing.

A commentary on material preferences by the fair organisers noted that “wood is simply invincible” because “it is not only sustainable, but also cosy, healthy and versatile”. The fair suggested a particularly strong preference for natural wood to be used “as raw as possible: not coarse, but un-smooth” and that, while paler monitone colours are still very fashionable, there is a growing trend for “warm colours tending to dark that harmonise with reddish wood”.

On the surface, all this should imply good opportunities to increase sales of tropical timber in Germany. However, in practice, the market has been moving decisively against tropical hardwood for some time. This is clear from data presented by Rupert Oliver, Trade Analyst to the FLEGT Independent Market Monitor (IMM) project (hosted by ITTO), to the GD Holz “Foreign Trade Day” on 4 April.

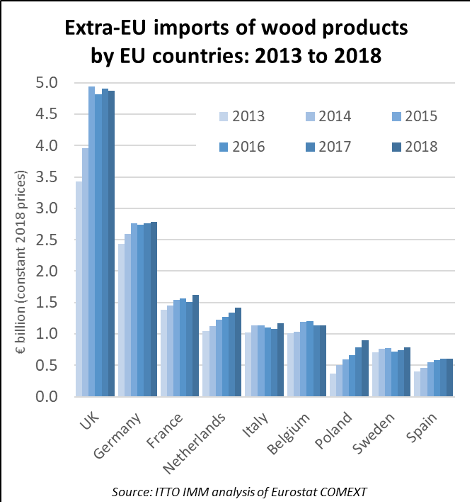

Overall the data shows that Germany is importing large and growing quantities of timber products. Should the UK leave the EU, an event now scheduled to happen by 31 October 2019, Germany will become by far the largest single EU importer of wood products from outside the bloc (Chart 1).

However, most of the gains in German imports are being made in softwoods, particularly from Russia and other European countries. Furthermore, where Germany is importing tropical timbers, direct purchases from the tropics are falling rapidly and more is being purchased indirectly from importers elsewhere in the EU. This has important implications for future development of policy measures like FLEGT and EUTR.

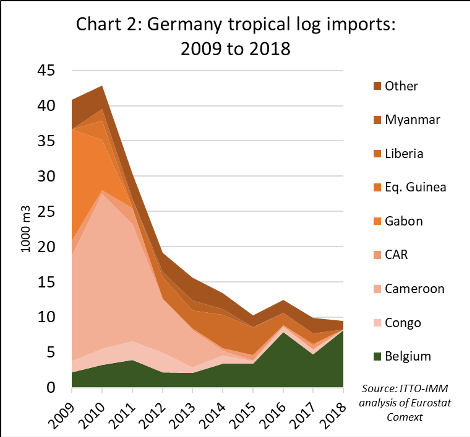

Germany imports around 8 million m3 of logs every year, but much is low grade, mainly softwood, material for manufacture of panels and other industrial applications. Around 90% of all Germany’s log imports derive from other EU countries. In 2018, Germany imported only around 400,000 m3 of hardwood logs, of which 330,000 m3 were from other EU countries and 70,000 m3 from non-EU countries. Germany’s imports of tropical hardwood logs declined sharply from 43,000 m3 in 2010 to only 9,000 m3 last year, with nearly all volume now sourced through Belgium (Chart 2).

Germany’s total imports of sawnwood increased from 5.0 million m3 in 2017 to 5.4 million m3 last year. This builds on a long-term upward trend which has seen Germany’s sawnwood imports increase by over 40% in the last decade. 85% of these imports comprise softwoods, and 67% is from other EU countries. Nearly all the sawnwood imported into Germany from outside the EU is from just three countries; Belarus, Russia and Ukraine. The rise in Germany’s timber imports in 2018 comes despite domestic softwood sawnwood production hitting an all-time high of around 23 million m3 last year. The signs are that total demand for sawnwood in Germany is “red hot” at present.

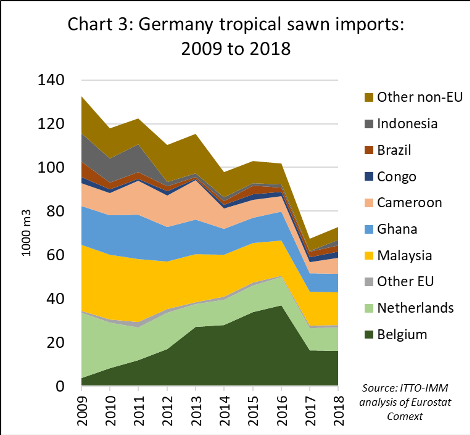

However, this is not at all reflected Germany’s tropical sawnwood imports which have been declining (Chart 3). Germany’s imports of tropical sawnwood were only around 73,000 m3 in 2018, a slight improvement on the 67,000 m3 imported the previous year, but well down on 103,000 m3 imported in 2016 and around half the level prevailing a decade ago. As in the log trade, there was a significant rise in indirect imports via Belgium between 2009 and 2016, at the expense of both direct imports from tropical countries and other indirect imports from the Netherlands. However, in 2017, there was also sharp reversal in Germany’s imports of tropical sawn timber via Belgium.

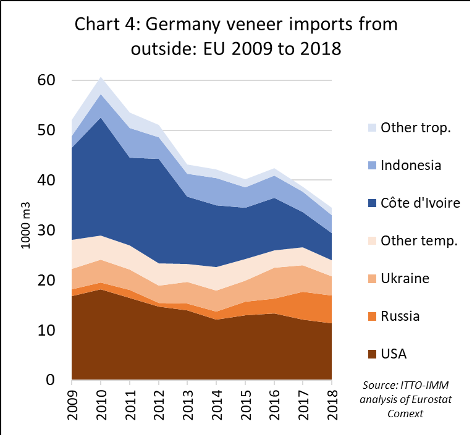

Germany imported 109,000 m3 of veneers in 2018, down from 115,000 m3 the previous year. Around 70% came from other EU countries and 34,000 m3 from outside the EU. Imports from other EU countries have been rising in recent years as a large part of Germany’s domestic production has been relocated to lower cost locations in Eastern Europe. Meanwhile Germany’s veneer imports from outside the EU have fallen sharply, mainly due to a decline in imports from the United States and Ivory Coast. This decline has been only partially offset by a rise in imports from Russia and Ukraine (Chart 4).

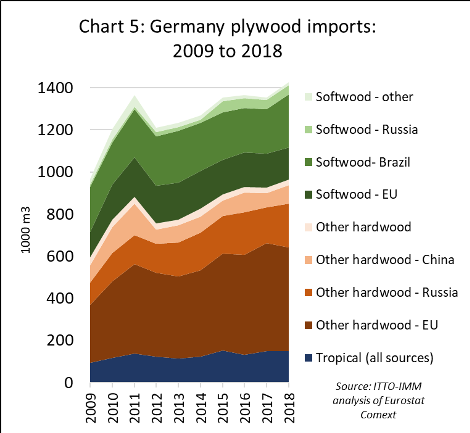

Germany’s plywood imports have been rising in recent years, peaking at 1.43 million m3 in 2018, of which 816,000 m3 was faced with hardwood and 615,000 m3 with softwood. Much of the recent growth in Germany’s plywood imports has comprised hardwood products (mainly birch) from other EU countries and Russia (Chart 5).

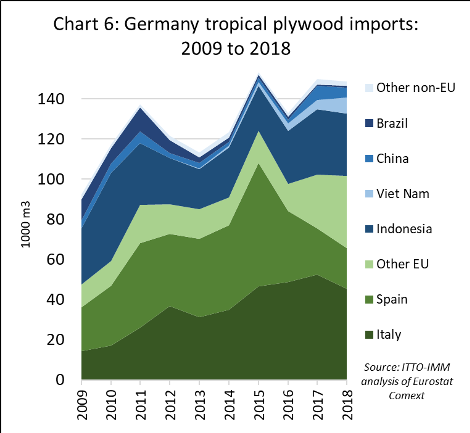

Despite stiff competition from birch plywood, tropical hardwood plywood has made gains in Germany in recent years, with total imports of tropical hardwood faced plywood rising from less than 100,000 m3 a decade ago to peak at 153,000 m3 in 2015. Imports fell back to 133,000 m3 in 2016 but rebounded to 150,000 m3 in 2017 and remained at that level last year.

Much of the recent gain in Germany’s tropical plywood imports comprises products either manufactured using tropical hardwoods in other EU countries, notably Italy and Spain, or imported indirectly via these countries. However, there has also been an increase in direct imports of tropical hardwood plywood from Indonesia, from a low of 20,000 m3 in 2013 to 31,000 m3 in 2018 (Chart 6).

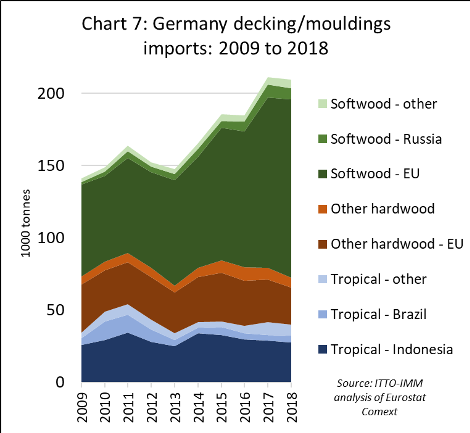

Germany’s imports of moulding and decking products (classified under HS code 4409) increased sharply from 148,000 m3 in 2013 to 210,000 m3 last year. Nearly all the gains were in softwood products from other EU countries. Germany’s imports of these products from the tropics have been edging downwards in recent years, from 42,000 m3 in 2015 to 40,000 m3 last year. Imports from Indonesia, by far the largest tropical supplier to Germany, fell from 33,000 m3 to 28,000 m3 (Chart 7).

IMM Trade Consultation explores drivers of tropical wood decline in Germany

Insights into the reasons for Germany’s shift away imports of tropical wood, particularly direct imports, were provided by the IMM Trade Consultation held in Berlin at the end of 2018. This consultation forms part of wider series of consultations being held during 2018 and 2019 in all the main European markets for tropical wood products to obtain feedback from the trade on the potential to develop markets for FLEGT licensed timber in the EU.

During the Berlin consultation, to help place FLEGT licensed timber in the correct market context, traders were asked to identify and rank the key factors driving market decline for tropical timber products in Germany in recent years. The main drivers identified, in declining order of significance, were:

- Substitution by temperate wood, composites and other materials (16 votes);

- Environmental prejudice and uncoordinated marketing (9 votes);

- Competition from China for material access and in markets for finished goods (9 votes); and

- The challenges of conformance to the EU Timber Regulation (8 votes).

The first driver is indicated both by the trade flow data, which shows large increases in Germany’s trade in wood products other than tropical timber, and by other reports from traders. These reports highlight, for example, that all solid wood products, but particularly tropical, are losing share to wood plastic composites in the market for decking and other exterior products. This trend is so far-reaching in Germany that even thermally and other treated temperate wood products, which are making ground elsewhere in Europe, are losing share in Germany.

Similarly, the market for real-wood flooring in Germany has been struggling in recent times even as broader domestic consumption trends have been on the rise, an indication of the pressure being felt in this market from alternatives such as laminated flooring and luxury vinyl tiles.

The fourth driver of tropical wood’s decline, relating to EUTR, features more strongly in Germany than in other EU countries. It is also reflected in the trade data which shows the growing proportion of tropical wood imported indirectly into Germany via other EU countries.

This tends to confirm reports that an increasing proportion of tropical wood imports into the EU are now being channelled via larger importing companies close to the main European ports that are willing and able to devote more time and resources for a wide range of specialist services, including EUTR due diligence.

A feature of the Germany IMM trade consultation (interestingly also repeated in a more recent Dutch/Belgian IMM event held in Antwerp) is that while EUTR is identified by the importing sector as a significant of driver of decline in tropical wood trade, at the same time it is also seen as a potentially important part of long-term strategy to maintain and, potentially, rebuild market share.

Having rated drivers of market decline, German importers at the consultation were then asked to rate the potential of different market development strategies for tropical timber in the EU. One strategy was rejected outright by all participants; this proposed “deregulation”, the total abolition of requirements for EUTR and FLEGT licensing, based on the assumption that tropical timber imports may be boosted by reducing the regulatory burden.

Not only was the deregulatory approach rejected, but the strategy receiving by far the most votes was the exact opposite; “a regulatory approach involving increased supply of FLEGT-licensed tropical timber linked to consistent and effective enforcement of EUTR to remove illegal wood”.

Practically all participants in Berlin regarded the EUTR combined with FLEGT licensing as the right approach to improve credibility and reputation of the tropical timber trade in the EU. The process of consolidation in the sector and the concentration of import activities in the hands of a smaller number of expert importers was also generally seen as a positive development by participants.

The second most favoured strategy for rebuilding tropical wood’s market share in Germany was identified as “highlighting/promoting the environmental benefits of tropical timber and underpinning these scientifically through life-cycle analysis (LCA)”. Here, traders were also calling for increased regulatory support through government procurement policies. Participants at the trade consultation also called for inclusion of FLEGT-licensed tropical timber in public procurement policies as evidence of both legality and sustainability.

While these strategies were seen as having potential to improve market conditions for tropical wood in the German market, trade consultation participants generally expected stagnation of the German and wider EU tropical timber market at the current low level, at least in the short to medium term.

New resource for timber buyers on benefits of FLEGT-licensed products

Timber buyers can now visit a new webpage in English, French, Italian or Spanish to learn about the business benefits of trading in FLEGT-licensed timber and the social, environmental and economic benefits that such trade brings to producer countries. The EU FLEGT Facility created the page — www.timberbuyers.flegtlicence.org — to inform traders, specifiers, architects and retailers, as well as sustainability specialists and end consumers of timber products.

Combining text, pictures and an animated film, it describes how the EU is working with tropical timber-exporting countries to stop illegal logging and promote trade in legal timber products.

The new resource explains what FLEGT licences are, how they benefit timber buyers in the EU, and how the advantages of FLEGT licensing extend far beyond legality to encompass social, economic and environmental gains in producer countries.

It includes links to multimedia stories that highlight the benefits of FLEGT licensing, and to downloadable resources that can help timber buyers to communicate about FLEGT-licensed products with their customers.

The EFI FLEGT Facility, that developed the site, note that “FLEGT-licensed timber products are best known for their verified legality. They automatically meet the requirements of the EU Timber Regulation so, for operators in the EU, they eliminate the risk of trading in illegal timber. Less well-known are the considerable social, economic and environmental credentials of FLEGT-licensed products. Yet the trade in these products, and the reforms and improvements that stand behind the licences, are helping ensure that forests contribute to economic growth and poverty reduction, while promoting responsible forest management”.

The new webpage is part of the FLEGT licence information point, which the Facility set up in 2016 to provide practical information about FLEGT licences, import procedures, trade scenarios and answers to frequently asked questions.

European parquet flooring industry reports stable to slightly positive trend

Compared to the same period last year, sales of wood parquet flooring in the EU in the first quarter of 2019 were stable or moderately increasing in all countries except Belgium, the Netherlands, Switzerland and the UK which reported limited declines. The shortage of hardwood face material – particularly oak – which has been a significant problem in recent years, seems to have eased so far in 2019. However, prices are rising for panel products (HDF, plywood) used in the other layers. These are the principal conclusion of the Board of Directors of the European Federation of the Parquet Industry (FEP) when they met on 4 April 2019 to discuss the parquet market situation.

The FEP Board also provided the following insights into current market conditions in each EU country in the first quarter of 2019:

- Austrian parquet sales were up 1% during the period.

- Parquet consumption fell 4% in Belgium during the period due mainly to competition from “wood look” floor coverings.

- Baltic states’ markets remained stable during the period.

- There was a slight upturn in the Czech Republic parquet market during the period.

- The Denmark market was flat in line with the static performance of residential.

- Parquet sales were stable in Finland – the residential market is performing well but retail is declining.

- After a difficult fourth quarter 2018, the French market improved during the first quarter of 2019

- After a poor year in 2018, parquet sales increased 4% in Germany in the first quarter 2019.

- The parquet market in Italy was flat during the first quarter and no improvement is expected soon.

- Parquet sales in the Netherlands declined during period due to competition from “wood look” floor coverings.

- The Norwegian market remained flat during period, seen as encouraging compared to significant decreases in consumption last year.

- Sales in Poland increased 2% during the period.

- The Spanish market was stable during the period, echoing the uncertain political context.

- Parquet consumption in Sweden continued to rise slowly, by 1% during the period with renovation the main driver.

- Switzerland consumption fell 2% during the period following completion of new construction projects.

- United Kingdom consumption fell 1% with the influence of the Brexit becoming discernible

European company looks to expand supply of acetylated wood in Asia

Accsys Technologies PLC has announced that its subsidiary, Tricoya Technologies Limited (“TTL”), has now entered into an agreement with Petronas Chemicals Group Berhad (“PCG”) to evaluate the feasibility of jointly funding, designing, building and operating an integrated acetic anhydride and Tricoya wood elements production plant in Malaysia.

It is envisaged that Tricoya wood elements produced at the plant would use acetic acid from PCG’s existing joint venture in Malaysia. The plant would then supply the wood panel industry within South East Asia, under licence, as the key raw material for the formation of Tricoya panels for the use in the construction industry in the region.

The evaluation is expected to include preliminary engineering studies, regional customer and market feasibility assessments and financing arrangements.

Accsys Technologies PLC is a chemical technology group whose primary focus is on the production of Accoya wood and Tricoya wood elements and technology licensing via its subsidiary, Titan Wood Limited.

Accoya Wood is produced using Accsys’ acetylation technology that effectively converts softwoods and non-durable hardwoods into more durable and stable products suited to exterior applications where performance and appearance are valued.

Tricoya Wood Elements are produced using Accsys’ technology for the acetylation of wood chips and particles for use in the fabrication of panel products such as medium density fibreboard and particle-board. These products demonstrate enhanced durability and dimensional stability which allow them to be used in a variety of applications that were once limited to solid wood or man-made products.

Wood acetylation is a process which increases the amount of naturally occurring ‘acetyl’ molecules in wood, thereby changing its physical properties. When carried out to a sufficient level throughout the wood, this process protects wood from rot by making it “inedible” to most micro-organisms and fungi, without – unlike conventional treatments – making it toxic. It also greatly reduces the wood’s tendency to swell and shrink, making it less prone to cracking and ensuring that, when painted, it requires much reduced maintenance.

The Malaysia feasibility study forms part of a wider strategy to develop markets for products manufactured using Accsys technology. Accsys Technologies PLC has recently made multi-million dollar investments in a Tricoya plant for annual production of up to 30,000 tonnes per year of acetylated wood chips in Hull, England, and to increase capacity of its Accoya production plant in Arnhem, Netherlands, by 50% to 60,000 m3.

The Ireland-based Medite Europe group currently has exclusive production and distribution rights to Tricoya wood-based panels in Ireland, the Netherlands and the UK. In March this year, the Spanish wood-based panel manufacturer Financiera Madereira (Finsa) acquired exclusive manufacturing rights to Tricoya wood-based panels in Spain and Portugal.

PDF of this article:

Copyright ITTO 2020 – All rights reserved