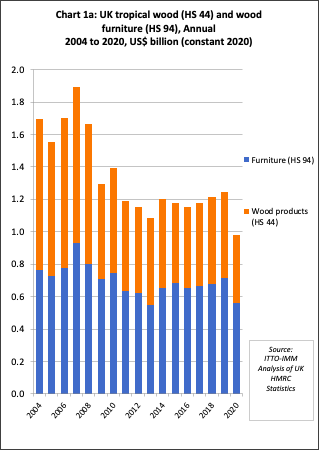

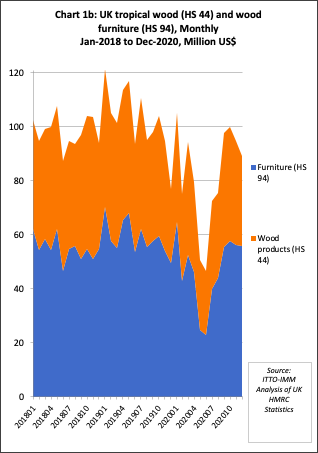

Total UK tropical wood and wood furniture imports in 2020 were USD981 million, 23% less than the previous year (Chart 1a). It is no surprise that imports fell so precipitously, the UK being amongst the world’s worst affected countries by the COVID-19 pandemic last year at a time when there was already uncertainty due to the country’s departure from the EU. However, UK imports from tropical countries did suffer a larger decline in the UK market than products from other regions, largely due to supply side problems, particularly lack of and rising costs of freight space from South East Asia during the year. But underlying demand is strong in the UK and new opportunities may well open up for tropical suppliers in the UK over the long term.

The decline in UK imports of tropical wood and wood furniture in 2020 was concentrated in May and June when imports fell to around 50% of the normal level. After recovering sharply between July and October, imports fell 5% to USD100 million in November and by a further 7% to USD89 million in December (Chart 1b). The slowdowns in 2020 coincided with the initial COVID-19 lockdown in Q2 2020 and a second lockdown in Q4 2020 as another more severe wave of the virus hit in the winter months.

A concern for tropical suppliers is that timber product imports from tropical countries suffered a disproportionately large share of the decline. There are, however, reasons to believe that the downturn in the UK market last year may be only temporary and that new opportunities for tropical suppliers will open up in the emerging post-Brexit trading environment.

The scale of 2020 downturn was strongly influenced by supply side issues. UK demand for all wood products has proved to be more resilient than expected during the pandemic and importers are widely reporting that the main obstacle to trade at present is lack of availability. The problems of shipment and rising costs of freight have been particularly intense from South East Asia, a factor which should ease gradually as trade flows begin to normalise this year.

While Brexit is likely to act as a significant drag on economic recovery in the UK, at least in the short to medium term, there are signs that the relatively thin trade agreement reached between the UK and the EU in the closing days of 2020 may help level the playing field for non-EU wood suppliers in the UK market relative to EU competitors.

This has particular significance for hardwood products since the UK, unlike the rest of EU, has only a very limited domestic hardwood resource, while the broader wood processing and furniture manufacturing industries are also relatively small in international terms. The country has always been very heavily dependent on imports for wood supply and now has a strong incentive to build stronger trade links with countries outside the EU.

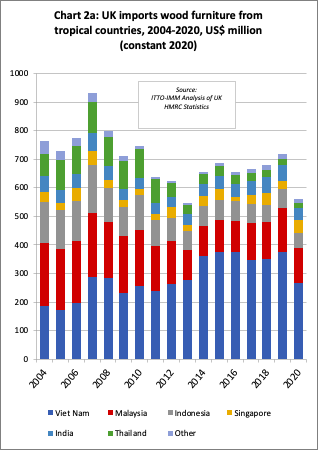

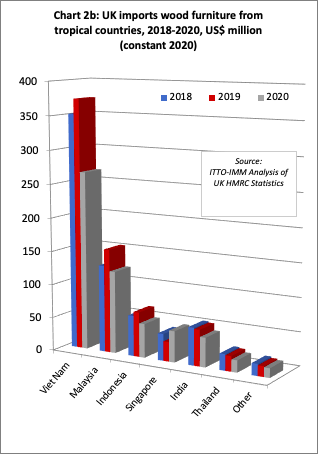

UK tropical wood furniture imports down 22% in 2020

Overall UK imports of wood furniture (HS 94) from tropical countries in 2020 were USD562 million, 22% less than in 2019. This was the lowest level since 2013 and followed four years of consistent growth (Chart 2a). UK imports from tropical countries fell much more than imports from other countries in 2020. Total UK imports of wood furniture fell 8% to USD3.52 billion in 2020, with imports down 7% from China to USD1.32 billion, down 5% from the EU to USD1.12 billion, and up 6% from other non-tropical countries to USD458 million.

UK imports of wood furniture declined sharply from all the leading tropical supply countries in 2020 (Chart 2b). Imports from Vietnam were down 29% to USD267 million, imports from Malaysia fell 21% to USD123 million, imports from Indonesia declined 24% to USD51 million, imports from India fell 19% to USD44 million and imports from Thailand were down 21% to USD18 million. In contrast, there was a 59% rise in imports from Singapore to USD46 million.

The rise from Singapore is mainly due to logistics as large container carriers left off the coast of Singapore during the most stringent coronavirus measures in the second quarter of 2020 re-entered the shipping market to help ship containers to Europe. Container space from other South Eastern countries was very limited and was likely an important factor explaining loss of share in the UK and wider European market for wood furniture in 2020.

UK imports of tropical HS 44 wood products at historically low level in 2020

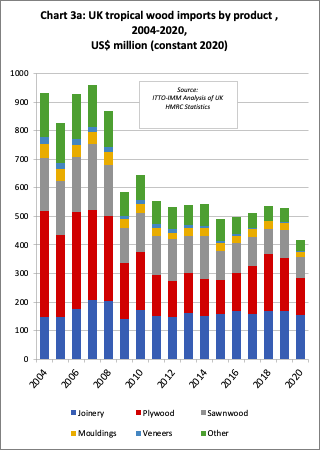

UK imports of all tropical wood products in Chapter 44 of the Harmonised System of product codes (excluding wood for energy) declined 21% to USD417 million in 2020. This is by far the lowest level since 2004, and probably for many years prior to that (Chart 3a).

The downturn in imports of HS 44 wood products was much greater from the tropics than other regions. Total UK imports of HS 44 wood products from all countries fell only 2% to USD5.02 billion in 2020. UK imports from the EU actually increased 1.5% to USD3.35 billion in 2020, the gain partly explained by stock building prior to the UK’s exit from the single market on 31st December 2020. Imports from China fell 6% to USD726 million while imports from other non-tropical countries declined 4% to USD544 million.

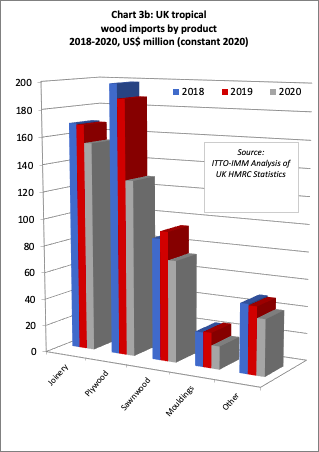

In 2020, UK import value of all the main HS 44 tropical wood product groups declined sharply, including tropical joinery (-8% to USD155 million), tropical plywood (-31% to USD130 million), tropical sawnwood (-22% to USD75 million), and tropical mouldings/decking (-35% to USD17 million) (Chart 3b).

UK hardwood market conditions unprecedented

According to the latest hardwood market report in the UK Timber Trades Journal (http://www.ttjonline.com/), the combined effect of COVID and Brexit has been to produce unprecedented market conditions: “Demand is reported as good to exceptional, but the supply situation, particularly, but not exclusively in North American, is proving exceptionally challenging. Prices are rising accordingly. While the sector reports sales slumping to just 30-40% of normal levels at the outset of the pandemic, since then, they have grown exponentially. Some companies reported a seasonal dip in December, others said they continued to climb and that they hit the ground running in January”.

TTJ highlights that that the surge in home improvement is a key factor driving consumption, with importers reporting high demand for anything to do with construction, refurbishment and the garden and that joinery customers are also flat out.

TTJ also notes that the hardwood supply situation is now extremely tight as hardwood mills worldwide have struggled to gear up production as markets emerge from lockdown due to lack of raw material, social distancing measures and a large proportion of personnel being in isolation. Many mills have also been overly cautious about increasing output, failing to forecast the huge surge in global demand as China experienced a very rapid recovery and the US and EU benefited from the home improvement boom.

On tropical hardwoods, TTJ reports that while African supply have been affected later and less than elsewhere by the pandemic, implementation of Covid-safe work practices has added to existing logistical problems and very extended lead times. UK importers are saying that on orders for kiln-dried African hardwood placed this February, delivery is not expected before January 2022 delivery.

This highlights the extent to which UK importers are having to rely on existing stockholdings and implies that prices, which are already up 5% this year for sapele, the most popular tropical hardwood species in the UK, will continue to rise. Based on reports of very tight availability from their suppliers in Cameroon, the Republic of the Congo and Ghana, UK importers expect price pressure on forward orders to increase.

One company told the TTJ that their Asian supply was currently on hold due to ‘off-the-chart’ freight rate increases resulting from the disruption to shipping and particularly container distribution caused by the pandemic. While a container from South East Asia cost $1500 to $2000 a year ago, companies now report being quoted $12,000-$16,000.

According to TTJ, UK importers are still generally reluctant to try alternative hardwoods despite the huge supply and price pressure on preferred species like white oak and sapele. However, a few importers report that tiama is being used as a sapele alternative, while there is steadily increasing, but still very restricted, demand for angelim-vermelho, angelim-amargoso, tatajuba, jutai and araracanga from South America and eveus (Klainedoxa gabonensis) from Africa. Amongst temperate species, American red oak has made some gains as the price of white oak is now 40% higher than it was a year ago.

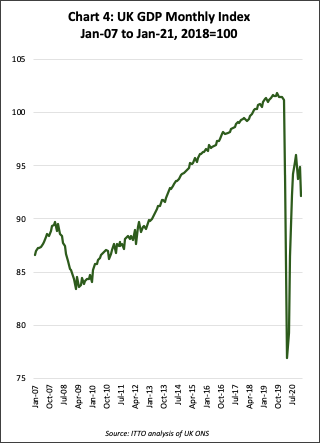

UK GDP unlikely to recover to pre-pandemic level until mid-2022 The UK government’s official estimate is that GDP contracted 9.9% in 2020, the biggest fall of any G7 country. The latest monthly data shows that the rebound in UK GDP stalled in the last quarter of 2020 and continued to decline in January 2021. The latest downturn coincides with a return to lockdown to counter a second, more severe, wave of the virus during the winter months. As a result GDP in January 2021 was still over 9% percentage points down compared to a year earlier (Chart 4). The UK government’s latest forecast is for the economy to rebound 4% this year and 7.3% in 2020. This means the economy is unlikely to return to pre-pandemic levels before the middle of 2022.

UK construction sector and builders’ merchants report strong growth

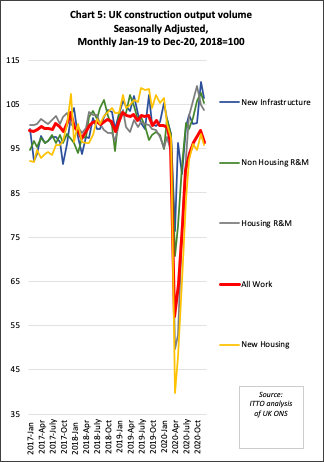

A positive factor for the UK timber trade in 2020 was that the initial downturn in construction sector activity, which is a key driver of timber demand, during the first “great lockdown” was short and followed by a stronger rebound than other areas of the economy.

Although the rebound in UK construction lost momentum in the last quarter of 2020, by the end of the year construction activity in new infrastructure and repair and maintenance, both for housing and non-housing, was slightly higher than before the pandemic. Activity in the new housing sector was only marginally down on the pre-pandemic level (Chart 5). In January 2021, construction was the only main sector of the UK economy to register growth, rising 0.9% compared to the previous month.

The sales figures of UK builders’ merchants follow the general trend in construction. The BMF’s Builders Merchants Building Index (BMBI) reported a strong performance in the third quarter of 2020 with sales returning to near normal levels after the first Covid lockdown greatly reduced sales in the second quarter. This positive overall trend continued into the fourth quarter, with total builders’ merchants’ sales 5.4% ahead of the same period the previous year.

For the tropical hardwood sector, it is notable that the fourth quarter year-on-year increase in merchant’s sales was driven by strong performances in Landscaping (+22.9%) and Timber & Joinery (+12.7%). Concerted efforts to build timber stocks at a time when supply was low and prices high was a key factor behind the rise in the value of trade during the period.

Taking 2020 as a whole, UK Builders Merchant’s sales were down by -10.7% compared to 2019. Given the public’s focus on their gardens during the first lockdown, it is no surprise that Landscaping was the only category to show an annual increase in sales value (+5.4%). In contrast, sales for interior improvement were amongst the worst performers including Kitchens & Bathrooms (-18.1%) and Decorating (-16.5%).

BMF chief executive John Newcomb said: “Given widespread site closures both at the start of the pandemic and for extended Christmas shut down periods, the continued year-on year growth seen in the final quarter of 2020 provides a positive indicator of the building industry’s recovery. No doubt the Covid effect, including its impact on product availability, will be felt for some time to come. But the adaptability to enforced changes demonstrated by merchants and their trade customers over the past 12 months gives me a cautious degree of optimism for the coming year.”

The extent to which material supply shortages are impacting on the UK construction sector, due both to COVID and the UK’s departure from the EU single market on 31st December, is highlighted in recent comments on Brexit by Rico Wojtulewicz, the head of housing and planning policy at the National Federation of Builder: ‘all materials from Europe are taking a while to get into the UK, most with cost increases. Members are having major issues with timber, such as MDF, veneers and solid wood. There are very long wait times of two to six months.’

He added: ‘Another issue having a major impact is the availability and cost of shipping containers. In some cases, the price per container has increased six-fold, in others there just aren’t any containers available.’

Immediate trade impact as UK leaves the EU single market

UK trade with the EU is now governed by the EU-UK Trade and Cooperation Agreement concluded on 24th December 2020 just a few days before the UK was due to leave the single market at the end of the year. The Agreement allows for zero tariff trade between the two partners but does not exempt UK companies from the red tape associated with a customs border, including the need to handle customs declarations for imports and exports.

The UK tax office has estimated that British businesses will spend £7.5 billion a year handling customs declarations for trade with the EU — as much as they would have done under a no-deal Brexit – and has stated that the number of customs forms needed to trade with the EU under the Brexit deal “is not materially different from a no-deal situation”.

The effects on UK exports to the EU have been immediate. A Road Haulage Association (RHA) member survey found the volume of exports going through British ports to the EU fell by 68% in January compared to the same month last year, mostly as a result of problems caused by Brexit.

While there has been a huge fall in UK exports to the EU with the immediate introduction of EU customs controls to UK products on 1st January, the situation in relation to UK imports from the EU has been different. UK imports from the EU have been affected by port congestion and a shortage of freight capacity. However, unlike the EU, the UK government chose a phased approach to introduction of customs controls, postponing the introduction of certain import procedures for EU products.

These grace periods are designed to give businesses more time to adapt to the new rules and ways of working. The UK’s initial intent was that requirements for phytosanitary certification of UK imports from the EU should be introduced from April while requirements for full customs declarations on entering the UK market, rather than submitting forms at a later date, should be introduced from July.

However, on 11th March, the UK announced that these grace periods would be extended for an extra six months in a bid to give businesses and customs officials more time to prepare for the additional red tape and to avoid the threat of food shortages in the summer. The move means the first checks on imports from the EU into the UK will not start until October, with full border controls not being carried out until 1 January 2022 – a full year after the UK left the EU.

These changes have significant implications for the UK timber importing trade. In a typical year, the UK imports around 9 million cubic metres of timber from Europe, mostly softwoods and panel products, but including some hardwood products, most notably oak sawnwood and birch plywood. Timber imported from the EU accounts for well over half of all timber and panels consumed in the UK. In addition, the UK imports wood furniture valued at around USD1.2 billion from the EU each year, one third of all imports and 15% of all consumption of wood furniture in the UK.

Insights on the immediate effects of the UK’s departure from the EU single market on the UK timber importing trade are provided in a TTF member survey published on 1st March. The survey draws on the views of thirty-six respondents representing timber importers, merchants, agents, and manufacturers. In introducing the survey, the TTF note that, “Q1 2021 has already brought multiple reports of haulage and freight companies rejecting jobs and hiking prices to travel to Britain amid long waiting times at British ports”.

The survey suggests that the effects of Brexit on the UK timber trade have been muted so far, particularly in the hardwood sector. However, since border controls have yet to be fully implemented, this may not be indicative of the long term impact. The survey report finds that “Brexit red tape has caused a mild impact on their business as customs and due diligence mapping combined with logistical challenges from increased border checks has slowed down trading, but not demand”.

Somewhat contradicting this conclusion, the survey report also finds that “Members have stated they are experiencing a dramatic slowdown in deliveries, particularly from haulage across the English Channel from European countries”.

Where impacts are reported, they are a very much focused on softwoods. While 66% of respondents stated they have had “logistics issues importing and exporting softwood due to haulage companies charging increased rates, rejecting their request for delivery in and out of the UK, and a lack of truck ability due to the trade barriers introduced by Brexit”, only 33% of respondents stated these same issues had impacted on the hardwood trade. Similarly, new requirements for phytosanitary certificates on UK imports from the EU had impacted on 33% of hardwood traders compared to 66% of softwood traders.

A significant issue for many TTF members to date has been growing obstacles to their trade with Northern Ireland (NI). Although NI is a part of the UK, the region also remains in the EU single market to prevent the creation of a hard border between NI and the Irish Republic and thereby protect the NI peace process.

The TTF survey report notes that “while ‘unfettered access’ from Great Britain to Northern Ireland had been promised, in reality trading has become more difficult, with a number of our members reporting they are looking to cease trading with Northern Ireland until the trade barriers are removed”.

The TTF also notes that new requirements for UKCA marking are starting to concern members. “While this year members can continue placing CE-marked goods onto the UK market, from January 2022 the UKCA mark will become the sole UK conformance mark. This would raise considerable trade barriers and challenges next year with concerns businesses will not have enough time to prepare for the implementation of the new mark.

The TTF has announced that it “will work with the Construction Products Association (CPA) and the Confederations of Business Industries (CBI) to advocate for a deferment of the implementation of the mark or to achieve equivalence with the CE Mark”.

EU exporters struggle to respond to UK due diligence requests

One measure already enforced in the UK is the UK Timber Regulation which imposes legality due diligence requirements on all timber products placed on the UK market, including from the EU, and which replaces the EUTR. The TTF survey suggests that this is a “mild barrier” to TTF members trade with the EU and Northern Ireland.

According to the TTF, importing timber from the EU has been made more difficult as “European companies unwilling or unable to share details of supply chains to help members complete the necessary due diligence has become a growing problem.” Furthermore, “each shipment must go through double due diligence. Stock going into the EU undergoes due diligence and then when it has been purchased by a UK trader, due diligence on the same product has to be undertaken again”.

One respondent to the TTF survey stated “Due diligence works for bulk supplies from regular customers outside the EU. But when topping up from the EU, there could be several supply chains involved in one shipment. Every chain has to be risk assessed despite already being risk assessed to enter the EU. Suppliers do not want to risk revealing their supply chains for smaller (but essential) occasional orders.”

Some respondents to the survey highlighted that European suppliers do not understand why they have to prove due diligence when the product is certified or when from a low-risk region of the EU. TTF note that “it is hoped that over time our members’ European suppliers will accept the new due diligence requirements and share their supply chain information to lessen the blocking of trade”.

In response to Brexit, Vandecasteele Houtimport, the large Belgian hardwood importer, has created a UK registered company to minimise post-Brexit administration and streamline service for customers. Vandecasteele Timber Ltd acts as operator under the UK Timber Regulation, handling all due diligence and other customs clearance procedures.

“We have set up the company basically to continue to service the UK market as before,” said export manager Geneviève Standaert. “It ensures for UK customers that nothing changes; all paperwork is from UK to UK, so there are no headaches for customs clearance, phytosanitary certificates, VAT prepayment and so on. Due diligence, in particular, can be a lot of work and a challenge for companies which may not have done it before. We take that work on on the UK customer’s behalf.”

Vandecasteele’s sales to the UK dropped sharply in the first two months of the pandemic but recovered rapidly from May. “Business has continued to grow since and today is really good,” said Ms Standaert.

PDF of this article:

Copyright ITTO 2021 – All rights reserved