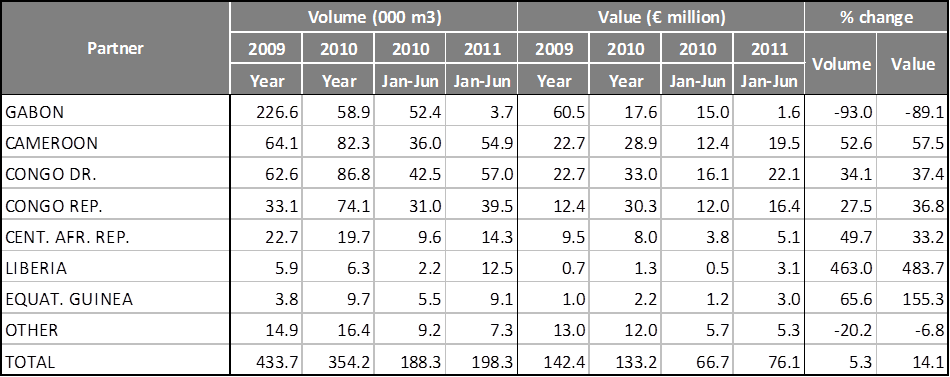

During the first half of 2011, the EU imported 198,300 m3 of hardwood logs from tropical countries, a 5% increase compared to the same period in 2010. As commercially valuable logs can no longer be exported from Gabon, EU imports from all the other main producing countries in the Congo region increased dramatically during the 6 month period (Table 1).

Table 1: EU-25 imports of hardwood logs from tropical countries

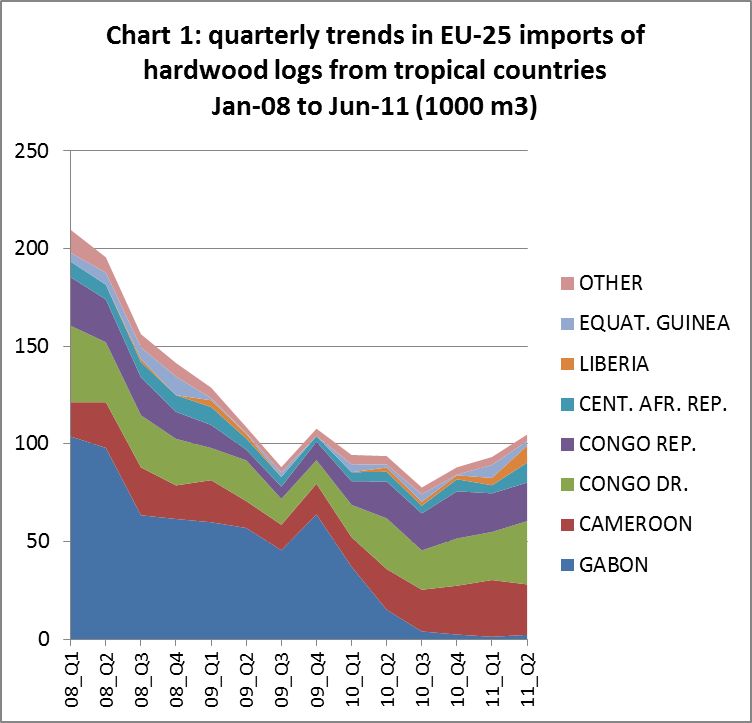

EU imports of tropical hardwood logs in the second quarter of 2011 reached 105,000 m3. Quarterly imports have risen now for three consecutive quarters, recovering from a low of only 78,000 m3 imported in the third quarter of 2010. However Chart 1 which tracks EU quarterly imports of tropical hardwood logs over the last three years, shows that imports of this commodity are only 50% of levels recorded in early 2008. There are various reasons including economic recession in Europe, Gabon’s log export ban from May 2010, and the significant recent decline in okoume plywood manufacturing in France.

Shipments of tropical hardwood logs to Europe during the second half of 2011 are unlikely to show any significant improvement. Buying was slow to pick up at the end of the European holiday season in September. Consumption is sufficiently slow that there are few reports of significant supply bottlenecks despite continuing reports of delayed shipments from Africa.

Stasis in EU veneer market

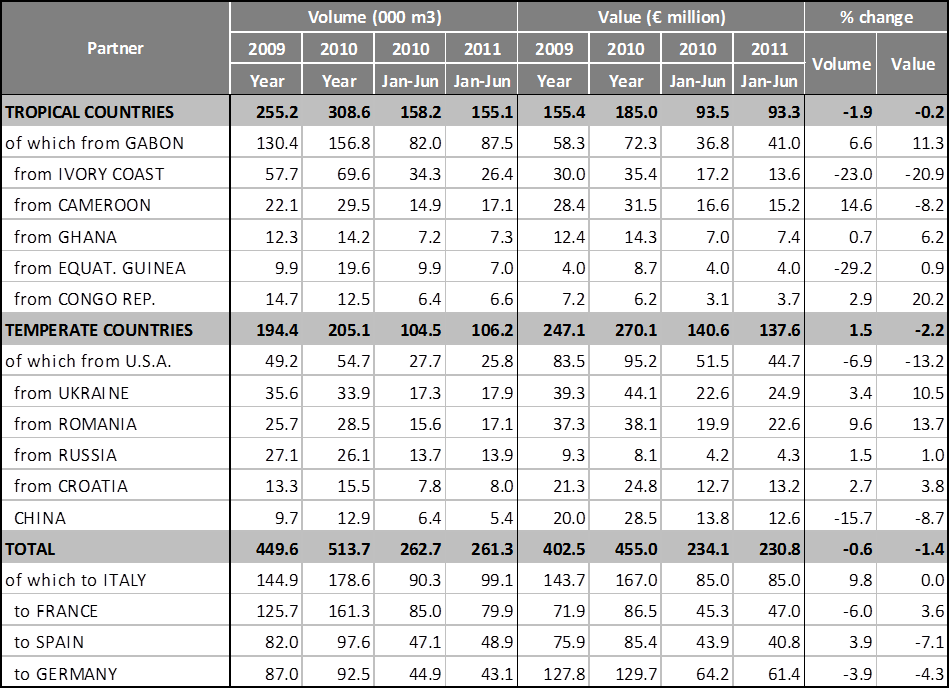

Table 2 showing recent trends in EU-25 imports of hardwood veneer, indicates that the decline in EU imports of tropical hardwood logs has not yet been offset by an increase in imports of tropical hardwood veneer. EU imports of this commodity reached 155,100 m3 in the first six months of 2011, down 1.9% compared to the same period in 2010. A slight increase in imports from Gabon and Cameroon was more than offset by a large decline in imports from Ivory Coast and Equatorial Guinea.

Table 2: EU-25 imports of hardwood veneers

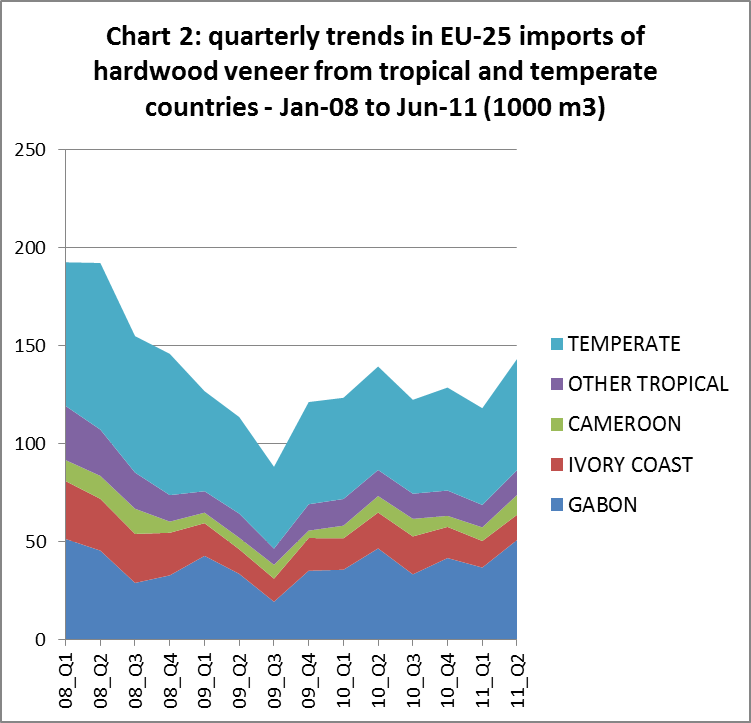

On a more positive note, Chart 2 shows that EU imports of tropical hardwood veneer, particularly from Gabon, rose sharply in the April to June 2011 period after a very slow start to the year. It remains to be seen whether recent efforts to increase investment in Gabon’s wood processing sector will lead to this becoming a sustained trend.

The relative stability of EU imports of hardwood veneer during 2011 masks deeper processes of on-going structural change in the sector. The reality is that there is considerable uncertainty about longer term market prospects which is encouraging a conservative approach to purchasing.

The European market for rotary veneers of tropical hardwood appears to be in long-term decline as okoume plywood manufacturing operations in Europe have closed and okoume plywood has come under intense pressure from cheaper products (particularly combi-products from China comprising a poplar core and decorative hardwood face veneer).

Meanwhile, demand for high quality tropical hardwood sliced veneers has been hit by a combination of factors. European manufacturers are increasingly switching to domestic hardwoods to reduce costs and supply chain risks in a market environment where nobody wants to be caught holding too much stock. This trend has gone hand-in-hand with improvements in treatment technologies allowing even the blandest of temperate hardwoods to produce a diversity of looks and finishes.

The most recent data from Germany, traditionally the centre of the European veneer trade, gives some indication of how far this trend has progressed. The latest survey of the German veneer industry by GD-Holz suggests that European hardwoods now account for 63% of veneer manufacturing, up from 56% last year. This year oak (both European and American) makes up 38% of total production, with beech, maple and walnut contributing a further 23%, 9%, and 8% respectively. Tropical hardwood currently accounts for around 15% of German veneer production.

At the same time, all sliced wood veneers continue to come under pressure from non-wood substitutes and from weak consumption in major end-using sectors. Despite concerted marketing efforts by the European veneer sector, European furniture and door producers are still shifting to non-wood alternatives. These losses have only been partly off-set by gains made in sales to the interior fittings market (floors and edges/borders) and higher value niche markets such as yachts, cars, and airplanes.

Hardwood plywood prices weaken as supply pressures ease

Availability of South East Asian plywood for forward shipment to Europe has improved in recent weeks. The supply problems that arose for European importers early in the year following the Japanese Tsunami have now eased. Although log supply to mills in Indonesia and Malaysia remains at relatively low levels, it is now sufficient to meet current subdued levels of demand. The slight improvement in log supply has coincided with slower consumption in Japan and continuing weak demand in Europe and North America.

Some mills in Malaysia are now offering BB/CC grade plywood to European buyers at lower prices than in September. However quality is now quite variable between Malaysian mills as some have been cutting corners in an effort to improve competitiveness. Prices for Indonesian plywood have remained more stable, but supply pressures are now less pronounced and lead times for some Indonesian products for delivery to Europe have fallen to around 5 weeks.

Demand for Chinese plywood in Europe remains slow. The UK is quite heavily stocked relative to current levels of subdued consumption so that forward buying has been slow in the autumn months. The German trade journal EUWID reports that consumption of Chinese hardwood plywood in Germany is so slow that some merchants have introduced promotional offers on their existing stocks. EUWID reports that Chinese exporters have pushed up FOB prices for hardwood plywood in response to rising labour and raw material costs. However, this has been offset for European buyers by falling freight rates.

MTCS rejected for Dutch government procurement

In 2010, the official Dutch government timber procurement body TPAC judged that the Malaysian Timber Certification System (MTCS) does not meet the Dutch procurement criteria for wood. On 19 October 2011, the Board of Appeal of Stichting Milieukeur (SMK), an independent panel, rejected the Malaysian Timber Certification Council’s (MTCC) appeal against this decision.

The main reason for TPAC’s rejection of MTCS is what it claims is the scheme’s limited recognition of the rights of indigenous peoples and lack of adequate protection against the conversion of certified natural forest to other uses, including plantations. The SMK appeals panel said MTCC had not provided substantive arguments in their case. “The result is that the MTCC Board’s action is on all counts dismissed,” it said.

MTCC said it regretted the decision, which it said undermined the efforts by developing tropical forest countries like Malaysia to implement timber certification. “As a voluntary timber certification scheme that has been developed through a Malaysian multi-stakeholder process, the MTCS is unfortunately held responsible by SMK for issues that are inherent to the Malaysian constitutional, legal and political system,” said MTCC chief executive Chew Lye Teng. “Secondly, the SMK unfortunately chose not to take into consideration the additional measures to address the TPAC concerns that have been agreed between MTCC and the Dutch state secretary Joop Atsma.”

“Contrary to the SMK ruling, the Danish, British, French and UK governments and the German municipality of Hamburg have recognised the MTCS as providing assurance of sustainable timber,” said the MTCC.

The Netherlands is the largest market for Malaysian timber in the EU. In 2010, Netherlands imported around 100,000 m3 of hardwood lumber from Malaysia. While the volume remains significant, it is only half that imported before the economic crises in 2006. Netherlands accounts for 49% of the MTCS’s exports of certified timber products.

Source: TTJ

PDF of this article:

Copyright ITTO 2011 – All rights reserved