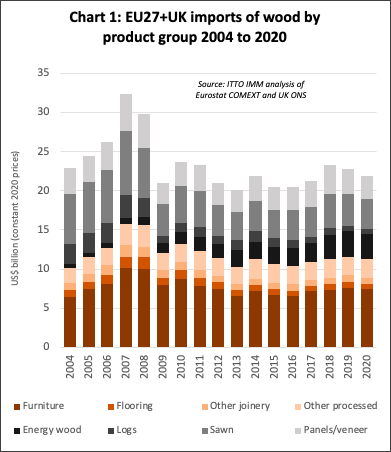

Despite upheaval in the EU27+UK wood market and wider economy in 2020 due to the COVID-19 pandemic, the total dollar value of EU27+UK imports of wood (HS44) and wood furniture (HS94) products fell only 4% to US$21.86 billion euro in 2020. In dollar terms, EU27+UK imports in 2020 were higher than during the 2015-2017 period and not significantly out of alignment with the trend of the previous 10 years (Chart 1).

While the overall level of EU27+UK imports of wood and wood furniture products remained surprisingly resilient during 2020, there were winners and losers. Unfortunately for tropical suppliers, their share of the European trade fell sharply in 2020 after making some tentative gains the previous year.

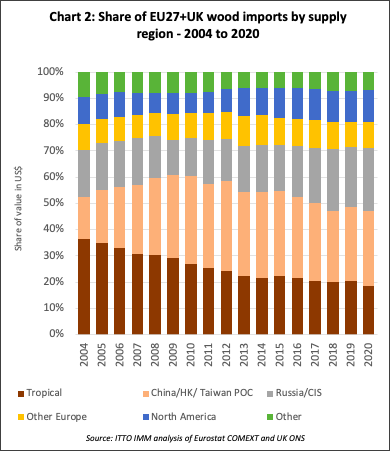

In total, wood and wood furniture imports into the EU27+UK from the tropics were US$4.08 billion in 2020, 13% less than the previous year. The share of tropical suppliers in the total value of EU27+UK wood product imports decreased from 20.5% in 2019 to 18.5% in 2020, the lowest level ever recorded which compares to a figure of over 35% only 15 years before (Chart 2).

The latest downturn in tropical wood’s share of the EU27+UK market is partly due to supply side problems in tropical countries during the pandemic, compounded by severe lack of container space, particularly in shipments from South East Asia to Europe. Another key factor was that in 2020 the pandemic impacted most heavily on a few western European countries – notably the UK, Spain, Italy, Belgium and France – which are the largest markets for tropical wood and wood furniture products in the region.

At the same time, the largest single market for tropical wood and wood furniture products in the region – the UK – went through the painful process of removing itself from the EU, officially leaving the bloc on 31st January 2020 and the single market on 31st December after a brief transition period last year.

In contrast to tropical countries, the total value of EU27+UK imports of wood and wood furniture products from China declined just 3% to US$6.18 billion in 2020, mainly driven by a slight decline in wood furniture. This follows marginal 1% gains in EU27+UK import value from China in 2018 and 2019 after a period of decline between 2014 and 2017.

EU27+UK imports of wood and wood furniture products from CIS countries actually increased in 2020, rising 1% to US$5.27 billion. The share of CIS countries in total EU27+UK imports increased from 22.9% in 2019 to 24.1% in 2020. EU27+UK imports of softwood sawnwood, birch plywood and wood furniture from the CIS region all made gains in 2020 while imports of wood pellets were stable.

EU27+UK imports of wood and wood furniture products from other non-EU European countries declined 2% to US$2.17 billion in 2020 and share of imports from these countries increased slightly, from 9.7% in 2019 to 9.9% in 2020. After dipping sharply early in the year, imports from Norway (mainly softwood logs and sawnwood) and Bosnia and Herzegovina (mainly wood furniture and some sawn hardwood) rebounded strongly in the second half of 2020. However, imports from Switzerland (mainly furniture and panels), Serbia (mainly furniture), and North Macedonia (all furniture) were recovering only slowly.

EU27+UK imports of wood and wood furniture products from North America (excluding Mexico) decreased by just 1% in 2020 to US$2.68 billion. The region’s share of total EU27+UK imports increased from 11.8% in 2019 to 12.3% in 2020. Rising imports of pellets offset declining imports of sawnwood, furniture, and veneers from North America.

EU wood furniture imports down 3% in 2020

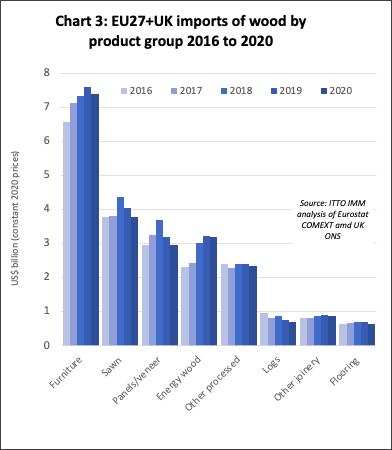

Considering individual products (Chart 3), the dollar value of EU27+UK imports of wood furniture decreased by 3% to US$7.4 billion in 2020 after a 4% increase in 2019. Wood furniture imports from temperate countries fared much better than imports from tropical countries during the year.

Imports of wood furniture from China, which alone accounts for around 50% of the EU27+UK external trade, declined only 3% to US$3.7 billion. Imports of wood furniture from all the other leading supply countries in temperate regions increased during the year including Turkey (+19% to US$335 billion), Bosnia (+6% to US$233 billion), Ukraine (+17% to US$215 billion), Belarus (+28% to US$183 billion) and Serbia (+3% to US$153 billion).

In contrast, there was a universal fall in imports of wood furniture from tropical countries in 2020, including Vietnam (-14% to US$751 billion), Indonesia (-12% to US$367 billion), India (-6% to US$280 billion), and Malaysia (-16% to US$222 billion).

Such consistency across the board – with rises in imports from temperate countries matched by declines from tropical countries – is unusual. It may be a short-term adjustment as European importers switched to more regional suppliers with the sharp drop in availability of container space and rising freight rates and other problems in sourcing products from South East Asia during the pandemic. On the other hand, it may have long term consequences if it reinforces the trend towards ‘reshoring’ and a preference for sourcing furniture from neighboring countries in Eastern Europe on-going now for some time in the region.

A similar trend is apparent for sawnwood. EU27+UK imports of sawnwood (inclusive of both softwood and hardwood, and decking) declined 6% to US$3.79 billion in 2020 following a 7% fall the previous year. The biggest falls in sawnwood imports during 2020 were all reserved for tropical suppliers. Imports fell 15% from Cameroon to US$223 million, 12% from Brazil to US$237 million, 17% from Malaysia to US$117 million and 15% from Indonesia to 114 million.

In contrast to tropical wood, imports of sawnwood from Russia, by far the largest external supplier, recovered 9% to US$889 million after falling 11% the previous year. Imports from Belarus also remained quite stable in 2020, declining only 2% to US$462 million after a 4% fall the previous year. Most sawnwood imports from Russia and Belarus comprise softwood and lower value hardwood species such as birch and aspen. EU27+UK imports of sawn wood from both countries have been high in recent years following imposition of log export bans.

Imports of sawnwood from Ukraine, comprising a mix of softwood and hardwood, fell 12% in 2020 to US$310 million following a 13% fall the previous year. Imports from the United States, almost exclusively hardwood, are also declining, down 14% to US$291 million in 2020 following a 13% decline the previous year.

EU27+UK imports of plywood and other wood panels decreased 7% to US$2.95 billion in 2020 after a 14% decline the previous year. This European market for plywood and panels weakened sharply in the second half of 2019 with widespread reports of overstocking and falling prices as the economy began to cool at that time. The onset of the pandemic last year deepened the prevailing downward trend.

With few exceptions, the downturn impacted on all the leading suppliers of plywood and panels, both in temperate regions and the tropics. Imports from Russia fell 5% to US$694 million following a 14% decline the previous year, similarly China fell 5% to US$510 million in 2020 following a 14% decline in 2019, Ukraine was down 7% in 2019 and 1% in 2020 to US$304 million, and Brazil fell 16% in 2019 and 26% in 2020 to only US$225 million. Of temperate suppliers, only Belarus made gains in 2020, rising 6% to US$249 million but this followed a 19% fall the previous year.

Amongst tropical suppliers of plywood and panels, EU27+UK imports declined 30% to US$86 million from Indonesia in 2020 after a 13% fall the previous year. However, in 2020 gains were made by Gabon, with imports rising 13% to US$110 million after a 5% fall the previous year, and Malaysia, from where imports increased 5%, to US$37 million, after falling 33% the previous year.

Following nearly 20 years of almost uninterrupted growth, the dollar value of EU27+UK imports of energy wood fell 1% to US$3.18 billion in 2020. Imports of energy wood are now dominated by pellets from North America, Russia and the CIS countries. Imports from the United States continued to rise in 2020, by 3% to US$ 1.4 billion, and also increased 25% from Canada to US$374 billion. Imports from Russia were US$501 million in 2020, no change compared to 2019. However, imports from Belarus fell 3% to US$190 million in 2020. Imports from Ukraine, which includes much charcoal as well as pellets and other fuelwood, declined 7% to US$185 million in 2020.

EU27+UK imports of logs declined 8% to US$680 million in 2020 after a 15% fall the previous year. In 2020, imports fell from nearly all the countries that continue to allow log exports, including Russia (-5% to US$290 million), Norway (-15% to US$223 million), Switzerland (-19% to US$43 million), and USA (-15% to US$35 million). However, after falling to negligible levels in 2018 and 2019 following imposition of tight export controls, log imports from Belarus increased sharply last year to US$21 million.

After years of decline, EU27+UK log imports from tropical countries are now very low and fell from all main supply countries in 2020, down 15% from Republic of Congo to US$18.1 million, 31% from Central African Republic to US$6.2 million, and 44% from DRC to US$3.7 million.

The value of EU27+UK imports of wood flooring fell 6% to US$640 million in 2020 after a 3% fall the previous year. Flooring imports from China, by far the largest external supplier accounting for around two thirds of the total, declined 9% to US$385 million in 2020, while imports from Ukraine were down 4% to US$97 million. However flooring imports from Malaysia increased last year, by 25% to US$29 million. Imports from Indonesia were down 4%, to US$21 million, continuing a long-term downward trend.

EU27+UK imports of ‘other’ joinery products (i.e. excluding flooring and mainly comprising doors and laminated wood for window frames and kitchen tops) fell 3% to US$880 million in 2020 after a gain of 5% the previous year. Imports from China were stable at US$206 million in 2020 after rising 4% in 2019. However, imports from Indonesia were down 16%, to US$174 million, reversing the 9% gains made the previous year. Imports from Malaysia also declined in 2020, by 6% to US$95 million after rising 10% in 2019. Imports from Vietnam increased by 1% to US$26.7 million in 2020, building on a 14% gain in 2019.

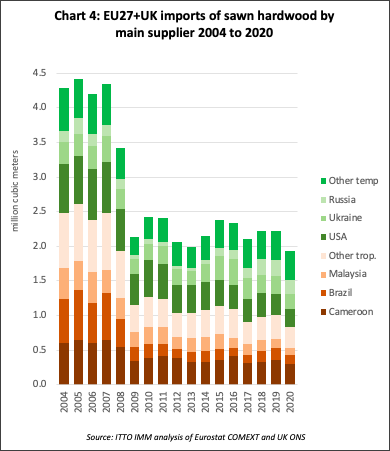

Record low EU27+UK imports of sawn hardwood in 2020

In quantity terms, EU27+UK imports of sawn hardwood fell 13% to 1.93 million m3 last year, the lowest level for at least thirty years and only the second year ever (alongside 2013 during the euro currency crises) that imports have fallen below 2 million m3. EU27+UK import quantity of tropical sawn hardwood declined 18% last year to only 828,000 m3, the lowest level ever recorded. Import quantity of temperate sawn hardwood fell 8% to 1.11 million m3.

Despite the sharp decline in trade, the level of EU27+UK sawn hardwood imports last year was not significantly out of alignment with imports in any year since 2009. The reality is that European sawn hardwood imports have been stuck at historically low levels ever since the financial crises. The decline last year is a relatively minor blip compared to the huge 50% fall between 2007 and 2009 (Chart 4).

In quantity terms, in 2020 EU27+UK imports of tropical sawnwood declined 17% from Cameroon to 303,000 m3, 25% from Brazil to 129,000 m3, and 13% from Malaysia to 105,000 m3. Imports of temperate sawn hardwood also declined from all leading supply countries including the US (-13% to 261,000 m3), Ukraine (-17% to 224,000 m3) and Russia (-15% to 197,000 m3).

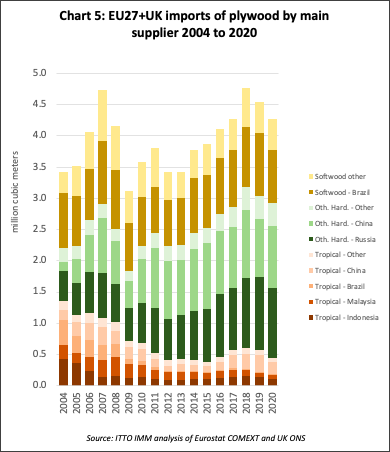

EU27+UK imports of tropical plywood down 22% in 2020

In quantity terms, in 2020 EU27+UK imports of plywood fell 6% to 4.28 million m3 following a 5% decline the previous year. While EU27+UK imports of plywood declined in both 2019 and 2020, they were still at historically high levels, last year being the fourth strongest year for plywood imports in the last 20 years (Chart ).

While overall EU27+UK plywood imports were strong in 2020, there was a significant loss of market share for tropical products. Imports of tropical hardwood plywood fell 22% to 441,000 m3 last year and share of all plywood import quantity declined from 12% in 2019 to 10% in 2020. Although imports of tropical hardwood plywood increased 24% from Malaysia to 72,000 m3, they declined from other leading supply countries including Indonesia (-27% to 104,000 m3) and China (-31% to 187,000 m3).

In 2020, tropical hardwood plywood lost share mainly to non-tropical hardwood plywood from China, including both mixed light hardwood (comprising mainly eucalyptus and poplar) and birch products. Total EU27+UK imports of non-tropical hardwood plywood increased 1% to 2.49 million m3 in 2020. A 6% increase in imports from China to 998,000 m3 offset a 5% decline in imports from Russia to 1.12 million m3. EU27+UK imports of softwood plywood fell 10% to 1.35 million m3 in 2020, mainly due to a 17% decline in imports from Brazil to 842,000 m3.

PDF of this article:

Copyright ITTO 2021 – All rights reserved