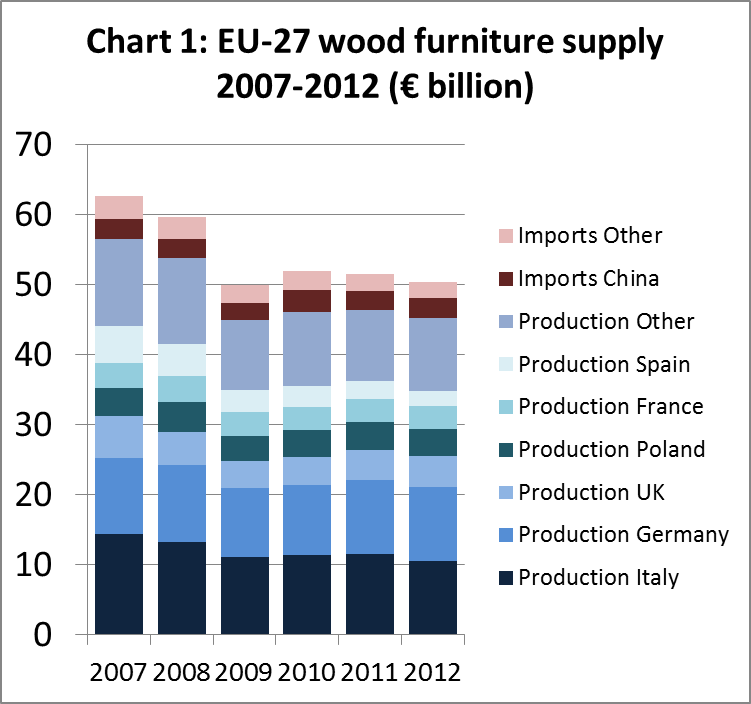

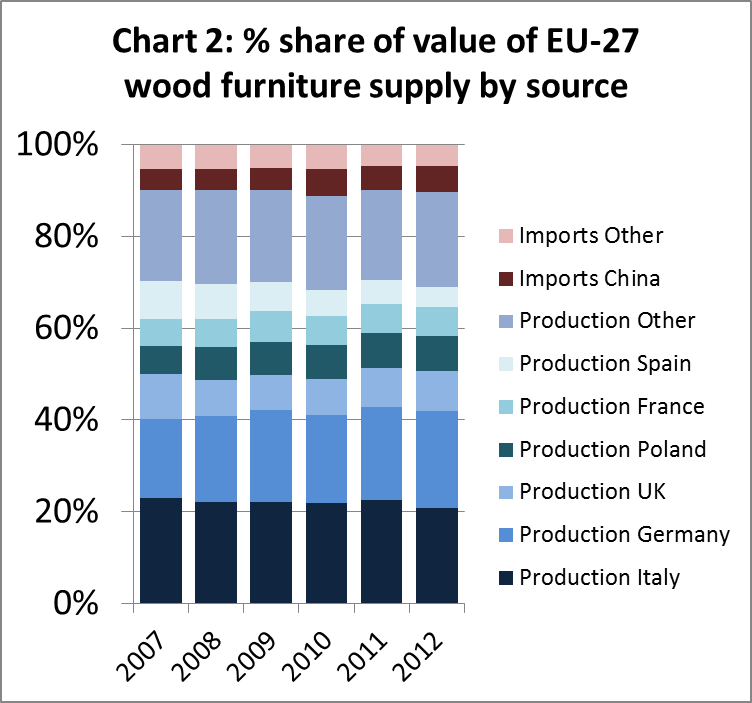

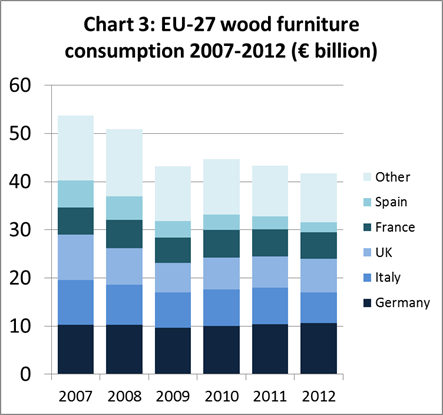

Total supply of wood furniture into the EU27 market is estimated to have been €50.4 billion in 2012, down 2% from €51.5 billion in 2011 (Chart 1). EU27 production decreased 4% from €46.45 billion to €45.22 billion. Imports increased 3% from 5.07 billion to 5.27 billion. In 2012, imports accounted for 11.6% of all furniture supply to the EU, up from 10.9% the previous year, but below 12.5% recorded in 2010 (Chart 2). Overall consumption is estimated to have fallen 4% in 2012 from €43.35 billion to €41.75 billion (Chart 3).

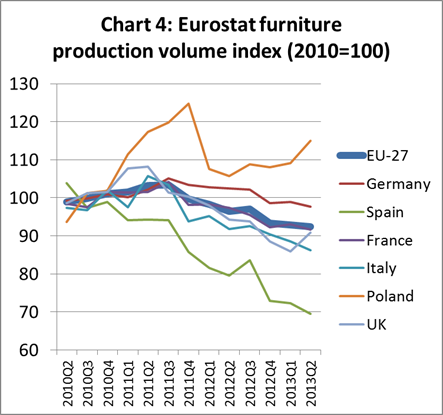

The Eurostat furniture production index suggests that the downward trend in EU production has continued into 2013 (Chart 4). However, the rate of decline has slowed due to stabilisation in German and French production, a strong rebound in Polish production and signs of improvement in the UK. Production has continued to slide in Italy and Spain this year.

These figures for wood furniture supply to the EU are provided by Forest Industries Intelligence (FII) Ltd drawing on a range of data derived from Eurostat and other sources. Much of the data is estimated due to the poor quality of information on wood furniture production in most EU countries.

Uncertainty surrounding Italian furniture production data

Eurostat report that the value of wood furniture production in Italy during 2012 increased 16% from €11.6 billion to €13.4 billion. This is almost certainly a statistical error. It would imply that production last year returned to levels similar to those prior to the financial crises in 2008. However this trend is contradicted by a wide range of other economic data and anecdotal reports which indicate that the sector is more likely to have contracted in 2012.

Timber traders report low and declining consumption of hardwood in the Italian furniture sector last year. Eurostat’s own index of production volume records a continuing decline in 2012. CSIL, the Milan-based furniture industry research organisation, records a 10% decline in total Italian furniture production last year. The FII Ltd analysis aligns with the CSIL estimates and assumes that Italian wood furniture production fell 9% from €11.57 billion to €10.50 billion last year.

Italian manufacturers recorded a 2% increase in export market sales during 2012, from €4.75 billion to €4.84 billion. However, weakness in the Italian domestic furniture market led to a sharp 14% decline in imports from €825 million to €713 million. Overall wood furniture consumption in Italy is estimated to have fallen 17% from €7.65 billion to €6.37 billion during 2012.

In contrast to Italy, the German wood furniture market remained quite stable during 2012. German wood furniture production is estimated to have increased by 1% from €10.53 billion in 2011 to €10.65 billion in 2012, mainly due to a 3% increase in domestic market consumption from €10.35 billion to €10.66 billion in 2012. If these estimates are accurate, it means that Germany may have overtaken Italy as the largest European wood furniture manufacturing country during 2012. Between 2011 and 2012, German wood furniture exports decreased 2% from €4.22 billion to €4.14 billion, while imports increased 3% from €3.98 billion to €4.10 billion.

Euro value of UK furniture consumption up 6% in 2012

In terms of € value, UK consumption of wood furniture recorded a 6% increase from €6.52 billion in 2011 to €6.88 billion in 2012. UK production is estimated to have increased 2% from €4.31 billion to €4.40 billion, boosted both by the rising value of domestic consumption and export sales. UK furniture exports are mainly targeted at the US and Irish markets, both of which are showing slow signs of recovery. UK exports of wood furniture increased 5% from €343 million in 2011 to €359 million in 2012. The value of UK wood furniture imports is estimated to have increased 11% from €2.55 billion to €2.84 billion between 2011 and 2012.

These positive numbers for the € value of consumption and production in the UK need to be considered in the light of the GBP being on average 10% stronger against the euro in 2012 compared to 2011. The UK government’s own Index of Production for UK furniture, which is measured in GBP and fed into the data that leads to the official GDP figures, suggested poor performance in 2012 over 2011 with a fall of over 10%.

The French wood furniture sector suffered a 4% decline last year from €3.35 billion to €3.21 billion. French products came under increasing competitive pressure both at home and in export markets. Exports of wood furniture from France decreased 4% from €782 million to €749 million while imports into the country increased 2% from €3.0 billion to €3.1 billion.

Catastrophic collapse of Spanish furniture sector continues

The catastrophic collapse of Spain’s wood furniture sector continued during 2012. Production fell a further 16% from €2.60 billion to only €2.17 billion. Concerted efforts to boost overseas sales led to a 4% increase in exports from €606 million in 2011 to €633 million in 2012. However this could not offset a 21% decrease in Spanish wood furniture consumption from €2.72 billion in 2011 to €2.15 billion in 2012. Spain’s imports of wood furniture declined 16% from €727 million in 2011 to €612 million.

Meanwhile Poland, a country which has seen significant inward investment in furniture production capacity in recent years, recorded a 2% decrease in production value from €3.92 billion in 2011 to €3.85 billion. This was mainly due to weakening consumption in the domestic market as exports remained stable at $3.38 billion.

Europe’s smaller wood furniture producing countries do well in 2012

Some positive trends were recorded by several of Europe’s smaller wood furniture manufacturing countries during 2012. Particularly notable is Portugal where wood furniture production increased 48% from €557 million in 2011 to €825 million in 2012. Portuguese wood furniture exports increased 13% from €432 million to €487 million during the same period.

A few Eastern European countries also increased wood furniture exports last year, including Lithuania (+23% to €808 million), Czech Republic (+11% to €310 million), Slovakia (+3% to €417 million), and Romania (+4% to €762 million). In most of these countries imports are declining at the same time as exports are rising, indicating their growing importance in the supply of wood furniture both inside and outside the region.

Declining EU wood furniture imports during 2013

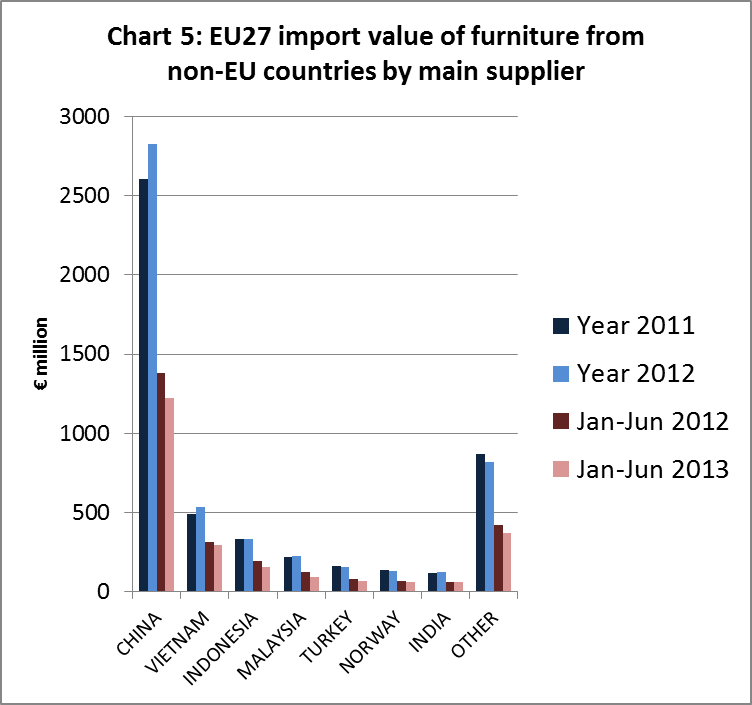

Imports of wood furniture into the EU from outside the region increased 3% from €5.07 billion in 2011 to €5.27 billion last year. However, the rising trend in imports in 2012 has reversed in 2013 (Chart 5). In the first 6 months of 2013, EU27 wood furniture imports were down from all the main external suppliers including China (-11% at €1224 million), Vietnam (-4% at €297 million), Indonesia (-19% at €154 million) and Malaysia (-27% at €91 million).

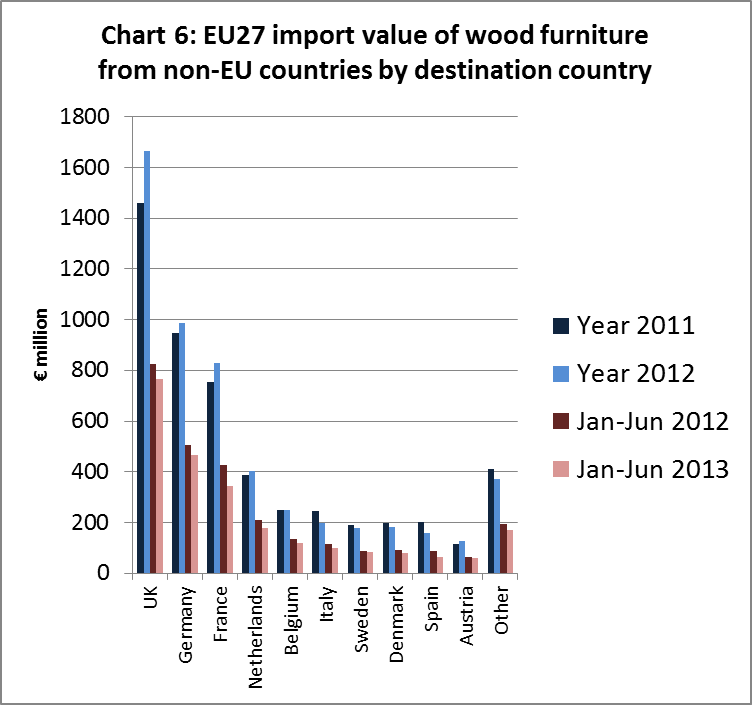

Imports of wood furniture from outside the EU have declined into all the largest European markets this year including the UK (-7% to €767 million), Germany (-8% to €465 million), France (-19% to €346 million), Netherlands (-16% to €177 million), Belgium (-12% to €118 million) and Italy (-14% to €99 million) (Chart 6).

It is tempting to attribute some of the decline in EU imports of wood furniture during 2013 to the implementation of the EU Timber Regulation (EUTR) in March 2013. The complexity of supply chains and difficulty of providing clear evidence of legal wood harvesting required by EUTR might lead to discrimination against imported wood furniture products. However the evidence of the trade data suggests that, so far, other commercial factors have probably been more important.

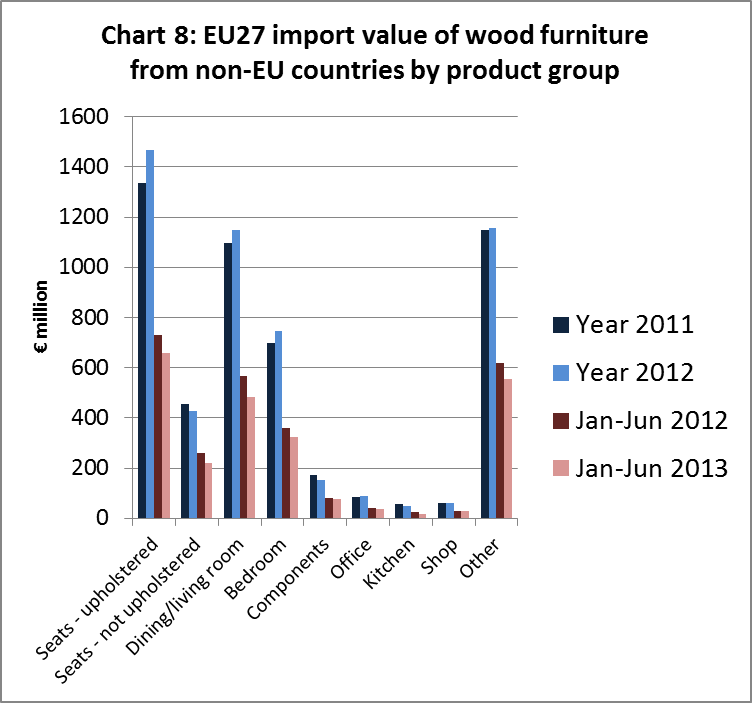

The recent downturn is apparent in imports of all furniture products, not just those regulated under EUTR. Chart 8 indicates there has been a significant decline this year in EU imports of wooden seats – which are not EUTR regulated – as well as in products such as dining/living room furniture and bedroom furniture which are EUTR-regulated.

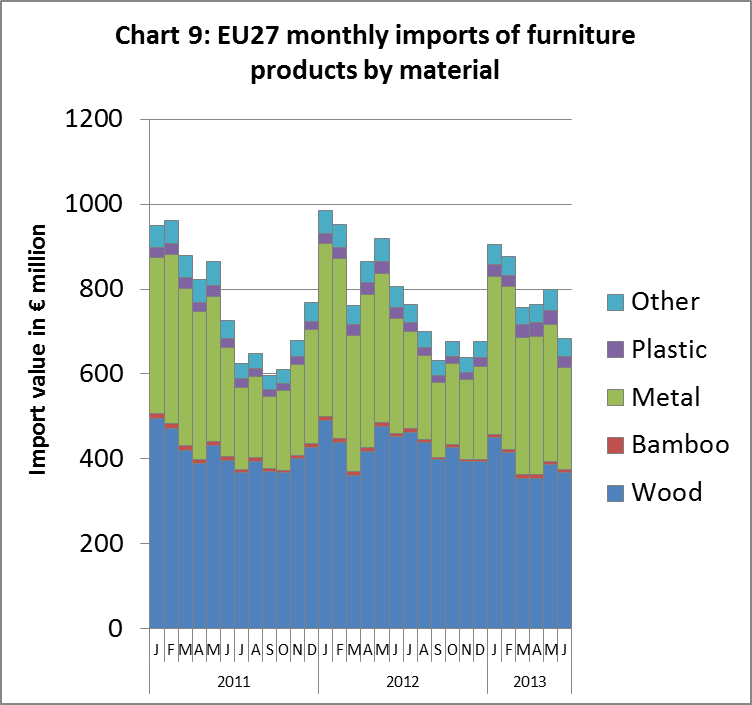

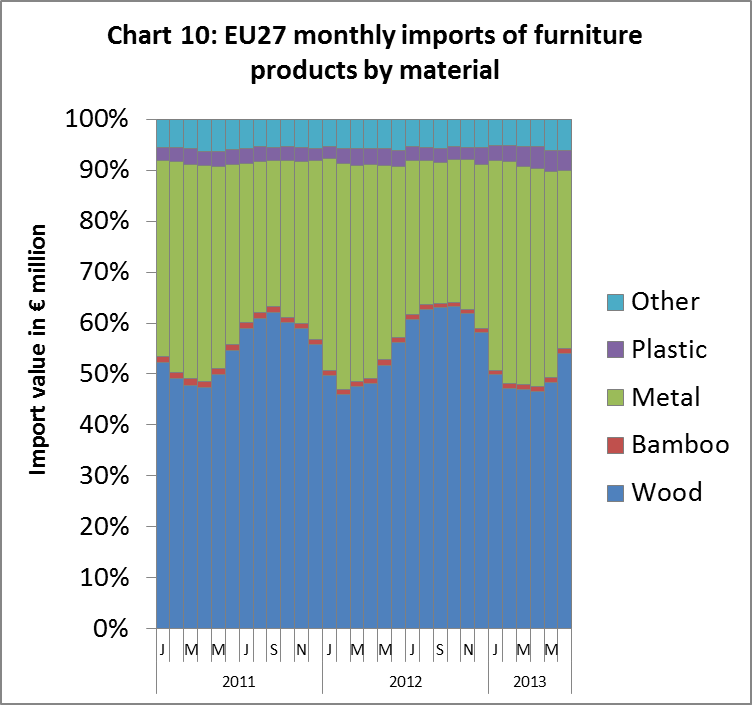

The downturn is also apparent in furniture manufactured in materials other than wood. Charts 9 and 10 show the recent trend in monthly import value of all furniture into the EU by material type. Chart 9 shows how wood furniture imports (in blue) have been lower in the first 6 months of this year compared to the first 6 months of both previous years. Chart 10 shows how the share of wood in all furniture imports has not changed significantly over the last 2 years. During this period, imports of metal furniture have declined as much as wood furniture.

Rather than EUTR, the main driver of the decline in EU furniture imports during 2013 may be a slight improvement in the competitiveness of domestic production as labour and other costs have been rising in China.

Chart 10 also highlights the strong seasonal fluctuation in import share between wood and metal furniture types. This is due to larger volumes of wooden interior furniture being imported in the autumn months in the build-up to Christmas and the January sales. Larger volumes of metal garden furniture are imported in the spring months in preparation for the summer season. This chart suggests that the real impact of EUTR will only become apparent when full data on wood furniture imports in autumn 2013 becomes available.

EU government authorities discuss EUTR implications for furniture sector

Chatham House, the London-based independent think-tank, hosted a workshop on “EUTR and the imported furniture sector” on 22 October. The meeting was an invitation-only event attended by representatives of the government Competent Authorities responsible for enforcing EUTR in the EU Member States. They were joined by a small number of private sector and environmental group representatives invited to advise the Competent Authorities on issues arising from implementation of EUTR in the furniture sector.

The meeting was convened under Chatham House rules. This means that while the content of the discussion may be reported, neither the identity nor the affiliation of the participants may be revealed.

The meeting began with a review and discussion of the supply of wood furniture into the EU. This highlighted that no more than 10% of the value of wood furniture supplied to the EU derives from non-EU countries. Of that which is imported, 50% is sourced from China, with much of the rest sourced from Vietnam, Indonesia, and Malaysia. However, the EU imports wood furniture with value of over €1 million from each of over 60 countries worldwide. It was also noted that of the €5.3 billion euro of wood furniture imported into the EU in 2012, nearly €2 billion was seating, which is not regulated, and €3.5 billion comprised regulated products.

The meeting noted the rapid rise in the share of China in supply of imported wood furniture into the EU, from around 22% of import value in 2003 to around 50% in 2012. This rise in share has mainly been at the expense of manufacturers in South East Asia and Latin America.

The meeting highlighted that the main burden for implementing EUTR in the wood furniture sector will lie with only three EU Member States – UK, Germany and France – which together take around 70% of wood furniture imported into the EU.

Contrast between exterior and interior furniture sectors

Discussion at the Chatham House meeting highlighted the different characteristics of the European market for exterior and interior furniture. In the case of the former, EU supply is heavily import dependent with the vast majority of manufacturers concentrated in East Asia, notably Vietnam, China, Thailand and Indonesia. This industry has traditionally strongly favoured natural forest teak from Myanmar, but has diversified into a range of alternative, mainly plantation grown species, in recent years. Under strong pressure from European retailers, a significant proportion of wood used for manufacture of exterior wood furniture sold into the EU is certified. However, supply restrictions have encouraged some Asian manufacturers to switch to alternative materials and/or to manufacture interior products instead.

It was noted that the EU market for interior furniture is much less dependent on imports, although there has been rising import penetration particularly in the bedroom furniture and dining/living room sectors over the last decade. The use of reconstituted panels with veneers and, more recently, a broadening range of décor paper and other artificial surfaces have taken much share from solid wood in the interior furniture sector. Where solid wood is still used, oak is now strongly favoured, sourced variously from the EU, US, Ukrainian and Russian sources.

It was observed that use of tropical wood for manufacture of interior furniture in the EU is now limited and declining, probably much less than 5% of total EU consumption. The traditional “tropical redwood” look is not at all fashionable in Europe. There has been expanding use of reconstituted veneers to replicate the exotic look of expensive tropical hardwoods. However a range of tropical species are used occasionally for specific applications in the sector, for example rubberwood, plantation teak and acacia. In addition, a wide variety of specialist exotic hardwoods are used very occasionally, all high end and in small volumes for individual pieces.

Numerous challenges of implementing EUTR in the furniture sector

Against this background, discussion at the Chatham House meeting turned to the numerous challenges of implementing EUTR in such a complex sector as furniture. The highly fragmented nature of the industry was noted, both on the supply side in Asia and in the EU retailing sector. In the EU, while larger retailers have become more prominent in the market, a large proportion of product is still sold through smaller companies. Retailers may buy direct or may source product from EU importers offering ‘own-brand’ furniture manufactured under contract in Asia.

Considerable concern was expressed during the meeting that the vast majority of companies importing furniture into the EU lack the appropriate knowledge and expertise to undertake due diligence in accordance to EUTR. They do not have the skills to assess the validity of documents and claims from their suppliers of legal sourcing. The situation has not been helped by lack of clarity and guidance on the steps EU furniture importers need to take to assess and mitigate risks. It was observed that “many overseas suppliers have not heard of EUTR, they do not understand it, and they do not want to comply”. It was noted that “margins in the wood furniture industry are tiny” and that “most companies do not have the resources to comply…. a lot of companies are buckling under the strain”.

Even large retailers are struggling as they are being required to assess hundreds, even thousands, of small suppliers in a short period of time. They are finding it extremely difficult to check and validate the huge quantities of data and numbers of documents returned by their suppliers. In theory, risk assessment is meant to take place, followed by action to mitigate risk, before any product is listed for sale in the retailer’s brochure or delivered to the EU market. In practice this is almost impossible in an industry dependent on rapid turn-around times.

Limitations of certification systems

Certification systems operating globally like FSC and PEFC have occasionally been proposed as the solution to the challenges of legality verification in lengthy and complex supply chains. However the information provided at the Chatham House meeting did not provide assurance that these systems are yet of sufficient scope, capacity or rigour to address these problems.

It was noted that the “majority of European furniture retailers have upwards of 200 suppliers, each of which buys from a similar number of sub suppliers, who may in turn buy from any number of agents, and that’s before you get anyway near the forest”. Ensuring that each supplier in the chain is chain of custody certified is an enormous challenge and very rarely achieved in the wood furniture importing sector. Even where it is achieved, the amount of certified wood available falls far short of what is required.

Concerns were expressed about the potential abuse of chain of custody certificates in such a complex trading environment. It was suggested that supplying companies frequently misuse chain of custody certificates by claiming they provide evidence that all their wood supply is legal, rather than just that proportion from certified forest.

It was also noted that European companies often lack the leverage to encourage significant change in the supply chain. In China for example, it was noted that the whole of the EU consumes less than 10% of the $50 billion of wood furniture manufactured in the country each year.

Wood furniture trade flows from China

It was acknowledged at the Chatham House meeting that “most wood furniture shipments from China are not in the high-risk category from an EUTR compliance perspective.” The rapid increase in log supply from China’s domestic forests and into China from countries like New Zealand, USA, Canada and Germany was noted.

However, it was also noted that some export flows from China into the EU are high risk due to the relative opacity of supply chains in the country and China’s own imports from several high risk countries. Specifically, it was claimed there is widespread abuse of sanitation permits in Russia and that timber transport documents from the country into China are regularly forged. It was also alleged that Chinese companies are trading in Dalbergia cochinchinensis of Cambodian origin, a species which is protected under Cambodian forest law. It was also claimed that there is no reliable information on the legality of much of the African timber now being imported into China.

Standard trade documents such as invoices, bills of lading and certificate of origin, may all be provided by the Chinese exporter to the EU operator. However it was suggested these documents are not sufficient for EUTR due diligence because they do not deal with legality of harvest.

Vietnam’s log imports in the FLEGT agreement

Concern was also expressed at the Chatham House meeting about handling of imported wood in the Vietnamese FLEGT VPA negotiations. It was noted that 80% of Vietnamese raw material supply is imported and that Principle 2 of the VPA, which deals with imported wood, only covers logs and only requires conformance to Vietnamese import controls. It was claimed that there is no requirement, in the current draft of the VPA, for logs to be legally harvested in the country of origin. Therefore, if this draft were to be accepted, it was alleged that the FLEGT VPA could be used to launder wood illegally harvested in another country.

Competent authorities urged to agree “reasonable measures”

The meeting fell short of suggesting any real solutions to these numerous problems of EUTR implementation in the wood furniture sector. Emphasis was placed on the need for Competent Authorities to “think carefully how to deal with these practicalities” and to work together to decide “what are reasonable measures”.

It was also observed that while certification had many short-comings, if applied rigorously systems like FSC and PEFC were “about the best tools we have” and from a company perspective, certified supply chains will always tend to be treated as lower risk. It was suggested that Competent Authorities need to allow importers the ability to use certification as a tool for due diligence, while also challenging the operators of these systems to strengthen procedures and improve capacity.

PDF of this article: