The recession in Europe has created many challenges for the European wood furniture sector. However the sector remains globally significant as a driver of design and production innovation. There are also signs that the international competitiveness of the European furniture sector is improving.

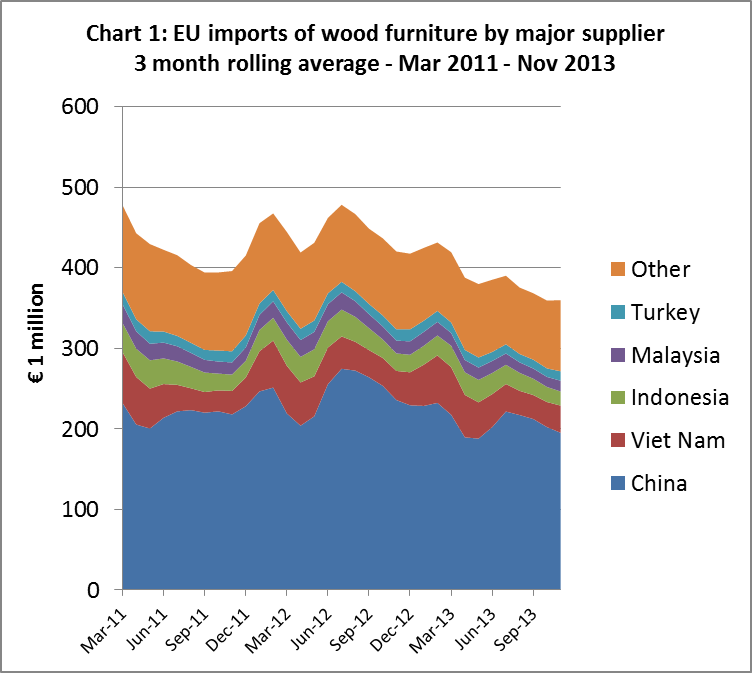

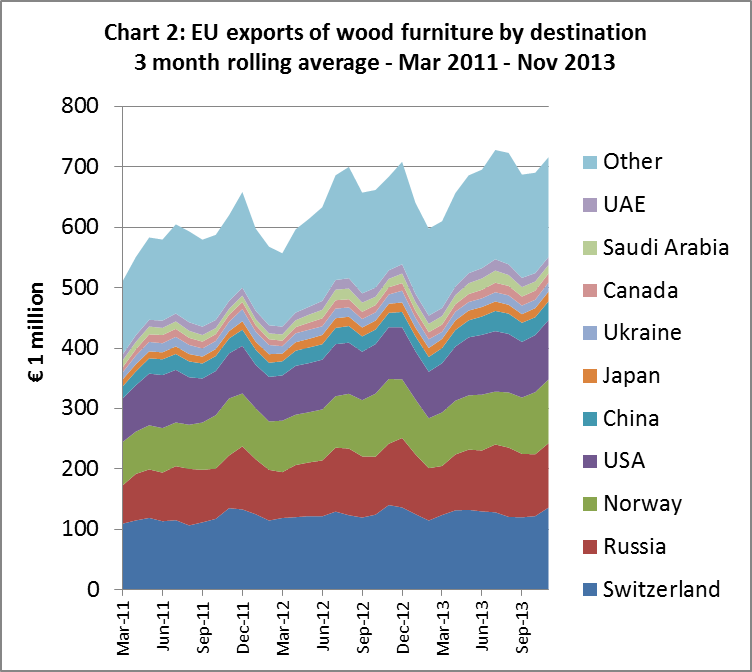

The charts below suggest a significant change in Europe’s position in the global market for wood furniture. Chart 1 shows the 3 month rolling average value of EU imports between the start of 2011 and November 2013. Chart 2 shows equivalent data on EU exports during the same period. The moving average is used to smooth out short-term fluctuations, which are strongly influenced by factors like vacations or shipping delays, so that the longer-term trend becomes clearer.

EU imports of wood furniture have been falling over the last 3 years (Chart 1) while exports have been rising (Chart 2). At the start of 2011, EU net trade in wood furniture was close to zero, with both imports and exports averaging close to €500 million per month. However, by the end of 2013, the EU had a trade surplus in wood furniture of around €350 million per month. Average monthly imports of wood furniture into the EU had fallen to €350 million while exports had risen to just over €700 million per month.

These figures should be put into perspective. EU external trade in wood furniture is relatively small compared to total consumption, which is about €50 billion per year (or €4200 million per month). There is much reliance on domestic manufacturers. Only about one quarter of wood furniture consumed in EU countries ever crosses a national boundary. Total internal trade in wood furniture between EU countries averages around €1200 million per month. Trade statistics and anecdotal reports suggest that the level of EU consumption and internal trade in wood furniture have been static at a low level since 2009 when there was a steep decline during the financial crises.

While external trade forms only a small part of the EU furniture sector, it is becoming much more relevant to European furniture manufacturers. During the recession, manufacturers have become more focused on improving competitiveness relative to manufacturers in other countries, particularly China. With consumption static in domestic markets, European furniture companies are seeking to increase sales in other parts of the world.

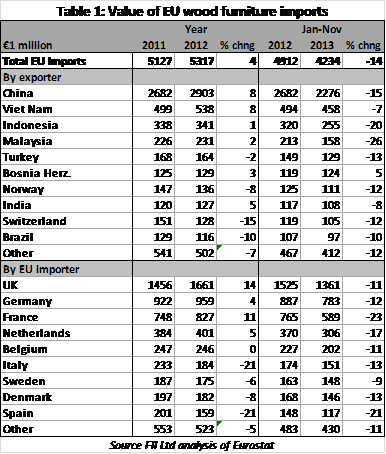

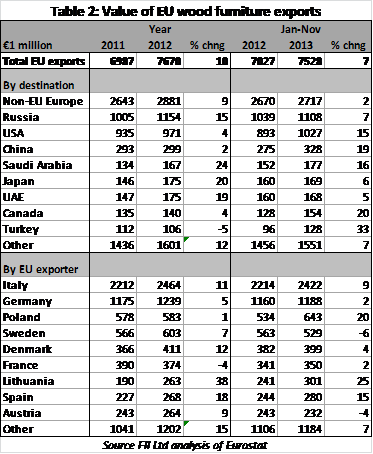

This more outward looking strategy seems to be working for EU manufacturers. Exports of wood furniture are rising, particularly to Russia, North America, China, and the Middle East. The rise in exports is being led by manufacturers in Italy, Germany and Poland (see Table 1). Meanwhile EU imports of wood furniture have been falling, a trend which strengthened in 2013 and affected all the main external suppliers including China, Viet Nam, Indonesia, Malaysia and Turkey (see Table 2). Overall these trends suggest a revival in the relative global competitiveness of European wood furniture manufacturers over the last 3 years.

Strong global influence of large EU furniture manufacturers

The latest edition of World Furniture (www.worldfurnitureonline.com), the quarterly journal of the Italian furniture industry research association CSIL, includes an overview of production trends in the European furniture sector. CSIL note that profits have declined and the total value of European furniture production has been static for a decade (or even decreased in some countries). However CSIL also highlight the strong global influence of Europe’s largest furniture companies.

Following the recent rapid growth in emerging markets, particularly China, the EU now accounts for one quarter of the world’s furniture production and consumption. EU share of world furniture production has contracted over the last decade so that the total value of production in the EU in 2012 was no more than ten years previously. Total EU furniture sector turnover in 2012 was €100 billion, just over the peak of 2008. European furniture industry profits after tax and net income have reduced by a cumulative 30% over the last 5 years.

However these trends are partly offset by a rise in furniture production in plants operated by European companies in other parts of the world. European furniture companies continue to play a leading role in the international market. Europe is home to 84 of the world’s Top 200 furniture manufacturers. These companies are mainly located (in order of importance), in Germany, Italy, Sweden, France, the UK, Poland, Finland, the Netherlands, Austria, Denmark, Lithuania, Spain and Romania.

Although in terms of numbers, around 85% of European furniture companies are micro enterprises with less than 10 employees, the leading European companies are very large. The 100 largest companies in Europe have a total turnover of €20 billion and average of €150 million. Together these 100 companies account for around 20% of the EU furniture sector turnover. Their productive presence now includes numerous plants outside the EU, notably in China, Russia, Ukraine, Belarus and USA.

Europe’s large furniture companies have adopted various strategies to improve competitive during the European financial crises. These include downsizing (with plant closures and lay-offs), increasing production efficiency, increased sourcing from Asia, strong investment in existing and new retailing formats (including in emerging markets) and a strong focus on brand development. As a result, despite the recession in domestic markets, European manufacturers have retained their global leadership in furniture design and production innovation.

European furniture manufacturers go east

CSIL report that around 80% of EU furniture production value in 2012 was in Western Europe (EU15 group of countries). This is down from around 90% a decade ago. However, these figures omit the rising value of production by Western European companies in plants outside the region. Weak European consumption has meant that Western European companies now focus heavily on expansion of exports to fast growing emerging markets.

Germany has the best performing furniture sector and recently overtook Italy as the largest European furniture producer (in terms of value). Germany now ranks as the world’s third largest furniture producer after China and the United States. It is also the second largest exporter after China. According to Eurostat data, Germany is host to over 9,000 furniture manufacturing companies.

The furniture sector in Italy, comprising 20,000 mainly small furniture companies, is more fragmented than in Germany. These companies are concentrated in several regional clusters in Italy. The performance of these clusters has varied widely in recent years depending on product specialisation and their diversity of export markets.

Rapid production growth in Poland

Production value in the EU13 group of Eastern European countries increased 50% between 2002 and 2012. This region now accounts for 20% of total EU production value. Production growth has been particularly rapid in Poland, Romania, Lithuania and Slovakia. Furniture production in this region has always been more export-oriented than in Western Europe. By combining relatively cheap labour with proximity to European customers, furniture production in these countries has risen alongside the on-going process of EU eastern expansion and market integration.

Poland is by far the leading furniture exporter in Eastern Europe with over €6 billion in 2012. Exports accounted for as much as 79% of Poland’s production value in 2012. Poland is also increasingly influential in the global furniture industry. In 2012, it was the world’s 7th largest manufacturer (up from 12th in 2002) and the 4th largest exporter (up from 5th in 2002) after China, Germany and Italy. As in Italy, production in Poland is highly fragmented. There are almost 24,000 furniture manufacturers in the country mainly concentrated in the Wielkopolskie, Mazowieckie and Malopolskie regions.

Romania is the second largest furniture producer in the EU13 group of countries, although production of €1.5 billion in 2012 was only a quarter of that in Poland. Furniture production in Romania expanded at an average annual rate of 6.3% between 2002 and 2012. Exports account for 88% of production and have driven this rapid growth.

The Czech Republic is the third largest producer of furniture in the EU13, with production value of €1.4 billion in 2012. The country has around 500 producers, mostly locally owned with lower levels of foreign investment than in other parts of the region.

Lithuania is now the fourth largest furniture manufacturer in Eastern Europe, with production value rising by 400% between 2002 and 2012, notably due to large investments by the Swedish giant Ikea.

Ikea reports strong market growth in China, Russia and US

The 2013 financial report for the Ikea Group, the world’s largest furniture retailer, provides insights into the outlook for the international furniture sector. In the financial year 2013 (to 31st August 2013), Ikea’s sales increased 3.1% to €27.9 billion and profit also increased by 3.1% to €3.3 billion. Market conditions continued to improve, reports the retailer, with strong growth in China, Russia and the US.

Ikea reports that “Consumer spending is improving in many countries. While the challenging economic situation may not be over, there are positive signs. Important consumer markets such as the US are coming back and Europe in general is starting to recover. Even some of the challenging markets in Southern Europe are showing good signs of activity.” The Ikea Group claims to have gained market share in almost all markets. The largest markets were Germany, the US, France, Russia and Sweden. Ikea, which specialises in large volume sales of low priced furniture, suggests “this indicates that value for money is increasingly important”.

The Ikea Group has an ambitious growth agenda, aiming for €50billion in sales by 2020. It states that the large emerging markets are important sources of future growth. In FY13, the Ikea Group opened two more stores in China – another step in expansion in the Chinese market. Ikea’s long-term focus is to “keep developing better products at lower prices, improving the shopping experience and becoming more accessible to our customers, for example through an improved service offer, e-commerce and continued expansion”.

European furniture shows highlight continuing strong fashion for oak

A recent report from the American Hardwood Export Council (AHEC) reviews fashion trends based on visits to European furniture shows. AHEC note that there are three high profile furniture shows in Europe. The imm show in Cologne, Germany and Maison Objet in Paris take place in January, while the Salone del Mobile is held in Milan, Italy in April. All attract an international audience both in terms of visitors and exhibitors. However, exhibitors often have to choose between the Cologne and Paris as they are held within only a few weeks of each other. Cologne is a more traditional fair and is of particular focus for companies selling into the German market and other Central and Northern EU countries. But as with all the big European shows there are always plenty of visitors from outside Europe.

Based on their visit to imm Cologne, AHEC suggest contemporary design furniture has a much greater representation than in the past. Traditional and reproduction furniture is shown but does not dominate. The exhibition is a platform for leading brands and individual designers targeting the higher end of the market. As a result, quality materials are used. There was a lot of real wood on display, often in combination with other materials. It is hard to quantify, but AHEC suggest that real wood was more prominent than in previous years and there were fewer paper foil and vinyl finishes. This suggests the higher end of the European furniture sector is still an important source of demand for hardwood.

According to AHEC, contrasting colours is a very obvious trend at the moment, and many manufacturers are using the natural tones of wood to contrast with bright colours. White with wood also seemed a particular theme for many brands this year. The vast majority of the wood was temperate hardwood; there were relatively small amounts of tropical hardwood or softwood species on show. The dominant species was oak, but ash was also common, a little beech and quite a lot of walnut, most of which was American.

AHEC report that the trend for a natural rustic look has grown in recent years. It is now common to see leading brands offering expensive designer collections with “character” solid oak. The oak contains grain and colour variations and even sometimes knots. Most of the character oak was from Europe. European producers are favouring European oak because they can source short dimensions and low grades more cheaply than white oak from the USA. For the cleaner more consistent look, manufacturers use mostly veneered panels for the surfaces but solid for legs, rails and chairs.

AHEC also note that at Cologne there was quite a lot of bent wood being used in the contemporary chair design especially ash which lends itself to this application, but also beech and some oak. One new trend this year was the use of heat treated hardwoods – European and North American – for outdoor furniture.

According to AHEC many of the wood trends apparent in Cologne were reinforced at Maison Objet in Paris. At this show, oak was by far the dominant wood material for both furniture and flooring. Flooring manufacturers exhibited oak in hundreds of different finishes and colours. Furniture and interior fittings in pale oak were very popular and often contrasted with other materials such as fabrics or metals in bright colours. The Paris show also highlighted the continued fashion for ‘streamline’ designs – tables with very thin legs and backs and tables with wafer-thin tops. For higher end products, many manufacturers were using American walnut which remains very popular for luxury goods. Many companies at the show reported that their production is now based in China, Vietnam, Poland and Romania.

Chinese products increase market share in the UK

The new Statistics Digest issued by the UK Furniture Industry Research Association (FIRA) at the end of 2013 suggests a small recovery for furniture manufacturing in the UK. However the sector continues to suffer from loss of market share to Chinese product in the domestic market and poor export market performance. The report indicates that the UK furniture sector manufactured £6.5 billion of product in 2012. The significance of imported furniture is reflected by the fact that, at between £4.3 and £4.5 billion, it comprises 40% of the home market. UK furniture exports, however, have remained relatively static for many years, and struggle to reach £1 billion each year.

There were 6131 furniture manufacturers in the UK in 2012. This number has changed little in recent years. The industry is dominated by micro-businesses and SMEs, with only 260 companies (4%) operating at turnovers in excess of £5 million in 2012. 83% of companies turned over less than £1 million. A high proportion of UK furniture companies are extremely small. 58% have annual turnover of less than £250,000. Furniture manufacturing is quite evenly spread around the UK, although there is a higher concentration in London and the South-east which together account for 24% of all UK furniture manufacturers.

Total imports of furniture into the UK decreased from £4.5 billion in 2010 to £4.3 billion in 2011 but then increased again to £4.5 billion in 2012. The largest external supplier was China which accounted for 33% of import value in 2012. Other major suppliers are Italy, accounting for 10% of import value in 2012, and Germany which supplied 9%.

UK furniture exports increased from £754 million in 2009, to £993m in 2011, but 2012 saw a reverse in this trend, with exports falling slightly to £946 million. The UK has traditionally targeted its exports at the Republic of Ireland and the USA and this continued to be the case in 2012 (16% and 13% respectively). Trade with leading European nations such as Germany, France, the Netherlands and Belgium was the other main source of income from exports.

The Statistics Digest also explores trends in the wider UK economy. Key points include:

- Total consumer expenditure in the UK increased by just over 2% between 2009 and 2012 to over £920 billion.

- Total lending to consumers in the UK has been increasing slowly. Between 2009 and 2012, total lending increased by £23 billion to £1475 billion.

- However total “unsecured” lending (i.e. excluding mortgages) of £210 billion in 2012 was much lower than its peak of £238 billion in September 2008.

- There was a slight upward trend in UK housing starts between 2008 and 2011 followed by a slight downturn in 2012. Preliminary indications are that housing starts increased again in 2013.

- While the total number of UK property transactions gradually increased over the 2009 to 2012 period (by 9%), there was a significant rise of over 5% between 2011 and 2012. Preliminary data suggests the rising trend continued in 2013.

FIRA conclude, based on their statistical analysis and other anecdotal evidence, that furniture consumption in the UK is recovering slowly. Consumers are becoming willing to borrow and spend more money, and housing starts and transactions are up. However the market remains well below the pre-2008 level and is unlikely to grow rapidly.

PDF of this article:

Copyright ITTO 2020 – All rights reserved