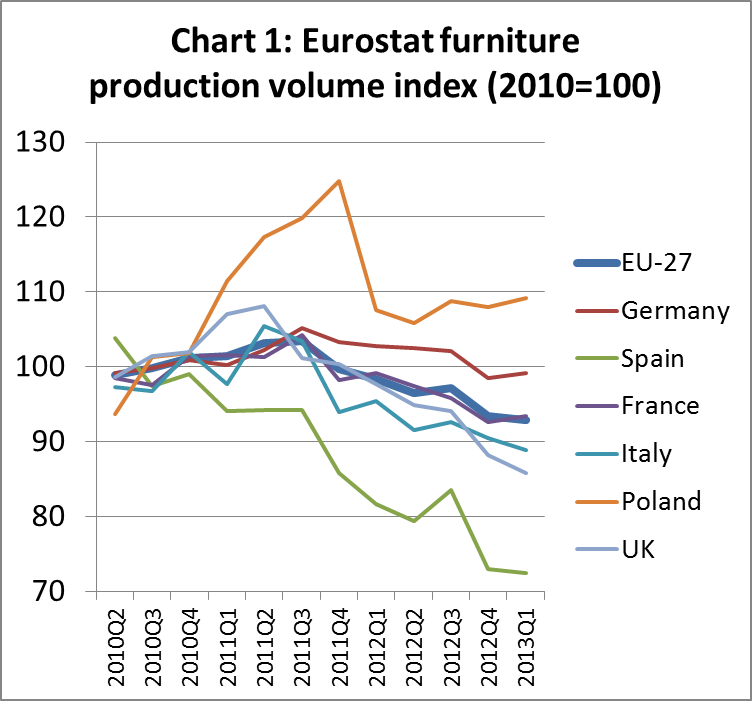

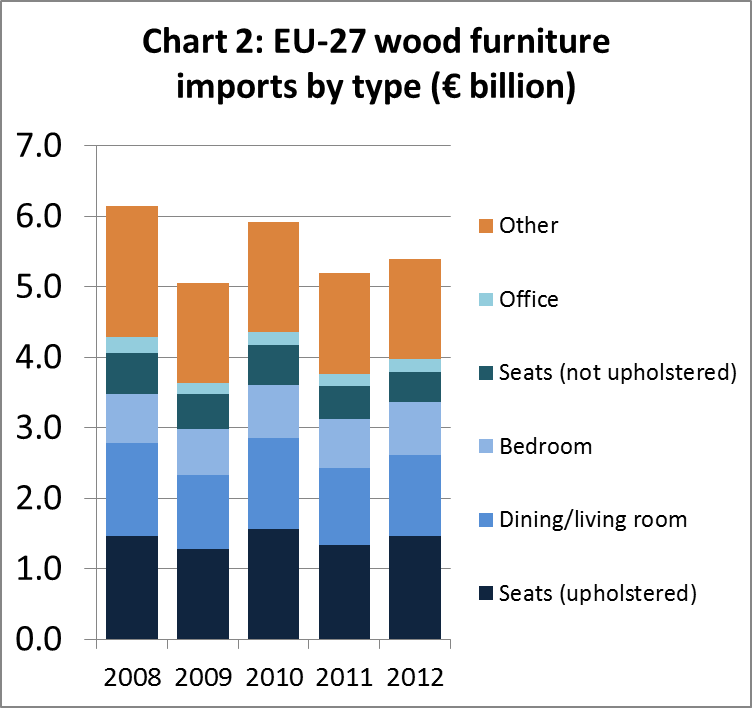

Share of imports in total EU wood furniture supply peaked at 16% in 2010 and then fell away again to 13% in 2011 (see February 2013 report). Eurostat has yet to publish furniture production figures for the whole of the EU in 2012, however the data already available suggests that import penetration rebounded again last year. The Eurostat index of furniture production in the EU, which was rising in 2011, fell throughout the course of 2012 (Chart 1). However the total value of EU27 wood furniture imports (from outside the EU) increased by 3.8% to €5.39 billion (Chart 2).

In 2012, EU imports of upholstered seats increased 10.1% to €1.47 billion, dining/living room furniture increased 4.8% to €1.15 billion, bedroom furniture increased 7.2% to €750 million, and office furniture increased 1.7% to €180 million. These gains offset a 6% decline in imports of non-upholstered seats to €430 million and a 1% decline in all other wood furniture categories to €1.42 billion.

Falling furniture production in Italy, Poland and France during 2012

Furniture production trends at national level in several leading manufacturing countries indicate that overall EU production is likely to have fallen last year. According to CSIL, the Italy-based furniture industry research organisation, Italy maintained its position as the EU’s largest manufacturer of furniture during 2012 despite a 10.5% decline in production value to €18.14 billion. Imports fell 10% to €1.58 billion and exports increased by 0.7% to €10.51 billion. Apparent consumption fell by 19.4% to €10.28 billion.

Data from the consultancy firm B+R indicates that the value of furniture produced in Poland, the EU’s third largest manufacturer, declined last year. B+R report a 7.3% fall in Polish production value to PLN29.4 billion (€6.91 billion). B+R suggest that declining production value was mainly due to a fall in demand from large commercial and public sector clients in Poland. By contrast, Polish furniture exports are estimated to have risen by around 3% last year.

France, Europe’s fifth largest furniture manufacturing country, also slowed in 2012. According to information jointly compiled by the French trade associations FNAEM and UNIFA, and the IPEA research institute, turnover in the French furniture sector declined 3% to €9.54 billion in 2012. Turnover fell in nearly all sectors of French furniture manufacturing including cabinets (-3.9% to €3.28 billion), kitchens (-1.6% to €2.38), upholstery (-4.7% to €2.33 billion), bathroom furniture (-2.9% to €270 million), garden furniture (-1.8% to €140 million). These falls were slightly offset by 0.5% growth in the beds and mattresses sector to €1.14 billion.

German furniture sales increase 1.3% in 2012

There was better news from Germany, Europe’s second largest furniture manufacturer. According to the German Federal Statistics agency, sales of furniture (excluding mattresses) manufactured in Germany increased by 1.3% to €16.28 billion in 2012. Sales of home furniture increased by 0.3% to €8.46 billion, kitchen furniture increased 3.9% to €4.20 billion, and shop and other contract furniture increased by 4.5% to €1.62 billion. These gains offset a 2.1% decline in sales of office furniture to €3.62 billion. German furniture production was rising strongly across all sectors in the first half of 2012 but then slowed again in the second half of the year.

Intra-EU versus extra-EU furniture trade

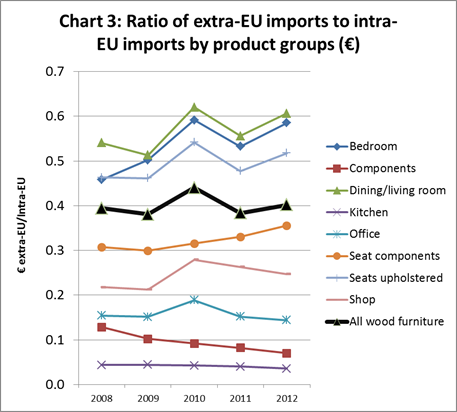

Chart 3 shows the ratio of extra-EU imports to intra-EU imports for wood furniture product groups. The ratio provides a measure of the extent to which EU importers of these products are dependent on suppliers outside the EU relative to suppliers inside the EU[1].

In 2012, extra-EU imports of all wood furniture products of €5.39 billion compared to intra-EU imports of €13.43 billion, a ratio of 0.40. This compares to 2011 figures of €5.20 billion for extra-EU imports and €13.54 billion for intra-EU trade, a ratio of 0.38. This trend suggests a slight increase in EU market penetration by non-EU manufacturers during 2012.

In 2012, market penetration by external suppliers rebounded particularly strongly in those sectors which are already relatively dependent on manufacturers outside the EU – the bedroom, dining/living room, and upholstered seating furniture sectors. However market penetration by external suppliers in 2012 was low and declining in the shop, office, and kitchen furniture sectors.

[1] A ratio of 1 implies that the value or quantity of extra-EU and intra-EU trade are exactly equivalent. A ratio below 1 implies greater dependence on intra-EU trade. A ratio above 1 implies greater dependence on imports from outside the EU.

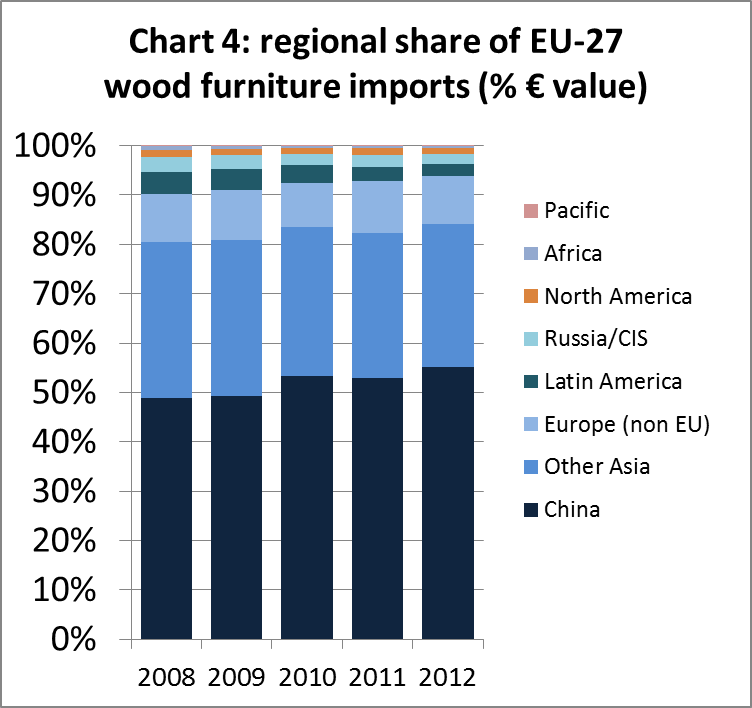

EU27 furniture imports by supply region and destination

Chart 4 highlights the extent to which China has come to dominate EU imports of wood furniture products. During the period 2008 to 2012, China’s share of EU import value increased from 49% to 55%. During the same period, the share of imports from other Asian countries fell from 32% to 29% and share from Latin America fell from 4% to 2%. Share of imports from the CIS region, Africa, and North America have been negligible during this period. However, non EU European countries maintained share of around 10% import value throughout the 5 year period.

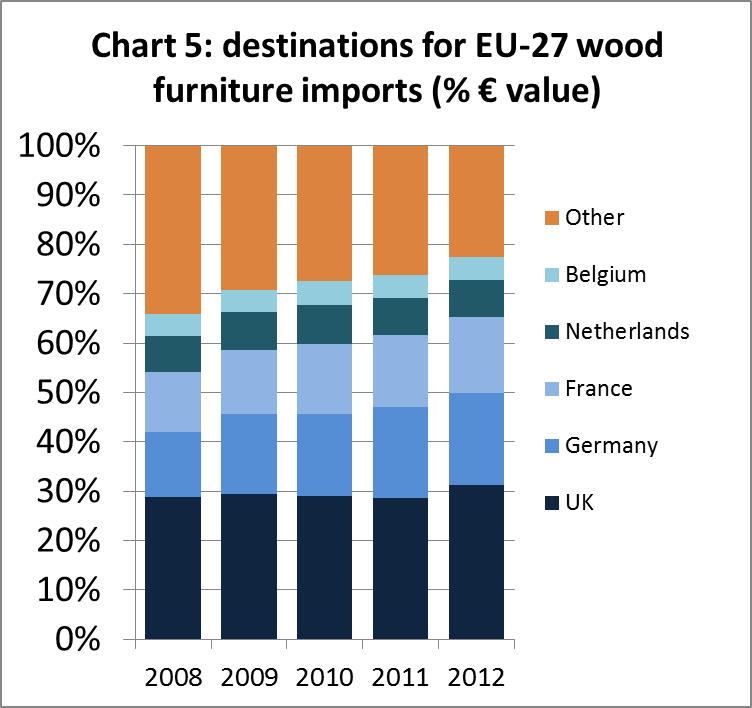

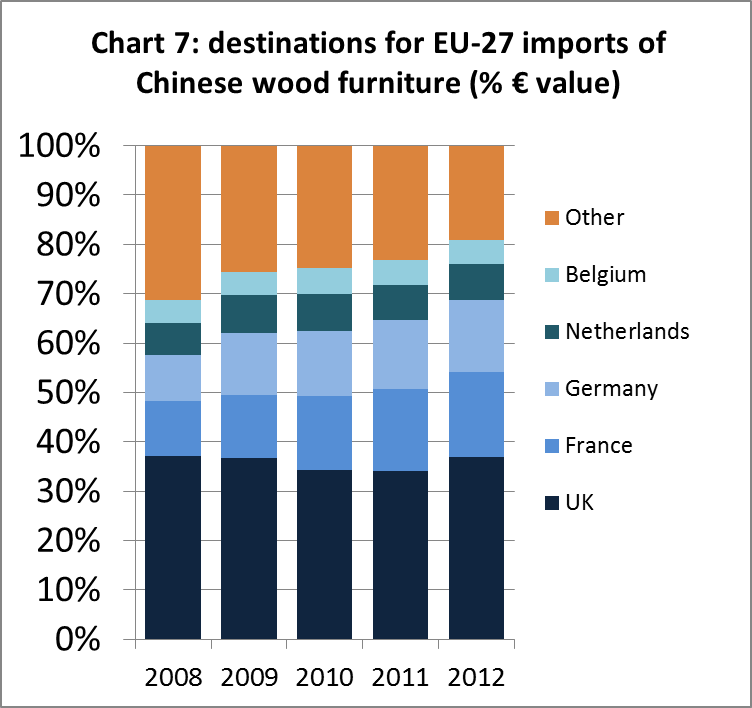

Over the last five years, a rising share of wood furniture imported into the EU has been destined for just three countries: the UK, Germany and France (Chart 5). In 2012, the UK accounted for 31% (€1.69 billion) of all EU imports, Germany for 18% (€1.00 billion), and France for 15% (€840 million). Between 2011 and 2012, import value increased by 13.8% into the UK, 4.1% into Germany and 10.3% into France.

EU wood furniture imports from China

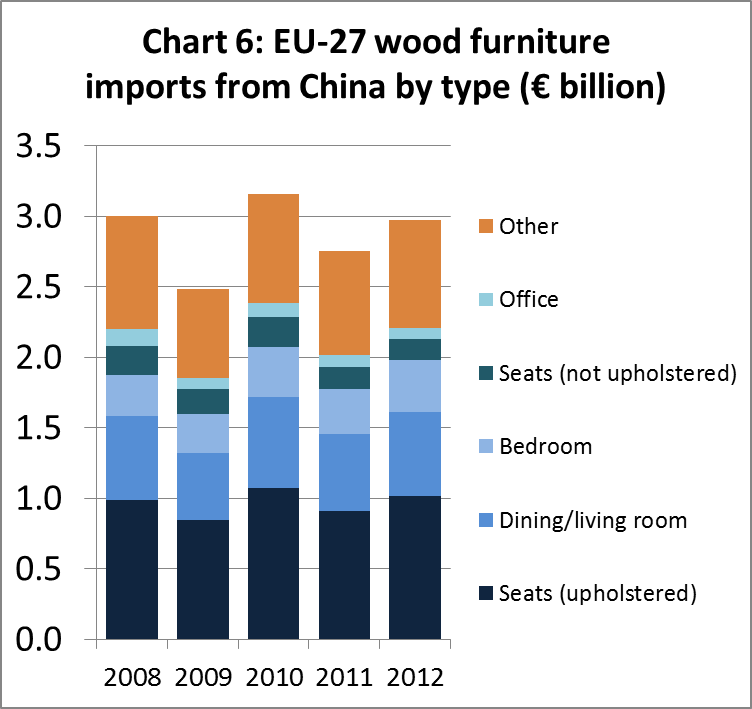

EU imports of wood furniture from China increased by 8% to €2.97 billion in 2012. This partially reversed a 13% decrease in imports from an all-time high of €3.16 billion in 2010 to €2.75 billion in 2011.

Between 2011 and 2012, the EU recorded a rise in imports from China of upholstered seats (+11.7% to €1.02 billion), dining/living room furniture (+8.8% to €590 million), bedroom furniture (+14.4% to €370 million), and office furniture (+3.0% to €80 million). However in 2012 there was a 5.5% decline in EU imports of non-upholstered seats from China to €150 million.

EU’s 10 largest wood furniture importers in 2012

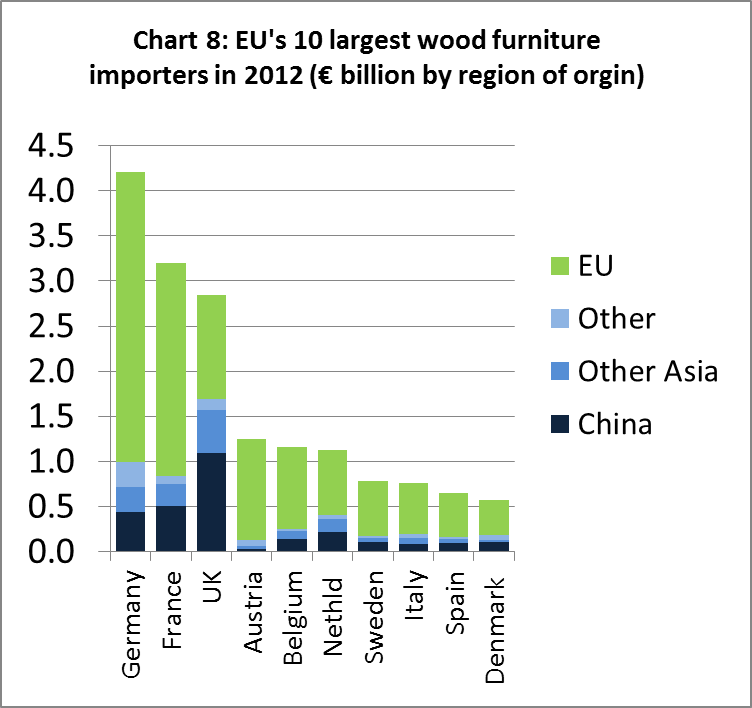

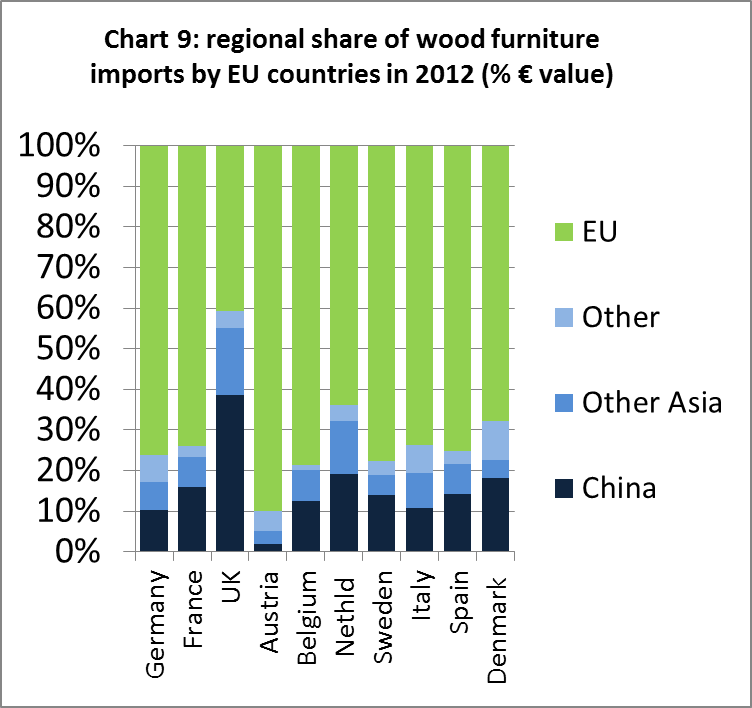

Chart 8 shows total imports of wood furniture by 10 EU Member States, including imports from both inside and outside the EU. Chart 9 indicates very high variability in Member State dependency on wood furniture imports from outside the EU – ranging from close to 60% in the UK to less than 10% in Austria. This variation is due to a number of factors including:

- The presence of very large domestic manufacturing furniture sectors in some countries (particularly Italy, Germany, and Poland);

- Proximity to these manufacturers elsewhere in the EU (most other Central European countries also source a very large proportion of furniture from Italy, Germany and Poland);

- The level of loyalty to domestic furniture brands (a major factor behind low levels of imports into Italy);

- Extent of consolidation in the retail sector – external suppliers have had more success developing markets for furniture products in countries with relatively large consolidated retail networks (such as the UK, Benelux countries, Germany and France) than in countries with more fragmented retail networks (such as in Italy and many Eastern European).

Implementing EUTR in the wood furniture sector

The challenges of implementing the EU Timber Regulation (EUTR) in the furniture sector are probably more pronounced than in any other sector. The wood content of furniture products is often extremely complex, a single piece combining composite and reconstituted panels with a variety of veneers and sawn timber, a large proportion of which may be finger-jointed from off-cuts in a wide variety of woods from numerous sources. Much of the wood content of a furniture item may be hidden, particularly in upholstered products.

For the time being, this is less of a problem than it might be for EUTR for the simple reason that a large proportion of furniture products are not actually covered by the regulation. EUTR currently only applies to wood furniture included under Harmonised System (HS) Code 9401 (furniture other than seating). Wood furniture under HS Code 9403 (seating) is excluded. Wooden seating accounts for €1.94 billion (36%) of the €5.39 billion of wood furniture imported in 2012. Considering just imports from China, €1.18 billion (40%) of imports of €2.97 billion are excluded from EUTR.

Implementing EUTR in the furniture sector is also complicated by the lack of vertical and horizontal integration. There has been some consolidation in the international furniture industry in recent years – particularly driven by IKEA in Europe – but the sector remains very fragmented compared to many other industrial sectors. The world’s 200 largest furniture manufacturers only account for around 30% of total production worldwide. The wood furniture sector particularly is characterised by relatively low barriers to entry, is still often based on small scale artisan operations, and is very widely distributed.

Even IKEA, the largest and most integrated furniture company in the world, has emphasised the considerable challenges of fully conforming to a strict interpretation of EUTR requirements across all its operations. The company is sourcing wood raw material from literally hundreds of thousands of different forests of origin every year. At every stage of the supply chain and during the manufacturing process, there is mixing of wood material from innumerable different sources. Despite the resources at its disposal and implementation of a very comprehensive due diligence system, IKEA emphasise that “it is not normally possible to trace individual product back to the forest” and that “physical tracing of wood is resource inefficient”[1].

In an effort to ease implementation of EUTR in sectors like furniture, the European Commission has issued specific guidance on how to handle composite products under the regulation. The guidance is rather cursory, and falls well short of providing all the answers. However, it offers some flexibility in interpreting the law which should assist the furniture trade.

The EC’s Guidance on composite wood products relates to Article 6(1) of the EUTR which sets out requirements for the due diligence system that must be implemented by the “operator” (i.e. the company that “places timber on the EU market”). The due diligence system must include “measures and procedures providing access to the following information concerning the operator’s supply of timber or timber products placed on the market”. The required information includes “description, including the trade name and type of product as well as the common name of tree species and, where applicable, it’s full scientific name; country of harvest, and where applicable sub-national region where the timber was harvested and concession of harvest.”

The guidance emphasises that the obligation to have “access to information” on the species content and place of harvest applies no matter how many different tree species are in any one product or how many countries of harvest are involved. However, the guidance also observes that there may be particular challenges to achieving this objective for composite products. The guidance accepts that the species mix in any one product group may be very wide and vary over time. It notes that “If the species of wood used to produce the product varies, the operator will have to provide a list of each species of wood that may have been used to produce the wood product“.

The guidance for composite wood products also needs to be considered alongside an obligation in the EUTR Implementing Regulation that “operators shall apply the due diligence system to each specific type of timber or timber product supplied by a particular supplier within a period not exceeding 12 months, provided that the tree species, the country or countries of harvest or, where applicable, the sub-national region(s) and concession(s) of harvest remain unchanged“[2].

This indicates that the list of possible species in each product group needs to be regularly reviewed at intervals not exceeding 12 months. Furthermore it implies that suppliers of wood products into the EU must be ready to inform operators immediately of any change that might occur in the species mix or region of origin.

The EC guidance goes on to give example descriptions of operator’s supply. These imply (although do not make explicit) that the following is acceptable when dealing with composite products where there is a negligible risk of illegal harvest:

- To define “supply” as all the consignments of a specified product (e.g. “flat-pack kitchen fittings”) over a specified period of time (e.g. “1 Jan – 31 Dec 2013”);

- To use broad terminology with no need necessarily to reference percentage mix to describe the species content of these consignments (e.g. ” Mixed conifer: mainly Scots pine (Pinus sylvatica) and Norway spruce (Picea abies)”);

- Having identified “country of harvest”, to then use broad terminology to describe the “concession of harvest” (e.g. “Multiple private forest owners”);

- To use national, regional or product-specific risk assessment prepared “under certification guidelines” as one way to demonstrate legal origin.

However, when sourcing products with a non-negligible risk of illegal harvest, the example descriptions imply (again without making explicit) that more specific information is required. For example, the illustration for “12-mm plywood” indicates that detailed source information should be sought for bintangor face veneer. In this instance, the operator should have access to information on the individual concession in a specified province. This may be demonstrated by documentation issued by a government agency in the country of harvest or by independent certification. Given that the commercial name “bintangor” encompasses 180-200 individual species within the genus Callophyllum, the illustration indicates that the species may be identified for purposes of EUTR conformance as “Callophyllum sp.”

[1]Anders Hildeman, IKEA, Presentation on policing due diligence, Workshop One Preparing for EUTR Implementation, hosted by Chatham House, January 2013, Brussels

[2] Commission Implementing Regulation (EU) No 607/2012 of 6 July 2012, Article 2.1

PDF of this article:

Copyright ITTO 2020 – All rights reserved