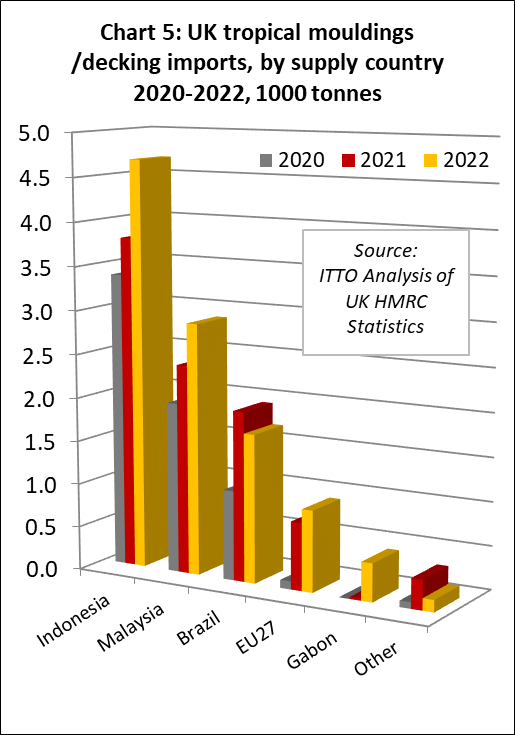

The UK imported USD731 million of tropical wood furniture products in 2022, 8% less than the previous year. In quantity terms, wood furniture imports were 153,000 tonnes last year, 9% less than in 2021. After the market turmoil in the previous two years during the COVID pandemic, UK tropical wood furniture imports in 2022 returned to a level slightly below the annual average between 2015 and 2019 (USD771 million). In a sign of deteriorating consumption, UK wood furniture import value in the last quarter of 2022 was 16% lower than the previous quarter and 15% down on the same period in 2021. In 2022, UK import value of wood furniture decreased 2% from Vietnam to USD365 million, 7% from Malaysia to USD130 million, 3% from India to USD80 million, 15% from Indonesia to USD69 million, 35% from Singapore to USD54 million. However imports increased 19% from Thailand to USD22 million (Chart 1).

UK tropical joinery imports slow dramatically in last quarter of 2022

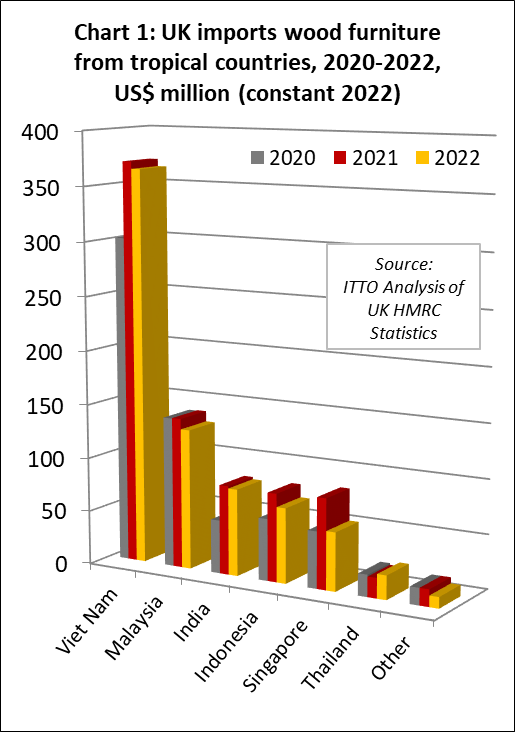

UK import value of tropical joinery products was USD271 million in 2022, 9% more than the previous year. However, as for wood furniture, all the gains were made in the first half of the year and imports slowed dramatically in the last quarter. Import value and quantity in the fourth quarter were down around 30% compared to both the previous quarter and the same quarter in 2021. In 2022, UK imported tropical joinery products from Indonesia (in this case mainly doors) with total value of USD138 million, 14% less than the previous year (Chart 2). In quantity terms, UK joinery imports from Indonesia were also down 14% to 45,000 tonnes in 2021.

UK imports of joinery products from Malaysia and Vietnam (mainly laminated products for kitchen and window applications) were slow throughout last year. In 2022, import value from Malaysia fell 18% to USD38 million and quantity fell 24% to 12,200 tonnes. Import value from Vietnam fell 49% to USD9 million and quantity fell 44% to 2,300 tonnes.

UK imports of tropical joinery products from a variety of non-tropical countries – including China, Ireland, Poland, and Lithuania – apparently increased sharply last year. However these increases were due to introduction from 1st January 2022 of new product codes which identify wood doors and windows manufactured using a wider range of tropical wood species in UK and EU trade statistics.

Large decline in UK tropical hardwood plywood imports in 2022

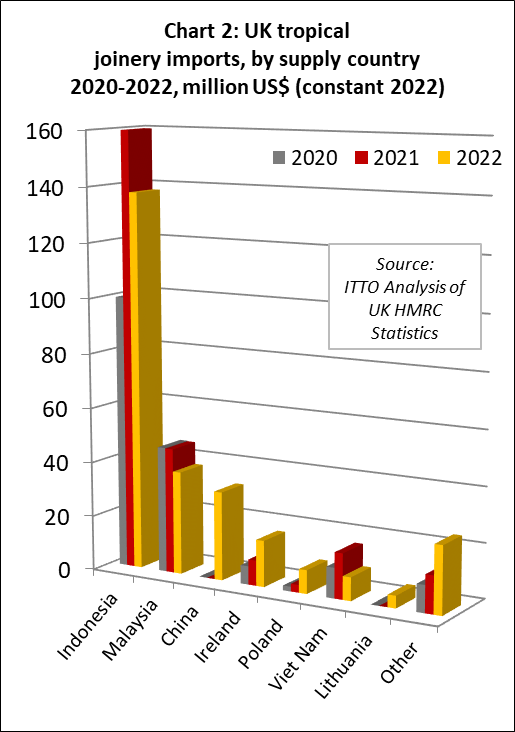

The UK imported 202,300 m3 of tropical hardwood plywood in 2022, 29% less than the previous year, with significant decline in imports from all the main traditional supply sources including Indonesia, Malaysia, and China (Chart 3). After a strong start to 2022, trade weakened sharply during and after the summer months. UK imports of tropical hardwood plywood were 34% lower in the second half of 2022 than in the first six months.

Indonesia overtook China as the UK’s largest supplier of tropical hardwood plywood in 2022. However, imports of 59,000 m3 from Indonesia were still down 18% compared to the previous year. Imports from Malaysia also declined 18% to 50,500 m3. In contrast, there were large percentage gains in imports of tropical hardwood plywood from two smaller suppliers to the UK; imports from Thailand increased 30% to 11,100 m3 last year, while imports from Gabon rose 65% to 8,500 m3.

The UK imported 48,600 m3 of tropical hardwood plywood from China in 2022, 48% less than the previous year. Probably the biggest shift in the UK hardwood plywood trade in the last two years has been a rapid decline in imports of Chinese products faced with tropical hardwoods in favour of temperate hardwood products. UK imports of Chinese plywood faced with temperate hardwood – primarily birch and poplar – increased 10% to just over 600,000 m3 last year, the highest level ever recorded (exceeding the previous record of 575,000 m3 in 2015). Chinese temperate hardwood plywood has been the largest beneficiary of UK sanctions against all trade in Russian wood products since the start of the Ukraine conflict. UK imports of hardwood plywood from Russia were just 14,900 m3, down 80% from 84,000 m3 the previous year.

Meanwhile, the combined effects of Brexit, supply shortages and rising energy and other material costs on the European continent is impacting on UK imports of tropical hardwood plywood from EU countries which were just 11,700 m3 in 2022 compared to over 25,000 m3 in the previous two years.

Robust UK imports of tropical sawnwood in 2022

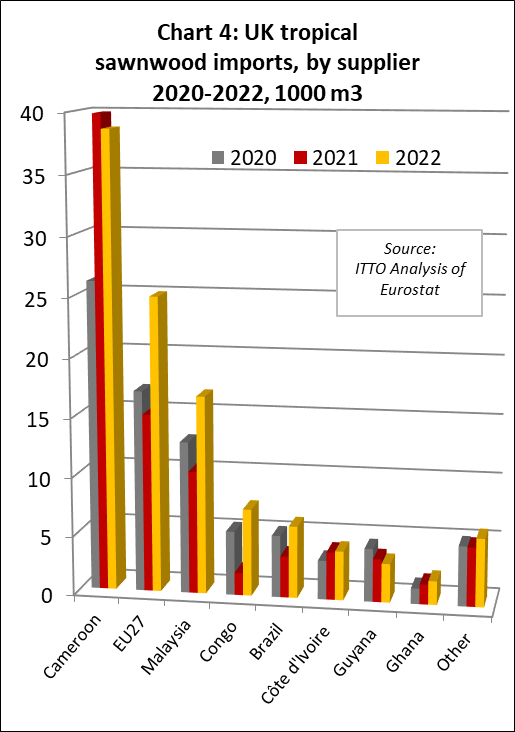

Unlike tropical hardwood plywood, UK imports of tropical sawnwood were robust last year. Total UK imports of tropical sawnwood were 108,900 m3 in 2022, 34% more than the same period in 2021 and the highest level since 2016. In addition to making gains overall, there were some significant changes in the countries supplying tropical sawnwood to the UK last year (Chart 4).

UK imports of tropical sawnwood from Cameroon were 38,600 m3 in 2022, 3% less than the relatively high level in 2021. UK imports of tropical sawnwood from the Republic of Congo recovered lost ground last year, with imports of 7,400 m3 being nearly a three-fold increase compared to the previous year. UK imports from Côte d’Ivoire were 4,100 m3 last year, a 3% rise compared to 2021.

UK imports of sawnwood from Malaysia, which had fallen to little more than a trickle in previous years, were 16,700 m3 in 2022, 62% more than in 2021. UK imports of tropical sawnwood from Brazil were 6,100 m3 last year, 74% more than in 2021. However UK imports from Guyana declined 10% to 3,300 m3 in 2022. Indirect UK imports of tropical sawnwood via the EU recovered ground last year despite the Brexit disruption, increasing 66% to 25,000 m3 in 2022.

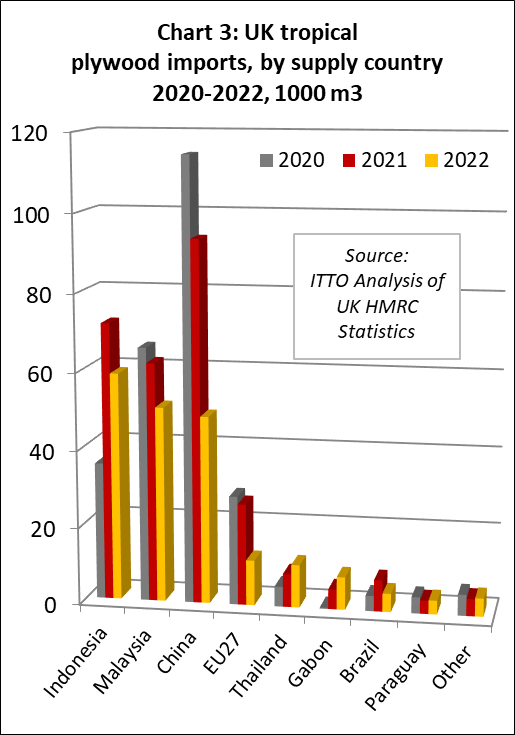

UK imports of tropical hardwood mouldings/decking were high in 2022, at 11,500 tonnes, 18% more than the previous year. Imports of 4,700 tonnes from Indonesia were 23% more than in 2021. Imports of 2,900 tonnes from Malaysia were 20% up compared to 2021. However mouldings/decking imports from Brazil of 1,700 tonnes were 13% less than in 2021 (Chart 5).

The UK market for tropical decking benefitted last year from shortages of non-tropical products, particularly since the start of the war in Ukraine and sanctions on Russian wood products. UK direct imports of Russian decking products – which mainly comprise larch – were just 630 tonnes last year, down from nearly 2000 tonnes the previous year. COVID lockdowns in China were another factor reducing availability of supply. UK imports of mouldings and decking products from China fell from 9,200 tonnes in 2021 to 7,400 tonnes last year.