Overall the year 2010 was probably a better year for the European trade in tropical hardwood than 2009, but purchasing continues at levels well below those prevailing before the recession. There is still considerable uncertainty about future prospects, with widespread concern over stubbornly high levels of unemployment, public sector spending cuts and rising taxes as European governments try to bring down national debt.

European demand for tropical sawn lumber fell away again at the end of 2010, the slow buying trend experienced in the autumn months reinforced by the usual slowdown in the run up to the Christmas vacation. Where buying did occur, emphasis remained firmly on small consignments. While purchasing by the general building trade has remained slow, demand from the joinery manufacturers in parts of Europe has been somewhat better, for example for flooring and windows in northern regions. However even this part of the business continues to be seriously affected by price pressure and tight margins.

After such a long period of limited buying, overall stocks of tropical hardwood sawn lumber are believed to be low across the continent and generally balanced with current low levels of consumption. This fact, coupled with very long lead times for new deliveries which extend to over 6 months for certain popular species of African redwood such as iroko and sipo, has helped prevent any significant weakening in prices for landed stock. However there are still occasional reports of importers selling sapele sawn lumber on to merchants and manufacturers at below replacement price.

Meanwhile European importers report that FOB prices have remained stable in recent weeks for the key tropical hardwood species sold into Europe. Although delivery times for new orders are very lengthy for some species due to restrictions on roundwood supplies during 2010 and reduced mill production in major supply regions, there are no reports of significant problems with on-going shipments.

Trading conditions for tropical hardwood sawn lumber have varied widely by European country. In the UK, many traders are reluctant to hold stock and are now very heavily reliant on just-in-time orders from the few larger importers, both in the UK and on the continent, that have maintained their commitment to holding diversified stock holdings. The joinery sector in the UK has been quite busy, more due to renovation activity than any significant improvement in the new build sector which remains weak.

UK consumption of African sapele sawn lumber was reasonable in the last quarter of 2010, but with a quite a lot of old landed stock around, prices for onward sale in the UK remain below replacement value. UK demand for meranti sawn lumber was very low during this period, partly due to sapele availability and partly to the strengthening dollar rate against European currencies which undermined competitiveness. On the other hand UK demand for some other tropical species such as iroko and framire remained quite firm.

The weak construction sector and fall out from the credit crises in Ireland has led to extremely low buying with reports that some importers are even cancelling existing orders. This is particularly dampening demand for iroko, a popular species in the country.

The German economy was more buoyant than most other European countries during 2010, and the overall market for wood has been improving. Construction activity appears to be strengthening, mainly in the refurbishment and renovation sectors. However, trading conditions for tropical hardwood have remained challenging, with most importers taking only small consignments and under a lot of pressure to reduce prices.

Overall wood demand in Italy’s domestic market remains weak, but there are signs of improving export demand for Italian furniture and joinery products which is helping to boost demand for hardwood lumber. However this coincides with a trend towards increased use of temperate hardwoods at the expense of tropical hardwoods in line with fashion trends in export markets.

The Spanish market for tropical hardwood remains very weak and hardwood importers are very concerned about prospects for 2011. Although hardwood stocks in Spain are extremely low after a long period of very low purchasing, importers are so worried about future demand that they are reluctant to rebuild inventory. Spain’s door manufacturers are still in a critical state with low and declining levels of domestic construction activity. Output in Spain’s furniture sector was down 9% in the nine months to end September 2010.

EU hardwood plywood imports up 36% in first nine months of 2010

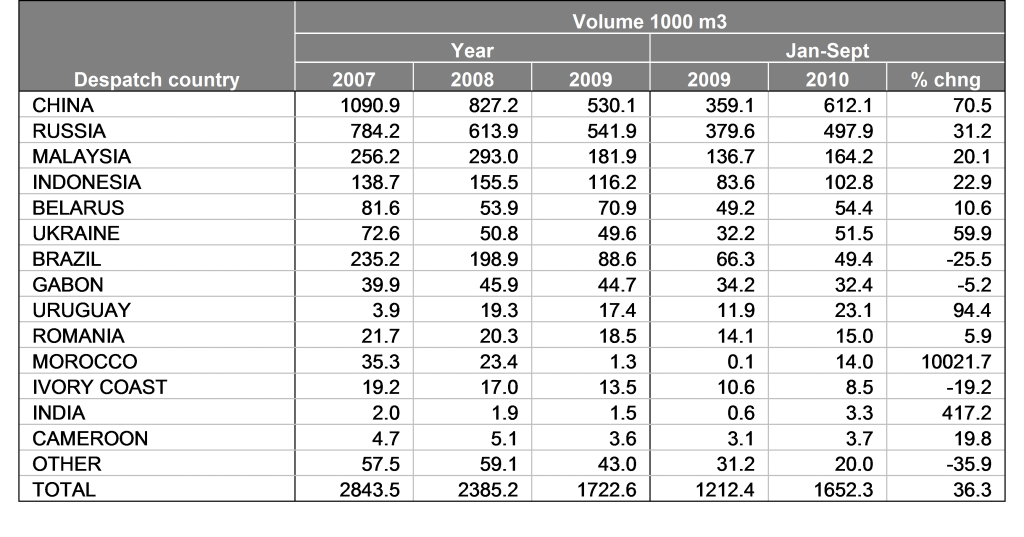

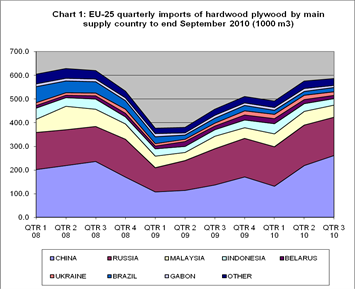

Imports of hardwood plywood into the EU-25 group of countries reached 1.65 million m3 in the first nine months of 2010, up 36% on the same period the previous year. Nevertheless, import volumes remained well below levels prevailing before the recession (Table 1). The quarterly data shows that after a significant rise in imports during the second quarter of 2010, the pace of growth in imports slowed in the third quarter of the year (Chart 1).

With regard to supply sources, the most notable recent trend has been strong growth in China’s share of the European hardwood plywood market during the course of 2010. EU-25 imports of hardwood plywood from China were up over 70% in the first nine months of the year. China’s share of overall hardwood plywood imports into the EU jumped from an average of around 30% in the 2008-09 period to nearly 45% in the third quarter of 2010. The major losers in recent times in terms of share of the EU hardwood plywood market have been Brazil and Gabon.

Table 1: EU-25 imports of hardwood plywood by main supplier

Recent market reports suggest that European demand for tropical and Chinese hardwood plywood slowed during the last quarter of 2010. According to the TTJ, following significant imports of plywood in the second and third quarters of 2010, the large UK market carried heavy stocks into the New Year relative to limited demand. There is therefore no expectation of any significant increase in UK buying during the first quarter of 2011.

EUWID reports that the continental European market for raw hardwood plywood grades was slow in the last quarter of 2010. However more specialist film-faced products were performing rather better, continuing to benefit from higher prices and low availability of birch plywood due to the forest fires in Russia during 2010 and the Russian export tax on birch logs.

EUWID also indicates that CIF Europe prices for hardwood plywood were relatively stable in the closing months of 2010. While exporters in China and South East Asia pushed up FOB prices in the last quarter of 2010, this trend was offset by a decrease in container rates. The peak season surcharge on freight from China levied in the run up to the European Christmas vacation period in previous years was not imposed this year. At present there are no reports of significant supply or shipping problems and product is generally available for prompt shipment.

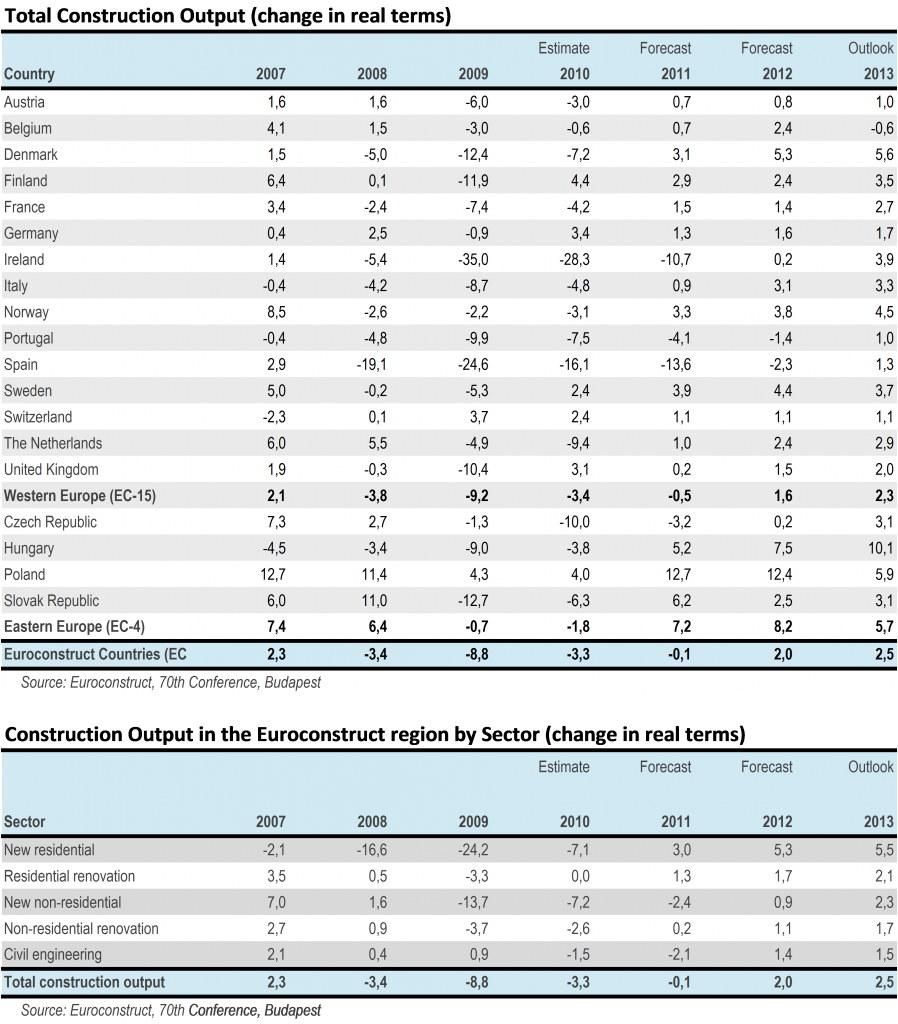

European construction sector fell 3.3% in 2010

According to the 70th Euroconstruct conference, held by Buildecon in Budapest on 2-3 December 2010, European construction output is likely to have fallen by 3.3% during 2010 (see tables). This follows an 8.8% fall the previous year. The difficulties of high public deficit in Ireland, Spain and Portugal forced further significant austerity measures including cuts in housing construction and public investment. Many other European countries were also affected by lack of domestic demand, reduced public investment and reassessment of ongoing public projects. However a number of countries, including Finland, Germany, Poland, the United Kingdom, Sweden, and Switzerland, began to see the benefits of growing domestic confidence and demand.

According to the new country-by-country analysis by the 19 Euroconstruct members, construction activity across Europe is expected to remain stable in 2011 compared to 2010 and then to grow by 2% in 2012 and 2.5% in 2013. Recovery will vary across Europe, with activity forecast to be significantly stronger in Central and Eastern Europe than in Western Europe.

Among the three construction sub-sectors, civil engineering has proved most resilient in recent years. A recent emphasis on transport infrastructure construction in Europe is now expected to shift towards energy and water construction. However public expenditure cuts are expected to badly influence all infrastructure spending in the Czech Republic, Ireland, Spain and the UK.

The new residential construction sector which was most badly affected by the recession is expected to return to growth in 2011. The renovation sector, which has remained more stable than the new build sector during the recession but which nevertheless suffered a downturn in 2009 and 2010, is also forecast to return to growth in 2011.

Meanwhile, non-residential construction is expected to see the slowest recovery with output in 2013 hardly reaching the level of the early 2000’s. Publicly financed health and school construction and renovation activity is expected to suffer from shrinking resources.

Euroconstruct report that the ten-year-period between 2004 and 2013 shows important structural changes within the European construction sector. For example, there has been a major shift away from new construction towards renovation, maintenance and improvement (RM&I). Nearly half of all construction activity by 2013 is expected to comprise RM&I. At the same time a growing proportion of total construction output is concentrated in smaller countries, including Central-East European and Scandinavian countries.

Another important structural change is the convergence of construction output as a percentage of the GDP to 10%. In Spain, Portugal and Ireland, construction contributed around 20% of GDP in 2004, but this figure has since contracted to 7-10%.

Euroconstruct also highlight various trends in construction which are contributing to the development of a “higher value and higher quality” sector. These include an emphasis on: efficient energy consumption; upgrading the built environment; housing replacement; new health utilities for the ageing population; and the lowering of CO2 emissions from buildings.

PDF of this article:

Copyright ITTO 2020 – All rights reserved