After a long period of stagnant CIF NW Europe prices for plywood products, European plywood agents believe that CIF prices may be on the verge of significant rises. Inflationary price pressures seem to be mounting. Shipping lines which have been shedding money over the last few months are laying up tonnage in an effort to drive up freight rates. And a long period of very low harvesting is contributing to a serious shortfall in log supplies which has increased raw material costs in major producing regions.

Meanwhile hardwood plywood stocks on the ground in the EU are low following a very long period of restricted forward buying which began in the third quarter of 2008. There has also been a limited upturn in consumption during the early summer months as a period of good weather has boosted construction activity in parts of Europe. All this has contributed to a minor increase in forward buying in recent weeks. But the volumes involved remain limited and no-one is expecting a dramatic increase in the pace of forward orders any time in the near future. In fact importers are very concerned about market prospects during the winter of 2009/2010 when construction activity across Europe is widely expected to stagnate once again. In the UK, the weakness of the GBP is another obstacle in the way of any significant increase in forward orders.

Another factor reducing prospects for significant forward orders is the big shift in recent years to containerisation of plywood imported into western European. The market now tends to receive smaller volumes on a more regular basis. This reduces the risks of “boom and bust” and is more aligned with the existing market focus on just-in-time trading.

The difficulty of obtaining credit insurance throughout the plywood trading chain has also gummed up the European plywood trade in recent months. Credit insurance is vital to the smooth running of the supply chain since it gives manufacturers insurance for the period between supplying goods to customers and being paid for those items. If withdrawn, suppliers may demand upfront payments from customers or refuse to supply goods.

There are at least some signs that credit insurance is less of an issue now than 6 months ago. Many suppliers appear to have accepted that lack of credit insurance should not be an over-riding factor preventing a sale. Instead suppliers are forming their own judgements on credit worthiness based on knowledge of the customer’s long-term track record in paying for goods.

European plywood importers have been employing two distinct market strategies during the downturn. One group of companies, mainly the larger and better capitalised companies, has been trying to boost market share by selling in volume at low margins. Another group has been working off very low stocks and selling only limited volumes while trying to ensure a good margin on each sale.

Malaysia and China are jostling for position as leading supplier of tropical hardwood faced plywood into the EU. Indonesia is now widely regarded as a spent-force, at least in the UK market, partly due to price but also according to one agent “because Indonesia has not properly addressed the environmental issue”. Several of the largest UK builders’ merchants continue to blacklist all Indonesian plywood on environmental grounds.

The major focus on product price during the downturn seems now to be having a significant impact on the quality of plywood products supplied into the EU. There are signs that in order to meet existing price expectations in the EU, some plywood suppliers are cutting corners with respect to log quality, glues and other raw materials.

Furthermore the market shift from tropical-hardwood-throughout plywood to combi-plywood comprising a softwood or eucalyptus core – which began several years ago – seems to have deepened. In the case of Chinese product, there is now a shift from poplar-cores to eucalyptus cores. There are also signs that this shift to combi-products is now going a step further, with reports of tropical hardwood faced plywood containing a palm or coconut core finding its way into the market. Contacts suggest these products have been supplied in the EU by both Chinese and Malaysian mills. As one agent comments “the market tends to get what it pays for” and this is an inevitable consequence of current price expectations in Europe.

While this shift to lower value products might fit with existing market conditions in the EU, the hardwood plywood sector could be storing up longer-term problems. Quality issues have already seriously dented plywood’s reputation for reliability amongst European manufacturers and construction professionals. The risks of structural weakness and fungal attack potentially associated with these new products may make matters worse. European importers are being advised to check carefully the products supplied against specification.

Over the long term, tropical hardwood plywood has lost significant market share in certain sectors of the European market. For example, 15 years ago tropical hardwood plywood was used widely for interior doors and cabinets, a niche now dominated in the EU by veneered MDF. The good news is that there are certain niches where tropical hardwood plywood is more difficult to substitute, for example for heavy duty exterior construction and marine applications. But with other materials sectors very actively engaged in product innovation and development, no-one can afford to be complacent.

European hardwood sawmillers predict 11% fall in hardwood consumption

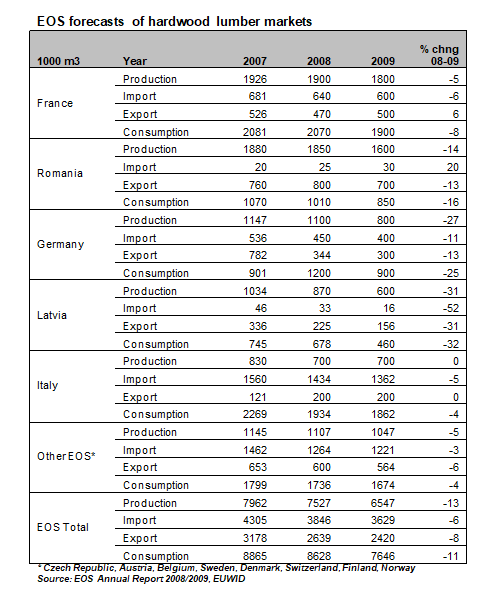

The European Organisation of Sawmillers (EOS) forecasts that overall hardwood lumber consumption in the EOS member countries will fall by 11% between 2008 and 2009 from 8.6 million m3 to 7.6 million m3 (see table). The downturn in consumption is predicted to affect all EOS member countries, although it is expected to be greatest in Latvia (-32%), Germany (-25%), and Romania (-16%).

In 2009, France and Romania are expected to remain the largest producers of hardwood lumber in the EOS member countries by a significant margin. Italy is the largest importer, followed a long way behind by France and Germany. Overall hardwood lumber imports into EOS countries are expected to be down 6% in 2009, again with Latvia and Germany bearing the brunt of the decline.

The EOS membership covers most of Europe’s largest hardwood lumber producers including France, Romania, Germany, Latvia, Italy, Czech Republic, Austria, Belgium, Sweden, denmark, Switzerland, Finland, and Norway.

German window market shows signs of improvement

The German trade journal EUWID reports that demand for windows in central Europe has remained reasonably stable over the last 6 months and that this sector has generally outperformed other wood industry sectors since the start of the year. EUWID notes that demand is being boosted by good residential renovation and refurbishment activity. However activity in the new-build and non-residential sector is described as stagnant. Energy related refurbishment projects which benefit from government subsidies are frequently cited as the primary driver. These projects are resulting in particularly good demand for triple glazed units which now account for around 30% of the total German window market.

In a related article, EUWID comment that demand for window scantlings seems to be rising in Germany, a development regarded by some market players as seasonal and by others as a response to the government’s second economic stimulus package which involves extensive investment in public sector buildings such as schools and hospitals. EUWID also notes that standard 72X86 mm scantlings are losing market share to thicker dimension product. As in other sections of the European wood market, distributors in this sector are generally looking for product to be supplied on a little-and-often basis.

On the other hand, EUWID report that the parquet flooring sector stagnated across Europe in the second quarter of 2009. EUWID suggest that overall demand for parquet across the region may be as much as 20% to 30% down on the same period last year. Demand varies widely by country. The UK and Ireland together with southern and eastern European countries have been very badly hit. Demand in Germany, Austria and the Nordic countries has been more stable. Demand is down both from retailers and wholesale traders. The lower quality end of the market has been particularly affected by the downturn.

PDF of this article:

Copyright ITTO 2009 – All rights reserved