The latest trade data shows that the volume of hardwood primary and secondary wood products (logs, rough sawn lumber, veneer and plywood) imported into the EU-25 group of countries from developing nations was down 48% during the first quarter of 2009 compared to the same period the previous year. Imports during the 1st quarter of 2009 were also down 20% on the 4th quarter of 2008. The figures reinforce anecdotal reports of a collapse in forward buying of tropical hardwood products at the end of last year as importers responded to the credit crunch with radical steps to cut stocks.

The extremely low levels of import during the first quarter of 2009, which follows on a from a long period of declining imports which set in at the start of 2008, also suggests that EU stocks may now be at historically low levels. This factor, combined with clear signs that forward supplies are tightening, raises the prospect of supply shortfalls in the EU later this year. A recent TTJ hardwood market report notes that “nearly all contacts reported that production cutbacks have resulted in tight supply, which is getting worse. It wouldn’t take much of a pick-up in demand for prices to rise and shortages to kick”. The report suggests that the shortfalls could be almost universal with respect to species, commenting that “75-80% of the supply areas are going to struggle to cope with any increases in demand”.

For the time being though there has yet to be any significant move by importers to replenish stocks. A widely expressed view in the trade is that existing European landed stocks of sapele, the dominant African joinery species, are probably sufficient to tide the trade over the quiet summer months. Significant forward orders are now unlikely to emerge at least until the autumn months. Although there is awareness of the potential for future supply shortages later in the year, there is insufficient confidence in the future development of European consumption to encourage importers to make speculative purchases. Added to this is considerable uncertainty over the future development of the euro, dollar and pound sterling exchange rates.

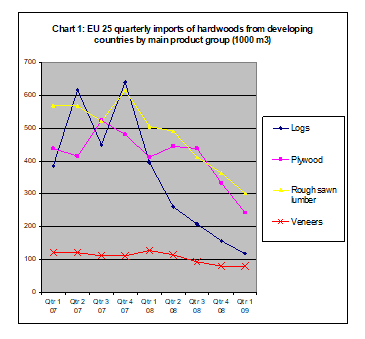

Chart 1 shows the quarterly volume of logs, rough sawn timber, veneer and plywood imported from developing countries by the EU-25 group of countries (i.e. all EU countries excepting new members Romania and Bulgaria) from the start of 2007 until the first quarter of 2009. It highlights that the dramatic decline in EU imports of hardwood logs and rough sawn lumber from developing countries which set in from the start of 2008 has continued at least until the end of the first quarter of 2009. It shows that EU imports of hardwood plywood from developing countries stayed reasonably stable until the end of the 3rd quarter of 2008, but then fell dramatically in the subsequent two quarters. Imports of hardwood veneer fell slowly and consistently throughout the course of 2008, but the decline flattened out in the first quarter of 2009.

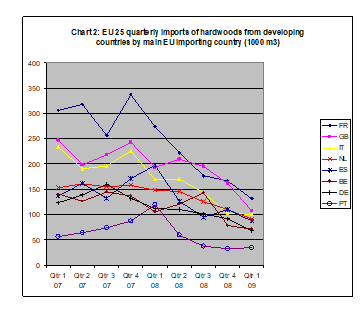

Chart 2 shows trends in total imports of primary and secondary hardwood products from developing countries by the eight EU Member States which are the largest importers of these commodities. It shows that the timing of the downward trend in imports has varied between EU Member States:

· imports have declined consistently and very steeply into France since the start of 2008.

· imports into the Netherlands and Germany have also declined consistently since the start of 2008 but less steeply than in France.

· a dramatic decline in imports into the UK set in during the second half of 2008 and continued very steeply into the first quarter of 2009.

· imports into Italy declined steeply and consistently during the whole of 2008, but seem to have bottomed out in the first quarter of 2009.

· the major decline in imports into Spain and Portugal occurred during the second two quarters of 2008 and volumes have stabilised at a low level since then.

· imports into Belgium fell very dramatically in the last quarter of 2008 and more slowly in the first quarter of 2009.

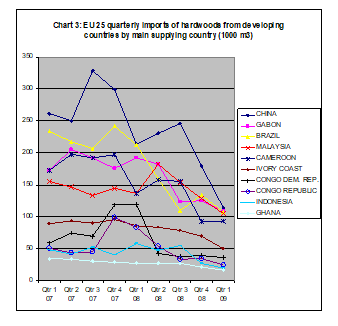

Chart 3, which shows EU quarterly data by major supplying country, suggests that the European market downturn has been felt across the board by all suppliers, although some have suffered more than others. EU hardwood imports from China (mainly plywood) have fallen very dramatically, with a particularly sharp drop occurring in the last quarter of 2008 and the first quarter of 2009. A big decline in EU-25 hardwood imports from Brazil occurred during the first 9 months of 2008 but imports have subsequently stabilised at a lower level.

The fortunes of African countries supplying the EU have varied widely over the last 18 months. Imports from Gabon – much of which are destined for France – fell away rapidly in the first nine months of 2008 and have stabilised at a low level since then. EU imports from Congo DR rose strongly at the end of 2008 and into the first quarter of 2008, but then fell dramatically in the second quarter of 2008 and have remained low ever since. Imports from Cameroon have followed a stepped pattern, declining dramatically in the first and last quarters of 2008, stabilising during the intervening quarters. Imports from Ivory Coast and Ghana have experienced a steady decline since the start of 2008.

Of all major tropical supply countries, only Malaysia has maintained a reasonably strong position in the European market over the last 18 months, significantly increasing market share during this period. At the end of 2007, Malaysia was only the fifth largest developing country supplier of hardwoods to the EU market, contributing much less than half the volume of China which then led the field by a very large margin. However by the first quarter of 2009, Malaysia was jostling for position with China and Brazil to become the largest developing world supplier of hardwoods to the EU.

The signs are that Malaysian suppliers have been the major beneficiaries of mounting supply problems and other competitive pressures in China and Brazil. Other factors which might be playing a role to enhance Malaysia’s market share include: relatively rapid turnaround times between ordering and shipment; the willingness of Malaysian shippers to match specifications to the letter; the strength of the euro against the US$ (which enhances competitiveness of US$-denominated Malaysian stock against competing €-denominated African stock); consistent marketing by the Malaysian Timber Council; and the country’s ability to supply the EU market with competitively priced FSC-certified combi-plywood lines and, following recent PEFC endorsement of the Malaysian Timber Certification System (MTCS), PEFC-certified sawn wood products.

A brief note on prices

Over recent months its has proved extremely difficult to gather reliable forward price information from European importers. Prices have tended to be quoted over a large range reflecting a market situation where there has, in reality, been extremely limited forward buying and heavy reliance on existing landed stocks which, for some species, are being sold at well below replacement price. To some extent therefore, the prices quoted here are more an indication of what the EU trade is willing to pay and what may be achieved when selling from existing landed stock rather than what would be an acceptable price to the shipper that truly reflected the cost of production.

PDF of this article:

Copyright ITTO 2009 – All rights reserved