There are significant new opportunities for the international hardwood sector, particularly with the growth of new markets in emerging countries and the development of new products such as hardwood CLT, but the industry continues to be held back by structural obstacles and is struggling to cope with rapid global shifts in trade and intense competition from substitute materials.

These were the major messages of the International Hardwood Conference (IHC) held in Venice on 15-17 November. Organised in association with the European Timber Trade Federation (ETTF) and European Organisation of Sawmill Industries (EOS) by Italian trade federation Fedecomlegno, part of FederlegnoArredo, the event attracted a capacity audience of 150, drawn from 17 countries.

Fedecomlegno chairman Alessandro Calcaterra opened with a portrayal of the wood industry at a critical point, facing increasing and shifting global demand. “By 2030 global industrial roundwood consumption is set to rise 60%, making it ever more important where wood comes from, how it’s produced (FAO forecast one third will come from plantations by then) and where it’s used,” he said.

Value of global hardwood trade static at US$35 billion

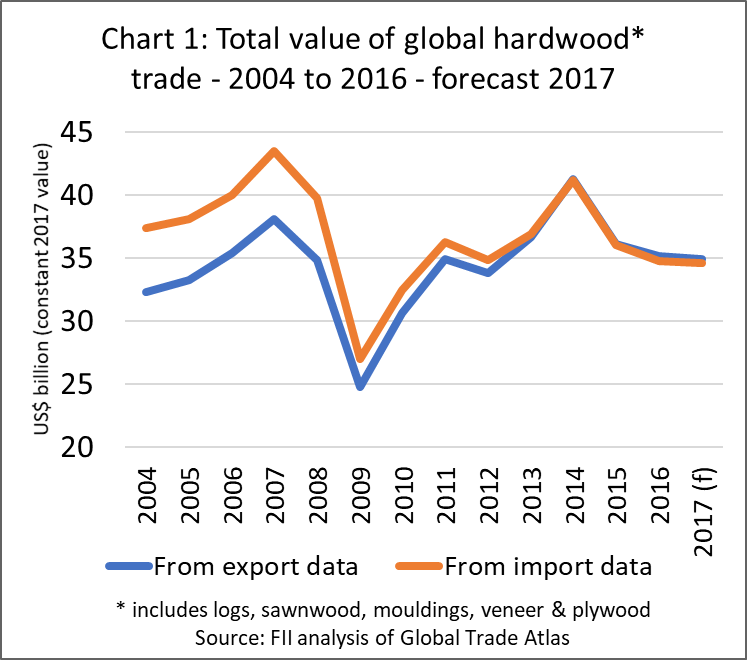

In an overview of the global market position of hardwood, analyst Rupert Oliver, of Forest Industries Intelligence, said latest statistics indicated total international trade in hardwood (including logs, sawnwood, mouldings, veneer and plywood) was valued at $35 billion in 2016, and this level is projected to be maintained in 2017.

Considering the longer-term trend, Mr. Oliver said that trade has been volatile in the last 15 years, declining sharply during the financial crises in 2008 and 2009, before rising to a peak in 2014, driven by demand in emerging markets, particularly the speculative boom in rosewood (hongmu) in China which receded in 2015. (Chart 1).

Mr. Oliver highlighted, that underlying this volatility, is a long-term lack of value growth. The total value of the international hardwood trade in 2017 was no more than in 2004 despite, in the intervening period, the world’s population increasing by more than 1 billion and 1.4 billion people being taken out of poverty.

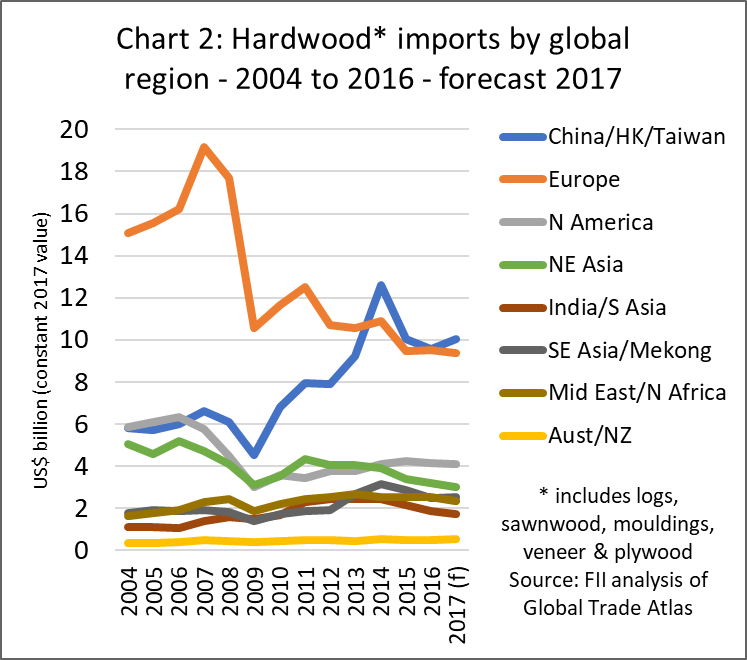

The overall stasis at global level obscures a significant shift in in the balance of market influence away from industrialised countries in Europe, North America and North-East Asia to emerging markets, notably China.

Total hardwood imports by European countries declined from a peak of US$19.2 billion in 2007 to a projected level of US$9.4 billion this year. During the same period, imports in North American countries fell from US$5.8 billion to US$4.1 billion and imports in North-East Asian countries fell from US$4.7 billion to US$3.0 billion. In contrast, imports increased from US$6.6 billion to US$10.0 billion in China and from US$1.9 billion to US$2.5 billion in South-East Asian countries (Chart 2).

Mr. Oliver said that India had been a hardwood log consumer on the rise, but blocks on teak exports from Myanmar and Malaysian supply issues had seen its transition to more lumber buying. But log imports by China, and to a lesser extent Vietnam and other Asian hardwood product manufacturers, continued their inexorable rise. In fact, Chinese imports hit 14.3 million metric tonnes in 2016, with 15.4 million tonnes forecast for 2017.

In sawn hardwood, Mr. Oliver said total global temperate trade was worth around $6 billion in 2016 and tropical $4.5 billion, with the US the single leading exporter and Thailand biggest tropical supplier. China again was the consumer making the headlines with sawn hardwood imports this year expected to be nine million tonnes, up from 2016’s eight million and including around 1.5 million tonnes from the US alone.

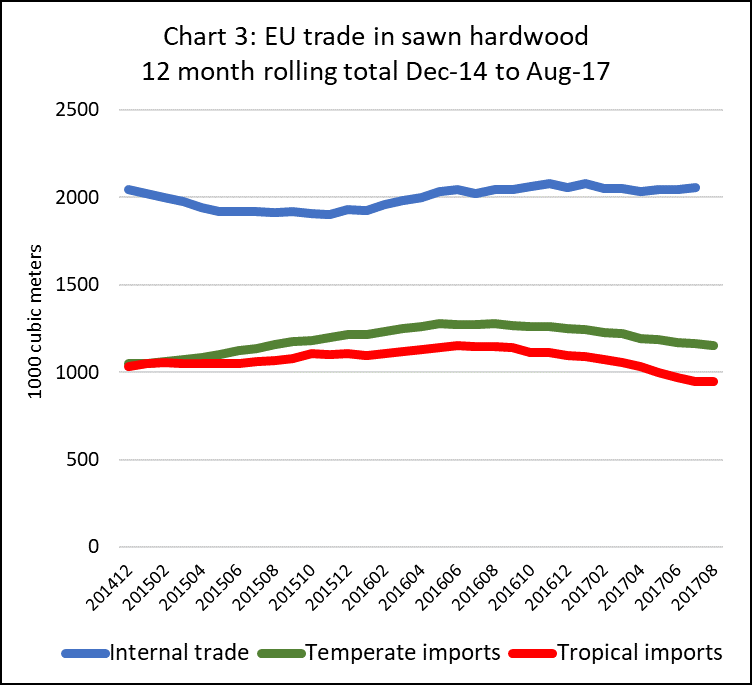

Focusing in on recent trends in the sawn hardwood trade in the EU, Mr. Oliver showed that since 2014, internal trade has remained flat at 2 million m3 per year, while imports from outside the EU increased in 2015 and 2016, but have been sliding again this year.

EU imports of temperate sawn hardwood increased from 1.05 million m3 in 2014, to 1.25 million m3 in 2016 and are projected to fall to 1.15 million m3 this year. EU imports of tropical sawn hardwood increased from 1.03 million m3 to 1.10 million m3 between 2014 and 2016, but are projected to fall back to less than 950,000 m3 this year. (Chart 3).

Mr Oliver concluded that the hardwood sector may struggle near term to grow trade volumes, but had opportunities to increase value. Difficulties to overcome included over reliance on a few species, limitations of current environmental controls to halt illegal trade and industry fragmentation, which limited opportunities for concerted promotion and investment.

But positives were revived interest among specifiers in real wood as opposed to substitutes, development of higher specification engineered and modified hardwood products and emergence of more realistic risk-based assurance of legality and sustainability. “Latest technology can also better evaluate trade data and reduce sustainability certification cost,” he said.

America’s hardwood transition

At IHC, AHEC’s Executive Director Mike Snow highlighted the dramatic transformation in the US hardwood sector in the last 15 years. He explained that the economic and construction crisis of the late 2000s and before that US manufacturing’s migration to lower labour cost countries, saw sawn hardwood output in the US slump. It has since recovered, but at 22.5 million m3 in 2016, is still well below the peak level of around 30 million m3 in 1999.

At the same time, reflecting decline in domestic construction and hardwood manufacturing demand, US mills have refocused on industrial lumber for the US market and grade exports. “In 2005 grade lumber accounted for 59.7% of US output, today that’s 48%,” said Mr Snow. “Moreover, 45% of it is now exported and rising, compared to 17% in 2000.”

China’s role in this evolution has been central, accounting for all US sawn hardwood export growth since 1992, and today buying 25% of the boards America produces. US exports to China have grown particularly rapidly since the international economic crisis, thanks to the potent combination of contraction in the American domestic market and the rise of China’s new middle class, firing growth in its domestic consumption.

“In 2000 85% of our exports to China were re-exported as finished goods,” said Mr Snow. “Today 80% goes into products for its domestic market.” Asked which country will be the “next China”, Mr Snow’s response was “still China” thanks to accelerating development of its less industrialised western regions. US mills see this as a further lumber market opportunity, however, their growing concern is the accompanying rise in China’s log imports.

“So far logs have gone mainly to finished goods makers processing timber for their requirements,” said Mr Snow. “The concern now is emergence of Chinese mills cutting US logs for the general market.”

Mr Snow suggested that, despite India’s vast population and a widening gap in wood supply, opportunities to expand sales of sawn hardwood in India are unlikely to match those in China, at least in the near term, because the country is not pursuing investment in manufacturing – or in infrastructure – and is focused instead on developing a service economy. However, India is now developing as an important market for hardwood furniture made elsewhere, notably in China and Vietnam.

Questioned about the impact of the persistently strong dollar on US hardwood exports, Mr Snow said that while it will act as a temporary drag, in practice it has not prevented US hardwood exports reaching record levels. It also increases US consumer demand for finished products, including hardwood furniture. Mr. Snow suggested that, based on current economic conditions, there is unlikely to be any significant weakening of the US dollar in the near term.

Africa expected to become a net wood importer

Another perspective on the global hardwood trade was provided at the IHC by consultant Pierre Marie Desclos who suggested that population growth will accelerate regionalisation and sharpen the focus on raw material supply and logistics. Mr. Desclos said that the hardwood resource in many tropical regions and some temperate countries is becoming depleted and that climate change may accelerate this trend.

Mr. Desclos also noted that, according to UN estimates, world population is projected to rise from 7.3 billion today to 9.7 billion by 2050, adding 80 million more inhabitants every year, with longer life expectancy and higher buying power. Mr Desclos suggested this would likely result in a critical increase in hardwood demand and changing relationship between buyers and consumers.

Due to particularly rapid population growth, and limited productive forest resources, Mr. Desclos suggested that changes would be dramatic in Africa which would soon be transformed from a significant exporter into a net importer of wood products.

While population growth is expected to moderate in other regions, in Africa it is expected to accelerate. Mr. Desclos said that before the end of this century, one third of the world’s population will be Africa. In 2050, Nigeria will be the world’s third most populous nation, ahead of the US. African forests, which account for only 15% of the world’s total forest area, will need to focus on supplying domestic needs.

ETTF view of European hardwood market situation

ETTF President Andreas von Möller provided an overview of the current state of the European hardwood market to the IHC. He described the contraction of Europe’s tropical wood imports in recent years as ‘sad’ and due both to the recession and to specifier misperceptions’ around the material’s legal and sustainable credentials.

However, Mr von Möller, added that European market prospects are generally positive, with most countries’ GDP and construction sectors trending up. He noted that the EU’s construction production index had risen 5% since the start of 2016 and made the following observations regarding individual European markets:

- The economy in Germany has been resilient in recent years and is now benefitting from improving economic conditions in neighbouring countries. Demand for wood woods in the first half of 2017 was very good, particularly for flooring and garden furniture. Expectations are that the market will remain strong in 2018, with 30% of members of the German importing association predicting that demand will be even better than in 2017.

- In the UK, the Brexit decision to leave the EU in March 2019 has created economic uncertainty and, together with the weaker GBP, is leading to inflation and reduced borrowing, business investment and consumer demand for home improvement. Nevertheless, the UK economy continues to expand, with GDP growth projected to be 1.5% in 2017 and 1.4% in 2018. Modest new housing growth of around 0.5% is expected in 2018. The British Woodworking Federation’s latest trade survey for Q3 2017 indicates that medium term prospects of the joinery industry remain sound. There are rising concerns over skill shortages and rising raw material costs, but many manufacturers expect sales to improve in the final quarter of the year.

- After a long and deep recession, the economy in Italy is beginning to recover, with construction performing better than expected this year. Hardwood stock levels in the country are low and delivery times are now extended which is feeding through into rising prices.

- The wood sector in Belgium reported positive turnover development in 2016 and the first half of 2017. Market share of wood in new housing is rising rapidly, from 6% in 2011 to 9% in 2016, but this is benefitting softwood more than hardwood. Outlook for wood demand in 2018 is considered positive.

- The Netherlands economy is recovering, recording 3.4% growth in the second quarter of 2017 and 3.2% growth forecast for 2017 and 2.4% in 2018. Over 55,000 housing permits are expected to be issued in 2017, double the level of 2013, although still some way below pre-crises levels.

- France, a large market for wood products, is recovering with building activity now rising to close to pre-crisis levels. However, the unemployment rate is still high, at around 10% for the last three years, and tropical wood has yet to see any benefit from growth in the wider economy.

- Spain’s economy is reviving following the financial crises with construction activity increasing consistently in the last two years, much of focus now being in large urban areas rather in coastal holiday towns and rural areas. However, finance for construction is still difficult and recent political events in Catalonia, which accounts for about 20% of national economy, has created uncertainty about market prospects in 2018.

- Greece has been 9 years in recession and national GDP this year will be 30% less than in 2008. Construction activity is nearly 90% down compared to 2005. Nearly one in four Greeks of working age are unemployed. Construction and other business activity is impaired by extremely high interest rates. Nevertheless, the wood sector expects the downturn to hit bottom this year and for recovery to start next year.

- The economy in Denmark, which is a big per capita consumer of wood, is expected to grow 1.7% this year and the construction sector is performing well. EUTR enforcement is very active in the country and creating much confusion in the importing sector and tending to hinder imports, particularly from the tropics.

European sawmills report static hardwood production

The European domestic hardwood supply situation was summarised at IHC by EOS Board Member Nicolae Tucunel. He reported that European annual sawn hardwood production has remained static at around 10.9 million m3 in the last three years despite the gradual economic recovery. Lack of raw material was highlighted as a problem in Germany, France and Belgium, where about 30% of hardwood sawmills across the three countries have been closed in the last decade.

Mr Tucunel said that that supply problems this year have become particularly pronounced in Romania, where production is constrained both by declining log harvests and lack of finance for investment in wood processing, and in Croatia where the government implemented a ban on exports of oak logs and lumber over 20% moisture content, ostensibly for phytosanitary reasons.

EU exports of hardwood logs to China have also been high this year, at 1.47 million tonnes in the first nine months, 10% more than the same period in 2016, with around 50% comprising oak. As in North America, the level of log exports to China is now creating concern in the European hardwood processing sector. “We must insist on a level timber market playing field,” said EOS President Sampsa Auvinen, “without raw material the European sawmill industry will be forced out of the market.”

Role of EUTR in trade diversion away from Europe

Raw material availability and distribution also formed a core theme for Davide Pettenella of Padua University. He addressed whether national and regional timber legality controls were creating a ‘dual market’ for tropical timber.

His study compared trends in primary tropical timber product imports by EU states, the USA and Australia, representing developed countries with strict timber market legality regulation, and China, Vietnam and India representing emerging consumers with lighter controls. This highlighted import swings to the latter. In 2001 of all tropical timber imported by these countries, the developed economies accounted for 63% and 72% by volume and value, the emerging countries 37% and 28%. Today the respective division is 44% and 47% and 56% and 53%.

While legality controls may be implicated in this trend, Mr Pettenella said it was not the exclusive factor. “Emerging countries’ economic development and increasing south-south trade are also involved,” he said. In fact, his conclusion was that monitoring should focus more on these emerging market trends. “It’s a phenomenon which should be of interest to policy makers,” said Mr Pettenella. “In 1990, there were just 20 regional trade agreements. Today there are 283.”

Innovation to expand opportunities for hardwood

Turning to hardwood use, European Director David Venables described AHEC’s work supporting application of hardwood species in engineered and thermally modified form in construction. Mr Venables observed that there is a new generation of timber towers being built which are rising ever higher, a development made possible by glulam and Cross Laminated Timber (CLT).

Engineers now believe that the maximum possible height of a CLT tower is only around 11 storeys but that hybrid towers, for example comprising a concrete core with a CLT shell, can extend up to 22 storeys.

Mr Venables said that interest in using engineered wood for high density urban construction is driven mainly by cost-savings and reduced time of construction. The BskyB building, the tallest commercial timber structure in the UK, was designed and constructed in less than one year, half the normal time of a project this size. The building weighs considerably less than an equivalent concrete building, therefore greatly reducing the costs and time required for delivery of materials on-site.

AHEC’s own work has focused on promoting the use of American hardwood for manufacture of specialist grades of CLT and glulam. “CLT production is forecast to reach 1 million m3 next year,” said Mr Venables. “softwood dominates the market, but imagine if hardwood took just a percentage.”

This work is drawing on experience acquired during AHEC’s high profile showcase projects at the London Design Festival – the Endless Stair and The Smile – where engineers and architects were commissioned to utilise experimental tulipwood CLT panels. Testing for these projects demonstrated that tulipwood CLT panels were three times stronger than spruce panels of equivalent size and weight.

The demonstration projects led directly to the first permanent use of hardwood CLT at a “Maggies Centre” in Oldham in north England. The panels for the project comprised the lowest grades of tulipwood, the natural wood fully on display using a hardwood previously considered suitable only for paint grade.

Tulipwood was chosen not only for its strength and aesthetic, but also because of the health benefits of an untreated natural material, a factor particularly important for a structure designed for the treatment of cancer-sufferers. The exterior panels were thermally modified to enhance durability.

In another major project, Mr Venables reported that American white oak was used for the 22-meter, 4-tonne, glulam structural beams installed as the core roof structure of the new stand at Lords cricket ground in London. White oak was chosen for these, the longest cantilevered beams in the world, because of the extremely high strength to weight ratio of the hardwood.

Mr Venables said that, while CLT and glulam offer opportunities to extend applications of hardwood, there are challenges. One issue is that manufacturers only purchase square-edged fixed-width timber which is often not supplied as standard in the hardwood industry, unlike the softwood sector which is more accustomed to supply large volumes in fixed dimensions.

Another problem is that the technical standards bodies are dominated by softwood interests and need to be persuaded to approve hardwoods for use in structural panels. Mr. Venables said AHEC has been forging links with the relevant Eurocodes committees who now appear to be more open to the idea of extending the standards to include hardwood species. This is less because of AHEC’s direct lobbying of committee members, and more because architects and engineers now recognise the potential of hardwood and are themselves demanding that the relevant standards be changed.

PDF of this article:

Copyright ITTO 2020 – All rights reserved