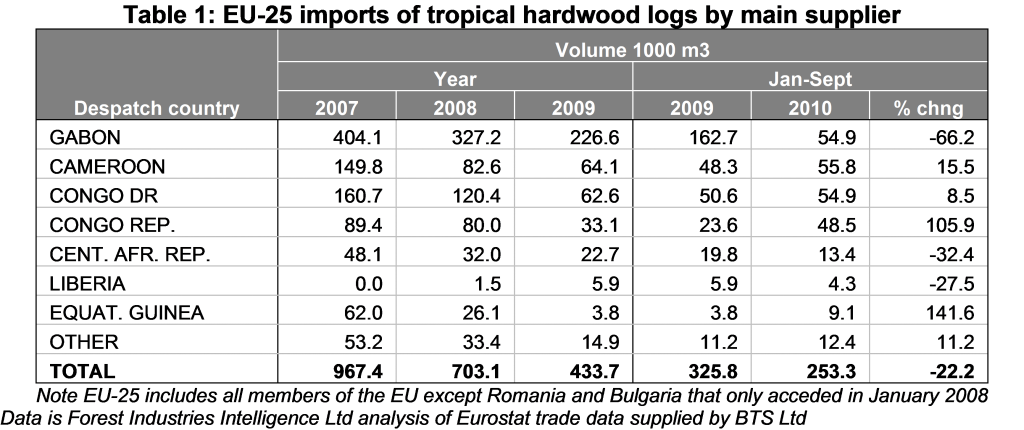

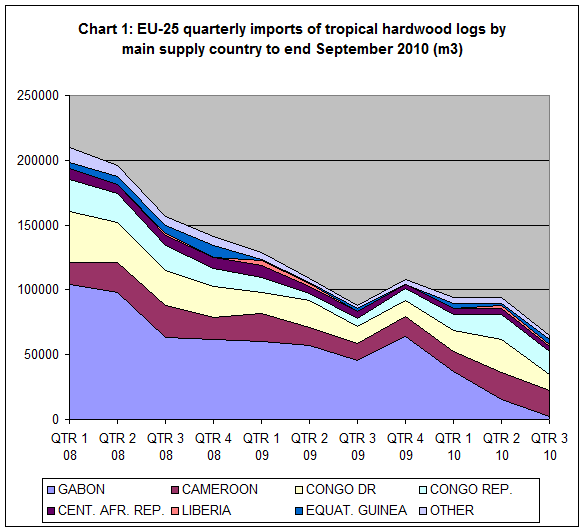

The latest EU-wide trade data indicates that imports of tropical hardwood logs into the region have continued to fall during the course of 2010 (Table 1). Overall imports during the first nine months of 2010 amounted to only 253,300 m3, that’s 22% down on the same period the previous year. The big decline in imports from Gabon following that country’s log export ban imposed from May 2010 onwards has been only partially offset by rising imports from other countries in the Congo basin.

The quarterly data (Chart 1) indicates that the removal of Gabon as a supplier of tropical hardwood logs to the international market in the first half of 2010 did not lead to any significant increase in European imports of this commodity from other countries during the third quarter of the year. EU-25 imports of tropical hardwood logs during the July to September 2010 period amounted to no more than 65,000 m3 – almost certainly the lowest quarterly volume ever recorded and around a quarter of the level prevailing only 2 years before.

of Eurostat trade data supplied by BTS Ltd

EU hardwood lumber imports turn downwards in 3rd quarter of 2010

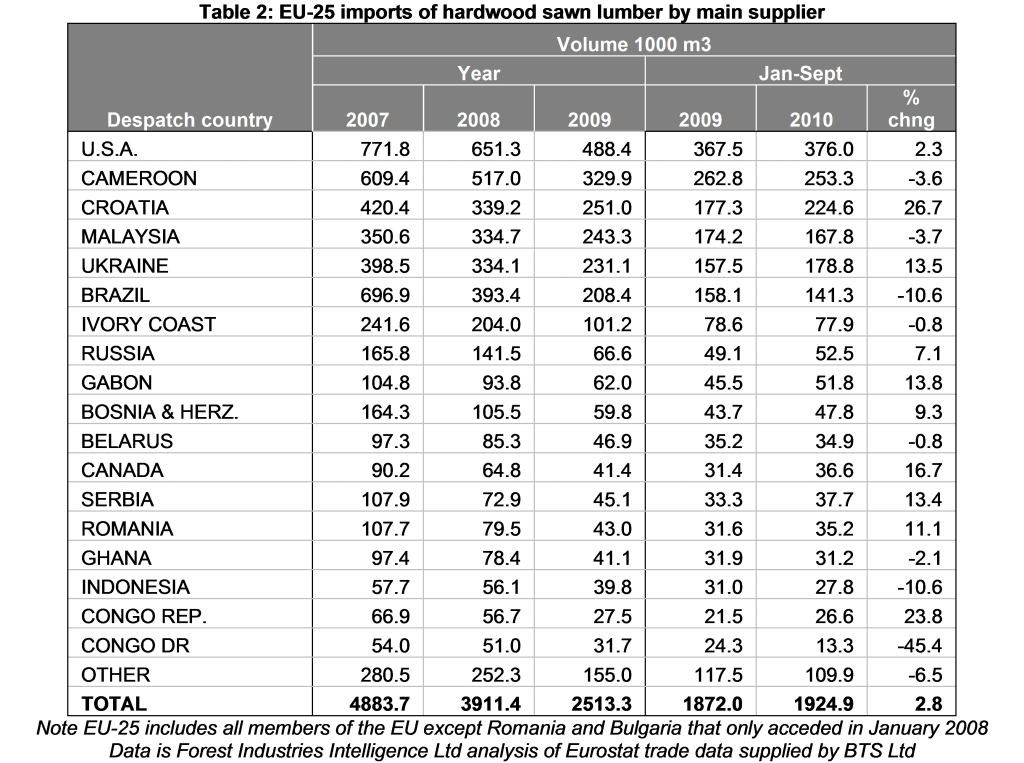

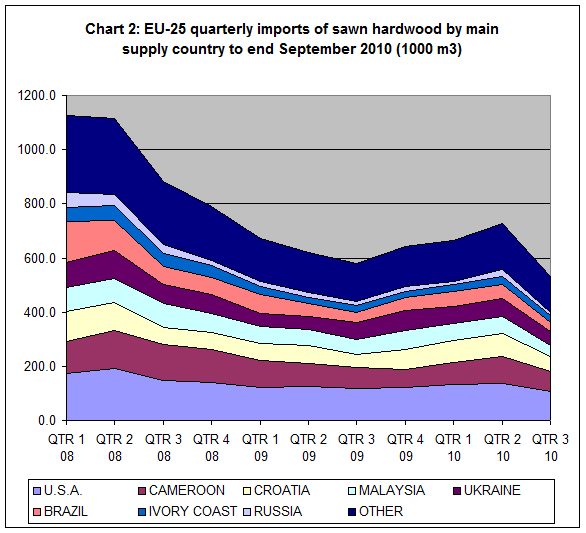

Although EU imports of hardwood lumber for the first 9 months of 2010 were 2.8% higher than the same period in 2009 (Table 2), the recovery in imports lost momentum in the third quarter of the year (Chart 2). This may be seasonal and be due to short-term stocking issues rather than to indicate a long-term reversal in underlying consumption trends. A similar decline in imports in the third quarter of 2009 was followed by recovery in the last quarter of the year. A clear indication of whether the recovery this year is sustainable or stalling will only come with publication of the full year figures.

EU imports of sawn hardwood from the leading tropical supply countries, Malaysia and Cameroon, were marginally down during the first nine months of 2010 compared to the same period in 2009. Imports from Brazil have lost significant ground, largely due to supply constraints and unfavourable exchange rates. However EU imports of tropical sawn lumber from Gabon and the Congo Republic have recovered strongly this year.

One of the most noticeable trends in EU sawn hardwood imports this year has been the growth in market share of several Eastern European countries, including Croatia, Ukraine, and Bosnia. Meanwhile imports from the United States, which remains the largest external supplier of sawn hardwood to the EU, have recovered slightly on figures recorded the previous year.

of Eurostat trade data supplied by BTS Ltd

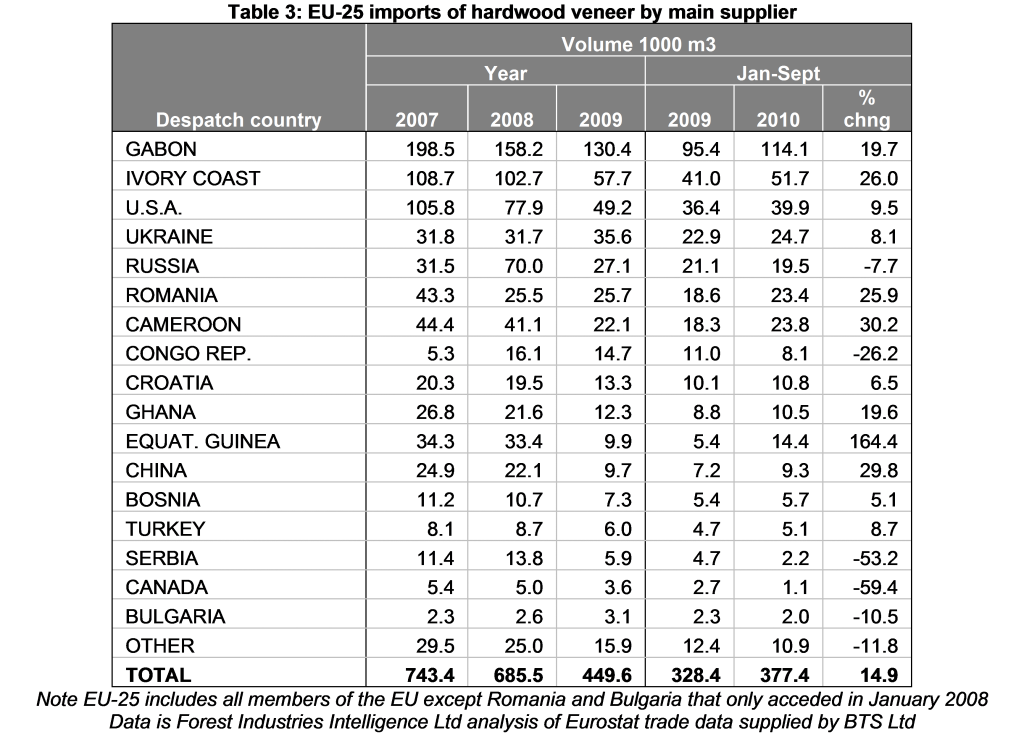

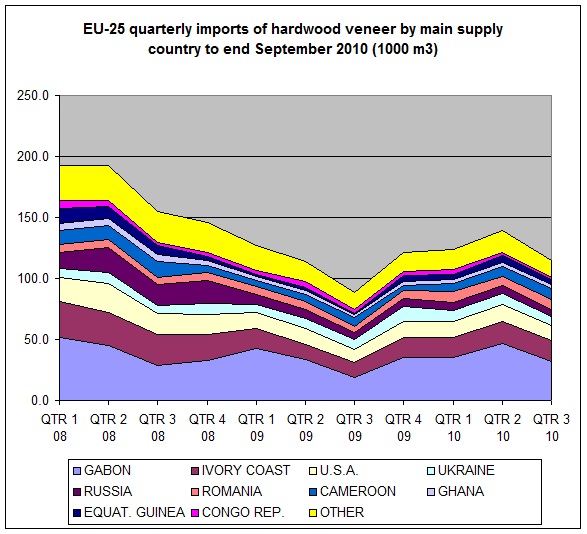

EU veneer imports rise in response to Gabon log export ban

During the first nine months of 2010, EU imports of hardwood veneer were up nearly 15% on the same period the previous year (Table 3). This is partly the result of a switch to hardwood rotary veneer imports by European plywood manufacturers in place of logs from Gabon following the log export ban in May. However, rising levels of veneer imports from countries better known for supply of sliced veneer – such as Ivory Coast, USA, and Romania – suggests this component of the veneer market has also seen some recovery this year.

Analysis of the quarterly data (Chart 3) suggests that overall EU imports of hardwood veneer turned downwards between the second and third quarters of 2010. This was mainly because of a big reduction in imports from Gabon during this period suggesting the trend is due to short term over-stocking of raw material in the European okoume plywood. Third quarter imports of veneer from countries better known for manufacture of sliced decorative veneer maintained the levels recorded in the previous quarter.

of Eurostat trade data supplied by BTS Ltd

UK hardwood market sends out some positive signals

The UK-based timber trade journal TTJ reports that the UK sawn hardwood market remains highly competitive and is slowing now in the run up to the Xmas vacation, but also that the majority of traders are still optimistic that the market is in recovery.

According to the TTJ, there is still a great reluctance on the part of many traders to hold stock and a heavy reliance on just-in-time orders from the few larger importers, both in the UK and on the continent, that have maintained their commitment to holding diversified stock holdings.

TTJ quotes one of the larger continental based importers as suggesting that this trading pattern may be storing up problems for the future, particularly in supply of specialities which “are not just a phone call away”. This importer noted that “the UK in particular seems to be buying last minute and that could create difficulties [in supply of specialities] as demand recovers elsewhere in Europe, which it is now doing”.

TTJ also reports that while UK consumption of African sapele sawn lumber has been reasonably healthy, there’s still a lot of old landed stock around with the result that prices for onward sale in the UK remain below replacement value. Meanwhile the combination of sapele availability and strengthening dollar rate against the euro has meant that forward demand for meranti has remained slow. But demand for iroko remains firm, and there are signs of growing interest in other tropical species previously under-utilised in the UK including idigbo, framire, massaranduba, angelique, and tigerwood.

TTJ forecast that UK sawn hardwood demand in 2011 will be at a similar level to 2010. Expected decreases in consumption due to a rise in VAT from January next year and a significant decline in public spending should be offset by the gradual economic recovery and a boost for construction and refurbishment activities in advance of the 2012 London Olympics.

PDF of this article:

Copyright ITTO 2020 – All rights reserved