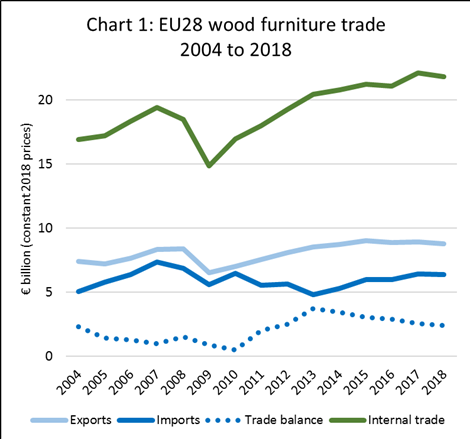

After a strong start to the year, the trade in wood furniture slowed sharply in the last quarter of 2018. EU imports of wood furniture from outside the region, which were up 6% in the first nine months of 2018, finished the year down around half a per-centage point compared to 2017 at €6.36 billion. This is a reversal of the slow recovery in EU imports that began in 2013. (Chart 1).

The decline in wood furniture imports closely mirrors changes in the wider European economy. According to the EU Winter 2019 Economic Forecast published in February, economic activity in the EU cooled in the second half of 2018 as political tensions and uncertainty over fiscal policy and Brexit sapped business and consumer confidence and output in some Member States.

GDP growth in both the euro area and the EU slipped to 1.9% in 2018, down from 2.4% in 2017. Slowing economic growth fed through into a fall in the value of the euro and the British pound, both of which weakened against the U.S. dollar by around 8% during 2018.

These changing economic conditions are also indicated by a slowdown in internal EU wood furniture trade which, after hitting a peak of €22.1 billion in 2017, fell back nearly 7% in 2018 to €21.8 billion. The Brexit situation led to a slowing in UK imports both from within and outside the EU in the second half of 2018, while broader concerns about the EU economy contributed to a slow-down in trade elsewhere in the region.

The decline last year interrupts a long-term sharply rising trend in internal EU trade on-going since the financial crises in 2008-2009. This long-term trend has been driven by increased market integration within the EU, the shift in manufacturing from higher cost countries in the western EU to lower cost eastern locations, particularly Poland, and the growing presence and influence of large-scale retailing chains operating at cross country level, most notably IKEA. More wood furniture imports into the EU from outside the region are also now being funnelled via the Netherlands.

The drive towards greater integration of the EU furniture market and access to relatively lower cost manufacturing locations in the eastern EU partly explain the continuing dominance of EU-based manufacturers in the region. ITTO’s own estimates based on analysis of Eurostat data indicate that EU-based manufacturers account for around 85% of all wood furniture sold in the region.

In recent years, European manufacturers have boosted productivity and competitiveness through investment in more advanced computer-controlled and automated manufacturing, cutting overheads and reducing the relative labour cost advantages of overseas producers.

There’s been a particularly large investment by Western European furniture manufacturers in Eastern European countries, notably since their accession into the EU from 2004, and this is now maturing. From being principally production satellites for large western European brands, Eastern European manufacturers are now developing their own identity and market momentum.

Furniture manufacturers in the EU area are also making a virtue of their shorter supply chains which not only reduce transport costs but also allow products to be delivered more rapidly.

External suppliers face other more direct challenges to expanding sales in the EU. Despite some recent consolidation, there is still a relatively high degree of fragmentation in the retailing sector in many European countries which complicates market access. Many overseas suppliers remain reliant on agents and lack direct access to information on fashions and other market trends.

The progressive migration of European furniture sales online is also tending to favour local manufacturers better placed to meet the short lead times demanded by internet retailers and consumers.

EU furniture manufacturers losing export market share

European furniture manufacturers are also strongly motivated to maintain and increase share in their home markets as they are now struggling to expand sales outside the EU. Last year there was a 1.7% fall in the value of EU wood furniture exports to €8.78 billion.

This continues a trend of flatlining, or slowly declining exports to countries outside the EU after reaching an all-time high of just over €9 billion in 2015. Since then the competitive benefits of the relative weakness of the euro against the dollar and other cost saving efforts of EU wood furniture manufacturers have waned.

Competition for EU-based manufacturers has intensified from newly emerging producers in Eastern European countries outside the EU, such as Bosnia, Ukraine and Turkey, and from Vietnam which in the last 5 years has rapidly overtaken all other tropical countries in the global league table of wood furniture producing nations.

EU wood furniture manufacturers have suffered in higher-end export markets in Asia, the CIS and Middle East from a range of factors including cooling of the Chinese economy, a sharp fall in global equity markets towards the end of 2018, extreme weakness of the Russian rouble, relatively low oil prices and political instability.

Given domestic market problems in the EU and the European Central Bank’s policy to keep interest rates at record-lows to boost demand, the euro is expected to depreciate against the dollar in 2019, which may boost EU exports a little this year.

However, while the risk of outright global recession in 2019 still seems low, a general global deceleration is widely forecast with growth falling below potential in most regions. Overall therefore, EU wood furniture exports are unlikely to rise significantly this year.

Challenging market for external suppliers to the EU

Prospects for non-EU wood furniture suppliers selling into the EU are mixed. All suppliers face an uphill struggle to compete with domestic manufacturers. Added to this challenge this year is the economic uncertainty inside the EU and the prospects for further weakening of European currencies against the US dollar. Gains are being made by some external suppliers, but nearly all are in countries neighbouring the EU. Only one tropical wood furniture supplier, India, is currently making ground in the EU market.

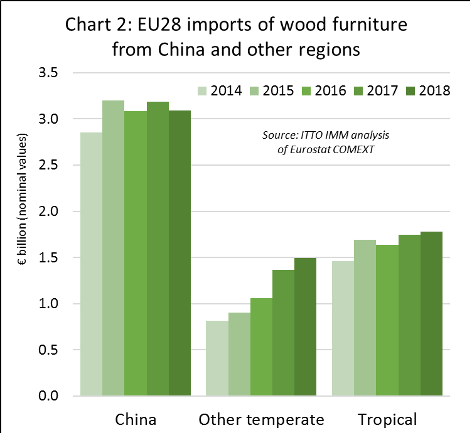

After a brief upturn in 2017, EU wood furniture imports from China, by far the largest external supplier, fell 3% to €3.09 billion in 2018. China’s competitiveness in the EU wood furniture market has been impeded as prices have risen on the back of growing domestic demand and new laws for pollution control pollution in China.

In 2018, EU imports of wood furniture continued to rise from other temperate countries, mainly bordering the EU. EU imports from these countries increased 9% to €1.49 billion in 2018, building on a 28% gain recorded the previous year. The biggest gains in 2018 were made by Ukraine, Belarus, Russia, USA, Bosnia, and Turkey.

After a slow start to the year, EU imports of wood furniture from tropical countries picked up pace a little in the second half, and were €1.78 billion overall for 2018, up 2% compared to the previous year (Chart 2).

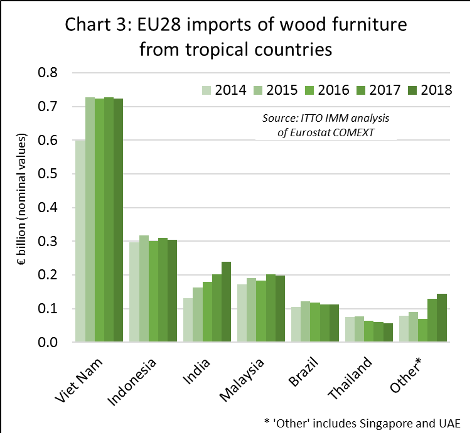

The main South East Asian supply countries have all followed a similar trajectory in the EU wood furniture market in the last two years. A rise in EU imports in 2017 was followed by a decline in 2018.

After increasing 1% to €728 million in 2017, EU imports from Viet Nam fell 0.5% to €724 million in 2018. Imports from Indonesia increased 4% to €311 million in 2017 but fell back 2% to €304 million in 2018. Imports from Malaysia increased 10% to €203 million in 2017 and were 2% down at €199 million last year.

In contrast, EU wood furniture imports from India continued to rise, up 18% to €239 million in 2018 after a 12% increase to €202 million in 2017. Imports from Brazil were €113 million in 2018, matching the 2017 level (Chart 3).

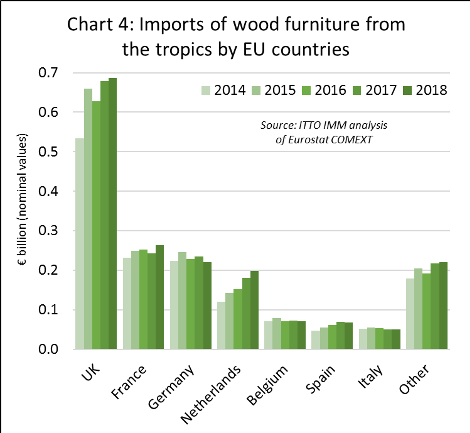

There were also shifts in the destinations for wood furniture imported into the EU from tropical countries in 2018. Imports in the UK, the largest market, were €687 million last year, 1% more than in 2017. There were also rising imports in France (+9% to €264 million) and Netherlands (+9% to €198 million).

However, these gains in 2018 were offset by falling imports of tropical wood furniture in Germany (-6% to €220 million), Belgium (-2% to €72 million), Spain (-4% to €67 million), and Italy (-1% to €50 million) (Chart 4).

Brexit saga damages prospects for market expansion

The UK’s dominant position in the EU as by far the leading destination for wood furniture imports from tropical countries, suggests that the on-going Brexit saga may have significant long-term effects.

While there may be long term benefits for external suppliers resulting from the UK’s decision to pull back from deeper EU integration, these benefits seem to be a very distant prospect. At present, the uncertainty is significantly undermining prospects for market growth in the short to medium term.

UK economic growth in 2018 was only 1.4%, down from 1.8% in 2017 and the joint worst year (with 2012) since the financial crisis. According to the latest UK government summary of independent forecasts, UK growth is expected to be around 1.3% in 2019 and even this is dependent on the UK resolving the Brexit issue one way or the other.

Even now that the official Brexit date of 29th March 2019 has passed, the full economic and political fallout of the UK’s vote to depart the EU are very hard to predict.

With the UK government asking the EU for a delay until such time as serious internal political differences can be resolved, there is still uncertainty over the timing of Brexit, or whether the UK will depart on terms agreed with the EU or, failing that, there is a “disorderly exit” with attendant severe economic disruption. It is still possible the UK changes course entirely and decides to remain in the EU.

Overall the indications are that the UK market for wood furniture, after making some small gains last year, will contract in 2019.

Europe central role in the global furniture industry

Despite recent deterioration in the EU’s balance of furniture trade, European manufacturers remain a major force in the international furniture sector. Their dominance of the EU’s internal wood furniture market is also unlikely to be seriously challenged in the foreseeable future.

This is made clear in a series of detailed reports on Europe’s place in the global furniture sector newly released by the Italy-based research organisation CSIL. (More details of the reports “The Fumiture Industry in Europe”, ‘World Furniture Outlook 2019’ and ‘Forecast Report on the Furniture Sector in Italy, 2019- 2021’ are available from www.worldfurnitureonline.com or by email csil@csilmilano.com).

CSIL estimate the total value of global furniture trade in 2018 was around US$149 billion, 4% up on the previous year and building on a 6% increase in 2017. CSIL expect the world furniture trade to continue to grow by 4% in 2019.

CSIL reckon world furniture consumption was US$460 billion in 2018 (production prices excluding the markup for distribution). World furniture consumption is forecast by CSIL to rise around 3.2% in real terms this year with growth concentrated in Asia and Pacific.

In the EU, CSIL estimate that total furniture production continued to grow in 2018, rising between 1% and 2% in real terms. According to CSIL forecasts, this rate of growth should continue until at least 2020.

The CSIL global ranking of 100 countries identifies Germany, the UK and France as the main importing countries worldwide after the United States (although at a distance). Germany, Italy and Poland are the main exporting countries at a global level, after China (at a distance).

CSIL highlight that while Asia has become more dominant in the global furniture sector, Europe remains the second largest furniture manufacturing region in the world and still accounts for around one quarter of global furniture production.

Europe is also the headquarter of some of the largest and most important sector players (around one third of the top 200 largest furniture companies in the world are located here).

Europe accounts for roughly one quarter of the global world furniture market. Per capita furniture consumption is the highest in the world (alongside North America). Europe accounts for around 44% of world furniture imports and 41% of world furniture exports

CSIL point out that the EU furniture sector now employs around one million workers, many of which are highly skilled, in 121,500 manufacturing firms, mainly micro and small sized. This, together with a rich cultural heritage, gives European manufacturers a competitive edge and promotes the development of creative competences which are recognized worldwide.

CSIL note that “the European industry is able to combine new technologies and innovation with cultural heritage, tradition and style, providing jobs for skilled workers and is also a world leader in the high-end segment of the furniture market”.

CSIL suggest that in addition to the barriers created by a large and highly competitive domestic industry, there are other obstacles to non-EU producers entering the market, including logistical costs and requirements for various forms of certification to specific technical and environmental standards.

PDF of this article:

Copyright ITTO 2020 – All rights reserved