Across the EU, signs are emerging of a gradual improvement in economic conditions and confidence. Fears of a euro currency collapse have receded into the background and the political situation seems more stable in Southern Europe. GDP growth resumed from the second quarter of 2013 in several European countries, notably the UK and Germany. Construction sector activity has also improved significantly in the UK and Germany from the start of the summer onwards.

However, there is little sign yet of these positive developments filtering through into the European market for tropical hardwood. After a slow start to the year and subdued buying in summer, the EU market for tropical sawn hardwood has continued weak into the autumn months. There was a brief increase in orders from European importers during September immediately after the summer lull to replenish depleted stocks. However, general lack of confidence and limited availability of credit meant that very few importers have been willing to speculate and to build stock holdings in anticipation of stronger future demand. The slow pace of tropical hardwood imports into Europe has been almost universal this year with nearly every EU Member State recording a significant downturn in imports.

With consumption so limited for so long, the number of tropical suppliers engaged in the European market has declined. This means that even when demand improves – as it has recently in the case of sawn sapele – supply soon becomes a problem. In addition to slow consumption and limited supply, imports this year have been hampered by legality concerns following introduction of the EU Timber Regulation (EUTR) in March 2013 and by mounting competition from a range of wood and non-wood substitutes.

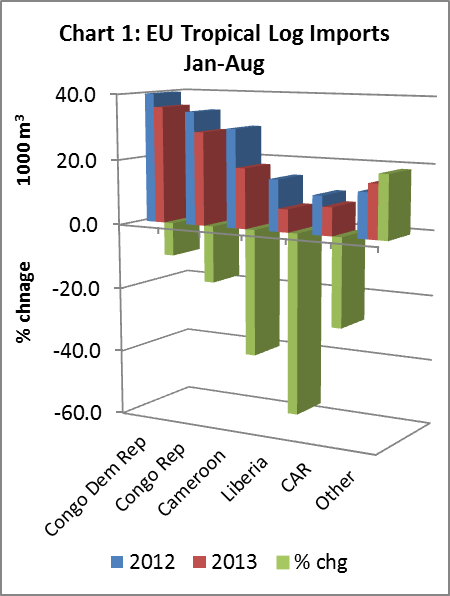

EU imports of tropical hardwood logs down 21%

In the first 8 months of 2013, EU imports of tropical hardwood logs were 114,000 m3, down 21% compared to the same period in 2012. Imports of this commodity into France, the main destination, were down 11% at 62,000 m3. Imports from all the leading supply countries declined, including Congo (Kinshasa), Congo (Brazzaville), Cameroon, Central African Republic, and Liberia (Chart 1).

The decline is due to the combined effects of weak European demand, supply constraints and regulatory uncertainty. Political unrest has restricted log availability from Central African Republic in 2013. The Liberian government placed a freeze on all logging activities in January this year, including on the exportation of logs from the country. In May this year, the Forest Stewardship Council (FSC) terminated its relationship with decorative veneer and hardwood timber producer Danzer Group following a complaint from an environmental group. This has further undermined European demand for products manufactured from Congolese logs.

Meanwhile, encouraged by the EUTR, environmental groups have focused heavily on finding discrepancies in the legal documentation for log exports from the Congo basin. A shipment of Congolese wenge logs is currently being held in custody by the German authorities as they deliberate over alleged irregularities in the certificates of origin filed for the shipment. The competent Congolese Ministry has intervened to state that the legal documentation is correct. A final decision is now awaited from the German authorities over whether the shipment will be confiscated and a fine imposed. Irrespective of the outcome, the dispute has added to the already high level of uncertainty in the EU tropical hardwood log trade.

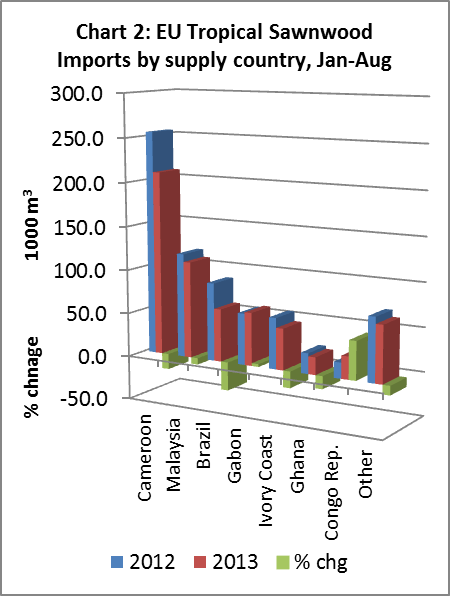

Tropical sawn hardwood imports unlikely to exceed 900,000 m3 in 2013

EU imports of tropical sawn hardwood in the first 8 months of 2013 were 597,000 m3, 14% down on the same period in 2012 (Chart 2). After falling below 1 million m3 for the first time since records began in 2012, it is unlikely that EU imports of sawn tropical hardwood will exceed 900,000 m3 in 2013 and they may be as low 850,000 m3.

EU imports of tropical sawn hardwood during the first eight months of this year fell particularly heavily from Cameroon, at 209,800 m3 down 18% compared to the same period in 2012. Imports also fell sharply from Brazil (down 32% at 60,000 m3) and Ivory Coast (down 19% at 47,000 m3). After a rapid fall between 2011 and 2012, the pace of decline in imports from Malaysia has slowed slightly this year. Imports of Malaysian sawn hardwood were down 7% at 109,900 m3 during the first 8 months of 2013.

In contrast, both Gabon and the Congo (Brazzaville) recorded rising sales of sawn hardwood in the EU during the first 8 months of this year. EU imports from Gabon increased 3% year-on-year to 60,200 m3, while imports from Congo (Brazzaville) were up 44% year-on-year at 25,700 m3.

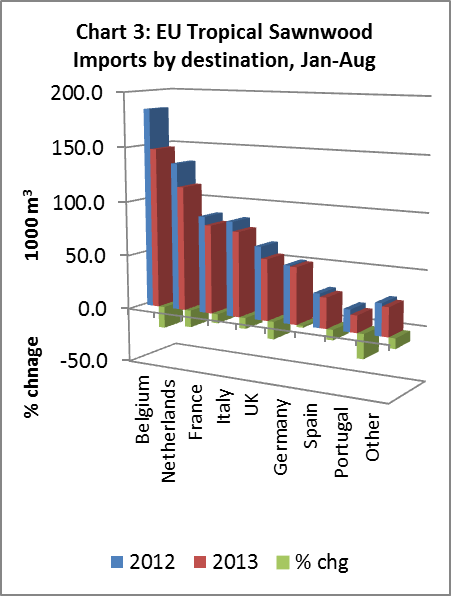

Imports of sawn tropical hardwood declined into all the major EU markets during the first 8 months of 2013 (Chart 3). Imports fell particularly heavily into Belgium (down 20% compared to the same period in 2013), the Netherlands (-16%), and the UK (-16%). Imports into France and Italy declined sharply in 2012 and have continued to slide in 2013, but at a slower pace. In the first 8 months of 2013, imports were 81,100 m3 into France and 77,800 m3 into Italy, respectively 9% and 10% down on the same period the previous year. Germany is the only large market where imports have remained relatively stable this year, reaching 51,600 m3 in the first 8 months, only 2% down on the same period in 2012.

Limited supply of sawn sapele

Falling EU imports during 2013 are only partly due to weak demand. Limited supply of sawn sapele is now beginning to have a significant impact on the level of imports. Lead times for sapele are becoming very lengthy with orders placed now not being offered for delivery until April next year at the earliest. This is resulting in sharply rising prices both on an FOB basis and for landed stock in the EU. A number of factors are being blamed for lack of supply, including increased diversion of trade to China and the US and the fact that African mills have not returned to pre-crises capacity. In addition, a representative of one large EU distributor with operations in Africa suggests that less sapele is available in the new concession areas now being allocated for harvesting. The reasons for this are unclear.

Supply is less of an issue and prices have been more stable for most other major African commercial species. Iroko prices on offer to European buyers have changed little in recent months, although there is speculation that this might change with rising demand, particularly in the US and Ireland. Expectations that Ivory Coast framire would be subject to widespread boycott in the UK market as a result of EUTR compliance concerns have not materialised. Although a few former buyers are no longer engaged in the trade, others have approved some Ivory Coast suppliers in line with their due diligence requirements. Those suppliers are now reaping the rewards of rising European demand for their products, particularly in the UK. The low prices for framire offered by some Ivory Coast exporters during the spring and summer months to stimulate demand are no longer available.

Less direct competition between sapele and meranti

In the past, there was strong direct competition in the European market between African sapele and South East Asian meranti, so much so that prices changes in one species would quickly impact on demand and prices in the other. However this relationship seems to have broken down during the recession. The European market has become increasingly accustomed to and oriented towards African sapele.

In the formerly large Dutch window sector, Malaysian meranti used to have a strong edge over African sapele due to quicker turnaround times and tight adherence to Dutch quality and size specifications. However this market has been devastated in recent years due to the recession and zealous adherence to FSC certification standards by public authorities. The result is that prices for meranti lumber on offer to European buyers have remained weak and unresponsive to the rise in prices for African sapele.

Another change is that Malaysian meranti is no longer readily available at short notice to European buyers. As the world’s demand for tropical hardwood has shifted away from Europe towards other markets, notably in Asia and the Middle East, very few Malaysian sawmills now maintain stocks of meranti lumber in European specifications. Instead of waiting a few weeks for products to arrive after ordering, turnaround times now extend to several months.

Weak demand for hardwood for marine defence and decking

European demand for heavy-duty species such as South American greenheart and African ekki has been very weak this year. This is due both to the long-term decline in local government funding during the recession and continuing efforts by government authorities to substitute tropical hardwood for other species and products with lower costs upfront and which are perceived to have a smaller environmental footprint.

The market for tropical decking timbers in Europe during the 2013 summer season proved to be very slow, with some reports suggesting demand down 20% or more compared to the previous year. Weather conditions in Europe were quite good this year and there was a reasonable level of activity in the decking sector as a whole. The decking market in the UK was particularly good, boosted by rising business confidence and better weather over the summer months.

However tropical hardwood has suffered a further loss of share in the decking sector this year both to other wood species and to Wood Plastic Composites. Amongst tropical hardwoods, Asian bangkirai has suffered more from substitution than South American alternatives such as a cumaru and ipe. Orders of bangkirai for the next spring season, usually placed in the autumn of the preceding year, are expected to be delayed and low again this year.

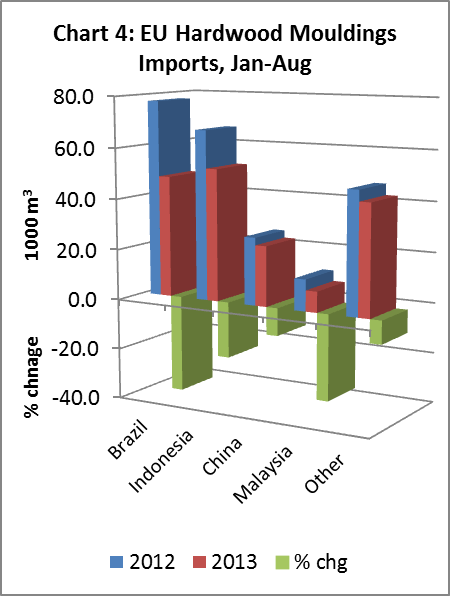

EU imports of hardwood mouldings decline 24%

In previous years, some of the decline in EU imports of sawn tropical hardwood has been offset by rising imports of hardwood mouldings and engineered wood products from tropical countries. However this year, imports of these products have also fallen sharply (Chart 4). EU imports of hardwood mouldings, most of which derive from developing countries, were 175,400 m3 in the first 8 months of 2013. That is 24% less than the same period in 2012. Imports from Brazil fell particularly heavily, down 38% at 47,900 m3. Imports also fell from Indonesia (-22% at 52,100 m3), China (-11% at 23,700 m3) and Malaysia (-34% at 8,200 m3).

Some of the decline in EU imports of hardwood mouldings may be due to declining competitiveness relative to EU domestic production. For example, Brazil’s hardwood industry continues to suffer from high and rising labour and other business costs, while China’s labour costs have risen rapidly in recent years. Hardwoods are also coming under intense competitive pressure in the mouldings sector from pine and MDF.

However, there are isolated reports of some tropical hardwood products regaining market share in the moulding sector at the expense of temperate hardwoods. For example, in recent years American tulipwood made significant inroads into the European market for painted mouldings. However this year there are reports of Ghanaian wawa retaking share as the price of American tulipwood is rising. During 2013, lack of log supply and rising US and international demand has led to a significant increase in prices across the full range of American hardwood species.

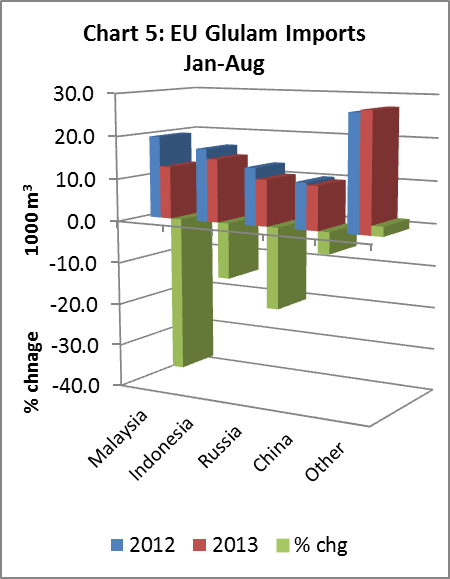

14% fall in EU imports of window scantlings

Weak construction sector activity during 2013 has led to further declines in EU glulam imports (Chart 5). EU imports of this product, which consist primarily of scantlings for the window sector, were 75,800 m3 in the first 8 months of 2013, 14% less than the same period the previous year. EU imports of scantlings from Malaysia were 12,300 m3 during this period, down 36% year-on-year. Imports from Indonesia were 14,800 m3 between January and August 2013, a 15% decline.

Short-term prospects for meranti window scantling in the EU market seem poor. Despite limited buying this year, importers’ inventories have run ahead of demand in recent weeks. Prices in Europe have been falling and exporters in Asia are also coming under intense pressure to reduce FOB prices.

However, longer term prospects appear more promising. More building permits are now being issued in Germany, the leading European market, and there is rising confidence in the German construction sector. The UK construction sector is also rebounding more strongly than expected this year. The UK has not been a significant market for tropical hardwood glulam in the past, but interest in engineered scantlings is now rising with introduction of tougher quality and energy-efficiency standards for wood windows. These factors, together with limited supply of sapele, the leading African wood used in European joinery, might lead to improving European demand for meranti window scantlings during 2014.

PDF of this article:

Copyright ITTO 2020 – All rights reserved