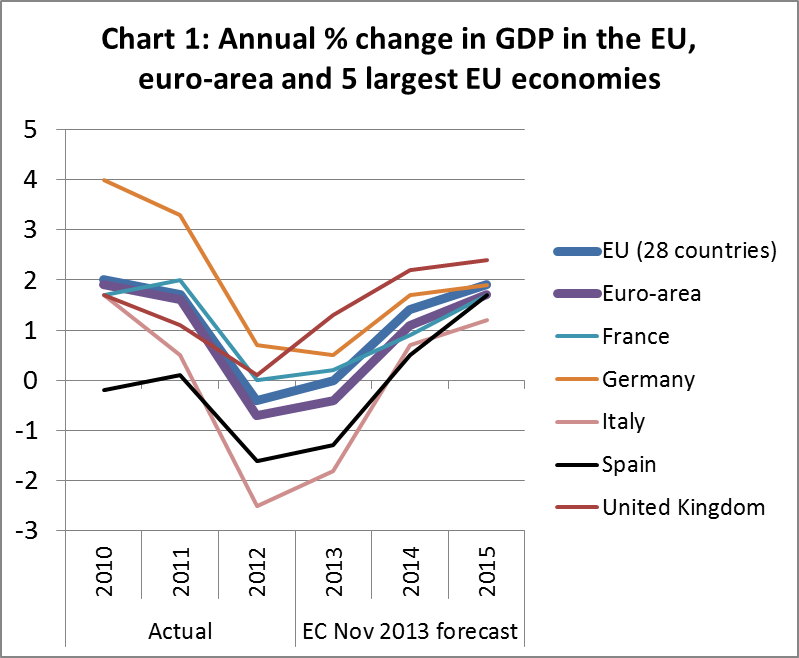

While economic conditions varied across the EU during 2013, the latest European Commission (EC) data indicates 0% GDP growth for the region as a whole during 2013 (Chart 1). That at least was an improvement on the 0.5% fall in GDP during 2012. The EC is also now confident that there will be a return to growth in 2014, albeit feeble at around 1.4%.

As a group, the 17 countries of the euro area performed less well in 2013 than the EU as whole. EC estimates that euro-area GDP fell by 0.4% in 2013 (after declining by 0.6% in 2012). The EC forecast euro-area growth of 1.1% in 2014.

The main impetus behind the euro-area’s forecast recovery in 2014 will be a significant rise in German growth. Germany’s economy probably grew by only 0.4% in 2013, but GDP is forecast by the EC to increase 1.7% in 2014. There is also expected to be a modest return to growth in Italy of 0.7% in 2014 after a decline of 1.9% in 2013. Similarly, Spain’s economy is expected to grow 0.5% in 2014 after declining 1.3% in 2013.

Outside the euro zone, the EC expects Sweden and Britain to do well in 2014, with growth of 2.8% and 2.2% respectively. However, the strongest growth rates in the EU in 2014 are forecast to be in the three Baltic States – Latvia (4.1%), Lithuania (3.6%), and Estonia (3.0%).

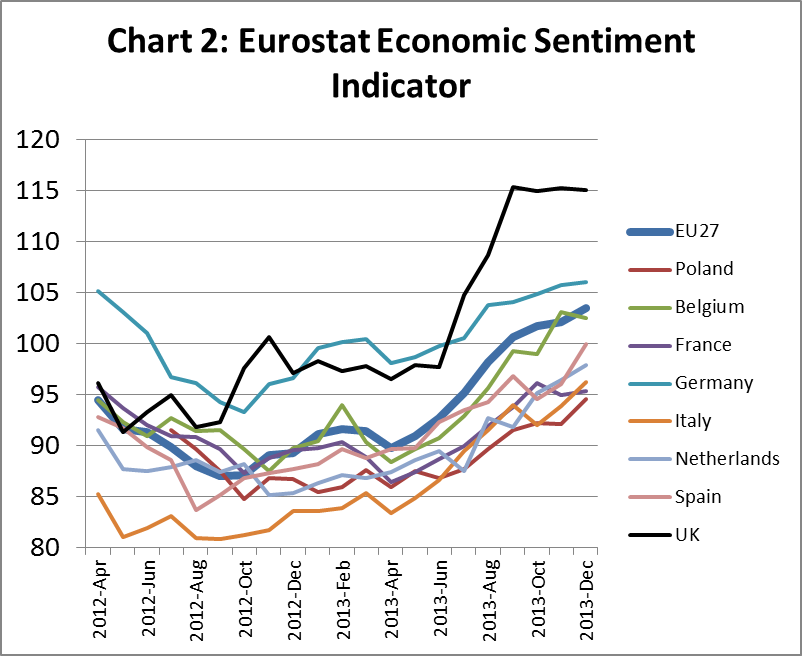

Rising confidence in the EU economy is evident from the significant improvement in the Eurostat Economic Sentiment Indicator between April and December 2013 (Chart 2). This indicator which draws on a regular monthly survey of perceptions and expectations in five sectors (industry, services, retail trade, construction and consumers) improved across a wide range of EU countries.

European construction hits bottom and set to grow

Construction activity in Europe hit bottom in 2013 and should grow slowly in 2014. This new forecast was issued on 28th November 2013 at the 76th Euroconstruct Conference in Prague. Euroconstruct’s new projection for 2013 represents a slight upgrade on their earlier forecast issued at the 75th Conference in June 2013. This is due to rising confidence and strong growth in Scandinavia and Poland.

The latest Euroconstruct construction output expectations point to a 3% dip overall in 2013 across the 19 Euroconstruct countries – 15 in Western Europe and four in Central and Eastern Europe. The decline is a slowing of the 5.2% fall seen in 2012, due to a sharp reduction in Spanish output and downturns in the UK and Italy.

Euroconstruct most recent forecasts for 2014 and 2015 are a marginal upgrade on their June predictions, and now show growth of 0.9% in 2014 and 1.8% in 2015. November’s publication also forecasts 2.2% growth in 2016.

Although quite small, the recent upgrades in forecasts are the first for several years. Euroconstruct forecasts issued every 6 months during the previous three years have typically been downgraded as construction activity consistently failed to live up to expectations.

Germany, the continent’s largest country for construction output, is forecast for flat growth this year before a 2.7% rise in 2014. The German recovery should be led by residential construction which is expected to increase 8% in 2014. After declining 7.8% in 2012, UK construction weakened a further 1.1% in 2013. However construction in the UK is forecast to rise 2.4% in 2014 and 3.1% in 2015. In France, construction output was quite stable in 2012, but is estimated to have fallen 2.8% in 2013. A further 1.5% decline in French construction is expected in 2014.

The largest falls in European construction output in recent times have been in southern Europe. Construction value in Spain fell 32% in 2012 and then by 23% in 2013. In total, Spanish construction output fell nearly 80% between 2007 and 2013. Euroconstruct forecast a further 6.7% fall in Spanish construction in 2014. Spain’s construction sector output is now little more than that of relatively smaller countries like Switzerland and Norway.

The decline in Italian construction, while much less dramatic than in Spain, is nevertheless severe. Italian construction output fell 6.3% in 2012 and 3.3% in 2013. Euroconstruct forecast a further decline of 0.3% in 2014 before a slow recovery of 1.1% in 2015.

Construction in the Netherlands, after declining 7.2% in 2012 and a further 5% in 2013, is expected to stabilize and recover by 0.4% in 2014 and 3.4% in 2015.

Euroconstruct identify Ireland, Norway, Poland and Denmark as potentially strong performers over the 2014-2016 period. Ireland has the largest forecast growth, at 9.8% in 2014 followed by 8.2% and 10.6% in the next two years. However this follows a dramatic downturn and the country will still fall short of 2010 output levels in 2016.

Poland’s forecast growth, totalling 13.5% between 2014 and 2016, is largely attributed to civil engineering. The 2014-20 budget plans for Poland are particularly expected to benefit infrastructure.

Residential construction across Europe has seen the strongest growth, and will account for 45.4% of European construction in 2013, according to Euroconstruct. This proportion is set to grow at the expense of the slower-moving non-residential construction market, following the pattern seen in previous recessions of housing becoming one of the first recovery sectors. European residential construction is forecast to grow by 2.4% in 2014 and 4% in 2015.

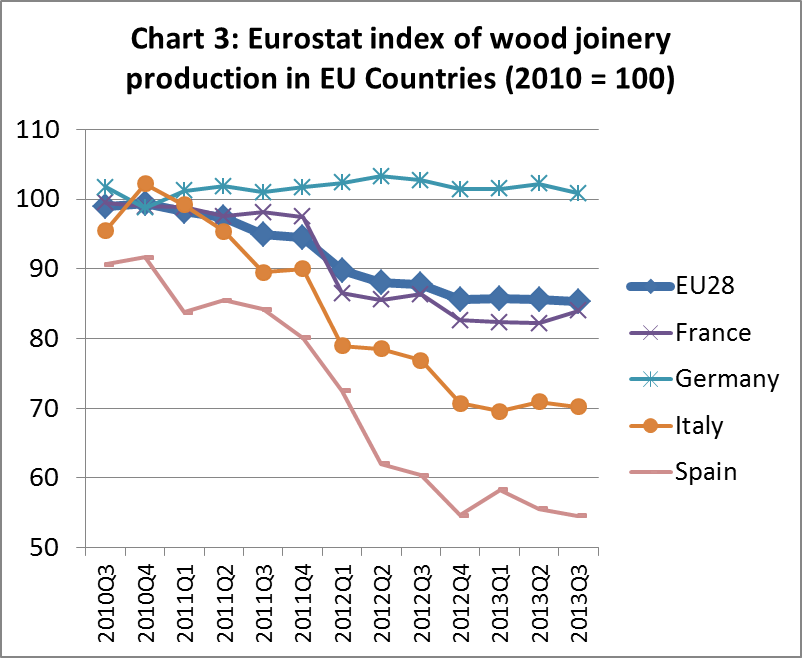

European joinery activity stable at a low level

In line with construction output, joinery activity in the EU remained flat at a low level during 2013 (Chart 3). Only in Germany was joinery activity being maintained in 2013 at a level comparable to that of the previous year. Elsewhere activity hit bottom in the last quarter of 2012 but showed little improvement in 2013. In line with forecasts for the European economy and construction industry as a whole, joinery activity across the region is expected to recover slowly during 2014. Germany is likely to play a key role in driving this recovery.

German window and door industry forecast to grow in 2014

In 2013, sales of windows in Germany increased 0.9% to 13.1 million units, while sales of external doors increased 1.1% to 1.316 million units. More significant increases in sales are forecast in both sectors during 2014. There should be robust growth during 2014 throughout the German construction sector. This includes new build and renovation, residential and non-residential. The need to pursue energy-efficiency measures in the existing building stock adds impetus to the market. This is a key part of government plans to meet carbon reduction targets.

These are the main conclusions of an annual survey of the German joinery sector undertaken by Heinze GmbH, a market research company, in collaboration of four leading industry associations.

The survey suggests that in 2013 the weather-related slow start to the year and capacity constraints were a major factor limiting higher sales in the German window sector. Although many manufacturers reported good demand during 2013, these factors meant they were unable to fulfil all orders during the year. There is now pent-up demand which will boost sales of windows in Germany by 5.7% to 13.9 million window units in 2014.

The share of wood windows in the German market is expected to decrease slightly to 15.3% in 2014. This is mainly due to a strong rise in market share for combination wood-metal windows, expected to reach 8.7% in 2014. However, plastic windows remain dominant and their market share continues to rise. Plastic windows are forecast to account for 57.7% of sales in 2014. The market share of metal windows is projected to remain level at 18.3% during 2014.

In 2014, 65% of window sales are expected to be for residential construction and 35% for non-residential construction. 61.1% of all windows sold in Germany during 2014 are forecast to be used in renovation projects on existing buildings, primarily for energy efficiency reasons. Sales to the renovation market are expected to rise 4.1% in 2014. The share of windows used in new construction is lower, expected to account for 38.9% of all sales in 2014. However sales into the new build sector will grow more strongly, by 8.4%, during 2014.

German sales of external doors expected to increase 5.7% in 2014

The Heinze survey forecasts that sales of external doors in Germany will reach 1.39 million units in 2014, up 5.7% compared to 2013. Growth in sales is forecast to be distributed evenly across all material types with no change in market share. Slightly more than one quarter (25.5%) of external doors sold in Germany during 2013 were made with wood. Plastic doors lead the market, accounting for 32.6% of sales in Germany during 2013. Aluminium doors accounted for 32.5% of the market in 2013. Other materials were used for 9.4% of external doors.

The survey notes that demand for both windows and external doors in Germany during 2014 and subsequent years will be partly dependent on progress to implement Germany’s Energy Saving Ordinances. Since 2002, these laws have imposed minimum requirements for energy-saving in building construction and renovation. The requirements (e.g. for U-values of new windows and doors) have been raised consistently and at shorter and shorter intervals over recent years. It is uncertain whether this trend will continue. Also uncertain is the level of future support for energy efficiency through practical measures such as tax incentives and low-interest loans to home-owners.

The priority attached to these measures is now heavily dependent on the make-up of Germany’s new government (particularly the position of the Green party) and their emphasis on climate change initiatives.

Rise in home building boosts UK joinery sector

A recent increase in residential building starts has boosted joinery activity in the UK. However concerns remain about just how sustainable the market upturn is likely to be. This is the main conclusion of the British Woodworking Federation (BWF) latest joinery industry survey covering the third quarter of 2013 and recently reported in the UK Timber Trade Journal (TTJ).

The BWFs State of Trade survey indicated that after two successive quarters where many respondents saw a decrease in sales volumes, the third quarter survey noted a balance of 43% of firms reporting an increase. Manufacturers also remained confident that sales volumes would improve in the next quarter, with a balance of 52% predicting an increase this winter, and a balance of 55% predicting an increase over the next year.

The Survey showed that demand remains the most important restriction on activity. However, demand is less of an issue than it was. In fact, 20% of respondents now list capacity as a restraining factor. About two-thirds of firms said they had used more than 70% of their manufacturing capacity for the last year. Capacity utilization was widely anticipated to increase over the next quarter and year. There are also a small proportion of companies that are now very busy. 15% of respondents indicated they are running at over 90% capacity for the previous year, three times the percentage of the previous survey.

Looking to the future, the survey showed respondents’ order books are now more healthy. About three quarters stated that their order book of future work extends from between one and three months. 19% of companies reported a current order book extending beyond three months, up from only 7% in the previous quarter’s survey.

Housing figures for the foreseeable future and data showing a rise in building permits in the UK during the third quarter of 2013, suggest continued growth in joinery activity during 2014. However, there are not yet signs of improving activity in repair and maintenance and in the commercial and public non-housing markets. All these sectors remain subdued. Furthermore, margins in the UK joinery sector are still very thin. Intense competition for sales means it is difficult to raise goods prices even while raw material, fuel and energy costs have been increasing.

Further fall in EU imports of joinery products in 2013

With the exception of flooring products (not covered in this report), imports contribute only a small proportion of total EU consumption of joinery products. In terms of value, only around 4.5% of doors and glulam, and around 0.5% of wood windows installed in the EU are imported from outside the region. This is indicative of the very strong commercial benefits from proximity to the consumer in the joinery sector and the essential need for detailed knowledge of national construction markets.

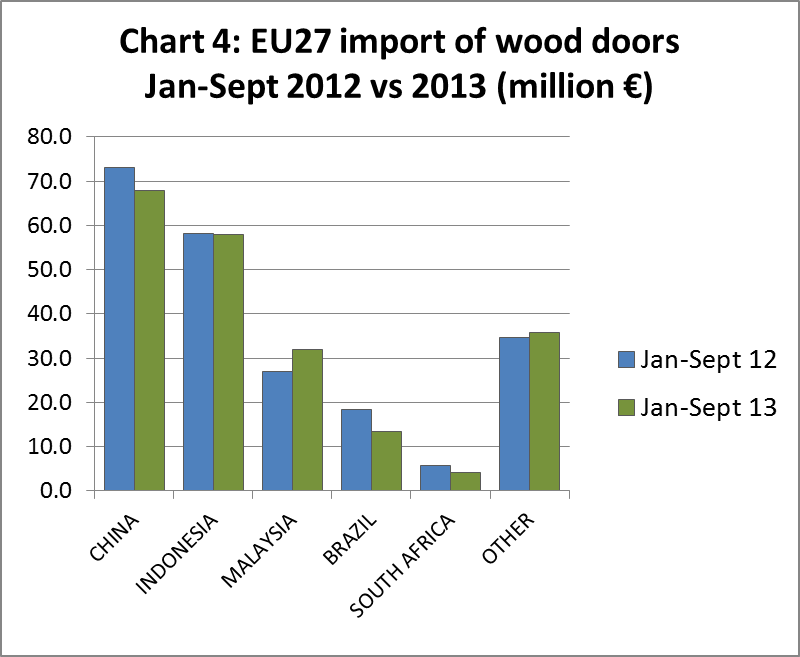

The EU imported wooden doors with total value of €211 million during the first nine months of 2013, 2.9% less than the same period in 2012 (Chart 4). The value of wooden door imports from China, the largest non-EU supplier, fell 7.2% to €67.8 million during this period. Imports from Indonesia, the second largest non-EU supplier, remained stable. Of other major suppliers, imports increased from Malaysia but declined from Brazil and South Africa in the first 9 months of 2013.

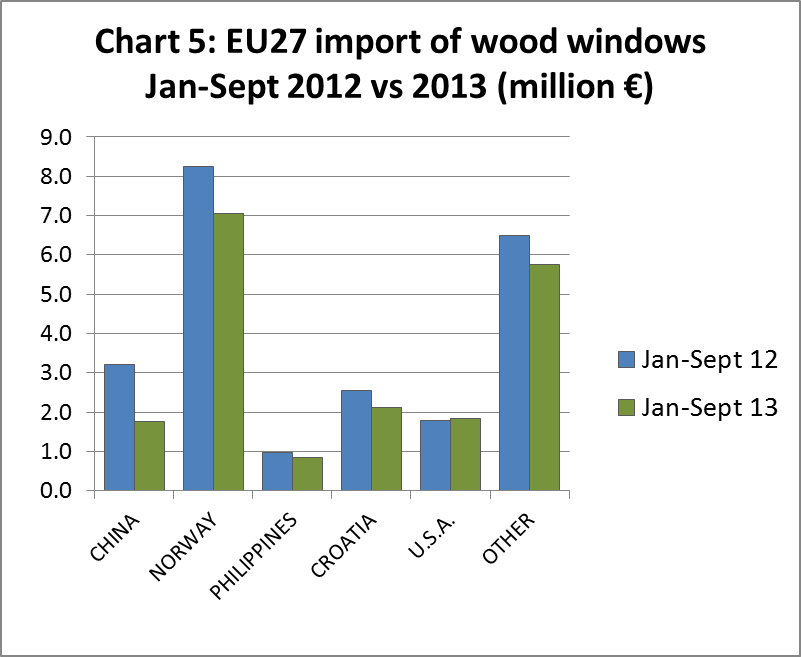

EU imports of wood windows were €19.4 million in the first nine months of 2013, 16.9% less than during the same period in 2012 (Chart 5). Most of these imports derive from other European countries, notably Norway and Croatia. Imports from China, the largest supplier outside Europe, were only €1.8 million in the first nine months of 2013, 45% less than the same period the previous year.

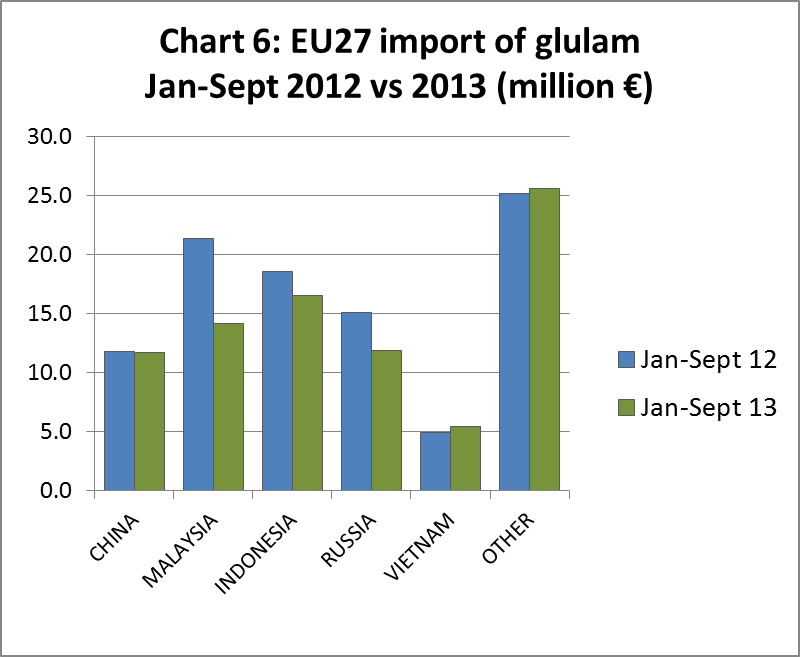

In the first 9 months of 2013, EU imported 85,500 m3 of glulam, 11.9% less than the same period in 2012 (Chart 6). During the nine month period, there was a significant fall in imports from Malaysia, Indonesia and Russia, the three largest external suppliers of glulam to the EU. Imports from China, the fourth largest external supplier were at a similar level to the previous year. Imports of glulam from Vietnam increased slightly. The European glulam market is currently suffering from saturation, with too much production chasing limited demand.

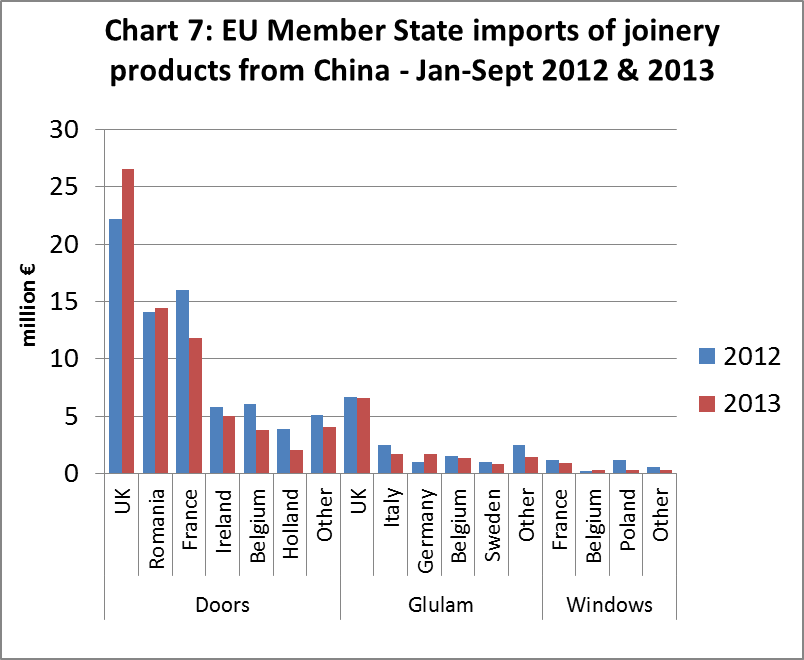

Chart 7 provides more detail of recent trends in EU markets for joinery products imported from China. Imports of wooden doors from China increased into the UK and Romania during the first nine months 2013, but declined into France, Ireland, Belgium and the Netherlands. During this period, German imports of Chinese glulam increased, but this was insufficient to offset declining imports into UK, Italy, Belgium and Sweden. EU imports of wooden windows from China have been mainly destined for France and Poland, both markets which weakened significantly in 2013.

Hard times drive development of leaner joinery industry

Over the last decade, the European joinery sector has been undergoing a major period of transformation. Various trends that began during the boom years before 2008 have deepened and become more widespread during the long period of recession. Taken together these trends have driven the development of a sector which is leaner and more high-tech, quality conscious, customer-oriented, environmentally aware and ultimately more competitive.

One particularly important trend led by joinery manufacturers has been the dramatic and far-reaching shift towards prefabrication. The trend has intensified and become more widespread during the recession. It has been driven by a range of factors including improving technology, tougher quality, waste management and energy efficiency standards, requirements for long-term product guarantees, reduced costs of construction, rising material costs, and high labour costs and skills shortages.

Processing technologies have advanced rapidly in recent years and this in turn has fed into significant changes in other aspects of the industry, such as supply chains, design concepts and demands for personnel and skills.

To take one prominent example, there is an on-going trend towards increased use of Computer Numerical Control (CNC) in the industry. CNC enables designs produced using Computer Aided Design (CAD) software to be transferred direct to wood processing machinery and turned into perfectly prepared timber components. The numbers generated through CNC are effectively coordinates describing the precise size and shape of the CAD design and control the movement of the cutting blades.

CNC is helping to overcome the shortage of traditional carpentry skills in Europe while at the same increasing the precision and quality of wood components and greatly reducing waste. CNC is an important element in the wood sector’s tool box to increase competitiveness with other materials. For example, CNC neutralises one key benefit of using plastics which can be extruded and have therefore benefitted in the past from the relative ease of fabrication.

Demand for credible product-specific data

Alongside the development of new processing and data management technologies, there is an increasing emphasis on information provision with all materials and products in the joinery sector. Manufacturers, construction companies and other customers increasingly require credible data on the full range of technical and environmental performance issues. This data needs to be made available both at point of sale and as digital downloads on corporate websites.

Joinery manufacturers are now investing heavily in development of websites providing easily accessible, up-to-date information on their full range of products, as well as additional information such as advice and care instructions to technical specifications, certification and brand values. Many sites have dedicated trade areas offering professional support and accurate information about products in CAD format so they can be inserted directly into building plans. All these services are seamlessly linked to information on pricing and with on-line ordering systems.

The demand for technical performance data in Europe has been given added impetus by the enforcement of the Construction Products Regulation (CPR). This dictated that from 1 July 2013 it is mandatory for manufacturers to apply CE marking to any construction products covered by a harmonised European standard (hEN) or European Technical Assessment (ETA).

Such standards already exist for a wide range of joinery products including windows and external doorsets (EN 14351) and traditionally designed prefabricated stairs made of solid wood (EN 15644). Additional harmonised standards, for example covering internal pedestrian doorsets (EN 14351-2) and fire door performance (prEN16034), are expected to be published in 2014.

Requirement for comprehensive environmental information

The need for performance data includes coverage of the environmental issues. There’s much focus in the timber industry on forest certification and illegal logging laws like EUTR. However the demand for environmental information now goes much further than this.

In the windows and doors sectors, demonstrating conformance to minimum energy efficiency standards has become critically important. This has driven numerous innovations in product design, many of which have benefitted the timber sector. For example, a recent article in the TTJ includes the following quote from a representative of Skaala, a Finnish company which is a leader in production of very highly energy efficient windows including one model with a U-value of 0.58 W/m2K:

“Timber turned out to be an extremely competitive material compared to expensive and difficult to work with plastic composites despite its structural strength being slightly lower…[timber] is in a class of its own when it comes to the combination of thermal insulation and recyclability, so the goal was to maximise the amount of timber in the product structure.”

Life cycle inventories being established

Meanwhile, developments in information technology are combining with the evolving science of Life Cycle Assessment (LCA) to offer a path towards integration of real environmental performance into key stages of joinery product design. European governments and commercial companies specialising in LCA are now building comprehensive “Life Cycle Inventories” containing verifiable quantitative data on the use of the world’s resources and outputs of emissions and pollutants.

At the same time, there has been significant progress to standardise the process of LCA to ensure comprehensive coverage of impacts and consistent results. The process is now subject to the ISO14040 series of international standards. A global framework is emerging for issue of Environmental Product Declarations (EPDs) to communicate data on individual products to consumers. At European level, the CPR requires use of EPDs to meet standards for environmental performance for construction products in all Member States. The EU has published EN15804 to provide core rules for construction product EPDs.

These developments mean that competitiveness in material supply to the joinery sector is becoming increasingly dependent on provision of the full range of environmental data to manufacturers. Wood suppliers are now responding by broadening the emphasis of their environmental communication to encompass LCA alongside existing messages on forestry and carbon.

For example, the American Hardwood Export Council (AHEC) has just launched an on-line system allowing AHEC member companies to issue “American Hardwood Environmental Profiles”. The aim is that the profiles will be delivered as part of the standard shipping documents with every consignment of US hardwood supplied by AHEC members into the EU. Each profile includes the data needed by EU importers to demonstrate EUTR conformance. It also includes data on forest sustainability and life cycle environmental impacts (including carbon footprint) of the US hardwood species in question.

The signs are that the timber trade and industry, driven by intense competitiveness, is responding well to these new demands. In fact, the timber sector is playing a leadership role by challenging manufacturers and other material suppliers to improve the quality and environmental performance of their own products.

This was evident, for example, from comments made by Hugh Pearson, Editor of the journal of the Royal Institute of British Architects on the occasion of the UK Wood Awards held in London in November. He observed that there is “no need to make the case for wood in architecture anymore, given timber’s proven durability, technological advances, aesthetic possibilities and environmental credentials”.

PDF of this article:

Copyright ITTO 2020 – All rights reserved